April 2025

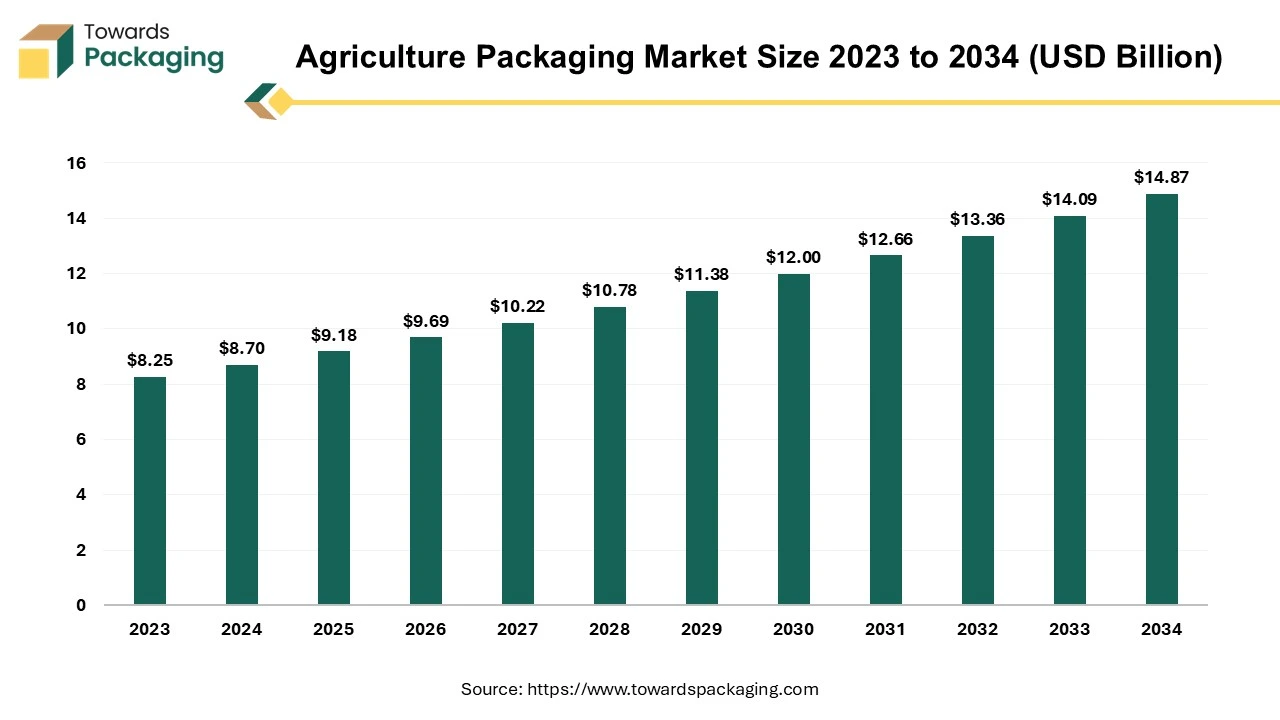

The agriculture packaging market size is projected to reach USD 14.87 billion by 2034, expanding from USD 9.18 billion in 2025, at an annual growth rate of 5.5% during the forecast period from 2025 to 2034.

Agriculture packaging is a packaging for agricultural products to contain, wrap, which will protect it during the processing, transportation, storage, and distribution. The scientific method of safeguarding agriculture products through packaging is crucial in preventing physical damage, chemical changes, and microbial contamination during transportation and storage. Additionally, an attractive packaging design plays a significant role in influencing consumer behaviour and contributes to the marketing process. While packaging does not enhance the inherent quality of the product, its primary function is to preserve the product's freshness and quality, ensuring easy and safe handling by consumers.

In the complex journey from grower to consumer, various packaging options such as crates, baskets, bags, wooden boxes, hampers, trays, film packaging, polythene wraps, palletized containers and bulk bins are employed to facilitate handling, transportation, and marketing of fresh produce. Recent trends indicate a shift towards a broader range of package sizes to meet the diverse requirements of consumers, wholesalers, processing operations and food service buyers. Agricultural business costs are heavily influenced by packing and packaging materials, therefore it is critical that producers, packers, shippers, purchasers, and consumers are aware of the variety of packaging options available.

In the face of a growing global population, the demand for increased food production is on the rise. Agricultural packaging emerges as a critical solution for farmers and producers, facilitating the efficient delivery of food with minimal losses. This specialized packaging addresses wastage concerns during post-harvest treatments, production processes, storage, and transportation, ensuring both short and long-term stability in the farmer-consumer relationship.

The packaging of pesticides, known for their toxicity and reactivity, demands meticulous attention. High-quality standards are applied in the agricultural packaging of pesticides, utilizing pouches that enhance sealing and handling, thus averting any potential malfunctioning. Adequate ventilation, allowing rapid heat dissipation, is essential in this context. The goal is to minimize water loss from the products, preserving their freshness over an extended period.

| Trends | |

| Biodegradable Packaging |

|

| Internet of Packaging |

|

| Recyclable Packaging |

|

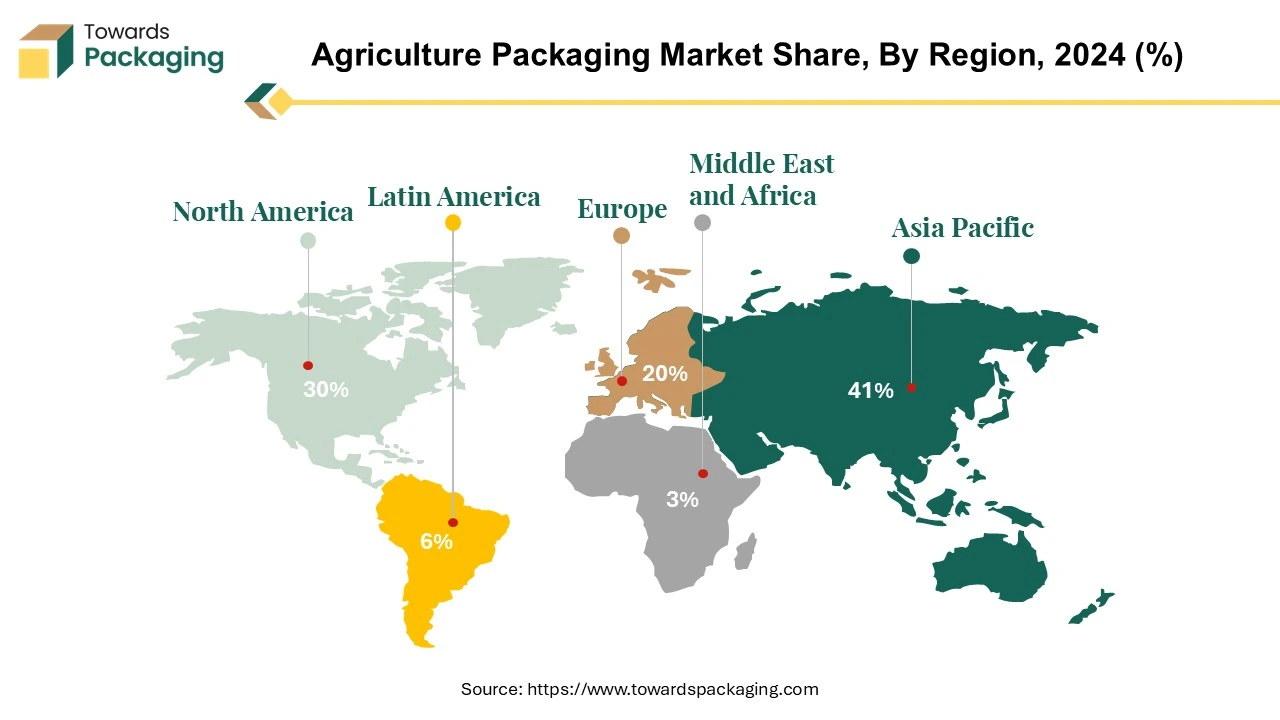

The agriculture packaging market in Asia has emerged as a global leader across various materials, including plastic, paper, paperboard, metal, and composite materials. Notably, Asia plays a pivotal role in driving innovation and setting trends in the packaging landscape for agricultural products.

In the realm of agriculture packaging, Asia stands out as the dominant force, with China spearheading both consumption and production. China, a key player in the region, leads the way by annually utilizing over 5.2 million tonnes of agricultural plastics. This substantial consumption underscores China's integral role in shaping the global agricultural packaging market. Asia plays a leading role in producing bio-plastic material from agriculture accounts 41% of the manufacture.

Plastic, being a versatile and widely used material in agriculture packaging, finds extensive applications in protecting and preserving crops, facilitating efficient transportation, and ensuring product quality. The dominance of Asia, particularly China, in the consumption and production of agricultural plastics highlights the region's strategic importance in the overall global agricultural supply chain.

Moreover, Asia's influence extends beyond plastic, encompassing a comprehensive array of packaging materials. The region's leadership is evident in categories such as paper, paperboard, metal, and composite materials. This multifaceted approach reflects the diverse needs and preferences within the agricultural sector, ranging from flexible and lightweight options to more robust and durable packaging solutions.

One notable statistic is that Asia represents nearly 70 percent of the global usage of films in agricultural applications. Films play a crucial role in agriculture packaging, serving functions such as protection against environmental factors, preservation of freshness, and even innovative marketing through visually appealing packaging.

China's prominence in both consumption and production of agricultural plastics further emphasizes the nation's strategic position in shaping the trajectory of the agriculture packaging market. As a major player, China's practices and preferences have a ripple effect on the broader Asian market and contribute significantly to global industry trends.

In conclusion, Asia, with China at the forefront, is a powerhouse in the agriculture packaging market, influencing the industry's direction across various materials. The region's dominance in plastic, paper and metal usage, particularly in agricultural applications, underscores its significance in ensuring the efficiency, sustainability, and innovation of packaging solutions that are integral to the agricultural supply chain on a global scale.

In August 2023, Amcor, a globally recognized leader in the development and production of sustainable packaging solutions, announced its strategic decision to acquire Phoenix Flexibles. This acquisition is positioned to enhance Amcor's capabilities in the rapidly growing Indian market, aligning with its commitment to expansion and industry leadership

The agriculture packaging market in North America has experienced robust growth, driven by various factors contributing to the industry's expansion. The region's diverse agricultural landscape, encompassing a wide range of crops and livestock, has necessitated versatile packaging solutions, fueling market demand. Sustainability initiatives have played a crucial role, with increasing awareness of environmental concerns leading to a shift towards eco-friendly packaging materials and practices. North America produces 18.9% bio-based packaging material for agriculture used in packaging industry.

Stringent regulatory standards governing packaging materials, safety, and labelling in North America have influenced industry players to adopt responsible practices, ensuring the quality and integrity of agricultural products. The adoption of cutting-edge technologies, including smart packaging solutions and digitalization for inventory management and real-time tracking, has enhanced supply chain efficiency.

Moreover, strategic collaborations, partnerships, and mergers among key industry players in North America have contributed to integrated packaging solutions tailored to the evolving needs of the agriculture sector. The region's commitment to innovation, sustainability, and adherence to consumer preferences positions North America as a leading player in shaping the trajectory of the global agriculture packaging market.

The United States Environmental Protection Agency (EPA), 2022 highlights that agriculture waste and packaging contribute substantially to solid waste, constituting nearly half of it. EUROSTAT's survey reveals that each European Union resident generates approximately 200 kg of packaging waste annually, with paper and cardboard comprising 41.5%, followed by plastic (19.5%), and glass (19.1%). EU proposes a revised Directive on Packaging and Packaging Waste, targeting full recyclability of all packaging by 2030. Despite a 25% increase in EU packaging waste, the industry lags in recycling efforts, partly attributed to evolving consumption habits and industry resistance to eco-friendly waste management practices. This misalignment perpetuates reliance on outdated disposal methods such as incineration and landfills.

Consumers in the agricultural sector now encounter a spectrum of innovative packaging choices. This strategic packaging not only guards against harm or contamination from micro-organisms, air, moisture, and toxins but also prevents product spillage or leakage, as noted by agriculturists. Industry experts emphasize the multifaceted benefits of proper packaging, encompassing cost-effectiveness, speed, quality, and innovation. Beyond these advantages, packaging serves as a crucial medium for preserving food quality, reducing wastage, and minimizing the need for preservatives. Experts highlight its pivotal role in protecting against chemical and physical damage while conveying essential information to both consumers and marketers.

Effective packaging not only enhances the visual appeal of agricultural products but also serves as a powerful advertising tool, contributing to increased product value and, consequently, higher sales. Moreover, it fosters customer satisfaction through a customer-oriented approach.

Plastic plays a pervasive role across various facets of agriculture, encompassing plant production, livestock management (including feed and animal care), and fisheries and aquaculture. Furthermore, they are integral in systematic applications within distribution and retail, serving to protect and uphold the quality of agricultural products.

This global utilization of plastic products exhibits regional and country-specific variations, influenced by factors such as the level of mechanization, the length of the supply chain, and reliance on export markets. The extensive use of plastic in agriculture is not uniform, with different regions employing varying types and quantities of plastic products. Notably, films emerge as the predominant category, constituting substantial volumes of non-packaging plastics employed in agricultural practices.

Recognizing the diverse applications and regional disparities in plastic usage within the agricultural sector is crucial for stakeholders to navigate challenges effectively. As the industry grapples with sustainability concerns, informed strategies for plastic use, disposal, and alternatives become imperative, aligning with global efforts to foster responsible and eco-friendly agricultural practices.

A predominant portion of agricultural plastics constitutes single-use products, with their operational lifespan contingent upon the specific application and geographical region. Despite this variability, the majority of these plastics, irrespective of their initial purpose, transition into waste within a twelve-month timeframe. The short-lived nature of these agricultural plastics underscores the pressing need for sustainable practices, recycling initiatives, and alternative materials within the agricultural sector to address the environmental impact associated with their disposal. As the industry grapples with the challenges posed by the rapid accumulation of agricultural plastic waste, there is a growing imperative to adopt strategies that promote extended usability, responsible disposal, and the integration of eco-friendly alternatives in pursuit of a more sustainable agricultural landscape.

The global utilization of plastic films in terrestrial agricultural production is estimated at 7.4 million tonnes annually, constituting approximately two percent of the total global plastic production, which was recently measured at 359 million tonnes. Notably, within the European Union (EU), plastic films dominate, accounting for 75 percent of all plastics employed in both crop and livestock production. While specific data from other regions is lacking, the European ratio pertaining to the prevalence of films in relation to all agricultural plastics has been utilized as a benchmark. This benchmark estimates the global usage of other agricultural plastic products, including irrigation tape, pipes, twines, and nets, at approximately 2.5 million tonnes annually. This data highlights the substantial role of plastic films in global agricultural practices, particularly in the EU, underscoring the need for sustainable practices and innovative solutions to manage and mitigate the environmental impact associated with their usage.

The agricultural packaging market is characterized by intense competition among key industry players, including Bemis Company, Inc., Sonoco Products Company, H.B. Fuller Company, Mondi Group Bemis Company, Inc., DS Smith Plc, LC Packaging International, BV, Smurfit Kappa Group Plc, International Paper Company, Parakh Agro Industries Ltd, Atlantic Packaging. These entities are making significant investments in the manufacturing of agricultural packaging solutions. Notably, industry leaders are adopting inorganic growth strategies such as acquisitions, mergers, partnerships, and collaborations to augment their product portfolios, thereby contributing to the global expansion of the agriculture packaging market.

November 2022, Sonoco demonstrated strategic growth by acquiring Westrock’s interest in RTS Packaging. This transaction grants Sonoco complete ownership of fourteen converting operations, comprising ten in the United States, two in Mexico, two in South America, and one paper mill in the United States. Such strategic moves underscore the dynamic nature of the agricultural packaging market, with key players strategically positioning themselves through acquisitions and collaborations to enhance their market presence and capabilities.

By Material

By End Use

By Region

April 2025

April 2025

April 2025

April 2025