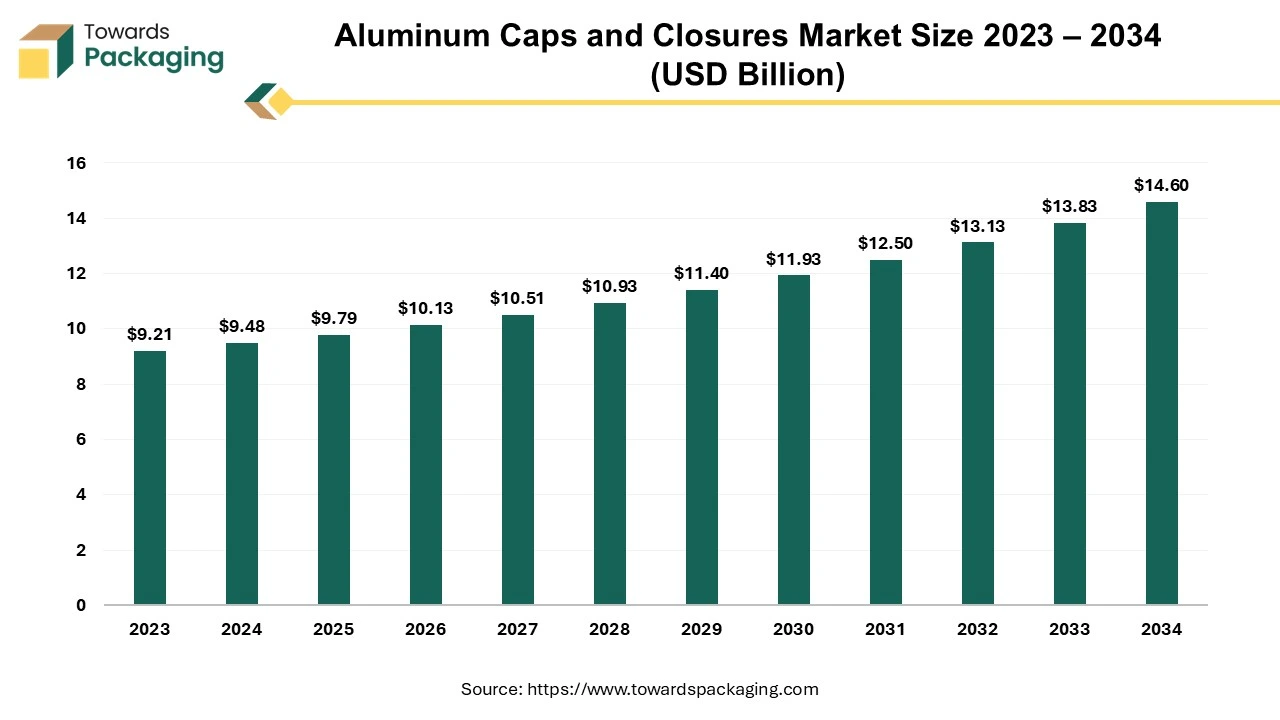

The global aluminum caps and closures market is estimated at USD 9.79 billion in 2025 and is expected to grow to USD 14.60 billion by 2034, with a CAGR of 4.28%. This report offers a thorough breakdown of the market by product type (including Roll-On Pilfer-Proof (ROPP) caps), end-use industries (such as beverages, pharmaceuticals, and food), and regional growth trends across North America, Europe, APAC, Latin America, and MEA. In addition, we examine the competitive landscape, highlighting leading manufacturers, their market share, and trade data. The report also features an analysis of the value chain, from raw material suppliers to end consumers.

The aluminum caps and closures market is anticipated to augment with a considerable CAGR during the forecast period. The parts that seal off different kinds of containers are called as caps and closures (also known as stoppers). Many types of bottles for soft beverages, dietary drinks, and other items are sealed with aluminum closures. Every industry uses closures to seal its products, from chemicals to food. Closures fit a range of containers, including tubes, jars, bottles, pails, and more. Depending on how the end user plans to utilize the product, for example, by resealing it for reuse or dispensing a certain quantity, different closure types are chosen.

The rising consumption of packaged beverages, including bottled water, carbonated drinks, and alcoholic beverages coupled with the rise of e-commerce is anticipated to augment the growth of the aluminum caps and closures market within the estimated timeframe. The pharmaceutical industry's expansion necessitates a secure and tamper-evident packaging solution which is also expected to support the market growth.

Furthermore, the increasing environmental concerns and the shift towards sustainability as well as the rising concerns about the product security and safety are also likely to contribute to the growth of the market in the years to come. The global packaging industry size is estimated to grow from USD 1.20 trillion in 2022 to reach an estimated USD 1.58 trillion by 2032, growing at a 3.16% CAGR between 2023 and 2032.

Artificial Intelligence (AI) has been a transformative technology for many industries with its full potential being still discovered. In aluminum caps and closures industry, AI and AI based technologies can become a game changer. In the packaging industry, quality standard is crucial. AI based systems can play an important role in quality control, making sure that quality remain consistent. Maintenance with AI technology also becomes a much easier task with predictive maintenance that ensures no sudden disruptions can hamper productivity.

AI technology enables using automation which can reduce human errors, produce consistent quality and boost output. Supply chain and operational efficiency improves through AI technology as it goes a long way in streamlining processes. AI technology in the aluminum caps and closures industry can help reduce costs, improve operations efficiency, ensuring quality, predictive maintenance, inventory management as well as supply chain optimization are some benefits of integrating AI technology into the infrastructure. This technology will prove to be a groundbreaking technology that will aid market growth during the forecast period.

The growing demand from alcoholic beverage industry is likely to support the growth of the market during the forecast period. The first alcoholic beverage industry to adopt this option was the spirits sector. Drinking alcohol is common and it is incorporated into the social gatherings and the customs. According to the International Organization of Vine and Wine, there has been an increase in both the supply and demand of the white wine worldwide. The amount of white wine produced grew by 13% in 2021, surpassing that of red wine. White wine made up 46% of the global total on average at the start of the century, but in recently it has increased to 49%. The surge in the popularity of the sparkling wine is one of the primary factors contributing to this increase.

Furthermore, the global market for rose wine has expanded substantially during the past 20 years, both in terms of the supply and demand. Total global output increased by 25% through 2001 to 2021. Additionally, as per the data by the Scotch Whisky Association, Scotch exports exceeded £5.6 billion globally in 2023. Last year, 1.35 billion 70cl bottles of the Scotch whisky or 43 bottles were shipped every second. With a 3% rise in the volume, Scotch Whisky exports have increased in value by 14% since 2019. Scotch whisky was responsible for 74 per cent of the Scottish food and beverage export in 2023 along with 22% of the total UK food and drink exports.

With this growing consumption of alcoholic beverages, the demand for aluminum caps and closures is also expected to increase as one of the universally popular packaging option. The high durability and resistance to corrosion of aluminum guarantees the condition of the product won't change. Cognac, whisky and the vintage rum all mature naturally. The valuable liquids within the container are not hampered by outside elements that result from conventional closure breakdown. Aluminum closures can also be integrated with technological aspects like authentication systems or anti-counterfeiting, tamper-evident devices, and other features. These can preserve both the integrity of the brand and its important contents.

The competition from alternative materials is expected to impede the growth of the aluminum caps and closures market within the estimated timeframe. With their light weight and simplicity of production, plastic closures are among the most commonly used since they can be produced in large quantities at a reasonable price. Also, its lightweight design reduces the cost of the bulk shipment. Additionally, plastic is quite adaptable and can take on a wide range of shapes.

Among the most widely used and resilient polymers that may be utilized to make an airtight seal and stop any products from leaking in storage are the polypropylene and polyethylene. The majority of plastic bottle caps are made to be extremely recyclable and reusable, which makes them perfect for environmentally conscious companies.

Furthermore, another common alternative to aluminum is cork stoppers. Since the cork material allows wines to mature without going bad, corks have remained as the chosen wine closure alternative for generations. Small amounts of air can interact with the wine cork's porous structure to assist the wine mature and change in flavor and aroma. Cork is an environmentally beneficial substance as well. It is sustainable since cork oaks don't require cutting down in order to harvest their distinctive cork bark. Another fascinating feature of the process is that the oak tree has to absorb carbon dioxide throughout photosynthesis to make cork, which means that the cork closure is a clean solution for the duration of its lifecycle.

In addition, carton packaging and the bag-in-box packaging offers sustainable alternatives and can be significantly adopted by the adult beverage lines while gaining all of the benefits of alternative packaging methods. The presence of these wide varieties of other packaging options means businesses can readily switch if they find a better value proposition.

One of the early adopters of the circular economy is aluminum. The material retains its original qualities even after processing it multiple times since it is totally recyclable. Furthermore, recycling aluminum uses roughly 95% less energy than producing it initially, which results in a reduction in the greenhouse gas emissions. Aluminum has a high scrap value, which makes it possible to cover most of the cost of collection and sorting.

According to the European Aluminum Foil Association's campaign "Aluminum Closures- Turn 360°", the mean recycling rate for aluminum closures in Europe has climbed to more than 50%. As per the Association, this enhancement can be attributed to the national policies and more effective collection and recycling programs implemented throughout Europe.

With the industry's on-going efforts to encourage recycling among waste management segment and the local governments, as well as through national projects and initiatives, it will be possible to increase the sorting, collection and recycling of even small things like closures. Aluminum closures are gathered either with glass packaging or in mixed packaging fractions, according to the recycling and collecting plans.

According to the European Aluminum projections, aluminum recycling could cut annual CO2 emissions by as much as 39 million tonnes by 2050 compared to current levels, or 46% less CO2 annually. This is mostly accomplished by substituting recycled domestic aluminum for carbon-intensive raw metal imports from outside of Europe. Aluminum closures are set to gain popularity among manufacturers and consumers worldwide as its recycling rates rise, energy and cost reductions are made, and sustainability advantages become more evident.

The roll-on-pilfer-proof (ROPP) segment captured largest market share of 47.35% in 2023. Roll-on pilfer proof caps, often known as ROPP caps, are highly sought after in the beverage companies. They are also utilized extensively in the edible oil, lubricant oil, pharmaceutical, and medical and food industries. Since they are simple to open, leak-proof as well as tamper-evident, they are favored over other kinds of closures. Champagne bottles and designer drinks are two excellent examples of containers featuring ROPP closures. The product's tamper-evident feature guarantees that it hasn't been opened or altered with before it is delivered to the customer.

In the pharmaceutical business, where the security of products is essential, this is extremely critical. One can modify the capping heads to make them suitable for any size and shape of bottle. The hermetic seal created by the ROPP capping process prevents air and moisture from entering the bottle, preserving the quality of the product and extending its shelf life.

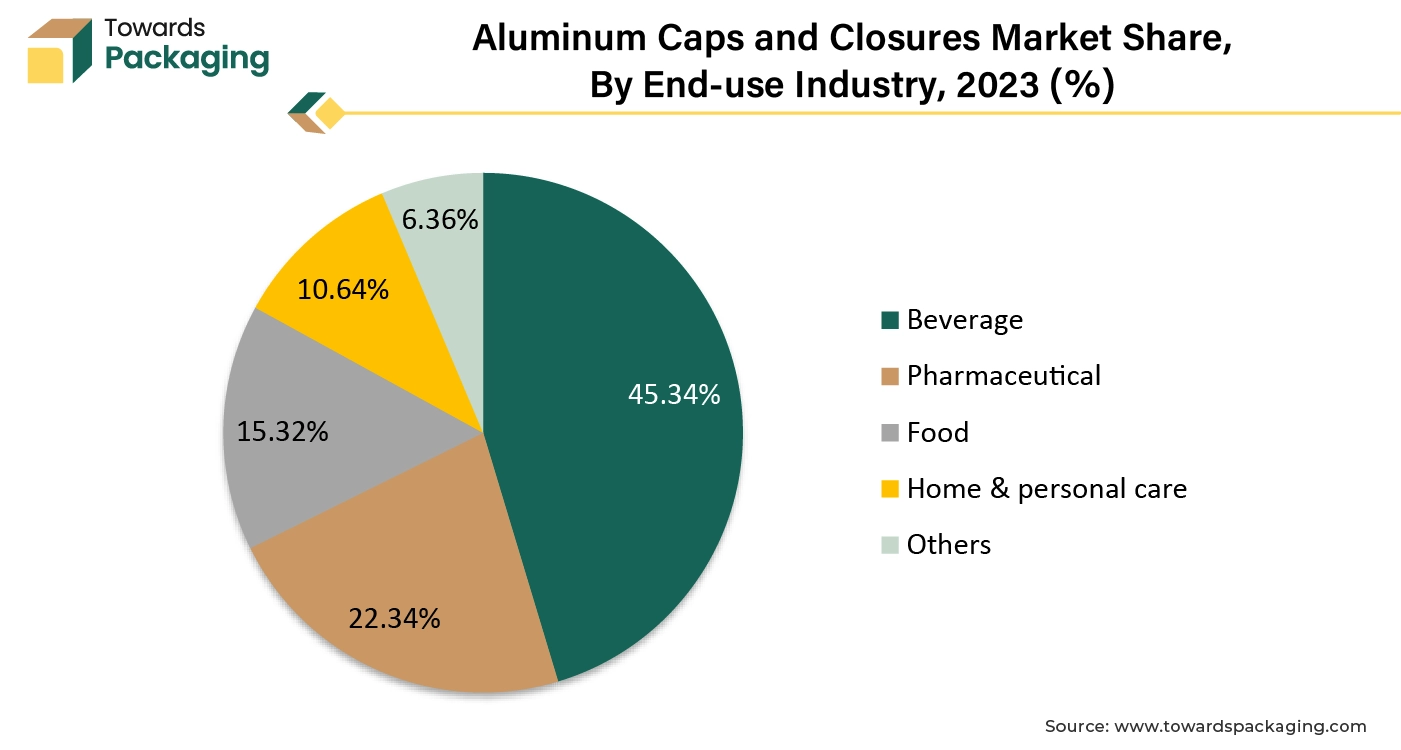

The beverage segment held largest market share of 45.34% in 2023. This is owing to the economic growth; consumers who are stable financially and have less debt are expected to offer the wine brand owners and premium spirits with more opportunities. Furthermore, sparkling wine's growth has accelerated in several regions due to pent-up desire to celebrate the personal milestones such as the weddings and the holiday parties. Another important factor is a shift in perception, with the drink being less associated with formal settings and special occasions and more appropriate for everyday use in informal settings.

Additionally, despite having a lower volume base, premium-priced RTDs have expanded more quickly than any other market over the previous two years, as new products are increasingly being introduced at higher price points. This is fueled by a surge in spirit-based options, higher ABVs, and popular premium brand expansions. With customers spending almost twice as much for the same size serving of an RTD in some areas, RTDs are an obvious upgrade from beer. This increase in consumption of both the alcoholic and non-alcoholic beverages is likely to result in a higher demand for aluminum caps and closures which provide excellent sealing properties and are also important for preserving the quality and freshness of beverages such as wines, spirits, beers and soft drinks.

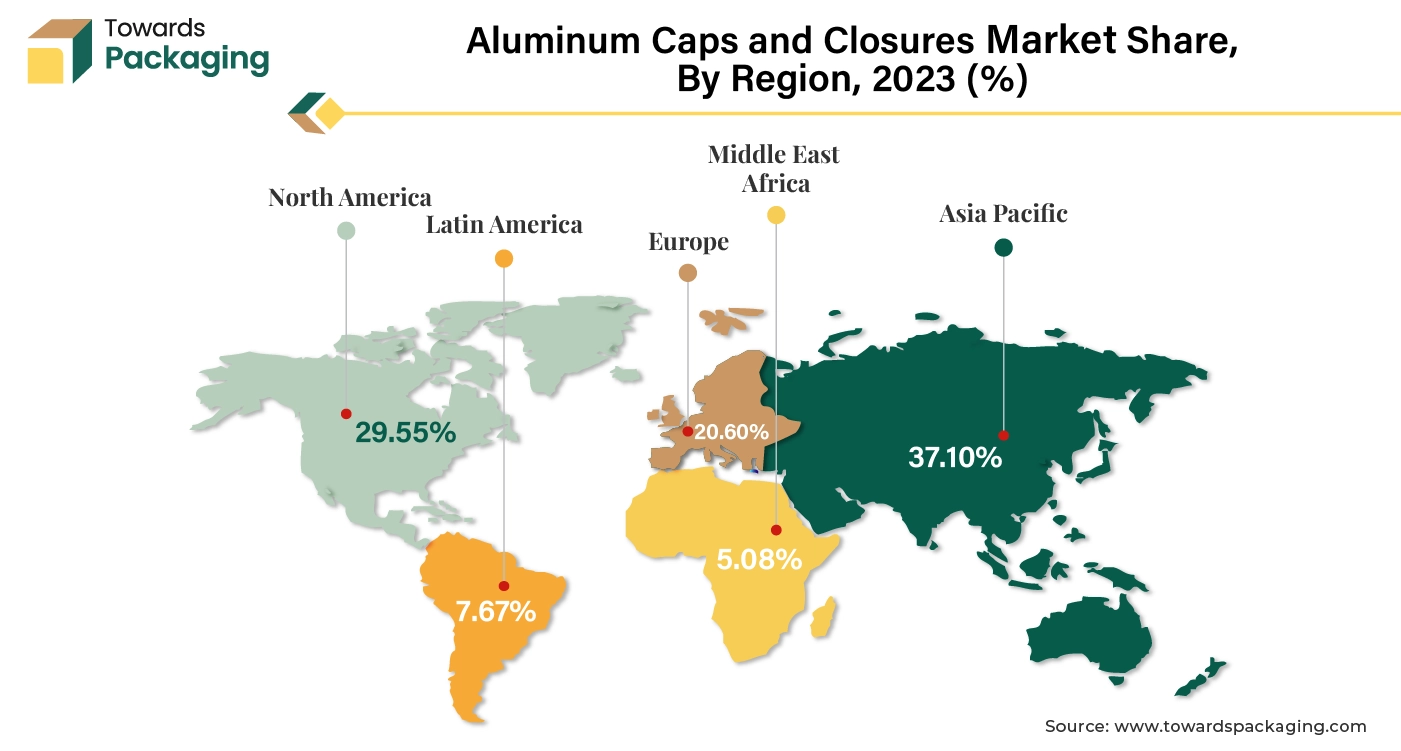

Asia Pacific held largest market share of 37.10% in 2023 and is expected to grow at a fastest CAGR of 6.30% during the forecast period. This is owing to the rapid urbanization and industrial growth that has increased the demand for packaged goods. Furthermore, the increasing popularity of bottled water, carbonated drinks, juices, energy drinks and alcoholic beverages like beer and spirits and a growing interest in premium wines is also likely to support the regional growth of the market.

According to the Scotch Whisky Association, Asia-Pacific remained the most significant market for Scotch Whisky by value in 2023, resulting in value growth in Taiwan (8%) and Singapore (19%), along with peak value exports to China with a market increasing by 165% on 2019. Additionally, the economic development in countries such as China, India and Southeast Asian nations and the higher disposable incomes is also anticipated to contribute to the regional growth of the market during the forecast period.

Europe is expected to grow at a substantial CAGR of 3.79% in 2023. This is due to the stringent regulations and policies promoting recycling and the use of sustainable materials and the circular economy initiatives on reducing the plastic waste across the region. Also, the well-established beverage industry, including wine, beer, spirits, and non-alcoholic drinks is further expected to support regional growth of the market in the years to come. The largest producer, consumer, and exporter of wine worldwide is the European Union. The majority of EU wine is produced in Spain, France, and Italy, making up half of the global production.

According to the EU wine market observatory, the value of EU exports in the 2021–2022 marketing year was €17.2 billion. The EU's top wine markets were Canada (€1.15 billion), the US (€4.7 billion), the UK (€3.4 billion), and Switzerland (€1.3 billion). Furthermore, the growing pharmaceuticals industry is also expected to support the regional growth of the market in the near future.

Some of the key players in aluminum caps and closures market are Guala Closures S.p.A, Crown Holdings Inc., Closure Systems International, Amcor plc, Reynolds Packaging Group Ltd, Alcopack Group, Silgan Holdings Inc., HERTI JSC, O.Berk Company, Pelliconi & C. SpA, Nippon Closures Co. Ltd., Yantai Hicap Closures Co., Ltd., SACMI, Xuzhou Colors Glass Co.,Ltd., MJS Packaging, Orora Packaging Australia Pty Ltd, Montebello Packaging, Alltub Group, and Hoffmann Neopac AG, among others.

By Product Type

By End-use Industry

By Region

December 2025

December 2025

December 2025

December 2025