April 2025

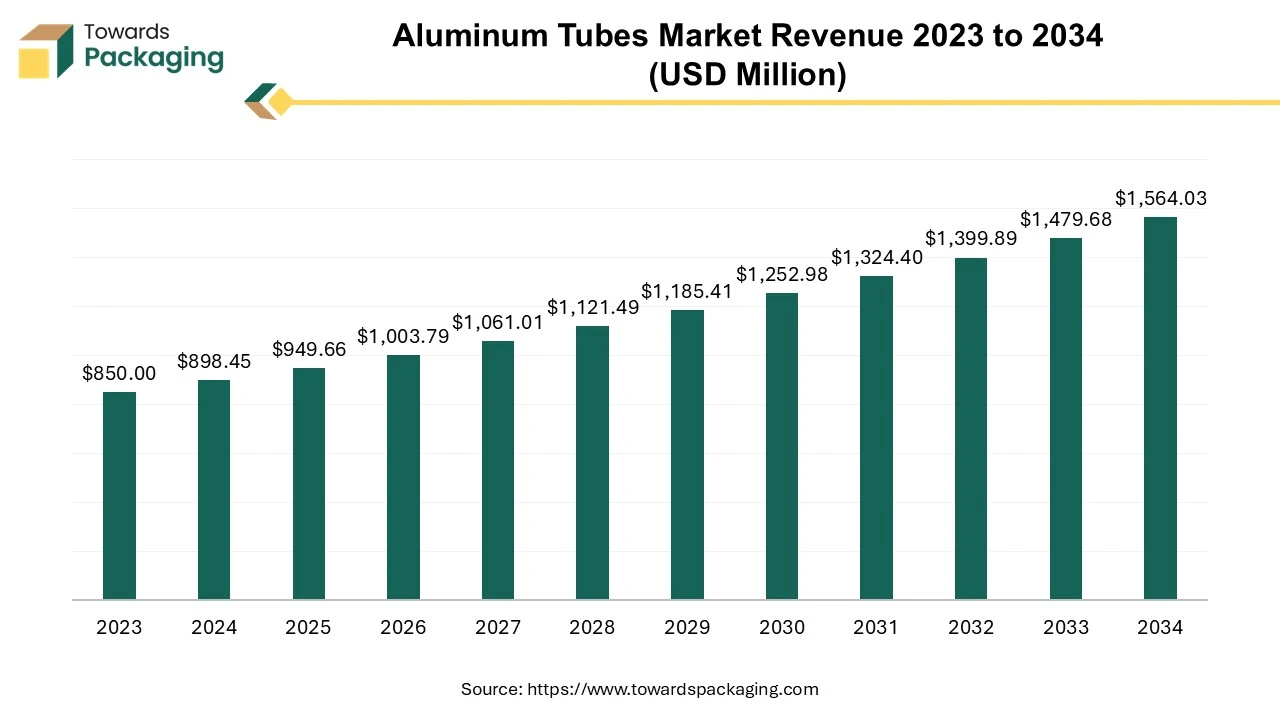

The aluminum tubes market is expected to increase from USD 949.56 millionin 2025 to USD 1564.03 millionby 2034, growing at a CAGR of 5.7% throughout the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing aluminum tubes which is estimated to drive the global aluminum tubes market over the forecast period.

Aluminum tubes are a versatile and ecological packaging solution widely used for a variety of liquid applications, from pastes and gels to lotions and effervescent tablets. Aluminum tubes are an integral part of the personal care and pharmaceutical markets, offering a combination of protection, durability, and aesthetic appeal. Their ability to preserve product quality while aligning with sustainability goals positions them as a preferred packaging solution. As the market continues to evolve, innovations in aluminum tube manufacturing and design will likely enhance their role in these sectors even further.

Aluminum tubes can be printed with high-quality graphics, colors, and branding elements, enhancing product visibility and consumer appeal. Aluminum is highly recyclable and can be repurposed without losing its quality, aligning with growing consumer demand for sustainable packaging solutions. Aluminum tubes represent a highly effective and versatile packaging solution suitable for various products, especially in personal care, pharmaceuticals, and food.

Their superior barrier properties, durability, aesthetic appeal, and recyclability make them a preferred choice for brands looking to enhance product longevity while appealing to environmentally conscious consumers. As industries continue to evolve, aluminum tubes will likely play an increasingly significant role in sustainable and innovative packaging strategies. The global packaging industry size is growing at a 3.16% CAGR.

AI can significantly enhance the aluminum tubes market for packaging purposes in several ways by providing optimized manufacturing processes, predictive maintenance, forecasting demand, sustainability initiatives, etc. AI can analyze machinery data to predict failures and schedule maintenance, reducing downtime and improving production efficiency. Machine learning algorithms can optimize extrusion and printing processes, minimizing waste and ensuring consistent quality.

AI-powered vision systems can inspect tubes for defects in real time, ensuring high-quality standards are met and reducing the need for manual checks. AI can analyze production data to identify trends and anomalies, enabling manufacturers to adjust processes proactively. AI algorithms can analyze market trends and consumer behaviour to predict demand, helping manufacturers optimize inventory levels and reduce excess stock.

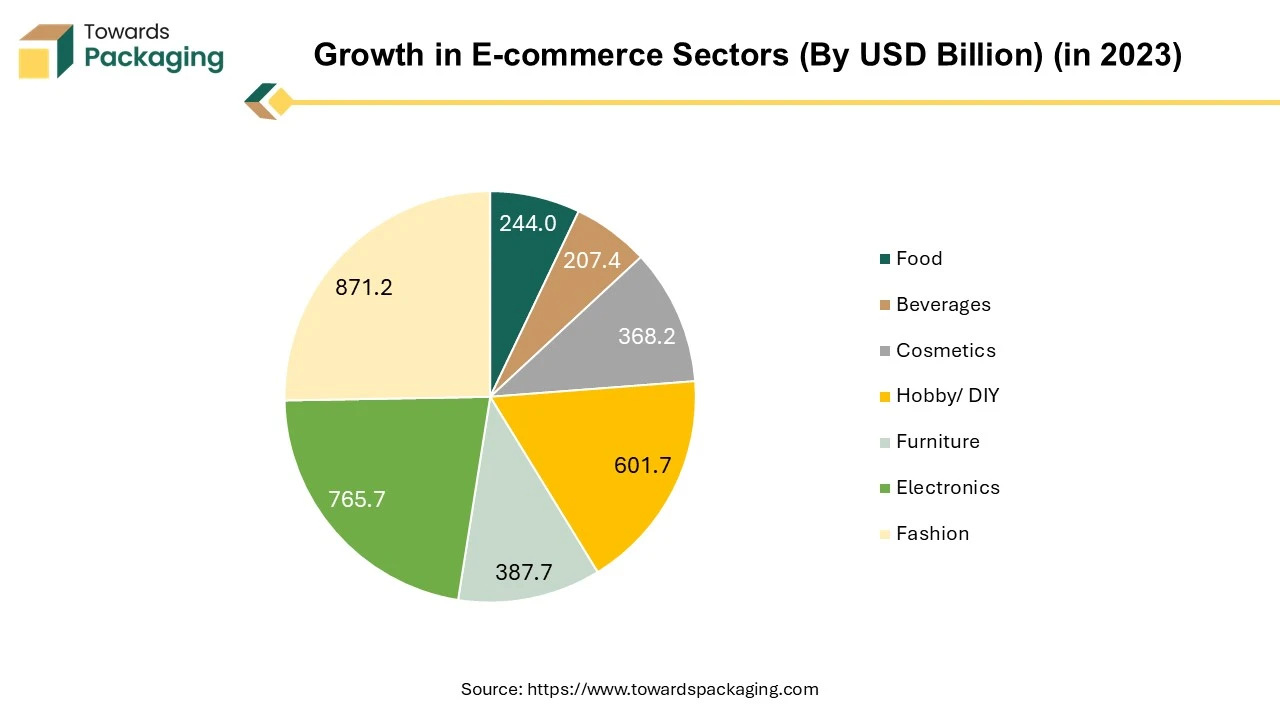

The rise of online shopping has increased the need for robust packaging solutions that protect products during transit. Aluminum tubes provide the necessary durability and tamper resistance. The growing trend of consumers purchasing products online has led to a greater need for effective packaging solutions that can withstand shipping and handling. Aluminum is lightweight compared to glass or certain plastics, which helps reduce shipping costs and improves overall logistics efficiency, appealing to both retailers and consumers. The growth of e-commerce has created a favourable environment for aluminum tube packaging, driven by the need for durability, safety, sustainability, and aesthetic appeal. As online shopping continues to flourish, the demand for effective packaging solutions, including aluminum tubes, is likely to rise further.

The key players operating in the market are facing challenges in fulfilling environmental regulations and technological challenges which is observed to restrict the growth of the global aluminum tubes market. Fluctuations in the prices of aluminum and other raw materials can impact production costs and pricing stability. The availability of alternative materials, such as plastics and glass, may limit the demand for aluminum tubes in certain applications. Stricter environmental regulations and sustainability concerns can increase production costs or restrict the use of certain manufacturing processes. In mature markets, saturation can lead to limited growth opportunities and increased competition among existing players.

The rising global demand for cosmetics and personal care products fuels the need for effective packaging. Aluminum tubes offer protection, aesthetic appeal, and convenience, making them a popular choice. Urbanization trends lead to changing consumer behaviours and increased spending on personal care and wellness products, which in turn drives demand for premium packaging solutions like aluminum tubes. The key players operating in the market are focused in introduction of the new aluminum tube packaging for cosmetic industry to meet the rising demand, which is estimated to create lucrative opportunities for the growth of the aluminum tubes market in the future.

According to reports, the MonoRefill is produced in a single process utilizing a single aluminum slug for the entire tube and is constructed of a special alloy that contains recycled aluminum packaging. Because of this, it is composed of just one material and doesn't need a plastic cap—features that should make recycling simple, save emissions, minimize waste, and protect priceless packaging materials in a closed loop.

Customers can snap off the aluminum closure of the pack to open it, then empty the product back into the original container. The tube's design makes pouring simple, guards against mess and spills, and guarantees that all of the substance is used. To ensure that all of the aluminum components are recycled together, the MonoRefill's closure can be turned over and put back into the tube once it is empty.

The squeeze tube segment held a dominant presence in the aluminum tubes market in 2024. Squeeze tubes provide easy dispensing and portion control, enhancing user convenience, especially for products like cosmetics, pharmaceuticals, and food items. Aluminum offers excellent protection against light, air, and moisture, helping preserve the integrity of sensitive products. Aluminum is highly recyclable, aligning with the growing consumer preference for sustainable packaging solutions.

Squeeze tubes can be designed with attractive finishes and graphics, appealing to brands looking to enhance product presentation. Compared to glass and some plastic alternatives, aluminum tubes are lightweight, reducing shipping costs and environmental impact.

They are suitable for a wide range of products, from creams and gels to sauces and pastes, making them an attractive option for various industries. Advances in manufacturing technology allow for more innovative and functional designs, including easy-to-use caps and applicators. These factors collectively contribute to the increasing preference for squeeze aluminum tubes in the packaging market.

The stand-up cap segment accounted for a considerable share of the aluminum tubes market in 2024. Stand-up tubes are easy to store and use, allowing for efficient dispensing and minimizing product waste. The upright design is visually appealing and practical, making it easier for consumers to access and use the product. Their design allows for efficient use of shelf space in retail environments, enhancing product visibility and appeal.

Stand-up cap tubes are versatile, suitable for a range of products including cosmetics, personal care items, and food sauces. Many stand-up tubes come with features like flip-top caps or spouts, enhancing usability and convenience. Increasingly, brands are seeking eco-friendly packaging options, and many stand-up tubes are designed to be recyclable or made from sustainable materials. Unique packaging can help brands stand out on crowded shelves, and the stand-up design offers opportunities for creative branding and marketing.

The 50 to 100 ml segment registered its dominance over the global aluminum tubes market in 2024. This volume range is well-suited for personal care items like creams, gels, and ointments, which are often sold in smaller quantities. The size 50 to 100 ml is convenient for consumers to carry, making it ideal for travel and on-the-go use. Smaller tubes allow for controlled dispensing, reducing waste and encouraging consumer satisfaction. They are generally more affordable for consumers than larger sizes, appealing to budget-conscious buyers. This size is adaptable for various industries, including cosmetics, pharmaceuticals, and food, broadening market appeal.

Smaller packaging can be more environmentally friendly, as it often requires less material and energy to produce. Increasing demand for smaller, more convenient packaging aligns with consumer preferences for practicality and efficiency. These factors contribute to the popularity and high sales of 50-100 ml aluminum tubes across multiple sectors.

Advances in tube manufacturing and design (e.g., airless pumps, flip-top caps) enhance functionality, further attracting brands in the cosmetics and personal care sectors. These factors collectively contribute to the increasing use of aluminum tubes in the cosmetics and personal care industry, driving market growth.

The key players operating in the personal care market are focused on introduction of their products in aluminum tubes, which is estimated to drive the growth of the segment over the forecast period.

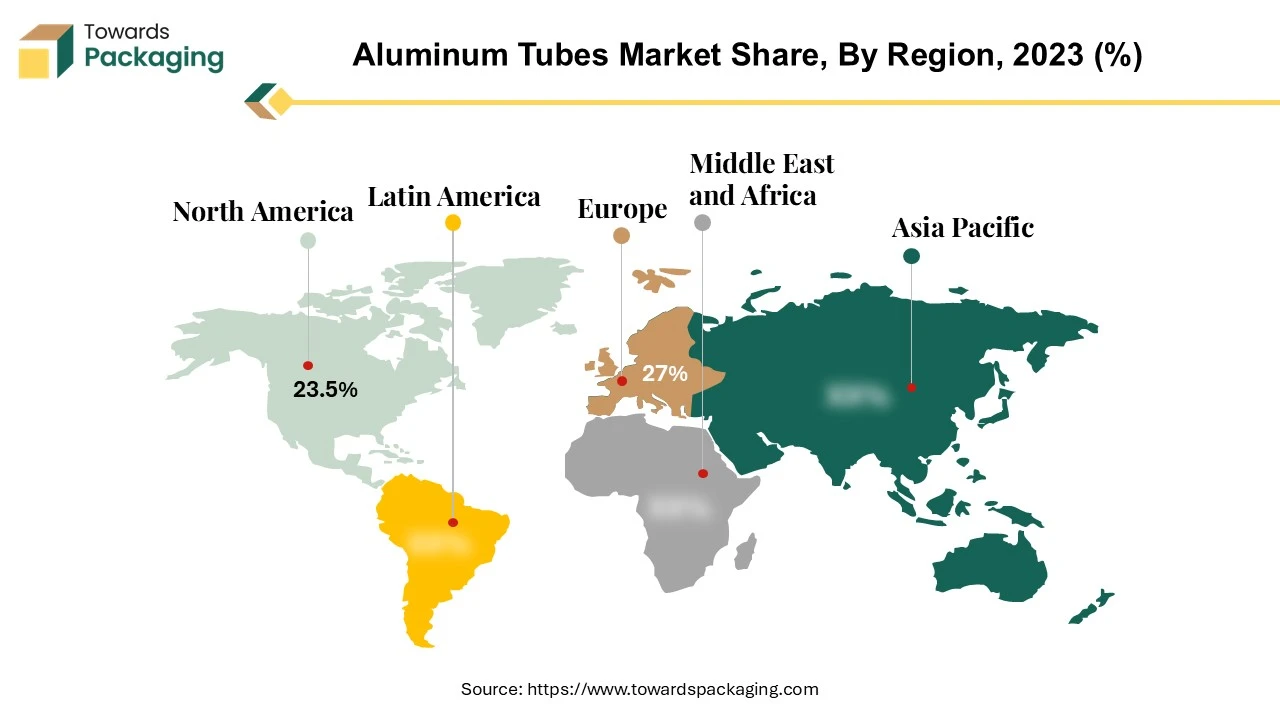

Europe region dominated the global aluminum tubes market in 2024. The region has a strong manufacturing infrastructure, facilitating efficient production and supply of aluminum tubes. European companies invest significantly in research and development, leading to innovative packaging solutions that enhance the appeal of aluminum tubes. There is a growing emphasis on eco-friendly packaging, and aluminum’s recyclability aligns with consumer preferences and regulatory trends in the region. The diverse range of products using aluminum tubes—ranging from personal care to food items—broadens market opportunities. Europe alongside, has a robust retail infrastructure, including e-commerce, which supports the distribution and visibility of aluminum tube products. Rising consumer awareness of quality packaging and product safety has led to an increased preference for aluminum tubes. These factors combined contribute to Europe’s leadership in the aluminum tubes market.

Asia Pacific region is anticipated to grow at the fastest rate in the aluminum tubes market during the forecast period. The region's fast-paced industrial growth increases the demand for aluminum tubes across various sectors, including cosmetics, pharmaceuticals, and food packaging. Rising disposable incomes and changing lifestyles contribute to increased spending on personal care and cosmetic products, driving demand for aluminum packaging.

Increasing urbanization leads to higher consumption of packaged goods, including personal care items that often utilize aluminum tubes. A growing emphasis on sustainable and recyclable packaging solutions aligns with the use of aluminum, attracting both consumers and manufacturers. Aluminum tubes are versatile and can be used for a wide range of products, making them appealing to multiple industries in the region.

Countries in the region are investing in advanced manufacturing technologies, improving production efficiency and quality of aluminum tubes. Favourable government policies aimed at promoting manufacturing and packaging innovations contribute to market growth. These factors collectively support the expanding aluminum tubes market in the Asia Pacific region.

By Tube Type

By Product

By Capacity

By End User

By Region

April 2025

April 2025

April 2025

April 2025