April 2025

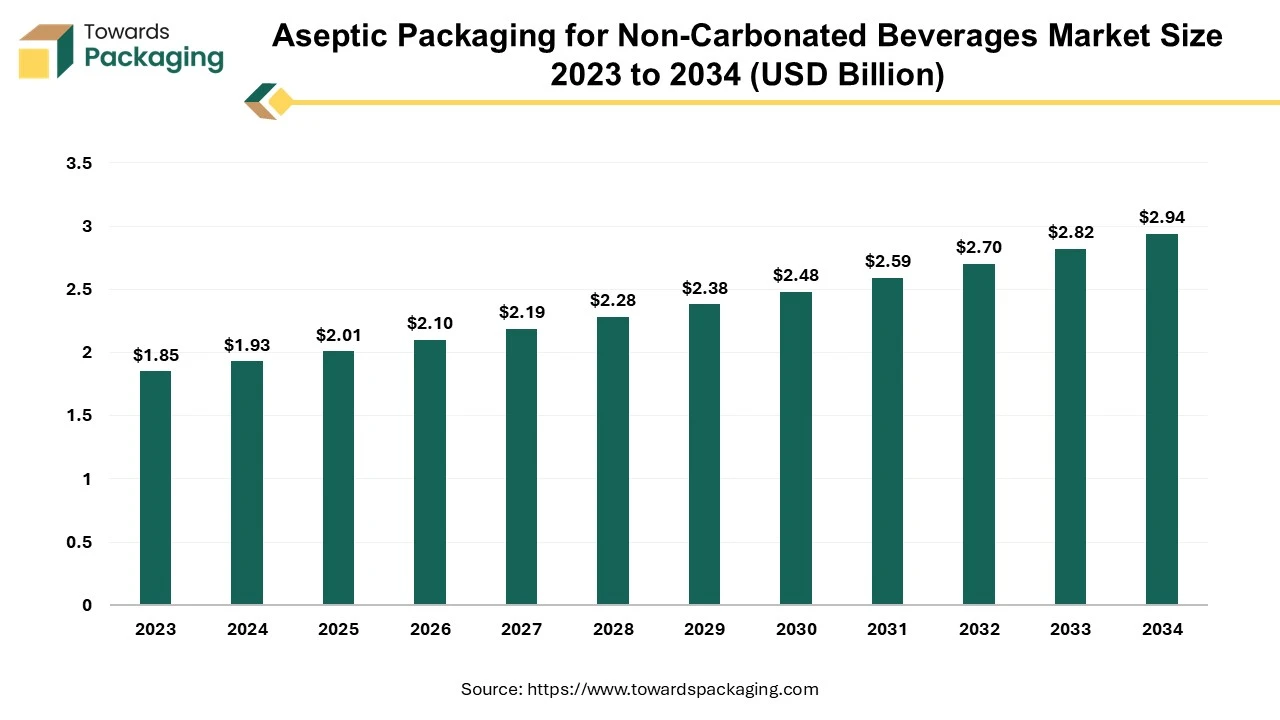

Forecasts suggest that the aseptic packaging for non-carbonated beverages market will expand from USD 1.93 billion in 2024 to USD 2.94 billion by 2034, with a CAGR of 4.3% during this period.

Unlock Infinite Advantages: Subscribe to Annual Membership

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing aseptic packaging which is estimated to drive the global aseptic packaging for non-carbonated beverages market over the forecast period. Consumers increasingly prefer non-carbonated beverages that can be stored for extended periods without refrigeration, enhancing the appeal of aseptic packaging.

Aseptic packaging for non-carbonated beverages refers to a method of packaging that ensures the product is sterile and free from harmful microorganisms without the need for preservatives. This process typically involves: sterilization, aseptic environment, filling process, and sealing. The aseptic packaging offers several benefits like extended shelf-life and preservation of nutrients and flavours. The sterilization process helps retain the beverage's natural flavor, color, and nutrients. Aseptic packaging provides convenience for distribution and storage, as products can be shipped and stored without refrigeration until opened. The global packaging industry size is growing at a 3.16% CAGR between 2025 and 2034.

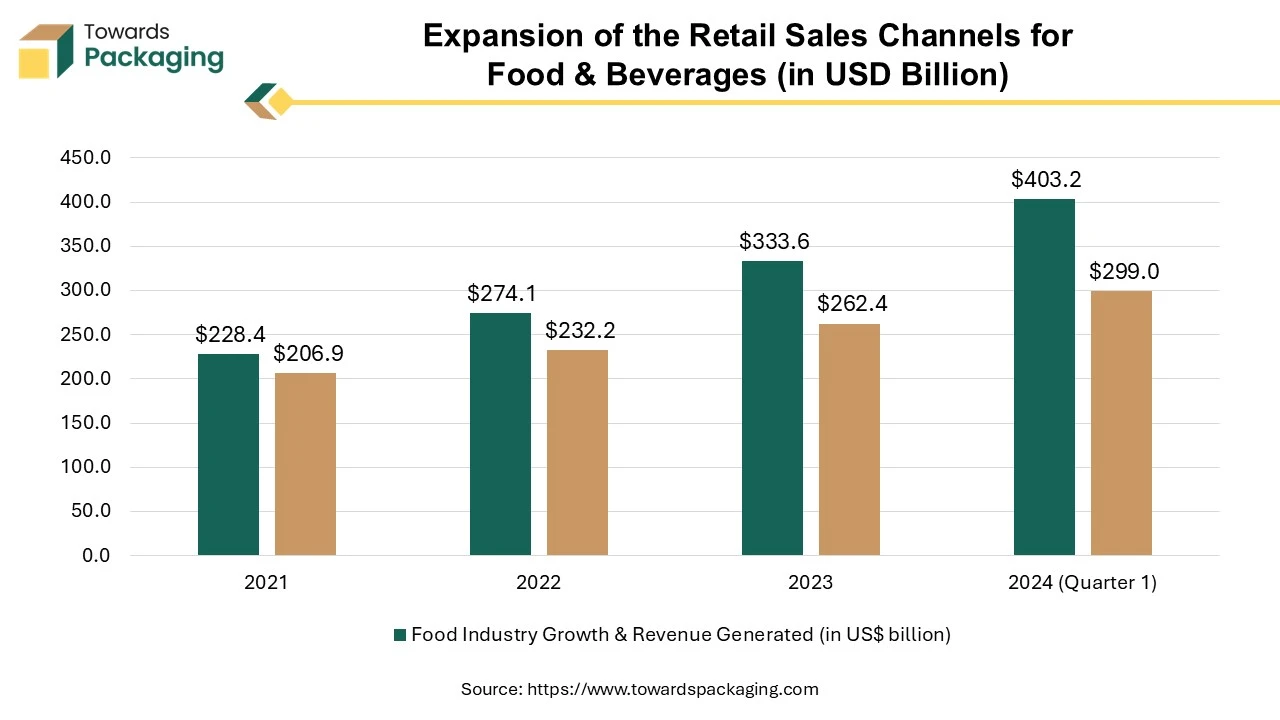

The growth of e-commerce and diverse retail channels increases product accessibility, promoting the use of aseptic packaging to ensure product safety during distribution. As companies expand into new markets, the need for durable, shelf-stable packaging that meets various regulatory requirements drives the adoption of aseptic solutions. Aseptic packaging offers lightweight, easy-to-carry options that appeal to on-the-go consumers, supporting the growth of ready-to-drink beverages.

As retail channels diversify and e-commerce platforms expand, consumers have greater access to a wide range of beverages. Aseptic packaging allows products to be shipped without refrigeration, making them suitable for online sales. Aseptic packaging is lightweight and durable, making it ideal for shipping. This aligns with the demand for convenient purchasing options, as consumers prefer easy-to-store and transport products.

As more consumers shop online, there is a growing demand for shelf-stable beverages that do not require refrigeration. Aseptic packaging caters to this preference by ensuring product safety and quality. Retailers and online platforms are more likely to stock and promote products with aseptic packaging due to their appeal and longer shelf life, leading to increased sales opportunities.

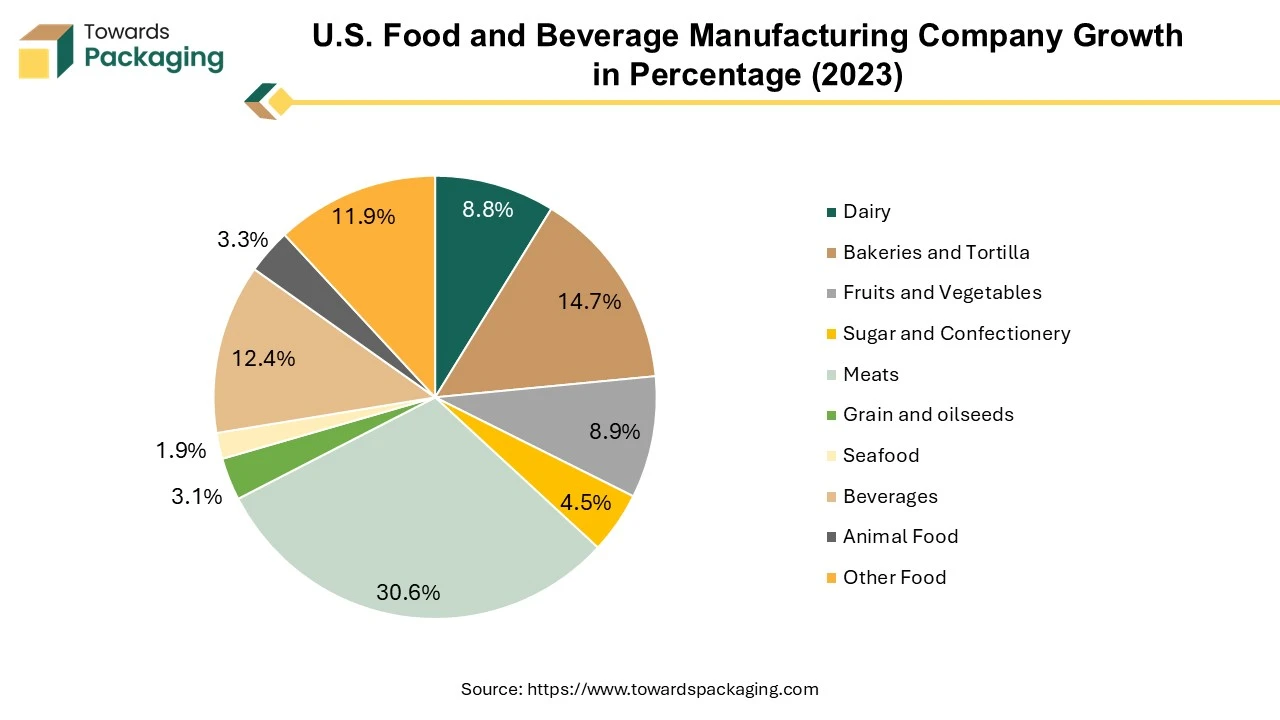

The popularity of plant-based and functional beverages necessitates effective packaging solutions that preserve flavor and nutritional value. As beverage companies expand into international markets, aseptic packaging helps ensure compliance with various safety regulations, facilitating broader distribution. Increasing introduction of the new beverages variety has risen the demand for the aseptic packaging which is estimated to create lucrative opportunity for the growth of the aseptic packaging for non-carbonated beverages market in the near future.

The growth of the aseptic packaging for non-carbonated beverages market can be restricted by several factors. Some consumers may prefer traditional packaging or have concerns about the safety and quality of aseptic products. Lack of awareness about the benefits of aseptic packaging among both manufacturers and consumers can hinder growth.

The technology and equipment required for aseptic packaging can be expensive, which may deter smaller manufacturers. Increasing demand for eco-friendly packaging may challenge the perception of aseptic materials, which can include plastics. Other packaging methods, such as glass or traditional cans, may be preferred by certain segments of the market.

North America region dominated the global aseptic packaging for non-carbonated beverages market in 2024. Increasing consumer demand for healthier beverage options has boosted the popularity of non-carbonated drinks, supporting the need for effective packaging solutions. Aseptic packaging provides an extended shelf life without refrigeration, making it attractive for manufacturers and retailers. Growing awareness of environmental issues drives the demand for more sustainable packaging options, and aseptic packaging can often be made from recyclable materials. The rise of niche beverage categories, such as plant-based drinks and functional beverages, is fostering the need for diverse packaging solutions.

Asia Pacific region is anticipated to grow at the fastest rate in the aseptic packaging for non-carbonated beverages market during the forecast period. Increased population and rapid urbanization in Asia Pacific lead to higher demand for convenient and shelf-stable beverage options. A growing preference for health-conscious and functional beverages, such as juices and plant-based drinks, is fueling the demand for aseptic packaging. Improved aseptic processing technologies enhance product safety and quality, encouraging manufacturers to adopt these packaging methods. Changing consumer lifestyles in countries like India, South Korea, etc. and preferences, particularly among younger generations, contribute to a growing market for non-carbonated beverages.

The soft packaging segment held a dominant presence in the aseptic packaging for non-carbonated beverages market in 2024. Soft packaging materials, such as pouches and bags, are lightweight, Soft packaging often requires less material than rigid alternatives, reducing production and shipping costs. making them easy to transport and handle, which appeals to consumers.

The flexible nature of soft packaging allows for various shapes and sizes, accommodating different beverage types and enhancing shelf appeal. Soft packaging can be designed with multiple layers that provide excellent barrier protection against light, oxygen, and moisture, preserving product quality. Many soft packaging options are recyclable or made from sustainable materials, aligning with the growing consumer demand for eco-friendly packaging solutions.

Soft packaging is easy to open and reseal, enhancing consumer convenience, especially for single-serve products. The production processes for soft packaging are often more efficient and require less energy compared to rigid packaging. These advantages make soft packaging a popular choice for manufacturers looking to meet consumer preferences and market demands in the aseptic packaging of non-carbonated beverages.

The functional drinks segment registered its dominance over the global aseptic packaging for non-carbonated beverages market in 2024. Increasing consumer awareness of health and wellness is driving demand for beverages that offer functional benefits, such as improved energy, hydration, and overall health. Consumers are increasingly focusing on preventative health measures, seeking drinks that support immune function, digestion, and mental clarity.

The introduction of new and diverse ingredients, such as adaptogens, probiotics, and superfoods, attracts health-conscious consumers looking for added benefits. Functional drinks provide a convenient way to incorporate nutrients and health benefits into daily routines, appealing to busy lifestyles. A wide range of functional drink options, including smoothies, herbal teas, and fortified waters, caters to varied consumer preferences. The rise of fitness and active lifestyles has led to increased demand for sports and energy drinks that enhance performance and recovery.

Consumers are becoming more informed and interested in ingredient sourcing and health claims, driving demand for products with clear, beneficial attributes.

By Type

By Application

By Region

April 2025

April 2025

April 2025

April 2025