Automated E-commerce Packaging Market Key Trends, Disruptions & Strategic Imperatives

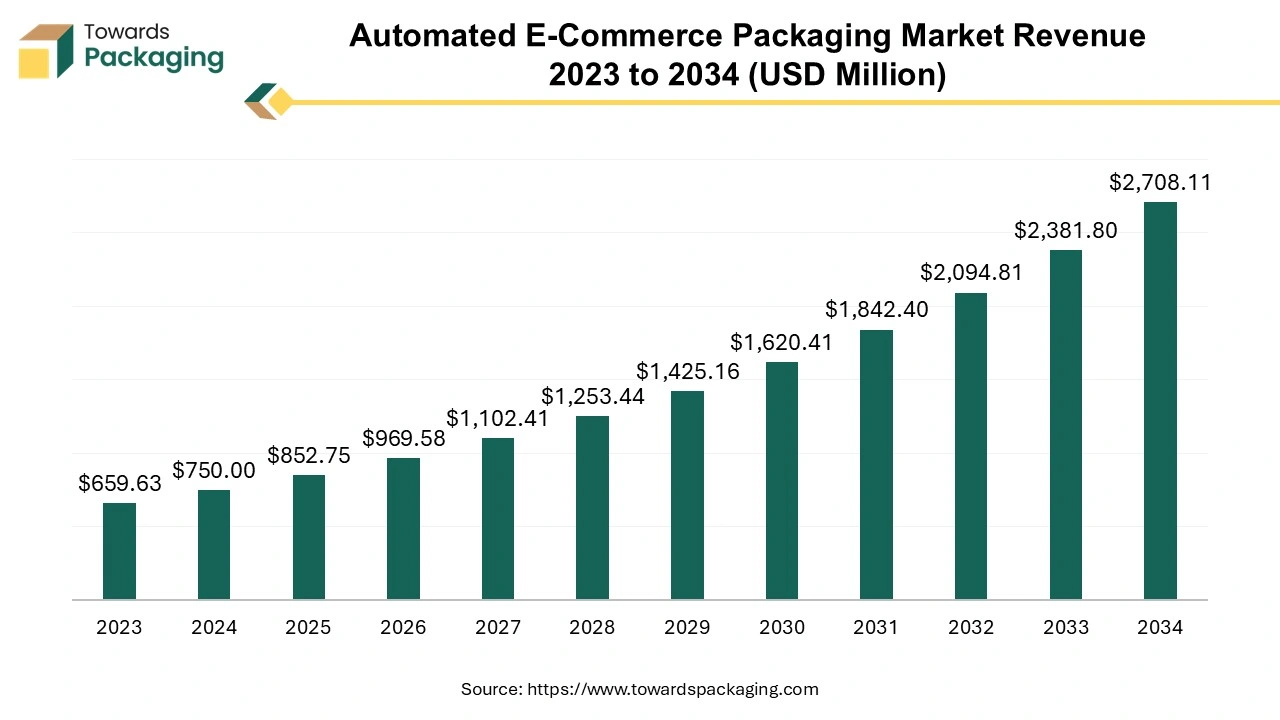

The automated e-commerce packaging market is forecasted to expand from USD 852.75 million in 2025 to USD 2708.11 million by 2034, growing at a CAGR of 13.7% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

Several market players are developing advanced technology for manufacturing e-commerce packaging, which is expected to drive the market over the forecast period.

Major Key Insights of the Automated E-commerce Packaging Market

- North America dominated the market in 2024.

- Asia Pacific is expected to grow at a significant rate in the market during the forecast period.

- By type, fully-automated segment is expected to grow at significant rate during the forecast period.

- By application, the food & beverage industry segment dominated the market in 2024.

Automated E-commerce Packaging Market: Emerging Packaging

Automated e-commerce packaging refers to the use of technology and machinery to streamline the packaging process for online orders. This can include automated systems for measuring, packing, sealing, and labeling products, which enhances efficiency, reduces labor costs, and minimizes packaging waste. The goal is to improve the speed and accuracy of order fulfillment while maintaining product safety during shipping. Automated e-commerce packaging is transforming the logistics landscape, enabling retailers to meet the demands of a growing online market. By enhancing efficiency, reducing costs, and promoting sustainability, automated packaging solutions are becoming essential for businesses looking to stay competitive in the e-commerce sector.

Automation speeds up the packaging process, allowing businesses to handle larger volumes of orders with less labor. Lower labor costs and reduced material waste contribute to overall savings. Automation can also minimize packaging errors, leading to fewer returns and customer complaints. Automated systems deliver uniform packaging quality, enhancing brand reputation and customer satisfaction. Automated packaging solutions can easily scale to meet fluctuating demand, making them ideal for businesses experiencing growth or seasonal spikes. Many automated systems are designed to optimize the use of materials, contributing to sustainable practices by reducing waste and using eco-friendly packaging options. The global packaging industry size is growing at a 3.16% CAGR.

Driver

Rising E-commerce Sales

The rapid increase in online shopping, especially post-pandemic, has led to a higher volume of orders, necessitating efficient packaging solutions to manage the demand. Higher e-commerce sales result in a greater number of orders that need to be processed and packaged efficiently. Automation helps businesses manage this increased volume without sacrificing speed or accuracy. Consumers expect rapid delivery times. Automated packaging systems streamline the packing process, allowing companies to fulfill orders more quickly and meet customer expectations.

E-commerce encompasses a wide range of products. Automated packaging systems can be easily adjusted to handle various item sizes and types, accommodating the diverse offerings of online retailers. As e-commerce grows, so does the emphasis on sustainable practices. Automated packaging can optimize material usage and facilitate the incorporation of eco-friendly packaging solutions, meeting consumer demand for sustainability. In summary, the rise in e-commerce sales creates a pressing need for efficient, scalable, and cost-effective packaging solutions. Automated e-commerce packaging systems address these challenges, driving their market growth alongside the expansion of online retail.

- Globally, 2.71 billion people purchase online. By 2024, it is anticipated that 20.1% of retail transactions will occur online. By 2027, this percentage will increase even more to 22.6%. By 2024, e-commerce revenues will surpass US$ 6.3 trillion. Globally, there are more than 26.6 million e-commerce stores. 52% of internet buyers search for goods from other countries. 34% of consumers make at least one online purchase each week.

- By 2024, there will be 2.71 billion internet shoppers worldwide. This indicates that 33% of people worldwide shop online, a 2.7% increase compared to the prior year. By 2025, there will be 2.77 billion online shoppers, reflecting the growth in commerce brought on by greater internet accessibility and convenience. In 2024, the US will have 270.11 million online purchasers, while China will have 915.1 million online consumers.

Key Factors Driving the Automated E-Commerce Packaging Market Growth

- The increasing adoption of advanced technologies for developing e-commerce packaging is estimated to drive the growth of the global automated e-commerce packaging market in the near future.

- The ability to quickly adapt to varying packaging requirements allows businesses to meet consumer demands for personalized packaging.

- Efficient packaging processes help companies streamline their supply chains, improving resilience against disruptions. Hence, global supply chain optimization drives the growth of the automated e-commerce packaging market in the near future.

- Increased investment in automation technologies by retailers and fulfillment centers supports the growth of the automated e-commerce packaging market.

- Automated systems can ensure adherence to packaging regulations and labeling requirements, reducing the risk of penalties and shipment delays.

- Difficulty in finding skilled labor pushes companies to automate processes to maintain productivity and efficiency, which is estimated to drive the automated e-commerce packaging market.

Market Trends

- Sustainability Focus: There is a growing emphasis on eco-friendly packaging materials and processes. Companies are adopting sustainable practices to meet consumer demand for greener options.

- Customization and Personalization: Consumers are looking for personalized packaging experiences. Automated solutions are evolving to offer customizable packaging options that cater to individual preferences.

- Integration of Technology: The use of AI, IoT, and machine learning in packaging solutions is on the rise. These technologies enhance efficiency, predict demand, and optimize packaging processes.

- Investment in Robotics: Robotics is increasingly being used in packaging lines to automate repetitive tasks, further enhancing efficiency and accuracy.

Market Opportunity

Rising Adoption of Inorganic Strategies

Automation that integrates with existing supply chain technologies can improve overall efficiency and reduce costs, appealing to businesses looking to optimize operations. As consumers seek personalized experiences, automated solutions that offer customization in packaging can tap into this trend. Key players operating in the market are focusing on business strategies to develop automated e-commerce packaging solutions, which is estimated to create lucrative opportunities in the the automated e-commerce packaging market in the near future.

- For instance, in July 2024, Mondi plc, a packaging company, entered into a partnership with CMC Packaging Automation, an automation company based in Italy, U.K., to provide packaging solutions that offer "customer benefits," such as increased product quality and sustainability. Mondi has been chosen as the ideal kraft paper partner for CMC machines. By creating synergies between Modi's kraft paper products and CMC's packaging on-demand technology, the firms aim to develop packaging alternatives. According to Mondi, its paper goods, including Advantage Com Kraft, EcoVantage Com Mailer Pro, and EcoVantage Com Mailer, are designed to run on CMC machines with the goal of achieving maximum effectiveness and performance. The partnership is centered on developing packaging materials that improve the packaging process and reduce environmental impact.

Market Challenge

Several factors may restrain the growth of the automated e-commerce packaging market:

- Technological Complexity: The integration of advanced technologies can be complex and may require specialized knowledge and training, creating barriers for some companies.

- Regulatory Challenges: Navigating various regulations and compliance requirements can complicate the implementation of automated packaging solutions, especially in different markets.

- Limited Flexibility: Some automated packaging systems may lack the flexibility needed to accommodate diverse product types and sizes, making them less appealing for businesses with varied inventories.

- Environmental Concerns: While sustainability is a growing trend, concerns about the environmental impact of some automated packaging materials and processes can limit adoption.

- Supply Chain Disruptions: Global supply chain issues can affect the availability of materials and components needed for automated packaging systems, hindering their adoption.

- Maintenance and Downtime: Automated systems require regular maintenance, and any downtime can disrupt operations, leading companies to hesitate in fully committing to automation.

- Resistance to Change: Established companies may resist transitioning from traditional packaging methods to automated solutions due to familiarity and comfort with existing processes.

- Economic Factors: Economic downturns can lead to reduced spending on automation and capital investments as companies focus on immediate cost-cutting measures.

Regional Insights

North America’s Technology Advancement to Support Dominance

North America dominated the global automated e-commerce packaging market in 2024. Advances in robotics and automation technologies are making packaging processes faster and more efficient, encouraging investment in automated solutions. These technologies help optimize packaging processes, reducing waste and improving overall efficiency. The key players operating in North America are focused on developing advanced technology for automated packaging solutions, further bolstering the growth of the automated e-commerce packaging market in North America.

- For instance, in September 2024, Premier Tech, packaging machinery manufacturing company, announced the introduction of the upgraded innovation to accelerate packaging automation, the TOMA product line. With its cutting-edge palletizing technology and industry-leading interface, the TOMA brand makes its premiere. It offers a smooth integration procedure that does not require coding, engineering, or programming by fusing user-friendly collaborative robotics with industrial-grade ruggedness. This advancement makes it possible for manufacturers of all sizes to benefit from automation.

Asia’s Expansion of E-commerce to Support Market Growth

Asia Pacific is anticipated to grow at the fastest rate in the global automated e-commerce packaging market during the forecast period. The Asia Pacific region has witnessed significant growth in e-commerce, driven by increasing internet penetration, smartphone usage, and changing consumer behaviors. With rapid urbanization and a growing middle-class population, the demand for efficient and sustainable packaging solutions have surged. As the largest e-commerce market, China leads in automated packaging solutions, with companies investing heavily in technology to streamline operations. With a burgeoning online retail market, India is gradually adopting automated packaging to meet rising demand, though infrastructure challenges remain. Countries like Singapore and Indonesia are investing in automated packaging technologies due to their strategic locations and growing logistics capabilities.

The convergence of technological advancements, consumer expectations, and sustainability concerns drives the growth of automated e-commerce packaging in the Asia Pacific region. While challenges exist, the overall trend toward automation represents a crucial step for businesses looking to thrive in a competitive landscape. As the market evolves, investments in automation are likely to become increasingly essential for success in the rapidly expanding e-commerce sector.

Fully Automated Segment to Lead the Market

The fully automated segment is expected to grow at a significant rate during the forecast period. The fully automated e-commerce packaging machine is widely used for its better efficiency, consistency and quality, scalability, and improved safety. These machines significantly speed up the packaging process, allowing companies to handle higher volumes of orders with less labor. These machines significantly speed up the packaging process, allowing companies to handle higher volumes of orders with less labor. Automating packaging reduces labor costs and minimizes material waste, leading to overall cost savings. Automated machines ensure uniformity in packaging, which enhances the professional appearance of products and reduces the likelihood of errors.

As e-commerce businesses grow, automated packaging systems can easily be scaled to meet increasing demand without major overhauls. Many automated machines are designed to maximize workspace, allowing for better use of facilities. These systems can integrate with inventory and order management systems, streamlining the entire fulfillment process. Reducing manual handling minimizes the risk of injuries associated with repetitive tasks. Overall, the efficiency, cost-effectiveness, and improved quality control make fully automated packaging machines essential in the competitive e-commerce landscape.

New Advancements in the Automated E-commerce Packaging Industry

- In March 2024, 3M, a multinational conglomerate company, introduced the Padded Automatable Curbside Recyclable (PACR) Mailer Material. The first known padded curbside recyclable mailer material made of paper is utilized to automate packing procedures. When combined with appropriate automated packaging equipment, this innovative material can produce packages up to three times faster than human packing.

- In October 2024, a single source for complete packaging automation introduced by Pacteon Group, a well-known brand in end-of-line packaging systems. Descon Conveyor Systems has joined our portfolio, joining Phoenix Stretch Wrappers, ESS Technologies, and Schneider Packaging Equipment. Our capacity to provide comprehensive solutions for a wide range of packaging requirements is improved by this development.

Automated E-commerce Packaging Market Companies

- BVM Brunner

- West Rock

- Sealed Air

- Pregis

- Sparck Technologies

- Maripak

- CMC Machinery

- Packsize

- Panotec

- Tension Packaging and Automation

- ProMach, Ranpak

- Smurfit Kappa

- Dongguan YiCheng Automation

- JR Automation

- Jiangsu Bealead Intelligent Technology

- Shenzhen Chuangqi Intelligent Equipment

Automated E-Commerce Packaging Market Segments

By Type

- Fully-automated

- Semi-automated

By Application

- Food & Beverage

- Cosmetics

- Apparel and Footwear

- Consumer Electronics

- Home Appliances

- Household Products

- Pharmaceuticals

- Others

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait