April 2025

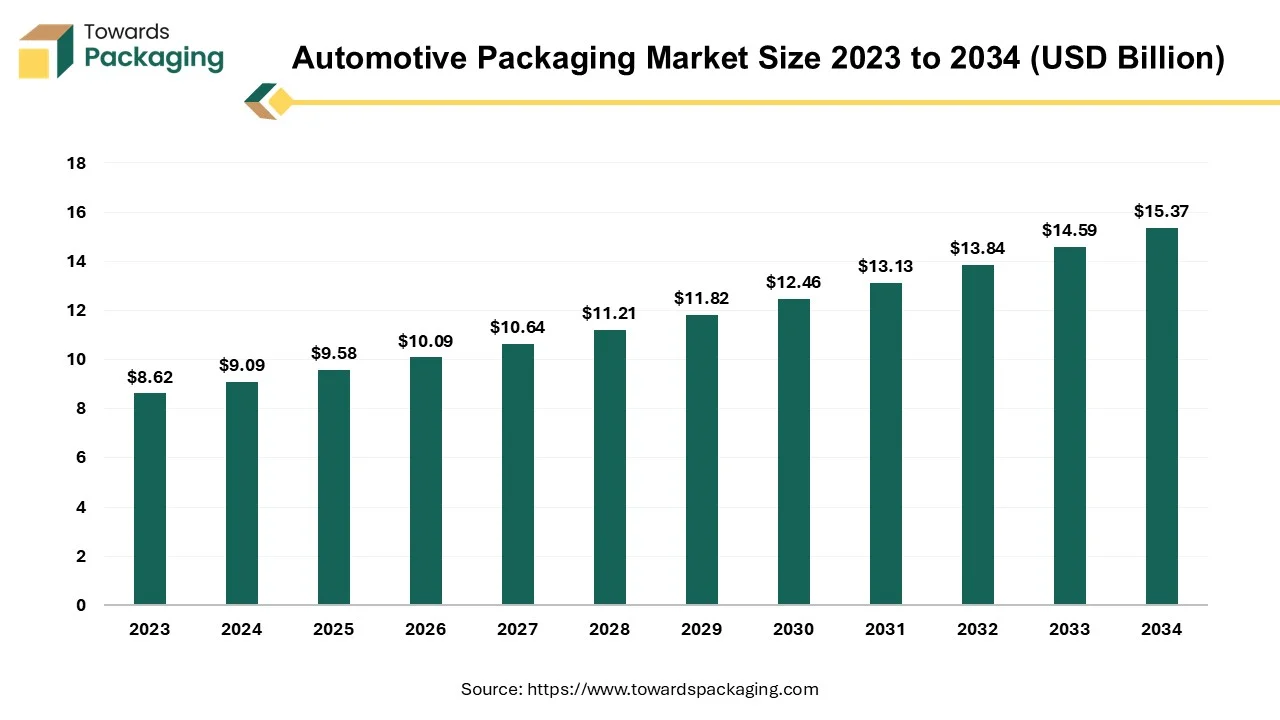

The automotive packaging market is projected to witness significant growth from 2025 to 2034. It will grow from USD 9.58 billion in 2025 to USD 15.37 billion by 2034, expanding at a CAGR of 5.4%, driven by innovations and key market players in the automotive sector. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing automotive packaging which is estimated to drive the global automotive packaging market over the forecast period.

Automotive packaging refers to the specialized packaging solutions utilized to protect, handle, store, and transport automotive components, parts, and sometimes even complete vehicles throughout the supply chain. It involves utilizing materials and designs that ensure high durability, security, and transit of automotive items. Packaging is engineered to safeguard sensitive or high-value parts (like engine components) against damage, contamination, or environmental factors. Packaging designs are often tailored to the specific dimensions, fragility, and requirements of the automotive parts being handled.

Increasing Sustainability Focus: Manufacturers are moving toward reusable packaging solutions like bulk containers, racks, and pallets to reduce packaging waste. While the initial investment is high, returnable packaging lowers long-term costs by reducing the need for disposable materials.

Biodegradable and recyclable materials are in high demand due to the rising environmental crisis. Companies are incorporating recycled plastics, molded pulp, and corrugated cardboard to meet sustainability goals. Stringent environmental regulations in North America and Europe are driving automakers to adopt eco-friendly packaging.

Precision Fit for Components: Custom-designed packaging helps protect delicate automotive parts (such as electronics, sensors, and lithium-ion batteries) from damage. Increase in demand for Foam and Cushioning Technologies: Advanced cushioning materials like EPP (expanded polypropylene) and foam inserts are being used for shock absorption.

Companies are embedding tracking technology into packaging to improve inventory management, traceability, and security in the supply chain. Smart packaging solutions enable real-time tracking of automotive components, reducing supply chain inefficiencies.

Shift towards lightweight plastics due to global warming has grown the demand for sustainable packaging. High-performance plastics and composite materials are replacing traditional metal packaging to reduce shipping costs and carbon footprint. Modern lightweight packaging is designed to be just as strong as traditional materials while being easier to handle.

The rise of electric vehicles has created demand for robust, thermally insulated, and impact-resistant packaging for lithium-ion batteries. EV battery packaging must comply with international shipping regulations for hazardous materials, influencing market innovations.

Automotive suppliers are adopting packaging solutions that align with JIT manufacturing, ensuring parts arrive exactly when needed. Modular Packaging Solutions has increased the demand for the automotive packaging. Stackable and collapsible packaging is being used to optimize warehouse storage and transportation efficiency.

Automated solutions are being integrated into the automotive packaging process to improve efficiency and reduce labor costs. Packaging is being designed to work seamlessly with automated handling systems in warehouses and manufacturing plants.

AI analyzes historical data and market trends to predict packaging needs accurately, reducing overstocking or shortages. AI-powered systems improve route planning, reducing transportation costs and ensuring just-in-time (JIT) delivery. AI enhances RFID and IoT-based tracking, allowing manufacturers to monitor shipments and prevent delays.

Automated robotic systems can efficiently assemble, pack, and palletize automotive parts, increasing speed and reducing human error. AI-powered image recognition detects defects in packaging, ensuring only high-quality materials are used. AI can adjust packaging machinery settings in real time based on part dimensions, reducing waste and downtime. Machine learning algorithms analyze sensor data to predict potential failures in packaging machinery before they occur.

Reduced Downtime: Proactive maintenance scheduling prevents unexpected equipment breakdowns, improving productivity. AI-Assisted Design Optimization: AI simulates different packaging structures to create lightweight yet durable packaging, reducing material costs. 3D Printing and AI Integration: AI can optimize 3D printing designs for custom-fit packaging solutions, particularly for fragile automotive components.

Lithium-ion batteries require fire-resistant, thermally insulated, and impact-resistant packaging. With the rise of ADAS (Advanced Driver Assistance Systems), infotainment, and AI-driven vehicle features, protective packaging for circuit boards, sensors, and chips is crucial. The rapid expansion of electric vehicles (EVs) has increased the need for protective EV battery packaging. Packaging must prevent static buildup that could damage sensitive semiconductor chips and circuit boards. Supply chain expansion and globalization of electric vehicles has increased the demand automotive packaging.

In December 2024, according to the data published by the Electric Mobility Financiers Association of India (EMFAI), India's sales of electric vehicles increased significantly in July 2024 in a number of categories. E2W sales increased to 107,016 from 79,868 in June. " Sales of e-rickshaws increased from 37.947 to 44,430. E-carts grew from 4,609 to 5,186, while E3W L5 passenger vehicles went from 7,817 to 11,431. Additionally, E3W L5 Cargo/Goods increased from 1,932 to 2,618. E-bus sales increased significantly from 135 to 436, while E4W sales increased somewhat from 7,208 to 7,539.

The key players operating in the automotive packaging market are facing issue due to fluctuation in automotive industry demand and complexity in customization which has estimated to restrict the growth of the automotive packaging market in the near future. Diverse components sizes & shapes has increased the complexity and costs. Automotive parts require custom packaging, which increases production complexity and costs. The absence of global standardization makes it difficult for suppliers to streamline packaging across different manufacturers.

Increasing vehicle production and export has risen the demand for the automotive packaging solutions. The need for durable and cost-efficient packaging solutions is increasing as global trade expands. Expansion of global automotive supply chains has created lucrative opportunity for the growth of the automotive packaging market in the near future. Companies are investing in customized and standardized packaging to ensure safe long-distance transportation.

The corrugated material segment held a dominant presence in the automotive packaging market in 2024. Corrugated cardboard material offers cushioning and impact resistance, protecting automotive parts from damage during transit. It absorbs shocks and prevents scratches or dents. Compared to other packaging materials like wood or plastic, corrugated cardboard is much lighter, reducing shipping costs and making handling easier. Corrugated material is relatively less in price and inexpensive to produce and transport, making it a cost-efficient option for automotive companies.

The returnable packaging segment accounted for a considerable share of the automotive packaging market in 2024. Returnable packaging is extensively utilized for automotive packaging due to its durability, sustainability and cost efficiency. While the initial investment in returnable packaging is high, it minimizes the demand for disposable packaging, leading to long-term cost savings. Returnable packaging is manufactured from durable materials like metal, composite materials, or plastic that provides superior protection for automotive parts.

The lighting components segment led the global automotive packaging market. The automotive lighting components, such as taillights, LED modules, headlights and signal lights, requires specialized packaging to ensure their safety, functionality, and aesthetic quality. Automotive lights are manufactured from glass, polycarbonate, and acrylic materials, making them highly susceptible to breakage. Proper packaging prevents damage from impacts, drops, and transportation vibrations.

By product segment registered its dominance over the global automotive packaging market in 2024. Automotive components like sensors, electronics, and lights requires custom packaging to prevent damage during transit. Many engines, transmissions, and large parts are shipped using returnable plastic or metal containers, reducing waste. Automakers are adopting biodegradable and recyclable materials or sustainability. Automotive manufacturers rely on timely delivery of pre-packaged parts to maintain production schedules.

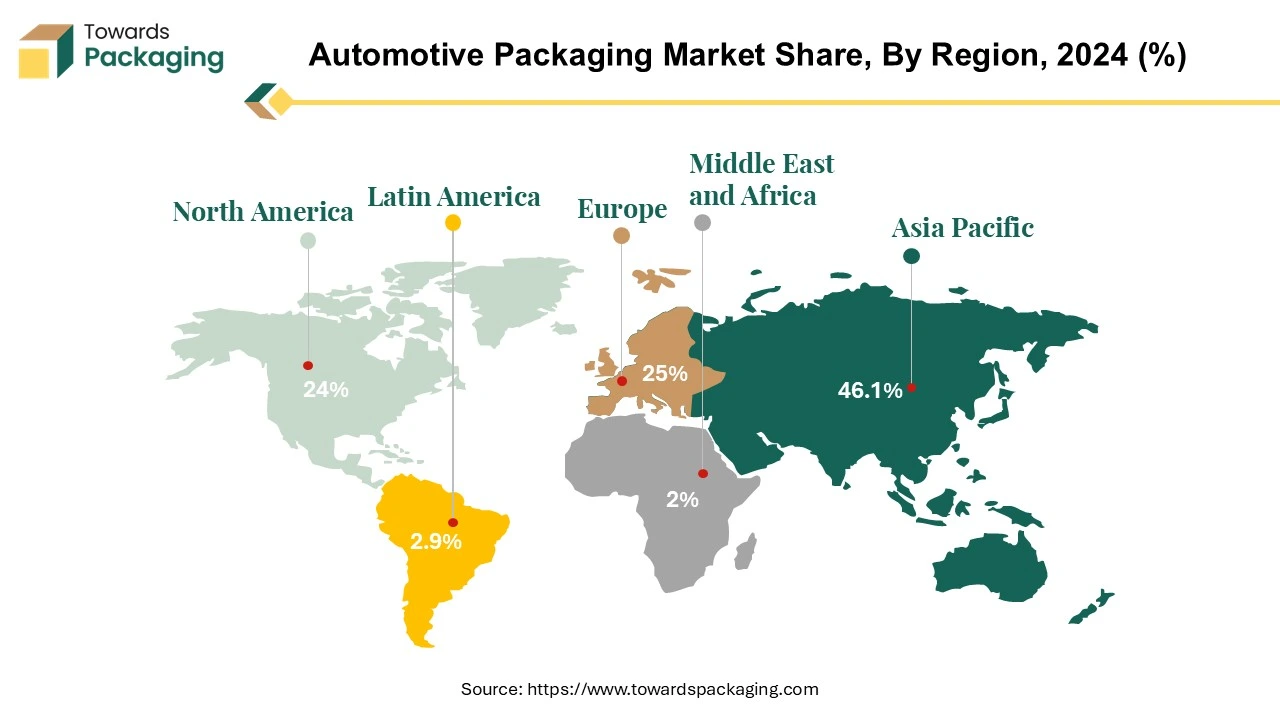

Asia Pacific region held a significant share of the automotive packaging market in 2024. Countries like China, Japan, India, and South Korea are major automotive hubs. Rising disposable incomes are increasing car ownership rates in Asia Pacific region, fueling higher demand for packaging solutions. Policies such as “Made in India” and China’s NEV (New Energy Vehicle) incentives are boosting automotive production. Many Asia Pacific governments are promoting EV adoption, driving demand for specialized battery packaging. Asia Pacific region is a major exporter of cars, auto components, and EV batteries, requiring durable and efficient packaging.

China Automotive Packaging Trends

China automotive packaging market is driven by the largest automotive manufacturing unit present in the region. China leads in global vehicle production, with over 27 million cars and commercial vehicles produced annually. Major automakers like BYD, Geely, SAIC, and global brands (Tesla, Volkswagen, Toyota, etc.) rely on efficient and cost-effective packaging for their supply chains. China dominates the EV market, accounting for over 60% of global EV sales. High demand for specialized packaging for EV batteries, which require fire-resistant, impact-proof, and anti-static packaging. China exports billions of dollars in auto components worldwide, requiring secure and cost-efficient packaging solutions.

Rising demand for customized protective packaging for fragile components like electronics, sensors, and LiDAR systems used in autonomous vehicles. China’s automotive industry adopts lean supply chain strategies, requiring efficient, space-saving, and damage-proof packaging.

North America is anticipated to grow at the fastest rate in the market during the forecast period. North America has adopted using electric vehicle to avoid pollution. The U.S., Canada, and Mexico are key automotive production centers, with major players like Ford, GM, Tesla, Stellantis, and Toyota. Growing exports of vehicles and auto parts require durable protective and returnable packaging solutions. Expansion of North American supply chains under trade agreements like USMCA is boosting demand for cost-efficient packaging.

Government incentives for EVs and battery manufacturing expansion (e.g., U.S. Inflation Reduction Act) are further fueling growth. Automakers in North America rely on JIT supply chains, requiring space-efficient, stackable, and reusable packaging to optimize logistics.

U.S. Automotive Packaging Market Trends

U.S. automotive packaging market is growing due to rise in import and export of automotive parts in other countries. The U.S. is home to major automakers like Ford, Tesla, General Motors, Stellantis, and Toyota, driving high demand for efficient packaging solutions. The key players operating in U.S. region like Sonoco, Sealed Air, DS Smith, and ORBIS are leading innovations in protective, sustainable and AI-integrated packaging.

Europe is seen to grow at a notable rate in the foreseeable future. High safety standards for lithium-ion batteries drive demand for fireproof, anti-static, and impact-resistant packaging. Gigafactories across Europe (Tesla, CATL, Northvolt, and LG Energy Solution) require customized battery packaging solutions. Strict EU regulations on packaging waste and recyclability drive eco-friendly and reusable packaging solutions.

Europe is home to leading automakers like Mercedes-Benz, Volkswagen, Renault, Volvo, Stellantis, and BMW driving high demand for packaging solutions. Major auto component manufacturing hubs in Germany, Italy, France, and the U.K. require secure and efficient packaging for global exports.

According to Bambang Candra, commercial vice-president of Dow Packaging and Specialty Plastics (P&SP) Asia Pacific, adopting sustainable materials can help address these problems by providing customers with eco-friendly choices and encouraging a circular economy in the automotive industry. In order to satisfy customers' demands for sustainability, Dow is committed to creating cutting-edge solutions for a circular economy and expanding Dow packaging company REVOLOOP line of recycled plastic resins.

By Product

By Packaging

By Automotive Parts

By Component

By Region

April 2025

April 2025

April 2025

April 2025