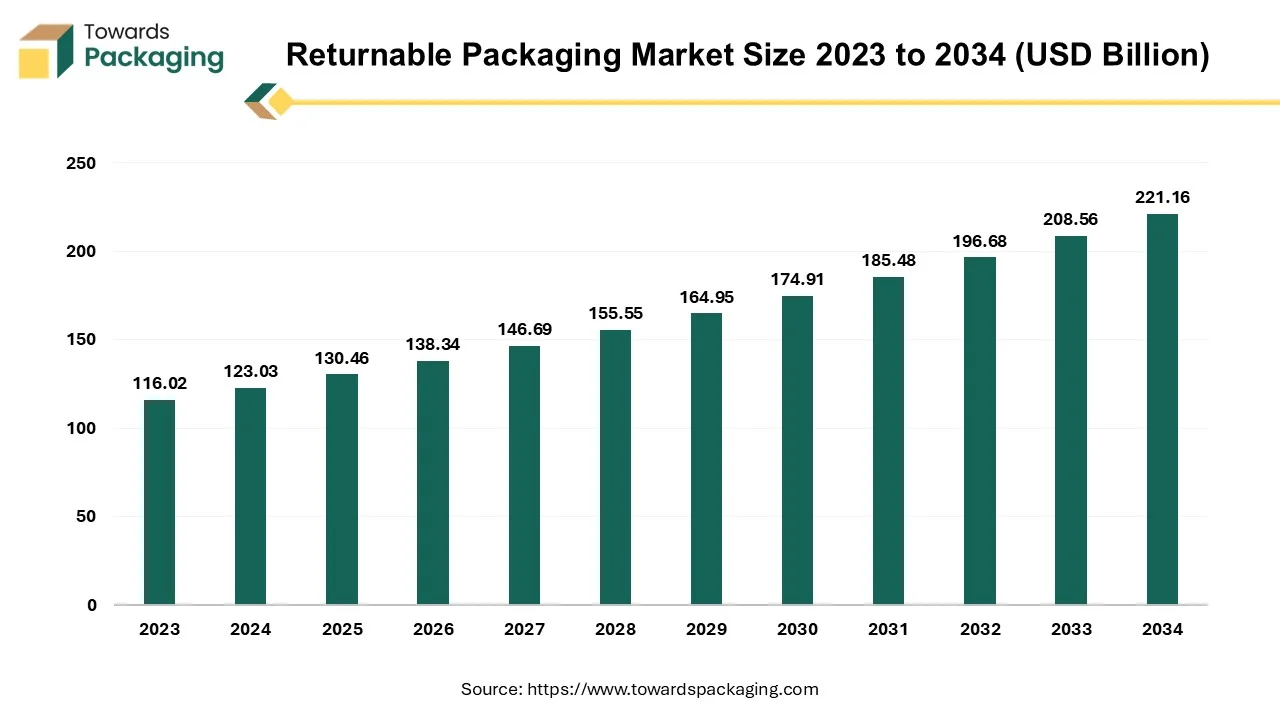

The returnable packaging market is forecasted to expand from USD 138.34 billion in 2026 to USD 234.52 billion by 2035, growing at a CAGR of 6.04% from 2026 to 2035. The study covers detailed segmentation by material (plastic, metal, wood), product (pallets, crates, IBCs, drums, dunnage, others), and end-use (food & beverage, automotive, consumer durables, healthcare, others) across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

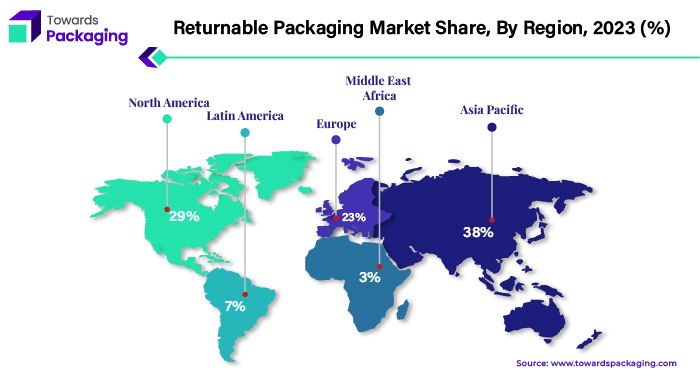

It features key players like ORBIS Corporation, NEFAB GROUP, PPS Midlands Limited, Tri-pack Packaging Systems Ltd., and Amatech, Inc., along with value chain and trade flow analysis. Asia Pacific led the market with 38% revenue share in 2024, while North America is poised for the fastest growth.

Government initiatives towards environmental protection in the form of stringent regulations and a global shift towards eco-friendly packaging by prominent sectors are the major drivers of the returnable packaging market.

| Metric | Details |

| Market Size in 2025 | USD 130.46 Billion |

| Projected Market Size in 2035 | USD 234.52 Billion |

| CAGR (2025 - 2035) | 6.04% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Material, By Product, By End Use and By Region |

| Top Key Players | ORBIS Corporation, NEFAB GROUP, PPS Midlands Limited, Tri-pack Packaging Systems Ltd., Amatech, Inc. |

Packaging the goods is one of the major aspects of any developing and established firm, and thus, it creates a higher manufacturing rate for developing an innovative packaging solution. Returnable packaging is the method used by many end users to increase their brand reputation as well as to comply with stringent regulations set by the respective country's Ministry of Health and Environment for legitimate business tactics, which eventually aid in the proliferation of the business in the global market.

The returnable packaging market is estimated to grow with a substantial growth rate during the upcoming period due to increasing concerns such as global warming and excessive carbon emission by almost every industry as capitalism is at its peak in the recent era, being in the rat race has become essential to the major countries to survive in the ever-changing and volatile global market. Returnable packaging is also one of the innovative ways to reduce waste materials and protect the environment from excessive garbage issues worldwide. The global packaging market size to grow at a 3.16% CAGR between 2025 - 2034.

In the context of returnable packaging, Asia Pacific dominates the global market with the agenda of protecting the environment from hazardous waste materials and limiting them to buried under landfills. Returnable packaging may hold a high initial cost for the establishment of the whole chain. However, as technology evolves, this drawback can be overcome, eventually leading to the market's expansion on a wider scale.

The major driver for the returnable packaging market is preceding activities in the e-commerce sector on a greater scale as penetration of the internet surpasses most corners of the world. Since convenience and efficiency play supreme roles in people’s lives, online shopping has become a trend and way closure to become a dominant force in the market, which affects every second sector including major regions around the globe.

The proliferation of e-commerce also impacted the packaging sector, in particular, the returnable packaging market. Returnable packaging is cost-effective and reduces the burden of establishing a separate base for packaging in the enterprise. Moreover, the sudden increase in the online shopping rate fuels the demand for durable, efficient, and visually aesthetic types of packaging that can be eco-friendly, too. Hence, packaging solutions have a profound effect on the e-commerce industry.

The major drawback a returnable packaging market is experiencing is the hectic process of recollection of the leftover packaging after delivering the goods to their destination. To recollect the packaging material, a robust transportation facility and a storage basement are needed before processing it. Transportation further adds the burden of cost on the market and makes it an inefficient way to handle returnable goods as it adds up to the overall expense.

Additionally, misplacement may be the concern, which again requires monitoring the area where returnable packaging can be stored. Tracking devices will be helpful in tackling this problem, but again, it adds up the cost, which may be hindering the SMEs whose economic budget is comparatively less. Such organizations would not opt for the adoption of tracking devices, and their mandates further create a concern of theft and misplacing or mishandling of goods. Despite these challenges, due to the growing demand for returnable packaging solutions, the market players will come up with innovative ways of adoption, which will aid the expansion of the global returnable packaging market on a broad scale.

A significant opportunity for the returnable packaging market is the integration of RFID tags and tracking systems on returnable packages. This method can lift up the market with lucrative opportunities in the future and holds the potential to expand the market further on a large scale. A technological revolution has ascended to every sector, including the market, where RFID tags will be helpful in tracking the details of the products, and a tracking system can deliver the exact location to the other end.

The returnable packaging market can leverage highly advanced technology like RFID and traceable sensors, which boost operational efficiency, streamline the shipping and receiving process of returnable packages, and supply chain system, which will eventually aid the expansion of the market on a global scale by creating several jobs to handle the technical aspect of the market. This system makes the collection and transportation of returnable goods much easier since RFID tags enhance traceability and make inventory management precise. Consumers can be assured by scanning the RFID tags if the product is real and recyclable or not.

The plastic segment dominated the returnable packaging market in 2024. The market is further segmented into metal and wood. The growth of the plastic resistance to withstand harsh environmental changes and wear and tear during transportation while absorbing a segment is attributed to its high resistibility to withstand the harsh environment changes and wear and tear during transportation while absorbing the greater amount of shock waves. Moreover, plastic made from materials such as HDPE and PE can be easily cleaned and can fight against corrosive elements. Hence, plastic packaging is particularly proliferating due to the food and beverage industry, pharma, and chemical industry, which is expected to fuel the global market. By recognizing the rising demand for plastic packaging, major key players are investing heavily in the R&D of returnable packaging solutions.

The metal segment is expected to grow at the highest CAGR in the returnable packaging market during the forecast period. The growth of this segment is attributed to several factors, including the ability of metal to resist the damage caused by pressure and mishandling the goods, as well as its high strength and durability, making it a more demandable packaging option in the market. Also, plastic with certain layers has been banned in many regions due to its non-biodegradable nature and its negative impact on the ecosystem, fuelling the need for the metal packaging segment in the market.

The returnable packaging is bifurcated into crates, IBCs, drums, barrels and others. The pallets segment dominated the market in 2024. This segment's growth is due to its high load-handling capacity and higher storage space, and the efficient delivery of goods. The palette can be manufactured in various sizes and shapes as required, which is the key factor prevailing in the growth of this segment in the market.

The IBC segment is expected to grow at the highest CAGR in the returnable packaging market during the forecast period. With the rising number of outlets in the food and beverage industry, the demand for the IBC segment is building momentum in the market. Developing economies like China, India, and Brazil also need IBCs for the pharmaceutical and chemical industries in these regions. This packaging is generally used for international trade with cost-effective solutions and sustainability; IBC demand globally witnessed a sudden jerk, fuelling the market rapidly.

The food & beverage segment dominated the returnable packaging market by 35% in 2024. Food and beverage have gained momentum due to the increasing disposable incomes in many regions, busy lifestyles in urban areas, and rising food and beverage outlets that need efficient packaging that helps to keep food fresh without compromising on quality and eco-friendliness. Therefore, returnable packaging provides greater options with innovative packaging such as IBCs, rigid intermediate bulk containers, flexible containers, etc. Among these, flexitanks are widely used due to their low cost, high efficiency, and large storage space.

The healthcare segment is expected to grow at the highest CAGR in the returnable packaging market during the forecast period. Growth of the healthcare segment is due to the increasing need for transportation of various medical equipment like oxymeters, stethoscopes, MRI, pacemakers, ventilators, etc., and medicines, which need to be handled delicately as they are highly sensitive to changes in the environment that may affect the potency of medications. Therefore, the healthcare segment is the major contributor to the market.

Asia Pacific dominated the returnable packaging market by 38% in 2024 including the availability of raw materials that are abundant in nature in the region, particularly in developing countries such as India, Japan, and China. Additionally, the food and beverage sector in Asia Pacific has witnessed a higher growth rate, which again presents an opportunity for the market to grow exponentially, as the region is the largest importer and exporter of various food and beverage products. Major Manufacturing companies are also based in these countries. Where China is the major contributor to market expansion.

China returnable packaging market is driven by strong e-commerce and logistics in the country. China is a global manufacturing hub, especially for electronics, automotive, chemicals, and consumer goods. These industries heavily use returnable packaging to reduce costs and manage logistics efficiently. The Chinese government has been pushing for more sustainable practices, including waste reduction and circular economy initiatives, which promote reusable and returnable packaging solutions.

China’s booming e-commerce industry, coupled with an advanced logistics network, encourages the use of durable, returnable packaging to minimize packaging waste and manage large volumes of product movement. China benefits from economics of scale and lower production costs, enabling widespread adoption and production of returnable systems.

Extended Producer Responsibility (EPR) Programs by Chinese government policies that hold manufacturers accountable for the entire lifecycle of their products, including the use of returnable packaging to reduce waste.

North America is expected to witness significant growth in the returnable packaging market during the forecast period. The growth of this region is attributed to the establishment of major sectors like pharmaceuticals, food and beverages, and automotive, specifically in major countries like Canada, Mexico, and the U.S. These sectors have a huge demand for packaging material for the transportation of essential goods, and the increasing trend towards sustainable and biodegradable, recyclable packaging is further fuelling the market in North America. Additionally, government in north America has set a strict rules and policies to restrict the waste material disposable without permission to protect forest, lands, watery areas from pollutants. Here, returnable packaging play important role to comply these regulations thus, fuelling the markets expansion in this region.

Europe region is seen to grow at a notable rate in the foreseeable future. The EU has some of the world’s strictest environmental policies, such as the European Green Deal, Circular Economy Action Plan, and Packaging and Packaging Waste Directive, all of which push for reusable, recyclable, and sustainable packaging solutions. Many European companies have aggressive ESG (Environmental, Social, and Governance) targets. Returnable packaging helps reduce carbon footprints, waste, and costs over time, aligning with these goals.

European consumers are increasingly eco-conscious, pressuring brands to adopt sustainable packaging. Returnable options are seen as premium, responsible choices. Europe has advanced reverse logistics infrastructure and innovations in materials (like RFID-enabled containers, smart tracking, etc.) making returnable systems more efficient and scalable. Several countries (like France, Germany, and the Netherlands) provide financial or policy incentives for reusable systems while phasing out single-use plastics.

Returnable packaging utilizes durable plastics such as HDPE and polypropylene, metals including aluminum and steel, composites, and sometimes RFID tags for tracking. Leading suppliers include Schoeller Allibert, Craemer, Orbis Corporation, and IFCO Systems, ensuring long-lasting performance.

This market relies on reverse logistics, including collection, cleaning, and redistribution of containers. Returnable packaging is widely used in automotive, FMCG, and food & beverage sectors. Key logistics providers include DHL Supply Chain, DB Schenker, and Kuehne + Nagel.

Sustainability is central to returnable packaging, focusing on extending product life and reducing waste. Damaged or end-of-life units are recycled into new raw materials. Major players involved in recycling and waste management include Veolia, Suez, Tomra, and TerraCycle.

By Material

By Product

By End Use

By Region

January 2026

January 2026

January 2026

January 2026