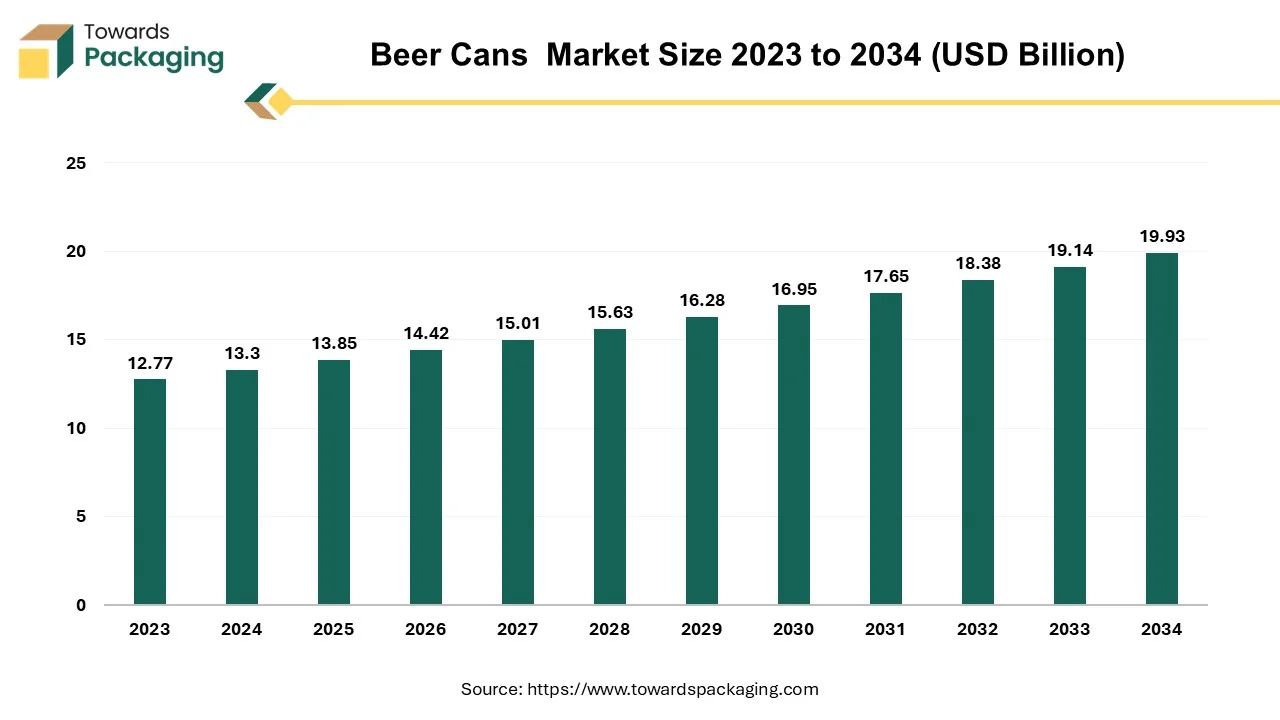

The beer cans market is forecasted to expand from USD 14.42 billion in 2026 to USD 20.76 billion by 2035, growing at a CAGR of 4.13% from 2026 to 2035. The increasing preference for aluminum cans, driven by their recyclability, lightness, and ability to preserve beer quality, is boosting market growth. In 2024, Asia Pacific dominated the market, holding the largest share, with North America projected to grow at a significant rate during the forecast period. The aluminum can segment led the market, while the 330 ml can size remains the most popular.

Emerging trends like digital printing, limited-edition packaging, and smart cans with QR codes are expected to further drive growth. Key players such as Ball Corporation, Crown Holdings, and Toyo Seikan Kaisha are focusing on sustainability and geographic expansion to maintain competitive advantage.

“The beer cans market refers to the industry involved in the production, distribution, and consumption of beer packaged in cans. Beer cans are typically made from aluminum or steel. Aluminum cans are more popular due to their lighter weight, recyclability, and ability to protect beer from light and oxygen, which can affect taste.”

Can bodies for beer and beverages are produced, degreased, and lacquered. Short bursts of airless spray from a lance positioned across from the center of the horizontal can's open end are used to apply the material quickly. The lance can be taken out of the can after being placed inside or it can be static. To provide the most uniform coating possible, the can is sprayed while being held in a chuck and rotated quickly. Very low coating viscosities with roughly 25–30% solids are required. The form is somewhat straightforward, but the insides are heated to 200 degrees Celsius for around three minutes using convectional air.

While beer is a less aggressive can filler, it still needs high-quality interior lacquers since it can easily lose flavor due to iron pick-up from the can or trace elements removed from the lacquer. Most of these coatings have been effectively transformed to emulsion polymer systems or water-borne colloidally dispersed polymer systems, particularly on aluminum, which is a simpler substrate to protect.

Water-based coatings have decreased overall expenses and the quantity of solvent that afterburners must get rid of to prevent pollution. Epoxy-acrylic copolymers containing amino or phenolic crosslinkers are the foundation of the majority of effective systems. The global packaging market size is growing at a 3.16% CAGR between 2025 and 2034.

The beer cans have the latest technological advancements, such as smart cans embedded with QR codes, NFC tags, and augmented reality features that develop user engagement and traceability. Innovations in waste management and recycling infrastructure are driving the application of closed-loop aluminium systems, making opportunities for brands to highlight sustainability and circular economy practices. On the manufacturing side, automation and robotics in can filling, palletizing, and inspection lines are boosting efficiency and lowering waste, too.

Increasing Launch of Beer Cans in Various Sizes and Application

Aluminium and steel cans are becoming more common in beer packaging as a result of international beer manufacturers' shift toward environmentally friendly and sustainable packaging alternatives which are available in varied sizes. The key players operating in the market are focused on launching the beer cans in different sizes which is estimated to fuel the growth of the beer cans market over the forecast period. The launch of such products is observed to attract more consumers which will directly impact on the overall growth of the market.

The beer cans market is initially driven by growing consumer demand for convenient, portable, and lightweight packaging that suits on-the-go lifestyles and outdoor consumption. Increasing preference for aluminium cans is fueled by their superior recyclability, faster cooling, and the ability to preserve beer freshness by blocking light and oxygen. Growth in craft beer and luxury beverage segments has further grown the move towards cans, as they serve excellent branding opportunities with high-quality printing and unique designs. Additionally, growing environmental awareness and investments in sustainable, recyclable packaging continue to encourage breweries and beverage companies toward canned formats.

For instance,

Limitation Imposed by the Cans Material

Some restriction imposed by the material of the cans can hamper the growth of the market over the forecast period. In January 2024, according to the article published by the National Center for Biotechnology Information, it was estimated that the use of the tin cans for storage of beer has converted the beer to be more acidic in nature and even changed the colour of the beer to some extent. Bisphenol A, or BPA, is a synthetic carbon-based material used in epoxies and plastics. Its potential to function as a synthetic hormone raises concerns about its safety when utilized in a variety of products, particularly those pertaining to food. There is significant concern here because it is utilized in many other plastic items, including the lining of beer cans.

Furthermore, screen-printed cans may have a considerable minimum order size. Small batches of canned beer can now be produced without needing to screen print large quantities owing to the growing popularity of labeled cans among brewers. However, the printed canned inventory that businesses require for production is typically costly to obtain.

lncreasing Launch of the Crafted Beers

The beer cans market carries main opportunities as breweries increasingly explore sustainable packaging inventions, such as lightweight aluminium and higher recycled content, to align with growing eco-conscious consumer expectations. Expanding craft beer culture worldwide makes room for specialty can designs, limited editions, and tailored packaging that develop brand identity. Growing demand in emerging markets, in which urbanization and growing disposable incomes are boosting beer consumption, further strengthens prospects.

The market will expand due to rising craft beer consumption in different countries as well as advantages for recreation and the environment. The growing demand from consumers for a diverse range of beers with flavor and taste is the main factor and opportunity behind the fast growing beer can industry. The fruit beer is beneficial for health in numerous ways such as it prevents heart disease, contains vitamins and antioxidants and helps to improve skin health among others.

Hence, various health benefits of fruit beer have influenced the consumers to shift towards crafted fruit beer consumption. Moreover, the key players operating in the market are focused on launching the crafted beer which is eventually less harmful for human health which is expected to create lucrative opportunity for the growth of the beer cans market in the near future.

Furthermore, in July 2024, Greene King Brewery, beer manufacturing company, announced the introduction of the limited-edition cask beers as part of its seasonal calendar. The Greene King Brewery launched the King Mango 4.3% alcohol by volume pale ale.

Hence, the increasing launch of the crafted beer is rising the demand for the beer cans for marketing purpose as well as for the sample taste purpose.

Aluminium can segment witnessed dominating the market share of the beer cans market in 2024. An aluminum can typically contains 70% recycled metal. Because they are lightweight and stackable, they reduce the total amount of carbon emissions created during transit. They also improve the efficiency of storage and shipping for logistics companies. Since aluminum is the most economical material to recycle, increasing use of environmentally friendly can metals is anticipated to be the main driver of market revenue development.

The majority of the aluminum used in cans is recyclable when melted down. Beverage cans are the most widely used aluminum container kind. Aluminum cans are now widely accepted by producers and customers alike as a safe and environmentally friendly packaging choice. Moreover, it is completely recyclable. The introduction of aluminum cans free of Bisphenol A has also encouraged the use of these cans as chemical-free packaging.

In April 2023, according to the data published by National Center for Biotechnology Information, it was projects that the amount of aluminum used globally in packaging applications will be 14.7 million tonnes in 2022 and rise to 15.2 million tonnes by 2023, representing a growth of almost 3.3%. Beverage cans, packaging foil, and pharmaceutical packaging applications were the key drivers of aluminum demand in this industry. Beverage cans made of aluminium are becoming more and more popular outside of industrialized economies, particularly in developing nations.

Moreover, the key players operating in the market are focused on product expansion by launching new product in the market which is expected to drive the growth of the beer cans market over the forecast period.

The steel/tin can segment is expected to grow at fastest rate over the forecast period. The advantages offered by the steel/tin can has influenced the beer manufacturers to use tin/steel can for beer storage, which is expected to drive the growth of the market over the forecast period. Some of the most beneficial ways to package food and beverage items, such beer, soups, spices, and soft drinks, are with tin cans. They are also often used for packaging consumer goods like cosmetics and medications. This is as a result of the many advantages that using tin cans has over other approaches. The steel/tin can offer high shelf life as they are non-corrosive and the beer can have long shelf life due to this. Tin/steel is light in weight and has incredible flexibility in packaging due to their rigidity and strength features.

The 3 piece can segment is expected to show significant growth over the forecast period. The 3 piece can is the three-part containers which consist of a can developed with sewn shell at one end and an attached lid at another end. The 3-piece can design is beneficial for the beer manufacturer and industrial sector, as it is feasible to assemble without the requirement of expensive machinery and tools. In addition, this type of cans offers a great number of possibilities for closing and opening, therefore it is easy to handle and achieve greater convenience, versatility and simplicity in the designing and manufacturing process. Hence, due the numerous advantages offered by the 3-piece type of can the beer industry is adopting it for packaging of beer.

The 330 ml segment held dominant position in the year 2024. The key players operating in the market are focusing on launching the 330 ml beer can which is estimated to drive the growth of the segment over the forecast period. The 330 ml beer cans are extensively utilized for the sampling purpose and for advertisement at big events. As well as the rising craft beer launch for sample test purpose has also projected to drive the segment over the forecast period.

Asia Pacific held the largest share of the market, owing to shifting cultural patterns, increasing population, rising urbanization, and youth beer popularity. The Asia Pacific region has been emerged as the primary manufacturer and supplier of the steel sheets and processed aluminium. Substantial sources of raw materials, including steel and aluminium, are characterized by high development rates, cheap labor costs, and well-established manufacturing bases that support market expansion. Moreover, increasing launch of the aluminium beer cans by the key players operating in the Asia Pacific market is expected to drive the growth for the beer cans market in the near future.

Furthermore, the Asia-Pacific region is responsible to a substantial share of the world's population, which significantly contributes to beverage consumption. Furthermore, as developing countries like China and India quickly industrialized, the population's disposable income rose. It is therefore anticipated that beverage demand would rise, supporting market expansion. The fast-paced lifestyle and rising demand for tinned and portable foods are driving growth in the beverage can industry in the region. As discretionary income and the demand for readily available, transportable food and beverages expanded, so did the use of aluminium cans. The reason for this is that aluminium cans readily maintain the carbonation pressure needed to package soda, withstanding pressures of up to 90 pounds per square inch.

North America is expected to witness a significant growth over the forecast period. The key players operating in the market are focused on developing and manufacturing beer which has anticipated to rise in the demand for the beer cans and is estimated to drive the growth of the beer cans market in the North America region over the forecast period. For instance, in June 2024, Hulk Hogan, an American retired professional wrestler, announced the launch of the new premium brand “Real American Beer” which contains 100% North American ingredient with 4.2% alcohol by volume. The Real American Beer cans have been showcased at the sports event took place in Massachusetts, U.S. for the marketing purpose.

Europe is set to play a significant role in the beer can market soon. This is largely due to high beer consumption rates, with many countries showing considerable per capita consumption. Additionally, there is a growing preference for sustainable packaging and a rise in craft beer popularity. The craft beer movement has gained significant traction across Europe, leading many brewers to prefer aluminum cans. These cans are favored for their ability to preserve the beer's flavor and provide convenience and portability, making them ideal for on-the-go consumption and outdoor activities.

Latin America is also a significant region for the beer can market, driven by increasing beer consumption, a growing consumer preference for convenient and sustainable packaging, and the rising popularity of craft beer. Countries such as Brazil, Chile, Colombia, and Argentina have well-established recycling systems that enhance the eco-friendliness of aluminum cans. Furthermore, the region’s large and growing population, combined with rising incomes and changing lifestyles, is boosting demand for canned beer.

The Middle East and Africa is becoming increasingly important in the beer can market due to rising demand for both traditional and craft beers, particularly in countries with large expatriate populations and popular tourist destinations. The thriving hospitality sector in the region, including hotels, resorts, and bars, caters to both local and international visitors, further driving the demand for beer and, consequently, beer cans. Additionally, an increasing demand for packaged food and beverages, along with a shift towards convenience and sustainability, is promoting the adoption of metal cans.

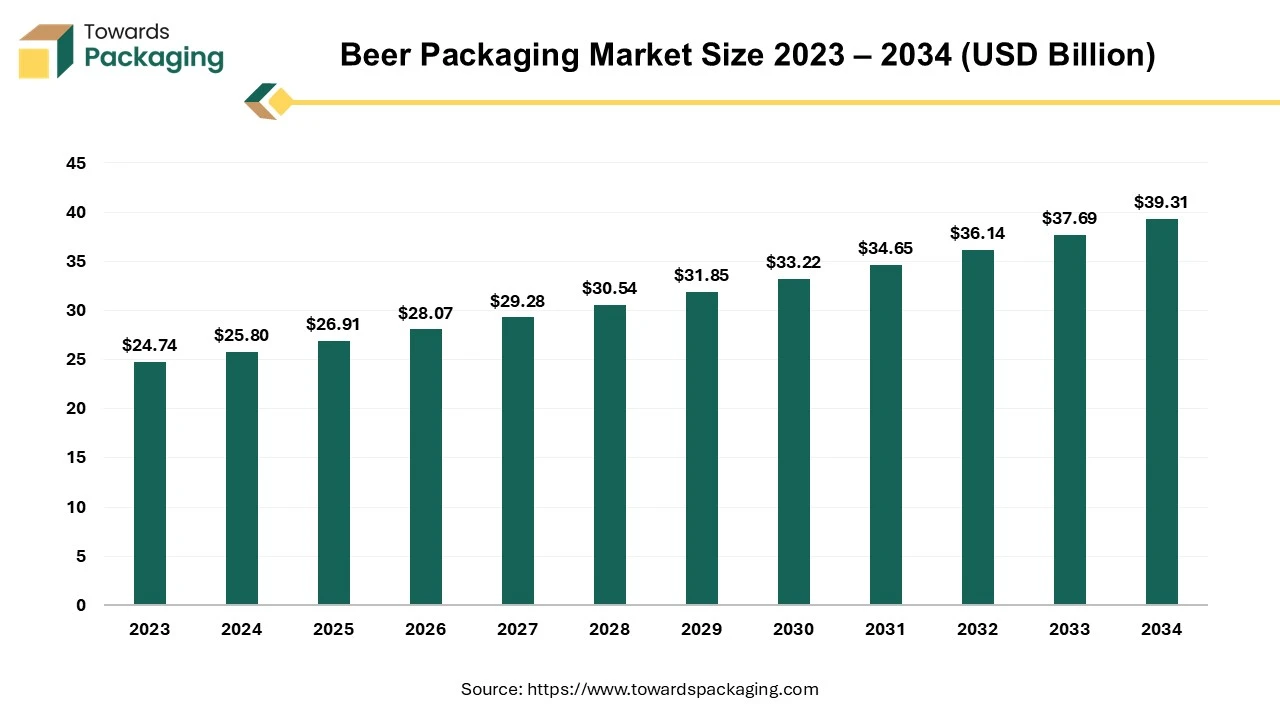

The beer packaging market is projected to reach USD 39.31 billion by 2034, expanding from USD 26.91 billion in 2025, at an annual growth rate of 4.3% during the forecast period from 2025 to 2034.

Beer, an alcoholic beverage, is one of the world's oldest and most popular fermented beverages made with water, malted barley, hops, and yeast. The beer packaging market defines the packaging industry segment that develops solutions for packaging and distributing beer goods.

Beer is the most popular alcoholic beverage globally, with billions of liters consumed yearly. However, the science of beer continues after brewing until the packaging phase, where the type of packaging used considerably impacts flavor and freshness. Global beer production will reach an astonishing 1.89 billion hectolitres in 2022 alone, demonstrating the industry's immense magnitude. Packaging is an essential aspect of the beer business, characterized by fierce competition between local breweries and large brands. It plays a critical function in defining a brand's identity and allows it to stand out on crowded shelves, attracting consumers' attention and preferences. The craft beer movement, recognized for its adherence to quality and creativity, has played a vital role in driving innovation in beer package design. Craft brewers, known for their willingness to experiment, frequently seek innovative and inventive packaging options.

The aluminium cans market is projected to reach USD 94.9 billion by 2034, growing from USD 62.23 billion in 2025, at a CAGR of 4.8% during the forecast period from 2025 to 2034.

Aluminium cans for beverage are even more preferable because of their light, yet sturdy structure, which will considerably help to lower the bills for shipping and to improve product preservation. They provide 70% cost benefits over conventional glass bottles and are aligned with major stringent environmental standards. The market growth of North America is a slightly increasing trend which users want different beverages. The European zone also decides to manufacture more aluminium cans as a result of green tendency. Distributing channels are the essential functions in the aluminium cans industry, which is led by the renowned companies that do their best to maintain their competitive advantage through innovation and sustainability.

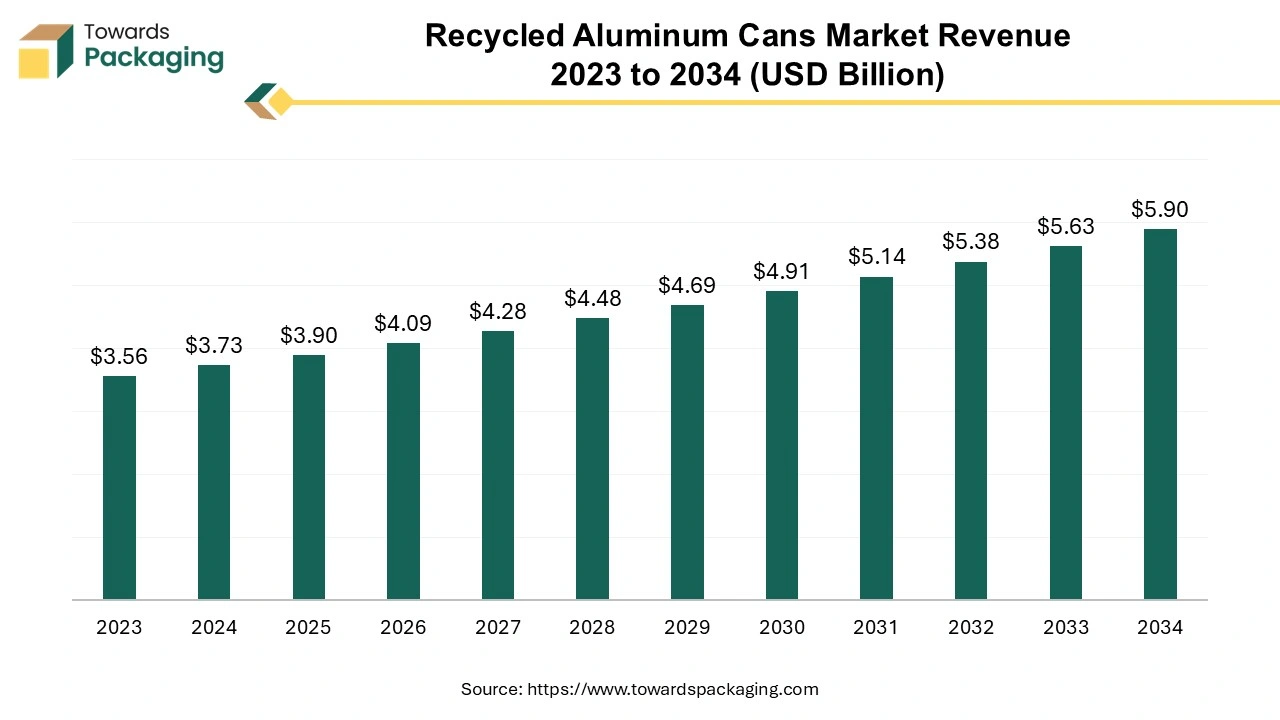

The recycled aluminum cans market is anticipated to grow from USD 3.90 billion in 2025 to USD 5.90 billion by 2034, with a compound annual growth rate (CAGR) of 4.7% during the forecast period from 2025 to 2034.

The market is flourishing due to the increasing medical sector, food and beverages, beauty and cosmetic brands, and several others which require aluminum cans to store various products in different sectors. The growing concern for health, hygiene, and medical cases is boosting the recycled aluminum cans market.

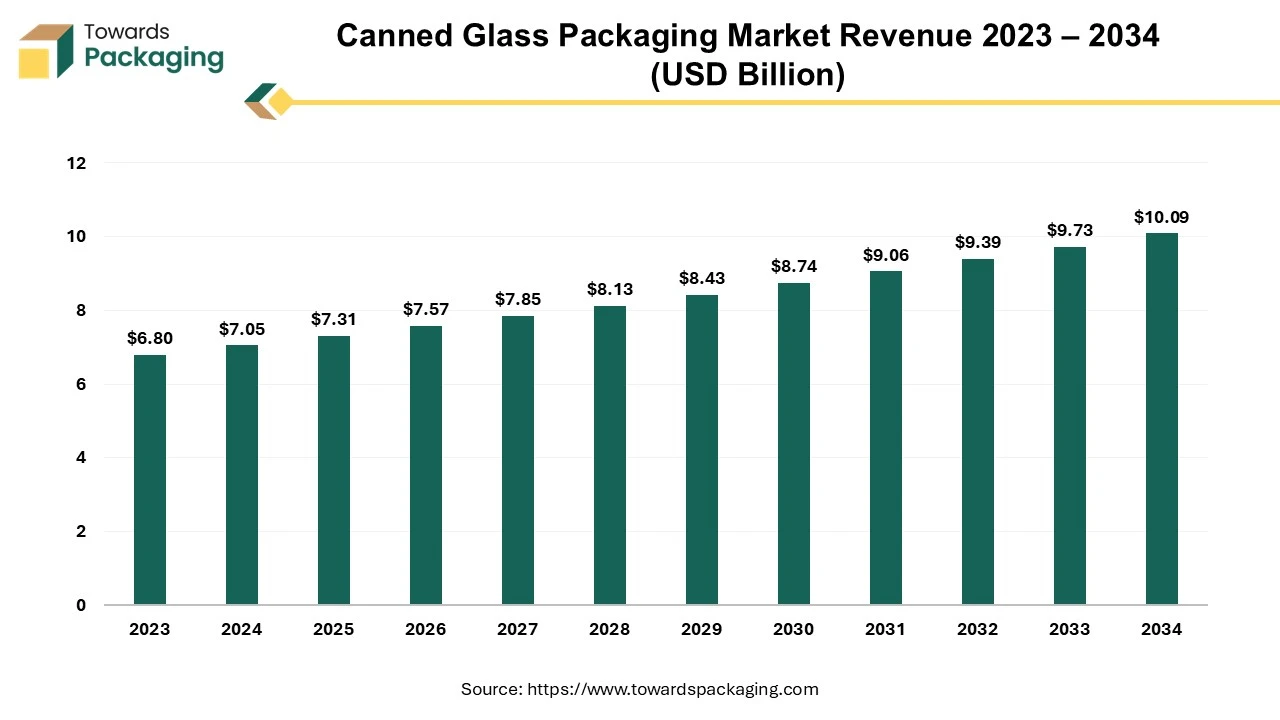

The canned glass packaging market is projected to reach USD 10.09 billion by 2034, growing from USD 7.31 billion in 2025, at a CAGR of 3.65% during the forecast period from 2025 to 2034.

The market is proliferating due to the increasing demand for packed pickles, milk, jam, and various such food and beverages industry, and pharmaceutical industries which demand safe and contamination-free packaging of drugs and vaccines. This eco-friendly and safe packaging demand in several industries significantly drives the canned glass packaging market.

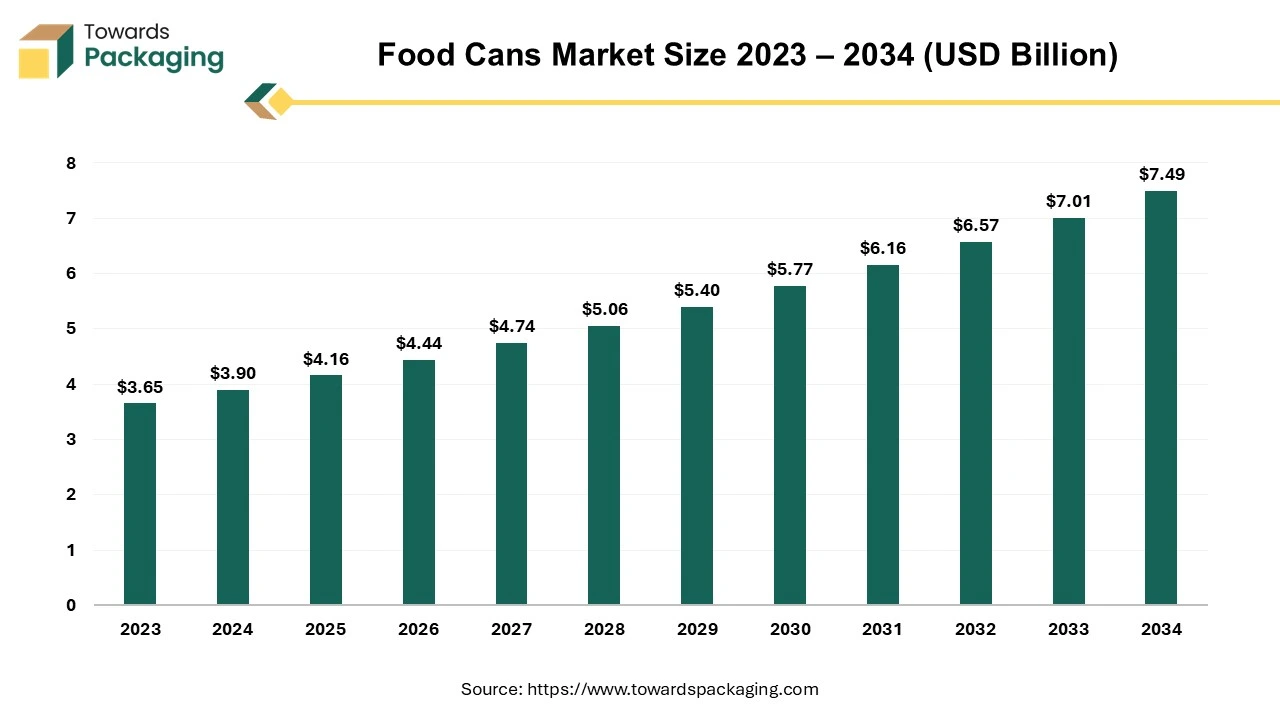

The global food cans market is poised for steady growth, expected to increase from USD 4.16 billion in 2025 to USD 7.49 billion by 2034, expanding at a CAGR of 6.75% during the forecast period.

The food cans market is growing significantly due to the rising demand for the consumption of packed food items due to a continuously changing lifestyle. There is a huge variety of food cans available to keep the food quality fresh and harmless to consume which enhances the development of the market. The growing demand for ready-to-eat food has influenced the food cans industry profoundly.

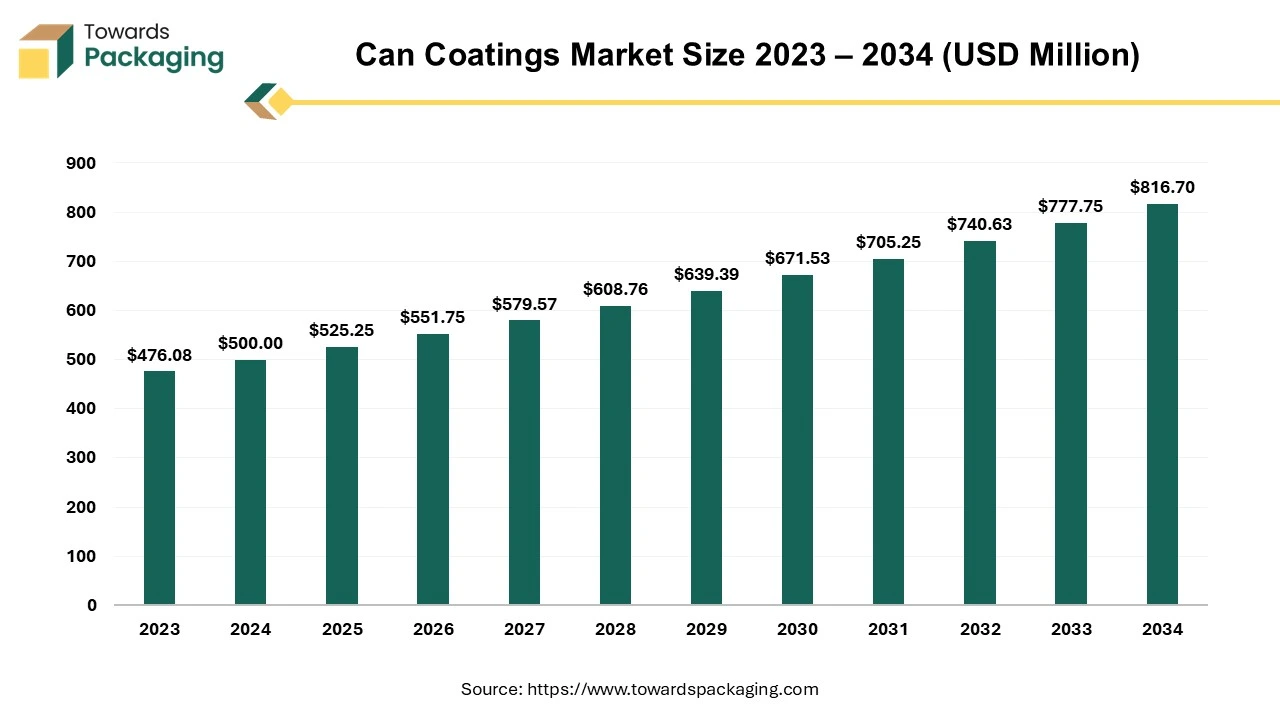

The global can coatings market size was evaluated at US$ 500.00 billion in 2024 and is expected to attain around US$ 816.70 billion by 2034, growing at a CAGR of 5.05% from 2025 to 2034.

The can coatings market is playing a significant role in the packaging industry majorly in the food & beverage industry due to safety as well as convenience. These are widely used for the preservation of food products. Can coatings are majorly used in the packaging of food products in schools, supermarkets, hospitals, and kitchens. The rising trend for canned food in the ready-to-eat food products section is driving the market to grow rapidly. Growing demand for the consumption of healthy food products in changing lifestyles has compelled market players to bring innovation to the can coatings market.

By Material

By Type

By Application

By Region

January 2026

January 2026

January 2026

January 2026