April 2025

The global bottled water packaging market size was valued at USD 106.68 billion in 2023 and is projected to reach USD 222.25 billion by 2034, registering a CAGR of 6.9% from 2024 to 2034. The market growth is attributed to the growing awareness of the importance of hydration for well-being and health and the increasingly popular choice among consumers with busy lifestyles.

Bottled water is packaged in an extensive variety of containers, such as cartons, bags, cans, glass bottles, and several kinds of plastic bottles. These are mostly single-use items that usually have a capacity of one litre or less. The earliest known cases of water bottling at the Holy Well took place early in the history of the United Kingdom, where this business originated.

The global bottled water industry is expanding rapidly with an estimated 600 million households purchasing bottled water by 2022. That's almost 446 billion litres of water each year, or one million bottles per minute. A major factor contributing to the increase in demand for bottled water is the renewed interest that European and American colonists have shown in spa culture and water therapy. Bottled water has changed significantly throughout the ages, with packaging and flavour profiles changing as a consequence of changes in consumer preferences and brand dynamics.

Today, bottled water firms place a high value on product packaging, recognising its important role in protecting customer health and safety while reducing environmental impact. The materials chosen are carefully considered, with an emphasis on those that provide strong protection without sacrificing sustainability.

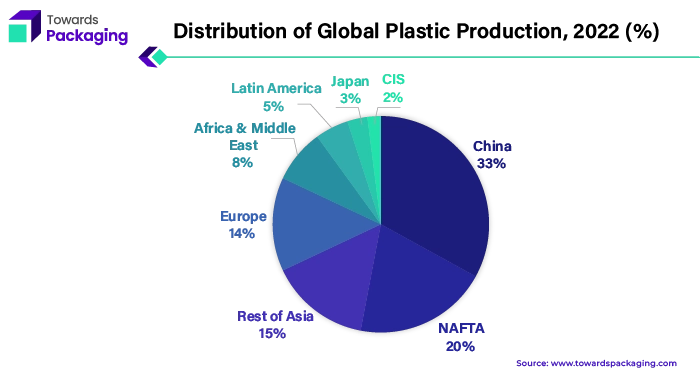

Plastic is still a widely used material for packaging since it is strong, lightweight, and recyclable. In contrast to popular belief, all plastic bottles used for bottled water—including the caps—are recyclable. Furthermore, plastic containers usually need less energy during the manufacture, shipping, and recycling processes as compared to other materials like aluminium, cartons, and glass, which increases their attractiveness from an environmental perspective.

The bottled water packaging industry has evolved significantly since it first emerged, driven by changes in customer tastes, technical improvements, and environmental concerns. Today, companies working in this industry prioritise sustainability and customer safety, which influences their packaging material and design choices.

For Instance,

Increasing Demand for Clean Drinking Water

For instance, in October 2023, the first bottled water in the United States, Chlorophyll Water to pass the strict Clean Label Project certification requirements has transitioned to bottles made from 100% recycled plastic (rPET) with CleanFlake technology. These bottles are 100% rPET and crafted from food-grade recycled polyethylene terephthalate.

With sustainability representing a global trend, the major trend in the bottled water packaging industry is a preference towards more climate-conscious packaging. That means moving away from bottles and towards cans, for many bottled water producers. 60% of customers agreed that plastic bottles are the least environmentally friendly drink packaging, in the UK. It appears that bottled water producers are moving away from plastic bottles in a bid to capture a sustainable market, with around half of British consumers finding sustainable packaging to be an important part of drink packaging design. In addition, sustainability has pushed brands to move towards less plastic packaging, in recent years.

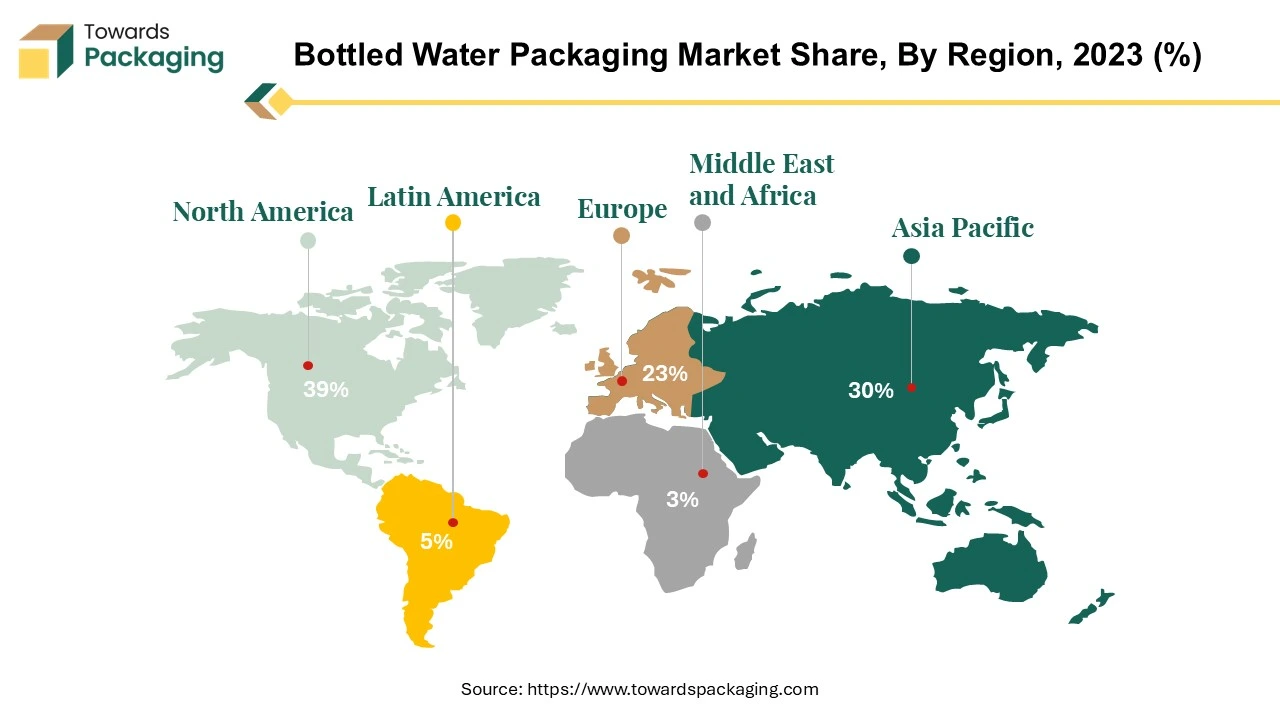

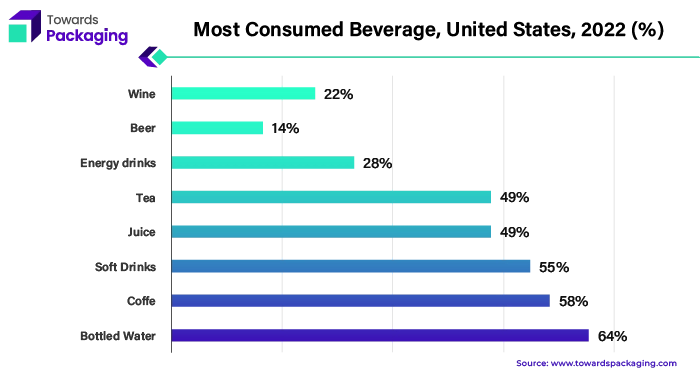

North America dominated the bottled water packaging market in 2024. North America presently has a significant share for bottled water packaging. There has been a noticeable trend in consumer tastes towards healthier beverage alternatives, with bottled water being seen as a superior option to sugary drinks or even tap water in some areas owing to water quality problems. Particularly in North America, where busy schedules and on-the-go drinking are standard, the convenience element linked to bottled water has contributed to its appeal. A key factor in the domination of the bottled water business in the area is the well-established infrastructure for beverage production, distribution, and retailing.

Bottled water products are widely available across a variety of channels because to U.S. excellent production capabilities, vast distribution networks, and strong retail environment.

Water generates a substantial amount of money. In 2022, the United States consumed 15.9 billion gallons of bottled water, generating a $94 billion sales in America. a number that stands out in comparison to hundreds of billions of gallons of tap water, that is a sizable market share for a product that is $10,000 more expensive than its equivalent in municipal settings. Bottled water companies have effectively leveraged consumer trends through their marketing and advertising campaigns, promoting the health advantages, convenience, and purity of their goods. Customers in North America responded effectively to these efforts, which has increased demand for bottled water packaging. Multiple variables contribute to the North American bottled water packaging market's continuous growth.

The preference for bottled water over other beverage alternatives is increasing as customers become more aware of their health and well-being. Environmental sustainability concerns have prompted innovation in packaging materials, with companies exploring into sustainable substitutes for conventional plastic bottles.

The region's market is expanding primarily to new trends including premiumization, increased hydration products, and waters with flavours and functions. These product developments broaden the range of bottled water alternatives available on the market and satisfy changing customer preferences. The combination of shifting consumer preferences, robust infrastructure, effective marketing strategies, and product innovation positions North America as a key player in the bottled water packaging market, with continued growth expected in the coming years.

Asia Pacific is expected to grow fastest during the forecast period. The Asia-Pacific area consumes the most bottled water, closely followed by North America. The lack of a dependable public water supply and water management infrastructure is a significant contributor to the increase in demand for bottled water packaging in many low- and middle-income nations, specifically in the Global South. This circumstance highlights governments' persistent inability to follow through on their promises to provide public water systems that are both accessible and safe. An indirectly indication of systemic problems in assuring access to clean and safe drinking water in these regions is the growing usage of bottled water packaging.

| Bottled Water Sales, China, 2022-2023 (In Million litres) | ||

| Category | 2022 | 2023 |

| Carbonated Water | 83.9 | 85.8 |

| Bottled Still Water | 52,045.90 | 54,841.60 |

| Functional Bottled Water | 50,598.80 | 53,365.90 |

China is the largest market for bottled water packaging, accounting for around 25% of global consumption. The Chinese population has grown increasingly sceptical about the quality of tap water, concerned about potential health risks linked with its consumption. This raised concern has spurred customers' willingness to pay extra for mineral water, specifically types with high mineral concentrations, fuelling demand in the bottled water packaging industry.

For Instance,

India has emerged as a significant participant in the bottled water industry, ranking as the 12th largest consumer by value and 14th by volume. The Indian market for bottled mineral water has grown at an average pace of 27% per year, replicating South Korea's 28%. Mineral water derived from subterranean reservoirs is one of the most popular varieties of bottled water due to the required health advantages connected with its mineral content. Treated water, which goes through stringent treatment and disinfection operations before consumption, is nevertheless popular, particularly in developing countries like India, where it dominates the market in terms of volume.

For Instance,

A number of factors, including health concerns, the lack of dependable public water infrastructure, and tap water quality concerns, are driving the bottled water packaging market in the Asia-Pacific region. These factors also shape consumer preferences and fuel demand for bottled water packaging across a range of segments.

Plastic is the most used packaging material which has the increasing demand around the globe. Plastic bottles are the most widely used packaging material in the bottled water industry and are widely employed in a variety of other applications. Bottled water containers are mostly made of three types of plastic: polyethylene terephthalate (PET), polycarbonate (PC), and high-density polyethylene (HDPE). The majority, made up of 78.8% PET, 12% PC, and 9.2% HDPE, are the next three materials.

Plastics can become hazardous because they may penetrate the body's cells and tissues as they break down into smaller particles known as microplastics or even nano plastics during time. Some bottled water containers made of recyclable, reusable, and BPA-free polymers, such as PET, have been approved for use as food packaging and are in widespread usage. As a result, not all plastic bottled water containers are harmful.

Using BPA-free, recyclable, biodegradable polymers like PET is becoming more popular as a solution to environmental and health issues. Premium bottled waters can also be packaged in glass, which has the advantages of being recyclable, long-lasting, and impermeable.

Bottled water packaging is fully recyclable, and reputable recycling providers make guarantees that the right materials are collected, separated, processed, and used again. Recycling programmes generally accept PET, PC, and HDPE containers since many plastics may be recycled more than once. PET bottled water container recycling rates in the US are higher than PET bottle recycling rates overall, at 33.4%. Positive recycling rate of bottled water packaging has increased the sales of bottled water packaging around the globe.

For Instance,

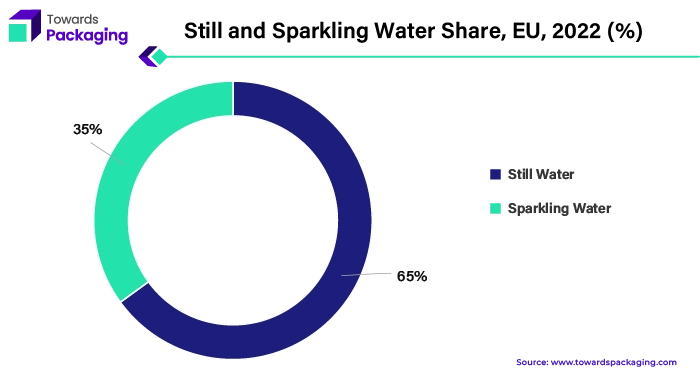

The market for beverage packaging still includes bottled water packaging, which is seeing steady demand increase in a number of countries. Still bottled water is a popular choice among customers worldwide because of its mobility, convenience, and supposed health benefits. The market for packaging for still bottled water has grown significantly in recent years for a number of reasons. Customers choose bottled water as a dependable and practical source of hydration due to growing worries about water quality and safety as well as an increased understanding of the benefits of being hydrated for general health.

The need for still bottled water packaging is further fueled by changes in lifestyle, urbanisation, and on-the-go consumption patterns. Customers look for hydration options that are quick and simple to obtain, particularly in areas where access to safe drinking water may be inconsistent or restricted. The increased demand for still bottled water packaging is a result of marketing campaigns highlighting the purity, freshness, and mineral content of bottled water brands. The desire of customers to spend more for specialised or high-quality bottled water goods, or premiumization tendencies, is another factor propelling market expansion.

When compared to sparkling water bottles, the still bottled water packaging industry in Europe is still growing due to changing consumer tastes, rising health awareness, and the ease of using bottled water as a hydration choice. Demand for bottled water is rising quickly on a global scale.

For Instance,

Bottled water producers sell their goods to different stores so that customers can purchase them through the retail shops distribution channel. A number of important parties are involved in this distribution chain, including wholesalers, retailers, distributors, and manufacturers. Bottled water producers use a variety of packaging materials, such glass or plastic bottles, to create and package their goods. After being packaged, the bottled water is given to distributors or wholesalers, who then provide the goods to retail establishments. The distribution of bottled water to customers is greatly aided by retail establishments such as supermarkets, convenience stores, petrol stations and specialised beverage shops. Accommodate a wide range of customer preferences, these businesses carry and display bottled water in a variety of brands and sizes.

Customers choose the brands, prices, container sizes, and conveniences to consider while visiting retail outlets to buy bottled water. In order to draw customers and increase sales of bottled water, retailers frequently use promotional techniques including discounts, special offers, and product placement methods. A broad variety of bottled water products are easily accessible in a variety of retail settings to the distribution channel of retail stores, which acts as a crucial bridge between bottled water producers and customers.

For Instance,

The competitive landscape of the bottled water packaging market is dominated by established industry giants such as Bisleri, Aquafina, Aim Technologies, Danone, The Coca-Cola Company, FIJI Water, Nestlé, Hangzhou Wahaha Group, Nongfu Spring Co Ltd, Plastipak Holdings, Sidel International, and Ball Corporation. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

India's popular brand Bisleri has been concentrating on growing both its product line and its market share. The firm has recently adopted innovative packaging types, such tetra packs and environmentally friendly bottles manufactured from recycled plastic. Bisleri has further demonstrated its dedication to sustainability by encouraging responsible plastic use and putting conservation efforts into action.

For Instance,

PepsiCo owns Aquafina, which has been using its extensive distribution network and high brand awareness to hold onto its market share in the bottled water industry. To lessen its influence on the environment, the firm has launched innovations including lightweight packaging. It has also increased the variety of products it offers by adding flavoured and improved water types. In order to stand out from rivals and highlight the health advantages of hydration, Aquafina has also invested in marketing initiatives.

For Instance,

FIJI Water has established a premium bottled water brand identity by highlighting the source of its water naturally occurring artesian aquifer in Fiji. The company's marketing plan emphasises how pure and distinctively mineral-rich their water is. Aside from introducing sustainable packaging measures, FIJI Water has also reduced plastic waste and used recycled materials in its packaging.

For Instance,

Nestlé has been supporting recycling programmes and investing in environmentally friendly packaging solutions through brands like Nestlé Pure Life and Perrier. The firm has expanded its product line to include flavoured and functional waters in addition to introducing lightweight bottles and environmentally friendly packaging alternatives. Nestlé Waters has also been concentrating on improving its e-commerce and digital marketing skills.

For Instance,

Bottled water packaging leading market players are Bisleri, Aquafina, Aim Technologies, Danone, The Coca-Cola Company, FIJI Water, Nestlé, Hangzhou Wahaha Group, Nongfu Spring Co Ltd, Plastipak Holdings, Sidel International, and Ball Corporation.

By Material

By Product Type

By Distribution Channel

By Region

April 2025

April 2025

April 2025

April 2025