April 2025

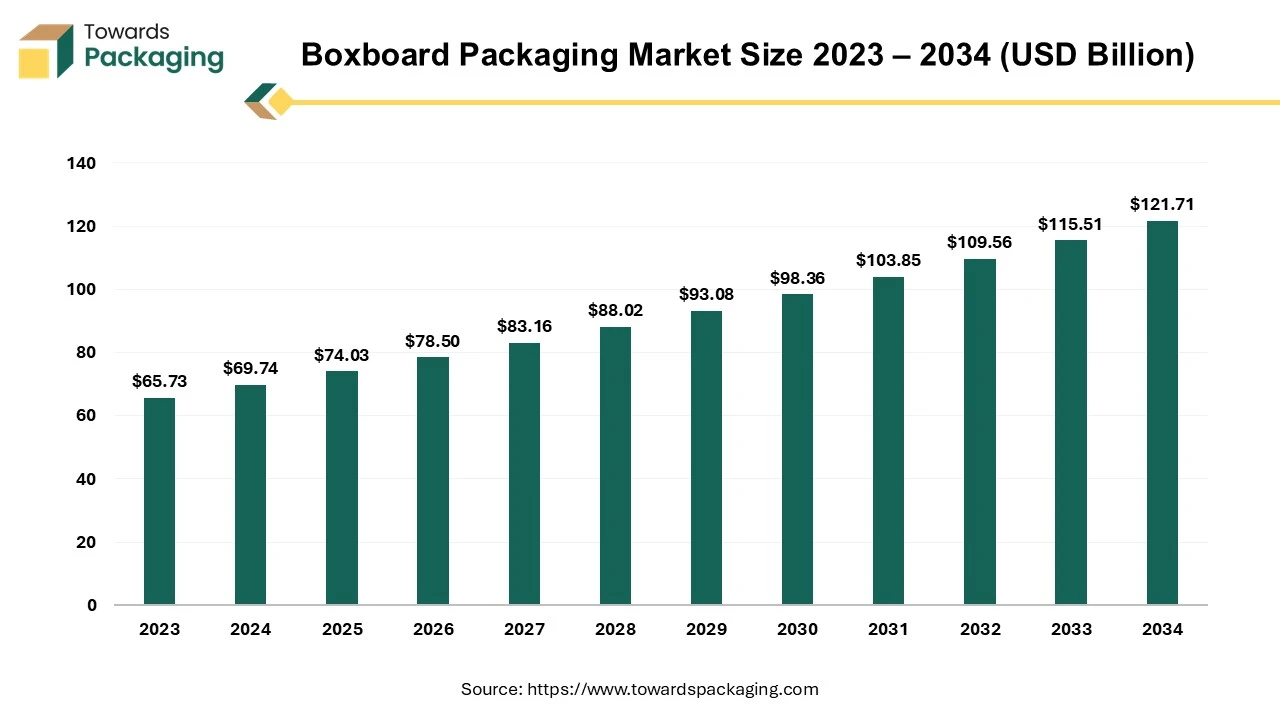

The boxboard packaging market is forecast to grow from USD 74.03 billion in 2025 to USD 121.71 billion by 2034, driven by a CAGR of 6.12% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The boxboard packaging market is likely to witness strong growth over the forecast period. The thin, lightweight carton known as boxboard is frequently used to transport a single item, like a toy, crackers, pair of shoes and luxury products, among others. Unlike corrugated boxes, it lacks the wavy corrugating medium intermediate layer. In addition, cardboard is utilized for the arts and crafts, displays, graphic board, partitions, cores and tubes for the gypsum wallboard items. When boxboard leaves the mill, it contains primarily recycled material and does not require strong paper fibers. It is constructed from a combination of used boxboard, used writing and printing paper, old newspapers, and corrugated boxes.

The increasing consumer preference for sustainable packaging and the rapid growth of the e-commerce sector are expected to augment the growth of the boxboard packaging market during the forecast period. Furthermore, the advancements in the printing technologies coupled with the food and beverage industry's focus on the eco-friendly and convenient packaging options are also likely to support the growth of the market. Additionally, the rise in urbanization and changing consumer lifestyles and expanding pharmaceutical and cosmetics industries as well as the government regulations and policies promoting sustainable packaging is also projected to contribute to the growth of the market in the years to come. The global packaging market size is growing at a 3.16% CAGR.

The increasing online retail is projected to support the growth of the boxboard packaging market during the forecast period. As per the data by the International Trade Administration, by 2027, it is projected that the worldwide B2C e-commerce revenue would reach USD$5.5 trillion, growing at a consistent 14.4% CAGR (compound annual growth rate). The consumer electronics segment is the leading segment followed by the fashion segment. This is owing to the increasing penetration of the internet and the widespread use of the smartphones.

According to the International Telecommunication Union, presently, almost 5.4 billion people, or roughly 67% of the world's population, use the internet. This is a rise from the 3.5% growth observed between 2021 and 2022 to 4.7% growth since 2022. In 2023, there was a 33% decline in the total number of people offline, with an expected 2.6 billion people living offline.

For customers around the globe, this has increased the accessibility and the convenience of online shopping. With only a few clicks, customers may now purchase whenever and wherever they choose, changing their expectations and tastes substantially. It is now essential to use packaging that can survive the rigorous conditions of the shipping and handling as online retail continues to grow at an unprecedented rate. Packaging for e-commerce needs to withstand several touch-points such as the warehouses, delivery vans and finally the customer doorsteps. Due to its strength, stiffness as well as the adaptability, boxboard is quickly taking the lead as the preferred material for e-commerce packaging. Its strong structure guarantees that products are protected against the damage during transit, reducing the likelihood of the returns and improving the customer satisfaction.

The growing environmental concerns and threat from substitute packaging materials is anticipated to hamper the growth of the boxboard packaging market within the estimated timeframe. As per the data by Eurostat, in the EU, paper and cardboard packaging waste accounted for 34.0 million tonnes (40.3%) in 2021 followed by plastic packaging waste with 16.1 million tonnes (19.0%) and glass packaging waste with 15.6 million tonnes (18.5%). Also, the energy required to make paper is considered to be three times higher than that of the plastic, while exact figures are unknown. Compared to plastic, it is also more difficult to carry. According to PAC Worldwide, a conventional corrugated package weighs 0.7 pounds whereas a bubble mailer weighs 0.05 pounds. This difference results in increased fuel expenses as well as the vehicle emissions.

Furthermore, flexible packaging and plastics has gained popularity. Due to its reduced weight and resource consumption, flexible packaging generates smaller amount of waste products with less energy consumption. Since it can be built on site using roll materials, it substantially decreases the transportation expenses. It appears to the customer to take up less room when empty.

Additionally, retailers and product brands are collaborating to switch to the bio-plastic packaging from traditional petroleum-based plastics to reduce their greenhouse gas emissions and achieve environmental goals. The significant competition from these alternatives are frequently viewed as more practical and cost-effective, increases pressure on the boxboard manufacturers to innovate and improve the functionality as well as appeal of their products to maintain market share in an increasingly competitive environment.

The increasing government initiatives and regulations towards sustainable options are expected to create opportunities for the growth of the boxboard packaging market in the near future. Many governments worldwide are implementing stringent regulations and policies aimed at reducing the environmental impact, particularly concerning the use of the non-recyclable and the single-use plastics. The implementation of sustainable packaging practices is greatly aided by the regulations. They act as rules and requirements that companies have to follow, which promotes the responsibility along with the transparency in the packaging industry.

For instance,

Due to this, companies are looking for packaging options that meet these regulations, which are growing the demand for the environmentally friendly substitutes like boxboard, which is often comprised of renewable materials and is recyclable.

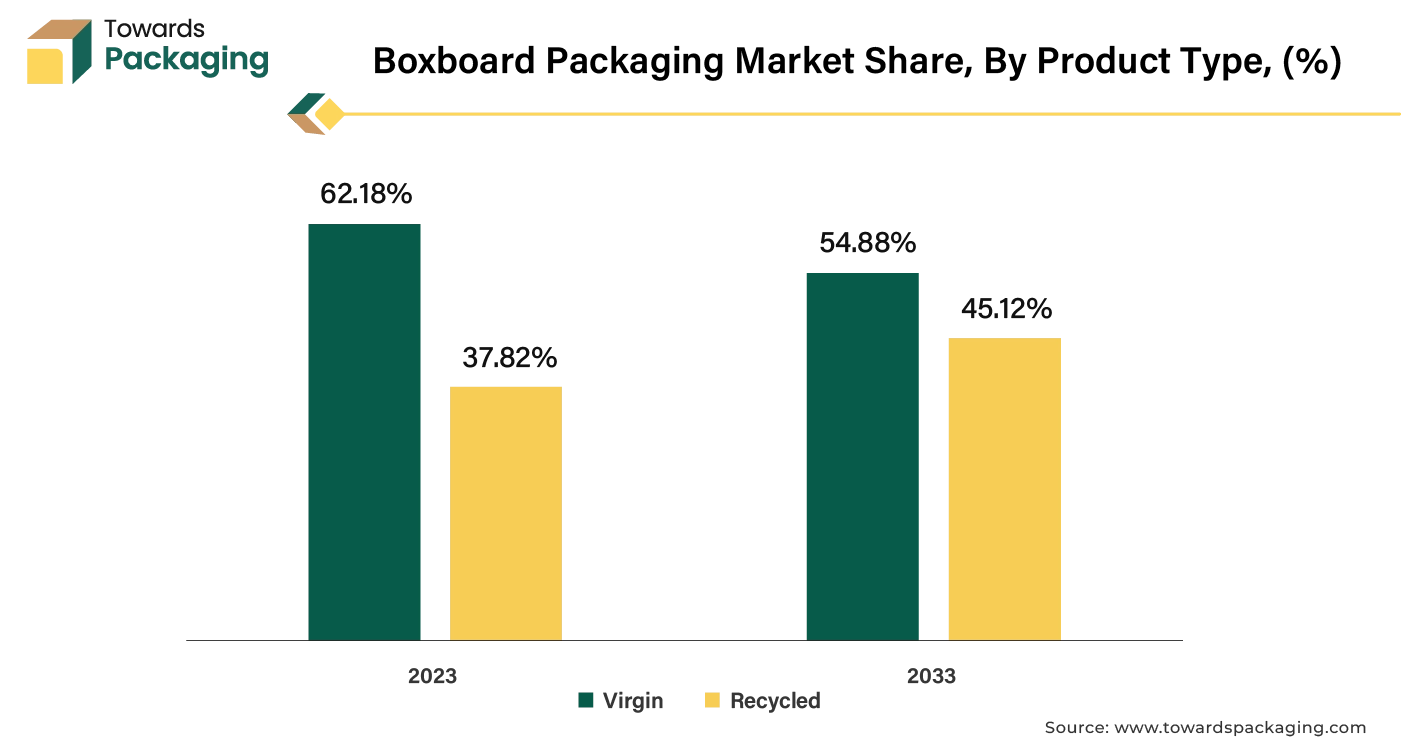

The virgin segment captured largest market share of 62.18% in 2023. Virgin fibers outlast their recycled counterparts in length and strength. They are therefore a better choice for bulky items or rough transit routes. Virgin boxboard is made from fresh, high-quality fibers, giving it the structural integrity needed to protect products, especially in sectors where packaging must endure rigorous handling and transport, such as the electronics and pharmaceuticals. Furthermore, virgin boxes provide better protection for goods kept in humid environments since they are more resilient to temperature fluctuations and dampness than recycled cardboard. After its initial usage, even virgin cardboard can be repurposed by the end consumer. Virgin fibers are undoubtedly better when it comes to of feel, look as well as functionality. These factors are likely to support the segmental growth of the market during the forecast period.

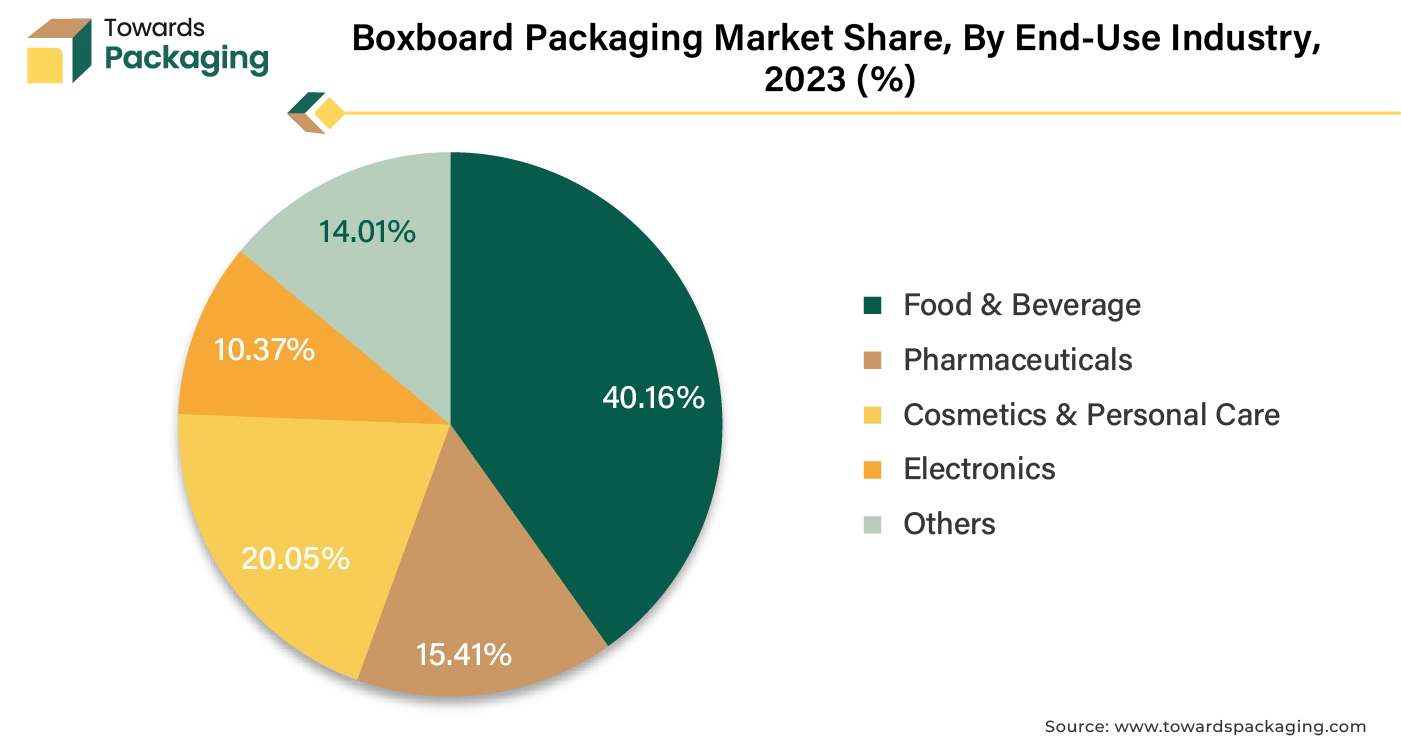

The food and beverage industry segment held largest market share of 40.16% in 2023. This is owing to the increasing demand for packaged and processed foods fueled by the rapid urbanization across the globe. Furthermore, the busy lifestyles, and a growing preference for convenience is also likely to support the growth of the segment in the years to come. The growing direct-to-consumer food delivery services and widespread use of mobile apps which has made ordering food online incredibly easy and accessible is also expected to contribute to the segmental growth of the market.

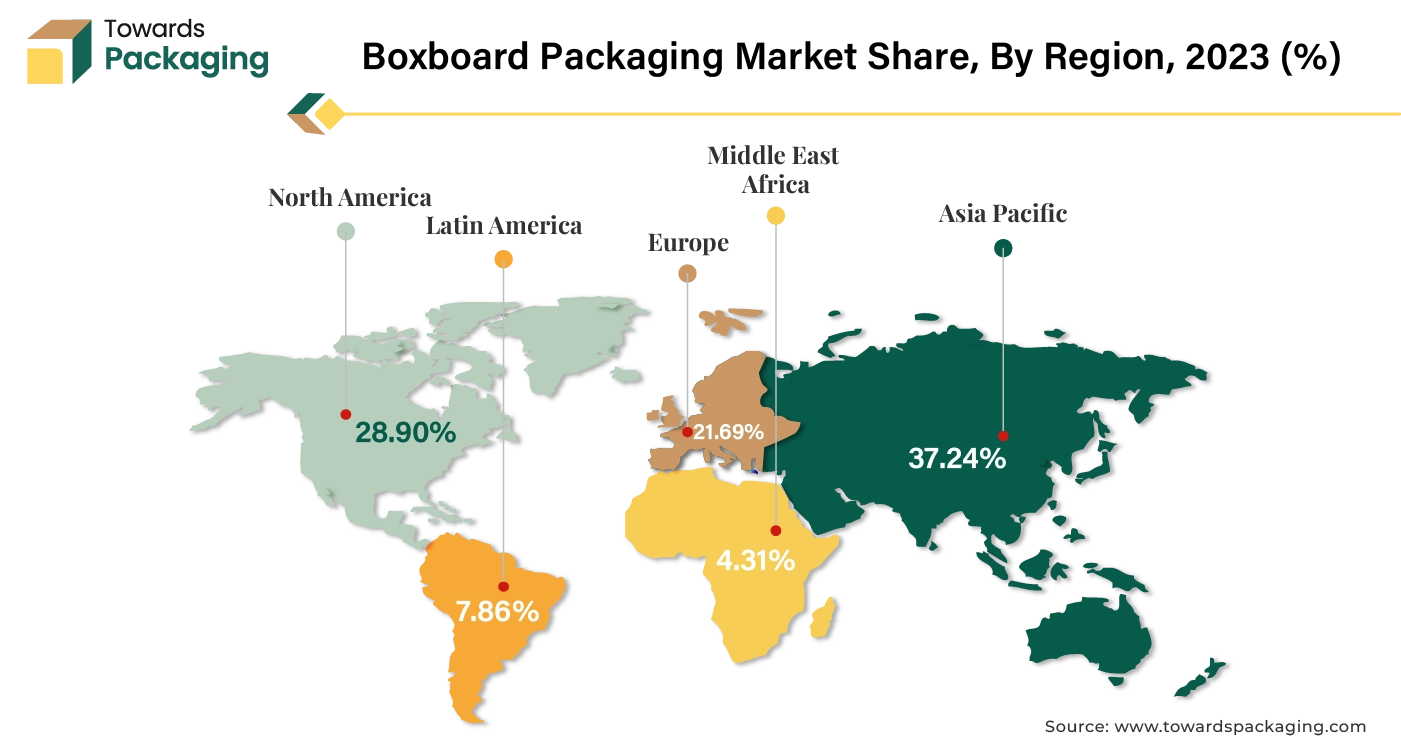

Asia Pacific held is likely to grow at fastest CAGR of 8.04% during the forecast period. This is owing to the rapid urbanization and economic expansion in countries like China, India, and Southeast Asian nations. As per the statistics by the United Nations, over 2.2 billion people, or 54% of the world's urban population, reside in Asia. Asia's urban population is predicted to increase by 50% by 2050, adding 1.2 billion new residents. Additionally, the increasing internet penetration, smartphone usage and a growing middle class along with the growth of the e-commerce industry are also anticipated to promote the growth of the market in the region in the years to come.

North America held considerable market share of 28.90% in 2023. This is due to the increasingly prioritizing sustainability which is driving the demand for eco-friendly packaging options across the region. Also, the stringent environmental regulations in the U.S. and Canada aimed at reducing the plastic waste and promoting recycling is further expected to support regional growth of the market in the years to come.

For instance,

By Material

By Product Type

By End-Use Industry

By Region

April 2025

April 2025

April 2025

April 2025