April 2025

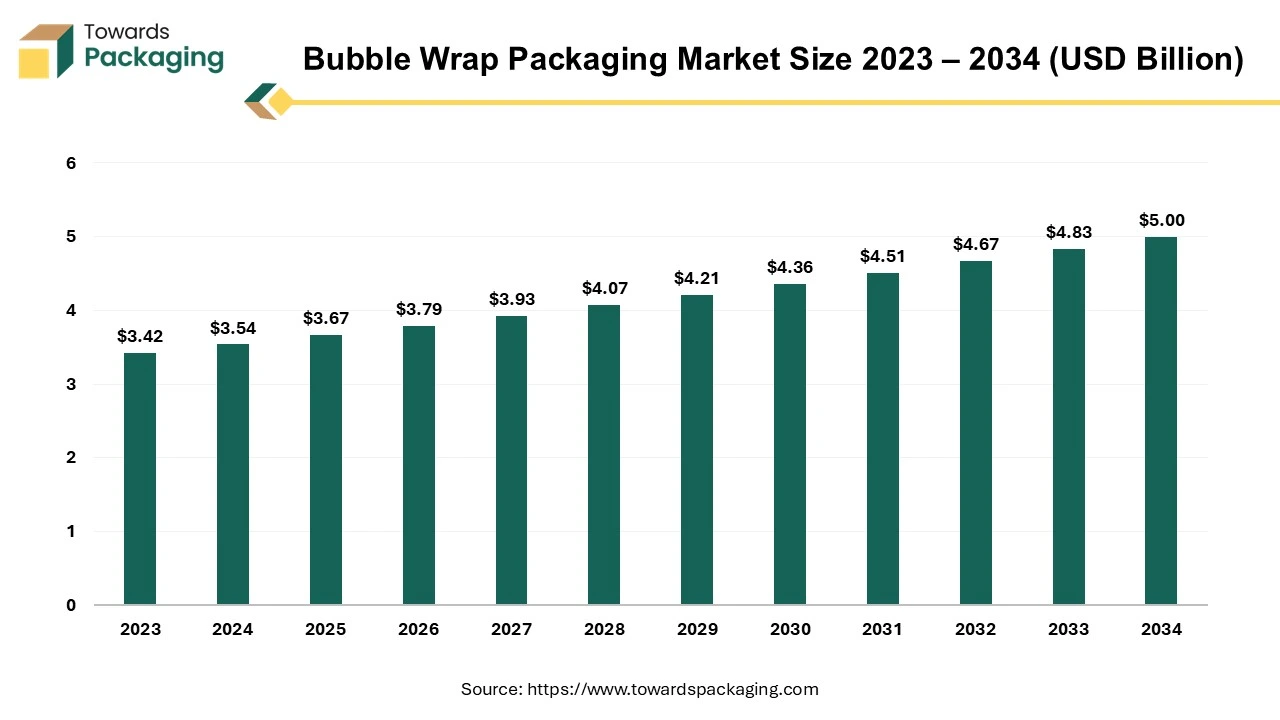

The global bubble wrap packaging market, valued at USD 3.54 billion in 2024, is anticipated to reach USD 5.00 billion by 2034, growing at a CAGR of 3.52% over the next decade.

The bubble wrap packaging market is set to grow prominently during the forecast period. One of the most often used forms of protective packaging is the innovative bubble wrap. As bubbles provide soft cushioning, including them in well-packaged objects is an easy and highly effective technique to safeguard items that are fragile during shipping, relocation, and storage. Bubble wrap is a very adaptable material that may be used to safeguard everything from huge, fragile things to smaller lightweight items. It comes in many sizes and varieties. Bubble wraps works well as an insulator in addition to being ideal for safeguarding objects. The use of bubble wrap as an insulator has various benefits. Moreover, bubble wrap can also be reused for multiple times, based upon its condition and the strength of the bubbles.

The surge in e-commerce activities and the increasing focus on consumer satisfaction in addition to the growing need for product protection is expected to augment the growth of the bubble wrap packaging market during the forecast period. Furthermore, the advancements in bubble wrap technology coupled with the rising awareness of sustainability are also likely to support the growth of the market. Additionally, growth in international trade and logistics as well as the growing demand from various end-users like manufacturing, retail, pharmaceuticals and electronics is also projected to contribute to the growth of the market in the years to come. The global packaging market size is growing at a 3.16% CAGR.

The growing e-commerce sale is likely to support the growth of the market during the forecast period. According to the latest data by Adobe Analytics, from January 2024 to April 2024, customers spent $331.6 billion on online shopping, a 7% increase YoY. Spending in segments like clothes and electronics has contributed to the surge. Adobe projects that over $500 billion in online spending is expected in the initial half of the 2024, indicating a 6.8% YoY growth. Consumers spent $61.8 billion on the electronics (up 3.1% YoY) along with $52.5 billion on the clothing (up 2.6% YoY) over the internet in the first four months of the year. The percentage of the cheapest products rose noticeably in a number of categories that include electronics (up 64%), clothing (up 47%), furniture and bedding (up 42%) and groceries (up 33%).

Additionally, as per the Prime day event data released by Adobe Analytics in July 2024, over the course of the two-day event, online sales for the electronics category increased by 61 percent. Products that have contributed to this increase include tablets (up 117 percent), fitness trackers (up 88 percent), smartphones (up 71 percent), laptops (up 80 percent) and cameras (up 60 percent), among other products. Bubble wrap provides delicate objects with impact-absorbing and damage-resistant protection. Bubble wrap is an essential component of the e-commerce packaging, much like packing paper. Additionally, the anti-static bubble wrap is made especially for packaging the electronic components and gadgets. Its air-filled bubbles protect the wrapped product from physical damage, while its anti-static characteristic protects its electronic products from any possible electrostatic discharge. Unlike normal bubble wrap, it does not generate the static electricity.

Polymer film made of plastic is used to make bubble wrap. This kind of plastic is renowned for its durability. However, it might take several centuries for it to decompose after disposal and it is poisonous as well as harmful to the environment. Hormone-disrupting substances and dangerous microplastics continue to infiltrate into the nearby land and water from these plastics. Earthday.org research indicates that about 380 million metric tons of plastic are produced year worldwide. Globally, only about 9% of this plastic is recycled, meaning that an astounding 91% of it ends up in landfills.

The utilization of the bubble wrap adds more plastic to the landfills and waterways along with other single-use plastic objects like straws, shopping bags and water bottles. This is an increasingly pressing problem. There is no way to recycle this kind of plastic. Even while it works well to keep things safe and undamaged, it is usually only reusable for a limited amount of time before being disposed of in a landfill or other disposal site. For this reason, it is an unsustainable method of product packaging.

Furthermore, the eco-friendly bubble wrap alternatives are also likely to hamper the growth of the market. For instance, one of the most extensively used recycled packaging materials is paper. Therefore, it makes perfect ecological sense to use recycled paper for the products packaging. There are lots of possibilities available. To package items safely, one can either repurpose any available paper source or invest in packaging made by corrugated paper which is 100% recyclable and reusable on its own and is frequently created from recycled materials. Also, the cornstarch-based bioplastics is a great, environmentally friendly substitute for bubble wrap. As it is entirely biodegradable and made from an organic, renewable source, it is becoming more and more popular across a wide range of companies.

Numerous sectors are placing a lot of effort into staying up to date with the newest trends as technology keeps developing. Packaging is one area where efforts toward making it safer, effective, and more sustainable are still being made. Nowadays, a lot of companies are using biodegradable bubble wrap to preserve their products while reducing the plastic waste. For instance, SoulTree announced that it will begin to utilize biodegradable bubble wrap for all online orders. The company is taking this action in an effort to become a more responsible and sustainable company in the long run. Biodegradable bubble wrap is manufactured with the use of the biodegradable substances. This shows that it can decompose spontaneously in a brief period of time and leave no toxic trace behind. This not only makes it a more environmentally friendly choice but it also guarantees that the shipments do not add to the large amount of the plastic waste that ends up in the oceans as well as the landfills. Although switching to biodegradable bubble wrap might seem like a little adjustment, it can have a significant environmental impact.

Also, the growing consumer and corporate demand for greener solutions is further presenting an opportunity for the market growth. Companies are investing in the development of the sustainable bubble wraps to differentiate them in a competitive market and reduce their carbon footprint.

For instance, in October 2022, a new line of protective packaging called Bubble Wrap was created by Sealed Air using either thirty percent or fifty percent recycled plastic waste. Both Bubble Wrap IB Recycled Content Films and Bubble Wrap brand AirCap LRT are manufactured with a minimum of 30% recycled plastic. A minimum of 50% recycled plastic is used in the production of the launched Bubble Wrap brand Fill-Air Extreme Efficiency Recycled Content Films. This comprises 20% Post Industrial Recycled content (PIR) and 30% third-party certified material that is gathered from post-consumer trash. Additionally, adopting these eco-friendly options help companies comply with the stringent environmental regulations as well as improve their brand reputation.

The bubble sheets segment captured largest market share of 61.73% in 2024. Bubble sheets are flexible plastic sheets with several little air pockets. The capacity of these bubble sheets to safeguard the goods during storage and transportation is one of its key benefits. As cushions, the air pockets disperse and absorb pressure to stop shock, impact and vibration damage. Additionally, as air bubble sheets are lightweight as well as adaptable enough to securely wrap and safeguard a wide range of products, including breakable ones such as glassware, electronics and furniture, they save money on shipping. The affordability of bubble sheets is another advantage. When compared to other materials, they are comparatively less expensive and need a smaller space in terms of storage and transportation than bulkier alternatives.

The e-commerce segment held largest market share in 2024. This is owing to the growth of online shopping with a significant increase in the volume of goods being shipped directly to consumers. Furthermore, the widespread availability of high-speed internet as well as the proliferation of smartphones have made online shopping more accessible to a broader audience which is also expected to support the segmental growth of the market. Additionally, modern consumers prefer the convenience of online shopping over the traditional brick-and-mortar stores. The ability to compare prices, read reviews and access a wide variety of the products from home has become a preferred shopping experience. As online retail continues to expand, the e-commerce sector's reliance on bubble wrap for its protective properties is also likely to increase during the forecast period.

Asia Pacific held largest market share of 36.25% in 2024. This is owing to the fastest-growing e-commerce segment across the region. According to the India Brand Equity Foundation, by 2034, the Indian e-commerce market is predicted to have surpassed the US to take the second place in the world, thereby continuing its upward growth trajectory. By 2030, the Indian e-commerce market is expected to have grown significantly and reach a valuation of US$ 300 billion. By 2028, it is expected that India's e-retail market would have grown to over US$ 160 billion. The market is anticipated to be worth US$ 57–60 billion in 2023, which is a substantial increase above earlier estimates. Additionally, the rising disposable incomes and improved living standards is also anticipated to promote the growth of the market in the region in the years to come.

North America is expected to grow at a substantial CAGR of 2.13% in 2024. This is due to the highly developed logistics and supply chain networks along with the efficient transportation and warehousing systems across the region. Also, the growing online shopping platforms and rise in e-commerce sales is further expected to support regional growth of the market in the years to come. Furthermore, the increasing awareness of environmental issues as well as the shift towards eco-friendly bubble wraps and the adoption of the recyclable material is also expected to support the regional growth of the market in the near future.

By Product Type

By End Use

By Region

April 2025

April 2025

April 2025

April 2025