Strategic Growth Outlook of E-Commerce Flexible Packaging Market Trends, Opportunities, and Sustainability Insights

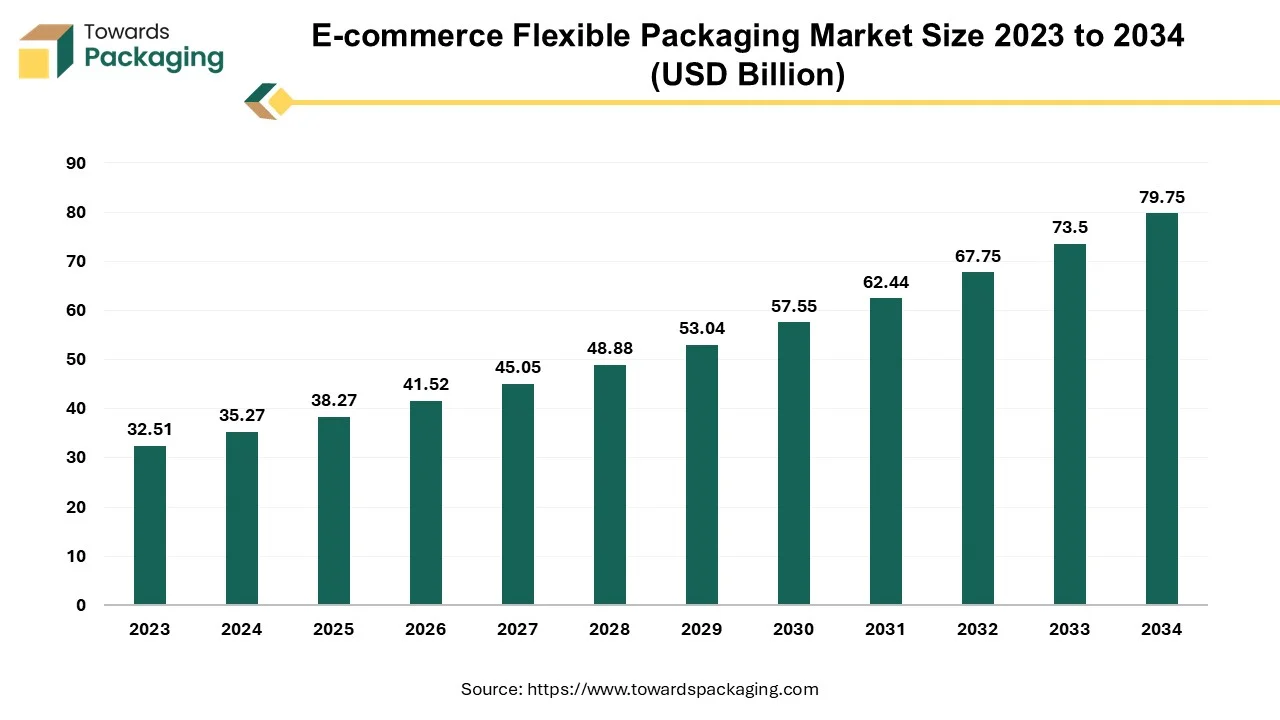

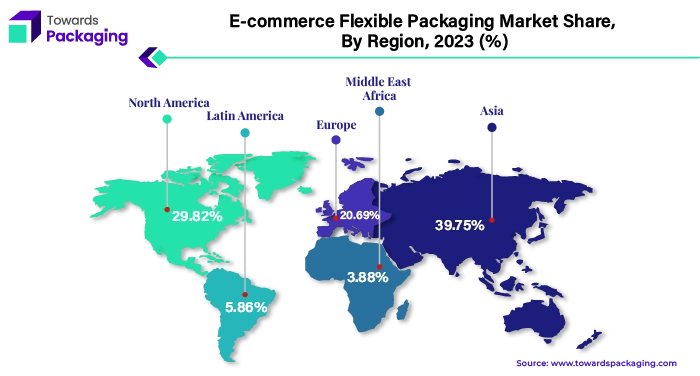

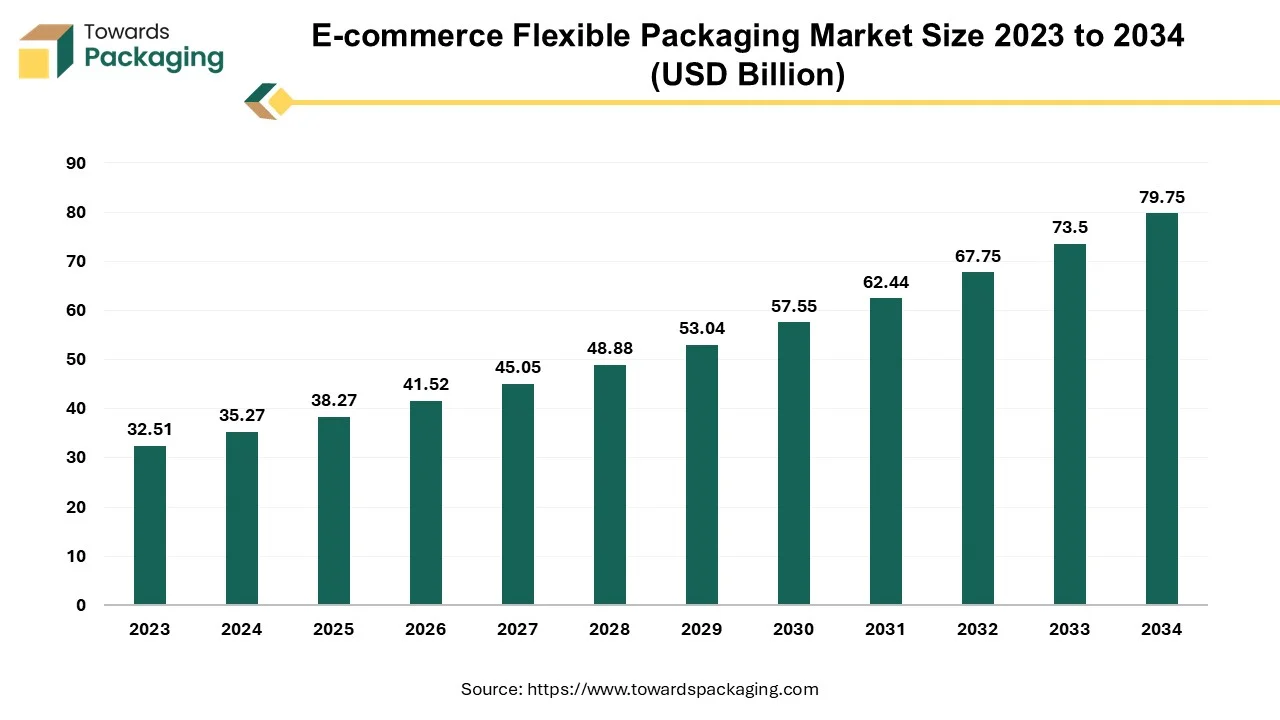

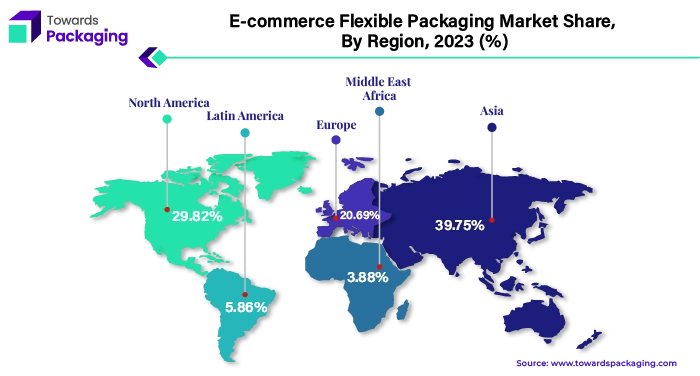

The e-commerce flexible packaging market is forecasted to expand from USD 41.52 billion in 2026 to USD 86.52 billion by 2035, growing at a CAGR of 8.50% from 2026 to 2035. This report provides an in-depth view of market segmentation by material (plastic, paper, metal), product type (pouches, bags, films, and others), and applications (electronics, apparel, food & beverages, personal care, and household goods). It also delivers a detailed regional breakdown across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, with Asia-Pacific holding a 39.75% share in 2024. The study includes a competitive landscape featuring top companies such as Amcor, Sealed Air, Berry Global, and Mondi Group, along with insights into trade flows, supplier networks, and value chain structure driving market profitability.

Flexible packaging is the rapidly growing sector of the global packaging industry and is one of the best solutions for the e-commerce applications. By using flexible packaging, retailers may accomplish e-commerce shipping that is affordable, effective, and lightweight. Flexible packaging typically uses less energy during production and transportation, produces less product waste, which lowers greenhouse gas emissions, and uses less landfill space. This is because flexible packaging makes it possible to use resources efficiently and hence widely adopted by the e-commerce sector. Thus, the e-commerce flexible packaging market is anticipated to witness significant growth during the forecast period.

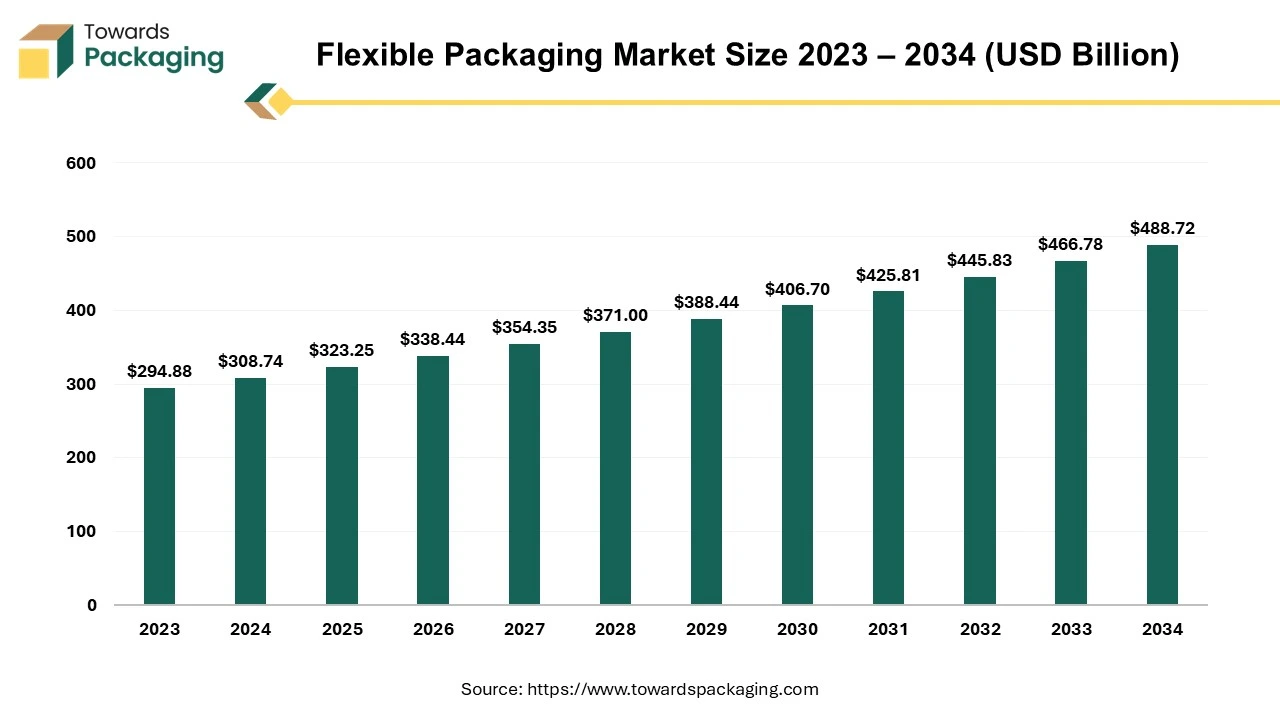

The growth of the e-commerce platforms coupled with the consumer demand for convenient and lightweight packaging as well as the increasing awareness of sustainability among consumers is anticipated to augment the growth of the market within the estimated timeframe. The market is further driven by the increasing investments by most of the key market players in the eco-friendly packaging methods to create sustainable use of plastics. The global packaging market size is growing at a 3.16% CAGR between 2025 and 2034. Growing research and innovation in the packaging industry to guarantee safety, hygiene along with integrity of the products is also likely to contribute to the growth of the market in the years to come.

Key Trends and Findings in the E-Commerce Flexible Packaging Market

- Nowadays, customers place significant importance on convenience while buying, thus the perfect e-commerce platform should make it simple and quick for the customers to find and get the items they require. The curbside delivery, home delivery and click-and-collect options can all help customers save time.

- Customers and commerce are more linked than ever. The increasing usage of the smartphones is opening up new channels for marketers to connect with customers. Mobile devices will account for over fifty percent of the e-commerce purchases in future.

- Social media has developed into a brand-new sector where customers can interact with the companies and find out about the new offerings. Voice commands can be used to place orders, track purchases as well as place orders automatically from the e-commerce sites with smart devices and apps.

- Currently, personalization has been one of the biggest trends. When customers have a designed shopping experience, they spend over 50% more. Online retailers have the ability to give the customized product recommendations and exclusive deals based on a customer's browsing history, past purchases, social media usage, personal information and ethnicity.

- Asia-Pacific held largest market share of 39.75% in 2024. This is owing to the economic development, rapid urbanization, increasing internet penetration and a thriving e-commerce sector in the region.

- The North America region is expected to grow at a CAGR of 7.95% during the forecast period owing to the presence of major key players as well as the high consumer demand for convenience and stringent sustainability regulations.

Market Drivers

Global E-Commerce Expansion

The increasing popularity of e-commerce among consumers has led to a gradual but continuous shift towards the online purchasing platforms. The epidemic augmented the growth of e-commerce, necessitating practical distribution methods, as digital customers adopted online channels for purchasing products. More and more packaged goods and the groceries that were traditionally purchased personally were being shipped straight to the customers.

Furthermore, the major retailers are focusing more and more on their digital marketing approach in an effort to profit from the clear advantages of online platforms such as increased reach, constant availability and customization. Major companies in this market state that mobile apps account for over 50% of their total income. Also, according to the data by Adobe, online spending by Americans from January 1 to April 30, 2024, was $331.6 billion, an increase of 7% YoY. This is owing to the steady spending in the premium areas like electronics and fashion as well as continued increase in the online grocery shopping. Cosmetics are another growing online segment which generated $35 billion in online spending in 2023, growing at 15.6% YoY. Customers continue to maintain the upward trend, spending $13.2 billion (up 8% YoY) on cosmetics online so far in 2024.

This data indicates consumer’s inclination towards online shopping for its convenience, variety, better prices and direct shipping to homes. This shift necessitates packaging that is not only protective but also lightweight, cost-effective and environmentally friendly. These requirements are completely met by flexible packaging options that have many benefits over the conventional packaging. Due to its lightweight design, shipping costs are greatly reduced, which is essential for e-commerce companies who are running on limited profit margins. Additionally, flexible packaging can be designed to fit products snugly, reducing the need for excess materials and minimizing waste.

Market Restraints

E-Commerce Growth: Balancing Market Expansion with Sustainable Packaging Solutions

The rise in production of plastic packaging waste is likely to limit the growth of the market during the forecast period. As it's convenient and easy, online shopping has grown in popularity in the recent years. But the packaging that is been used for shipping of the products have considerably negative impact on the environment. Amazon alone generated around 465 million pounds of waste from the plastic packaging in 2019, based on a report by the Oceana. Included in this waste are the bubble wraps, air pillows and other types of plastic packing materials added to the almost 7 billion Amazon parcels that were shipped in 2019.

Furthermore, plastic packaging frequently ends up contaminating the oceans and damaging marine life since it requires numerous years to break down. A garbage truck load of plastic debris is dumped into the ocean every minute, as per the United Nations, which estimates more than 8 million metric tons of garbage made of plastic end up in the oceans annually.

Online shopping package waste has another drawback that it is frequently not reused or recycled. As per Ellen MacArthur Foundation report, only 14% of the plastic that is used worldwide is gathered for reuse and recycling purpose, with very less being recycled. The remaining waste ends up in the environment or landfills, where it may take countless years for the materials to decompose and release the toxic chemicals. It is remarkable how much garbage is produced by e-commerce packaging. In addition to consuming valuable landfill space, this waste damages the environment and generates greenhouse gas emissions. Therefore, improved waste management practices are essential to balance the demand for flexible packaging.

Market Opportunities

E-Commerce Sustainability: Transitioning to a Circular Economy for Competitive Advantage

Reducing environmental impact is very important to distributors, manufacturers, retailers and suppliers. This is influenced by the implementation of laws and regulations from the government as well as pressure from stakeholders and customers. Companies will gain significant advantages from more exposure and openness regarding their environmental actions. The majority of firms have made it public that they are striving toward having all of their packaging recyclable. Numerous firms are also developing refillable and reusable systems. Lastly, in order to decrease the demand for additional virgin materials, the full supply chain is eager to witness more post-consumer recycled content (PCR) employed in packaging.

- In May 2024, At Chinaplas 2024, Dow revealed new collaboration with Sealed Air to create products that satisfy the needs of performance and circularity. Sealed Air and Dow jointly launched a line of e-commerce packaging that contains more recycled materials. Through the collaboration, both the companies will use Dow's REVOLOOPTM post-consumer recycled (PCR) resins to create better e-commerce packaging, providing a practical means of protecting goods as well as lowering the carbon footprint by utilizing fewer virgin plastics.

- In June 2023, Amazon and the Ellen MacArthur Foundation announced expansion of their partnership to promote scalable options for a circular economy industry-wide. A circular economy is essential to achieving this objective and is being prioritized in every aspect of Amazon's operations, including data centers, packaging and products. Certifications for goods having circular features will be a major area of concentration for this partnership. Giving clients the knowledge they need to make more circular decisions is the aim of these certifications.

The shift towards the circular economy offers the market a pathway to sustainability. This transition not only benefits the environment but also improves the brand reputation and adheres with the regulations and standards favoring the sustainable practices.

Key Segment Analysis

Dominance of Plastic in Sustainable Packaging Solutions

The plastic segment captured largest market share of 64.31% in 2024. Plastic is the most widely used material owing to the several advantages it offers in packaging. Compared to the other materials, plastics use less energy, which lowers energy expenditures and the corresponding emissions of pollutants. This material has a wide range of performance characteristics and it can be easily molded into any desired shape. Furthermore, packaging made from the plastic is lightweight and takes up less space as compared to the other alternatives, resulting in smaller weights on the flights and trucks and hence less pollution. Also, as plastic packaging is capable of being recycled again to make new products, the recycling rates and the variety of plastics that can be recycled have been increasing globally.

Application Segment Analysis Preview: The Surge of Apparels & Accessories in E-Commerce

The apparels and accessories segment captured a significant market share of 27.12% in 2024. Customers are now more at ease using their laptops and smartphones to make purchases of clothing. For a long time, customers were cautious about ordering the clothes online, but now that online merchants have reduced the risk with their generous return, refund procedures and active utilization of free delivery, they are beginning to feel more at ease about it.

Furthermore, online shopping platforms offer a broad range of options, enabling customers to peruse numerous high-end clothing designers and collections. Due to this accessibility, consumer behavior has significantly changed, with an increasing number of consumers choosing to purchase online for their fashion requirements. Additionally, the emergence of augmented reality has offered consumers with further interactive shopping experience and hence they can try on the clothes virtually now. These factors are likely to support segmental growth of the market within the estimated timeframe.

E-commerce Flexible Packaging Regional Insights

Asia Pacific held largest market share of 39.75% in 2024 and is expected to grow at a fastest CAGR of 10.28% during the forecast period. China is the largest market in the region. According to the National Bureau of Statistics of China, in 2023, the total value of online retail sales in the country was USD 2,163.51 billion (15,426.4 billion Yuan), representing an increase of 11.0 percent as compared to the previous year. Of these, the value of online retail sales of physical products was USD 1,825.65 billion (13,017.4 billion Yuan), representing an 8.4 percent increase and contributing to 27.6 percent of all consumer goods retail sales. This is owing to the rapid urbanization along with rising middle class population across the region.

Additionally, the changing lifestyles of the people and increasing smartphone and internet usage is also projected to contribute to the growth of the market across the region. Furthermore, increased preference for packaging options that are lightweight, recyclable and minimize waste is likely to support the regional growth of the market.

North America held considerable market shares of 29.82% in 2024. This is due to the wide range of product choices and reliable logistics networks across the region. Also, the strong consumer and regulatory push towards sustainable packaging are further expected to drive the demand for labels in the years to come. Furthermore, the advancements in barrier films and adoption of new printing technologies and smart packaging solutions are also expected to support the regional growth of the market in the near future.

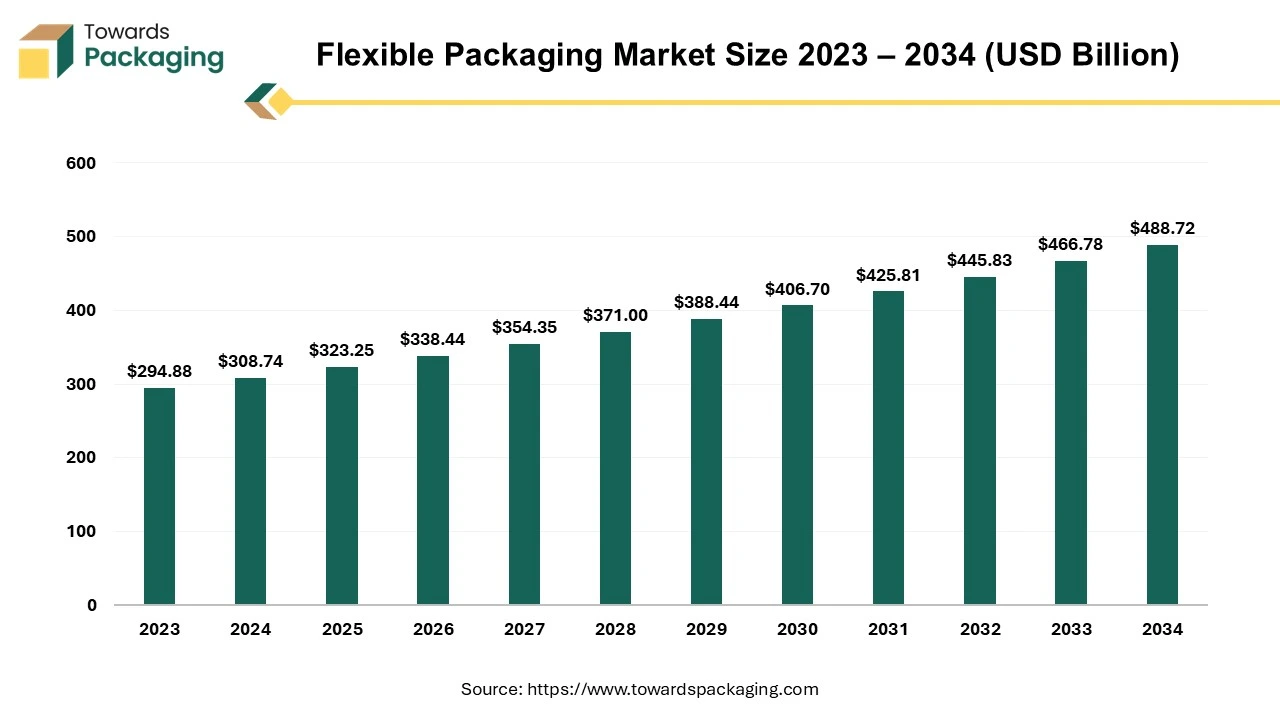

Flexible Packaging Market

The flexible packaging market is expected to increase from USD 323.25 billion in 2025 to USD 488.72 billion by 2034, growing at a CAGR of 4.7% throughout the forecast period from 2025 to 2034. The shift in consumer behavior toward convenience, coupled with regulatory pressure for eco-friendly solutions, has accelerated market adoption across industries.

The packaging type in which packaging materials is used which can easily change shape, typically manufactured from paper, plastic, foil, or a combination of these. Unlike rigid packaging such metal cans or glass jars, bottles, flexible packaging is lightweight, durable adaptable to various product types. The common types of flexible packaging are bags, pouches, sachets, and wraps & films. The flexible packaging is lightweight, cost effective, has extended shelf-life, sustainable option and convenience features. The flexible packaging is extensively utilized for personal care, pharmaceuticals, industrial applications and food & beverages.

Recent Developments by Key Market Players

- April, 2024: DS Smith and Jonsac, a Swedish producer of eco-friendly e-commerce bags, announced a new collaboration. The goal of this partnership is to expedite the European e-commerce industry's transition from plastic packaging to sustainable paper substitutes. The arrangement builds on the two companies' previous collaboration, in which Jonsac provided paper-bag options for DS Smith clients in the Nordic area.

- March, 2024: ProAmpac declared the purchase of UP Paper, a manufacturer of recycled kraft paper in North American. It is anticipated that the partnership between UP Paper and ProAmpac will utilize their combined knowledge of materials science based on fiber and film to provide flexible packaging options that are favorable to the environment.

E-commerce Flexible Packaging Market Companies

E-commerce Flexible Packaging Market Segments

By Material

By Product

- Pouches

- Bags

- Films

- Others

By Application

- Electronics

- Apparels And Accessories

- Food And Beverages

- Personal Care

- Household

- Others

By Region

- North America

- Europe

- U.K.

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-East Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East & Africa