April 2025

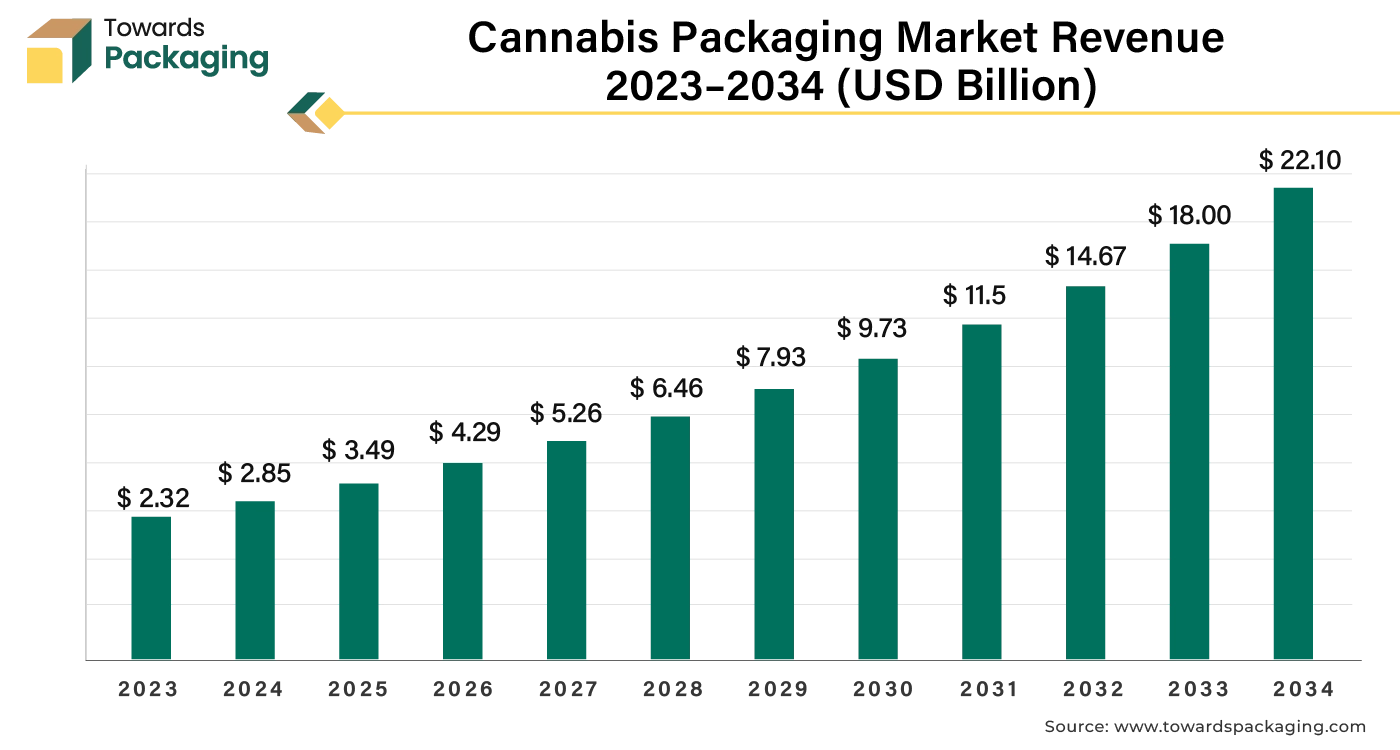

The cannabis packaging market is projected to reach USD 22.10 billion by 2034, growing from USD 3.49 billion in 2025, at a CAGR of 22.74% during the forecast period from 2025 to 2034.

Stricter regulations around child-resistant and tamper-evident packaging are pushing companies to invest in secure and complaint packaging solutions. The key players operating in the market are focused on adopting inorganic growth strategies like merger to develop advance technology for manufacturing cannabis packaging which is estimated to drive the global cannabis packaging market over the forecast period.

Cannabis packaging is a specialized category of the packaging industry engineered to meet the unique demands of cannabis products, which include ensuring compliance with preserving product quality, legal regulations, and providing consumer information. The packaging for cannabis products must address both the practical aspects of preservation and the legal requirements for safety and labeling. Cannabis packaging must adhere to strict regulations that vary by region. These regulations typically cover child-resistance, tamper-evidence, labeling, and dosage information.

The packaging often needs to be opaque to prevent the degradation of cannabinoids and to ensure privacy. Given the potential risks to children, cannabis packaging often includes mechanisms to prevent easy access. This may involve complex opening mechanisms or special closures that are difficult for children to open but accessible to adults. The global packaging market size is growing at a 3.16% CAGR.

Cannabis packaging must include features that indicate if a product has been tampered with. This could be in the form of seals, shrink bands, or breakable tabs. Packaging materials must protect the cannabis product from external elements such as light, moisture, and air. The process of cannabis packaging starts with designing the packaging, taking into account regulatory requirements, branding, and functionality.

AI-powered systems can enhance quality control by using machine learning to detect defects, ensure consistency, and monitor packaging integrity, reducing waste and improving product reliability. AI can optimize supply chain management by predicting demand, managing inventory levels, and streamlining logistics, leading to cost savings and improved efficiency. AI can analyze consumer preferences and purchasing behaviour to create personalized packaging solutions and tailor marketing strategies, enhancing customer engagement.

AI can predict equipment failures and maintenance needs in packaging machinery, minimizing downtime and improving overall operational efficiency. AI can help ensure compliance with regulatory requirements by monitoring packaging practices and flagging any deviations, thus reducing the risk of non-compliance. AI can enable smart packaging solutions, such as integrating sensors and QR codes that provide real-time information about the product’s condition, origin, and usage instructions. By leveraging AI, the cannabis packaging industry can achieve higher efficiency, better compliance, and more personalized consumer experiences.

Growing evidence supporting cannabis's medical benefits has increased demand for therapeutic products. Societal perceptions of cannabis have become more positive, reducing stigma and encouraging consumer interest. Many regions are increasingly legalizing cannabis for medical and recreational use, which expands market access and opportunities. The development of new cannabis products and delivery methods attracts a wider range of consumers. As the industry grows, it creates jobs and economic benefits, which further stimulates market expansion.

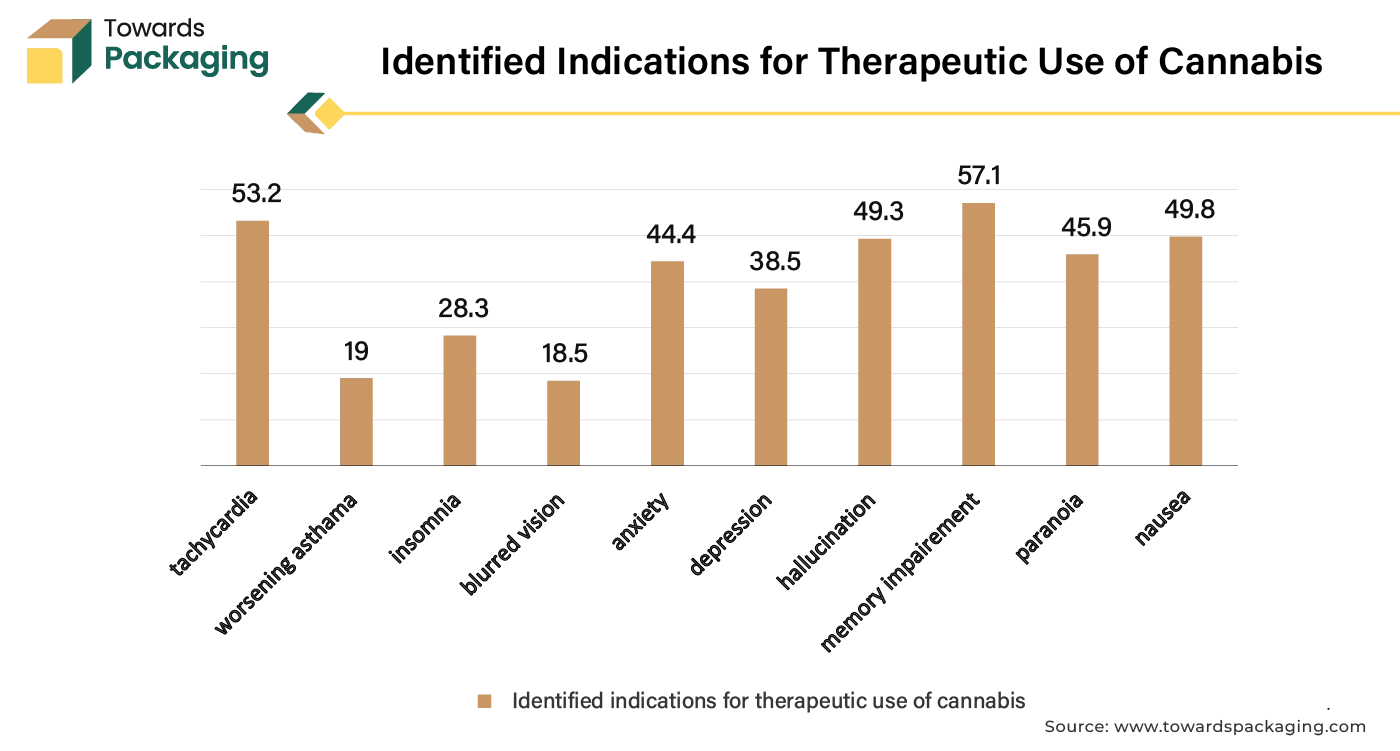

Cannabis reduces tenseness in the muscles, anxiety, and insomnia. The World Health Organization states that consuming cannabinoids has shown therapeutic effects against nausea and vomiting brought on by AIDS and cancer treatments. This information is helping to drive the growing use of cannabis in medical applications and bodes well for the future of cannabis packaging.

The key players operating in the market are facing challenges in meeting the complex regulations across regions and supply chain logistics, which is observed to restrict the growth of the cannabis packaging market. Cannabis remains illegal in some jurisdictions, limiting market access and opportunities. High taxes and regulatory costs can drive up prices, making legal cannabis less competitive compared to illicit markets. The cost of specialized packaging, including child-resistant features and tamper-evident seals, can be high. This may limit market growth, particularly for smaller producers. The cannabis industry is highly fragmented, with numerous small players. This fragmentation can make it difficult for packaging companies to achieve economies of scale.

As more regions and countries legalize cannabis for medical and recreational use, there is an increased demand for cannabis products and, consequently, for specialized packaging solutions. The key players operating in the market are focused getting legalization, which is estimated to create lucrative growth opportunities for the expansion of the cannabis packaging market.

For instance,

The rigid segment registered its dominance over the global cannabis packaging market in 2024. Rigid packaging provides superior protection for cannabis products, safeguarding them from physical damage, contamination, and tampering. This is crucial for preserving the quality and potency of the product. Rigid containers help in maintaining the product's freshness and extending its shelf life by providing a more airtight seal, which is important for preventing moisture and air from degrading the cannabis.

Rigid packaging often meets regulatory requirements more effectively. Many jurisdictions have stringent packaging regulations for cannabis, including child-resistant features, which are more reliably incorporated into rigid containers. These packages are often easier for consumers to handle and use, with features like resealable lids or integrated storage options that enhance user experience. Overall, the combination of protection, regulatory compliance, extended shelf life, and branding potential makes rigid packaging a preferred choice in the cannabis industry. Increasing launch of cannabis products is rising the demand for the rigid cannabis packaging.

For instance,

The plastic segment held the dominating share of the cannabis packaging market in 2024. Plastic provides effective barriers against moisture, oxygen, and UV light, which helps preserve the freshness, potency, and quality of cannabis by protecting it from environmental factors that could degrade the product. Many plastic packaging options can incorporate child-resistant mechanisms, which are often required for cannabis products to ensure safety. Plastic can be easily printed or labeled, allowing for effective branding and marketing while also providing essential product information. The players operating in the market are focused on launching plastic material cannabis packaging to meet the rising demand of consumers.

For instance,

The bottles & jars segment is held the largest share of the global cannabis packaging market in 2024. Bottles and jars are user-friendly, allowing for easy opening, closing, and dispensing of the product. They often come with features like resealable lids, which help maintain the product’s freshness after initial use. Bottles and jars, especially when made from materials like glass or high-quality plastic, provide excellent protection against light, moisture, and air. This helps in preserving the freshness, potency, and overall quality of the cannabis product. Many bottles and jars are designed with child-resistant closures to comply with regulatory requirements, ensuring that the product is safely stored and inaccessible to children.

Jars and bottles can be designed with tamper-evident features, which help assure consumers that the product has not been compromised before purchase. Bottles and jars can be designed to meet various regulatory requirements, including those related to child resistance, tamper evidence, and accurate labeling. he suitability exhibited by bottles and jars to pack various forms of cannabis products, such as powder, gummies, and concentrates, is a major factor contributing to the segment's growth. The compatibility exhibited by bottles & jars to pack various different forms of cannabis products, such as concentrates, powder, and gummies, is a prime factor contributing to the segment's growth. Increasing launch of new cannabis products are rising the demand for bottes & jars for packaging purpose.

For instance,

The recreational use segment accounted for a considerable share of the cannabis packaging market in 2024. There is a growing cultural acceptance of cannabis, driven by changing societal attitudes and increasing awareness of its recreational benefits. Many regions and countries like Uruguay, Thailand Canada and Malta have legalized recreational cannabis use, creating a legal market that supports its widespread consumption.

This has led to increased availability and normalization of recreational use. Users often seek cannabis for its psychoactive effects, which can enhance social experiences, relaxation, and recreational activities. This appeal drives its popularity compared to medicinal use. The cannabis industry has effectively marketed recreational products, creating a diverse range of products and experiences tailored to consumer preferences, which boosts recreational use.

Furthermore, the recreational cannabis market has become a significant economic driver, contributing to tax revenues and job creation. This economic interest encourages the growth of recreational use.

For instance,

There is strong consumer demand for recreational cannabis products, fueled by curiosity, personal preferences, and the desire for novel experiences. These factors contribute to the dominance of recreational cannabis use, as it aligns with changing legal, social, and economic landscapes.

North America dominated the global cannabis packaging market in 2024. As cannabis legalization spreads across North America, particularly in the U.S. and Canada, there is an increasing need for compliant packaging that meets regulatory standards. The expanding range of cannabis products, including edibles, concentrates, and topicals, requires specialized packaging to ensure product safety, freshness, and convenience. Increasing launch of the new cannabis products in the North America market are rising the demand for the cannabis packaging in the North America.

For instance,

Asia Pacific region is projected to host the fastest-growing market in the coming years. The growing interest in cannabis for medical and recreational use in countries like Thailand and potentially in other regions is driving the demand for compliant packaging solutions. Investment in the cannabis sector is increasing in Asia Pacific, leading to the development of local cannabis markets and, consequently, a need for specialized packaging. Increased awareness about the benefits of cannabis and its acceptance for medical use in various countries like China, Japan, India and South Korea is expanding cannabis packaging market opportunities. Increasing research and development activities for developing drugs using cannabis for medical treatment, is estimated drive the growth of the cannabis packaging market in Asia Pacific.

For instance,

Packaging Type

Product Type

Application Type

Region

April 2025

April 2025

April 2025

April 2025