December 2025

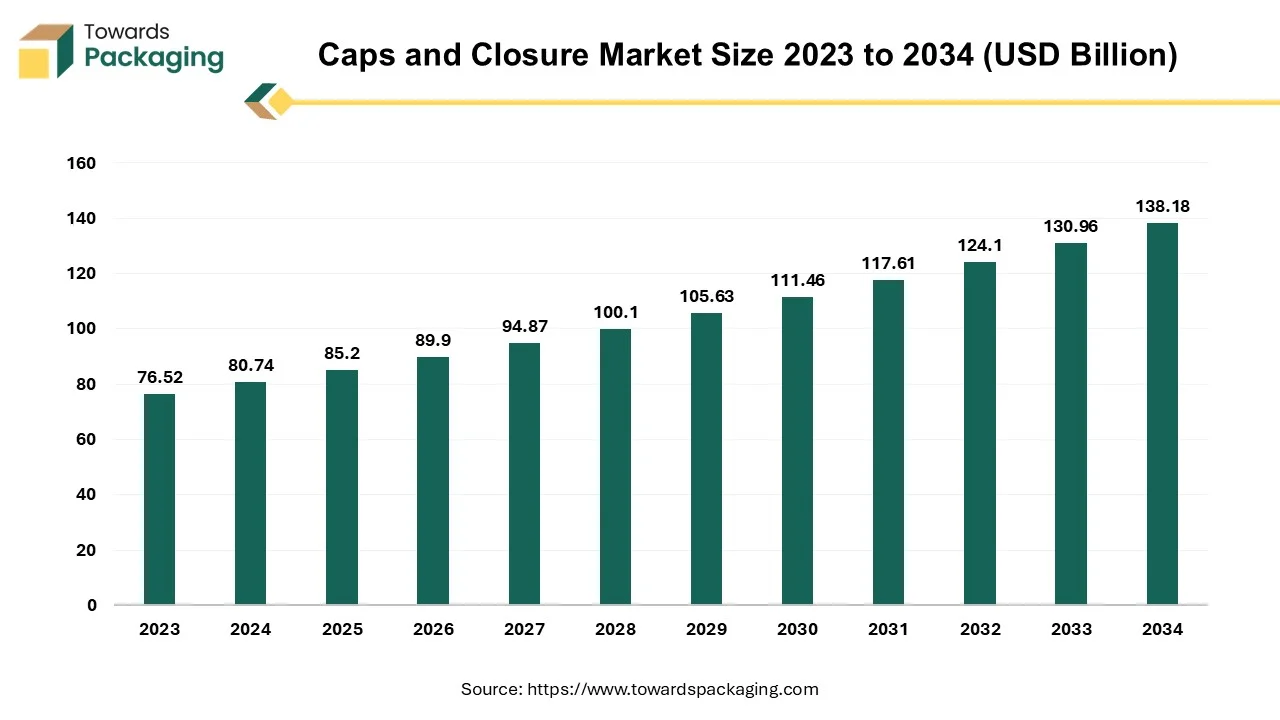

The caps and closures market is projected to expand from USD 85.2 billion in 2025 to USD 138.18 billion by 2034, growing at a CAGR of 5.52%. This report delivers a comprehensive breakdown by material, product, application, and region, highlighting the strong performance of Asia Pacific (39.24% share) as the leading region. It provides in-depth insights into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa, along with a detailed value chain analysis, trade statistics, and profiles of key players such as BERICAP Holding GmbH, Avery Dennison Corporation, Crown Holdings Inc., Guala Closures S.p.A, and Amcor Limited. The study also explores manufacturers’ profitability, suppliers’ EBITDA margins, and competitive dynamics shaping the global landscape.

The caps and closure market is anticipated to grow at a significant CAGR during the forecast period. Caps and closures account for a significant portion of the packaging industry as numerous applications need them. For instance, bottles of soda and water, bottles for sports drinks and medications bottles. Depending on the particular bottle type and intended usage, a variety of caps and closures are available. The most common materials for caps and closures are polypropylene, HDPE, LDPE and LLDPE. Both general purpose caps and carbonated drinks are frequently made of HDPE and bimodal HDPE.

The increasing demand for convenience and concerns about product safety and security coupled with the growing demand for bottled water is anticipated to augment the growth of the market within the estimated timeframe. Additionally, the growing consumption of packed food along with the rising demand for carbonated drinks is also likely to contribute to the market growth. Furthermore, the increase in focus by various manufacturers on sustainable caps and closures is also likely to contribute to the growth of the market in the years to come.

| Metric | Details |

| Market Size in 2024 | USD 80.74 Billion |

| Projected Market Size in 2034 | USD 138.18 Billion |

| CAGR (2025 - 2034) | 5.52% |

| Leading Region | Asia Pacific |

| Market Segmentation | By Material, By Product, By Application and By Region |

| Top Key Players | BERICAP Holding GmbH, Avery Dennison Corporation, Crown Holdings, Inc., Guala Closures S.p.A, Amcor Limited. |

Artificial Intelligence (AI) is poised to significantly enhance the Caps and Closures market by driving innovation, efficiency, and market growth. AI technologies are transforming various aspects of the industry, from manufacturing to consumer engagement. In manufacturing, AI-driven predictive maintenance can foresee equipment failures, minimizing downtime and improving operational efficiency. Machine learning algorithms optimize production processes by analyzing data to refine quality control and reduce waste, ensuring consistent product quality.

AI is also enhancing design capabilities, with advanced algorithms enabling the development of more functional and aesthetically pleasing caps and closures. These innovations cater to evolving consumer preferences and industry requirements, such as sustainability and convenience. Furthermore, AI-powered market analysis tools provide valuable insights into consumer trends and preferences, allowing companies to tailor their products and marketing strategies effectively.

On the consumer front, AI enables personalized packaging solutions, improving user experience and driving brand loyalty. Overall, AI integration in the Caps and Closures market is not only boosting operational efficiency but also fostering innovation, leading to accelerated growth and a more dynamic market landscape.

The food and beverage industry is growing considerably owing to the increasing urbanization, population growth and technological advancements. According to the World Bank, about 4.4 billion people or 56% of the world's population, live in cities. By 2050, over seven out of ten people will live in the cities as a result of this trend, with the urban population predicted to have more than doubled from its current level. This increase in urbanization as well as the hectic lifestyles has shifted the consumer preferences towards ready-to-eat meals, convenience foods and beverages that provide quick consumption along with easy portability. Additionally, the global rise in disposable incomes coupled with the growing middle class and increase in spending on the branded packaged foods and beverages is also likely to contribute to the market growth during the forecast period.

Furthermore, according to a study by Water Quality Association, seven out of ten households (71%) bought bottled water. The convenience and flavor were the two main drivers that prompted people to buy bottled water. Not surprisingly, 61% of people who purchase bottled water believe it to be "more effective than tap water," while only 33% believe it to be "of the same quality as tap water." Customers also believe that bottle water is more portable and easily obtainable than other options. Positive environmental and social lifestyles are also promoted by bottled water firms through their advertising.

This has increased its demand which in turn is expected to support the growth of the market. Packaging options for the food and beverage industry are needed for anything from pods of coffee to bottles for beverages to plastic food containers. Depending on the product, food and beverage caps and closures may need to resist severe temperatures and prevent leakage.

The increasing environmental concerns and the negative impact of plastic waste are likely to hamper the growth of the market during the forecast period. According to the data by United Nations, an estimated 430 million tonnes of plastic is generated by the humans each year, two thirds of which are disposable goods that end up in the trash, the ocean and sometimes even in the human food supplies. Less than 9% of the plastic trash is truly recycled after losses, with 46% of it being landfilled, 22% becomes litter, and 17% is being burned and 15% being collected for recycling. In addition to the harming soil and the groundwater and choking the marine life, this pollution can have negative effects on the human health.

Furthermore, concerns also exist over the negative effects of the chemicals used to make plastics so durable. Chemicals may seep into the water and soil sources when plastics are disposed of in the landfills or left in marine or the land. A number of phases in the plastic value chain, including the extraction and transportation of the fossil fuels, their manufacture and disposal, and their incineration and recycling, are also linked to greenhouse gas emissions. With 0.9 metric tons of net CO2 emissions produced for each metric ton of the plastic burned, combustion is the largest source of greenhouse gas emissions.

Also, according to the Organization for Economic Co-operation and Development, emissions generated by the plastics lifespan are predicted to more than double, exceeding 4.3 billion tons of greenhouse gas emissions by 2060. Greenhouse gas emissions from the manufacturing, usage and disposal of the plastics can affect the resilience and the natural adaption processes in addition to contributing to the climate change. These factors are likely to limit the caps and closures market growth within the estimated timeframe as it uses plastic as a major raw material for its production and the increasing regulations and standards by the government bodies and associations aimed at reducing plastic waste and promoting circular economies.

With the goal to promote more environmentally friendly packaging options, manufacturers are progressively adopting lower weight caps and closures as customer consciousness of environmental problems increases. Smaller diameter neck trims and closures, once typically linked with inexpensive brands, are becoming more and more popular choices for premium companies. By lowering cycle times, light-weighting can increase production efficiency by reducing component weight and raw material cost-per-piece. Furthermore, they are also termed as sustainable option in respect to circularity. Leading the way in this trend, innovative caps and closures have sparked an innovation in tooling that makes it possible to manufacture lightweight, sustainable designs in a flexible and economical way.

The plastic segment captured a significant market share of 57.80% in 2024. Since plastics are inexpensive to make in large quantities and have a low density, plastic closures and caps are among the most extensively used products. Additionally, its lightweight design reduces the cost of the bulk shipment. Also, plastic is quite adaptable and can take on a wide range of shapes. Among the most widely used and resilient polymers that may be utilized to make an airtight seal and stop any products from leaking in storage are the polypropylene and polyethylene. The majority of the plastic closures and caps are made to be extremely recyclable and reusable, which makes them perfect for environmentally conscious companies. Owing to its many advantages, plastic is now the most widely used material for closures and caps across a variety of sectors.

The food and beverages segment captured a significant market share of 40.36% in 2024. This is owing to the extensive use of caps and closure in products such as bottled water, juices, dairy products, carbonated drinks and alcoholic beverages. The high revenue of these essential commodities is expected to drive substantial demand for the different packaging options. Additionally, major influence on the present trends in the food and beverage industry comes from the younger customer groups. Bright, dramatic colors make a product visually appealing and make it stand apart at the point of sale. Exotic flavors and striking colors are the main focus here. Consumers get excited about new beverages with eye-catching colors, like the 2023's Viva Magenta and are more likely to make spontaneous purchases. These numerous interesting impressions combine taste and color in novel ways to produce the singular sensory experiences. This is expected to support the growth of the segment and in turn increase the demand for caps and closures in the near future.

Asia Pacific held largest market share of 39.24% and is expected to grow at a fastest CAGR of 7.02% during the forecast period in the global caps and closure market. The rising consumption of bottled water, soft drinks, and alcoholic beverages is projected to contribute to the growth of the market across the region. Furthermore, growth of e-commerce platforms coupled with the increasing preference for online grocery shopping is likely to support the regional growth of the market. Additionally, rapid urbanization and industrialization, rising disposable incomes as well as the changing lifestyles with the increasing disposable income is also anticipated to augment the growth of the market in the region.

Asia Pacific dominated the caps and closure market in 2024. The market growth in the region is attributed to the increasing demand for home care and cosmetic products, growing food and beverage industry and increasing presence of highly populous countries. China and India are significant countries in the region. The increasing growth of online retailing and e-commerce, increasing demand for hygienic and secure packaging, increasing consumer preference towards caps and closure designs are expected to drive the growth of the caps and closure market in India.

North America is expected to grow at a considerable CAGR of 4.60% during the forecast period. This is due to the growing preference for convenience products, such as ready-to-eat meals and on-the-go beverages across the region. Also, the increasing demand for premium and the specialty products, particularly in the food, beverage and cosmetic sectors is further expected to drive the demand for labels in the years to come. Furthermore, the shift towards sustainable practices to meet regulatory requirements and consumer expectations along with the strong recycling initiatives is also expected to support the regional growth of the market in the years to come.

North America is expected to grow fastest during the forecast period. The market growth in the market is driven by factors such as growing beverage industry, increasing consumption of non-alcoholic and alcoholic beverages, increasing consumption of non-alcoholic and alcoholic beverages and increasing demand for packaging products. The U.S. and Canada are dominating countries propelling the market growth.

The demand in Europe is highly advanced, driven by a rigid urge from the pharmaceutical, food and beverage, and personal care products. The region is home to leading production manufacturers and benefits from strict regulations that market the product safety, sustainability, and quality. Countries such as Germany, Italy, and France play a major role in manufacturing, assisted by robust industrial infrastructure and innovation in packaging technologies. Growing user choice for lightweight designs, eco-friendly materials, and recyclable closures is further shaping the sector, pushing manufacturers to accept sustainable solutions while tracking functionality and aesthetics.

The manufacturing of caps and closures in Latin America is experiencing steady growth, driven by rising demand from the food and beverage, personal care, and pharmaceutical industries. Increasing urbanization, expanding packaged goods consumption, and the move towards easy, lightweight, and sustainable packaging solutions are boosting regional production. Countries like Brazil and Mexico are leading in production due to rigid industrial bases and expanding export activities. Additionally, innovation in recyclable and eco-friendly closure materials is gaining attention, as brand owners and manufacturers respond to regulatory pressures and user choice for sustainable packaging.

The production of caps and closures in the Middle East and Africa is growing steadily, supported by the development of the food and beverage, cosmetics, and pharmaceutical sectors in the region. Rising disposable incomes, urbanization, and growing demand for packaged drinking water and carbonated

Beverages are the main drivers. Countries like the UAE, Saudi Arabia, and South Africa are emerging as main manufacturing hubs due to their strong industrial production centers in packaging technologies. Additionally, the industry is witnessing a move towards durable, lightweight, and recyclable closure materials, aligning with sustainability goals and global packaging trends.

In the caps and closures market, the supply chain plays a crucial role in ensuring the seamless flow of products from manufacturers to end-users. The process begins with raw material procurement, where suppliers provide essential inputs like plastics, metals, or composites. These materials are then transported to production facilities where they are transformed into various types of closures, including screw caps, dispensing caps, and aerosol closures.

Manufacturers must manage complex logistics to maintain efficient production schedules and meet market demands. This involves coordinating with suppliers for timely delivery of raw materials and managing inventory levels to avoid disruptions. Once produced, caps and closures are distributed through a network of wholesalers and distributors who ensure the products reach diverse end-users, including food and beverage companies, pharmaceuticals, and consumer goods industries.

Effective supply chain management in this market requires close collaboration between manufacturers, suppliers, and distributors to optimize production efficiency and reduce lead times. Additionally, leveraging technology for real-time tracking and inventory management helps in adapting to market fluctuations and ensuring timely delivery, thereby enhancing overall market responsiveness and customer satisfaction.

By Material

By Product

By Application

By Region

December 2025

December 2025

November 2025

November 2025