April 2025

The carded packaging market is experiencing rapid growth, with revenue expected to surge into the hundreds of millions from 2025 to 2034. This expansion is set to drive a revolution in sustainable transportation, fueled by increasing demand for eco-friendly and efficient packaging solutions.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and mergers to develop advance technology for manufacturing carded packaging which is estimated to drive the global carded packaging market over the forecast period.

Card packaging is known as a type of packaging that combines a rigid card (usually made of paperboard) with a plastic film or covering to develop a durable and visually appealing package. It is extensively utilized to display, protect, and transport various products while offering branding opportunities and tamper-proof features.

The carded packaging helps in product visibility and often includes transparent window or covering to showcase the product. The carded packaging is tamper evidence and securely seals to make tampering noticeable, ensuring product integrity. The branding space offered by carded packaging provides ample surface area for instructions, printed designs, and logos. The carded packaging is cost effective and combines inexpensive materials with a professional presentation. The carded packaging provides shielding to the product from damage, contamination, and moisture during storage and transit.

Rising demand for environmentally friendly materials like bio-based and biodegradable carded packaging. This aligns with increasing global awareness of cutting-down environmental impact and achieving circular economy goals. Consumers and governments are emphasizing eco-friendly packaging solutions. Biodegradable and recyclable materials are becoming popular, aligning with global sustainability goals. Brands are investing in innovative materials that reduce environmental impact while maintaining functionality.

Advances in materials and printing technologies, such as digital and flexographic printing, are enhancing the design and functionality of carded packaging. These innovations cater to industries like food, electronics, and pharmaceuticals that prioritize product safety and aesthetics.

Carded packaging finds extensive utilization across various sectors, including pharmaceuticals, consumer goods, hardware, and food & beverages, offering versatile and customizable solutions.

AI-driven design tools help create innovative, eco-friendly, and functional packaging solutions. These tools can simulate various design scenarios, optimizing materials and shapes for sustainability and cost-effectiveness. Advanced software predicts consumer preferences and industry trends, allowing manufacturers to stay ahead in a competitive market. AI improves supply chain management by predicting demand and optimizing inventory levels. This reduces waste and ensures timely delivery, especially crucial for industries like e-commerce and healthcare.

AI-powered automation in production lines enhances precision and speed, minimizing errors and production costs. Technologies like computer vision ensure quality control by identifying defects in real-time. Integration of Internet of Things (IoT) with AI allows predictive maintenance of machinery, minimizing downtime. Integration of AI and robotics in the carded packaging industry can enhance warehouse operations, packaging assembly, and logistics. AI-powered analytics provide insights into regional trends, enabling market-specific adaptations for global players.

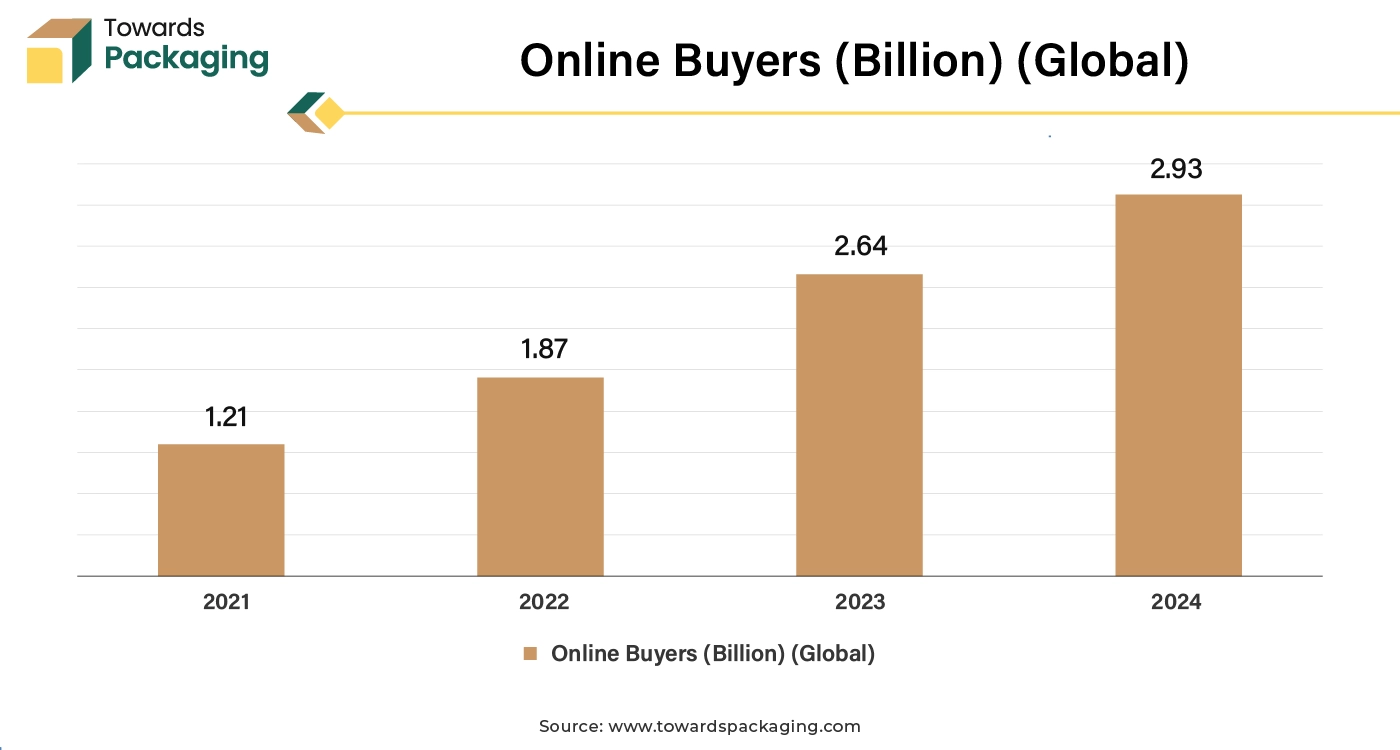

The rapid growth of e-commerce has developed a surge in demand for lightweight, protective, and customizable carded packaging to ensure safe delivery and enhance customer experience. Thereby the rapid expansion is seen to promote the overall growth of the carded packaging market. According to the data published by eCommerce Association of India (ECAI), is estimated that as of 2024, the number of commerce sites worldwide has increased by 3.83% to 26.6 million. For 2023 and 2024, this means that 2,685 Commerce websites were launched every day. The United States is home to about half of the world's commercial sites. The majority of online stores are powered by Shopify and Wix, which together account for 19.07% and 11.84% of all stores.

Unlock Infinite Advantages: Subscribe to Annual Membership

According to estimates, the worldwide online pharmacy market was worth 32 billion dollars by the end of 2024. Its place as one of the biggest online pharmacy markets is expected to be cemented when this number rises to about 5.7 billion in the US. However, China leads the global pharmaceutical e-commerce market, bringing in close to 8.5 billion dollars annually. Given China's leadership, it is not surprising that the fastest-growing market category in Asia for digital health is digital pharmacies.

The key players operating in the market are facing issue in fulfilling the stringent regulatory norms and technology barriers, which may restrict the growth of the carded packaging market in the near future. Fluctuations in raw material availability and costs, particularly for sustainable materials, can disrupt production and increase costs. Geopolitical issues and global supply chain disruptions, like those experienced during the COVID-19 pandemic, have impacted the timely availability of materials. Adopting advanced manufacturing and AI technologies requires skilled labor, which may not be readily available in all regions. Small and medium-sized enterprises (SMEs) often lack the resources to invest in cutting-edge technology, limiting their competitiveness. The carded packaging market faces competition from alternative packaging types, such as flexible and rigid packaging, which may offer more cost-effective or customizable solutions for certain applications.

Growth in pharmaceutical and medical devices products fuels demand for tamper-proof and hygienic carded packaging solutions, which has estimated to create lucrative opportunity for the growth of the carded packaging market in the new future. Injectable products, often sensitive to contamination and damage, require secure and protective packaging. Carded packaging, such as blister packs, ensures individual product containment, preventing breakage or contamination during transportation and storage.

Carded packaging offers clear visibility of the injectable product while providing space for essential information such as usage instructions, dosage, and safety warnings. This feature is particularly valuable for medical professionals and end-users. The rise of biologics and biosimilars, which are often administered via injection, has created a surge in demand for specialized packaging. Carded packaging is ideal for such high-value, sensitive products.

For instance, in December 2024, Baxter International Inc., pharmaceutical and healthcare products providing company, revealed the introduction of the five new injectable pharmaceutical products. The following are the five new products that Baxter Pharmaceuticals has introduced in the United States, which have been mentioned here as follows: Micafungin in 0.9% Sodium Chloride Injection single-dose, Cyclophosphamide Injection, Pantoprazole Sodium in 0.9% Sodium Chloride Injection, Cefazolin in Dextrose Injection, and Levetiracetam in Sodium Chloride Injection.

The plastic segment held a dominant presence in the carded packaging market in 2024. Plastics like PP (polypropylene), PET (polyethylene terephthalate), and HDPE (high-density polyethylene) are extensively utilized due to their flexibility, strength, and adaptability for various packaging designs. PET and similar plastics offer superior clarity and transparency compared to PVC, making products more visible and appealing on retail shelves. PET and other recyclable plastics are increasingly preferred over PVC, which has faced environmental concerns due to its difficulty in recycling and potential release of harmful chemicals during production and disposal.

The PVC segment is expected to grow at the fastest rate in the carded packaging market during the forecast period of 2024 to 2034. PVC is often cheaper in cost than other plastics, making it suitable for low-cost packaging solutions. PVC can be heat-sealed to a variety of substrates, which is useful in blister packaging. Its stiffness makes it ideal for certain types of carded packaging requiring a rigid structure.

The pharmaceutical segment registered its dominance over the global carded packaging market in 2024. Pharmaceuticals rely heavily on blister packaging, a key type of carded packaging, for capsules, tablets, and other small doses. This ensures product safety, dosage accuracy, and tamper resistance. The pharmaceutical industry is subject to stringent regulations that prioritize safety, hygiene, and traceability. Carded packaging meets these requirements effectively.

The growing healthcare sector, fueled by aging populations, chronic diseases, and increasing access to medications in developing regions, drives consistent demand for pharmaceutical carded packaging. The pharmaceutical sector dominates the carded packaging market due to its reliance on strict safety standards, blister packs, and consistent demand globally. While the food sector contributes significantly, its applications are more niche compared to the widespread utilization in pharmaceuticals.

North America region held a significant share of the carded packaging market in 2024. North America benefits from a mature supply chain infrastructure, ensuring the efficient production and distribution of carded packaging. This supports timely delivery and cost optimization. North American companies are leaders in adopting advanced technologies, such as digital printing and smart packaging, enabling customization and enhanced product appeal. Innovation also extends to the use of sustainable material. The presence of strong key companies like WestRock, International Paper, amcor, Berry Global Group Inc., Ball Corp., Crown Holdings Inc. and Avery Dennison Corp., in North America makes it dominant region for carded packaging.

The Asia Pacific region is anticipated to grow at the fastest rate in the carded packaging market during the forecast period. The region's large and growing population, particularly in countries like China and India, drives demand for consumer goods, including electronics, pharmaceuticals, and packaged food, which rely heavily on carded packaging. Asia-Pacific is witnessing rapid growth in e-commerce, fueled by increased internet penetration and smartphone usage. This creates a high demand for durable and visually appealing packaging solutions for shipping and branding. The packaging is being increasingly used for shipping small consumer goods, electronics, apparel, and cosmetics, as carded packaging offers durability and product visibility while minimizing damage during transit.

Bayer AG, pharmaceutical and biotechnology company developed a "first-of-its-kind" PET blister pack for its over-the-counter Aleve medication brand in collaboration with Live Research. By doing away with PVC, the company claims to have reduced its carbon footprint by 38%. Blister packaging's conventional multilayer plastic and aluminum composition makes it challenging to sort and recycle. However, according to Bayer, PET is a plastic that is frequently recycled in other sectors.

By Type

By Applications

By Region

April 2025

April 2025

April 2025

April 2025