April 2025

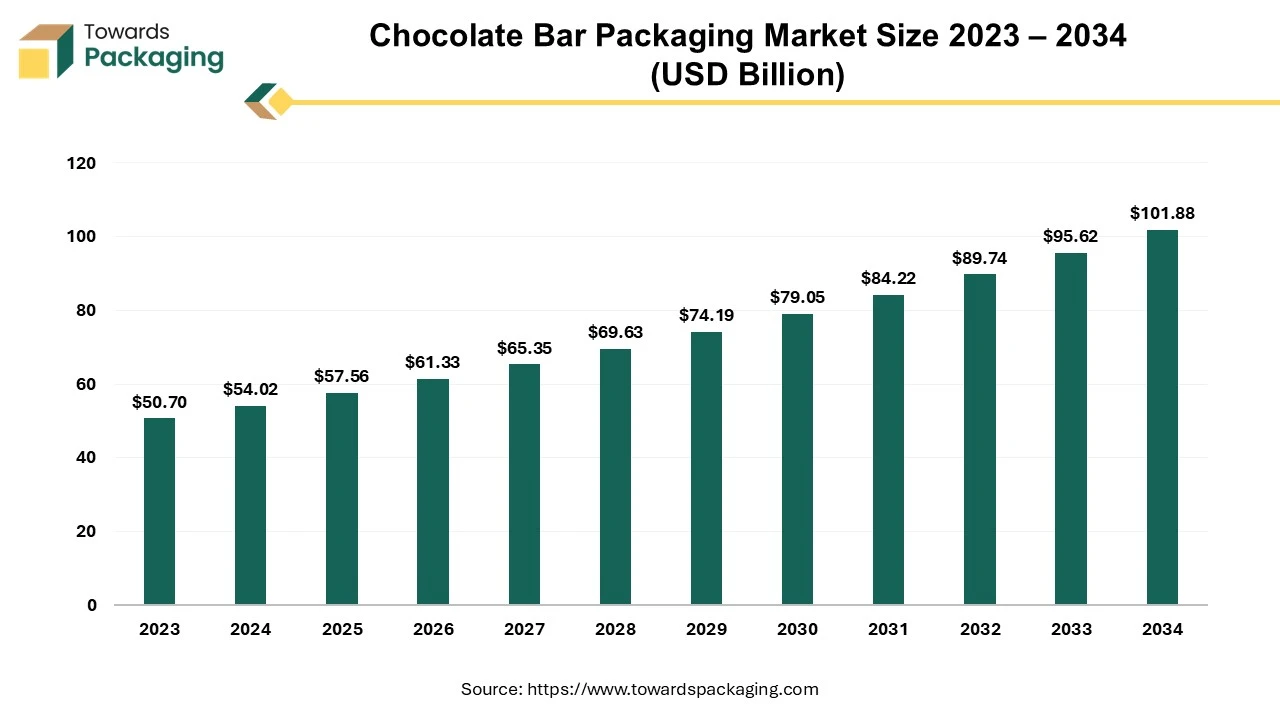

The chocolate bar packaging market is forecasted to expand from USD 57.56 billion in 2025 to USD 101.88 billion by 2034, growing at a CAGR of 6.55% from 2025 to 2034.

The chocolate bar, a beloved treat crafted from cocoa solids, butter, sugar, and sometimes milk powder or additional flavourings, is prominent in the confectionery market. This sector is vital and constantly evolving, projected to surpass $130 billion in global retail sales by the conclusion of 2024. Consumers are growing interested in ensuring the entire chocolate production process is ethically responsible for farmers and environmentally sustainable in manufacturing and packaging practices. Transparency and traceability have become imperative to foster consumer trust. A significant 66% of global consumers prefer chocolate brands and products that contribute positively to people and the planet.

For Instance,

Prominent chocolate corporations, like Mars, Ferrero, Mondelez, and Hershey, hold a dominant position in the market, shaping developments in packaging, flavours, and sustainability efforts. Despite the sector's overall success and notable sales growth during the pandemic, various challenges hinder the expansion of brands and the industry. The bar chocolates category remains the market's primary driver, characterized by low consumer engagement and sporadic product consumption. Regarding retail sales, Nestlé España AS emerged as the leading company in 2023, holding a retail value share of (17.3%), followed closely by Ferrero Ibérica SA (15.7%).

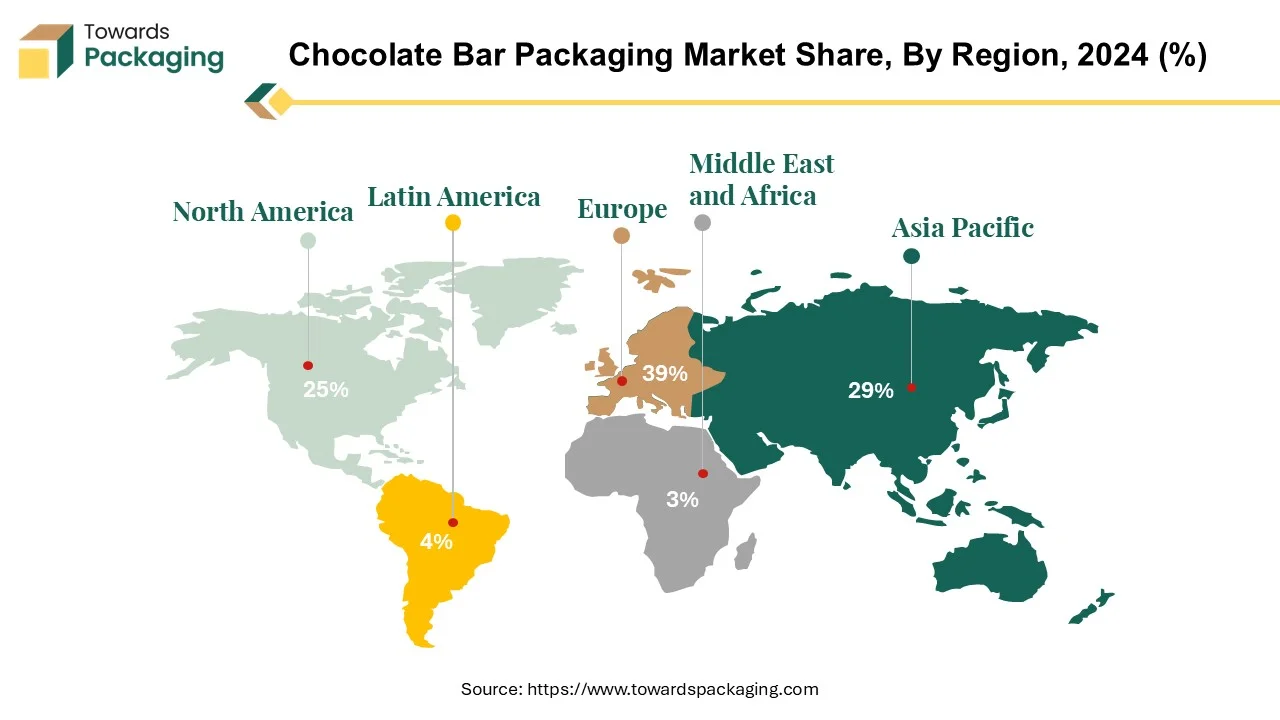

Europe dominates the chocolate bar packaging market, accounting for 35% of the worldwide chocolate business. Packaging plays a vital role in customer choice, with options including sticks, wrappers, and pouches all substantially impacting purchasing decisions.

Switzerland, renowned for its high-quality chocolates, is a significant player in the global market. Swiss brands such as Lindt and Toblerone are well-known worldwide, helping Switzerland maintain its position as one of the world's leading chocolate exporters. Switzerland has a solid domestic market, with its consumers ranked second globally regarding chocolate consumption per capita.

In Germany, a primary European market, the Consumer Price Index (CPI) for individual chocolate bar consumption increased in 2023 to 119.1 points. This demonstrates that consumer demand remains stable despite swings in economic situations.

Overall, Europe's chocolate bar packaging market domination demonstrates the region's importance in driving worldwide trends and customer preferences in the confectionery sector.

For Instance,

The chocolate bar packaging market in Asia Pacific is expected to grow significantly, owing to the introduction of various new products and the presence of prominent industry players. The region has recovered since the outbreak despite problems such as fluctuating chocolate consumption in China due to market dynamics.

Price sensitivity significantly influences various countries, with customers prioritizing affordability over quality. Japanese (75%), Taiwanese (68%), and Indonesians (62%) choose budget-friendly chocolate options, but Chinese and Indian consumers place a higher value on chocolate quality.

In China, where chocolate consumption has fluctuated, packaging serves an important function beyond simply enclosing the food. With customers placing a high value on container design, it has developed as an essential component of brand identity. In this regard, the attractiveness of packaging frequently influences whether a buyer chooses a product. The attractiveness of packaging can have a considerable impact on customer behavior, with unattractive packaging discouraging people from even considering the product itself.

Thus, in the competitive landscape of the chocolate bar packaging market, particularly in regions such as Asia Pacific, attention to packaging design and aesthetics is critical for businesses looking to grab customer interest and increase sales.

For Instance,

Plastic remains prevalent in the chocolate bar packaging market, constituting many packaging solutions. Despite increasing awareness of environmental concerns associated with plastic usage, it continues to be favoured for its versatility, durability, and cost-effectiveness in packaging chocolate bars. Market research indicates plastic holds a considerable market percentage, with estimates suggesting it accounts for approximately 40% to 50% of chocolate bar packaging globally.

Without a question, each one has an intense passion for chocolate; each year consume almost 660,000 tonnes, or 11 kg per person. Unfortunately, this love adds to plastic use because the majority of well-known chocolate bars are wrapped in polypropylene, which is made from fossil fuels and is frequently used in food packaging, such as teabags. Local recycling programmes are strained by the non-recyclable polypropylene plastic found in the wrappers of Mars, Cadbury, and Nestlé chocolate bars.

Mars, the parent company of M&Ms, Galaxy, and Snickers, plans to have all of its packaging 100% recyclable, reused, or biodegradable by 2025 at the latest.

There is a growing trend towards sustainability in packaging practices, leading to efforts to reduce plastic usage and explore alternative materials that are more environmentally friendly. This shift reflects consumer preferences for eco-conscious packaging solutions and the industry's commitment to addressing environmental challenges associated with plastic waste.

For Instance,

The chocolate packaging industry is seeing an increase in the adoption of stick packs, driven by rising demand from on-the-go customers and a preference for convenience and eco-friendly packaging options. This revolutionary narrow web flexible packaging alternative is gaining traction because of its versatility and compatibility with a wide range of items, especially with the advent of online retail.

Stick packs provide various advantages, including improved usability with features such as notched and easy-open variants, which make them easier to handle, open, squeeze, and dispense. Their elegant and sophisticated design enables firms to expand their offerings into single-use and bundle packaging, meeting a wide range of consumer tastes and market demands. Stick packs are designed to be thinner while providing more barrier capabilities, enhancing product protection from moisture and oxygen.

Stick packs are eco-friendly, with each unit requiring 10-40% less packing than standard packets. They take up less room in shipping and on shelves, release less carbon dioxide, and allow consumer packaged goods companies to minimize their overall carbon footprint. As such, stick packs represent a promising alternative for brands trying to address the changing expectations of consumers while reducing their environmental impact.

For Instance,

The retail segment is vital for spreading chocolate bar packaging in the market. Retail outlets are essential in selling and distributing chocolate products since they are the significant interaction between manufacturers and customers. This section includes a variety of retail formats such as supermarkets, convenience stores, specialized chocolate shops, online merchants, and vending machines.

Supermarkets and convenience stores frequently account for a sizable portion of the chocolate bar packaging industry, offering a variety of brands and flavors to cater to varying consumer preferences. Specialty chocolate shops cater to customers looking for one-of-a-kind, high-quality chocolate bars.

E-commerce has grown significantly in recent years, especially for specialty or niche chocolate businesses, as online retailers provide consumers with accessibility and convenience. Additionally, vending machines offer easy access to chocolate bars in busy places like train stations, airports, and office buildings.

The competitive landscape of the chocolate bar packaging market is dominated by established industry giants such as Amcor Plc, Packman Packaging, Swiftpak Limited, Sonoco Products Company, Mondi Plc, Huhtamaki Oyj, Charpak Ltd, Marber S.r.l., Stora Enso Oyj, JBM Packaging, Packle Packaging Industries and The Sherwood Group. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Leading manufacturer of flexible packaging materials, Swiss Pack is based in England and specializes in spout pouches, zippers, printed rewind rolls, shrink sleeves, coffee valve packaging, block-bottomed bags, and stand-up, resealable packaging. With an unrivaled selection, the company has rapidly expanded to become the industry leader in stock stand-up pouches.

For Instance,

Amcor holds a prominent position in the chocolate bar packaging industry. The company provides a range of packaging options, including rigid containers, cartons, and flexible packaging. Amcor's emphasis on sustainability and innovation has led to consistent market growth. The business has been making significant R&D investments to bring novel, aesthetically pleasing, and environmentally responsible materials and designs to market.

For Instance,

By Material

By Product Type

By Distribution

By Region

April 2025

April 2025

April 2025

April 2025