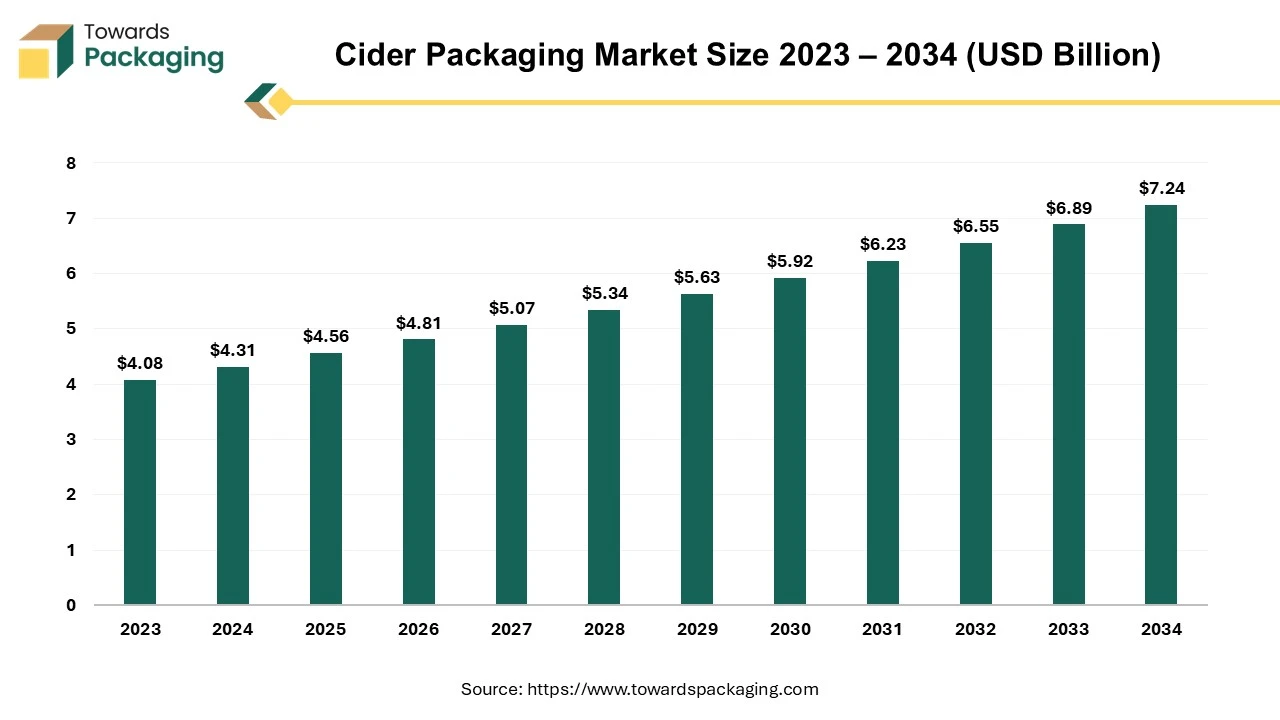

The cider packaging market is forecasted to expand from USD $4.82 billion in 2026 to USD 7.99 billion by 2035, growing at a CAGR of 5.77% from 2026 to 2035. The report provides a comprehensive analysis of material segments such as glass, metal, plastic, and paper/cardboard, along with packaging types including bottles, cans, and pouches.

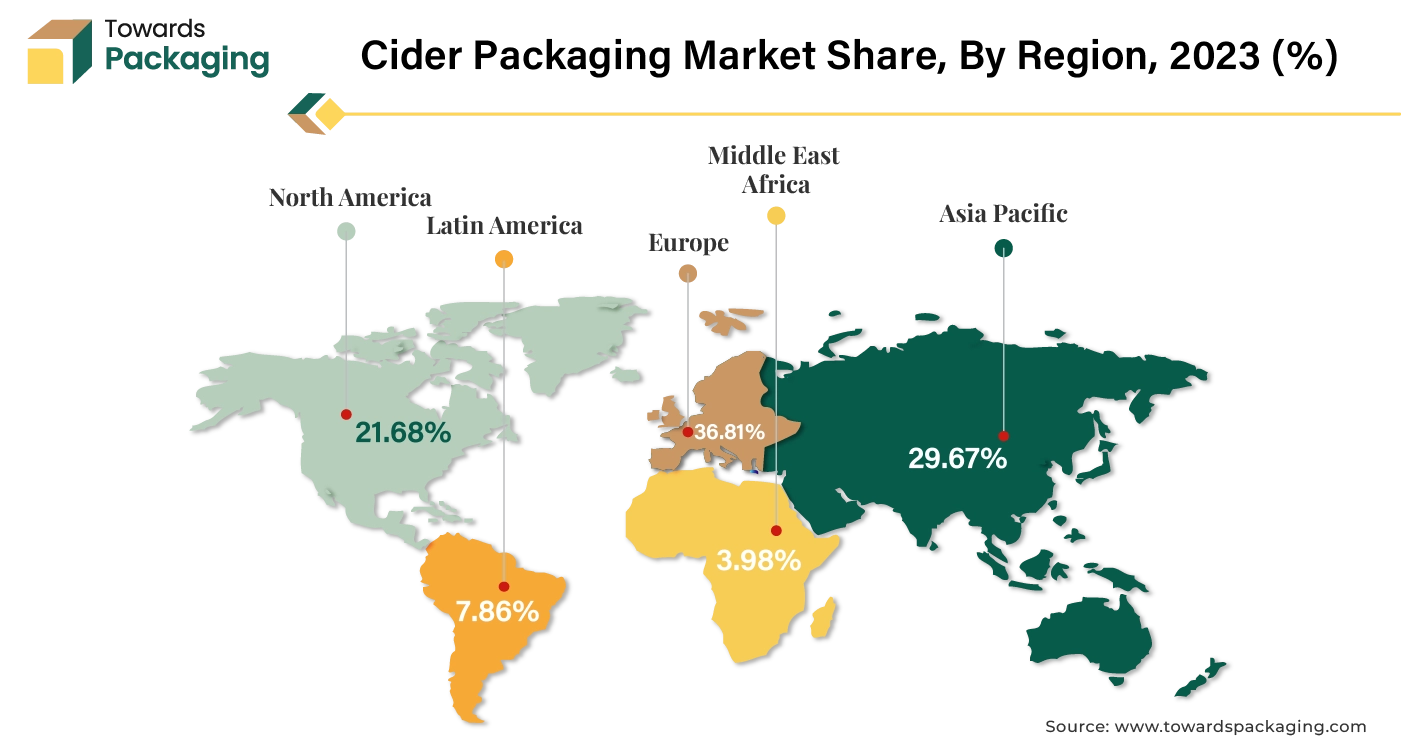

Regional coverage includes North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, highlighting Europe’s 36.81% market share in 2023 and Asia-Pacific’s fastest 7.92% CAGR. The study includes company profiles of leading manufacturers such as Ardagh Group, Ball Corporation, O-I, and Smurfit Kappa Group, detailing their revenue, trade performance, and supply chain integration strategies.

The cider packaging market is expected to experience significant growth throughout the forecast period. Cider is an alcoholic drink made simply by fermenting the fresh apple juice either completely or partially. Cider packaging means the various materials and formats that are utilized to pack cider. The packaging helps in preserving the quality, flavor as well as the freshness of the cider while also serving the marketing and the branding purposes. The cider packaging comes in different formats such as the glass bottles, aluminum cans and bag-in-box, among others.

The rising global demand for cider among the millennials and Gen Z along with the premiumization trend in the beverage industry is expected to augment the growth of the cider packaging market during the forecast period. Furthermore, the increasing environmental concerns are leading to a shift towards sustainable packaging materials such as the recyclable glass, aluminum and the biodegradable cartons which is also likely to support the growth of the market. Additionally, the expansion of cider consumption in emerging markets, particularly in Asia-Pacific and Latin America as well as the growing popularity of e-commerce globally is also projected to contribute to the growth of the market in the years to come.

The rising global consumption of cider is projected to support the growth of the cider packaging market during the forecast period. Millennials and Generation Z are increasingly drawn to cider as a refreshing alternative to the traditional beer and wine attracted by its diverse flavor profiles, lower alcohol content and often perceived for its health benefits. Due to its evolution, cider is still popular with a wide range of consumers for a variety of drinking occasions.

Consumers of cider still seek out reputable brands, but they also seek out novel, thrilling, and distinctive on-trade drinking experiences. Draught cider is still in high demand; among those who drink apple cider, 4 out of the 5 consumers would drink it more frequently if it were draught. The wide range of flavors, sweeter taste, and allure of "trying something new" makes flavored ciders increasingly popular, especially among the women and Generation Z.

Furthermore, while cider's are mostly associated with hot summer days, the cider sector has a chance to expand its appeal by making it available all year round, as most cider lovers now choose to enjoy their cider during the winter. There is growing attraction towards the darker berries, mulled cider and other wintery flavors. This growing interest is not just limited to the traditional markets like Europe but is expanding into regions such as North America, Asia-Pacific and Latin America, where cider is gaining popularity as a trendy as well as a premium beverage option.

As a result, companies are focusing on altering their packaging to attract the attention of the consumers. Additionally, as the cider consumption increases around the world, packaging that reflects the cultural preferences along with the regulatory standards in numerous nations becomes ever more important, leading to innovation in this industry. The global packaging market size is estimated to grow from USD 1.20 trillion in 2022 to reach an estimated USD 1.58 trillion by 2032, growing at a 3.16% CAGR between 2023 and 2032.

The rising competition from alternative beverages such as craft beer, hard seltzers, and ready-to-drink (RTD) cocktails is projected to hinder the growth of the cider packaging market within the estimated timeframe. RTD sales have increased consistently from year to year. Emerging RTD cocktail drinks and the hard seltzer brands such as the White Claw and Truly have contributed to the most remarkable surge in RTD sales. The flavored malt beverage category has been able to continue its growth due to the ongoing innovation in flavor and style and the RTDs that are spirits-based are once again reshaping the alcohol market by providing a more cost-effective option for cocktails.

As more people explore these options, the cider companies must innovate to keep its market share. Packaging is important in the competition for the customer attention, but with so many tempting choices available, cider brands may struggle to stand out. This increased competition may lead to market saturation, with cider being just one of several options, thus reducing overall demand and affecting the growth of the cider packaging market.

Furthermore, Cider is packaged in the recyclable aluminum cans, yet these cans still have negative environmental effects and could be harmful to people's health. Manufacturers of aluminum cans use a thin plastic lining inside the cans to stop aluminum from leaking into the food. Unfortunately, consumers may be exposed to harmful quantities of BPA as a result of aluminum cans having a plastic lining. The Environmental Working Group claims that BPA exposure in experimental animals resulted in insulin resistance, cancer, infertility and polycystic ovarian disease and the group claims that this may also affect humans.

Additionally, according to the Container Recycling Institute, almost half of all aluminum cans are disposed of in landfills or incinerators, necessitating the production of new cans made of aluminum. These factors are likely to further limit the market growth within the estimates timeframe.

The rise of bag-in-box packaging and premiumization trends is expected to create opportunities for the growth of the cider packaging market in the near future. Bag-in-box packaging offers numerous benefits when it comes to the cider packaging. As it is 100% recyclable, lightweight and requires little space when in transit, it is an environmentally friendly option.

As a result, fewer vehicles are required to deliver it and they consume less fuel. Cider bag-in-boxes also save a lot in expenses since they are eight times more environmentally friendly than their glass bottle equivalents and take up to 92% less room during the transportation. Cider bag-in-boxes have the added benefit of looking more sustainable to the customers, who are far more inclined to choose cardboard than plastic when given the option, in addition to being generally better for the environment.

Furthermore, premiumization of cider is also seeing a growth in terms of the revenue and awareness. Customers who have changed their drinking habits in the past year, looking to reward themselves as they go out and seeking superior drinking experiences in pubs are mostly responsible for this growth. Consumers are spending more every time they go out, despite the fact that they are not going to pubs as frequently. Cider is presently consumed more frequently in the on-trade by drinkers between the ages of 25 and 34 than by any other age group.

Additionally, this group is probably looking for high-end drinking options. As cider gains popularity as a premium beverage, there is an opportunity for the packaging that represents this status. High-quality materials, creative designs and premium features such as resealable closures may attract buyers with high standards and justify higher prices.

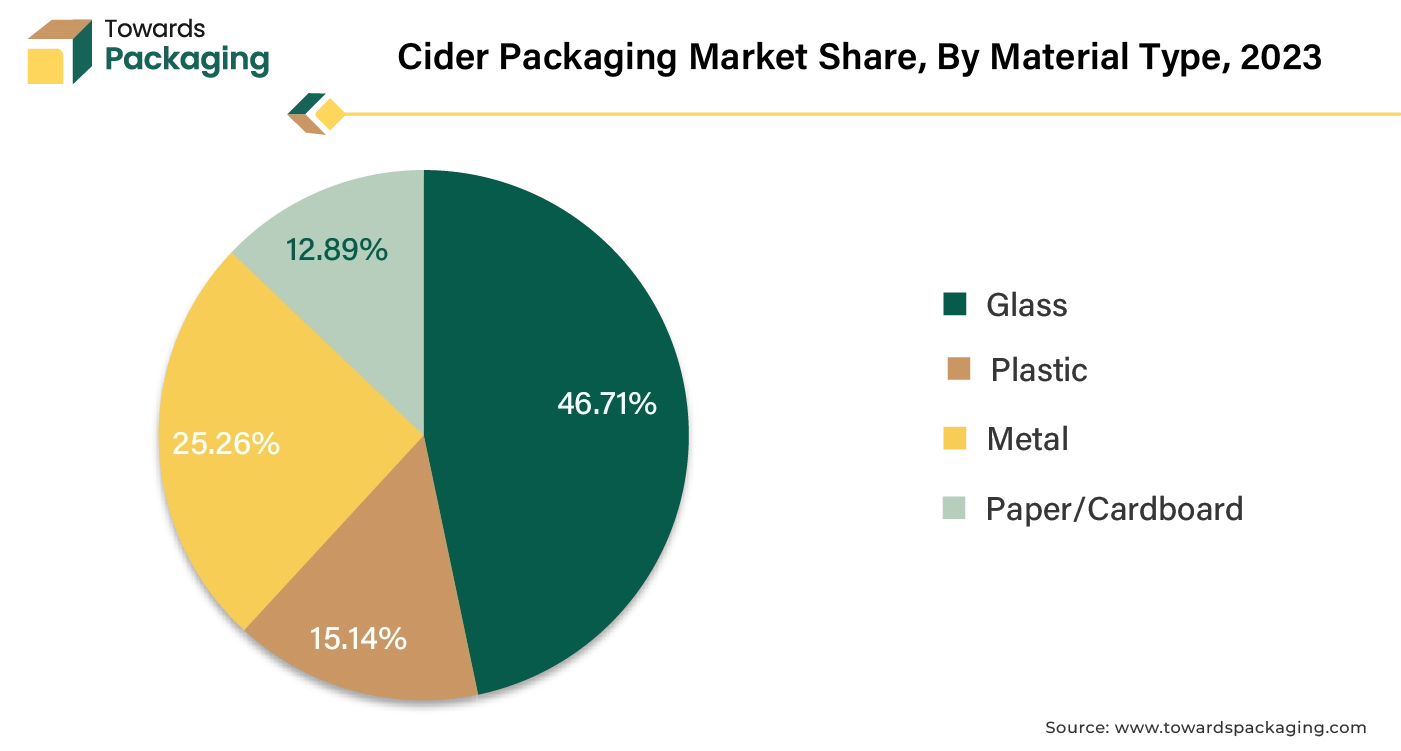

The glass segment captured largest market share of 46.71% in 2023. Glass is widely recognized for its greater capacity to preserve the flavor and the carbonation of the cider, guaranteeing that the quality of the beverage remains consistent over the time. This preservation property is particularly important for the premium and artisan ciders. Furthermore, glass packaging is associated with a sense of heritage and luxury, which is prominent in the regions such as Europe, where cider has a long history and cultural significance. The visual appeal is important for attracting the customers who are prepared to pay more for a high-quality experience.

Additionally, glass can be recycled endlessly without losing the quality, making it a sustainable option that fits the sustainability standards that are increasingly being prioritized by both the customers and environmental regulations. These factors are likely to support the growth of the segment in the global cider packaging market during the forecast period.

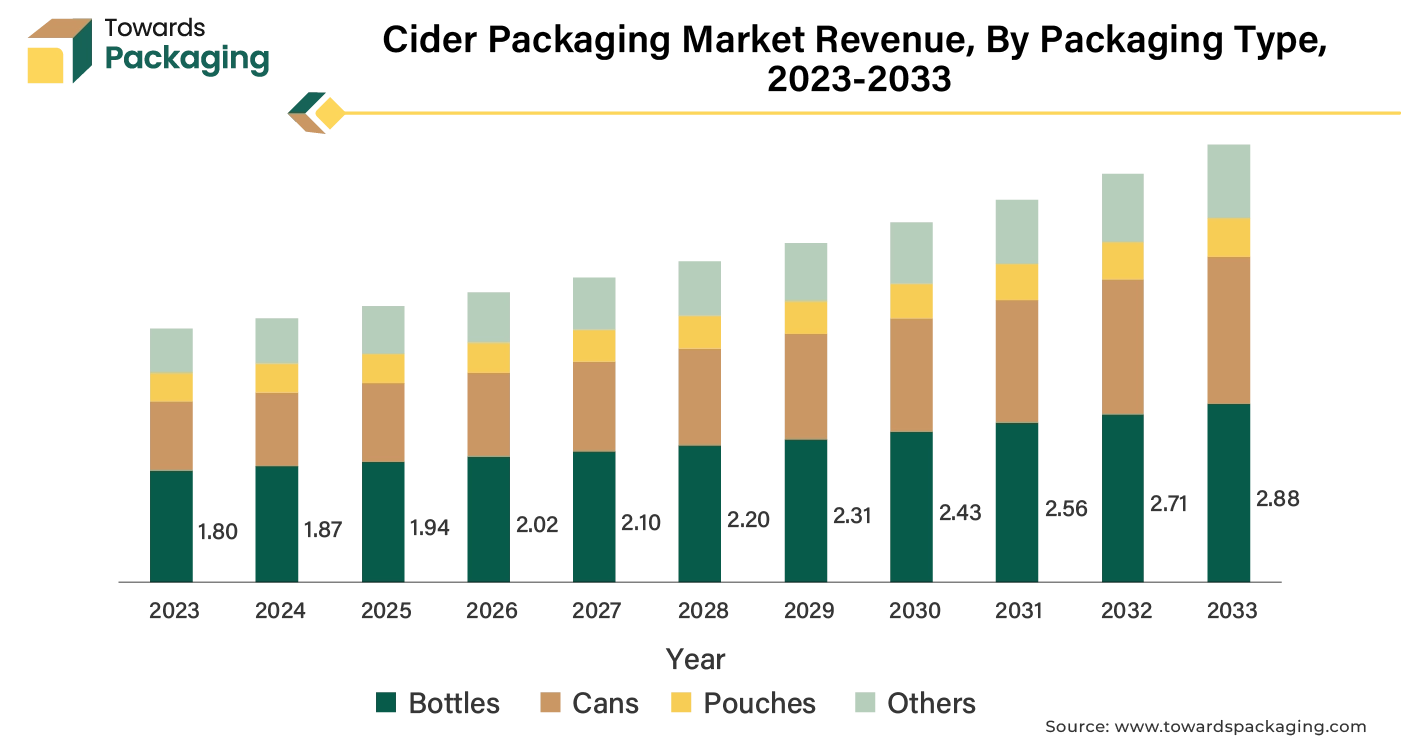

The bottles segment held largest market share of 44.23% in 2023. When it comes to storing the brew, bottling is the leading choice and is relatively simple. The bottled cider looks attractive and has the advantage of being easy to store and transport. Additionally, glass bottles are transparent or colored and allow the customers to visually enjoy the product, which is important for luxury ciders. The ability to display the color of the cider and its carbonation improves the sensory experience as well as makes it more attractive to the customers. Glass bottles are now considered to be the highest standard of quality and are frequently connected to the luxury goods and exclusivity. This feeling of custom and cultural relevance is frequently incorporated by the brands into their advertising campaigns. They may provide a product that is premium in quality, presentation and history by utilizing the glass bottles.

Asia Pacific is likely to grow at fastest CAGR of 7.92% during the forecast period. This is owing to the growing influence of the western beverage trends and shifts in the lifestyle, particularly among the younger and urban populations across the region. Furthermore, the expanding middle-class population in the economies like India and China is also expected to contribute to the growth of the market in the region. Additionally, the rise of e-commerce platforms as well as the modern retail channels along with the evolving trends in beverage consumption such as the growing interest in low-alcohol and flavored beverages are also anticipated to promote the growth of the market in the region in the years to come.

Europe held largest market share of 36.81% in 2023. This is due to the long-standing tradition of cider consumption particularly in the countries like the United Kingdom, France and Spain. Also, the increasing popularity of premium and craft ciders and consumers’ willingness to pay a premium for the artisanal and high-end ciders is further expected to support regional growth of the market in the years to come. Furthermore, the trend towards premiumization in the beverage sector as well as the introduction of new fruity flavors is also expected to support the regional growth of the market in the near future.

By Material Type

By Packaging Types

By End Use

By Region

January 2026

January 2026

January 2026

January 2026