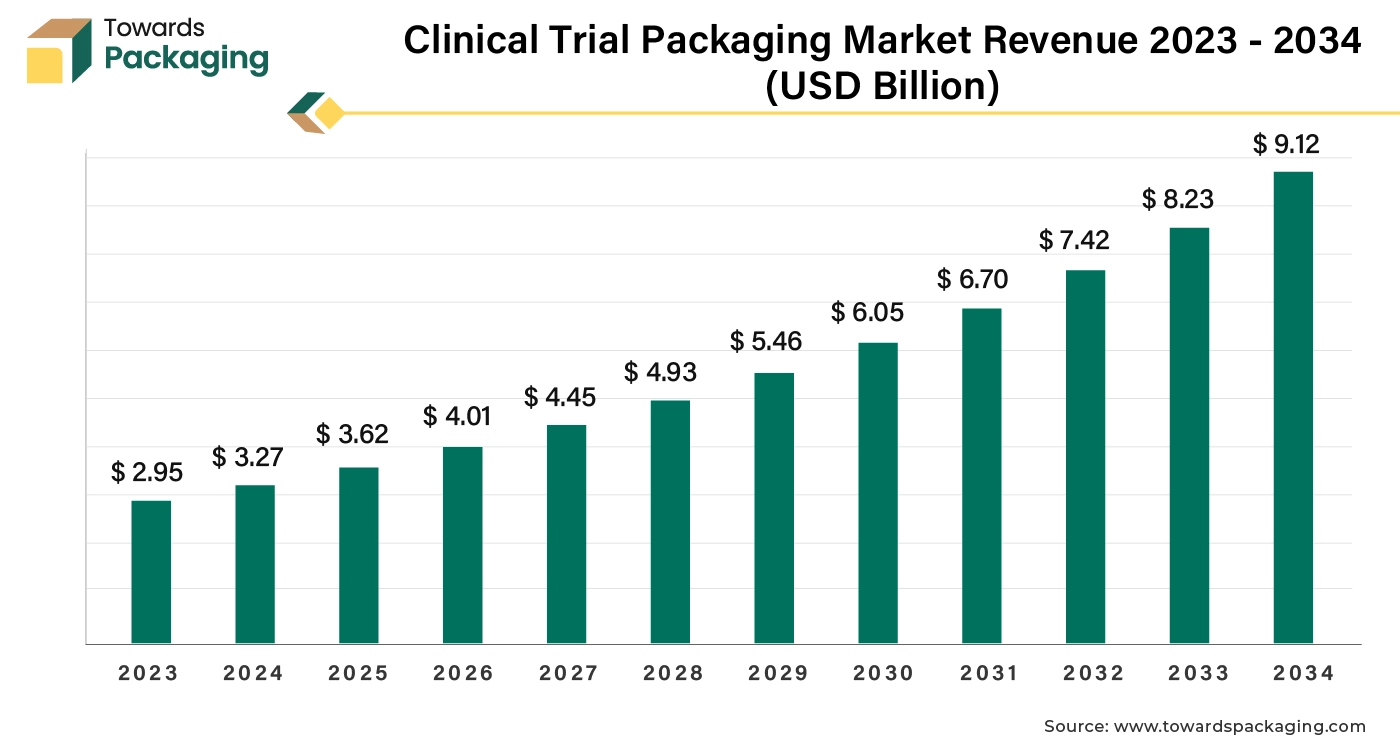

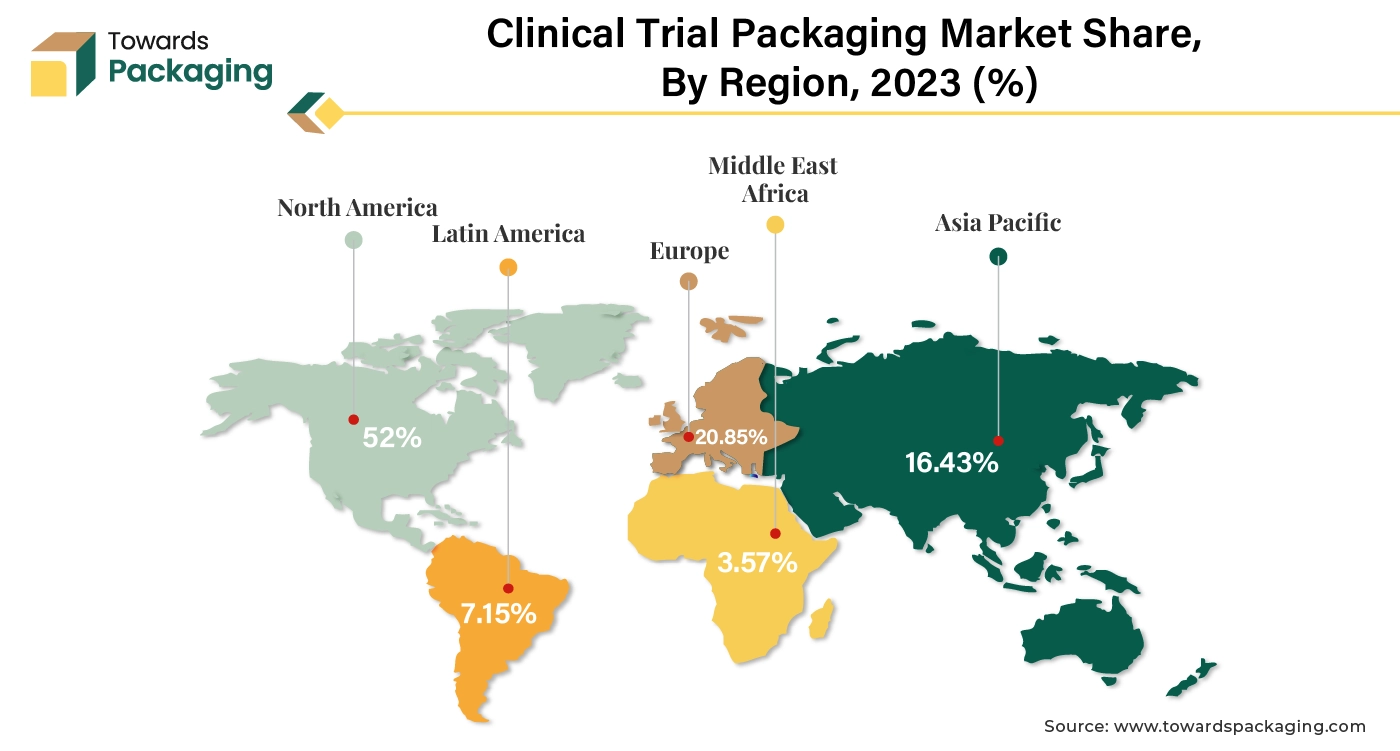

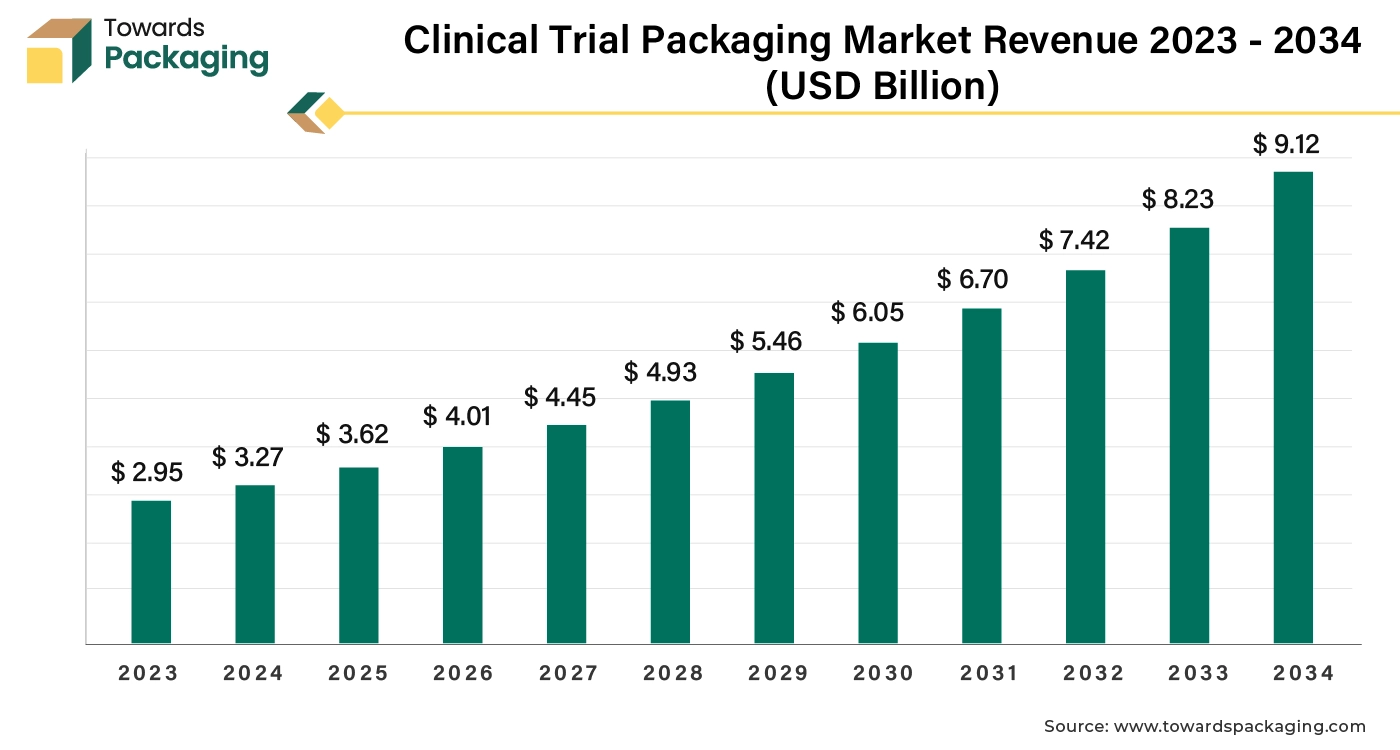

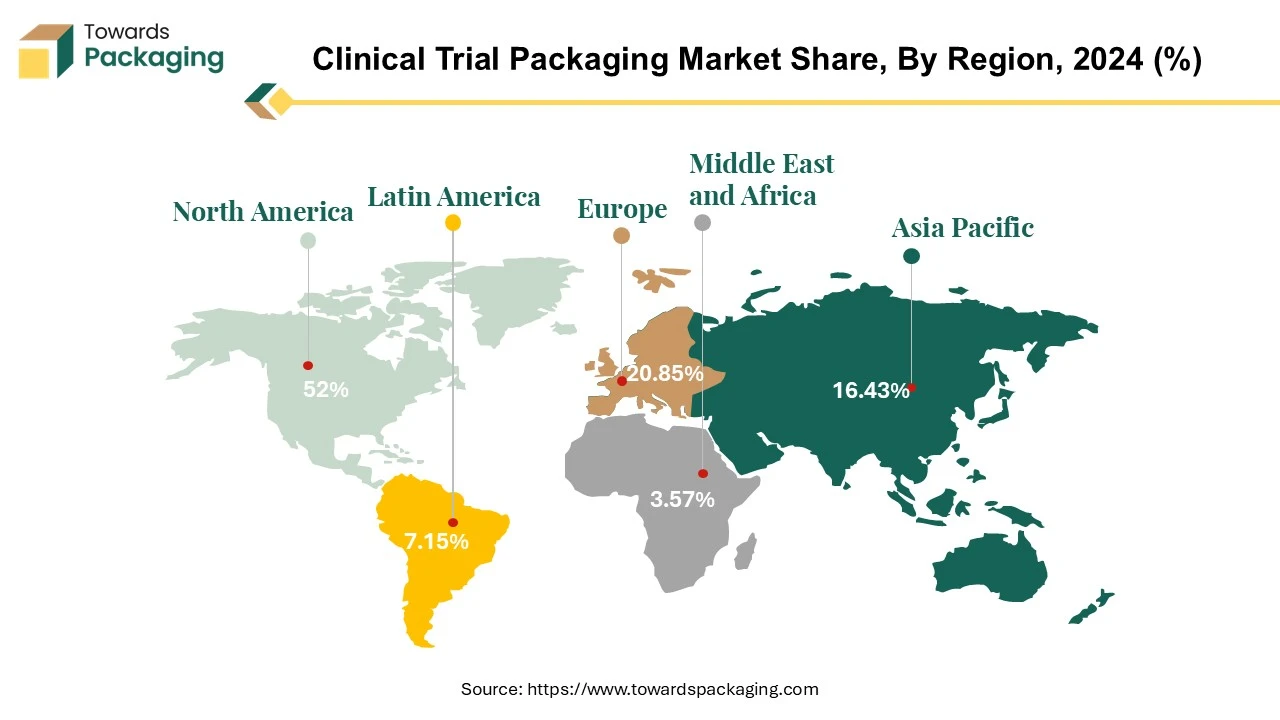

The clinical trial packaging market is forecasted to expand from USD 4.01 billion in 2026 to USD 10.10 billion by 2035, growing at a CAGR of 10.80% from 2026 to 2035. This report provides detailed insights into market segmentation by clinical trial type, packaging type, material, and end user, along with regional analysis across North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. It highlights the dominance of North America (2024) and the rapid growth of Asia Pacific. The study covers major players such as Schreiner MediPharm, PCI Pharma Services, Fisher Clinical Services, and Almac Group, along with trade data of aluminum tubes, glass bottles, and containers, and a value chain analysis illustrating supplier-to-end-user flow.

Packaging designed to enhance patient adherence, such as easy-to-use and informative packaging, is becoming increasingly important, influencing market demand. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance clinical trial packaging which is estimated to drive the global clinical trial packaging market over the forecast period. The global packaging market size is estimated to grow from USD 1.20 trillion in 2022 to reach an estimated USD 1.58 trillion by 2032, growing at a 3.16% CAGR between 2023 and 2032.

Clinical trial packaging is a critical component in the management and execution of clinical trials. It involves the design, production, and labeling of packaging materials used to contain and protect investigational products (such as drugs or medical devices) during a clinical trial. The process ensures that the investigational product is stored, handled, and administered correctly to maintain its integrity and ensure patient safety.

Clinical trial packaging must comply with regulatory requirements set by agencies like the FDA (U.S. Food and Drug Administration) or EMA (European Medicines Agency). This involves adherence to guidelines that ensure the safety, efficacy, and quality of the investigational products. Packaging must also meet standards for labeling, which includes details about dosage, administration, storage, and potential side effects. In summary, clinical trial packaging is a multi-faceted process involving careful design, regulatory compliance, and attention to detail to ensure that investigational products are safe, effective, and handled correctly throughout the clinical trial process.

| CONSIGNEE_NAME | SHIPPER_NAME | SUM OF QUANTITY | SUM OF WEIGHT (kg) | PRODUCT_NAME |

| PAC TECH INTERNATIONAL INC | POLYPLAS DOMINICANA S A | 197251500 | 204831 | Aluminum Tubes/Containers |

| GRIFOLS BIOLOGICALS INC | NIHON TAISANBIN GLASS BOTLE MFG CO | 8108688 | 710440 | Glass Bottles |

| PAC TECH INTERNATIONAL INC | POLYPLAS DOMINICANA S A | 10440000 | 10754 | Aluminum Tubes/Containers |

| E AND J GALLO WINERY | GREAT CHINA METAL IND CO LIMITED | 3744000 | 25992 | Beverage Cans |

| DESTILERIA SERRALLES INC | OWENS AMERICA S DE RL DE CV | 3740424 | 1545836 | Glass Bottles |

| Product Name | North America | Europe | Asia Pacific | Latin America | Middle East & Africa |

| Aluminum Tubes/Containers | $8.80 - $10.73 | $9.75 - $11.72 | $7.32 - $8.80 | $7.81 - $9.76 | $8.30 - $10.23 |

| Glass Bottles | $3.09 - $3.66 | $3.38 - $4.03 | $2.53 - $3.10 | $2.67 - $3.24 | $2.73 - $3.66 |

| Beverage Cans | $7.56 - $9.63 | $7.56 - $9.63 | $6.96 - $8.89 | $7.43 - $9.25 | $7.89 - $9.63 |

Note:

AI can automate and optimize packaging processes, reducing the time and cost associated with manual tasks. This includes automated labeling, packaging, and quality control. AI systems can minimize human errors by ensuring accurate and consistent labeling and packaging. This is crucial in clinical trials where precision is essential. AI can monitor packaging processes in real-time, identifying and addressing issues immediately to maintain quality and compliance. AI tools can help ensure that packaging meets regulatory requirements by automatically checking compliance and flagging potential issues. Overall, AI integration enhances efficiency, accuracy, and regulatory adherence in the clinical trial packaging industry, ultimately contributing to smoother and more effective trials.

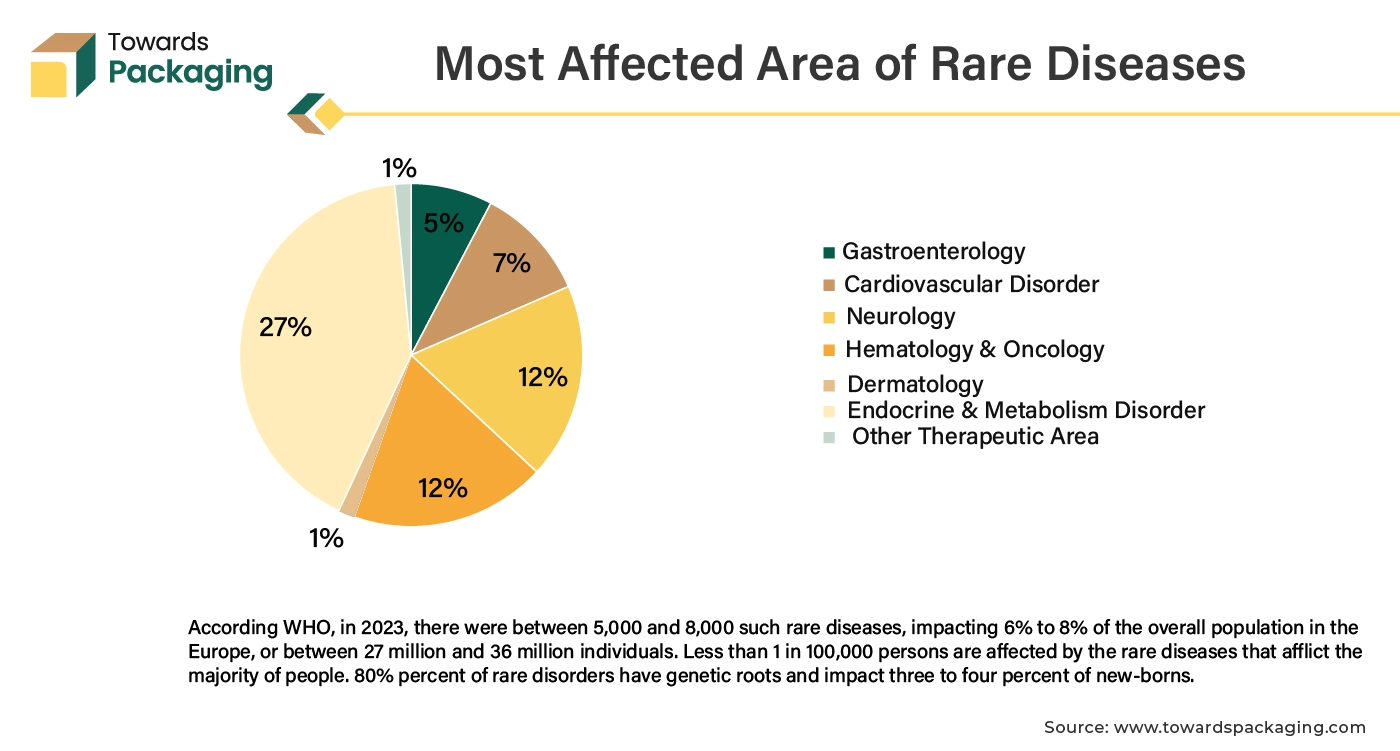

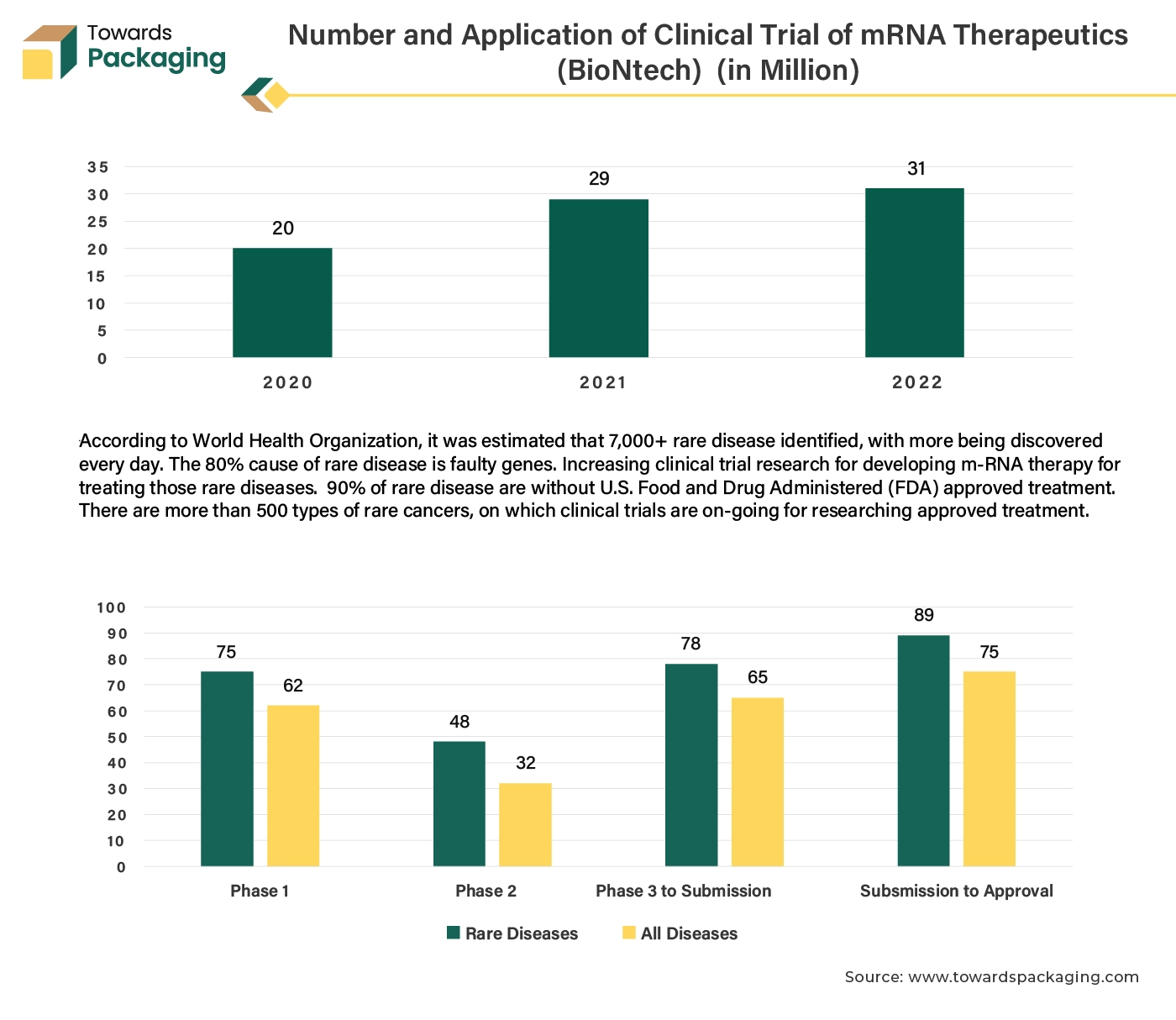

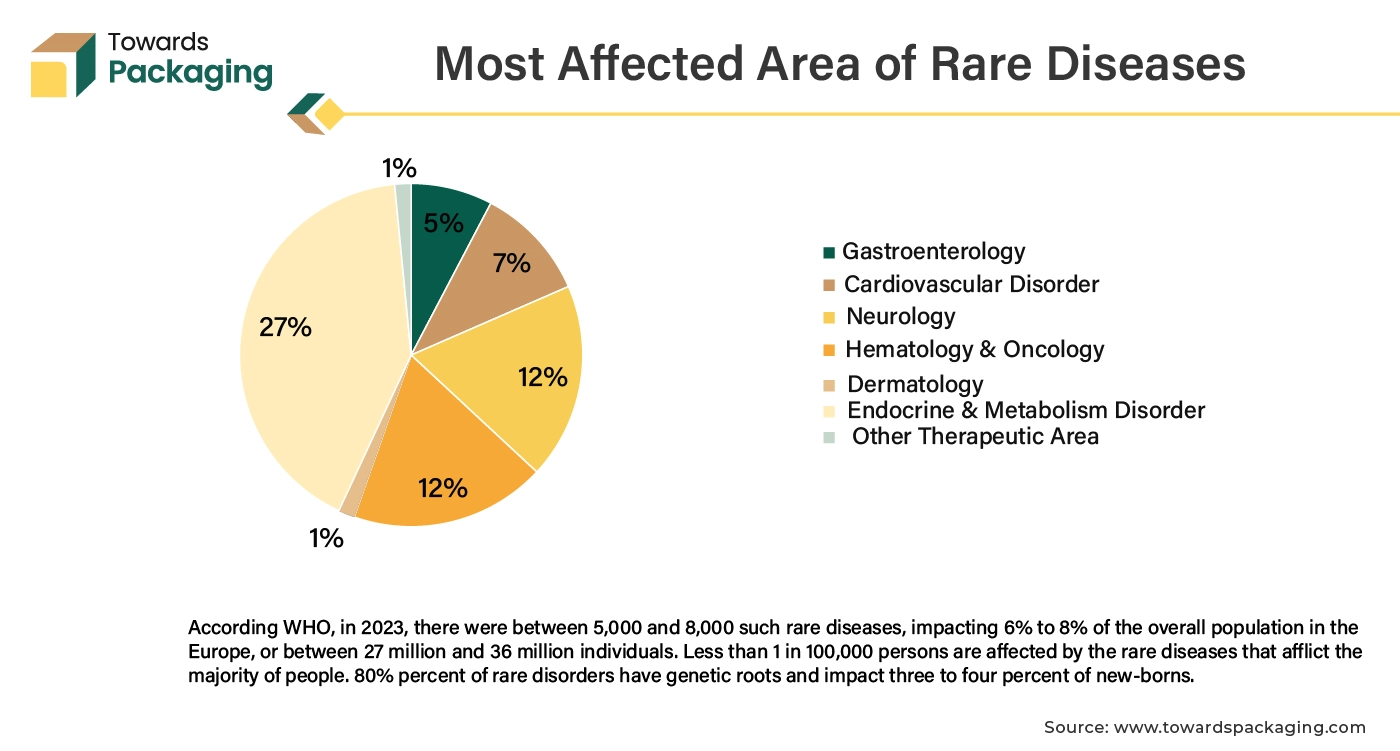

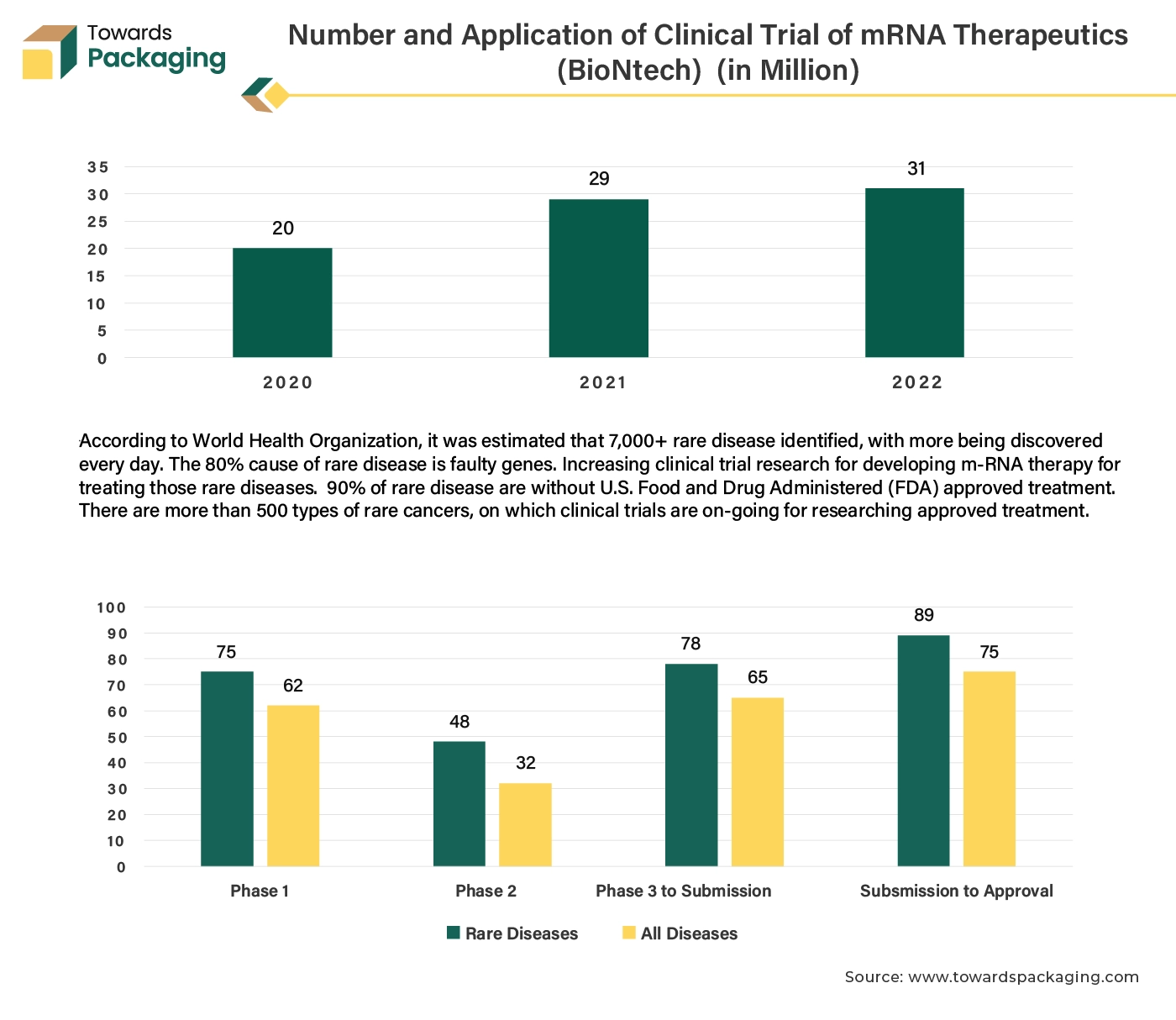

Increasing epidemiology of the rare disease has risen the clinical trial activity, carried to develop drug to treat those rare diseases. The rising demand for clinical trials is closely linked to the increasing investment in research and development (R&D) across various sectors, particularly pharmaceuticals and biotechnology. Research and development efforts are focused on developing new and innovative treatments, therapies, and drugs. Each new product or approach requires rigorous testing through clinical trials to ensure safety and efficacy before it can be approved for public use.

The increasing complexity of diseases, including rare and chronic conditions, necessitates more specialized clinical trials to understand and address these health issues effectively. Emerging global health challenges and pandemics (like COVID-19) create urgent needs for new interventions and treatments, driving a surge in clinical trials to address these issues. Overall, as R&D activities expand and evolve, there is an increased need for clinical trials packaging to support the development and approval of new and effective treatments.

The key players operating in the market are facing challenges in meeting regulatory body regulation and deployment of proper technology for packaging, which is observed to restrict the growth of the clinical trial packaging market. Strict and varying regulations across different regions can complicate the packaging process and increase costs. Compliance with these regulations is crucial but can be a significant barrier. The cost of specialized packaging materials and technologies can be substantial. This includes the cost of ensuring the integrity and security of clinical trial products, which can be a burden, especially for smaller companies.

The logistics involved in packaging and distributing clinical trial materials can be complex. Managing these supply chains efficiently while maintaining quality can be challenging. The need for advanced packaging technologies that can handle various types of drugs, including biologics and personalized medicines, might not always be met by existing solutions. The consolidation of pharmaceutical companies and packaging providers can lead to reduced competition and innovation in the packaging market. Increasing emphasis on sustainability and environmental impact may require additional adjustments to packaging practices, which can be costly and complex. Addressing these challenges requires a multifaceted approach, including investment in technology, regulatory compliance, and efficient supply chain management.

The shift towards personalized and precision medicine requires customized packaging solutions tailored to individual patient needs, which presents opportunities for innovation in packaging design and technology. With a rise in clinical trials for new drugs, biologics, and medical devices, there’s a growing need for specialized packaging solutions. The rise in the introduction of the clinical research centers to develop precision medicines has increased the demand for the clinical trial packaging, which is estimated to create lucrative opportunity for the growth of the clinical trial packaging market over the forecast period.

For instance,

Schreiner MediPharm has engineered a smart extension for the proven Key-Pak wallet for oral solid dosage medication from Keystone Folding Box Company, headquartered in U.S. The novel solution combines a child-resistant paperboard package with technology for digital adherence monitoring.

The therapeutic and prevention segment held the dominating share of the clinical trial packaging market in 2024. The increased health awareness, medical technology advancement, aging population, and advances in genetics and personalized medicine, are factors collectively contribute to the expansion of the therapeutic and prevention segment in clinical trial packaging market. People are becoming more proactive about their health, seeking ways to prevent illness and manage chronic conditions effectively. Innovations in medical technology and digital health tools are making it easier to monitor, diagnose, and treat various conditions. An aging global population requires more healthcare services, including preventive measures and chronic disease management.

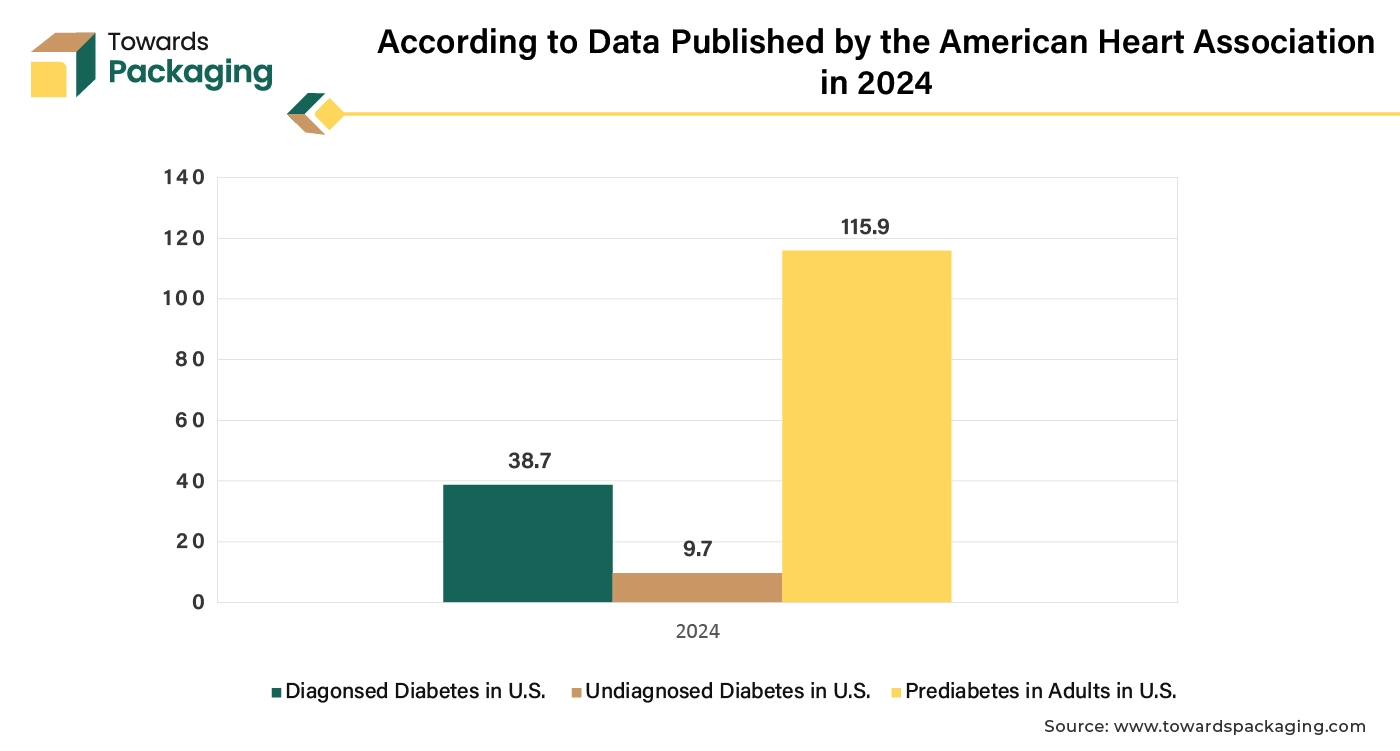

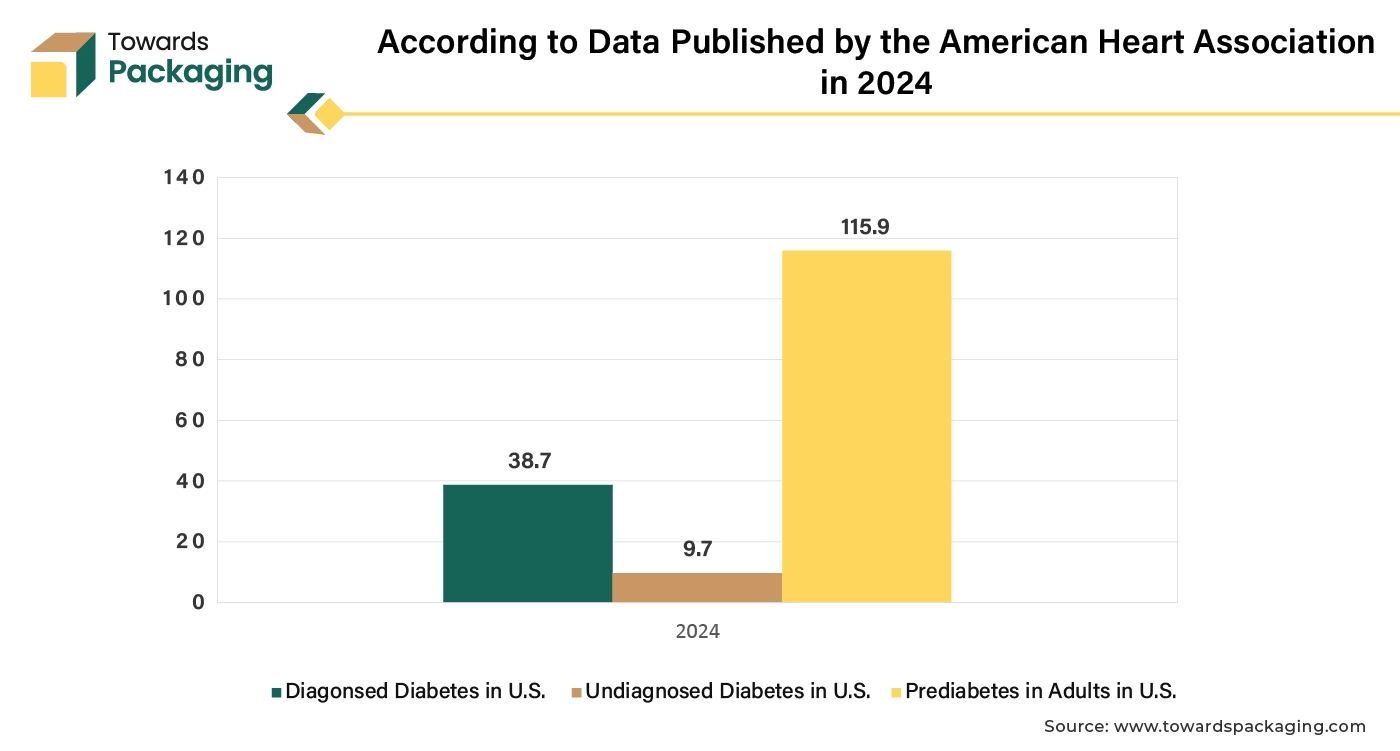

Advances in genetics and personalized medicine allow for more targeted and effective therapies and prevention strategies. Increasing prevalence of chronic diseases like diabetes and cardiovascular conditions drives demand for ongoing therapeutic and preventive solutions.

The bags & pouches segment accounted for a significant share of the clinical trial packaging market in 2024. Bags and pouches can be easily customized to fit various sizes and shapes of clinical trial materials, including pharmaceuticals and medical devices. They provide effective protection against contamination, moisture, and light, which is crucial for maintaining the integrity and stability of clinical trial products. Many bags and pouches can be designed with tamper-evident features, ensuring that any unauthorized access is detectable. They can be tailored to meet regulatory requirements for labeling, serialization, and traceability in clinical trials.

Bags and pouches are generally user-friendly, making them convenient for both healthcare professionals and patients during the clinical trial process. Significant rise in the demand for blood bags is observed, which are utilized to preserve blood and blood components. During COVID-19 period, there was rise in patients number, there was a two-fold increase in the need for convalescent plasma. Along COVID-19, other health-related issues such as diabetes, cardiovascular disease, cancer, infectious disease, etc. are also driving up demand for intravenous (IV) and dialysis bags.

The plastic segment led the global clinical trial packaging market in 2024. Plastics can be molded into a wide range of shapes and sizes, making them suitable for various types of medical and clinical trial products. Many plastics offer excellent barriers against moisture, oxygen, and light, helping to preserve the stability and efficacy of pharmaceutical products. Advances in plastic technology are improving the recyclability of plastic packaging and promoting the use of sustainable materials. The key players operating in market are focused on introduction of the launching new plastic packaging system, which drives the segment over the forecast period.

For instance,

The clinical research organization segment held the dominating share of the clinical trial packaging market in 2024. Clinical research organization possess specialized knowledge and experience in managing clinical trials, including regulatory compliance, data collection, and site management. This expertise enhances the efficiency and quality of trials. Clinical research organizations typically have a global network of sites, investigators, and patient populations. This global reach allows for faster recruitment and access to diverse populations, which is critical for meeting regulatory requirements and accelerating timelines.

For instance,

North America witness the highest revenue shares for the year 2024. North America, particularly the United States, is a leading hub for clinical trials due to its advanced healthcare infrastructure, significant investment in research and development, and large patient population. The region has well-established regulatory frameworks and standards, such as those set by the U.S. Food and Drug Administration (FDA). This encourages adherence to high standards in clinical trial packaging to ensure safety, compliance, and quality. North America is home to many leading Clinical Research Organizations (CROs) that manage a large volume of clinical trials, further driving the demand for specialized packaging solutions. Moreover, increasing launch of the clinical trial services in North America is estimated to drive the clinical trial packaging market in the near future.

For instance,

U.S. Market Trends

U.S. clinical trial packaging market is driven by the growing robust pharmaceutical research and development infrastructure as well as stringent regulatory environment laws in the country. The U.S. boasts a well-established pharmaceutical industry with significant investments in research and development. This robust infrastructure supports a high volume of clinical trials, necessitating advanced packaging solutions to ensure the safety and integrity of investigational products.

The U.S. Food and Drug Administration (FDA) enforces strict regulations for clinical trial packaging, emphasizing quality assurance and patient safety. These regulations drive the demand for specialized packaging that meets compliance standards. Innovations such as smart packaging, RFID technology, and digital tracking systems are increasingly adopted in the U.S. These technologies enhance the monitoring and management of clinical trial materials, improving efficiency and data accuracy.

The shift towards personalized and precision medicine in the U.S. requires customized packaging solutions tailored to individual patient needs. This trend drives the development of flexible and adaptive packaging designs. The presence and growth of CROs in the U.S. contribute to the increasing demand for clinical trial packaging. These organizations manage various aspects of clinical trials, including packaging, thus fueling market growth.

Asia Pacific is anticipated to grow at the fastest rate in the clinical trial packaging market during the forecast period. The Asia Pacific region has seen rapid expansion in its pharmaceutical and biotechnology sectors. Countries like China and India are becoming major hubs for clinical trials due to their large patient populations and increasing investments in drug development. Many Asia Pacific countries have implemented regulatory reforms to streamline the clinical trial process, making it easier and more efficient for international companies to conduct trials in the region.

There is a growing emphasis on drug development and innovation in Asia Pacific, driven by both local pharmaceutical companies and multinational corporations looking to tap into new markets. These factors collectively contribute to the dominance of the clinical trial packaging market in the APAC region, as it offers a combination of cost advantages, regulatory support, and a robust healthcare infrastructure. The establishment of the clinical trial supply chain in Asia Pacific is estimated to drive the growth of the clinical trial packaging market in Asia Pacific market in near future.

For instance,

China Market Trends

China clinical trial packaging market is driven by the surge in clinical trial activities and expansion of contract packaging services. China has witnessed a significant increase in clinical trials conducted by both domestic and international pharmaceutical companies. This uptick is fueled by the country's large and diverse patient population, making it an attractive location for clinical research. Consequently, there's a growing demand for reliable, customizable, and compliant packaging solutions to support these trials.

The Chinese government, through agencies like the National Medical Products Administration (NMPA), has implemented rigorous standards for clinical trial packaging. These regulations emphasize Good Manufacturing Practices (GMP) and Good Clinical Practices (GCP), ensuring that packaging solutions meet both national and international quality standards. China is investing heavily in advanced packaging technologies, including smart packaging solutions that incorporate real-time tracking, temperature monitoring, and data analytics. These innovations enhance the integrity and safety of clinical trial materials, especially for temperature-sensitive products. With an aging population and a shift towards personalized medicine, there's an increasing emphasis on patient-centric packaging designs. Features such as easy-open containers, clear labeling, and adherence aids are becoming standard to improve patient compliance and trial outcomes.

The rise of small to medium-sized pharmaceutical companies in China, which may lack in-house packaging capabilities, has led to increased demand for contract packaging services. These services offer specialized expertise and advanced technologies, enabling efficient and compliant packaging solutions. Environmental concerns are prompting Chinese pharmaceutical companies to adopt sustainable packaging practices. This includes the use of eco-friendly materials and processes, aligning with global sustainability goals and consumer preferences.

| Schreiner MediPharm | Packaging and functional label solutions for the healthcare industry |

| Headquartered | Germany, Europe |

| Recent Development | In April 2024, Schreiner MediPharm unveiled the launch of the late-stage customization capabilities for its Radio-Frequency IDentification (RFID)-Labels series allowing sophisticated smart labels to be supplied on short notice and order-specific programming of the integrated RFID chip. |

By Clinical Trial Type

By Packaging Type

By Material

By End User

By Region

February 2026

February 2026

February 2026

February 2026