Confectionery Packaging Market Size and Rising Demand in North America

The confectionery packaging market is forecasted to expand from USD 11.85 billion in 2026 to USD 16.29 billion by 2035, growing at a CAGR of 3.6% from 2026 to 2035. The market segments are categorized by material (plastic, paper & paperboard, aluminium foil, glass, metal), product type (chocolate, biscuits, cookies, candy, ice creams), and distribution channels (retail shops, confectionery stores, supermarkets, hypermarkets, others).

Report Highlights: Important Revelations

- Global confectionery packaging sector is poised for growth, starting at a value of USD 11.44 billion in 2025.

- The market is expected to surge, reaching an estimated value of USD 16.29 billion by 2035.

- This expansion is at a consistent CAGR of 3.6% over the period from 2023 to 2035.

- Factors growing the expansion of confectionery packaging in North America.

- Influence of Asia-Pacific on confectionery packaging industry trends.

- Flexible nature of plastic in the confectionery packaging sector.

- Innovative approaches to chocolate product packaging for enhanced sensory experience.

- Utilizing retail outlets for efficient confectionery packaging distribution.

The confectionery packaging sector is undergoing substantial expansion fuelled by various factors. Confectionery products, encompassing a diverse range of delights like cakes, pastries, candies, chocolates, and chewing gum, are widely favoured across all age groups, especially among children and young adults. Key players in the confectionery industry, such as Cadbury, Nestle, Perfetti, and Wrigley, are propelling this growth through their innovative product offerings and marketing strategies. According to the National Confectioners Association's (NCA) 2024 State of Treating report, confectionery sales reached an unprecedented high of nearly $49 billion in 2023. This surge in sales signifies an escalating global demand for confectionery products.

The packaging of confectionery items plays a crucial role in ensuring product quality, safety, and appeal throughout the distribution, storage, and sales processes. Confectionery packaging must effectively preserve the taste, texture, and freshness of the products while protecting them from chemical and microbiological degradation.

Various packaging materials are employed in confectionery packaging, including high-grade plastics, aluminium, recyclable paper, and metal containers. These materials offer different levels of protection and sustainability, catering to the diverse needs of consumers and manufacturers. Additionally, different packaging formats are utilized to accommodate retail and bulk quantities of confectionery products, ensuring convenience for both consumers and retailers.

Confectionery packaging serves multiple functions beyond preservation and protection. It also serves as a means of branding and marketing, with eye-catching designs and labelling attracting consumers' attention and influencing their purchasing decisions. Packaging innovations, such as resealable pouches and portion-controlled packs, further enhance convenience and appeal for consumers.

The growing awareness of environmental sustainability is driving the adoption of eco-friendly packaging solutions within the confectionery industry. Manufacturers are increasingly utilizing recyclable and biodegradable materials, as well as reducing packaging waste through efficient design and production processes.

Overall, the confectionery packaging market is witnessing robust growth driven by increasing consumer demand, technological advancements, and evolving industry trends towards sustainability and convenience. As companies continue to innovate in both product offerings and packaging solutions, the market is expected to expand further in the coming years.

Confectionery Packaging Market Trends

Eco-friendly and Sustainable Packaging

There is rising demand for packaging made from sustainable and biodegradable materials like paper, cardboard, and plant-based plastics. Confectionery manufacturers are focusing on minimizing packaging waste by using lightweight materials and optimizing package sizes. The consumers are sicking confectionery products packaged in package which can easily recycled or composted.

Consumer Convenience

There is rising demand for packaging which is re-sealable, easy-to-open and has portioned packaging. Individual packs cater to on-the-go consumption and portion control.

Enhanced Product Presentation

The consumers are seeking eye-catching design, packaging which is innovative and visually appealing packaging designs to attract consumers. The demand for transparent packaging for confectionery is high as it allows consumers to see the product inside, building trust and showcasing its quality.

The unique packaging formats which are interactive with consumers seek more attention which sales that particular confectionery at higher rate. Incorporating elements like augmented reality or QR codes to engage consumers. Customized designs and messages to create a more personal experience.

Driver

Expansion of Confectionery Market

There is rising demand for on-the-go and convenience packaging, especially with busy lifestyles. This has led to a rise in individually wrapped products and resealable packaging. The launch of new confectionery products and expansion of confectionery market has risen the demand for the confectionery packaging solutions, which has been estimated to drive the growth of the confectionery packaging market over the forecast period.

- For instance, in September 2024, At the TFWA World Exhibition in Cannes, Ferrero Travel Market will introduce new products from its candy and biscuit lines. In response to the changing needs of consumers who travel, businesses such as Kinder, Tic Tac, Raffaello, Nutella, and Ferrero Rocher have introduced new products. The new Rocher Gift Box, which is exclusive to travel retail and is reportedly perfect for high-end presents with an emphasis on sustainability, is one of the highlights.

- For instance, in September 2024, Mars Wrigley, a company manufacturing mints, chewing gum, chocolate, and fruity confections revealed the introduction of the Twix & Friends Medium Selection Box and M&M’s Crispy Milk Chocolate Santa Treat for Christmas, 2024.

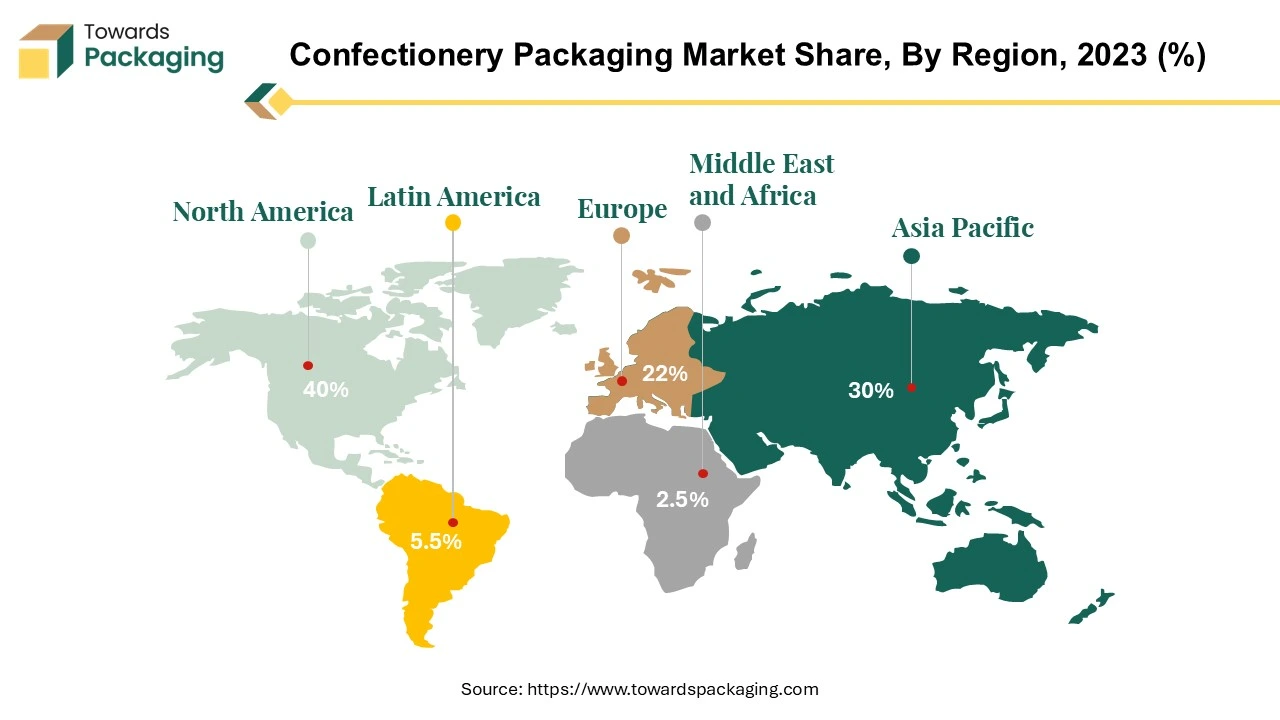

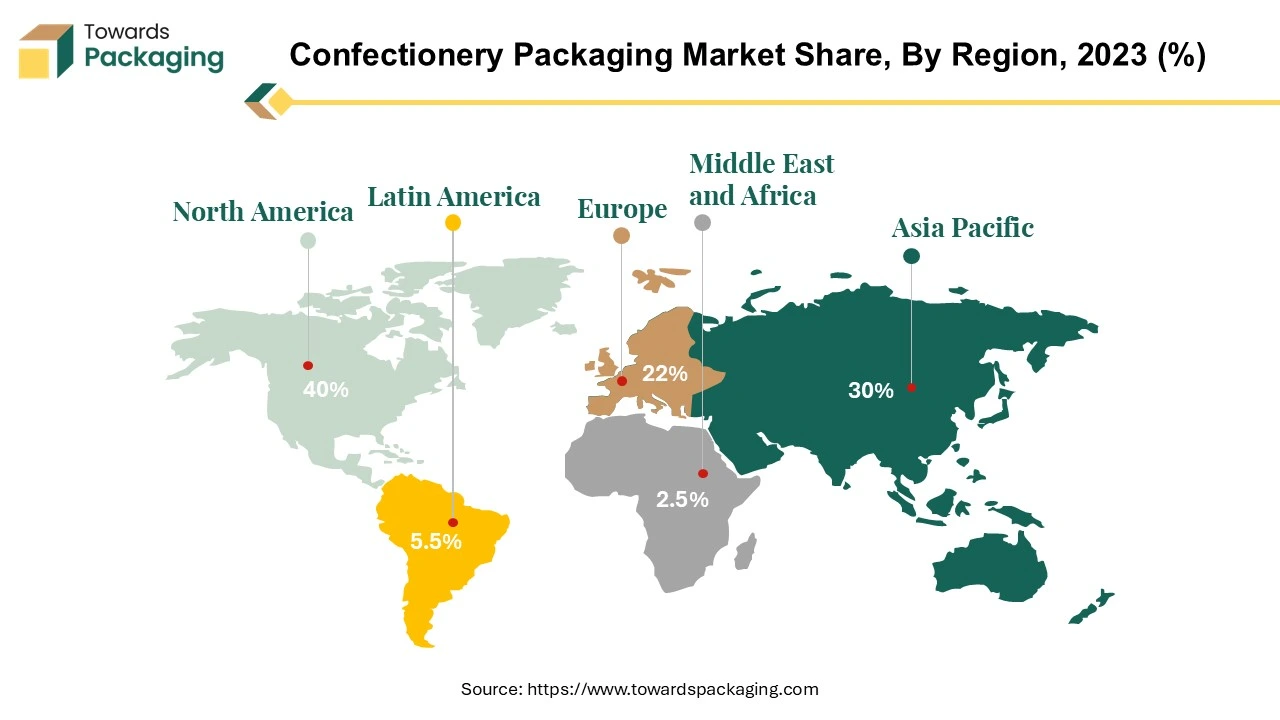

Driving Factors Behind the Growth of Confectionery Packaging in North America

North America is the house of confectionery producers. With about 93% of the market by 2027, the United States is clearly the leading country in the North American confectionery packaging market. This unwavering hold highlights the industry's noteworthy growth trajectory. The United States' increasing consumption of candy products is one of the main drivers of this growth.

One of the main factors fuelling the growth in demand for confectionery packaging solutions is customers' growing fondness for sweet treats. The demand for efficient packaging to present and preserve sweets is growing as more Americans indulge in them. As a result, producers must increase output to keep up with the growing demand, which drives the market for confectionery packaging to expand.

The increased trend in consumption can be attributed to changing consumer preferences and lifestyle shifts, as confectionery goods are now a necessary component of celebrations and everyday enjoyment. Confectionery goods are consumed in large quantities in the US. People of all ages adore these goodies, that include things from chocolates to candy, throughout the entire country. Confectionery products tend to be available in grocery stores, convenience stores and specialty shops and are frequently eaten as snacks or desserts.

Candy is very popular in the United States because it's easy to find, reasonably priced, and gives a satisfying, decadent feeling. Convenience, creative packaging designs, and the introduction of new product lines are further elements that support the market's ongoing growth. A culture of indulgence and enjoyment is fostered by the impact of marketing strategies and brand awareness initiatives, which highlight the attractiveness of confectionary items even more. This customer resonance not only keeps the market alive but also pushes manufacturers to look into new and improved product lines.

The confectionery packaging industry has experienced exceptional growth due to the growing demand for confectionery treats in the United States. This growth trajectory indicates that innovation and expansion in the market will continue in the coming years.

For Instance,

- In August 2023, Alanna Cotton assumed leadership of Ferrero North America, encompassing the United States, Canada, and the Caribbean. She is currently supervising the company's substantial investments in talent, R&D, and manufacturing.

The confectionery packaging market is driven by the Asia-Pacific region, which constitutes the largest part of the confectionery industry, with a projected value of US$443.2 billion in 2023. This leading presence indicates how important the region was in forming the worldwide confectionary industry. The prominent position of the Asia-Pacific confectionery packaging market is due to of several factors. Confectionery objects are in great demand due to the region's growing population, changing lifestyles, and rising disposable incomes. The packaging industry is growing as a consequence of consumers' growing need for convenience and pleasure, which increases the need for effective and enticing packaging solutions.

A conducive environment for market expansion is created by the Asia-Pacific region's rapid urbanisation and growing retail infrastructure. Supermarkets, convenience stores, and internet channels make confectionary items more accessible to consumers, which increases need for creative packaging solutions that attract and hold the interest of discriminating consumers while maintaining freshness. The dynamic economic landscape of the region creates an atmosphere that is favourable to investment and innovation in packaging technology. In order to satisfy a wide range of consumer preferences and sustainability concerns, market participants take advantage of developments in materials, design, and production techniques, which in turn promotes market expansion.

The use of advanced packaging solutions which ensure product quality and compliance with strict regulations is driven by changing regulatory frameworks and an increased focus on food safety standards. With a strong forecast for continued growth and expansion in the near future, the Asia-Pacific region is a leading force in the confectionery packaging industry, reflecting its critical role in setting global trends and innovations.

Confectionery Production in Europe with Market Influence in America

The European confectionery industry is a major player globally, with over 12,000 companies producing 14.7 million tons of confectionery annually, according to Caobisco. However, the United States leads the world in confectionery production, with a predicted turnover of 264 billion euros in 2023 and the highest growth forecast for the next five years, as per Euromonitor International.

Chocolate is the top choice for consumers. In 2020, Switzerland had the highest per-capita chocolate consumption in Europe at over 11 kilograms per year, followed by Germany (9.2 kg), Estonia (8.3 kg), and Denmark (8.2 kg), according to Chocosuisse. Estonia led in overall per-capita confectionery consumption in 2022, with each person consuming 13.6 kilograms. This trend is expected to continue growing strongly in the Baltic country over the next five years.

A 2022 survey revealed that women are more likely to eat sweets daily, with 34% of women versus 23% of men reporting daily consumption of sweets or savory snacks. Additionally, a study also found that a quarter of participants have increased their sweet and snack consumption since the pandemic began.

For Instance,

- In January 2024, Scoop Capital has bought Apollo Food Holdings, a Malaysian company that produces layer cakes and chocolate confections. Keynote Capital, a regional investor, sold Scooped a 51.3% majority ownership interest in Apollo for RM238.1 million (US$50.8 million).

Confectionery Packaging Market, DRO

Demand:

- Confectionery packaging must effectively protect delicate and perishable products from physical damage, moisture, air exposure, and temperature fluctuations. Packaging materials with barrier properties help extend the shelf life of confectionery items, ensuring product freshness and quality until consumption.

Restraint:

- Product fragility and perishability must be adequately protected against physical harm, moisture, air exposure, and temperature fluctuation via confectionery packaging.

Opportunity:

- Smart packaging innovations that improve customer satisfaction and brand interaction include augmented reality (AR) experiences, NFC (near-field communication) tags, and QR (quick response) codes.

Plastic's Versatility in Confectionery Packaging Market

The material of choice for confectionery packaging is plastic, especially when it comes to flexible forms. This is because plastic can offer vital features like grease resistance, physical strength, printability, preservation, protection, and machinability. Its lightweight quality adds even more allure, making it the material of choice for a variety of package configurations, such as roll packs, pillow packs, twist wraps, and vertical flow packs.

The confectionery packaging industry is undergoing rapid changes as traditional materials such as aluminium foil and waxed paper are gradually replaced by plastic films and their laminates. The higher qualities of plastic substitutes, which provide improved flex crack resistance and cost-effectiveness, are driving this shift.

The across the industry concern of moisture-related product deterioration is mitigated by polyethylene, which is known for having a low water permeability and therefore protecting confections from this type of damage. Polypropylene films, on the other hand, are becoming more and more popular. This is because of their natural rigidity, which makes them extremely machineable and superior in clarity. Sealability problems are still present, but creative fixes like vinyl coatings and PVDC are used to help reduce them.

Packaging for chocolate bars is characterised by horizontal form-fill-seal (HFFS) machines, which are used to wrap individual bars using materials like polyester and oriented polypropylene (OPP), which can be pearlized or metallized. The combination of advanced supplies and packaging equipment demonstrates the industry's dedication to improving product appearance, longevity, and consumer appeal.

For Instance,

- In October 2022, Leading manufacturer of personalised flexible packaging, PPC Flexible Packaging LLC, has announced that Plastic Packaging Technologies, LLC (PPT), located in Kansas City, KS, has been acquired.

Indulging the Senses Innovations in Chocolate Product Packaging

Chocolate products constitute a significant sector of the confectionery packaging industry, distinguished by a wide range of items that include truffles, pralines, and chocolate bars. Chocolate product packaging also provides protection, preservation, and visual appeal. Confectionery packaging innovations mainly focus on the particular requirements of chocolate goods, making sure they stay intact, fresh, and appealing all the way through the supply chain and when they get to the consumers. As they can act as a barrier against moisture, light, and air all of which can negatively impact chocolate's quality and shelf life materials including plastic films, laminates, and foils are widely utilised for chocolate packaging.

The total amount of revenue made from the sale of chocolate-based confections globally is referred to as global chocolate confectionery sales. This covers a range of chocolate-based items, including truffles, bars, candies, and filled chocolates. The sales figures usually show the total dollar amount of chocolate confectionery items sold in a specific period of time, usually expressed as an annual or quarterly figure. Chocolate product packaging designs frequently place a high value on aesthetics in order to draw customers in and communicate brand identity. Chocolate packaging is made more alluring by eye-catching images, vivid colours, and tactile finishes that encourage customers to base their judgements not only on the quality of the product but also on its aesthetic appeal.

Chocolate packaging is changing as a result of sustainability concerns, with an increasing focus on environmentally friendly materials and packaging techniques. Compostable or biodegradable materials are being investigated by brands as alternatives to typical plastic packaging in an effort to lessen their impact on the environment and satisfy consumer demands for sustainable goods. Driven by a confluence of functional needs, aesthetic considerations, and environmental imperatives, chocolate product packaging is a dynamic and evolving sector of the confectionery packaging market.

For Instance,

- In September 2023, Nestlé and Advent International have struck a deal for Nestlé to buy the bulk of Grupo CRM, a Brazilian manufacturer of luxury chocolate.

Leveraging Retail Stores in Confectionery Packaging Distribution

The distribution channel that retail stores provide as a vital conduit between producers and customers is crucial to the confectionery packaging market. This distribution channel includes a range of retail locations, such as supermarkets, convenience stores, specialty candy stores, and internet merchants. A sizable amount of candy sales occurs in supermarkets, which provide a broad assortment of packaged sweets to suit a variety of consumer tastes. These stores offer customers the convenience of a one-stop shopping experience, enabling them to peruse a wide range of confectionary items and make impulsive purchases.

Convenience stores are also essential for the distribution of confectionary goods, especially for consumers who are constantly on the go. These stores usually carry a carefully chosen assortment of popular confectionery and chocolate bars that are placed close to checkout counters to entice impulsive purchases. Specialisation confectionery stores provide a more considerately selected and high-quality assortment of candies, frequently including novelty confections, gourmet truffles and handmade chocolates. These companies offer a distinctive shopping experience, attracting customers looking for expensive and superior goods for gifts or special occasions.

The distribution channel that retail stores provide is an essential means for transporting confectionary items from producers to customers. It offers a wide range of possibilities for purchases to accommodate a variety of tastes and shopping styles. In this cutthroat retail climate, appealing packaging is essential for drawing customers in, guaranteeing product freshness, and raising brand awareness.

For Instance,

- In October 2023, Paper Twister, an innovative a paper-based twist-wrap packaging method, has been introduced by the European flexible packaging manufacturer Adapa Group for use in confections and sweets.

Top Confectionery Packaging Market Players

- International Paper Company

- Sonoco Products Company

- WestRock Company

- Crown Holdings, Inc.

- Berry Global Group,

- Amcor plc

- Mondi plc,

- DS Smith plc,

- Sealed Air Corporation

- Smurfit Kappa Group

- Huhtamaki Oyj

- Packman Packaging

- Parkside

- Viraj Packers

- JBM Packaging

Latest Announcements by Industry Leaders

- In September 2024, Dirk Van de Put, CEO of Mondelēz International, stated that sourcing material linked to advanced recycling technologies (mass balance) helps send a signal to the broader industry and can help to drive collection, sortation, and processing of more plastic waste. The company work hard to improve confectionery packaging in order to promote a more circular packaging economy. The company accomplish this by utilizing creative collaborations, optimizing processes, and minimizing and changing packaging.

In the U.S. and Canada, Mondelèz International has declared that it will procure plastic associated with sophisticated recycling technology, commonly referred to as chemical or molecular recycling, for the packaging of most of its SKUs for its Triscuit Crackers. Triscuit is a well-known snacking brand with over a century of history and tradition. Through this program, the Triscuit brand is supporting a more circular pack economy in the United States and Canada by obtaining recycled plastics using the ISCC mass balance approach. This advances Mondeléz International's objective of having roughly 5% of its plastic come from recycled sources by 2025. Soft plastic packaging was once thought to be a one-time use item.

Recent Developments in the Confectionery Packaging Market

- In June, 2024, Saica Group in collaboration with Mondelèz have introduced a novel paper-based product that is intended to be recyclable in the paper waste stream and targets multipack items for the chocolate, biscuit, and confectionery markets. The product can be made coated or uncoated and is reportedly appropriate for the heat sealable packing process. According to the companies, it was created to satisfy the Confederation of European Paper's (CEPI) sustainability criteria.

- In October 2023, Paper Twister, a new twist-wrap packaging solution based on paper, has been introduced by the European flexible packaging manufacturer Adapa Group for use in confections and sweets.

Confectionery Packaging Market Segments

By Material

- Plastic

- Paper & Paperboard

- Aluminium Foil

- Glass

- Metal

By Product Type

- Chocolate

- Biscuit

- Cookies

- Candy

- Ice Creams

By Distribution

- Retail Shops

- Confectionery Stores

- Supermarket

- Hypermarket

- Others

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait