April 2025

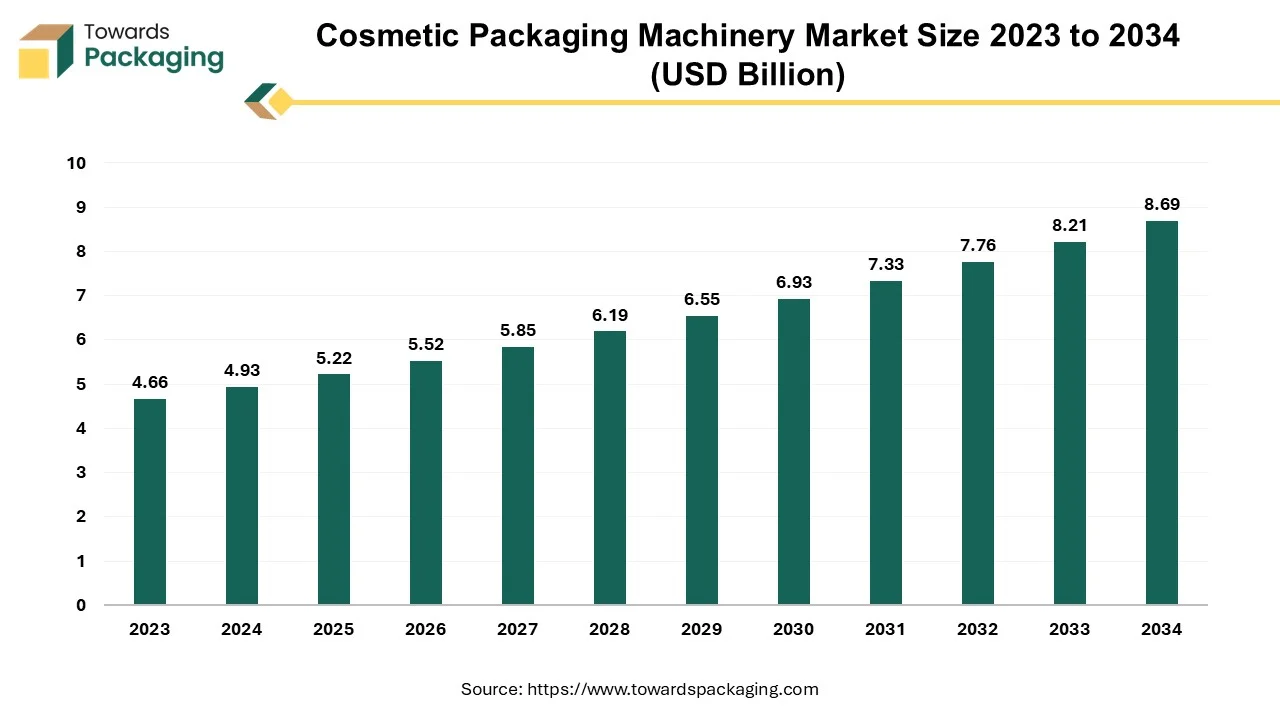

The cosmetic packaging market is expected to grow from USD 5.22 billion in 2025 to USD 8.69 billion by 2034, with a CAGR of 5.83% throughout the forecast period from 2025 to 2034.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition to develop innovative cosmetic packaging technology which is expected to drive the growth of the cosmetic packaging machinery market over the forecast period. The global packaging market to grow at a 3.16% CAGR between 2025 and 2034.

A product applied to the body to enhance beauty or conceal a flaw is referred to as cosmetics. These goods can include nail polish, face creams, skin lotions, shampoo, and other cosmetics like lipstick and eye shadow. Under a broad definition, even toothpaste and perfumes may be categorized as cosmetic products. The cosmetics sector uses a wide range of packaging machinery to prepare its products for sale, as well as a vast variety of packaged goods.

A variety of cosmetic packaging machinery options for powders, liquids, and pastes are available due to rapid technology growth because the needs for cosmetic packaging might differ greatly. The market players can provide customer with the ideal cosmetic packaging machinery, be it an auger or a piston machine. The cosmetic filling machinery is used to fill shampoo sachets, nail polish, creams jars, make-up kits, or any other containers. The cosmetics industry is advancing to create cosmetic equipment which can accommodate containers of various sizes and shapes and also able to handle products with varying levels of viscosity.

Brand owners place even greater emphasis on packaging for cosmetic items since they want it to improve the product's appearance. Cosmetic businesses spend money on packaging since it is a marketing tool and they want the packaging to represent the product. Since their goal is for the customer to be enamoured with the entire thing from the start, the product's appearance is crucial. Some businesses create packaging that has a similar language to the cosmetics within.

For instance, their packaging would more accurately reflect that their cosmetic product is produced entirely of natural materials if they were to highlight that fact.

The growth of the cosmetics and cosmetic packaging sectors is directly correlated; the former indicates the latter's expansion. The cosmetic packaging market has expanded and is predicted to continue growing at a rapid pace in the years to come.

A significant part of the cosmetics industry is packaging. It draws customers' attention and represents the image of the cosmetic products. The success of cosmetic items is directly correlated with their packaging, and the market leader will continue to generate profits in the future. The necessity for superior packaging engineering and premium design has essentially increased due to shifting consumer tastes and preferences for high-end cosmetic items, thereby elevating the importance of cosmetic packaging.

The commercial success of cosmetic items is directly correlated with their packaging, and the market leader will continue to generate profits in the future. The increasing need for superior packaging engineering and premium design due to shifting consumer tastes and preferences for high-end cosmetic items has elevated the importance of cosmetic packaging. Increasing launch of the advanced technology cosmetic packaging machinery is expected to drive the growth of the global cosmetic packaging market over the forecast period.

The key players operating in the market face challenges due to shifting consumer preference and lack of raw material which has anticipated to restrict the growth of the market. Sales of beauty giants are declining, primarily in the United States, as a result of agile competitors and shifting consumer preferences. The current economic uncertainty and the growing demand for affordable over-the-counter skincare products in emerging nations like China and India are likely to slow down the growth of the cosmetic packaging machinery market. During the course of the forecast period, these factors are anticipated to limit market expansion.

High levels of disposable wealth and shifting consumer preferences have made it difficult for manufacturers to portray their brands as symbols of excellence and product safety. Manufacturers are implementing cutting-edge solutions as a result, offering better design and effective packaging. Over the course of the forecast period, these factors are anticipated to drive up product demand in the cosmetic packaging machinery market. Moreover, the key players operating in the market are focused on developing new capping machinery for cosmetic products which is estimated to create lucrative opportunity for the growth of the global cosmetic packaging machinery market over the forecast period.

The form/fill/seal machinery segment held the dominating share of the cosmetic packaging machinery market in 2024. The type of filling machine that is utilized for a cosmetic product is determined by the product itself. Filling equipment comes in a variety of automated levels, just as container cleaning equipment. But rather than the production requirement, the product will dictate the kind of filling principle that is used. For certain cosmetic products with lesser viscosities, like mouthwash and perfume, overflow fillers and gravity filling machines might be the best options. Thick creams, toothpaste, and other cosmetics with higher viscosities are better suited for piston fillers and pump filling equipment.

Additionally, filling machines are compatible with a large variety of containers, such as glass and plastic bottles, bags or pouches, and customized containers for certain cosmetic goods. The key players operating in the market are focused on adopting the organic growth strategies like marketing and market expansion by showcasing cosmetic packaging machinery at launch exhibition and events, which is expected to drive the growth of the segment over the forecast period.

Furthermore, increasing launch of the cosmetic filling machine is expected to drive the growth of the segment over the forecast period.

The labelling machinery segment is estimated to grow at fastest rate over the forecast period. There are numerous ways to apply the label once the cosmetic product has been packed and sealed. Remember that the product label offers customers the chance to differentiate from the competition and to enlighten potential buyer.

By enabling labels to be put on a product's front and back, around its perimeter, as a three-panel design, or in any other unique way, labelling machines can foster creativity. Glass or plastic containers may usually be labeled with pressure-sensitive labelling machines and coding equipment that prints lot numbers, expiration dates, and other information directly onto the label. Cosmetic product labelling devices are available in varied automation levels to meet the production capacity of each individual packager. The key players operating in the market are focused on launching new labelling machine which for cosmetic products which is expected to drive the growth of the segment during the forecast period.

Moreover, increasing launch of the new cosmetic ingredient in cosmetic products has up-surge the need for mentioning it on labels which has risen the demand for labelling machinery. For instance, in March 2024, L’Oréal Groupe, cosmetic company, revealed the introduction of the MelasylTM, an advanced molecule innovated to cure localized pigmentation problem that lead to age spots and post-acne marks. The new registered component in L'Oréal formulations addresses pigmented markings on the skin and improves their appearance inclusively across all skin tones. Hence, the new formulation of L'Oréal cream need new labels which has risen the demand for the labelling machine.

A cosmetics packaging system may make use of numerous additional packaging machines. Conveyor systems with or without power can be utilized to increase packing process efficiency. Products can be shown to have been tampered with using induction sealers and neck banders. More packaging choices are possible using cartoners or shrink wrap bundlers. The product, the containers, and the essential production requirements will dictate the packaging equipment utilized on any cosmetic line.

The skin care segment dominated the global cosmetic packaging machinery market in 2024. The overall condition of the skin has a significant impact on both looks and general health. The skin is the greatest organ in human body. Skin care routines emphasize washing, moisturizing, and treating particular disorders, with a primary focus on the delicate parts of face, neck, and chest. The growing desire for organic products has resulted in an exponential growth in the skincare market. The younger generation, who are looking for preventative treatments for acne, dullness, and early symptoms of aging, has significantly raised demand for serums and anti-aging creams. The segment is anticipated to increase at a rapid pace throughout the forecast period because to the growing demand for sustainable packaging and the shift in customer preferences toward natural products. Furthermore, the key players in the market are focused on launching the new organic skin care range which has risen the demand for the cosmetic packaging machinery.

The hair care segment is expected to grow at the fastest rate over the forecast owing to increasing ageing population which has risen the demand for the hair oils and hair dyes. The hair care has been considered as part of proper hygiene and it even enhances the person’s over all appearance. The key players operating in the market are focused on launching new hair care products and expanding their product portfolio which is expected to drive the segment over the forecast period.

North America held a significant share of the market in 2024. North America has the rapidly developing market for cosmetics due to social media, internationality, and e-commerce, which have a lasting effect on buying behaviour when it comes to beauty products. Particularly in the United States, the e-commerce market has grown rapidly in recent years. E-commerce packaging demands are different from those of traditional retail establishments since they want higher levels of protection and present various supply chain difficulties. Over the next seven years, it is anticipated that there will be an increase in product demand because to the growing need for flexible packaging solutions that do not adhere to current sizing requirements.

Leading manufacturers' prerequisite for eco-friendly solutions is predicted to be driven by growing awareness of the depletion of natural resources, followed by pressure from the government, society, and economy. This has made it more important to optimize machinery by combining completely automated and Artificial Intelligence (AI) enabled filling and warehousing technologies, as well as by tailoring machinery to meet new sustainability regulation demands. Moreover, integration of the Artificial Intelligence (AI) in beauty industry has enhanced the sustainability.

Although tackling environmental impact from the design phase is one of the biggest problems facing the cosmetics business, sustainability has emerged as a critical component of product development in the beauty sector. Consequently, certain technology businesses have created solutions supported by artificial intelligence (AI) to help with the design process.

Furthermore, the key players operating in the North America region are focused on launching new labelling machinery in the market which is estimated to drive the growth of the global cosmetic packaging machinery market in the near future. For instance, in March 2024, Videojet Technologies, Inc. automation and solution company, revealed the launch of the new Videojet 9560 PL pallet labeling system.

The 9560 PL is capable of handling up to 120 pallets per hour in a variety of applications since it can cover up to three sides of a pallet and apply up to four labels. Adherence to industrial laws and secure warehouse management are further facilitated by the 9560 PL. To assist guarantee error-free operations and boost productivity and profitability, the 9560 PL can check label accuracy and reprint wrong labels as necessary. To check if bar codes on printed labels can be read, an inbuilt bar code scanner can be utilized. The 9560 PL automatically reprints the label in landscape orientation and applies the advanced rotating tamp pad over the illegible label if a dead dot occurrence renders the bar code unreadable.

Asia Pacific is expected to grow at fastest rate over the forecast period. Asia Pacific is a significant market for the cosmetics sector. According to L'Oreal's annual report, it is also the largest personal care market in the world, accounting for 43% of the worldwide total in 2024. Asia has been a source of innovation for the beauty industry in recent years, in addition to its large consumption of beauty products. The Western Asia Pacific has been especially enthralled with K-Beauty (from Korea) and more recently J-Beauty (from Japan). In Asia, Korea is regarded as the cosmetics queen. This is partially due to the fact that many Westerners associate Korea with big companies like Sulwhasoo, Dr. Jart+, and Amore Pacific that have achieved success outside of Asia Pacific region.

As more individuals turn to age-old remedies to improve blood flow, circulation, and other bodily functions, Traditional Chinese medicine (TCM) is becoming more and more popular in China. This is also beginning to be seen in skincare products, where local Chinese brands like Pechoin and TCM-infused brands like Yue Sai (owned by L'Oreal) are being used. Hence, due to the large cosmetic market in Asia Pacific the demand for the cosmetic packaging machinery is at peak.

Because more people are exposed to the beauty industry, there is a record level of beauty consumption worldwide. As a result of the growing middle class and rising disposable income in the Asia-Pacific area, the region has become the global leader in the cosmetics business thanks to a sharp increase in the consumption of beauty products. The area is home to some of the most prestigious beauty marketplaces and produces significant income and spending from the cosmetics industry. Other Asia-Pacific nations are making inroads into the region's cosmetics sector, despite South Korea's long-standing reputation for having the region's most fashionable cosmetics. In the world of beauty, China, Japan, Indonesia, Malaysia, and Thailand are all becoming more significant.

Moreover, increasing launch of the ayurvedic and organic skin care brand in India has risen the demand for the cosmetic packaging machinery which is expected to drive the growth of the cosmetic packaging machinery market during the forecast period.

Europe's need for packaging machinery is predicted to increase due to the continent's highly urbanized population, shifting consumer behavior, and rising demand for upscale, single-use personal hygiene packaging. In order to incorporate new features such as size, shape, and features, equipment makers are investing more in research and development (R&D). This will probably lead to an increase in product demand in the upcoming years.

Machine Type

Application

Region

April 2025

April 2025

April 2025

April 2025