April 2025

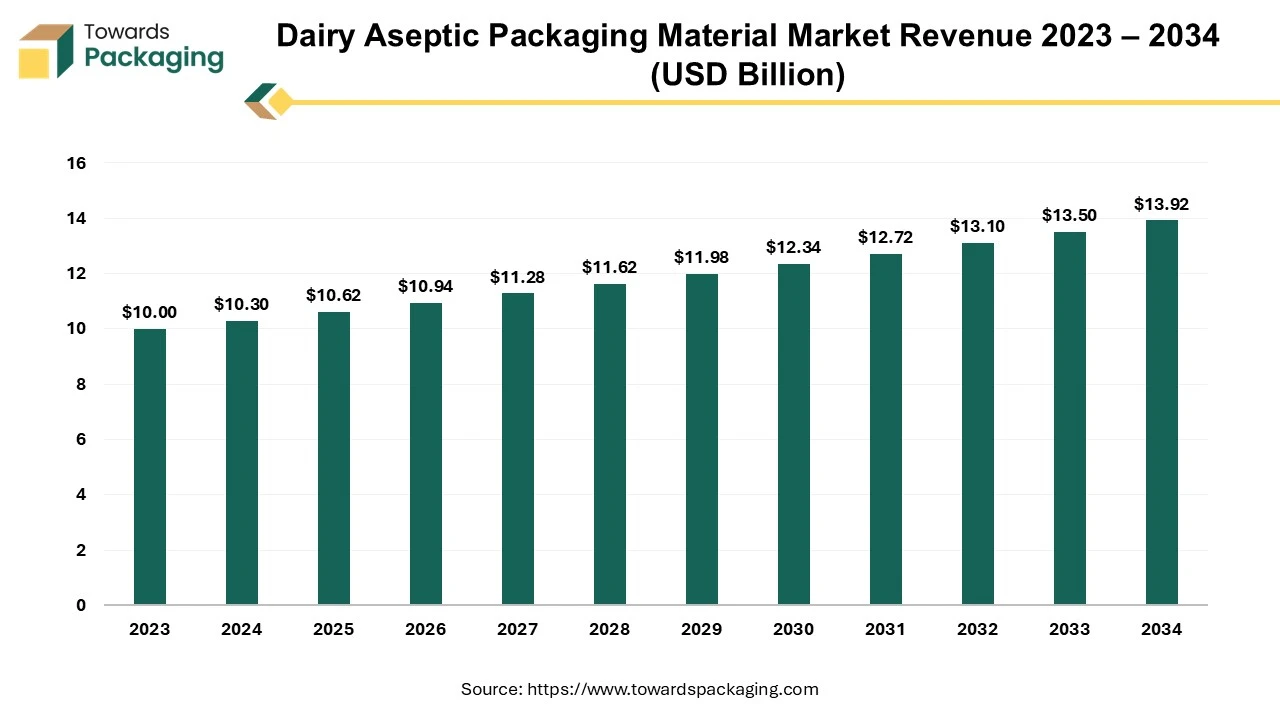

The dairy aseptic packaging material market is expected to increase from USD 10.62 billion in 2025 to USD 13.92 billion by 2034, growing at a CAGR of 3.05% throughout the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing dairy aseptic packaging material which is estimated to drive the global dairy aseptic packaging material market over the forecast period.

The method of packaging dairy products in a way that prevents microbial contamination is referred to as dairy aseptic packaging. The process of aseptic dairy packaging involves heating the dairy product to kill harmful bacteria and then sealing it in a sterile container under aseptic conditions. The aim is to extend shelf life without refrigeration, allowing products like milk, cream, and yogurt to be stored at room temperature until opened. This method preserves nutritional quality and flavor while ensuring safety.

Dairy aseptic packaging materials are designed to preserve the quality and safety of dairy products while extending their shelf life. The dairy aseptic packaging is typically manufactured of multi-layer composition, including paperboard, polyethylene, and aluminum foil. The paperboard provides strength and rigidity, while the aluminum layer acts as a barrier against light and oxygen. Polyethylene seals the package and provides moisture resistance. The dairy aseptic packaging materials can be polyethylene terephthalate (PET), polypropylene (PP), and high-density polyethylene (HDPE).

These materials are lightweight, shatterproof, and can be produced in various shapes. They also provide good barrier properties but may require additional layers for extended shelf life. The dairy aseptic packaging material protects against moisture ingress, which can compromise product integrity. The dairy aseptic packaging material provides various advantages such as extended shelf life, nutritional preservation and prevents from contamination. The global packaging industry size is growing at a 3.16% CAGR between 2025 and 2034.

Due to the rising trend of online grocery shopping the need for the dairy aseptic packaging material increased in order to avoid The increase in rate of online grocery shopping necessitates durable packaging that can withstand transportation without refrigeration. Families in the urban middle class have become addicted to online shopping as a result of a year of aggressive marketing, significant sales from online retailers like Amazon and Flipkart, and lockdowns brought on by the COVID-19 pandemic.

There is a growing demand for sustainable packaging solutions, including recyclable and biodegradable materials. Companies are investing in developing eco-friendly packaging to meet consumer expectations. Initiatives to minimize carbon footprints and promote circular economy practices are influencing packaging design and production.

Brands are increasingly seeking customized packaging solutions that align with their product branding and marketing strategies. There is a rising demand for shelf-stable dairy products, such as UHT milk and yogurt, which can be stored without refrigeration. This convenience appeals to busy lifestyles. Increasing demand for shelf-stable products has projected to drive the growth of the dairy aseptic packaging material market in the near future

Incorporating features such as freshness indicators or QR codes can enhance consumer engagement and provide added value, opening new market segments. Increase in adoption of the advanced technology for the production of dairy aseptic packaging materials is estimated to drive the growth of the global dairy aseptic packaging material market in the near future.

The key players are continuously engaged in innovations for multilayer materials are enhancing barrier properties, leading to better preservation of taste and nutritional value. Developing and marketing sustainable packaging materials can attract environmentally conscious consumers and comply with regulatory demands for reduced plastic use. The key players operating in the market are focused on innovation of new products for aseptic packaging, which is estimated to create lucrative opportunity for the growth of the dairy aseptic packaging material market over the forecast period.

The key players operating in the market are facing challenges in selecting exact technology for manufacturing dairy aseptic packaging and meet the regulatory guideline, which is estimated to restrict the growth of the global dairy aseptic packaging material market in the near future. The cost of advanced aseptic packaging technology and equipment can be prohibitive for smaller manufacturers, limiting their ability to compete.

Some consumers may prefer traditional packaging methods, viewing them as safer or more natural, which can hinder the adoption of aseptic solutions. Aseptic processing and packaging require sophisticated technology and expertise, which can pose challenges for companies unfamiliar with the process. Stricter food safety and packaging regulations can create barriers to entry for new companies and complicate the manufacturing process for existing players.

The market is becoming increasingly competitive, with numerous players vying for market share, which can limit growth opportunities for individual companies. Economic instability can impact consumer spending on dairy products and related packaging, leading to reduced demand.

Asia Pacific region dominated the global dairy aseptic packaging material market in 2024. The Asia Pacific region has a significant and growing population, leading to increased demand for dairy products, particularly in countries like India and China. Economic growth in many Asia Pacific countries has led to rising disposable incomes, enabling consumers to spend more on dairy products. Growing awareness of the nutritional benefits of dairy, including protein, calcium, and probiotics, is driving consumption. The presence of extensive dairy farming infrastructure in Asia Pacific region and favourable climatic conditions support local dairy production, reducing reliance on imports. These factors combine to create a robust environment for diary aseptic packaging material market growth in the Asia Pacific region.

North America region is anticipated to grow at the fastest rate in the dairy aseptic packaging material market during the forecast period. There is a strong preference for shelf-stable dairy products, such as UHT milk, which can be stored without refrigeration in North America region, appealing to convenience-driven consumers. North America is a hub for technological innovation in packaging, leading to improved aseptic packaging methods that enhance product safety and shelf life. Increasing awareness of health benefits associated with dairy consumption, including the demand for functional dairy products, drives the need for effective packaging that preserves product integrity in the North America region.

The 100-250 ml segment held a dominant presence in the dairy aseptic packaging material market in 2024. The 100-250 ml packaging sizes cater to busy lifestyles, allowing consumers to easily carry and consume products like milk, yogurt, and flavoured dairy drinks. The 100-250 ml package size are ideal for single servings, reducing food waste and appealing to health-conscious consumers who prefer controlled portion sizes. This segment meets the needs of various consumers, from children to adults, making it versatile for family households and individual buyers.

The 100 – 250 ml packages allow brands to offer a wider range of flavours and product types, encouraging trial and repeat purchases. The smaller format allows for creative and visually appealing designs that can enhance brand visibility and appeal to consumers. Smaller packages are often more affordable, making dairy products accessible to a broader range of consumers, particularly in price-sensitive markets.

The segment aligns well with the growing demand for functional and fortified dairy products, allowing consumers to try new health-focused options without committing to larger sizes. The packages of size 100-250ml are easier to handle and ship, making them suitable for online sales, which are increasingly popular.

Brik shape segment registered its dominance over the global dairy aseptic packaging material market in 2024. The rectangular shape allows for efficient stacking and storage, maximizing space in warehouses and during transportation. Brik packaging typically uses less material compared to other shapes, reducing production costs and making it an economical choice for manufacturers. The flat surfaces of brik cartons provide ample space for branding and product information, enhancing shelf visibility and consumer appeal. The multi-layer structure of brik packaging offers excellent barrier properties against light, oxygen, and moisture, helping to preserve the quality and shelf life of dairy products.

Brik cartons often come with easy-to-pour spouts or screw caps, making them user-friendly for consumers. Many brik packages are made from recyclable materials, appealing to environmentally conscious consumers. The multi-layer structure of brik packaging offers excellent barrier properties against light, oxygen, and moisture, helping to preserve the quality and shelf life of dairy products. Brik packaging is engineered to withstand the high temperatures required for aseptic processing, ensuring product safety and integrity.

By Type

By Application

By Region

April 2025

April 2025

April 2025

April 2025