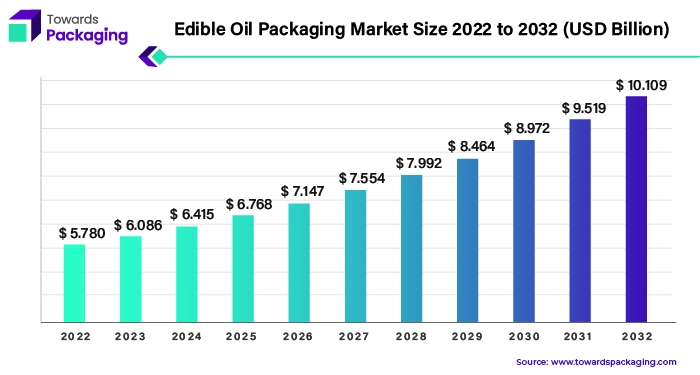

The edible oil packaging market is forecasted to expand from USD 7.21 billion in 2026 to USD 11.97 billion by 2035, growing at a CAGR of 5.8% from 2026 to 2035. This report provides a detailed segmentation by material (plastic, glass, metal, paper & paperboard), packaging type (bottles, pouches, cans, drums, cartons, boxes), and distribution channel (retail stores, e-commerce, supermarkets, hypermarkets).

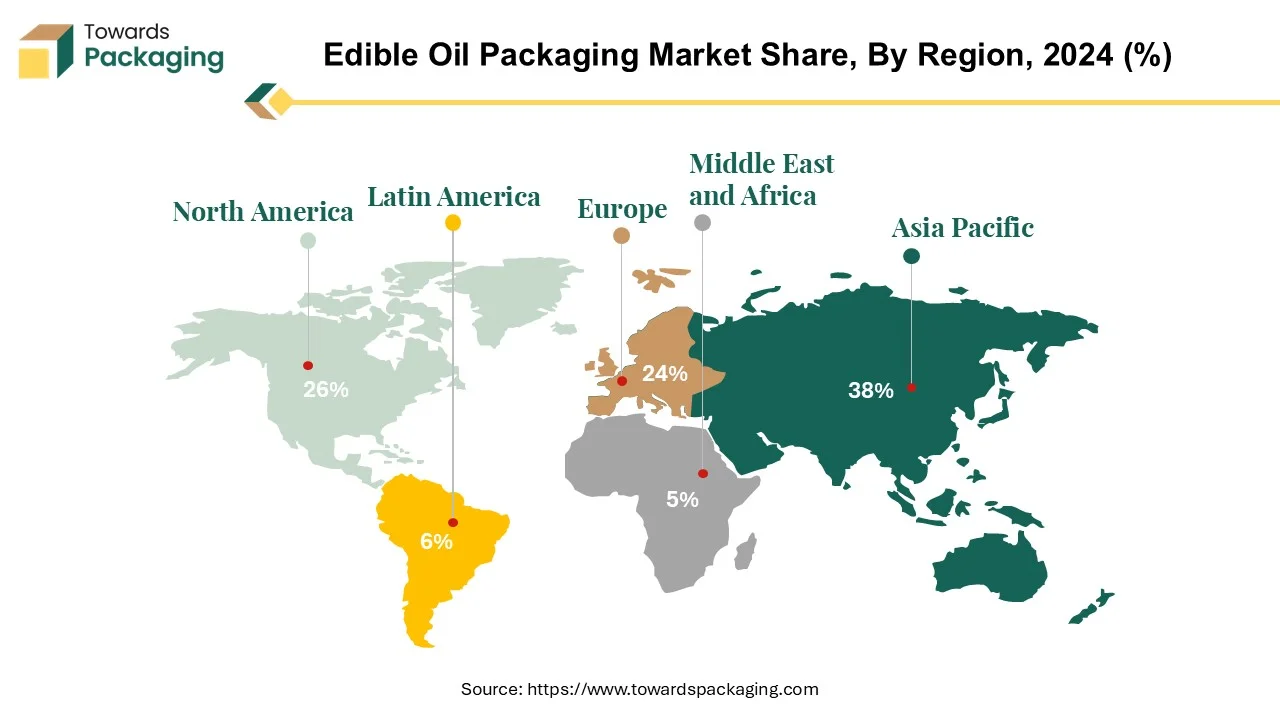

Regional data covers Asia-Pacific, North America, Europe, Latin America, and the Middle East & Africa, analyzing consumption patterns and trade flows. The study also explores leading manufacturers such as Cargill, Tetra Pak, Uflex, Berry Global, and Amcor, offering insights into their market shares, EBITDA margins, and innovation strategies across the value chain.

The market of edible oil packaging including the production, design, and distribution of packaging, especially for these edible oil types e.g. palm, olive, sesame, sunflower seed, and peanut oils. Market tendencies show increased importance of product safety, packaging innovation, sustainability, and digitalization. While in the Asia-Pacific, factors like palm oil dependency and economic expansion shape the market. Additionally, within the North American market, issues such as health consciousness, technological advancements, and e-commerce affect the market growth. Plastic packaging is mostly used because it is better for keeping the oil quality and freshness. The main stakeholders concentrate on sustainability, innovation and meeting consumer preferences. The edible oil products are effectively promoted by retail stores, which increase market growth. The business environment is competitive as the established giants and new entrants share focus on innovation and sustainability.

The market of edible oil packaging involves the production, designing, and distribution of packaging that are created especially for edible oils. These include bottles, cans, pouches and drums, among others, besides preservation technologies designed to preserve freshness and oil quality, while at the same time give takeaway consumers comfort and safety. This market provides manufacturers, retailers, and customers with a variety of packaging solutions to ensure secure storage, movement, and usage of edible oils.

The different refined and unrefined oils such as palm, olive, soyabean, sesame, sunflower seed, and peanut oils are consumed differently by different regions. Therefore, different package designs are required for each oil that keeps them fresh based on their reactions to oxygen, moisture, heat, and light.

The overall demand for edible oils by developed and developing nations is expected to grow by 2% by 2026, totalling 87 million metric tons. The leading producers are China, India, the United States, Indonesia, Brazil, Argentina, Malaysia, Russia, Ukraine, and the European Union. They enjoyed various advantages, including an advantageous climate, vast cultivable areas, modern agricultural technology, investments, and regulations, which ultimately led to high oil production.

The edible oil packaging market is indeed under experience of continuous growth as an outcome of the sustained demand for edible oils. The driving factors for such a growth are the rise in the population, a change in dietary habit, urbanization and emerging health benefits of different vegetable oils. Technological advancements in packaging materials and techniques also widen the market boundaries. The edible oil industry is ever-changing and, as it does, the packaging sector seeks to fulfill emerging consumer wants and needs while complying with existing rules and regulations thereby ensuring safe and convenient oil storage and consumption.

The expansion of edible oil packaging market in the Asia Pacific region is powered by the synergy of the several important factors. Primarily, the country’s dependence on palm oil, which is a crucial commodity, encourages the development of packaging that is suitable for storing and transporting these products.

| Top Edible Oil Producing Countries, 2024 (Metric Tons, Million) | ||

| Country | Main Edible Oil Produced | Production |

| China | Soybean, Rapeseed, Peanut, Sunflower | 31.3 |

| India | Soybean, Groundnut, Mustard | 30.2 |

| United States | Soybean, Canola, Sunflower | 20.2 |

| Indonesia | Palm | 20 |

| Brazil | Soybean | 9.2 |

| Argentina | Soybean, Sunflower | 5.4 |

| Malaysia | Palm | 3.9 |

| Russia | Sunflower, Soybean, Rapeseed | 4.9 |

| Ukraine | Sunflower, Soybean, Rapeseed | 5.3 |

| EU | Olive, Sunflower, Rapeseed | 3.3 |

China's fast-growing economy and huge population makes it an important player in the global market for edible oils, creating the demand for packaging solutions in global. India's rank of being the second largest oil producer in the world contributes to the market power which in turn drives the demand for packaging materials.

The growing market for MPO in the Asia Pacific market is supported by more than just the rising GDP, increasing middle class population, urbanization and manufacturing. Particularly, the Philippine and Vietnamese markets are key players in terms of MPO imports in the region, together contributing to a vast share.

To cater to the increasing global demand for palm oil, Malaysia devises the strategy of scaling up production by aiming to produce 4.2 million tons of edible oils by 2024-end. This action confirms the accelerating global demand for palm oil, ultimately resulting in specific packaging applied to the edible oil sector. Together, these factors fuel rising demand for packaging from the Asia Pacific edible oil sector, creating prospects for a booming industry.

Edible oil packaging market in North American region is witnessing highest growth rate and is considered as the fastest growing region. The United States is known to be a big player in the production of edible oils because of its high level of expertise that has been developed for many years. Utilizing its experience of oil extraction and oil refination, the U.S has developed a robust reputation for quality throughout the sector.

U.S. export large amounts of edible oil to the other countries. Several factors which contribute to the growth of the edible oil packaging market in North America will be listed below. the fact that more and more people are becoming aware of their health-consciousness brings about the increased demand for a diversity of edible oils, so manufacturers put a lot of effort into the development of package innovations that keep the oil fresh and nutritious. Convenience and sustainability become driving factors of packaging choices and therefore, the creation of eco-friendly packaging formats.

Edible oils reach more consumers as online shopping becomes popular and e-commerce platforms sell these. This development demands packaging that will not spoil the products and will ensure safe delivery. In short, North America’s burgeoning edible oil packaging market is fueled by the customer’s tastes, development of technology, and shifts in the market.

Plastic has come to dominate edible oil packaging because of its ability to assist in maintaining the quality and freshness of the oils and since it offers various benefits. Apart from the fact that plastic packaging provides a great barrier to environmental factors that could otherwise promote oxidation and spoilage of edible oils (moisture, oxygen, light, and contaminants), it is also washable and recyclable. This guarantees the oils will stay safe for consumption longer after their expiry date.

Plastic packaging is lightweight and resilient hence offering convenience during transport and storage, thereby minimizing breakages and spillage during movement. Its flexibility offers the possibility of manufacturing different packaging forms like bottles, pouches and containers that can be appealing to numerous consumers and supply different market needs. PET in polyethylene bottles (PET) is a good barrier for odor and oxygen and it is clear in terms of view. The reason behind using HDPE bottles as packaging material is their strength, hardness and resistance to chemicals, which is excellent. Laminated or multi-layered plastic pouches are usually made out of films with different compositions. They offer light weight and space-saving properties for storage.

Consumers' growing demand for plastic packaging used for edible oils is underpinning by many variables. These include the growing worldwide usage of edible oils, inclusive of the demand for convenience and on-the-go packaging solutions and continuing advances in plastic packaging technology with a focus of sustainability and recyclability. Due to the growing demand for vegetable oils, manufacturers also require highly effective and efficient packaging solutions, consequently leading to fast-growing plastics packaging segment in edible oil packaging market.

Edible oil packaging is now invariably related to a round bottle of a specific shape. Originally, plastic and glass bottles were used by industry for packing and preserving edible oils. The making of bottles has drastically increased lately since they are hassle-free, robust, and affordable. Bottles provide easy and safe method to store and pump diverse kinds of edible oils - from olive oil to sunflower oil.

The market for edible oil bottles has been observing a gradual growth, due to reasons as the consumers’ interest for healthier cooking oils, growing household income and of course a change in their shopping pattern. Innovative bottle designs like easy pour spouts, ergonomic grips, and tamper-evident seal are part of the manufacturer's responses to this increasing consumer need. These elements are added on purpose to improve the user experience and enhance product safety. The demand for the bottles used in bottled edible oils keeps rising and we foresee a big output for edible oil bottles in the next coming years.

The role of packaging in the development of edible oil market, particularly palm oil, is multidimensional. Palm oil becomes a basis of edible oil consumption, where it will hold the most significant market share in 2024, second only to the soybean oil. The food industry was seeking for products such as margarine, baked fat, fried fat, and cooking oil, which made palm oil replaceable.

Proper packaging of palm oil is of great importance for several reasons. The purpose of the packaging is for it to shield the oil from the outside world, which include factors such as light, oxygen, moisture, and contamination, that can ruin the oil’s flavor, aroma, and freshness. Low density polyethylene packaging materials have a heat-sealable, inert, and odor-less properties that help preserve palm oil.

Sustainable production methods are gaining prominence in the palm oil sector. Packaging conveys commitment to sustainability with the palm oil being packaged responsibly in such a way as to address the environmental impact and the social responsibility concerns.

Indonesia and Malaysia lead the world in palm oil production, which underlines the significance of good packaging solutions in these regions. On the other hand, the many countries that produce palm oil highlight the necessity of packaging standards and approaches that are implemented consistently industry-wide in order to sustain the product quality and to satisfy the market demands. Ultimately, packaging plays a dual role of not only safeguarding and maintaining the viability of palm oil, but also ensuring its competitive edge in the face of shifting consumer preferences and the more complex global dynamics.

The function of retail stores among those companies making edible oil packaging is indispensable to the market growth of this sector. Consumer-retail shops are main selling outlets for many packaged edible oil products, acting as one of the key points of contact between the consumers and the producers. The shopping experience, ease of store operations, and marketing and advertising strategies employed by retail stores can significantly influence customers' purchasing power. Store-brands sell different kinds of edible oil packaged in differing formats, packing and materials to meet the individualized needs and taste of consumers.

The store itself acts as a channel for promoting products, visibility of brands and getting more knowledge to consumers regarding the advantages of a variety of package options. Shopping stores in turn assist the market growth and creation of consumer demand for edible oils products because of the variety of packages and convenience shopping arrangement for edible oils packaging. Efficient distribution channels and opening of path for swapping of ideas between packeted oil food manufacturers and retailers greatly contribute towards market expansion and accessibility.

The competitive landscape of the edible oil packaging market is dominated by established industry giants such as Cargill, Guala closures, Nichrome Packaging Solution, Sunpack Corp, Tetra Pak International S.A., Berry Global Group Inc, Scholle IPN Corporation, Glenroy, Inc., Crown Holdings, Inc., Sealed Air Corporation, DS Smith Plc, Smurfit Kappa Group, Technocan S.A., Amcor Plc, ASA Group, Colep Packaging, Vetropack Holding Ltd, Baralan International S.p.A., Vidrala, S.A., Uflex Ltd, TPAC Packaging India Private Limited (Sunpet), Neo Sun Industries Limited, Duropack Industries, and Parekhplast India Limited. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Cargill concentrates on sustainable packaging, choosing from its wide experience of supply chain operations that guarantee the effective and environmentally friendly oils delivery.

Guala Closures provides a wide range of creative closure solutions for packagings used for edible oil. These manufacturers have strategies they apply mainly on production of top precise closure system to maintain product purity and quality. The patient-focused nature of iClosure watertight lids means they aim to produce customizable closure designs that are efficient to manufacture.

Uflex Solutions aims at providing a whole package of solutions fitting with edible oils industry. Their approaches can range from their ability to provide the packaging machineries which can fill the packages made of different kinds of materials and formats, while after-sales services and maintenance of them also is a part of this.

Sunpack Corp concentrates on delivering low-cost packaging solutions for edible oil brands. The supply chain strategies are based on the reuse of economies of scale in manufacturing which directly influence the packaging materials costing. Hence, they also make research and innovation in packaging design an integral part of their product development to cater for the changing expectations of their customers in the edible oil industry.

By Material

By Packaging Type

By Distribution Channel

By Region

January 2026

January 2026

January 2026

January 2026