April 2025

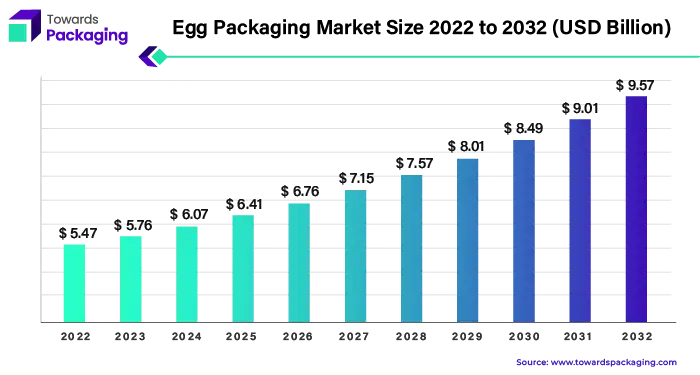

The egg packaging market size is calculated at USD 6.09 billion in 2024 and is projected to reach around USD 10.71 billion by 2034. The market is expanding at a CAGR of 5.8% between 2024 and 2034.

Egg packing ranges from the use of different materials or containers that are employed in safeguarding and shipping eggs from the processing point to the consumer market. It comprises a wide variety of packaging solutions, examples being cartons, trays, and crates which are made from different materials like cardboard, plastic, and molded pulp among others.

The market for egg packaging has in recent days maintained the normal growth trend, and this has primarily been due to some critical factors. A large number of people all around the globe will say they do eat eggs, but one nation tops the list of eggs consumption than all other countries on earth. Among the best egg consumers in the world is the Japanese people on a per capita basis. It takes an average Japanese person to consume nearly three thirds a year. To put it drastically, that almost amounts to one egg per day. Population increase and change of eating habits ensue in higher consumption of eggs with the need for eggs to be well packaged as the custom now. We expect the goose egg production to be 138.38 million units during the same time. It has been fixed at a growth rate of 6.77% annually during 2022-23 i.e the growth rate from 2021-22. Consumers first thing they search for in egg packages is it guarantees freshness and safety of the eggs and at the same time provides suitable in handling and storage.

Food safety and hygiene are, thus, paramount effect on customers today so they prefer to use the eggs packaged in clean and hygiene containers. Renewable and reusable packaging materials, like recyclable packaging or biodegradable packaging materials, are also gaining popularity as the adoption of eco-friendly strategies continues due to an increase in environmental concern. Innovations in packaging design and materials also give encouragement to the market segment. Companies are bringing new formats to market, which help to prolong shelf-life, be sold on a shelf with a view, and more attractive for customers. Egg packaging market will continue to grow and consumers' preferences will be changing, packaging needs and responding to the demands of additional innovative, green and consumer-friendly practices.

For Instance,

There is a strong push toward sustainable packaging and eco-friendly materials such as molded pulp, recycled paper, and biodegradable plastics. This shift is driven by increasing consumer awareness of environmental issues and regulatory pressures to minimize plastic utilization.

Manufacturers and Industrialist are developing designs that improve egg protection, convenience, and consumer appeal. These include tamper-evident seals, easy-open lids, and stackable cartons.

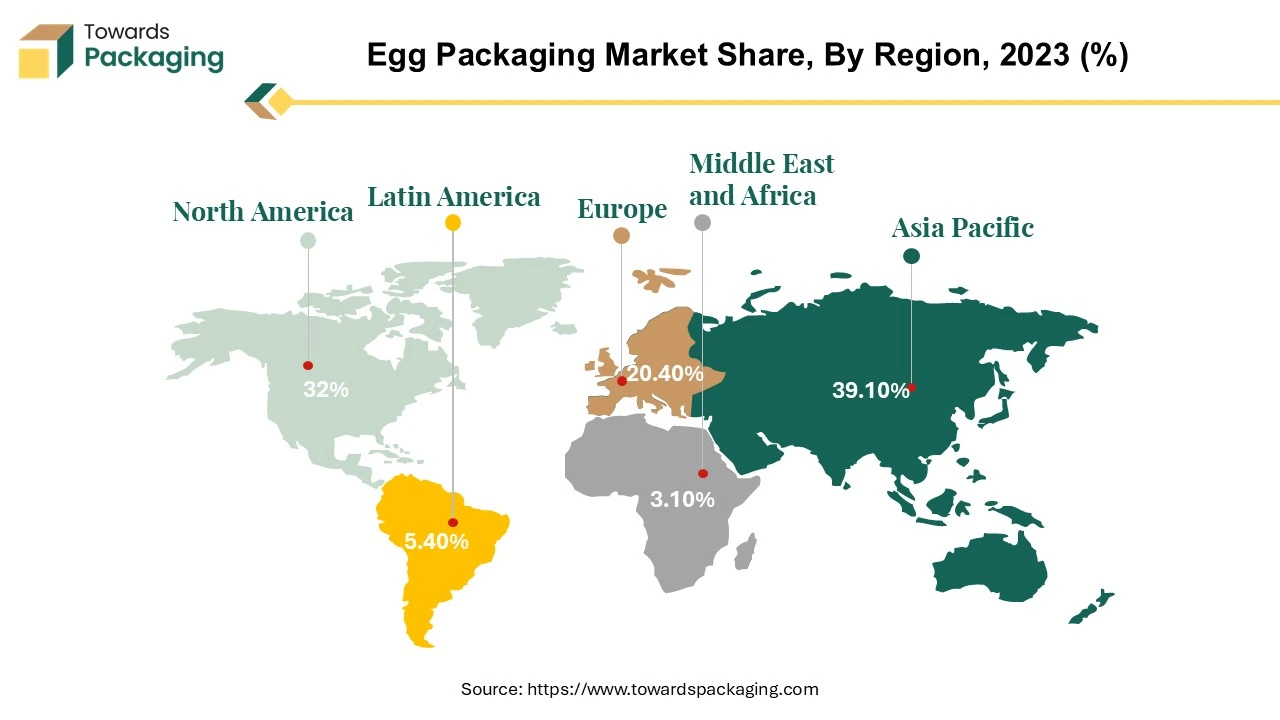

Rapid urbanization and rising incomes in regions like Asia-Pacific and Latin America are boosting demand for packaged eggs. These regions are expected to dominate market growth over the next decade.

The innovations in packaging materials such as biodegradable plastics, recycled fibres, and compostable alternatives provide the opportunity of upgrading sustainability and reducing the impact on the environment in the egg market packaging sector.

The egg packaging market is experiencing positive growth, especially in the Asia Pacific region, which is the largest consumer of eggs globally. Several factors contribute to this growth trajectory, primarily driven by the favourable conditions in Asia's poultry and egg production sector. Rising income levels, increasing urbanization, improved disease control measures, and the adoption of new technologies are all shaping a conducive environment for the egg packaging market.

One significant trend in the region is the shift towards processing larger birds in the broiler industry. While birds processed in Asia tend to be smaller compared to other regions, there is a noticeable move towards processing larger birds, with around 40% of birds processed in the Asia Pacific region weighing under 2 kilograms. Countries like Indonesia and China are examples of this trend, with a significant portion of poultry processed at weights below 2 kilograms.

Thailand has emerged as a significant exporter in the region, catering to the specific needs of customers in Europe and Japan. This tailored approach to production has contributed to the overall growth of the egg packaging market.

| Egg Consumption by Country, 2024 (1000 tons, Kg) | ||

| Country | Total Consumption (1000 Tons) | Consumption Per Capita (Kg) |

| China | 31,851 | 21.67 |

| India | 5,419 | 3.94 |

| United States | 5,337 | 16.13 |

| Indonesia | 4,272 | 15.63 |

| Brazil | 2,725 | 12.83 |

| Mexico | 2,660 | 20.63 |

| Japan | 2,512 | 19.86 |

| Russia | 2,411 | 16.52 |

| Germany | 1,283 | 15.3 |

| France | 911 | 13.94 |

China, as the world largest importer of egg by country, has their high market demand for growth driven by the huge population and food customs of the country, accounts for a great part of the entire egg consumption. China's position as the world's largest egg producer also has a significant impact on the egg packaging market. With substantial production volumes, the demand for efficient and reliable egg packaging solutions is high, further driving market growth.

The positive production and consumption balance in the Asia Pacific region, coupled with advancements in poultry production practices and export-oriented strategies, are fueling the growth of the egg packaging market in the region.

For Instance,

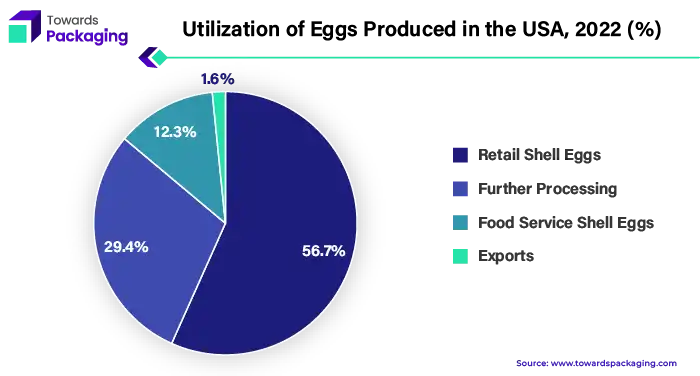

The North American region turns out to be the one of the most high-growth regions in egg packaging business due to inimitable factors concerning customers’ tastes and consumption patterns. In the year of 2022, out of 271 million egg cases that have been produced, over a half of them were sold as retail shell with the rest being sold as an ingredient through the food service industry. It should be noted that more than percent of the eggs were involved in one or more post-production uses such as food security, manufacturing, retailing and trade.

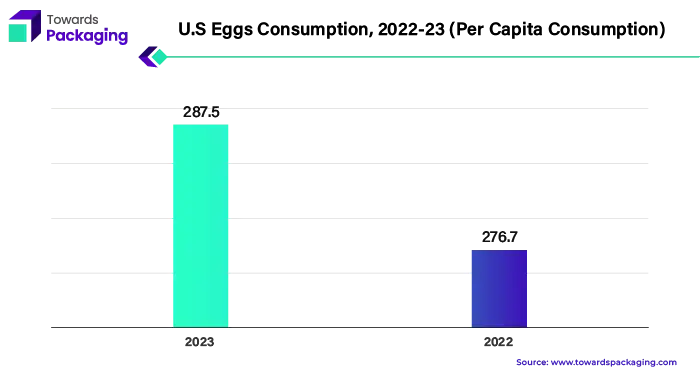

American dietary habits, particularly the frequent use of eggs, make the US the largest consumer of eggs per capita among all nations. This dictates the need for egg packaging solutions on the market. The number of eggs people are eating per person was lower in 2022, and the planner of the US Department of Agriculture expecting a tiny alteration of 2.8 eggs per person, though the overall egg consumption was still high. Consumers in North America made the same egg quantity purchase despite the egg's comparatively lower supply and a relatively higher commodity cost in 2022. It tells that the market has the capability to resist shocks.

Most of the egg production in the US mainly is consumed at home. However, 112.4 million eggs were exported in 2022 totalling less than 160.65% of produced quantity. The same domestic consumption and even market volatility that affect the demand for eggs leads to a market that is specifically catered to the North American region, thereby, becoming a popular area that is specifically created for the purpose of packaging in North America. Consumer demand for eggs as a basic food product continues to rise. Consequently, the North American market for eggs- a primarily packaging oriented sector - experience growth as the trend geared towards the usability of packaging assets which holds the eggs in a place higher.

For Instance,

Paper is the predominant material used in egg packaging, with recycled paper egg trays emerging as a popular eco-friendly alternative to traditional plastic and Styrofoam trays. These trays are crafted from recycled paper materials, processed into pulp, and molded into the shape of an egg tray. Being biodegradable, they decompose within months, offering a sustainable solution for poultry farmers.

As the demand for eggs rises, so does the need for egg packaging. Traditional plastic and Styrofoam trays pose environmental hazards, taking years to decompose. In response, an increasing number of poultry farmers are adopting recycled paper egg trays, recognizing their sustainability benefits.

The surge in e-commerce packaging, predominantly utilizing paper and paperboard materials, further drives the growth of the egg packaging market. As online retail continues to expand, so does the demand for environmentally friendly packaging solutions, aligning with the trend towards sustainable practices in various industries.

The adoption of recycled paper egg trays signifies a shift towards a more environmentally conscious approach within the poultry industry. Their benefits extend beyond environmental sustainability, encompassing factors such as consumer preference for eco-friendly products and regulatory pressures to reduce plastic usage. Consequently, recycled paper egg trays are positioned as the future of the poultry industry, offering a viable and responsible packaging solution amidst evolving market dynamics.

For Instance,

Egg box packaging, commonly known as egg cartons or egg trays, serves the essential purpose of safeguarding eggs from shock, collisions, and damage during transportation while facilitating handling and carrying. Found ubiquitously in supermarkets and shopping malls, egg cartons come in two main types: paper pulp and plastic.

| Top Poultry Broilers Companies, 2022 (In Millions) | ||

| Countries | Company | Broilers Slaughtered annually (Millions) |

| Brazil, US, Mexico, UK | JBS S.A. | 4426 |

| US | Tyson Foods | 1900 |

| Brazil | BRF | 1732 |

| China | Wen’s Food Group | 1101 |

| China | Wellhope Agri-Tech | 695 |

| Thailand | CP Group | 685 |

| US | Koch Foods Inc. | 655 |

| US | Sanderson Farms Inc. | 635 |

| Mexico | Industrias Bachoco | 627 |

| US, Honduras, Colombia, Honduras, Nicaragua, Costa Rica, Thailand, UK, China | Cargil | 625 |

Tyson Foods, Pilgrim's Pride and Perdue Farms as the major players in the poultry broilers’ market accounts for a significant part of the market. Because their development calls for packaging materials such as egg boxes that are expected to rise in number due to an increase in the production of eggs.

In recent years, there has been a notable increase in the popularity of paper pulp egg cartons due to their environmentally friendly nature. These cartons are crafted from recycled paper pulp, offering a cost-effective and sustainable packaging solution. Utilizing an egg tray production line, waste paper can be efficiently processed into egg cartons, further enhancing their appeal among consumers and producers alike.

One of the primary motivations for choosing sturdy egg cartons is the economic consideration. The cost of broken eggs during transportation, averaging around 4.5%, can be offset by investing in better packaging, particularly for premium brand eggs with higher unit prices. Additionally, the stickiness of broken eggs poses a risk of contaminating surrounding cartons, emphasizing the importance of reliable packaging materials in preserving product integrity and minimizing environmental impact.

As awareness of environmental concerns grows and consumer preferences shift towards eco-friendly options, the demand for paper pulp egg cartons is expected to continue rising. Their combination of affordability, sustainability, and functionality makes them an attractive choice for both producers and consumers in the egg packaging market.

For Instance,

The egg packaging market focused on poultry stores hand down helps in serving the poultry farmers as platforms for specialization. They make sure a plethora of packaging is present which can suit the specific needs of poultry farms ranging from containing eggs to different trays. They concentrate on the sustainability by offering recyclable paper pulp cartons among other eco-friendly options to appeal to the public due to consumer preferences and abide with regulatory standards.

The United States’ eggs are distributed through retail and other channels with a great deal of them are consumed domestically and another smaller bit of them are exported overseas. At poultry stores around, the learned staff will help the farmers to get what they need. They will instruct farmers on the best packaging and other necessities. By having this expertise, the process is less stresses and it increase efficiency and the organization meets the regulatory requirements by the industry. Along with the worldly needs for poultry products, poultry stores serve as a crucial basis which is needed while the industry is expanding.

The two main purposes of the agreements and partnerships are to promote new packaging designs which require less resources to produce the products and to ensure the transition to the sustainable ways of doing business. Such local shops basically provide bird owners with many functions by giving products, expertise, and support. This contributes significantly to the successful nature and sustainability of egg packaging market. They become the central figures within the poultry growers' community and through providing the required packages; they help in creating sustainable development in the industry.

For Instance,

The competitive landscape of the egg packaging market is dominated by established industry giants such as Brodrene Hartmann AS, Maspack Limited, Placon Corp, Packman Packaging, Tekni-Plex, Cascades Inc., Bell Printers, Reynolds Group Holdings Ltd., CELLULOSES DE LA LOIRE, Sonovo Technology, MAUSER Corporate GmbH CKF Inc., JIN FU HUA PACKAGING INDUSTRIAL Co. Ltd., Sonoco Products Co. and Huhtamaki Oyj. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Brodren Hartmann AS this company focuses on novelty and sustainability. They invest in research and development to create bio-degradable packaging solutions, like molded fiber egg cartons. Moreover, they focus on developing long-term relationships with their clients to be able to learn about their precise needs and provide customized packaging solutions.

For Instance,

Tekni-Plex distinguishes by offering tailor-made solutions to meet the specific requirements of their customers. They manufacture various kinds of packaging, including the classic paperboard cartons as well as plastic trays that fit the different needs and expectations. Their approach is that of flexibility and agility to adapt to customers’ needs.

For Instance,

Placon Corp uses innovative technology in egg packing. They apply advanced production processes and materials that yield shipping containers with improved strength and functionality. The plan is based on the burden of constantly innovating to lead the market and stay ahead of new packaging solutions.

For Instance,

Cascades emphasizes affordable and environmentally friendly packaging. They focus on optimizing production processes to achieve superior pricing for their customers. Moreover, they focus on environmental sustainability through promoting the use of recycled and biodegradable materials in packaging products.

For Instance,

Egg packaging leading market players are Brodrene Hartmann AS, Maspack Limited, Placon Corp, Packman Packaging, Tekni-Plex, Cascades Inc., Bell Printers, Reynolds Group Holdings Ltd., CELLULOSES DE LA LOIRE, Sonovo Technology, MAUSER Corporate GmbH CKF Inc., JIN FU HUA PACKAGING INDUSTRIAL Co. Ltd., Sonoco Products Co. and Huhtamaki Oyj.

By Material

By Packaging

By Distribution

By Region

April 2025

April 2025

April 2025

April 2025