April 2025

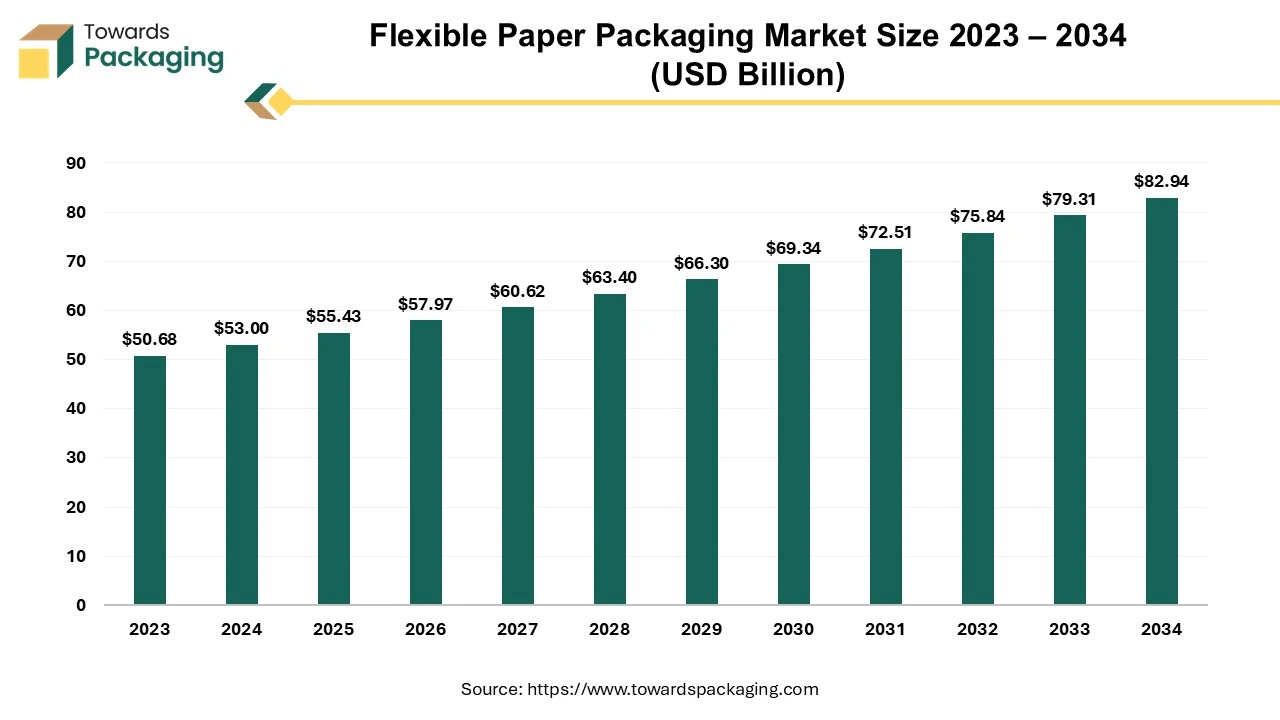

The global flexible paper packaging market size is estimated to reach USD 82.94 billion by 2034, up from USD 53 billion in 2024, at a compound annual growth rate (CAGR) of 4.58% from 2024 to 2034.

The protective purpose of the flexible paper packaging is the same as that of traditional, plastic packaging, but it is composed of renewable, fossil-free materials. Flexible papers are free of silicone, glassine, laminations and labels, and their weight is lower than 100 grams per square meter. Flexible paper packaging has several applications including the chocolates, pet food, meals and personal hygiene. Fibrous materials can be used to create any type of flexible packaging like bags, flow wraps, pouches and so on.

Nowadays, a growing number of brand owners are realizing the advantages of the flexible packaging made-up of paper rather than plastic. Paper is robust, thin, sustainable, and safe for use with food. It can be printed on both analog and digital devices. Thus, the demand for flexible paper packaging is anticipated to augment with a considerable CAGR during the forecast period.

The increasing consumer awareness and demand for sustainable packaging solutions coupled with the rise of regulatory pressures and government initiatives worldwide is anticipated to augment the growth of the flexible paper packaging market within the estimated timeframe. The cost-effectiveness and increased product shelf life along with the growing investments in sustainable packaging by major companies is also expected to support the market growth.

Furthermore, the growing demand from end-use industries and increasing e-commerce sales as well as the innovative designs and customizations in paper packaging are also likely to contribute to the growth of the market in the years to come. The global packaging market size is estimated to grow from USD 1.20 trillion in 2022 to reach an estimated USD 1.58 trillion by 2032, growing at a 3.16% CAGR between 2023 and 2032.

Artificial Intelligence (AI) is finding various applications across different industries; slowly but steadily integrating itself showing promising potential. AI has the ability to power different systems and combine well with other technologies to enhance functioning capabilities. In flexible paper packaging industry, applications of AI like predictive analysis and machine learning (ML) can help the manufacturers better understand consumer trends and manage the supply chain accordingly. AI technology can be used for automation that leads to noticeable reduction in labor costs, while enhancing consistent quality in products.

AI can help streamline operations which make a difference in the overall efficiency. With AI technology, even designing and sustainable material usage could be made easier. It eliminates combinations which do not work, increasing the speed and quality of material and helping create interactive designs integrated with smart packaging like QR codes. The AI technology being integrated into this industry will aid market growth in the forecast period. Adopting AI into the flexible paper packaging industry will help with operational efficiency, maintaining consistent quality, reduced labor costs, minimizing human errors, supply chain optimization etc. are some benefits that will help market growth.

The food industry, which includes segments such as snacks, confectionery, bakery products and ready-to-eat meals, is mainly inclined towards using the flexible paper packaging due to its excellent barrier properties that protect against moisture, oxygen, and contaminants, thereby extending the shelf life of the food products. Paper is an incredibly versatile material that works well for food packaging and can be recycled several times before losing its original quality. Paper is the perfect material to preserve and safeguard the qualities of sweets and solid, shelf-stable meals.

Chocolate wrapping is one of the best uses for paper packaging. Chocolate is highly resistant to the moisture and oxidative damage because of its high fat content as well as the antioxidant content. Protecting chocolate from light, pests and odor loss are its three primary objectives. When coated with specialty materials, more sustainable paper packaging can accomplish all of these objectives and offer a strong grease barrier as well.

Although plastics have traditionally led the food packaging industry, especially in the confectionary sector, a shift toward paper packaging has been driven by growing awareness of the environmental damage caused by packaging leaking. Paper offers the identical amount of barrier protection as plastic flow wrap when it comes to chocolate, but it can be recycled much more easily. Paper packaging is adaptable enough to be utilized for a variety of the food products needing minimal protection, such as sugar, tea, flour and rice and prepared snacks. It is appropriate to be used in the cold-seal and heat-seal applications.

Paper may be easily branded utilizing the printing techniques and textural variations, similar to the various other food packaging materials. This allows brands to set themselves above the competition and differentiate their products. Brand managers who want to ensure responsible forest management and protect natural resources should seek out paper packaging providers whose products have earned the Forest Stewardship Council (FSC) certification. Additionally, this helps food firms with their corporate responsibility programs, which in turn helps to increase the brand awareness among the customers.

Packaging made of paper poses unique issues in terms of recycling and utilizing the recycled paper content. There are principally two causes. First, it's difficult to locate the sophisticated infrastructure needed for recycling paper packaging. This implies that, despite the claims that it can, most packaging cannot be recycled or composted. Paper fibers decay completely after only a few recycling cycles. This suggests that in spite of the best recycling strategies, an increase in the overall amount of paper used for packaging will eventually lead to a rise in the demand for virgin pulp.

Also, for most of the packaging applications, paper is insufficient to deliver the necessary functionality. For this reason, adding a barrier to paper packaging is an easy way to get the expected effect. These essential barriers enable the necessary defense against the water vapor, fat, oxygen, and scent. But they make recycling challenging or unfeasible. Furthermore, the paper packaging sector faces enormous issues due to the forest destruction as well as biodiversity loss.

A World Wildlife Fund assessment states that the human activity poses a threat of destroying almost 80% of the intact forest landscapes globally, with paper packaging serving as the key contributing factor to this devastation. As per the Environmental Paper Network, the paper sector is the 3rd largest commercial emitter of the greenhouse gases and the world's fifth-largest energy consumer. It produces about 5% of the world's carbon emissions. Consequently, these factors are likely to hamper the growth of the market within the estimated timeframe.

In the next decade, the packaging business is expected to undergo a radical change, especially in the field of the flexible paper-based packaging. The growing opposition to the plastic packaging and the increasing awareness of its negative effects on the environment are the driving forces behind this change. Through legislation and the creative packaging solutions, governments and companies are actively advocating for transformation. Leading brands are driving the transition to paper packaging by actively looking for the sustainable substitutes.

For instance,

Diageo is another example; who joined forces with Pilot Lite, they founded Pulpex, a paper bottle company based in the UK that constantly aims to push the envelope in terms of sustainable packaging. Diageo intends to sell Johnnie Walker whisky in Pulpex bottles, which are custom-made by Pulpex and fit for a variety of liquid products. Diageo claims that these well-thought-out containers actively support the company's commitment to Goal 12 of the UN Sustainable Development Goals, which is centered on encouraging "Responsible Consumption and Production."

Mars declared that it will be testing paper-wrapped Mars bars instead of plastic ones. To package Kit-Kats in paper, Nestle has also created a high-speed flow wrap line.

These illustrations demonstrate how well-known beverage and the food brands are widely utilizing the paper packaging. Innovation in the creation of the paper packaging is being driven by brands. They are pushing the limits of what is feasible with the paper packaging through partnerships with manufacturers of the packaging, investigating modern technologies and methods to improve its robustness, moisture resistance and the other desired qualities.

The pouches segment captured largest market share of 36.71% in 2023. Since pouches are lightweight and small, they help companies to save money on the shipping and transit as well as the storage space. Additionally, this increases the number of units that may be put on the supermarket shelves, which improves the overall sales. Comparing pouches to the heavier packaging that generates more waste, the carbon footprint associated with their manufacture, transit and distribution is substantially reduced due to their lightweight nature and ease of storage. Also, most of the companies are focusing on launching paper pouches as a step towards sustainability.

For instance,

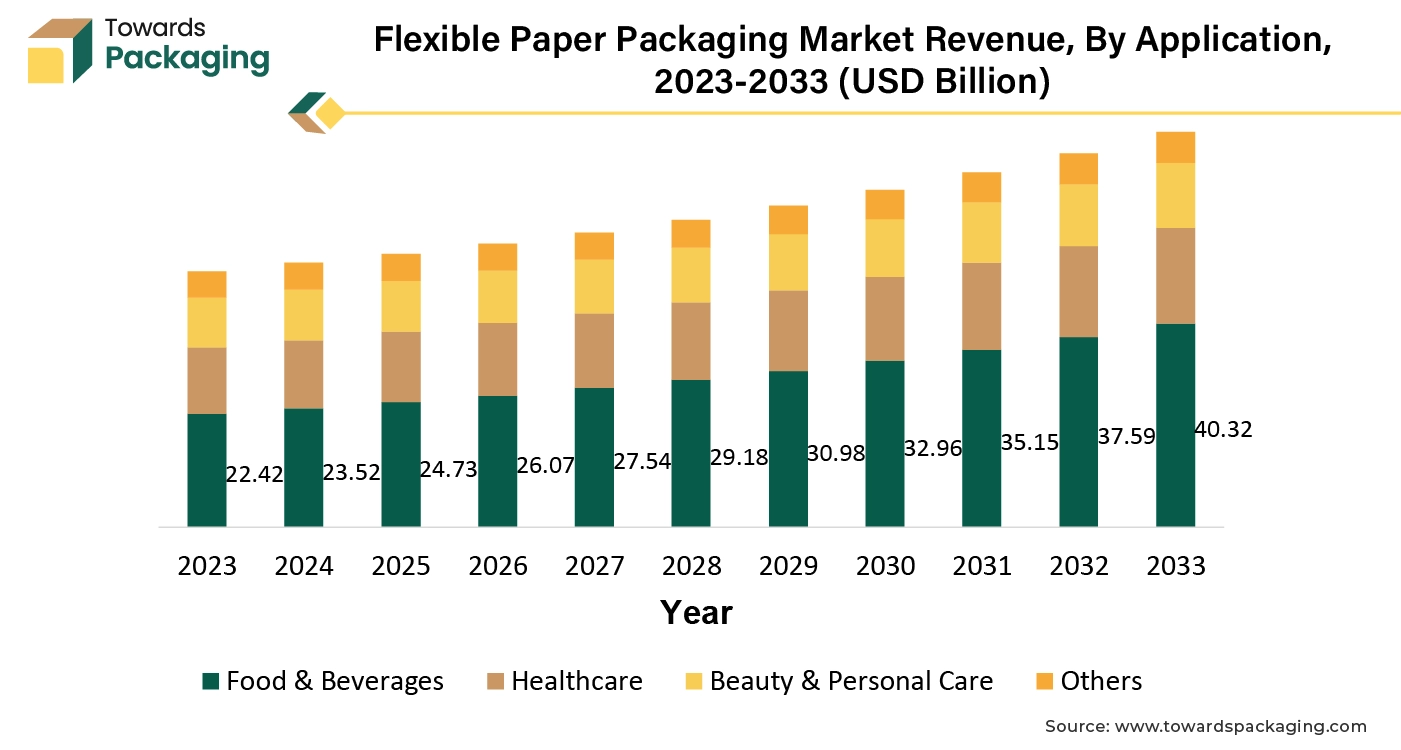

The food & beverages segment held largest market share of 44.23% in 2023. The rising popularity of on-the-go lifestyles has spurred the demand for portable and easy-to-use packaging formats, such as the pouches and wraps, which are highly prevalent in this segment. Furthermore, Paper-based packaging products are growing in popularity as food companies set aggressive goals to switch to more sustainable materials and use less plastic in the food packaging. Also, the customers are expecting a greater variety from their preferred companies to offer sustainable substitutes for conventional packaging materials. These factors are likely to contribute to the segmental growth of the market.

Asia Pacific is expected to grow at a fastest CAGR of 6.78% during the forecast period. This is owing to the growing awareness and concern about environmental sustainability among the consumers and governments. Furthermore, the expansion of e-commerce in the economies like China and India is also likely to support the regional growth of the market. As per the Ministry of Commerce (MOC), since the year's beginning, China's e-commerce initiatives have contributed to the expansion of the global trade and the economic cooperation as well as the recovery of consumption. Online retail sales increased 12.4 percent from the same period last year to a total of about 810.11 billion USD (5.77 trillion Yuan) in the first five months of 2024.

Additionally, the food and beverage industry is expanding rapidly due to the population growth, increasing urbanization along with the rising incomes which is also anticipated to contribute to the regional growth of the market during the forecast period.

North America held largest market share of 36.25% in 2023. This is due to the stringent environmental regulations and the policies aimed at reducing the plastic waste and the consumers demand for sustainability and eco-friendly products across the region. Also, in the United States, approximately 89% of corrugated cardboard and 66% of the overall paper-based packaging are recycled into other products.

The paper sector continues to increase its spending in the recycling infrastructure, thus it is projected that these high recycling rates will rise even more. Furthermore, the presence of major packaging companies and a well-established supply chain infrastructure is also expected to support the regional growth of the market in the near future.

In the Asia Pacific region, China and India have shown incredible growth in demand with rapid rise of industries like pharmaceuticals, cosmetics, food and beverage, household care etc. which require flexible paper packaging. This growth combined with the rising demand for ecommerce and online platforms will further help push the growth of flexible paper packaging market during the forecast period in this region.

Some of the key players in flexible paper packaging market are Amcor Plc, Mondi Group, Sealed Air Corporation, Smurfit Kappa Group, DS Smith Plc, Sonoco Products Company, Huhtamaki Oyj, WestRock Company, Sappi Limited, International Paper Company, Reynolds Group Holdings Ltd., and Graphic Packaging International, LLC, among others.

By Packaging Type

By Applications

By Region

April 2025

April 2025

April 2025

April 2025