April 2025

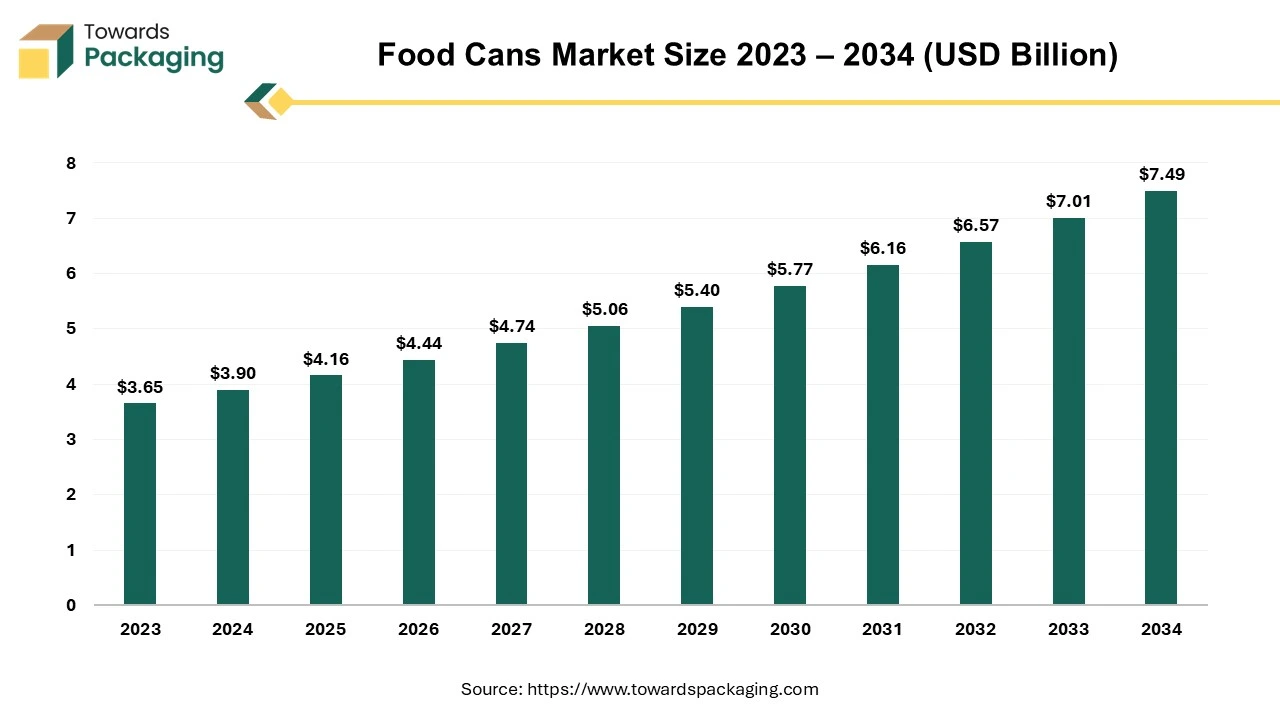

The global food cans market is poised for steady growth, expected to increase from USD 4.16 billion in 2025 to USD 7.49 billion by 2034, expanding at a CAGR of 6.75% during the forecast period.

Unlock Infinite Advantages: Subscribe to Annual Membership

The food cans market is growing significantly due to the rising demand for the consumption of packed food items due to a continuously changing lifestyle. There is a huge variety of food cans available to keep the food quality fresh and harmless to consume which enhances the development of the market. The growing demand for ready-to-eat food has influenced the food cans industry profoundly.

Some of the major market players such as Crown Holdings Inc., Kaira Can Company Limited, Ardagh Group, Shetron Limited, Ball Corporation, Kraft Heinz, and many others. The rising number of food delivery platforms such as Zomato, Swiggy, Uber Eats, Domino's, DoorDash, Grubhub, and several others are also influencing this market to grow. The rising demand for eco-friendly food packaging options is also one of the major reasons behind the development of this industry.

In the food cans market, there is a huge impact AI as it is used in the production of cans for food packaging that does not react with food products. It controls the strong standards of the packaging industry by predicting the maintenance of the machinery for smooth running. It enhances the efficiency of packaging by optimizing and streamlining the manufacturing procedure. With the incorporation of technologies such as machine learning algorithms, it is easy to analyse all the gathered data. Enhance the quality of the packaging of food products by checking the quality of the packaging material used, it enhances the reliability of brands as well as consumers.

Analysing the market demand reduces wastage as well as manufacturing energy consumption which decreases the carbon footprint and helps to produce eco-friendly packaging. Artificial intelligence is widely used for ensuring traceability and transparency while supplying food products.

The food cans market is growing rapidly due to rising demand for eco-friendly packaging of food products such as aluminum, steel, tinplate, glass, and many others. There is a huge demand for the packaging of food products that maintain their freshness and nutritional quality whereas metal cans packaging is highly preferred by both companies and consumers. There is a huge demand growing for steel-packaged food products as they keep dishes fresh and harmless. The growing shift towards urban areas has influenced the demand for the food cans packaging market as there is a drastic change in the lifestyle of people due to which there is no time or very little time available for cooking has led to the consumption of packaged food products.

The growing awareness regarding environmental issues due to government initiatives has raised concerns among people regarding eco-friendly packaging. With the rising economy of the countries the food habits changes among people which incline huge population towards food packed in cans. Aluminum cans are highly recyclable which makes them an eco-friendly option for packaging food products. Aluminum cans are widely used in the food & beverages industry due to their property to protect packaged materials from air, moisture, pollution and any other external factors that can damage the quality of the products.

There is a huge demand for alternative plastics in the food packaging industry which influences the potential of the food cans market. There are various initiatives taken by the government to raise awareness towards environmental issues and plastic has been one of the reasons behind ecological issues. There is a rapid shift towards eco-friendly packaging which should be decomposable and recyclable increasing the opportunities for the market to bring innovation.

Plastic packaging takes decades to decompose which accumulates in oceans, and landfills and damages the ecosystem significantly. The food and beverage industry has faced several issues due to plastic packaging hence this alternate form of packaging has been adopted by several brands that attract a huge number of consumers. The major market players such as CPMC Holdings Limited, Coca-Cola European Partners, Kraft Heinz Company, Silgan Holdings Inc., Irwin Packaging Pty Ltd., Ball Corporation, Toyo Seikan Group Holdings Ltd., and various others are continuously introducing innovative ways of food cans packaging.

It is highly preferred as these types of packaging are durable and convenient to use which attract more customers towards these packaging products. These cans' packaging has evolved continuously to meet the changing demands of consumers and for the packaging of perishable food items. This enhanced shelf-life packaging is a major reason behind the growing demand for the food cans market.

The high price of these cans packaging food products is a major hindrance to the growth of the food cans market. The high price of these raw materials causes the rise in the price of the packaging which is the primary focus of the market players to make it favorable for the consumers.

The 3-piece segment dominated the market in 2024 due to the traditional packaging method. This type of packaging is widely used in paint, aerosols, food, and several other products. This come with a top, bottom, and body which is well-known for its durability and affordability which preserve food quality while stored for a longer period of time. These are extensively used for packaging a wide range of food products such as vegetables, soups, meat, and various other ready-to-eat products. The strong manufacturing of these cans ensures to protect food products from air, moisture, dust, or any other pollutant that can damage the quality of food.

The steel food cans segment dominated the market in 2024. This segment is dominating due to the quality of cans manufactured with steel being stronger, durable, and it has a high ability to maintain the freshness of the food products. Steel can offer airtight packaging to the food products which protects them from contamination or spoilage. As steel is a corrosion-free substance and does not react with any such ingredients like oil, water, or any spices hence it is preferred as a suitable material for manufacturing cans. This material is extremely recyclable and highly sustainable which is highly preferred as an eco-friendly form of food packaging.

The 301 gm – 500 gm food cans segment dominated the market in 2024. This segment is dominating due to the rising demand for convenient, low-cost, and portion-controlled food cans. These are extremely used by people as it is affordable and does not provide huge quantities which prevent from wastage of food products. One of the prime reasons behind the growth of this segment is its packaging versatility which raises the demand for these sizes of cans. These are considered to be mid-range cans that can be easily used for packaging a wide range of products as trial packs as well.

The beverage cans segment dominated the market in 2024. This segment is dominating due to the rising demand for ready-to-drink beverages in various events or regular basis such as cold drinks, milk, and many others. The major reason behind the growth of this segment is its potential to store beverages without any compromise on the quality of the product. It protects drinks from oxidation, contamination, and spoilage, enhancing the demand for this segment in the market. These are also convenient to use for consumers, raising the market demand from both manufacturers and consumers.

North America is estimated the largest share in the market in 2024. This is due to the rapidly growing demand for eco-friendly packaging of food products due to the growing awareness regarding environmental issues. The rising concern about the harmful effect plastic packaging cause on the environment has raised the demand for cans packaging that can be recycled, decomposable, and cause no harm to people as well as the environment. In countries such as the U.S. and Canada, aluminum cans are extensively used for food packaging due to their properties to intact the quality of food products.

Asia Pacific witnessed the fastest-growing revenue share for the year 2024. There is a huge demand for canned food products due to the rapid change in the lifestyle of the people. The rising number of working women in countries such as India, China, South Korea, Thailand, and Japan has enhanced the usage of canned food products. Due to hectic schedules, many people do not like to spend much of their time cooking but looking for healthier options and these cans packaging are suitable for such people.

By Type

By Material

By Capacity

By Application

By Region Covered

April 2025

April 2025

March 2025

March 2025