April 2025

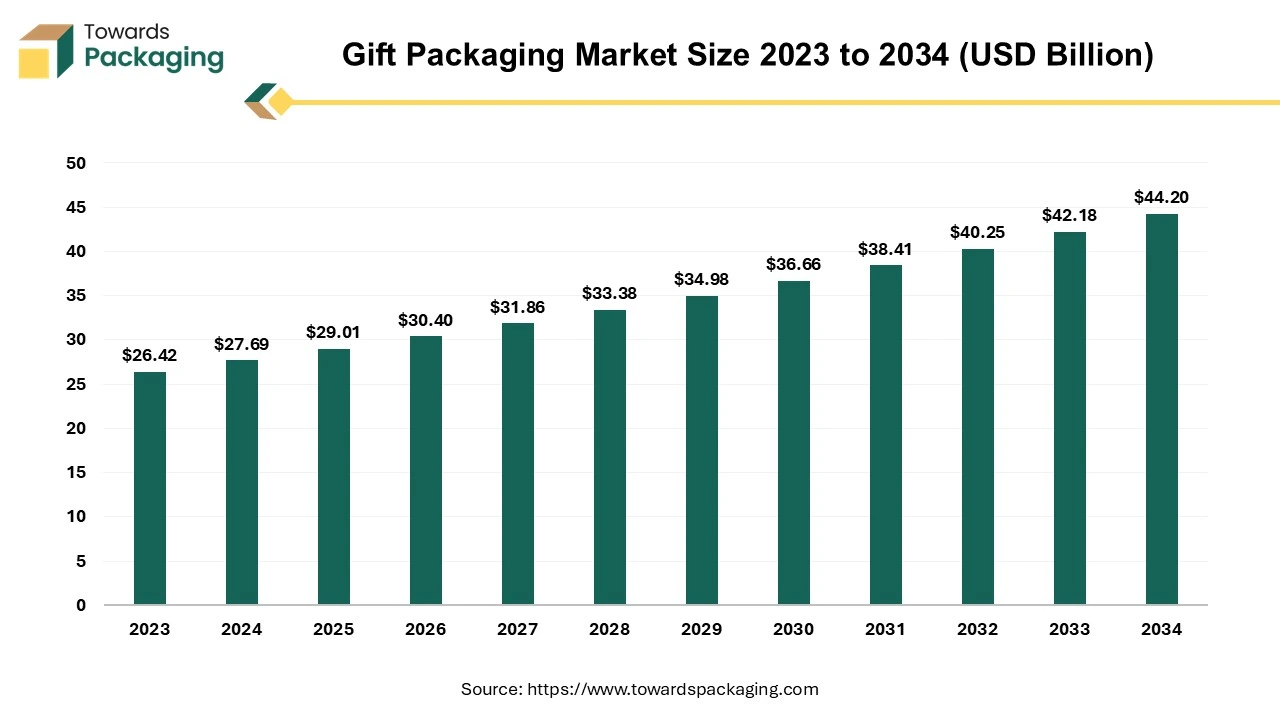

The gift packagin market is forecasted to expand from USD 29.01 billion in 2025 to USD 44.20 billion by 2034, growing at a CAGR of 4.79% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The gift packaging market is expected to experience significant growth throughout the forecast period. Gift packaging is far more than wrapping a gift with attractive paper or presenting it in an attractive bag. A correct packaging can build expectation and enthusiasm. It may additionally increase the sense of uniqueness felt by the gift receiver. Gifts can take on new meaning when they are packaged beautifully, adding to the overall experience. This gift packaging includes various options such as gift boxes, wrapping paper, gift bags, ribbons, bows, tissue paper and decorative accessories. These products are designed not only to protect and contain gifts but also to improve their presentation and make the act of giving more special.

The increasing disposable incomes and consumer spending on premium and personalized gifts are expected to augment the growth of the gift packaging market during the forecast period. Furthermore, the rise of e-commerce and online shopping trend is also anticipated to augment the growth of the market across the globe. Additionally, the growing trend towards sustainable and eco-friendly packaging as well as the rising seasonal events and celebrations such as holidays, weddings and birthdays is also projected to contribute to the growth of the market in the years to come.

The increasing consumer spending and disposable income is projected to support the growth of the market during the forecast period. This is due to the rising employment along with ongoing wage increases. According to the statistics by the Bureau of Economic Analysis released in February 2024, in January, there was a $233.7 billion (or 1.0 percent) increase in personal income. Personal consumption expenditures (PCE) climbed by $43.9 billion (0.2%) while disposable personal income (DPI), which is defined as personal income less personal current taxes, increased by $67.6 billion (0.3 percent).

Also, in September 2023, the U.S. Bureau of Labor Statistics (BLS) reported that in 2022, the average yearly expenses for all customers were $72,967, representing a 9.0% rise over 2021. The average income prior to taxes rose by 7.5 percent over the same time period. Consequently, as consumer spending increases, the trend of gifting is also likely to increase and this in turn is expected to drive the demand for gift packaging.

Moreover, as economies expand and the standard of living improves, customers get the ability to afford to spend money in higher-end, premium products. This shift is reflected in the increasing demand for the luxury and personalized gift wrapping, which customers see as an extension of the gift's value and thoughtfulness. Premium packaging is especially popular during the holiday season, weddings and other key life events where gift presentation is important. Additionally, the rising disposable income is driving up demand for the luxury packaging while also increasing the customizing trend. Consumers are increasingly seeking distinctive, personalized packaging options that represent their personal tastes or the preferences of the gift recipient.

The environmental concerns with non-recyclable packaging are expected to hinder the growth of the gift packaging market during the forecast period. During the holiday season, demand for gift packaging or wrapping paper frequently surges. Traditional gift wrapping has a significant environmental impact, making sustainable options more essential than ever. It is estimated that each year, approximately 2.6 billion pounds of paper for wrapping are thrown away in the US alone. Also, it was predicted that after Christmas over 108 million rolls of wrapping paper were thrown away by Britons in the UK in 2018. Customers in the UK use over 227,000 kilometers of wrapping paper annually, and they discard 108 million rolls of paper in the waste stream. This waste paper can take years to break down and release toxic methane gas, taking up valuable landfill space. An estimated 50,000 or more trees are chopped down annually to produce enough wrapping paper.

Furthermore, traditional wrapping paper is frequently covered with glitter, making recycling expensive or impossible and contains nothing but microplastics. Glitter pollutes the oceans and is swallowed by animals, accumulating in their stomachs over time and possibly causing death. Also, the fibers in less expensive wrapping paper are not sufficiently sturdy to be recycled; wrapping paper is frequently laminated and colored, and it might additionally contain non-paper components like plastic and coloring in gold and silver. Additionally, there's another problem of sticky tape that continues to be frequently stuck to paper after being discarded. However, as the awareness of environmental issues rises, both consumers and governments are becoming increasingly skeptical of these packaging techniques, resulting in greater attention and pressure for change.

The sustainable packaging innovation is expected to create immense growth opportunities for the gift packaging market in the near future. Gift packaging and wrapping paper have a reputation for being difficult to recycle. In addition, as more people purchase online, there will be a greater need for shipping boxes and mailers, and around the holidays, gift wrap is going to be utilized extensively. Single-use materials are typically used for gift wrapping and packing during the holidays. Hence, packaging firms and gift wrap manufacturers are striving to offer environmentally friendly options, like wrapping choices manufactured from bio-based materials or recycled content and are also teaching customers about the basics of recycling.

For instance,

In the long run, there are opportunities for cost savings as packaging becomes more sustainable. For instance, reusable packaging options may reduce down the requirement of single-use materials, which lowers waste and production costs. Companies can gain a competitive advantage and contribute to a more sustainable future by adopting innovative sustainable packaging practices.

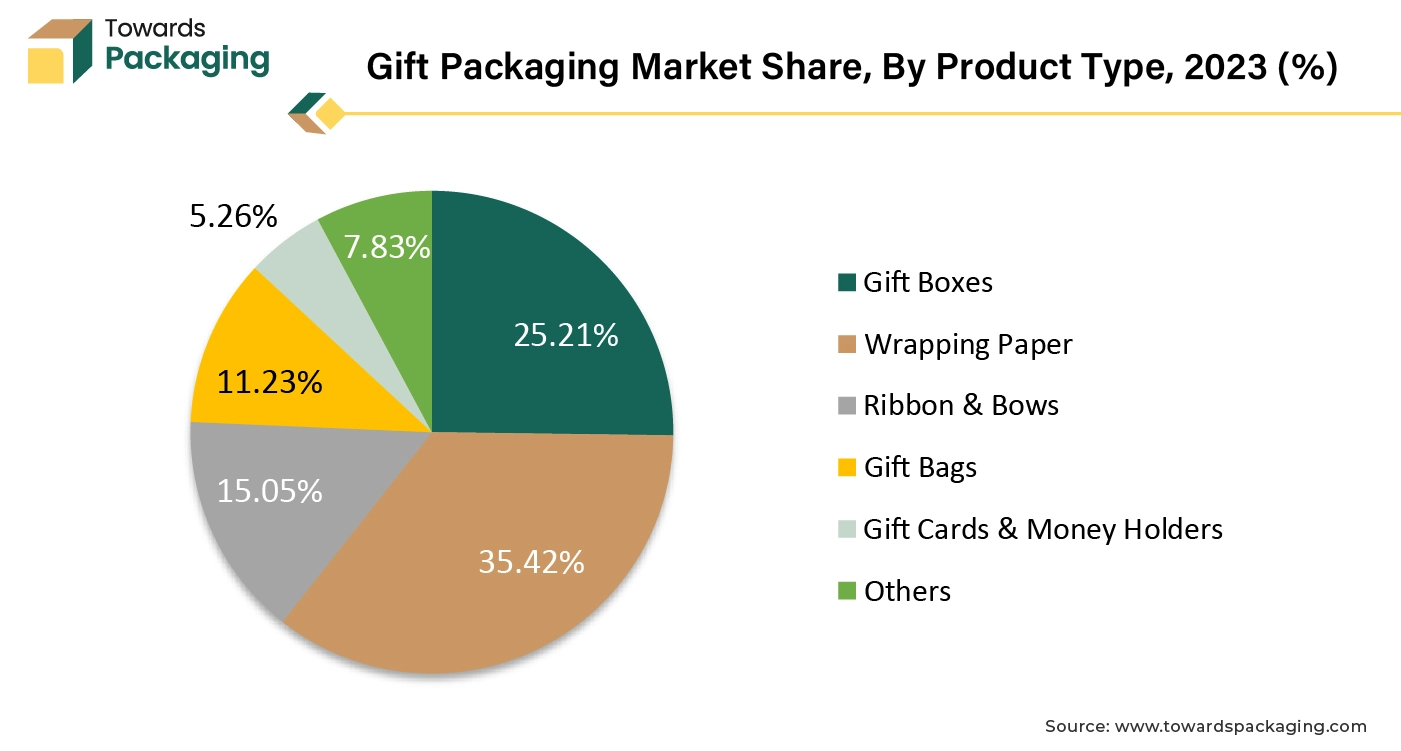

The wrapping paper segment captured largest market share of 35.42% in 2024. This is owing to the widespread use of the paper across various gifting occasions such as the birthdays, holidays, weddings and other celebrations. Using wrapping paper gives the gifts an air of mystery and surprise and it has a wonderful emotional effect on the recipient as they try to figure out what's inside. Furthermore, the wrapping paper is a cost-effective and an accessible option for the consumers, making it a popular choice for both every day as well as the special occasion gifting. Its appeal is further improved by the wide range of designs, colors and patterns available; giving the consumers to choose wrapping paper that suits their personal tastes or the specific theme of an event. These factors are likely to support the growth of the segment in the global gift packaging market during the forecast period.

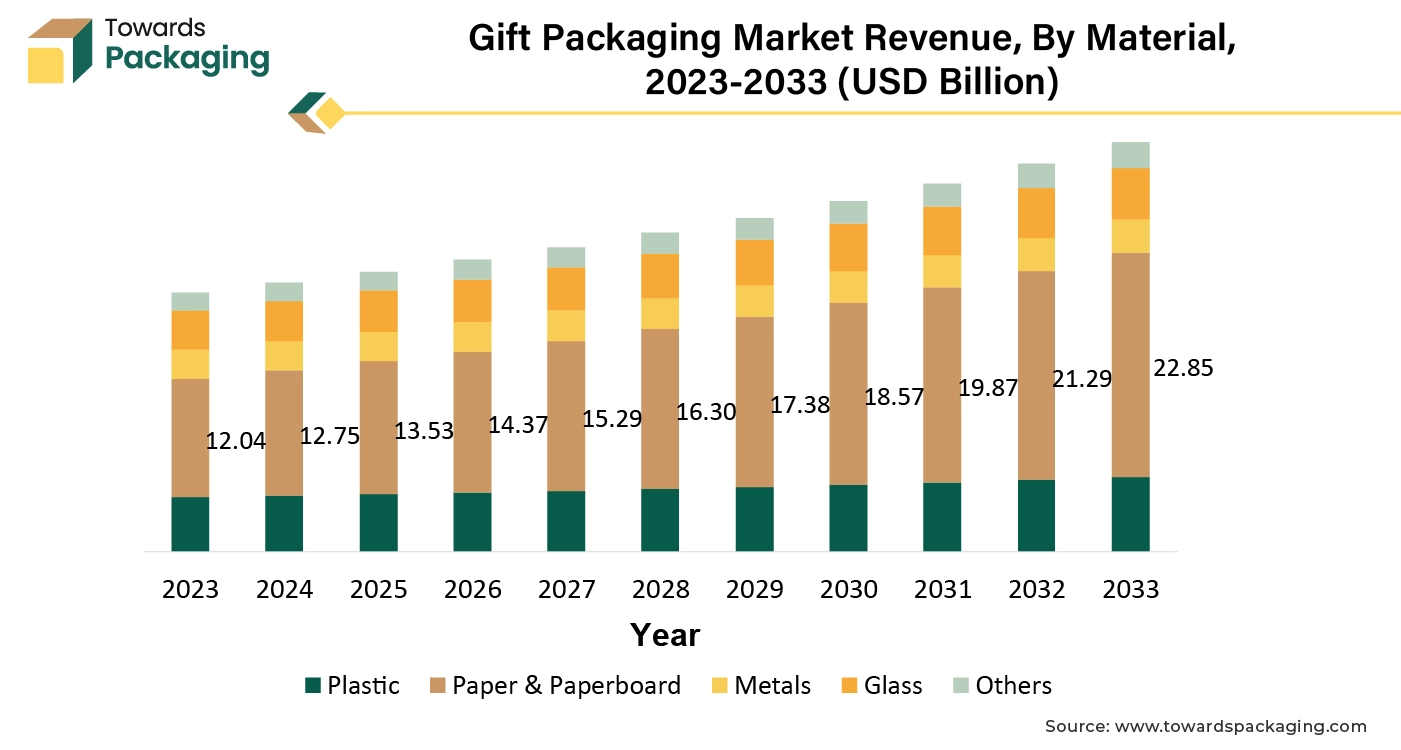

The paper & paperboard segment captured largest market share of 45.56% in 2024. This is owing to the growing consumer preference for sustainable and eco-friendly packaging options across the globe. Paper is manufactured from sustainable resources like paper and paperboard, which have unique environmental sustainability qualities. The raw material is easily biodegradable. It can be obtained from forests that are managed sustainably, much like wood. Additionally, the paper packaging can be reused as many things such as wrapping paper, fiber-board and paper sacks. This is further expected to contribute to the growth of the segment in the years to come.

Asia Pacific is likely to grow at fastest CAGR of 6.43% during the forecast period. This is owing to the economic growth and the rise in income levels of the consumers. Furthermore, the rapid growth of e-commerce in economies such as India and China as well as the expanding middle class is also expected to contribute to the growth of the market in the region.

As per the report by the People Research on India's Consumer Economy (PRICE) and India's Citizen Environment, with ongoing stability in the politics and economic improvements driving the country's growth at a consistent 6% to 7% annual rate over the next 25 years, India's middle class is expected to nearly double to 61% of the country's total population by 2047, from 31% in 2020–21. This will position India as one of the largest markets globally. Additionally, the increase in spend on luxury and branded packaging are also anticipated to promote the growth of the market in the region in the years to come.

North America held considerable market share of 36.87% in 2024. This is due to the strong culture of gifting and growing consumer spending on holidays, birthdays and festive occasions like Christmas, Thanksgiving and Valentine's Day. As per the data by WorldRemit, in 2023, the average amount spent by US customers on Christmas gifts was $826, or almost 69% of all expenses related to the holiday. The remaining funds were used for decor and meals. Furthermore, the growing environmental awareness among consumers and stringent regulations imposed by governments as well as the presence of numerous luxury and premium brands is also expected to support the regional growth of the market in the near future.

By Packaging Type

By Product Type

By Material

By Region

April 2025

April 2025

April 2025

April 2025