March 2025

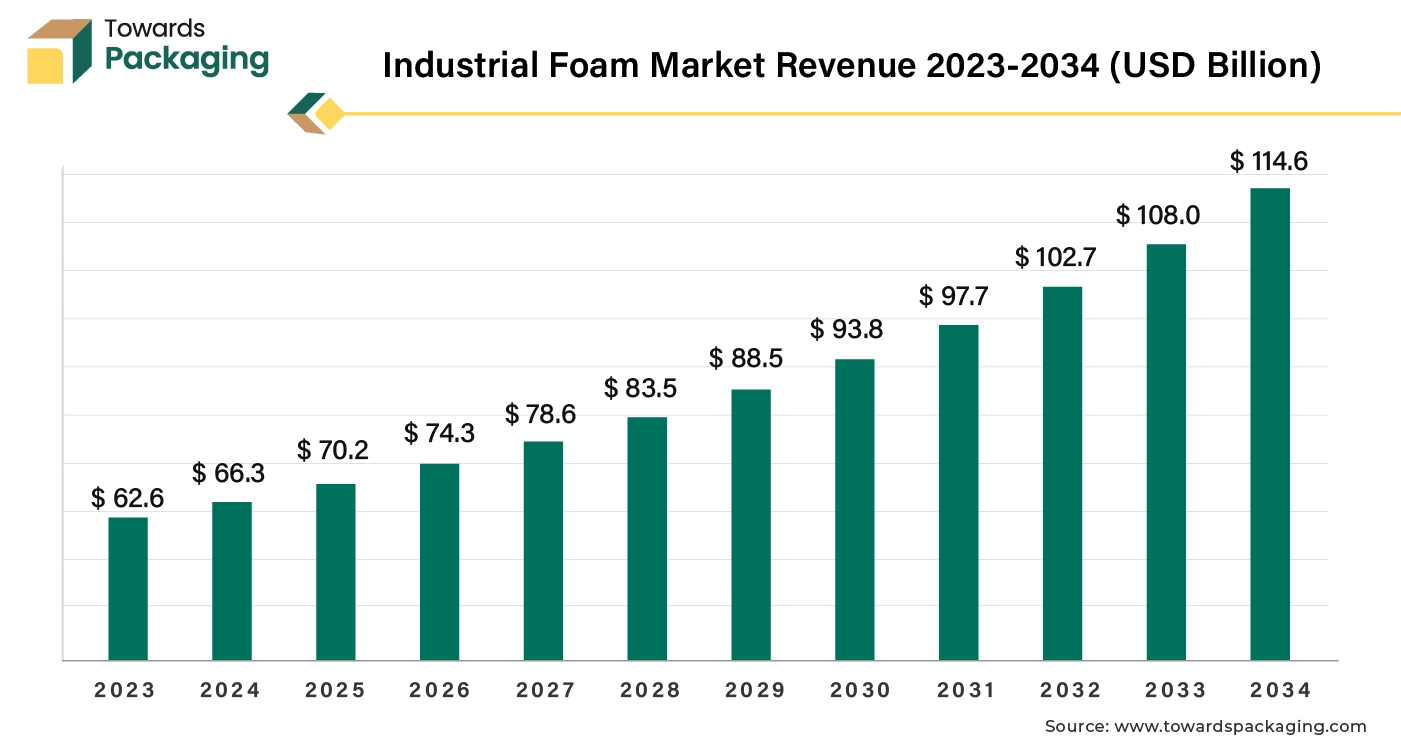

The industrial foam market size was USD 62.6 billion in 2023, calculated at USD 66.3 billion in 2024, and is expected to reach around USD 114.6 billion by 2034, expanding at a CAGR of 5.65% from 2025 to 2034. The demand for the industrial foam packaging market is growing because of widening scope of applications by various end-use industries is driving market surge.

Unlock Infinite Advantages: Subscribe to Annual Membership

The industrial foam market is experiencing robust growth driven by increasing demand for lightweight and durable material across various sectors such as automotive, construction, packaging, medical, and healthcare.

The industrial form market includes different foam materials that are utilized across various industries for multiple purposes like packaging, insulation, cushioning, structural applications etc. Foam is a material that consists a mass of small bubbles that are formed typically when a gas is trapped in liquid or solid substance. Industrial foams include polyurethane, polyethylene, polystyrene, and polyvinyl chloride. The rising demand for foam can be attributed to several factors across different industries like construction industry, automotive sector, packaging, consumer goods, medical, and healthcare industries.

It is driven by their properties like lightweight, thermal, and insulation capabilities, cushioning, and suitability for various applications across industries. Advancements and innovation in the manufacturing process improve the efficiency, performance, and sustainability of foam as well as the development of biodegradable and recycled foam. The global packaging industry size is estimated to grow from USD 1.20 trillion in 2022 to reach an estimated USD 1.58 trillion by 2032, growing at a 3.16% CAGR between 2023 and 2032.

Artificial Intelligence (AI) is proving to be a game-changer for different industries. Slowly but steadily, it is being integrated into infrastructure across industries. It has the ability to change the work processes of the industrial foam industry. AI driven technology plays an important role s enhancing manufacturing processes, improving efficiency, and lowering operational costs. With AI technology analytics, manufacturers can optimize their productivity and minimize wastage as AI enabled automation can reduce risks of inconsistent quality and human error. Inventory management and supply chain optimization can be streamlined through this technology. Combining AI technology with machine learning or Internet of Things (IoT) can open new opportunities for industrial foam processes o function smoothly. AI helps in predictive maintenance, analyzing patterns and market trends, preferences of consumers etc. that can help the organization gave a competitive edge.

Global foam production is rising because the demand for insulation in buildings and appliances is rising. Rigid polyurethane foam (RPUF) is widely used for building panels because it's lightweight, durable, and has low thermal conductivity. Advancements are ongoing to meet strict fire safety standards in homes and commercial buildings. The focus on reducing energy use for heating and cooling is also increasing, boosting the need for polymeric foams as insulation. Spray Polyurethane Foam (SPF) insulation is a better insulation choice. That has driven the growth of the industrial foam market.

In China, the "Dual Carbon" vision goals to peak carbon emissions by 2030 and achieve carbon neutrality by 2060. This initiative has stimulated energy conservation efforts. China's investment plans focus on opportunities for rigid foams and lightweight polyurethane composites. These materials are used in various sectors such as the cold chain, district cooling and heating systems, high-speed rail, new electric vehicles (NEVs), and temperature-controlled data server centres.

Global population growth drives demand for polymeric foams used in industries, including building & construction, cold chain, furniture & bedding, packaging, and transportation industries, automotive industries. These sectors heavily rely on polymeric foams for various applications, highlighting their essential role in meeting growing needs worldwide, which have driven the growth of the industrial foam market.

Cold chain logistics, which involves transporting temperature sensitive goods such as food and pharmaceuticals, insulated foam packaging ensures that products remain within specified temperature ranges throughout transportation.

One significant restraint affecting the industrial foam industry is the fluctuation in raw material prices. Raw materials like petrochemicals and styrene are highly sensitive to market conditions, geopolitical factors, and global supply-demand dynamics. Petrochemicals used in producing polyurethane foams, and polystyrene foams, limit the growth of the industrial foam market. If there's a sudden increase in crude oil prices, it directly impacts the cost of petrochemical-based foams like polyurethane. Manufacturers may face higher production costs, which can potentially lead to increased prices for foam products.

The increasing demand for bio-based polyurethanes presents significant opportunities within the industrial foam industry. Bio-based polyurethanes are derived from renewable resources such as biomass, vegetable oils, or even waste materials, offering several advantages over traditional petrochemical-based polyurethanes.

Bio-based polyurethanes have a lower carbon footprint compared to their petrochemical foam. There is a growing consumer awareness and preference for environmentally friendly products. Industries and consumers increasingly prioritize sustainable materials and products, creating a market demand for bio-based alternatives across various sectors including building & construction, furniture, packaging, and automotive, which boosts the growth of the industrial foam market.

Asia Pacific dominated the industrial foam market with the largest revenue share in 2023. The growth of the market is driven by the construction and furniture sectors, along with rising demand for foam-based home furnishings like mattresses and pillows. The packaging industry's increasing use of foam to protect delicate items further boosts sales. In automotive, foam enhances fuel efficiency through components like seats and bumpers. These factors together contribute to the region's promising market growth. Rapid urbanization, infrastructure development, and increasing consumer demand for electronics and packaged goods contribute to its leadership in the industrial foam market.

Industrial Foam Market in Asian Countries

North America is expected to grow at the highest CAGR in the market during the forecast period, especially in sectors such as wind turbines, automobiles, and construction, primarily in the United States and Canada. Foam has lightweight properties that make it ideal for wind turbine blades, aligning with the region's increasing adoption of wind energy. This illustrates how technological trends drive market expansion. The region's focus on sustainability and stringent building codes further drive the adoption of industrial foams for insulation and structural purposes. Additionally, the expanding electronics and automotive industries contribute to the growth of the industrial foam market in North America.

According to the U.S. Department of Energy, wind energy is the fastest-growing source of renewable energy. U.S. wind energy demand for balsa in 2050 could exceed five times the current level of global production. Material substitution, for example, increases the use of PVC foam.

Following the same development, Huntsman developed a new type of rigid polyurethane foam that is 25% lighter than conventional materials. This foam was used in seat cushions and dashboard components, resulting in a 5% overall reduction in vehicle weight and a corresponding increase in fuel efficiency.

The flexible foam segment dominated the global Industrial foam market in 2023. Its versatility makes it widely used across industries such as automotive, furniture, bedding, packaging, and construction. Flexible foam molds easily to different shapes, offering excellent cushioning and comfort, making it popular in mattresses, and seat cushions. Flexible polyurethane foams provide acoustic insulation, energy absorption for packaging, and comfort in applications such as mattresses and furniture.

The rigid foam segment is observed to grow at the fastest rate in the industrial foam market during the forecast period. This growth is driven by its increasing applications in construction, insulation, packaging, and other industries. Rigid foam's properties, such as strength, thermal insulation capability, and structural support, are highly valued in these sectors, contributing to its rapid expansion in market demand and production. Rigid foams could be used with lower densities offering low thermal conductivity for hot and cold applications. It was used in tanks, pipes, and construction in panels, roofing, and spray foam in industrial, commercial, and residential buildings. It was also used in the cold chain (commercial and domestic refrigeration and transportation).

The polyurethane segment dominated the industrial foam market in 2023, driven by its versatile properties such as strength, lightweight nature, adaptability, and resistance to vibration and corrosion. Polyurethanes have improved the quality of modern life due to a large number of applications such as insulation foams in houses and buildings to control temperature, flexible foams in car seats and furniture, dampers in shoes for comfort, and coatings to protect wooden and metallic materials or simply to improve aesthetics, packing, and medical devices. Polyurethanes are a unique class of materials that can be used in different applications such as flexible foams, rigid foams, coatings, adhesives, elastomers, sealants, and films. Out of these types, foams based on polyurethane have a high demand.

Polyurethane spray foam (SPF) has been used successfully in the UK, Europe, and worldwide for more than 30 years and is a valuable addition to improving the energy efficiency of many buildings. It is estimated that more than 250,000 properties in the UK have been treated with SPF insulation improving thermal performance for building occupants as well as reducing fuel bills.

The polystyrene segment is expected to grow significantly, primarily due to the widespread adoption of PS foam in applications like food packaging. Polystyrene foam products, commonly referred to as Styrofoam, and are widely used as single-use consumer goods. PS foam is valued for its insulation properties, long operational life, and cost-effectiveness, making it ideal for food service packaging, electronics protection, and lightweight packaging solutions.

Polystyrene foam, particularly expanded polystyrene (EPS), is widely used in packaging due to its excellent cushioning properties, lightweight nature, and ability to protect fragile items during shipping. This makes it indispensable for e-commerce and electronics industries. Polystyrene is used in various consumer goods, including disposable food containers, cups, and trays, due to its moisture resistance and thermal insulation properties.

The building & construction segment led the industrial foam market with the largest share in 2023. The foam is used for air sealing, flooring, and waterproofing, and as thermal insulation. Buildings also use rigid and spray industrial foams for insulation and structural purposes. Spray polyurethane foam (SPF) can play a major role in insulating and air sealing homes and buildings, helping to reduce air leakage, which can result in lower utility bills, reduced greenhouse gas emissions, and enhancing indoor air quality by preventing dust and allergen infiltration that boost the growth of industrial foam market. In the construction industry, polystyrene foam is used for insulation purposes. It provides thermal insulation in walls, roofs, and foundations, contributing to energy efficiency in buildings.

The aerospace segment is expected to grow at the highest CAGR in the market during the forecast period. Increasing demand for high-performance polymer foams due to their lightweight, insulating, and shock-absorbing properties. These foams, made from materials like ceramics, metals, and polymers, are utilized in various applications such as walls, ceilings, aircraft seats, and floors. Additionally, there is a rising need for aerospace foams that can reduce aircraft noise, meeting requirements across general aviation, commercial aviation, military aircraft, and rotary aircraft sectors. Aerospace manufacturers are focusing on producing custom-built, flame-retardant polyurethane products including integral-skin foams for aircraft flight decks and interior cabins.

By Type

By Foam Type

By End Use Industry

By Region

March 2025

March 2025

March 2025

March 2025