April 2025

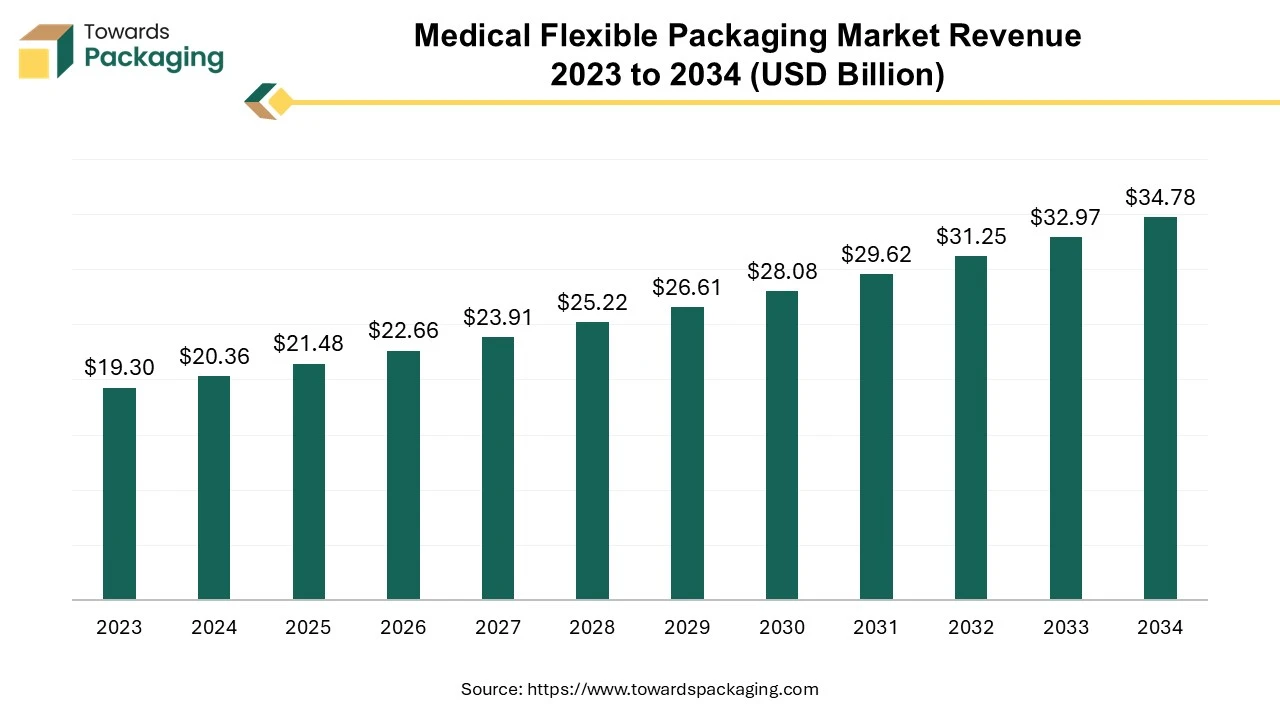

The medical flexible packaging market is anticipated to grow from USD 21.48 billion in 2025 to USD 34.78 billion by 2034, with a compound annual growth rate (CAGR) of 5.5% during the forecast period from 2025 to 2034.

The market is proliferating due to the increasing demand for pharmaceutical industry telemedicine, delivery of drugs, and packaging of various other things that require safe and flexible packaging. The growing trend of online ordering systems is boosting the medical flexible packaging market.

The healthcare sector is showing a major transition towards convenience and portable packaging due to the growing online facility in this sector. This flexible medical packaging provides lightweight, safe, leakage-proof, and compact rigid packaging for different products. Such packaging makes it easier to carry small products such as inhalers, injection needles, bandages, and many others. Due to this convenience in carrying such essential products the demand for medical flexible packaging market. Biotechnology and the pharmaceutical industry together contribute towards the growth of the medical flexible packaging market.

These industries are continuously growing with innovations in the medical sector which ultimately raise the demand for such packaging that can protect all the products from damage, moisture, contamination and many other factors. So, the major market players are also focusing on developing packaging materials that can fulfil all the demand and enhance the market development. Packaging that can protect the shelf life of medicines is also preferred the most in this healthcare sector so the market players are primarily focusing on producing the best quality films for packaging purposes. The global packaging industry size is growing at a 3.16% CAGR between 2025 and 2034.

AI is useful in gathering historical data about the demand for products in the medical packaging industry. It influences a major section from production to quality and sales of the packaging products. From pharmaceutical packaging to biotechnologically advanced machinery the demand for different products is different which needs precise observation that becomes easy with the incorporation of AI in this field. It is helpful to segregate any defective piece that can degrade the market quality and also protect from overproduction by analysing the requirements of the market from customers purchases and product reviews.

AI helps to detect the quality of the packaging by using algorithms and avoid any defects or anomalies. With the adoption of artificial intelligence packaging companies can track the path of each product sold for medical packaging purposes. This can help to reduce waste and enhance the customer experience through improved packaging. With equipped packaging in the medical sector like sensors, the monitoring ability of the operations group rises to observe several parameters immediately. Any defect found in such cases can be improved easily.

Rising investment of the government to private companies for the development of both the pharmaceutical sector as well as biotechnology sector to provide more facilities to patients and advancement in the treatment of patients ultimately drive the medical flexible packaging market. The medical sector is now constantly trying to develop cost-effective products. For that reason, there is a huge demand for low-charge but good-quality packaging products for safe delivery and storage of products at a reasonable price. The demand for one-time-use medical products is increasing rapidly, consuming more packaging products and driving the market development rapidly.

There are several varieties of packaging such as blister packs, shrink sleeves, strip packs, roll stock, stand-up pouches and many other types of flexible packaging. Due to the growing mobile lifestyle among people, it has been observed that the requirement of medical flexible packaging has increased as everyone wants the delivery of products to their doorstep and for this purpose, there is a need for good packaging of all the drugs and injectables which ultimately drive the mobile flexible packaging market.

There are several guidelines in the packaging market which are required to be followed strictly for environmental safety which act as a barrier for the development of the packaging industry. People are more concerned regarding decomposable waste, using recycled products, and many others which is becoming a challenge for the market players to develop such products that can fulfil both the requirements like keeping the product safe and contamination-free and also satisfying all the norms or guidelines introduced for the manufacturing industry. These strict rules and lengthy process of product approval hinder the market from growing rapidly.

Several chronic diseases such as cancer, STDs, lung diseases, diabetes, strokes, and many others can be seen rising frequently in recent times ultimately increasing the demand for enhanced medicines and their packaging that need to be safe and hygienic.

According to WHO there are several reasons for the widespread of cancer such as consumption of tobacco, physical inactivity, alcohol, unhealthy diet, irregular sleep cycle, and many others. This is majorly spreading in middle to low-economy countries.

With the concern of raising such issues, there is a high demand for ensuring safe packaging that can be stored for long duration and protect products in adverse environmental condition. The flexible packaging market offers packing with lightweight materials, easy-to-use, space-efficient products, and ideal for packing medical products in several ways. Such offerings enhance the demand for the market and lead manufacturing companies to introduce innovative products in the market hence raising several opportunities in this field.

The paper packaging segment held the dominating share of the medical flexible packaging market in 2024. Paper-based packaging plays a significant role in the medical flexible packaging market as it is the sustainable and versatile option available in the packaging industry. It is preferred as it is easy to customise and economically affordable which is beneficial for both brands of packaging and the medical industry. It is a comparatively new method in the packaging market and is popular due to its cost-effective and highly efficient nature. This packaging method uses a large number of flexible materials plastic and paper, including foil, to create pouches, bags, and other flexible product containers.

These are mainly useful in industries that require versatile packaging, such as personal care, food and beverage, and pharmaceutical industries. Moreover, supportive government strategies endorsing sustainability and renewable resources inspired several companies to choose eco-friendly substitutes within the medical flexible packaging market. With the introduction of enhanced capacity to endure moisture, oxygen, and outside effects aids packaged things have an extended shelf life. Firms using these advanced coatings are receiving a competitive benefit by providing wrapping solutions that gratify industries with stringent quality regulators and protection supplies to preserve product integrity.

The high barrier film held the dominating share of the medical flexible packaging market in 2024. This type of packaging protects sensitive products against any adverse environmental issues such as oxygen, moisture, and light. These barriers play a crucial role in maintaining safety, integrity, and efficacy of the products associated with pharmaceuticals and medical devices majorly to those products which need to be stored for a longer period. The rising cases of chronic diseases increases the demand for manufacturing such products in the packaging industry. In this high barrier packaging industry products such as foil-based structures, advanced polymers, and laminated films are developed for transportation and storage purposes.

The pharmaceutical manufacturing segment held a significant share of the medical flexible packaging market in 2024. This segment comprehends a variety of products such as blisters, pouches, and films that are designed in a particular way to fulfil all the requirements of the medical sector. The major reason behind the growing demand for this sector is the rising demand for unit-dose packaging which is highly influencing the packaging industry.

In the pharmaceutical industry, the growing demand for biosimilar and biologics packaging products has driven market development rapidly. There is also a high demand for multiple-layer packaging to ensure the protection of products from light, moisture or any external agent that can cause damage to the medicines. The market shifting towards self-administration and home healthcare has also had a high impact on the manufacturers of this industry.

Asia Pacific witness the highest revenue shares for the year 2024. Due to the rising population in countries such as India, China, Japan, South Korea, and Thailand, there is a high chance of people getting affected by various chronic diseases. There are constant efforts from both government and private entities to deal with these issues by bringing innovation and development to the healthcare sector.

This development comprises healthcare infrastructure, equipment, medications, self-care kits, monitoring devices, and many more. To ensure the safety of such products the packaging market is highly responsible for its innovative development with long-time storage facility, safety and many other facilities associated with this field.

North America is estimated to grow at the fastest rate over the forecast period. This region is growing rapidly due to the advancement in the packaging industry which led to the establishment of several companies in this field. Rapid growth is observed in the pharma companies and hence the demand for packaging also increased. The innovation of detection methods and equipment led to the requirement of their packaging as well which resulted in the rise of the packaging industry. With the growth in the healthcare industry in countries such as the US and Canada the medical flexible packaging market is also experiencing major growth.

By Material Outlook

By Product Outlook

By End-use Outlook

By Region Covered

April 2025

April 2025

April 2025

April 2025