April 2025

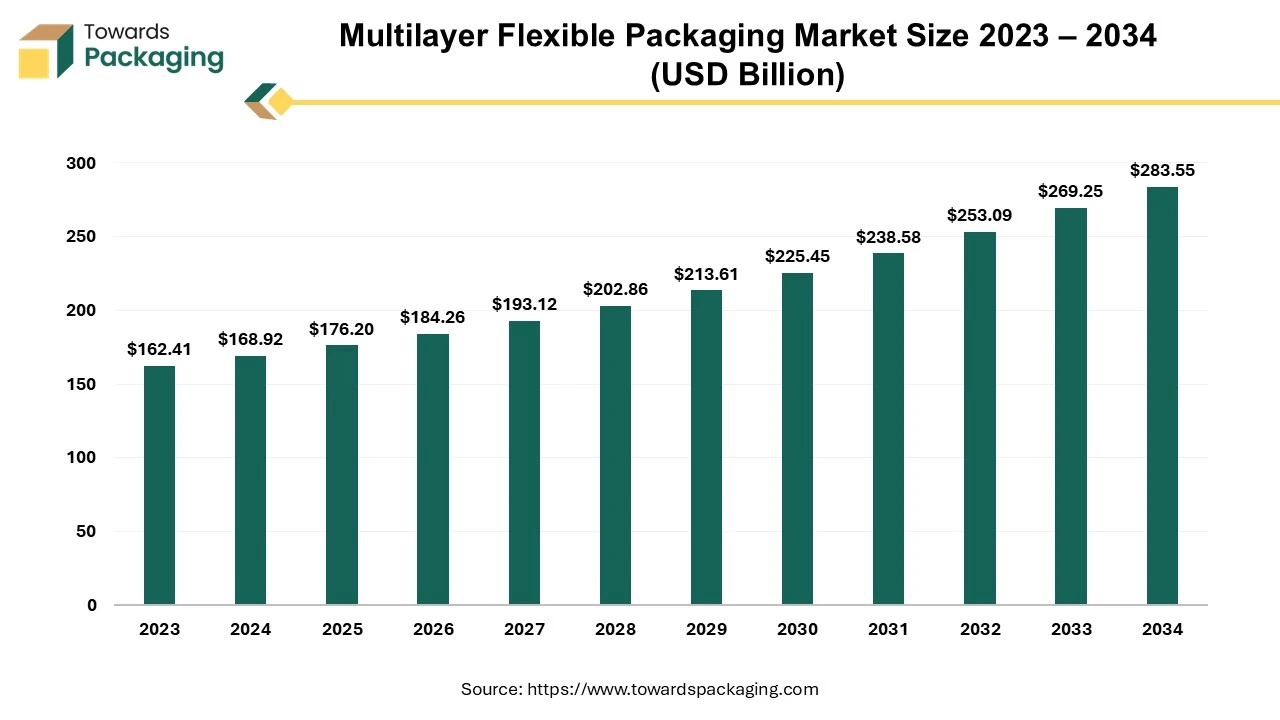

The global multilayer flexible packaging market is estimated to reach USD 283.55 billion by 2034, up from USD 168.92 billion in 2024, at a compound annual growth rate (CAGR) of 5.32% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The multilayer flexible packaging market is anticipated to grow at a substantial rate during the forecast period. Multilayer flexible packaging is made by combining multiple layers of materials such as plastics, paper, aluminum or bio-based films, to create a single structure. These layers are supposed to utilize each material's specific features such as strength and barrier protection, creating a packaging that is lightweight, strong as well as highly functional.

This form of packaging is mostly utilized in the food and beverage, pharmaceutical and personal care industries to provide moisture resistance, increased shelf life and ease of customization. Its capacity to protect the products from environmental conditions while being simple and visually appealing makes it a better alternative for the modern consumer needs.

The increasing consumer demand for convenient and lightweight packaging along with the growing advancements in the materials and co-extrusion technologies is expected to augment the growth of the multilayer flexible packaging market during the forecast period. Furthermore, the rising need for sustainable packaging coupled with the increase in the environmental concerns and regulatory pressures are also anticipated to augment the growth of the market. Additionally, the growth of the food and beverage industry and the changing consumer lifestyles as well as the e-commerce growth along with the innovations in the printing and design technologies is also projected to contribute to the growth of the market in the near future.

The growing consumer demand for convenience due to the by rapid lifestyle changes, urbanization as well as shifting demographics is anticipated to support the growth of the multilayer flexible packaging market during the estimated timeframe. Customers having more power and flexibility in the checkout lane are one factor contributing to the multifaceted move away from larger sizes and toward convenience and more choices.

Many consumers are interested in trying a variety of foods or household goods in smaller containers instead of committing to a large box or bag. Developing practical strategies for integrating package sizes with the stated requirements of contemporary consumers is one strategy to fulfill the desire for greater options. Packaging companies help producers through providing simple packing options for selling various food products targeted at healthy lifestyles.

Along with the convenient reclosable containers for powders, snacks and other food products, simple alternatives such as single-serving packs that dispense the appropriate amount of products are also available. Multilayer flexible packaging meets these needs as it is lightweight, portable, and convenient with its resealable zippers, easy-tear openings, and portion-sized packaging for convenience. This demand is mostly visible in the food and beverage industry, where customers want ready-to-eat meals, snacks, and single-serve products. As consumer expectations continue to evolve, the adaptability and practicality of multilayer flexible packaging make it an important choice, driving wider adoption across a variety of industries.

The issue with multilayer packaging recycling is expected to hamper the growth of the multilayer flexible packaging market within the estimated timeframe. The composite structure of multilayer plastic, which combines many layers of different materials to fully utilize their unique capabilities, sets it apart from single-layer plastics. They are perfect for packing food and medications because, for example, one layer may offer strength and flexibility while another may offer resistance to the oxygen barrier.

Complex manufacturing procedures like co-extrusion and lamination are more expensive than making single-layer plastics. Despite their higher functionality, multilayer plastics tend to be harmful to the environment since it is more difficult to separate the layers during recycling. Even though single-use plastics are known to have detrimental effects, multilayer plastics still add to the world's plastic waste issue.

The layers utilized in multilayer packaging like the PET-PE, PET-PP, and polymer-metal layers, are part of different polymeric families. When processed together, these layers are incompatible; for instance, the melting temperatures of PET and PE differ, resulting in a reduction in the recycled material's quality. Furthermore, multi-layer flexible packaging is developed by attaching layers together, depending on the manufacturing process. The quality of the recycled material may be impacted by the adhesives utilized, which are difficult to remove.

If the label adhesive is difficult to remove during the recycling process, it might also have an impact on the quality of the recycled material. Additionally, Strong colors and inks are frequently used to embellish flexible packaging. Prints are frequently coated in polymer layers, which makes de-inking challenging. The recycling turns colorless without de-inking, and restricts its end-use applications. These factors make the recycling process more complex and further limit the growth of the market through contributing to the environmental pollution and resource wastage.

The growing focus on various recycling initiatives and innovations is expected to create substantial opportunity for the growth of the multilayer flexible packaging market in the near future. With the global push for sustainability; governments, companies as well as consumers are actively seeking options to reduce the waste and promote a circular economy. Recycling initiatives and innovations are at the forefront of these efforts. For instance:

Furthermore, partnerships between packaging firms and recycling organizations are promoting closed-loop systems in which used packaging is collected, processed, as well as converted into new products. Since consumers and stakeholders prioritize eco-friendly practices, companies that engage in recycling-compatible multilayer packaging alternatives can gain a competitive advantage while also contributing to global sustainability goals.

Artificial intelligence (AI), like many other things, is starting to be a helpful tool for the market for multilayer flexible packaging. AI-selected algorithms are being utilized by large corporations to decide when to switch from cardboard boxes to flexible packaging. This minimizes the cost of the inventory, electricity and storage space. Waste materials can be sorted faster and with greater precision compared to traditional human and automated sorting with the use of AI algorithms to evaluate signatures and identify materials. For instance:

Ishitva Robotic Systems Pvt Ltd., company based in India, recently designed artificial intelligence based high-speed air sorters for flexible packaging. This AI-powered Air Sorter SUKA(R) can separate multilayered flexible packaging based on the definition of the various layers involved, in addition to recovering flexible material at a very high speed and giving a scalable recovery solution. Based on the structure and layers, this scalable material recovery method effectively recovers the multi-layered flexible packaging material from the post-consumer waste stream.

Furthermore, AI assists manufacturers to optimize the packaging designs, reducing the material consumption and waste while increasing functionality and popularity among consumers. AI-powered automation and robotics speed production lines, improve precision, and reduce downtime with predictive maintenance, leading to cost savings and increased efficiency. Additionally, AI-powered solutions provide individualized packaging layouts as well as targeted branding strategies that makes it possible for the companies to adapt to the consumer preferences while also differentiating their products in competitive markets. The incorporation of the AI technologies helps companies to stay competitive, reduce environmental impact as well as meet the evolving demands of the multilayer flexible packaging market.

The pouches and sachets segment held largest share of 32.28% in the year 2023. Pouches and sachets use less material, which leads to lower transportation and production costs. They also reduce material waste with their high product-to-package ratio. Flexible shapes enable creative structural designs that are striking when displayed on store shelves.

Furthermore, flexible pouches are less harmful to the environment because they produce minimal greenhouse gasses during production and shipping. The most popular type of flexible pouch is the stand-up pouch. In stand-up pouch packaging, the use of mono material film seems unavoidable, especially given the increased awareness of the waste issue. In addition, superior barrier qualities contribute to a longer shelf life of the product. Flexible pouches are a resource-efficient packaging style that meets many of the requirements of consumers' rising interest for sustainable packaging.

The food and beverages segment held largest share of 45.25% in the year 2023. This is owing to the increasing demand for the packaged and processed foods along with the inclination of the consumers toward convenience. Consumers today want products that are not only easy to store and eat but also maintain freshness and quality over long periods of time and this makes the multilayer flexible packaging a perfect option. Furthermore, growing popularity of ready-to-eat meals, snacks, frozen foods, as well as beverages is also anticipated to contribute to the growth of the segment during the forecast period. Additionally, the increasing interest in the organic, plant-based, and functional food and beverage options are further expected to support the segmental growth of the market in the near future.

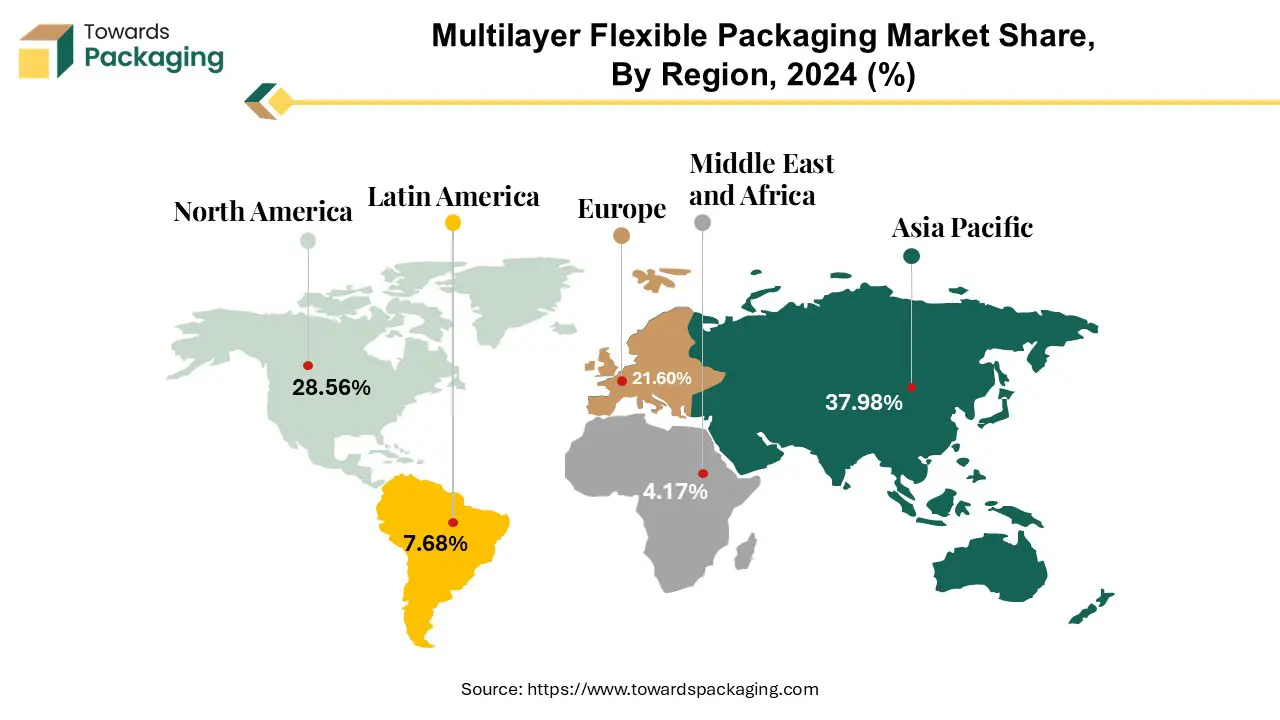

North America held substantial market share of 28.56% in the year 2023. This is owing to the growth of the packaged foods, frozen meals and ready-to-eat products coupled with the increasing demand for extended shelf-life options across the region. Additionally, the advancements in the packaging technology with the innovation of high-barrier films, bio-based materials as well as advanced printing technologies is also expected to contribute to the regional growth of the market. For instance, in July 2022, SP GROUP announced the release of its initial vacuum packing product, a recyclable top film, high-barrier retortable and base web specifically made for food items within the FMCG industry. Furthermore, the growing awareness about the eco-friendly practices is also expected to contribute to the regional growth of the market.

Asia Pacific is likely to grow at the fastest CAGR of 7.19% during the forecast period. This is due to the rising disposable incomes and changing lifestyles of the expanding middle class. Also, the expanding pharmaceutical and healthcare industries as well as the high consumption of the ready-to-eat meals along with the rising food processing industry is likely to contribute to the regional growth of the market. According to the India Brand Equity Foundation data, the Indian healthcare sector, which was supported by both the public and private sectors, grew substantially in 2023 and reached a valuation of US$ 372 billion. Furthermore, the growth of the manufacturing and export-oriented industries is also expected to contribute to the regional growth of the market.

By Material

By Product

By Layer Structure

By End-Use

By Region

April 2025

April 2025

April 2025

April 2025