The nutraceutical flexible packaging market grows, the demand for innovative and sustainable packaging solutions is on the rise. Flexible packaging, which includes pouches, sachets, and stick packs, is increasingly favored in the nutraceutical sector due to its versatility and convenience. With growing health consciousness and a greater focus on preventive healthcare, nutraceutical companies are turning to flexible packaging to meet the needs of consumers who seek high-quality, on-the-go solutions for their supplements and functional foods. Additionally, the emphasis on eco-friendly materials and reducing plastic waste is prompting market players to invest in recyclable and biodegradable packaging alternatives.

The nutraceutical flexible packaging market is likely to witness strong growth over the forecast period. Vitamin and supplement packaging has evolved beyond providing simple protection to become a strategic tool that can accelerate the success in this highly competitive sector. Packaging has the power to increase the convenience, highlight creativity as well as demonstrate a company's dedication to sustainability. In this quickly growing market, the success of the nutraceuticals brand in attracting customers may depend on selecting appropriate and environmentally friendly packaging. In this industry, stick packs, blisters, sachets, and pouches are typical forms of flexible packaging.

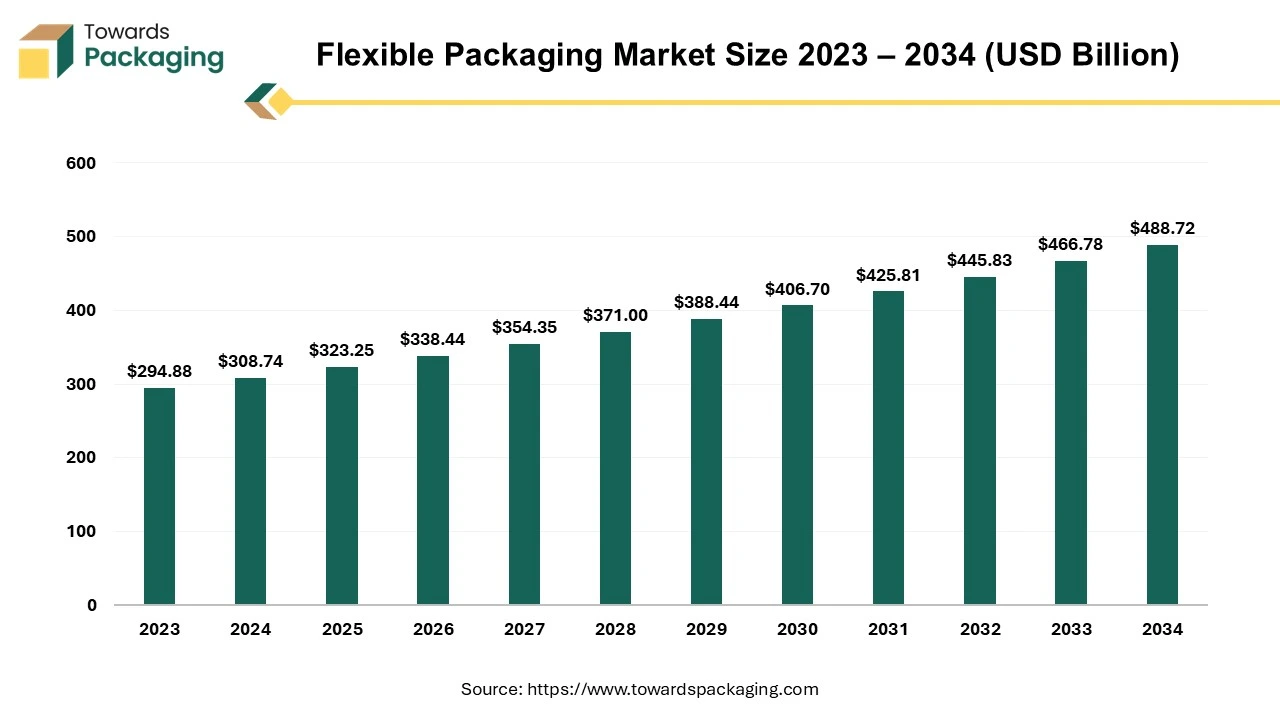

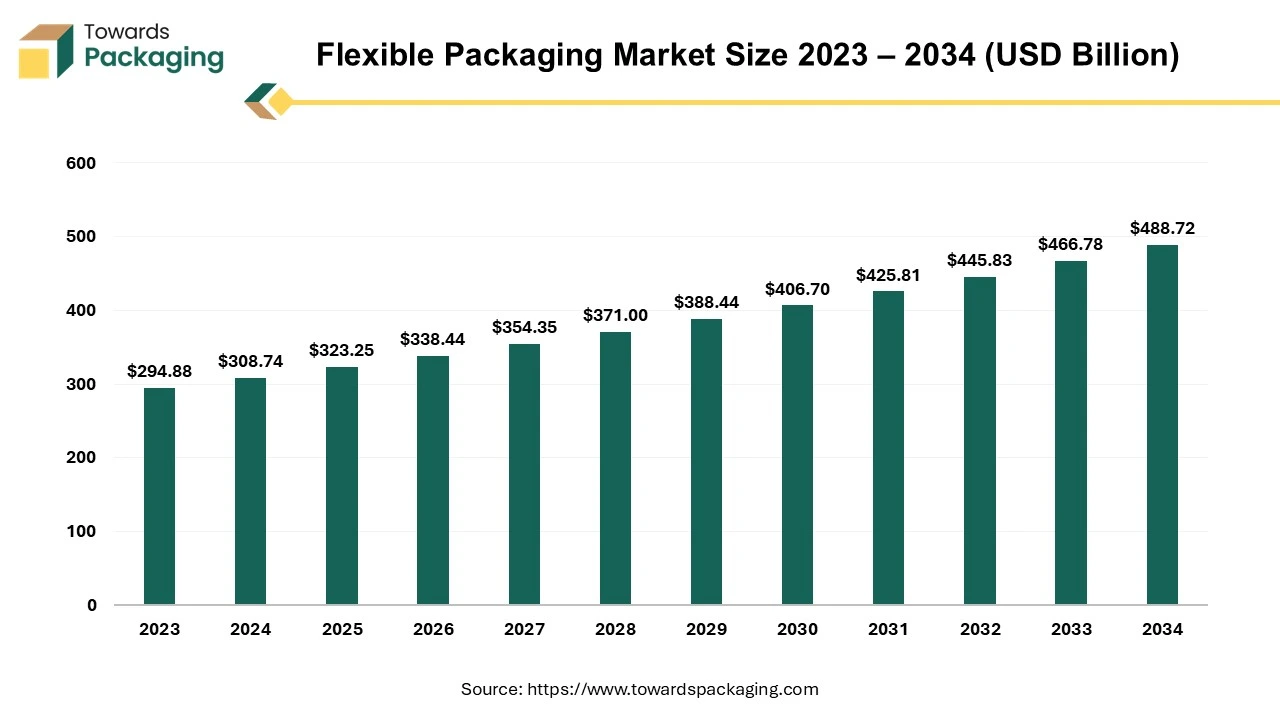

The rising consumer health consciousness along with the growing popularity of e-commerce platforms are expected to augment the growth of the nutraceutical flexible packaging market during the forecast period. Furthermore, the consumption of premium nutraceutical products as well as the rising disposable incomes in emerging economies is also anticipated to augment the growth of the market. Additionally, the shift towards personalized nutrition as well as the growing elderly population, which relies heavily on the supplements and functional foods, is also projected to contribute to the growth of the market in the years to come. The packaging industry size is growing at a 3.16% CAGR.

Key Trends and Findings

- According to the survey by the Council for Responsible Nutrition (CRN), people take supplements to help them achieve their goals of optimal wellness and to promote the healthier and more active lifestyles. They also use them to make up for nutritional inadequacies. Though supplements have somewhat decreased in the popularity as a justification for the supplementation, immunity is still one of the main reasons people take them.

- Approximately over 74% of adult Americans consume dietary supplements, with 55% of them being frequent users. The dietary supplement industry is trusted by 74% of American citizens, which includes individuals who do not use supplements, and 92% of users believe that using supplements is necessary for staying in good health. In past years, the study also revealed that 83% of consumers of dietary supplements expressed belief in the sector.

- The perceived quality and safety of sports nutrition supplements were viewed positively by supplement users, who increased their confidence by 5 percentage points to 66% from the previous year along with 4 percent to 56% in the weight management category compared to 2022.

- Seventy percent of consumers are still taking multivitamin/mineral supplements, which continue to top the rankings. However, specialized supplements that are characterized as having special ingredients or being condition-specific are becoming more and more popular.

- Asia-Pacific is expected to grow at a fastest CAGR during the forecast period owing to the rising disposable incomes, increasing health awareness and a growing nutraceutical industry in countries like China, Japan and India.

- North America held largest market share in 2024. This is due to the high consumer awareness of health and wellness along with a strong demand for dietary supplements and functional foods.

Key Metrics and Overview

| Metric |

Details |

| Leading Region |

North America |

| Market Segmentation |

By Material, By Packaging Type, By Product Type and By Region |

| Top Key Players |

Amcor Plc, Berry Global Group, Inc., Sealed Air Corporation, Constantia Flexibles Group GmbH, Huhtamaki Oyj, Mondi Group. |

| Key Market Drivers |

- Rising health consciousness

- Personalized nutrition demand

- E-commerce expansion

- Aging population reliance on supplements |

Market Drivers

Rising Health Consciousness

The rise in health consciousness among the consumers is projected to support the growth of the nutraceutical flexible packaging market during the forecast period. This is owing to the increased access to the information, growing awareness of lifestyle-related health issues along with a shift towards the preventive healthcare. This awareness has identified the importance of the nutrition in preventing the chronic diseases such as the obesity, diabetes and heart disease, pushing people to take proactive efforts to improve their health.

According to the World Health Organization, noncommunicable diseases (NCDs) or the chronic diseases account for 41 million annual deaths across the globe or 74% of all fatalities. The majority of NCD deaths that is 17.9 million are due to the cardiovascular illnesses, which are followed in death by cancer (9.3 million), persistent respiratory disorders (4.1 million) and diabetes with 2.0 million deaths.

This has resulted in an increase in the use of vitamins, minerals, herbal supplements, protein powders and other health-related products. Additionally, the global pandemic has demonstrated the necessity of keeping strong immune systems, resulting in increased interest in wellness products and supplements. Also, the aging population in many economies is likely to contribute to this growing trend. With the increasing demand for the nutraceuticals, there is a need for the packaging options that maintain the quality, efficacy as well as the safety of these products. Flexible packaging is ideal for the nutraceuticals as it offers convenient features such as resealable pouches, easy-to-use sachets and tamper-evident designs.

Market Restraints

Environmental Concerns over Plastic Use

The environmental concerns surrounding the use of plastic in flexible packaging is projected to hinder the growth of the nutraceutical flexible packaging market during the forecast period. Flexible packaging is the fastest growing plastic packaging category. As per the Waste and Resources Action Programme, globally plastic packaging production amounts to 141 million tonnes annually. Environmental pollution results from collecting system leaks affecting about one-third of all plastic packaging sold worldwide. Also, as per the Eurostats, in 2021, an anticipated 84.3 million tons of packaging waste were produced in the EU, an increase of 6.0% from 2020, or 188.7 kg of waste due to packaging per person. Annual carbon emissions from the manufacturing, use, and disposal of plastics amount to around 1.8 billion tons.

As per the United Nations Environment Programme, by 2040, it is projected that greenhouse gas emissions from the manufacture, usage, and disposal of traditional plastics derived from fossil fuels will account for 19% of the world's carbon budget. The projected yearly loss in value of waste generated by plastic packaging due to sorting and processing alone is between $80 and $120 billion. Additionally, there are currently between 75 and 199 million tonnes of plastic in the oceans, despite the ongoing efforts to reduce the amount.

As a result, governments have implemented more stringent measures to reduce the plastic waste such as bans on single-use plastics, greater recycling objectives and taxes on plastic packaging. The utilization of the materials derived from plastic not only risks the image of companies but also makes it more difficult to comply with the regulations. If creative, affordable alternatives aren't found, this could hinder the market growth.

Market Opportunities

Personalized Nutrition Solutions Fueling Packaging Growth

The growing trend of personalized nutrition is expected to augment the growth of the market in the years to come. In recent years, personalized nutrition has become increasingly popular and profitable for the companies offering the service. Within the domain of the consumer health and wellness, vitamins and supplements are another product segment where personalization is starting to stand out. The goal of personalized nutrition is to give the customers food and supplements based on their unique needs and preferences for better nutrition and way of life. In particular, the advancement of the new technology is driving this trend. Companies are also trying to get into the rapidly growing supplement market by providing the customized vitamins.

Furthermore, the primary demographic consists of Gen Z and millennials, with women making up a sizable majority of clients. The gender gap was unexpected at first, but it has since been evident that women frequently have a significant role in decisions pertaining to health and well-being inside households, especially in the US. Nutraceutical firms are responding by providing small, personalized doses that consumers can easily include into their regular routines.

Flexible packaging supports this trend by enabling products to be packaged in a variety of quantities and formats such as single-serve sachets, small pouches and individually wrapped capsules or powders. This helps consumers to easily take the appropriate dosage for their unique requirements, whether at home or on the go. Additionally, the individualized packaging attracts the consumers seeking precision, which is expected to fuel the growth of the nutraceutical flexible packaging market.

Nutraceutical Flexible Packaging Market Trends:

- The increase in demand for sustainable packaging solutions, like rise of eco-friendly material demand like recyclable pouches, drives the growth.

- Brand emphasis on low-carbon packaging is increasing, especially in the premium nutraceutical products segment, which increases the demand.

- Rise in demand for smart and functional packaging, like us of QR codes, RFID, and augmented reality for authentication, traceability, and consumer engagement, drives the growth.

- Clean label and transparency align with consumer demand for ingredient transparency and trust, creating a safe space and large adoption, which helps in the growth and expansion of the market.

Key Segment Analysis

Material Segment Analysis Preview

The plastic segment captured considerable market share in 2024. Plastics are multipurpose materials that are simple to work with, recycle and utilized in a variety of applications. The plastics polypropylene (PP) and low- and high-density polyethylene (PE-LD and PE-HD) are most frequently utilized in the flexible packaging applications. It is highly lightweight and economical, while also providing excellent protection for the products. Furthermore, new plastic items and packaging are produced through recycling flexible packaging and plastics, which minimizes waste and advances sustainability.

Over 40 percent of Europe's plastic packaging waste is recycled and in 2021, the EU27+3 used 5.5 million tons of post-consumer recycled plastics in new products and parts, as per the data by PlasticsEurope. These factors are likely to contribute to the growth of the segment during the forecast period.

Packaging Type Segment Analysis Preview

The pouches and bags segment held considerable market share in 2024. Pouches are one-time use bags that are often composed of plastic, occasionally paper, and metal foil. Over the last few years, flexible pouches have gained a lot of popularity in the packaging industry. This is due to the fact that a large number of them are less expensive, more ecologically friendly and resealable than alternatives like cardboard, metal, and glass containers. Since they require far less space in the landfills and have a significantly less carbon impact compared to the alternative packaging materials, they are frequently utilized. Also, producers of flexible packaging can make pouches in any size or shape to meet the growing demand of the product.

Regional Insights

North America held largest market share in 2024. This is due to the increasing health consciousness among consumers and the growing focus on personal health across the region. Furthermore, the rise of online shopping for nutraceutical products through platforms like Amazon and specialized wellness stores is also expected to contribute to the regional growth of the market. Also, the growing regulatory focus on product safety and labeling in the nutraceutical sector is further expected to support regional growth of the market in the years to come.

Asia Pacific is likely to grow at fastest CAGR during the forecast period. This is owing to the rising disposable incomes in countries like China, India and Southeast Asian nations and expanding middle class. Additionally, the growing health awareness among consumers and accelerated the adoption of dietary supplements, functional foods, and wellness beverages is also anticipated to promote the growth of the market in the region in the years to come. Furthermore, the increasing elderly population in countries like Japan and South Korea is contributing to the demand for nutraceuticals which is further expected to support the growth of the market within the estimated timeframe.

Flexible Packaging Market

The flexible packaging market is expected to increase from USD 323.25 billion in 2025 to USD 488.72 billion by 2034, growing at a CAGR of 4.7% throughout the forecast period from 2025 to 2034. The shift in consumer behavior toward convenience, coupled with regulatory pressure for eco-friendly solutions, has accelerated market adoption across industries.

The packaging type in which packaging materials is used which can easily change shape, typically manufactured from paper, plastic, foil, or a combination of these. Unlike rigid packaging such metal cans or glass jars, bottles, flexible packaging is lightweight, durable adaptable to various product types. The common types of flexible packaging are bags, pouches, sachets, and wraps & films. The flexible packaging is lightweight, cost effective, has extended shelf-life, sustainable option and convenience features. The flexible packaging is extensively utilized for personal care, pharmaceuticals, industrial applications and food & beverages.

Recent Developments by Key Market Players

- In April 2025, TricorBraun Flex, a leader in flexible packaging solutions, introduced its PolyRecycle Store Drop-off recyclable bag equipped with a one-way degassing valve, tailored specifically for fresh coffee packaging. This innovation addresses the coffee industry’s need for eco-friendly solutions while preserving product freshness by allowing excess gases to escape without compromising the bag’s integrity.

- In December 2024, CG Engineering, a division of ACG and a key supplier of integrated manufacturing solutions to the global pharmaceutical and nutraceutical sectors, introduced its new ADAPT X feeder at CpHI & PMEC 2024 in Delhi. This innovative feeder is specifically designed to manage complex and irregular tablet shapes, offering enhanced flexibility to meet a wide range of packaging requirements.

- In September 2024, ProAmpac, a leader in flexible packaging and material science, is set to showcase its latest sustainable packaging innovations at FACHPACK 2024, taking place from September 24–26 in Nuremberg, Germany. At stand 5-126, the company will present cutting-edge products including ProActive Recyclable FibreSculpt, ProActive Intelligence Moisture Protect MP-1000, and ProActive Recyclable RP-1050, along with its RAP Packaging line designed for fiber-based food-to-go solutions.

- In September 2024, Pakka, a manufacturer of compostable packaging solutions, introduced a new range of flexible compostable packaging products. This innovative product line is designed to meet the growing demand for sustainable flexible packaging in the food and beverage industry, aiming to support environmental sustainability and promote a cleaner planet.

- April, 2024: Berry Global introduced two lightweight closures in response to the growing market for nutraceutical packaging. The closure designs showcase the company by integrating modern design with reduced greenhouse gas emissions while using less material than prior models. The new closures are an integral component of Berry's B Circular Range of packaging and product solutions, which lower the environmental impact of products by utilizing the engineering knowledge and unique technologies of the packaging company.

- October, 2023: Wonderfeel revealed their Wonderfeel Youngr pouch. The company's on-going subscription refill service will be incorporated with these new totally biodegradable pouches. One packaging option for the nutraceutical business that is 100% recyclable and biodegradable is the Wonderfeel Youngr refill bag. The breakthrough new recyclable material called SPTek ECLIPSE is used to create the entirely biodegradable pouches.

Key Players in the Nutraceutical Flexible Packaging Market

Nutraceutical Flexible Packaging Market Segments

By Material

- Plastic

- Paper & Paperboard

- Others

By Packaging Type

- Pouches and Bags

- Sachets

- Blister Packs

- Stick Packs

- Others

By Product Type

- Dietary Supplements

- Functional Foods

- Functional Beverages

- Others

By Region

- North America

-

- Europe

- U.K.

- France

- Germany

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-East Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of Middle East & Africa