April 2025

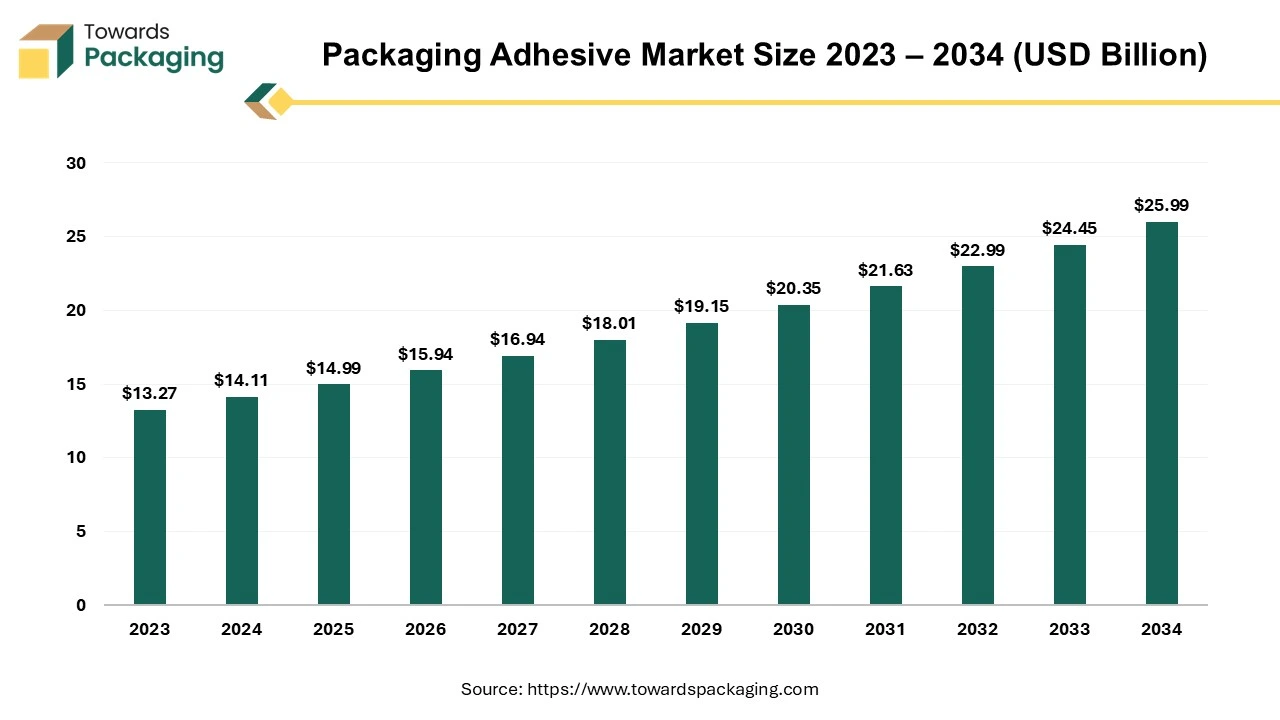

The packaging adhesive market is anticipated to grow from USD 14.99 billion in 2025 to USD 25.99 billion by 2034, with a compound annual growth rate (CAGR) of 6.3% during the forecast period from 2025 to 2034.

Adhesive, sometimes known as glue, is any non-metallic material applied to one or both surfaces of two separate things to bind them together and prevent separation. Adhesives can be found naturally or synthesised. They are frequently classed according to their adhesion mechanism, which is further classified as reactive or non-reactive depending on whether they harden through a chemical reaction.

Polymeric materials, including natural and synthetic polymers such as polyurethane, polyvinyl acetate, cellulose, polychloroprene, polyvinyl alcohol, and polyvinyl pyrrolidone, are critical components of adhesive raw materials. Adhesives come in various forms, including solvent, water, and hot-melt adhesives. Water-based adhesives, such as polyurethanes and polychloroprene, are employed, whereas solvent-based adhesives are used in other polymeric materials.

The packaging adhesive market refers to the industry that manufactures and supplies adhesives for packaging purposes. Adhesives are essential in the packaging business because they attach diverse materials to offer structural integrity and secure sealing of packaging components.

Adhesives are utilized in a broad range of paper bonding applications, from creating corrugated boxes and laminating printed sheets to packaging consumer goods of all kinds and manufacturing sizable industrial tubes and cores used by producers of role goods and other materials. They are also present in daily consumer goods, including paper towels, books, and toilet tissue. Comparing adhesives to other binding methods like bolting, welding, screwing, sewing, etc., reveals several advantages. These benefits include the capacity to fuse disparate materials and disperse stress more effectively throughout the joint, the economic benefit of an easily mechanized procedure, enhanced design freedom, and improved aesthetics.

The packaging adhesive market is witnessing several trends that are shaping its trajectory globally. One prominent trend is the increasing emphasis on sustainability. With growing environmental concerns, there is a rising demand for eco-friendly packaging adhesives. This includes the adoption of water-based adhesives, which are considered more environmentally friendly than solvent-based alternatives. Manufacturers are investing in research and development to create adhesives that offer high performance while minimizing their impact on the environment. Both regulatory requirements and consumer preferences for sustainable packaging solutions drive this trend.

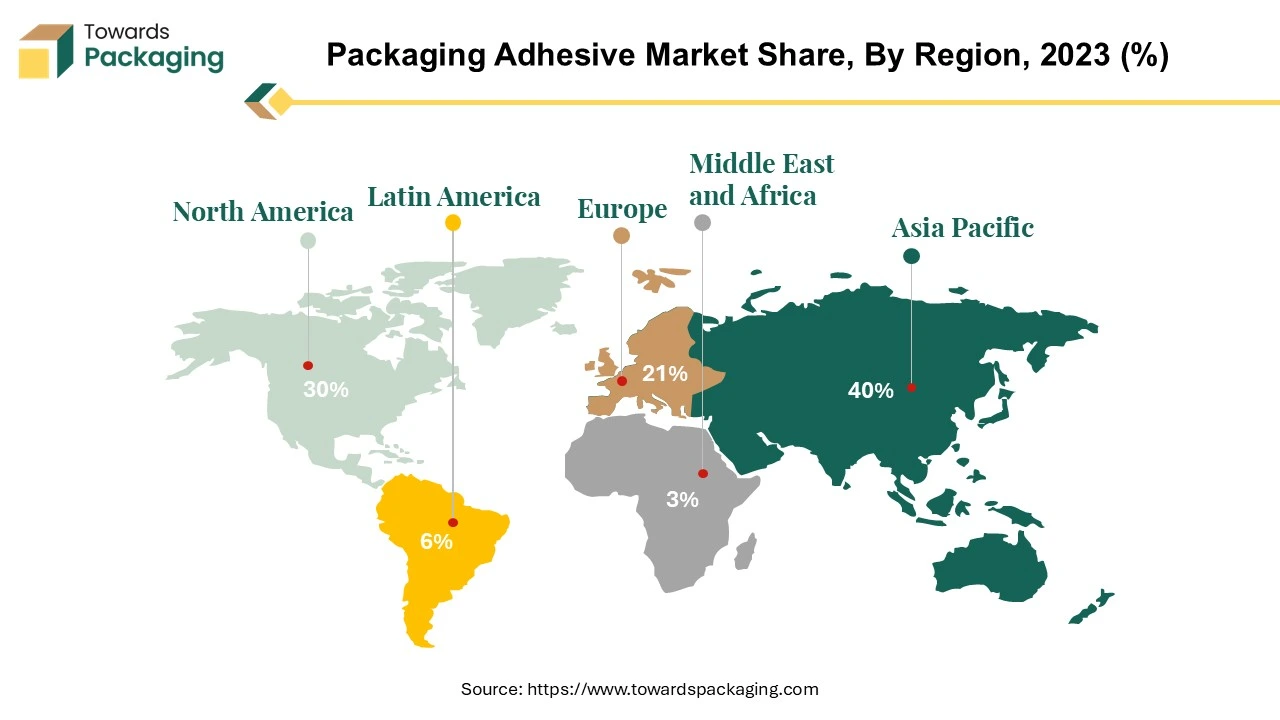

The Asia Pacific region has emerged as a dominant force in the packaging adhesive market, and several key factors contribute to its commanding position. In Asia, economic growth was approximately 3.5 per cent. One of the primary drivers is the rapid pace of industrialization and urbanization in countries such as China and India. China alone contributed to around 20% of the world's adhesives. As these nations continue to undergo significant economic development, there is a parallel surge in the demand for packaged goods, ranging from food and beverages to consumer products. This escalating demand, driven by a rising population and increasing disposable income, propels the need for efficient and reliable packaging solutions, thereby fuelling the demand for packaging adhesives.

The region's dynamic economic growth has also led to the expansion of various end-use industries, notably the food and beverage sector. With changing lifestyles and preferences, there is an escalating trend toward packaged and convenience foods, creating a substantial market for packaging adhesives. Additionally, the robust growth of the manufacturing sector in the Asia Pacific region further amplifies the demand for packaging materials and adhesives, given their integral role in securing and sealing diverse packaging formats.

Furthermore, the Asia Pacific region has established itself as a central production hub for packaging adhesives. Several key market players have strategically positioned themselves in this region to capitalize on the burgeoning market opportunities. The presence of these industry leaders, combined with the region's conducive business environment and skilled workforce, has facilitated the growth of a competitive and vibrant packaging adhesive manufacturing ecosystem. The significance of the Asia Pacific region is not confined to domestic consumption alone; it plays a pivotal role in global trade. Robust export activities, driven by the production capabilities of countries within the region, contribute to the overall expansion of the packaging adhesive market. As Asia Pacific countries export a substantial amount of packaged goods, the demand for high-quality packaging materials, including adhesives, remains consistently strong.

The Asia Pacific region's dominance in the packaging adhesive market results from a confluence of factors, including rapid industrialization, urbanization, a growing middle class, expanding end-use industries, and a strategic focus by key market players. As the region continues to evolve economically, the demand for packaging adhesives is expected to maintain its upward trajectory, solidifying the Asia Pacific market's pivotal role in the global packaging adhesive industry.

North America emerges as a formidable contender, closely trailing behind the Asia Pacific, to secure its position as the second leading market for packaging adhesives. Renowned for its mature packaging industry, the region stands out due to its stringent quality standards and a remarkable embrace of cutting-edge technologies. The demand for advanced and speciality adhesives in North America is notably propelled by well-established and diverse industries, including pharmaceuticals, electronics, and automotive, each requiring specialized adhesive solutions to meet their unique packaging needs.

The mature nature of North America's packaging industry signifies a well-established framework with high experience and expertise. This maturity translates into a sophisticated demand for packaging adhesives that adhere to stringent quality benchmarks and showcase innovation and versatility. As industries within the region continue to evolve, the need for adhesive solutions that align with these changes becomes increasingly critical, contributing to the steady growth of the packaging adhesive market.

Thriving sectors such as pharmaceuticals, electronics, and automotive significantly influence the demand for packaging adhesives. These industries rely on specialized adhesives to ensure the integrity and reliability of their packaging, where precision and durability are paramount. As a result, North America has become a critical consumer of advanced packaging adhesives, driving manufacturers to continually innovate and tailor their products to meet the evolving demands of these dynamic industries.

The surge in e-commerce activities further amplifies the significance of packaging adhesives in North America. The booming e-commerce sector demands packaging solutions that can withstand the challenges of shipping and handling while ensuring product safety. The need for reliable and robust packaging solutions becomes a critical factor, propelling the demand for high-performance adhesives in the region.

In the ever-evolving landscape of adhesive technologies, water-based adhesives emerge as frontrunners, leading the charge in the packaging adhesive market. The supremacy of water-based adhesives is rooted in their eco-friendly attributes, low Volatile Organic Compound (VOC) emissions, and unwavering compliance with stringent environmental regulations. Renowned for their versatility, these adhesives exhibit robust bonding capabilities across various substrates without compromising safety standards.

The pivotal driver behind the ascendancy of water-based adhesives lies in their eco-friendly profile. Water-based adhesives align seamlessly with this focus as sustainability assumes a central role in the packaging industry. The reduced environmental impact and lower VOC emissions during application position water-based adhesives as a responsible and forward-thinking choice for manufacturers aiming to meet consumer expectations and regulatory requirements. The versatility of water-based adhesives further solidifies their leadership position. These adhesives can form strong bonds across various substrates, including paper, cardboard, plastic, and more. This versatility enhances the performance of packaging materials and offers manufacturers flexibility in choosing suitable adhesive solutions for diverse applications.

As sustainability gains prominence globally, adopting water-based adhesives is poised for sustained growth. Consumer preferences increasingly gravitate toward eco-friendly options, and regulatory pressures continue to tighten environmental standards. Therefore, the trajectory of water-based adhesives appears to rise, driven by a conscientious consumer base and a proactive response to evolving industry regulations. The reign of water-based adhesives in the packaging adhesive market signifies a technological shift towards sustainability and versatility. As the industry navigates the complexities of environmental responsibility, water-based adhesives stand as a testament to innovation, meeting the demands of consumer preferences and regulatory imperatives to pursue a more sustainable and responsible future.

Flexible packaging emerges as the vanguard among application segments, paving the way for a transformative era. The surge in adopting flexible packaging is underpinned by its trifecta of virtues lightweight design, cost-effectiveness, and unparalleled convenience. Industries at the forefront of consumer engagement, such as food and beverage, healthcare, and personal care, are leading the charge in the widespread embrace of flexible packaging formats. By 2025, the market value of the global flexible packaging industry is expected to reach USD 278.9 billion. The flexible packaging market is anticipated to be driven by consumer demand for customer-friendly Packaging and increased product protection.

Cost-effectiveness stands as another compelling factor propelling the dominance of flexible packaging. Manufacturers find solace in the economic efficiencies derived from the streamlined production processes, reduced material requirements, and lower transportation expenses associated with flexible packaging. This bolsters the bottom line for businesses and resonates positively with consumers who increasingly value affordability without compromising quality. Industries spearheading consumer-centric markets, such as food and beverage, healthcare, and personal care, quickly recognize the consumer appeal and operational advantages of flexible packaging. The malleability of these materials allows for innovative and eye-catching designs, enhancing the shelf presence of products. Moreover, the flexibility of packaging adhesives designed for these materials becomes paramount in ensuring a secure and durable bond, preserving the integrity of the package throughout its lifecycle.

The growing demand for flexible packaging is not a transient trend but a seismic shift in consumer preferences and industry dynamics. As this shift gains momentum, the packaging adhesive market is poised for sustained growth within the flexible packaging application segment. Manufacturers and adhesive innovators are expected to play a pivotal role in this evolution, developing cutting-edge solutions that seamlessly integrate with the demands of a market undergoing a revolutionary transformation. The future unfolds with flexible packaging at its helm, defining the trajectory of the packaging adhesive industry.

The packaging adhesive market features a competitive landscape, with key players vying for market share and striving for technological advancements. Major players in the industry include Henkel AG & Co. KGaA, 3M Company, H.B. Fuller Company, and Bostik, Arkema Group, among others. These companies are engaged in strategic initiatives such as mergers and acquisitions, product innovations, and partnerships to strengthen their market position. The focus on research and development remains crucial for gaining a competitive edge, emphasizing the creation of adhesives that cater to evolving industry trends, especially in sustainability and advanced packaging formats. The competitive landscape is characterized by a mix of global and regional players, each adapting to the specific demands of their target markets.

By Technology

By Application

By Region

April 2025

April 2025

April 2025

April 2025