Pesticide Packaging Market Outlook Scenario Planning & Strategic Insights for 2034

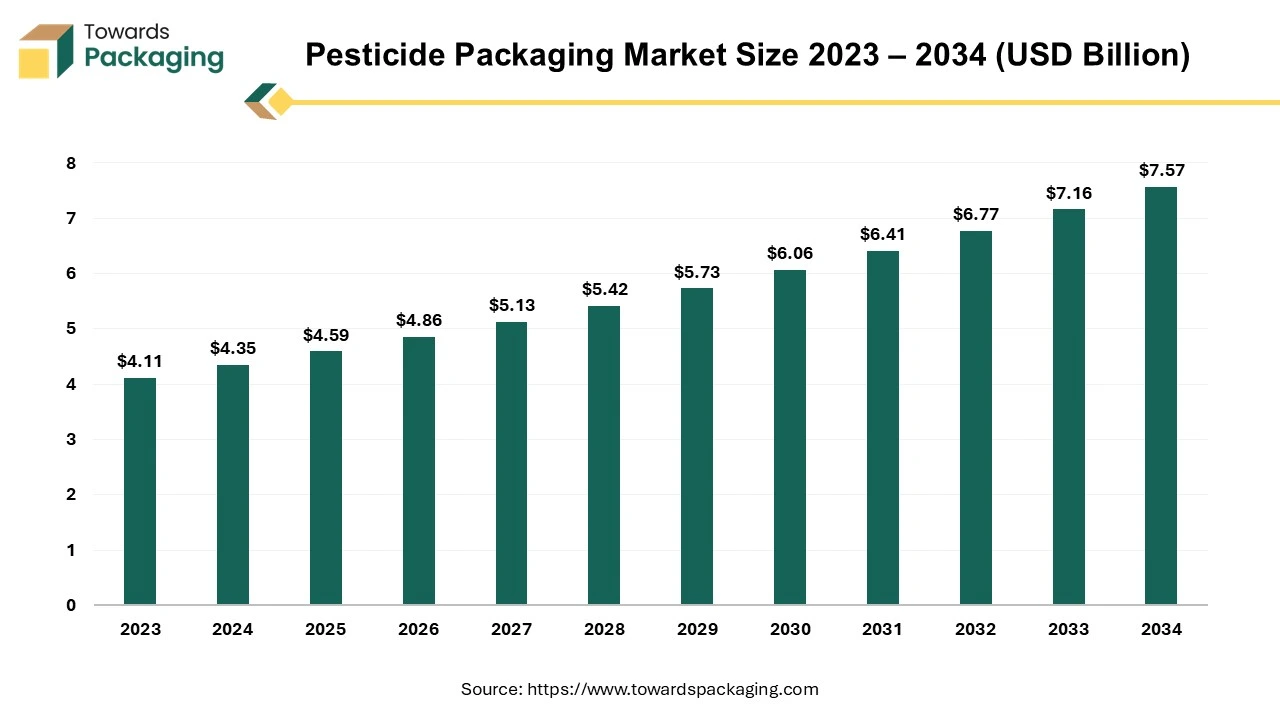

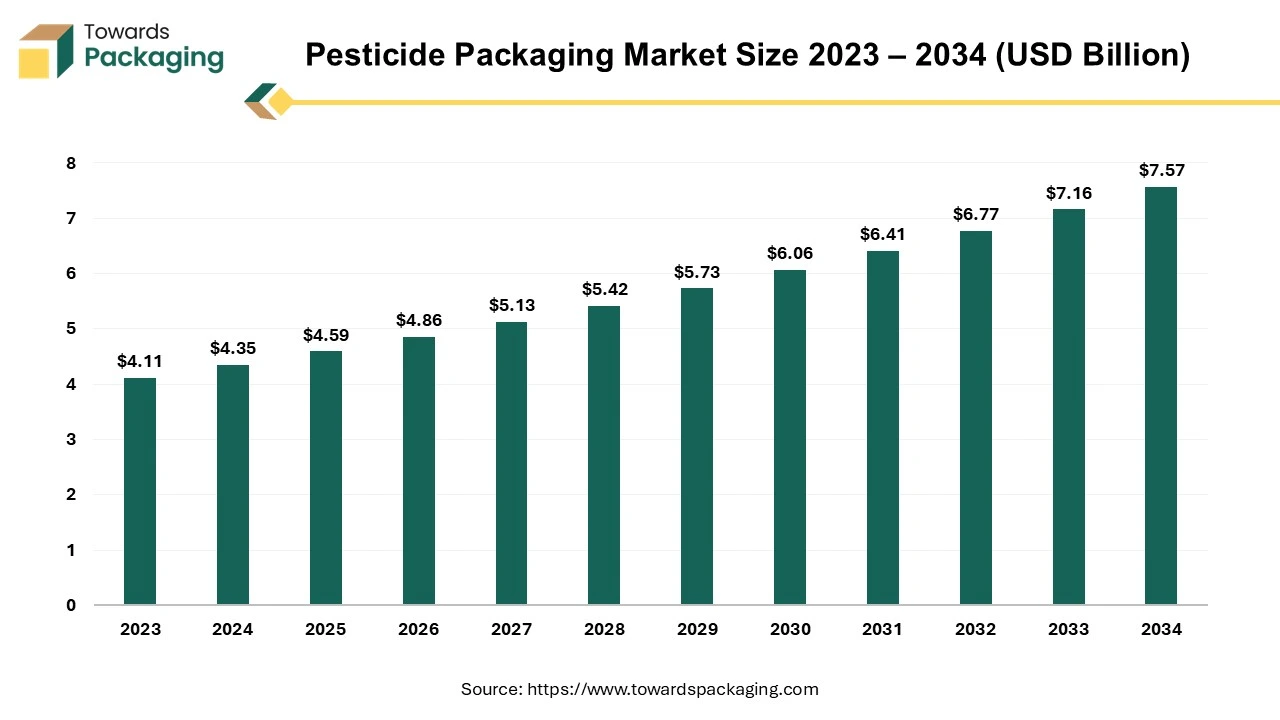

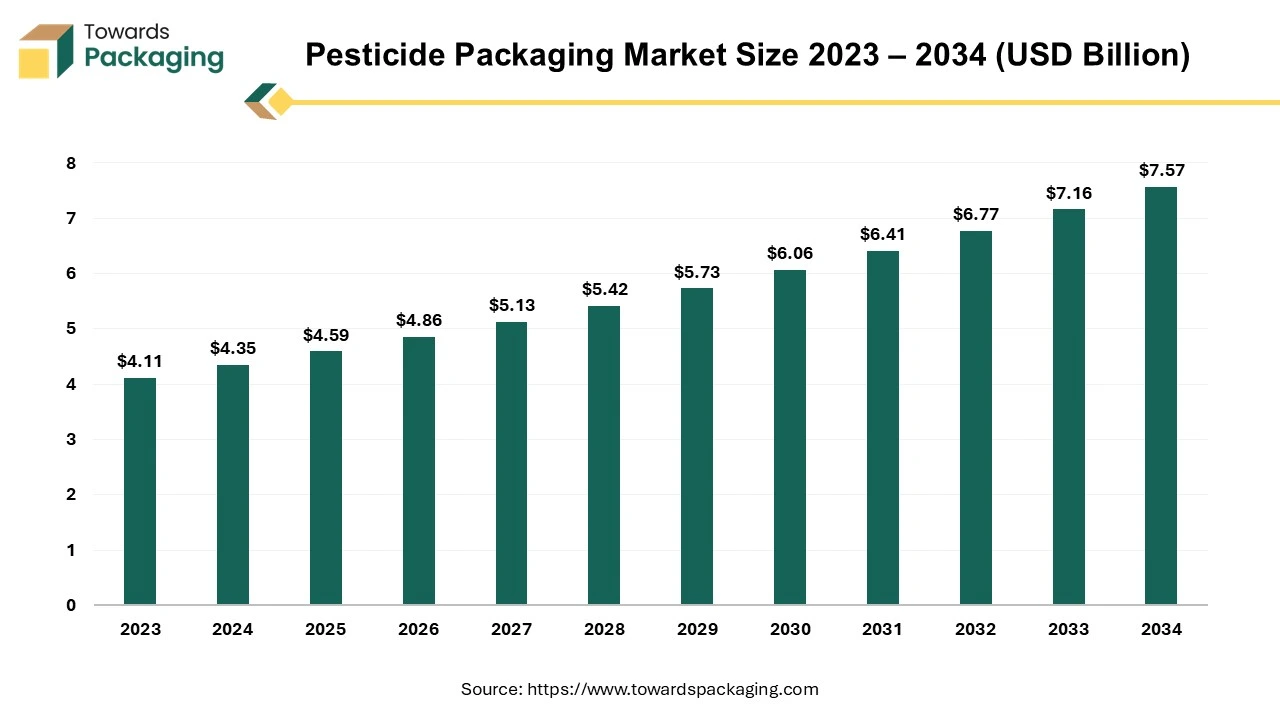

The pesticide packaging market is forecasted to expand from USD 4.86 billion in 2026 to USD 8.00 billion by 2035, growing at a CAGR of 5.7% from 2026 to 2035. This report delves into market size, segments, and regional analysis for Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa. It also provides insights into key players such as Syngenta, BASF, and Amcor, alongside competitive analysis, value chain dynamics, and trade data to understand market trends and growth factors.

Report Highlights: Important Revelations

- Empowering Asia Pacific's ascendancy in pesticide packaging.

- Influence of North America on catalysts in the pesticide packaging sector.

- Eco-friendly approaches to plastic utilization in pesticide packaging.

- Leveraging pouches in the pesticide packaging landscape.

- Importance of retail channels in the pesticide packaging arena.

Pesticides, which include herbicides, insecticides, fungicides, and other pest control agents, manage and protect crops against hazardous organisms. These compounds have been employed in agriculture for thousands of years, with ancient agricultural civilizations frequently turning to naturally occurring elements such as sulphur, arsenic, or mercury to control crop pests. Pesticide packaging is based on continual innovation, with well-designed containers improving farmers' accessibility and safety while protecting the environment and assuring product purity.

The top exporters of pesticides are China ($8.41 billion), the United States ($4.79 billion), France ($4.42 billion), Germany ($3.85 billion), and India ($3.55 billion). The pesticide packaging market includes the manufacturing and distributing containers and packaging materials designed specifically for these chemicals. Pesticides are chemicals used in agricultural and non-agricultural settings to control pests such as insects, weeds, and fungi. Adequate packaging is required to transport, store, and apply these compounds safely.

The pesticide packaging industry was established in response to the growing demand for effective pest management solutions, and it has grown tremendously since then. The market includes a variety of packaging forms, such as bottles, cans, drums, pouches, and aerosol canisters, each designed to fulfill the specific needs of different pesticides and applications.

For Instance,

- In February 2024, ADAMA Ltd. announced the increased distribution of its newly designed one-liter containers, representing a significant step forward in its dedication to sustainability and farmer usability.

Pesticide Packaging Market Trends

- The demand for environmentally friendly pesticide packaging solutions is rising as environmental issues become more significant.

- Packaging design innovations are critical to enhancing the pesticide packaging sector's functionality, efficiency, and user experience.

- User-friendly packaging characteristics are critical for improving ease and usage in the pesticide packaging sector.

- Bulk packaging and dispensing systems provide cost-effective and efficient methods for managing vast volumes of insecticides.

Fuelling the Dominance of Asia Pacific in Pesticide Packaging

Asia Pacific is home to some of the world's greatest agricultural producers, including China and India. These countries have extensive agricultural regions and rely significantly on pesticides to preserve their crops from pests and illnesses. As a result, there is a strong demand for pesticide packaging in this region to meet the agricultural sector's requirements. The Asia Pacific region has a vast population, meaning a significant market for food items exists. Farmers in this region widely use pesticides to improve crop yields in response to rising food demand. This increases the demand for pesticide packaging since farmers need packaging materials to store and transport these chemicals securely.

The Asia-Pacific region is rapidly industrializing and urbanizing, resulting in the development of the agrochemical sector. As more agricultural enterprises and pesticide manufacturers establish operations in the area, there is a greater demand for packaging materials to package and distribute their products.

Pesticide packaging technology is advancing in the Asia Pacific. Manufacturers in China, Japan, and South Korea are investing in R&D to innovate and improve the form and functioning of pesticide packages. This involves designing eco-friendly materials, child-resistant packaging, and tamper-evident seals, which are increasingly significant in the pesticide packaging industry. The Asia Pacific region's dominance in the pesticide packaging market is owing to its vast agricultural sector, growing population, developing agrochemical industry, and technological advances in packaging materials and design.

For Instance,

- In September 2021, by purchasing Best Crop Science Pvt Ltd, the expanding agricultural chemical firm Best Agrolife Limited gained the capability of Backward Integration bolstered by robust R&D Synthesis in the production of Active Ingredients of Herbicides, Insecticides, and Fungicides.

North America is regarded as one of the regions with the most significant growth rates in the pesticide packaging market for several reasons. With a 10-year growth rate of 3 percent per year, the United States possesses competitive advantages that position it to maintain its worldwide export dominance. Several factors may impact future sales, such as pesticide maximum residue level compliance, which has become more complex when selling to the EU. With 1.1 million tonnes and USD 6.9 million worth of pesticide imports from foreign regions, the Americas had the most significant volume of imports. With an annual average of around 1 Mt, the Americas used the most insecticides in agriculture. Additionally, the region used the most insecticides per inhabitant and per hectare of agriculture (2.83 kg per ha annually).

The region has a highly developed agricultural sector that employs advanced farming techniques and heavily relies on pesticides to protect crops from pests, weeds, and illnesses. The United States and Canada are significant producers of agricultural commodities such as corn, soybeans, wheat, and fruits, which require massive pesticide application to assure good yields and quality. As a result, there is a steady need for pesticide packaging materials in North America to meet the needs of the agricultural business.

Environmental sustainability and food safety are becoming more critical issues in North America. Consumers are becoming more aware of the chemicals used in food production and seeking environmentally friendly and safe pesticide packaging options. This leads to a growing tendency in the region towards using sustainable packaging materials and technologies, driving the pesticide packaging market forward.

For Instance,

- In October 2023, Tyson Foods Inc., one of the world's major food corporations, decided to increase its investment in Protix, the United States' leading global insect ingredients company.

Pesticide Packaging Market, DRO

Demand:

- Pesticide packaging must protect the product from moisture, light, air, and physical harm to retain its stability and effectiveness.

Restraint:

- Manufacturers need help complying with pesticide packaging restrictions, labelling requirements, and safety standards.

Opportunity:

Sustainable Solutions for Plastic Use in Pesticide Packaging

Plastic is essential in pesticide packaging because it ensures the safe delivery of crop protection goods to end users and protects humans during application. 66% of plastic pesticide and biopesticide containers were successfully recovered, highlighting the material's importance in the business. Plastic's usefulness goes beyond packaging; it has various environmental and socioeconomic benefits in plant agriculture. Plastic mulch films, which account for over half of all agricultural plastics by mass, are widely used in crop cultivation. These coatings help with weed control, moisture retention, and temperature regulation, resulting in higher crop yields and quality.

Farmers burnt pesticide plastic bags and bottles at rates of 23.83% and 16.20%, respectively. Farmers are aware of PPW environmental damage, with 44.92% believing that discarding PPWs will have a significant impact on water and soil.

However, 23.83% of respondents said that discarding PPWs would have little or little effect on the environment. Farmers in the study area reported that local governments and agricultural authorities did not provide awareness or recycling facilities for PPWs.

Pesticide packaging often consists of lightweight, resilient, and degradable plastics, ensuring long shelf life and reliable containment of dangerous chemicals. Despite its advantages, the use of plastic in agriculture raises questions regarding environmental sustainability and pollution. Efforts are being made to solve these challenges through projects that promote recycling, circular economy ideas, and the development of biodegradable plastic alternatives. While plastic is a prominent material in pesticide packaging because of its practical benefits, continued innovation and sustainability efforts are critical to reducing its environmental impact and ensuring agriculture's continued existence.

For Instance,

- In January 2024, Container Services Inc (CSI), a plastic blow-molded company, paid a confidential amount to US firm Apex Plastics.

Harnessing the Power of Pouches in Pesticide Packaging Market

Pouches are rising as a key product type in the pesticide packaging market, owing to various variables. Pouches are versatile and convenient for packaging pesticides. They are available in multiple sizes and shapes, making them easily customizable to fit varied pesticide volumes and types. This versatility makes pouches excellent for both liquid and dry pesticide formulations, meeting the different needs of farmers and agricultural businesses.

Pouches are lightweight and compact, making them perfect for transit and storage. Pouches use less material and take up less space than traditional packaging formats like bottles or cans, which reduces transportation costs and carbon emissions. As a result, pouches are a less expensive and more environmentally beneficial pesticide-packing solution.

Pouches come with resealable closures, spouts, and handles, which improve their usability and convenience for end-users. These features enable farmers to dispense and apply pesticides fast while reducing spillage and waste, increasing operational efficiency, and lowering product loss.

For Instance,

- In June 2023, CCL Industries Inc. said it had signed a contractual agreement to purchase Pouch Partners s.r.l., Italy, from Pouch Partners AG, Switzerland, which the Swiss-based Capri-Sun Group controls.

Significance of Retail Distribution Channels in the Pesticide Packaging Market

The retail distribution channel is an essential part of the pesticide packaging market since it is the significant means of selling and distributing pesticide products to end users, primarily farmers and agricultural businesses. Retailers play an essential role in the pesticide packaging market by offering a wide choice of pesticide products from various manufacturers to satisfy the diverse needs of customers. These solutions are often available in multiple formulations, concentrations, and packaging sizes, allowing farmers to choose the best solution for their unique crop protection needs.

One of the key benefits of retail distribution channels in the pesticide packaging business is ease of access. Pesticides are readily available to farmers through local retail stores, agricultural supply centers, hardware stores, and online platforms. This widespread availability guarantees farmers easy access to pesticides, especially at significant times like planting, growing, and harvesting. Retailers frequently offer extra services such as product advice, technical assistance, pesticide usage, and safety training. This knowledge enables farmers to make sound judgments about pesticide selection, application methods, and dosage rates, resulting in effective pest control while minimizing environmental impact and health concerns.

For Instance,

- In July 2023, Insecticides (India) Limited (IIL), one of the country's top crop protection and nutrition companies, released Mission. This new-age pesticide efficiently controls several lepidopteran pests in crops such as rice, sugarcane, soybean, and vegetables.

Key Players and Competitive Dynamics in the Pesticide Packaging Market

The competitive landscape of the pesticide packaging market is dominated by established industry giants such Syngenta AG, Amcor Limited, Ardagh Group, Ball Corporation, BASF SE, Bayer AG, DS Smith Plc, DowDupont, FMC Corporation, Huhtamaki Oyj, International Paper Company, Mondi Group, Monsanto Company, Nufarm Limited, Silgan Holdings, Sinochem Group, Smurfit Kappa Group, Sonoco Products Company, WestRock Company and Tetra Pak International. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

One of the first businesses in the agrochemical industry to use pesticide containers in its operations, Syngenta pioneered and implemented recycled products from the Campo Limpo System (the reverse logistics program for empty packaging and post-consumer leftover pesticides). These containers were made from recycled packaging resin that stored comparable ingredients.

BASF is committed to continual innovation in pesticide packaging to satisfy its clients' changing demands and preferences. This includes creating novel packaging materials and designs that improve product safety, usability, and sustainability. BASF intends to create unique solutions that distinguish its products from competitors while also addressing developing difficulties in the pesticide packaging industry by investing in R&D.

- In December 2022, BASF Agricultural Solutions began to adapt its liquid crop protection product packaging in the first European countries to allow the use of the easily connected closed transfer system (CTS). This represents a watershed moment in agriculture, as CTS is the next generation of filling technologies that will make farm operations safer for users and the environment.

Pesticide Packaging Market Player

- Amcor Limited

- Ardagh Group

- Ball Corporation

- BASF SE

- Bayer AG

- DS Smith Plc

- Dow Dupont

- FMC Corporation

- Huhtamaki Oyj

- International Paper Company

- Mondi Group

- Monsanto Company

- Nufarm Limited

- Silgan Holdings

- Sinochem Group

- Smurfit Kappa Group

- Sonoco Products Company

- Syngenta AG

- WestRock Company

- Tetra Pak International

Pesticide Packaging Market Segments

By Material

- Plastic

- Paper & Paperboard

- Metal

- Others

By Products

- Pouches

- Bags

- Bottles

- Cans

By Distribution

By Region

- Asia Pacific

- North America

- Europe

- LA

- MEA