April 2025

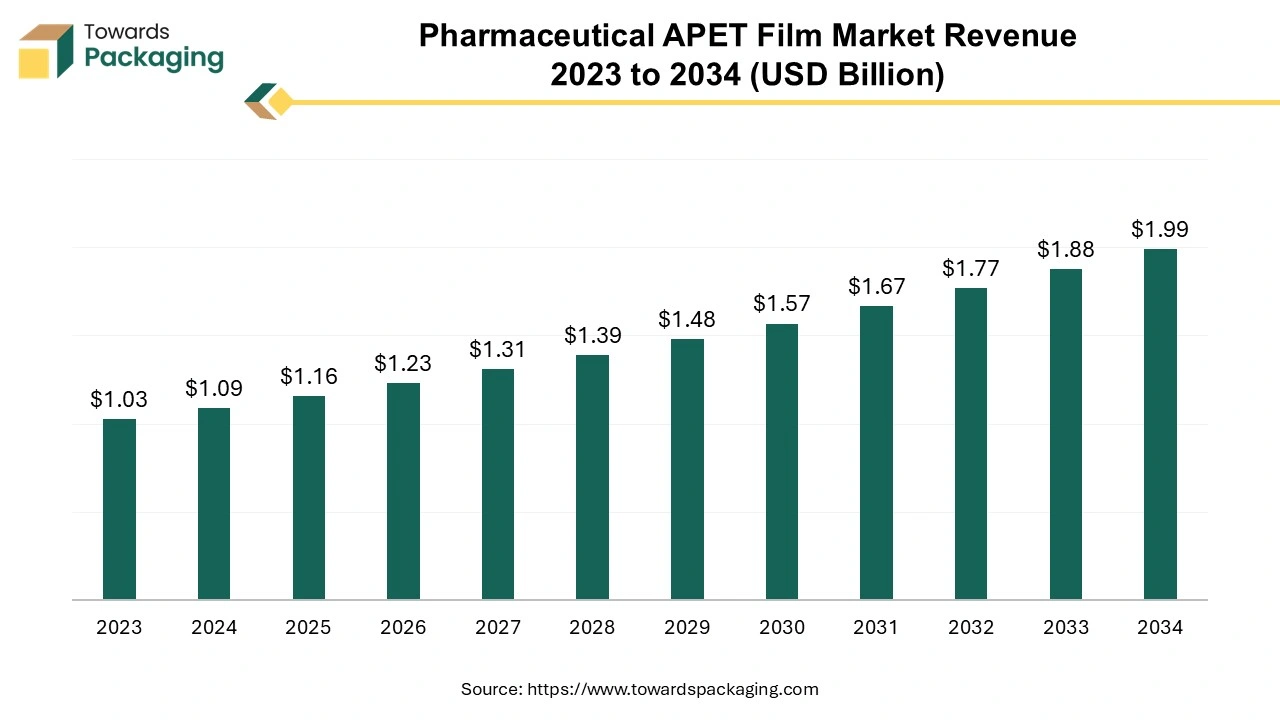

The pharmaceutical APET film market is projected to reach USD 1.99 billion by 2034, growing from USD 1.16 billion in 2025, at a CAGR of 6.2% during the forecast period from 2025 to 2034.

The market is proliferating due to the increasing demand for pharmaceutical industry telemedicine, delivery of drugs, and packaging of various other things that require safe and flexible packaging. The growing trend of online ordering systems is boosting the pharmaceutical APET film market.

Pharmaceutical APET (Amorphous Polyethylene Terephthalate) film is the finest quality packaging material extensively used by the pharmaceutical market for its excellent protective, strength, and clarity properties. The healthcare sector is showing a major transition towards convenience and portable packaging due to the growing online facility in this sector. This pharmaceutical APET film provides lightweight, safe, leakage-proof, and compact rigid packaging for different products.

Additionally, APET film is the rigid polyester film or rigid PET film that is widely spreading rapidly as a packaging material because of its excellent ease, super strength, and clarity of handing out. Moreover, polyester material is used as an environment-friendly substitute for plastic materials such as PVC film. The pharmaceutical APET film market plays an important role in the pharmaceutical industry, confirming that several devices used in healthcare centers are packed efficiently in several applications. The global packaging industry size is growing at a 3.16% CAGR.

Rising investment of the government to private companies for the development of both the pharmaceutical sector as well as biotechnology sector to provide more facilities to patients and advancement in the treatment of patients ultimately drive the pharmaceutical APET film market. The continuous rise of the need for ecologically friendly and biodegradable packaging in all industries. It is also due to its recyclability, thermal stability, and clearness of pharmaceutical APET film that enables producers to diminish their ecological impression. The growing food & beverage market mixed with customers who are concerned with clean, clear packaging enhances the demand for pharmaceutical APET film. There are several other features, such as the numerous industrial claims of this substance from the healthcare to food industry, because of its contamination-free packaging properties. All these factors boost the inclusive development of the international pharmaceutical APET film market to grow.

There is a rising trend in the demand for hygienic packaging of pharmaceutical devices influenced by growing innovative packaging solutions that comply with ecological guidelines.

The growing innovation in pharmaceutical devices needs proper packaging methods for the safety purpose of the products. APET films work as safe layers for all devices small-size injectables to large display screens.

Due to the growing diseases influencing the packaging market to develop, demand for healthcare products such as in hospitals, clinics, camps, and various other places also drives the packaging solutions.

With the advancements in the technology of the manufacturing process of medical devices, there is an increasing demand for better-quality packaging which has enhanced the development scope in the pharmaceutical APET film market.

Various chronic diseases such as lung diseases, cancer, STDs, strokes, diabetes, and many others can be seen growing frequently in current times eventually raising the demand for enhanced medicines and their packaging that need to be safe and hygienic. With the concern of raising such issues, there is a high demand for ensuring safe packaging that can be stored for a long duration and protect products in adverse environmental conditions. The pharmaceutical APET film market offers packing with lightweight materials, easy-to-use, space-efficient products, and ideal for packing medical products in several ways.

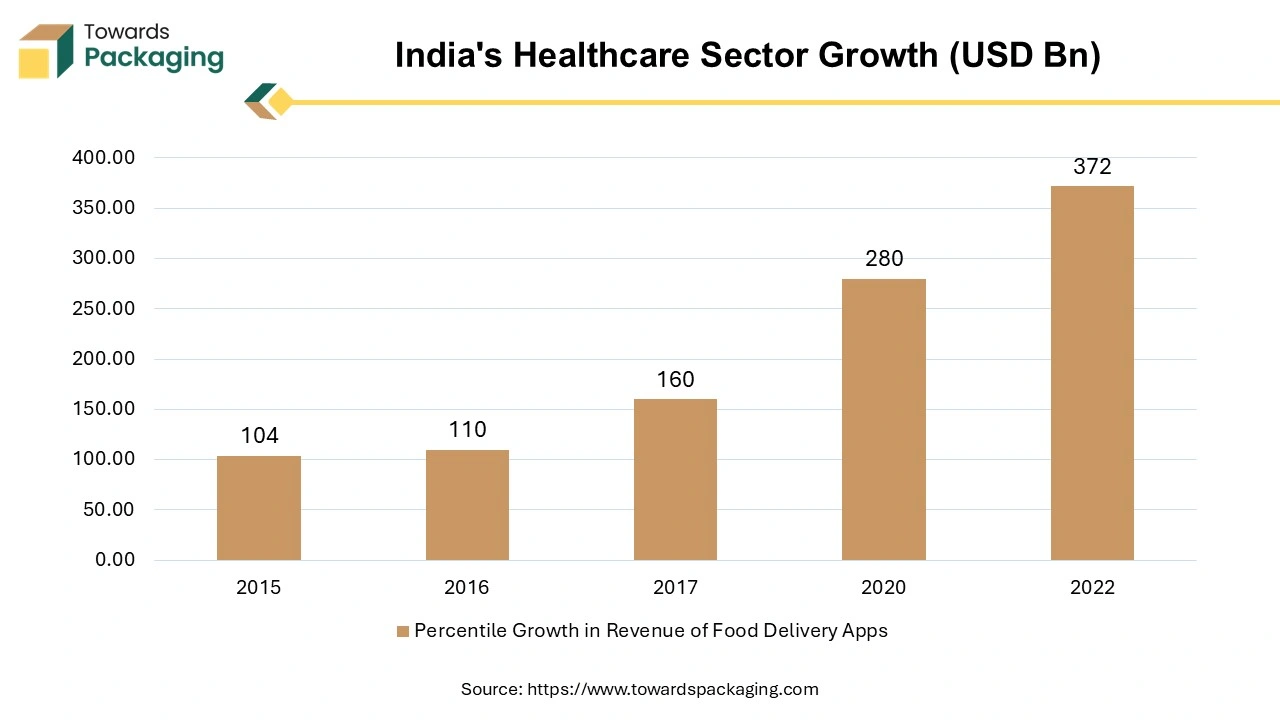

Asia Pacific witnessed the highest revenue share for the year 2024 this growth is because of its hygienic and contamination-free packaging properties. It is widely used by various hospitals, pharma companies, and packaging applications. Due to the rising population in countries such as India, China, Japan, South Korea, and Thailand, there is a high chance of people getting affected by various chronic diseases. These films are highly resistant to heat and are lightweight, making them perfect for various packaging services.

There are continuous efforts from both government and private sectors to deal with these issues by bringing innovation and development to the healthcare sector. This development comprises healthcare equipment, infrastructure, medications, monitoring devices, self-care kits, and many more.

To confirm the safety of such products the packaging market is highly responsible for its innovative development with long-time storage facility, safety, and many other facilities associated with this field. These films are highly recyclable and also require less energy for their manufacturing in comparison with other plastics available in the market. Strict rules of the government for the usage of plastic packaging also influence the pharmaceutical APET film market.

North America is estimated to grow at the fastest rate over the forecast period. This film offers an effective blockade against oxygen, contaminants, and moisture confirming the stability and integrity of delicate pharmaceutical products such as packs for capsules and tablets. Its excellent clarity permits for easy checkups and identification of medicines, adding security and acquiescence. Moreover, pharmaceutical APET film is chemically inactive and unaffected by a wide range of heat, making it appropriate for several packaging setups and packing conditions. With this rapid change in the current trend of pharmaceutical APET films is growing in the market in the United States. Its recyclability property additionally supports the industry that moves in the direction of more sustainable packaging results, contributing a consistent and eco-friendly option for pharmaceutical packaging requirements.

By type, the anti-fog APET film segment led the pharmaceutical APET film market in 2024. Anti-fog APET film is widely used to avoid the damage caused due to moisture on the packaging of food products to avoid contamination or spoiling. These anti-fog layered APET films are free from any toxic substances. FDA-approved films can be applied to toys, food, cosmetics, medicines, and various other products that require anti-fogging visual packaging. Anti-fog-treated APET film is suitable for food packaging to protect against food from fogging on the inside of the surface. Water content is available in food which causes condensation on the surface of the packaging that can cause damage.

By application, the blister packaging APET film segment led the pharmaceutical APET film market in 2024. The blister packaging category makes up the major portion of the pharmaceutical APET film packaging industry. Pharmaceutical market players commonly use blister packaging due to their efficiency in delivering tamper-evident wrapping, suitability of use, and protection against ecological elements, comprising pollutants and moisture. It is considered a suitable packaging type to protect all electronic products. It provides top-quality safety to the products from dust, moisture, or any physical damage. As industries are seeking aesthetics and functionality, this segment of blister packaging is contributing to significant growth in this market.

By Type

By Application

By Region

April 2025

April 2025

April 2025

April 2025