April 2025

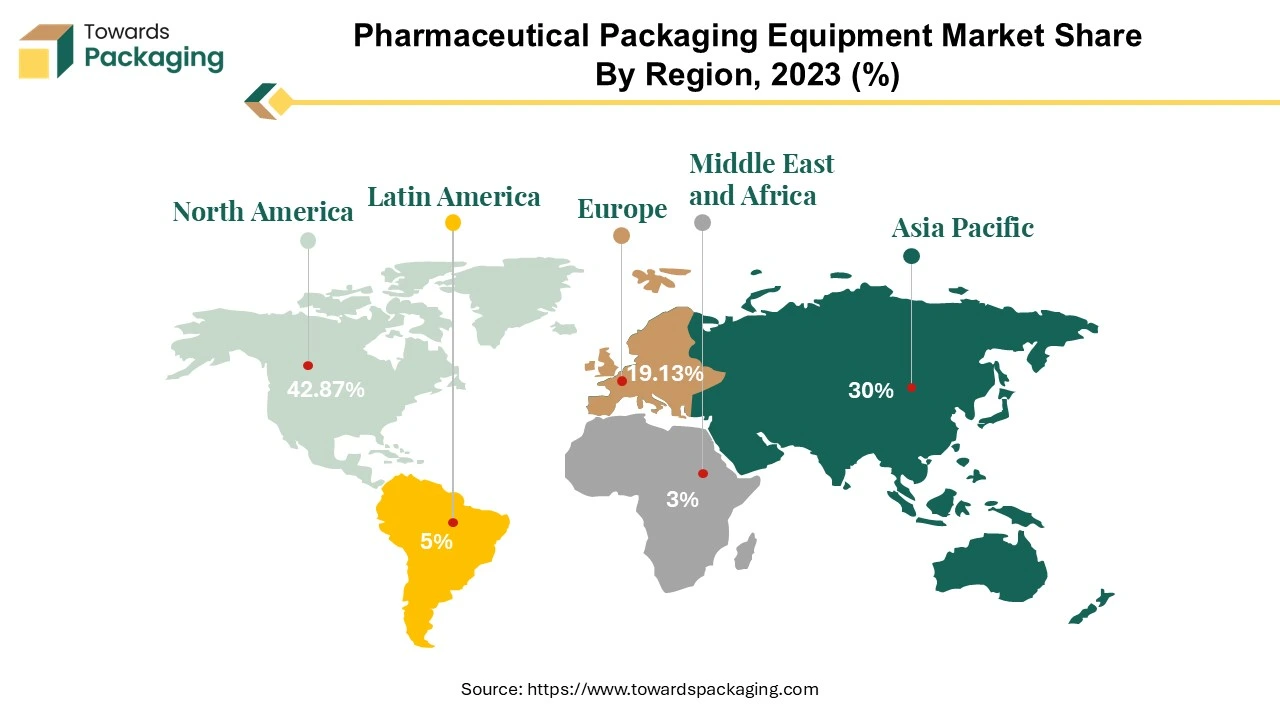

The global pharmaceutical packaging equipment market size was valued at USD 8.92 billion in 2024 predicted to hit around USD 18.39 billion by 2034. The market is expected to expand at a CAGR of 7.5% between 2024 and 2034.

The market for pharmaceutical packaging equipment contains equipment and instruments used in the packaging of pharmaceuticals. These items are formed into packages using heat-sealable and flexible materials, which are subsequently filled with the product and sealed. This industry, often referred to as medicine packaging, is essential to the healthcare sector because it ensures the effectiveness, safety, and integrity of pharmaceutical products at each step of the supply chain. The need for advanced packaging technology is growing significantly, with projections indicating that the global pharmaceutical packaging market size is expected to be valued USD 322.50 billion by 2032.

Pharmaceutical and nutraceutical product distribution can be efficiently prepared with the help of pharmaceutical packaging equipment. A variety of instruments, including sealers, label applicators, case packers, hand packing stations, and hard film over wrappers, are included in modern pharmaceutical packaging equipment. The pharmaceutical sector uses a variety of liquids, all of which need to be precisely measured in order to guarantee correct dosages. Because of this variability, packaging equipment needs to be flexible enough to adjust to the specific needs of each product.

The industry for pharmaceutical packaging equipment is expanding due in large part to the ongoing emphasis on patient safety, quality, and compliance. Pharmaceutical packaging businesses are essential to maintaining these standards since they make sure that goods are packaged safely to preserve their effectiveness and stop contamination or manipulation. The production and manufacturing processes for pharmaceuticals are more productive and efficient thanks to technological developments in packaging equipment.

The growing need for customised and specialised drugs calls for adaptable packaging options that satisfy a range of product specifications. Pharmaceutical packaging equipment must be adaptable enough to satisfy the specific requirements of each product, whether it is for liquid drugs, solid tablets, or other dosage forms. The need for sophisticated packaging equipment that can guarantee product quality, safety, and compliance will only increase as the pharmaceutical industry develops and innovates more, propelling the market for pharmaceutical packaging equipment to grow even more.

For Instance,

A significant trend towards automation in pharmaceutical packaging, driven by the need for faster production, higher efficiency, and reduced human error. Equipment with advanced features such as machine learning, predictive maintenance, and real-time monitoring is becoming more common, enabling pharmaceutical manufacturers to optimize their operations.

With the increase of vaccines, biologics, and personalized medicines, there is increase in requirement for specialized packaging solutions that can ensure the integrity and safety of these sensitive products. Packaging equipment that can handle small batches, complex formulations, and cold chain requirements is seeing a rise.

Environmental concerns are influencing the pharmaceutical packaging industry, with an increasing focus on minimizing waste, utilizing biodegradable or recyclable materials, and reducing the environmental footprint of packaging operations. Pharmaceutical companies are seeking packaging solutions that align with sustainability goals.

Stringent global regulations, such as the Drug Supply Chain Security Act (DSCSA) in the U.S. and the Falsified Medicines Directive (FMD) in the EU, have driven the adoption of serialization and traceability systems. Pharmaceutical packaging equipment is increasingly integrated with serialization technology to ensure compliance with these regulations.

The rise of digital technologies is leading to the integration of smart packaging solutions that incorporate elements like RFID tags, QR codes, and temperature sensors to provide real-time data on the condition and location of products. This trend is particularly relevant for high-value or sensitive drugs, such as biologics and vaccines.

The demand for single-use, sterile packaging solutions is rising, especially in the context of biologic drugs and parenteral products. This packaging ensures sterility, reduces the risk of contamination, and often eliminates the need for additional sterilization procedures.

New drug delivery systems, such as vaccines, biologicsand injectables, require specialized and highly precise packaging. This drives the need for specialized packaging machinery that can handle such products efficiently and safely. Increasing innovation in drug delivery systems has risen the demand for the pharmaceutical packaging equipments which is estimated to drive the growth of the pharmaceutical packaging equipment market in the near future.

The growth of the pharmaceutical industry in emerging markets, especially in Asia-Pacific and Latin America, is contributing to the demand for pharmaceutical packaging equipment. As these markets expand, the need for cost-effective, high-quality packaging solutions increases.

The pharmaceutical packaging equipment industry in North America is expanding rapidly due to a variety of leads. The need for effective and smart packaging solutions has increased due to the growing demand for pharmaceutical products, which is being driven by reasons including an ageing population, an increase in the prevalence of chronic diseases, and improvements in medical treatments. Pharmaceutical companies are investing in advanced packaging equipment to assure customer safety and meet with severe regulatory requirements involving tamper resistance, serialisation, and product safety. Automation, robotics, and smart packaging solutions are among the innovative technologies that are making a significant impact in the market. These technologies are designed to increase productivity, lower expenses of production, and minimise errors in packaging procedures. Sustainable packaging methods are increasing significance, which is encouraging the use of eco-friendly products and energy-saving equipment.

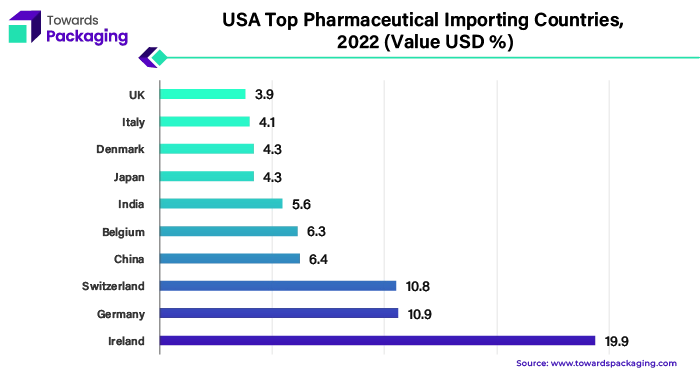

North America is a major player in the global commerce of pharmaceutical packaging equipment, when it comes to import-export trends. Packaging equipment and equipment are heavily imported and exported from the region. Despite importing specific specialised gear to fulfil domestic demand and technological demands, it also exports a significant amount of pharmaceutical packaging equipment to other regions by taking advantage of its technological know-how and superior manufacturing skills.

Driven by factors such developing pharmaceutical output, technical advances, regulatory compliance requirements, and changing customer preferences, the pharmaceutical packaging equipment market in North America is expected to increase in the coming years. The region's prominent role in the global pharmaceutical packaging equipment sector has been strengthened by its active involvement in import-export operations.

For Instance,

The pharmaceutical packaging equipment industry in the Asia-Pacific (APAC) region is rapidly expanding. The pharmaceutical sector has strong regulatory standards in place to reduce errors and prevent counterfeit products, which has led to an increase in demand for specialised packaging equipment in APAC nations such as China. The expanding healthcare industry in the region, including ongoing COVID-19 difficulties, are driving this demand spike.

Pharmaceutical product development in Asia Pacific, especially in nations like China, India, and Japan, heavily relies on packaging and labelling. The demand for pharmaceutical products and drug delivery systems is particularly high in this region, which has some of the greatest industry growth rates globally. Strong packaging and labelling solutions are essential for both general pharmaceutical products and the large amounts of COVID vaccines and medications that are currently in circulation. The COVID-19 pandemic, which has had a severe impact on several APAC nations, continues to have an impact on economies, businesses, and populations.

India is an established player in the pharmaceutical industry. India has a widely recognised domestic pharmaceutical industry with around 10,500 manufacturing units and 3,000 drug companies, making it the 14th largest global producer of pharmaceuticals by value and the third largest by volume.

The Indian pharmaceutical products market is expected to grow to be worth about US$132 billion by 2030, indicating that the industry has a promising future. Meanwhile, the global pharmaceutical goods market is projected to exceed the $1 trillion mark in 2023, indicating the substantial contribution that Asia-Pacific, and particularly India, makes to the growth trajectory of the global pharmaceutical packaging equipments industry. The demand for innovative packaging solutions is anticipated to increase in the upcoming years as the region's pharmaceutical industry and healthcare infrastructure keep developing.

For Instance,

Demand for Key variables to keep into consideration in pharmaceutical packaging operations are productivity and efficiency. For producers to maximise resource utilisation, minimise downtime, and meet production targets, packaging equipment needs to ensure high throughput, precision, and reliability.

The regulatory requirements for pharmaceutical packaging equipment must be met through stringent validation, documentation, and adherence to industry norms and guidelines.

Manufacturers can diversify their products and adapt to changing market demands by utilising advancements in packing equipment technologies. Predictive maintenance, real-time monitoring, and performance optimisation are made possible by emerging technologies like equipment learning, artificial intelligence (AI), and the Internet of Things (IoT), which also improve equipment efficiency, connectivity, and reliability.

Extractables and leachables (E&L) analysis is a crucial aspect of developing pharmaceutical products. This analysis involves testing pharmaceutical container closure systems, process equipment, and medical device packaging to determine the quantity of leachable impurities and assess any associated risks.

Why are Extractable and Leachable Studies Important?

E&L studies are comprehensive analytical investigations that examine the chemical interactions between:

The primary goal of an E&L investigation is to identify any potential chemicals that result from the interaction of constituent parts and to determine the impact these chemicals may have on human health and drug efficacy.

By identifying and mitigating risks associated with leachable impurities, E&L studies help ensure the safety and effectiveness of pharmaceutical products and medical devices.

Effective packaging is an important consideration to take into account when working with pharmaceutical products. Due to the nature of the pharmaceuticals, it is imperative to make sure that the packing methods are perfect. To guarantee patient handling and avoid cross-contamination, all medications are often packaged in easily handled packaging. Four types of filling techniques are often used by pharmaceutical companies. They consist of powder, syringes, tubes, and filling vials. A particular equipment is in charge of each of the filling equipment’s described. Another extremely common type of packaging used in this industry is the capsule, which is also made with specialised equipment.

The diverse filling and packaging methods Used in the pharmaceutical industry. It follows that a system to fill and then package medications in each of the aforementioned procedures is necessary given the variety of packaging approaches. Vial filling, for example, is essential when filling bottles with precisely measured amounts of the drugs in liquid, powder, and suspension form. Tube filling equipment’s are used for filling and packing liquids such as tooth paste, suspensions, and other sticky materials.

The majority of medicines that are supplied in powder form require specialised powder filling equipment to package. The manufacturers of all these various kinds of pharmaceuticals need to invest in the right equipment for them to do their duties. The Standout Features of the Most Popular Powder Filling Equipment’s This equipment works well for filling and packing powdered materials of any kind, as demonstrated by the task at hand. It can be used in a variety of industries, including pharmaceutical, industrial, and agricultural.

Filling equipment is in high demand in the pharmaceutical sector due to growing pharmaceutical production volumes, technical developments, and regulatory compliance. Filling equipment continues to play a crucial role in the pharmaceutical packaging equipment market as producers of pharmaceuticals aim for efficiency, precision, and compliance.

For Instance,

Equipment used to directly contain pharmaceutical products is called to as primary packaging equipment in the pharmaceutical packaging sector. These devices handle the first packaging of medications, making sure they are presented to customers in an aesthetically pleasing manner and are protected and preserved. With the goal to preserve product integrity, avoid contamination, and increase shelf life, primary packaging equipment is essential.

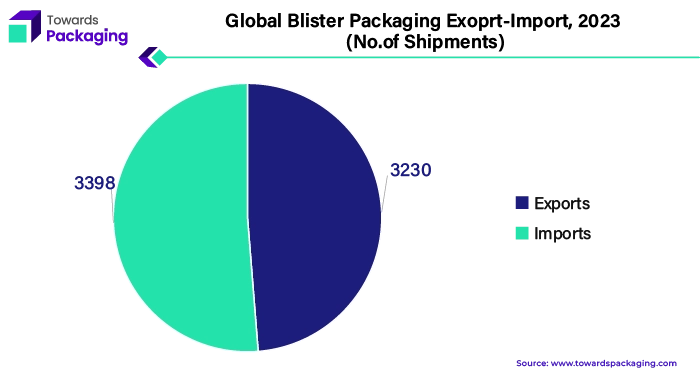

Primary packaging equipment generally involves blister packaging equipments, ampoule filling and sealing equipments, bottle filling and capping equipments, tube filling equipments, and sachet packaging devices. To protect a product from air, light, and moisture, blister packaging equipments, for example, create pockets or cavities in a sheet of material and then seal the product inside. Medication filling and capping equipments automate the process of filling bottles with liquid or solid substances and covering them with closures or caps.

The necessity for efficient and automated packaging solutions, together with regulatory requirements for product safety and tamper resistance, are some of the drivers propelling the pharmaceutical industry's demand for primary packaging equipment. Primary packaging equipment plays a vital role in the pharmaceutical packaging equipment industry as pharmaceutical companies aim to maximise productivity, minimise production costs, and guarantee regulatory compliance.

For Instance,

Pharmaceutical products that are in a dry, powdery state are termed to as being packaged in powder form in the pharmaceutical packaging equipment market. These powders can contain excipients, active pharmaceutical ingredients (APIs), or a combination of the two. Medications in powder form are frequently used for a variety of purposes, such as oral, topical, inhaler, and injectable forms.

Pharmaceutical powder packaging equipment is made to handle the special properties of powders, including their density, flowability, and air and moisture sensitivity. Powder packaging equipments accurately measure and dispense powder into bottles, sachets or capsules utilising methods including auger filling, vacuum filling or gravity filling.

Equipment for powder packing may have features like tamper-evident packaging, dust containment systems, and sealing mechanisms to guarantee the safety and integrity of the product. These devices are necessary to prolong shelf life, avoid contamination, and maintain product quality.

The market for pharmaceutical packaging equipment provides a variety of specialised equipments designed to meet the particular needs of powder form pharmaceuticals, as the demand for powdered medications increases due to factors like patient convenience, dose accuracy, and formulation versatility. This apparatus is essential to guaranteeing the effective and dependable packing of tablets for administration and ingestion.

For Instance,

The competitive landscape of the pharmaceutical packaging equipment market is dominated by established industry giants such as Robert Bosch GmbH, MULTIVAC Group, Coesia S.P.A., Romaco Group, Uhlmann Group, Marchesini Group S.p.A., Optima Packaging Group, Vanguard Pharmaceutical Equipment, Accutek Packaging Equipment Companies, Bausch + Strobel Maschinenfabrik Ilshofen GmbH + Co. KG, Industria Macchine Automatiche S.p.A., MG2 s.r.l., ACG Group, Syntegon Technology, Trustar Pharma & Packing Equipment, Inline Filling Systems, Dara Pharmaceutical Packaging, ARPAC LLC, N.K.P. Pharma, and Ropack. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

Robert Bosch Enterprises Bosch, a company renowned for its technological prowess and inventiveness, concentrates on creating state-of-the-art packaging solutions that meet the changing demands of the pharmaceutical sector. Their approach entails ongoing research and development to introduce new technologies—like automation and robotics—with the goal of improving productivity, cutting expenses, and guaranteeing regulatory compliance.

For Instance,

MULTIVAC places a strong emphasis on adaptability and customisation in its packaging equipment selection. Their approach entails close collaboration with pharmaceutical businesses to provide customised packaging solutions that satisfy certain manufacturing demands and product specifications.

For Instance,

Coesia has a diverse strategy, providing a wide range of packaging solutions and equipment through its subsidiaries. Their approach entails utilising the group's synergies between several companies to offer comprehensive packaging solutions that cater to the diverse requirements of the pharmaceutical industry.

For Instance,

Romaco is an industry leader in supplying innovative processing and packaging equipment to the pharmaceutical industry. Their approach focuses on creating high-performance equipments with innovative features like serialisation and tamper-evident packaging, with an emphasis on product innovation and differentiation.

For Instance,

Badre Hammond, general manager Aptar CSP Technologies stated that with ProAmpac, the company introduce ProActive Intelligence Moisture Protect (MP-1000) new platform of active material science solutions. By offering the market a fully integrated, flexible, multi-layer film solution driven by CSP's proven Activ-Polymer technology, this partnership aims to revolutionize the delivery of active packaging and address unmet needs, according to for Aptar CSP Technologies and vice president of global commercial operations.

By Equipment Type

By Product

By Application

By Region

April 2025

April 2025

April 2025

April 2025