April 2025

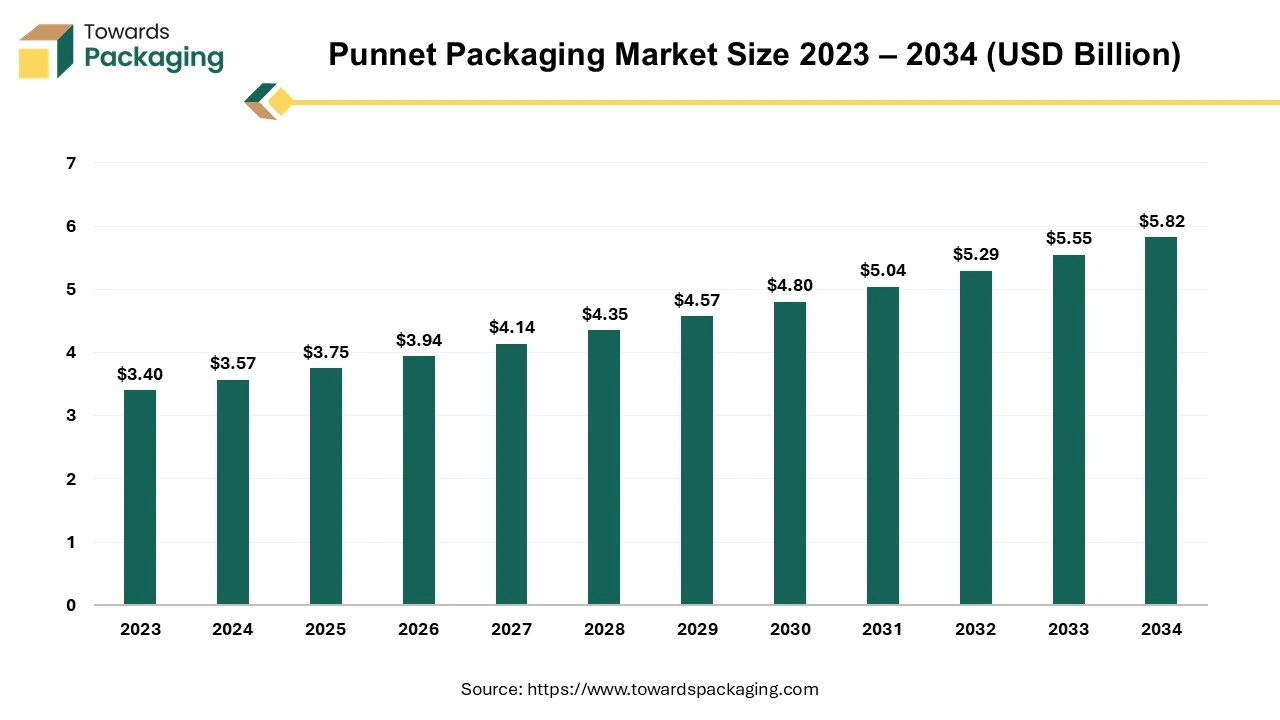

The punnet packaging market is anticipated to grow from USD 3.75 billion in 2025 to USD 5.82 billion by 2034, with a compound annual growth rate (CAGR) of 5.05% during the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

Fruits and vegetables are packaged and displayed in punnet packaging, which is a little, shallow basket or container. Produce is shielded from bruising, squashing, and spoiling by punnets. Additionally, they aid in extending the fruits' and vegetables' shelf life. In order to maintain ideal conditions for the packed goods, punnets feature ventilation slits to let airflow. A range of materials, such as paper, plastic, and molded fiber, can be used to create punnets.

Because they are lightweight, punnets take up less storage space. The purpose of punnets is to improve the produce's aesthetic appeal to consumers. Mushrooms, bell peppers, grapes, berries, cherries, and other fruits and vegetables are all packaged and transported in punnets. Agricultural, culinary, and dairy items are also packaged with them.

There's a strong emphasis on eco-friendly materials, such as biodegradable and recyclable options, driven by consumer demand for environmental responsibility.

Integration of technologies like QR codes and NFC enables interactive consumer engagement and supply chain transparency.

The industry is exploring bioplastics as sustainable alternatives to traditional plastics, aiming to reduce environmental impact.

A trend towards clean, simple designs that reduce material usage while enhancing product usability.

AI can significantly improve the punnet packaging industry (used for packaging fresh produce like berries, tomatoes, and mushrooms) by enhancing efficiency, sustainability, and quality control. AI-powered vision systems can inspect punnets for defects (cracks, misalignment, improper sealing) at high speeds, reducing waste. Machine learning can detect variations in packaging integrity and ensure that punnets meet food safety standards. AI-driven robotic arms can handle delicate produce efficiently, optimizing the packing process and reducing human labor costs.

Automated AI systems can adjust packaging configurations dynamically based on the size, weight, or type of produce being packed. AI can analyze packaging materials and suggest eco-friendly alternatives, reducing plastic usage and improving recyclability. AI-driven predictive modeling helps optimize the design of punnets to minimize material waste while maintaining durability.

AI can forecast demand trends and optimize production schedules to prevent overproduction or shortages. Internet of Things and AI integration enable real-time tracking of packaging materials, reducing storage costs and improving logistics. AI can facilitate on-demand packaging customization, allowing brands to adjust punnet designs quickly for different markets or promotions. AI-enabled QR codes or RFID tags on punnets can provide real-time tracking, freshness indicators, and consumer engagement features. AI can forecast demand trends and optimize production schedules to prevent overproduction or shortages. Internet of Things and AI integration enable real-time tracking of packaging materials, reducing storage costs and improving logistics.

Greyscale AI is a U.S.-based startup offers AI technology to inspect seals of pouches, bags, and rigid containers. Their advanced imaging solutions utilize AI and machine learning to detect seal defects and measure seal strength, ensuring packaging integrity.

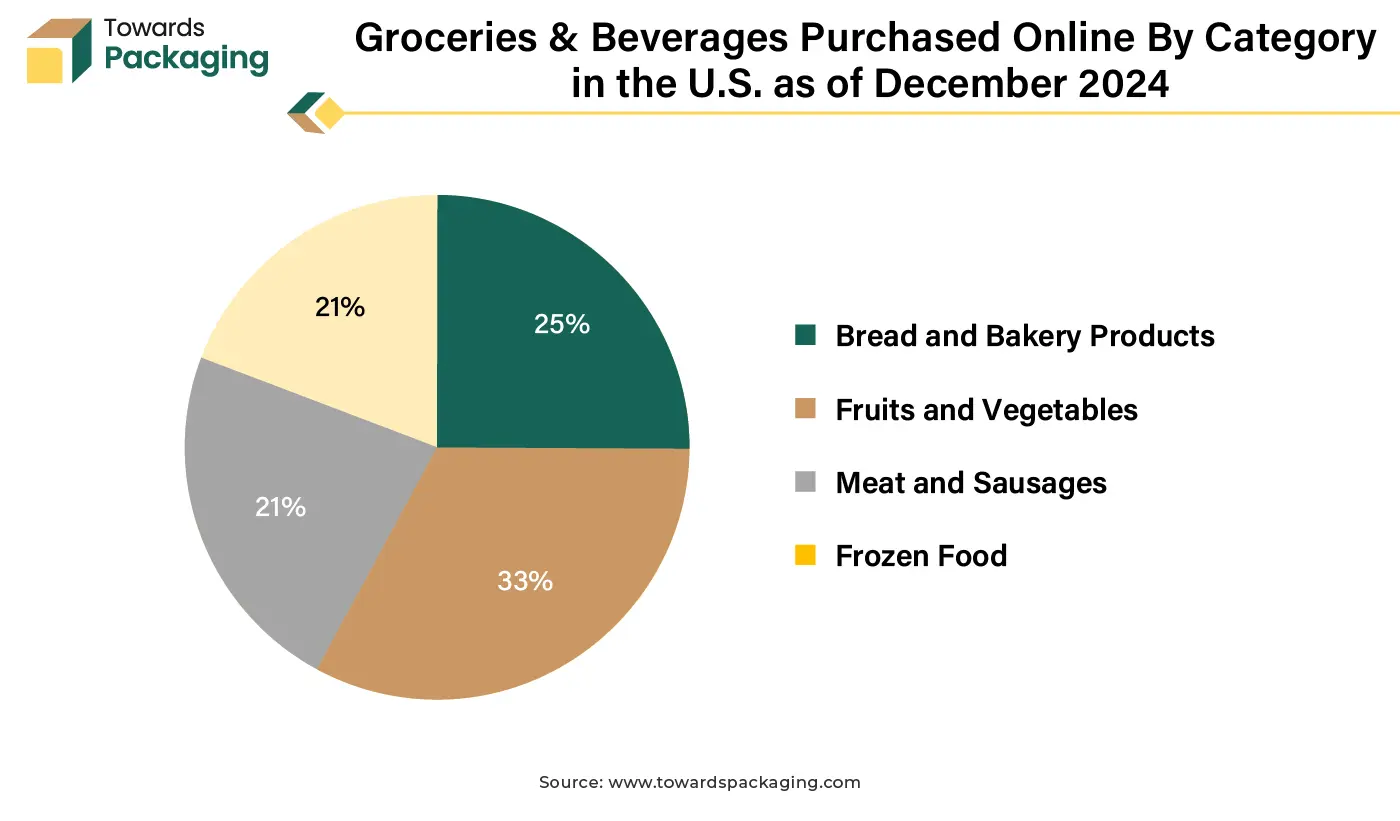

Increasing consumer preference for fresh fruits, vegetables, and ready-to-eat salads is boosting the demand for punnet packaging. Growth in e-commerce grocery shopping has increased the need for durable and lightweight packaging.

The key players operating in the market are facing issue due to stringent regulatory norms for manufacturing punnet packaging and competition from alternative packaging solutions, which has estimated to restrict the growth of the punnet packaging market in the near future. Plastic bans and packaging waste regulations in various countries make compliance challenging, leading to increased costs for manufacturers.

Strict recycling and disposal requirements put pressure on companies to innovate while maintaining cost efficiency. Flexible pouches, net bags, and loose produce sales are emerging as viable alternatives, reducing reliance on punnet packaging. Some retailers are adopting minimal or plastic-free packaging, reducing demand for traditional punnet formats.

Expanding fresh fruit, vegetable, and berry markets, especially in North America and Europe. Higher demand for pre-packed salads, cut fruit, and snack-sized produce in urban areas due to convenience. Development of high-barrier bio-based coatings to enhance moisture resistance in paper-based punnets. Smart packaging solutions like QR codes for traceability and modified atmosphere packaging (MAP) to extend shelf life.

The plastic segment held a dominant presence in the punnet packaging market in 2024. Plastic punnets offer high strength and impact resistance, protecting delicate items like berries and cherry tomatoes during transport. They help prevent crushing, bruising, or moisture damage, which is critical for fresh produce.

Plastic is lightweight, reducing shipping costs and making transportation more efficient. Compared to alternatives like molded fiber or glass, plastic production costs are lower, making it attractive for manufacturers. Clear plastic punnets (PET, rPET, or PP) allow consumers to see the product inside, boosting purchasing decisions. Visibility helps retailers reduce food waste, as customers can check freshness without opening packages.

Plastic punnets provide a barrier against moisture and bacteria, extending the shelf life of fresh produce. Unlike cardboard or molded fiber, plastic doesn’t absorb water, preventing sogginess. Many brands are switching to 100% recycled PET (rPET) punnets, which reduce virgin plastic use and are fully recyclable. Mono-material packaging (e.g., all-PET or all-PP designs) improves recyclability since mixed-material packaging is harder to process. The shift toward sustainable plastic alternatives in punnet packaging is being driven by regulations, retailer commitments, and consumer demand for eco-friendly solutions.

The 301 to 500 grams segment accounted for a considerable share of the punnet packaging market in 2024. Perfect for single households & small families as it offers enough product for a few servings without excess waste. Affordable price point and this size is easy to stack and display, maximizing shelf space.

Compared to bulk packaging, this size is budget-friendly for consumers. 301 to 500 grams punnet packaging is widely used because it strikes a balance between consumer convenience, retail efficiency, and product protection. Common for fresh fruits, vegetables, and salads, especially in grab-and-go sections. Fits e-commerce and meal kit deliveriesOnline grocery platforms prefer this size for easy handling and portion control. Many 301-500g punnets use rPET, paperboard, or compostable materials, aligning with eco-friendly packaging goals.

The fruits and vegetables segment dominated the punnet packaging market globally. Punnet packaging is widely used for fruits and vegetables because it offers a balance of protection, convenience, and efficient handling. The punnet packaging prevents bruising, crushing, and moisture loss, especially for soft fruits like berries, grapes, and cherry tomatoes. The punnet packaging protects delicate produce and offers ventilation to maintain freshness and reduce condensation. The fruits and vegetables punnet packaging enhances shelf life and works well with Modified Atmosphere Packaging (MAP) to slow ripening and spoilage. Some materials (e.g., rPET with anti-fog lids) preserve freshness longer. Transparent plastic or windowed fiber punnets allow product visibility.

Asia Pacific region dominated the global punnet packaging market in 2024. Asia-Pacific is the largest producer and consumer of fruits & vegetables, with countries like China, India, and Thailand leading in production. Rising demand for convenient, pre-packaged fresh produce in urban areas. Growth of supermarkets, hypermarkets, and online grocery platforms (e.g., Alibaba’s Freshippo, BigBasket, JD Fresh) in India increases demand for pre-packed produce.

China, India, and Japan are reducing single-use plastics, leading to increased adoption of rPET, biodegradable, and fiber-based punnets. AVI Global Plast Private Limited headquartered in India manufactures a variety of plastic packaging products, including punnets, serving both domestic and international markets.

North America region is anticipated to grow at the fastest rate in the punnet packaging market during the forecast period. Large-scale fruit & vegetable production in the U.S. (California, Florida, Washington) and Canada has estimated to drive the growth of the punnet packaging market in the North America. High demand for punnets in berries, grapes, tomatoes, mushrooms, and salad greens. In North America drive the growth of the market. Major retailers like Walmart, Kroger, Costco, and Whole Foods in North America prefer pre-packaged fresh produce for hygiene and convenience. North America leads in rPET and compostable punnet adoption, driven by regulations (e.g., Canada’s single-use plastic ban, U.S. state-level policies).

Graphic packaging international based in Georgia, U.S., a leader in consumer packaging solutions, Graphic Packaging provides a range of products, including folding cartons and foodservice packaging. They focus on sustainable, fiber-based packaging options suitable for fresh produce. International Paper company based in Tennessee, U.S. specializing in paper and packaging products, International Paper offers corrugated packaging solutions like MaxNest, designed for efficient transportation and protection of fresh produce.

Sonoco Products Company headquartered in South Carolina, US, provides a variety of produce packaging solutions, including clamshells, plastic tubs, and stand-up pouches, catering to the specific needs of the fresh produce market.

Rachel Bastow, marketing manager at Xact, revealed that the addition of the two new Rev range mark a notable step forward in the move towards making the U.K. grocery industry more sustainable. In an effort to lessen the excessive use of plastic packaging for fresh fruit, Xact has created a closing machine for winged cartonboard punnets and an automatic taper for bunching loose items. With a maximum pace of 250 packs per minute, the Rev Elephant is said to be the quickest machine of its sort available. According to Xact, other cartonboard-based solutions normally operate at 80 packs per minute.

By Material

By Capacity

By Application:

By Region

April 2025

April 2025

April 2025

April 2025