February 2025

The recycle ready retort pouches market is accelerating, with forecasts predicting hundreds of millions in revenue growth between 2025 and 2034, powering sustainable infrastructure globally.

The recycle ready retort pouches market is expected to grow at a substantial CAGR during the forecast period. Recyclable retort pouches are intended to be recovered and repurposed after they are utilized in order to prevent waste from reaching the landfills. For better sorting and recyclability, they generally utilize mono-material architecture with a single polymer type in all layers.

Prominent mono-polymer configurations consist of retort pouches made entirely of polyethylene or polypropylene and does not have composite layers like nylon or aluminum foil as they are difficult to recycle. Solvent-free adhesives enable appropriate separation and to avoid heavy metals, water-based inks are used. Mono-material retort pouches are capable of being recycled through processing those using methods such as density separation, flotation, infrared sorting as well as manual separation. This will yield a homogenous stream of polymers that can be remanufactured. By doing this, precious resources are kept out of landfills and in use.

The rising environmental concerns and the stringent government regulations on plastic waste is expected to augment the growth of the recycle ready retort pouches market during the forecast period. Furthermore, the increasing consumer demand for eco-friendly and recyclable packaging along with the investments in the circular economy initiatives and corporate sustainability goals are also anticipated to augment the growth of the market. Additionally, the growing processed and ready-to-eat foods industry as well as the expansion of the pet food and pharmaceutical packaging sectors coupled with the improvements in the manufacturing efficiency and cost-effective production methods is also projected to contribute to the growth of the market in the near future.

The rising global demand for pet food owing to the growing pet ownership trend, increasing humanization of pets as well as a shift towards premium and specialized pet nutrition is anticipated to support the growth of the recycle ready retort pouches market during the estimated timeframe.

| Statistic | Dogs | Cats |

| Percentage of U.S. households owning | 45.5 | 32.1 |

| Total number of U.S. households owning | 59.8M | 42.2M |

| Average number per pet-owning household | 1.5 | 1.8 |

| Total number in the U.S. | 89.7M | 73.8M |

| Average spending on veterinary care per household per year | $580 | $433 |

These foods need high-barrier; durable as well as convenient packaging that preserves freshness, extends shelf life, and retains nutritional value. Retort pouches are a popular choice due to their lightweight design as well as its ability to survive the high-temperature sterilization. With the pet care industry expanding, demand for recycle-ready retort pouches is likely to climb, and this makes the sustainable packaging an important differentiator for pet food brands wanting to attract environmentally concerned customers.

The high production costs and substantial initial investments are expected to limit the growth of the recycle ready retort pouches market within the estimated timeframe. For enterprises, the switch to the recyclable pouches presents serious cost obstacles. The possible spike in the expenses related to implementing the new packaging materials is among one of the most immediate concerns. Compared to the conventional packaging, recyclable choices frequently ask for new materials as well as methods that might be more costly.

These expenses may result from the need to buy new machinery for production and from the fact that sustainable materials are more expensive than their non-sustainable equivalents. Additionally, for companies to identify efficient and successful recyclable packaging alternatives that satisfy their unique product needs, firms will have to make investments in research and development. Many firms, specifically small and medium-sized ones, could discover the substantial initial expenditure required to be prohibitive.

Furthermore, perhaps more complicated processing requirements as well as the demand for more employees to handle all the details of a sustainable packaging operation would probably result in the higher operational expenses for corporations. Also, the complete supply chain is impacted by the switch to recyclable packaging, which increases costs. For a closed-loop system to be genuinely sustainable, manufacturers, distributors, retailers as well as suppliers must work together to make sure recyclable materials are managed appropriately. This increases the costs even more because it implies major training and operational changes. These higher expenses make the change financially challenging. As a result, many companies are unwilling to utilize the recyclable retort pouches, limiting their general adoption in spite of the increasing sustainability demands.

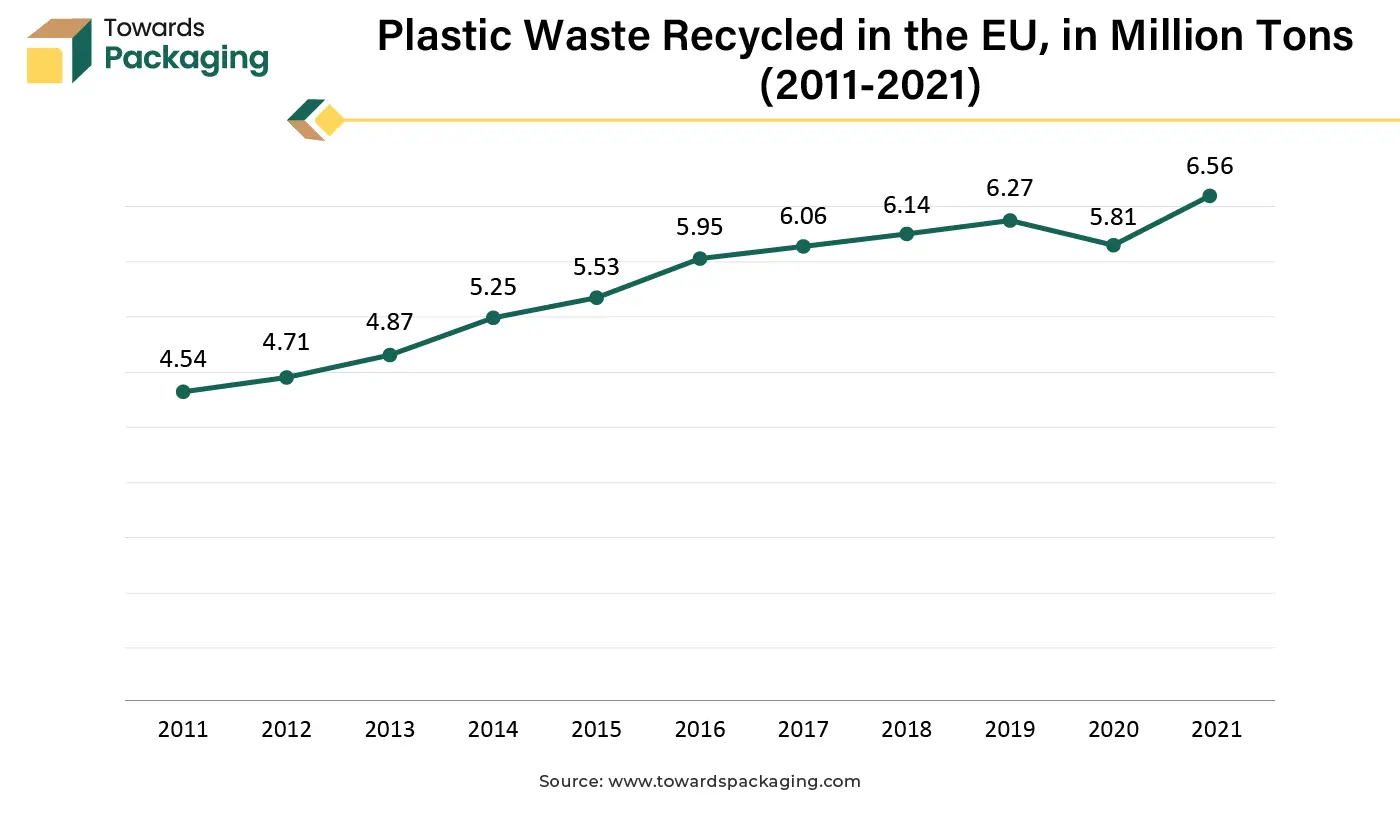

The increase in investments and the expansion of the recycling infrastructure as well as the improvements in the waste management systems is expected to create substantial opportunity for the growth of the recycle ready retort pouches market in the near future. This is due to the global sustainability goals, stricter environmental regulations and the growing consumer demand for recyclable packaging. These investments are important in handling the multi-layered and high-barrier packaging options.

Recycling infrastructure development is being dominated by regions such as Europe and North America, which have allocated substantial investments to updating waste management systems. As these facilities become more widely available and effective, the consumption of recycle-ready retort pouches is likely to increase, promoting a more sustainable packaging environment.

Artificial intelligence (AI) is likely to redefine the recycle-ready retort pouch market and bring innovation throughout the packaging value chain. Artificial intelligence based automation and predictive analytics are improving the manufacturing processes, decreasing material waste, and increasing production efficiency. In the process of the recycling and waste management, AI-powered sorting technologies at Material Recovery Facilities (MRFs) improve the accuracy of recognizing and separating the recyclable materials, guaranteeing that recycle-ready retort pouches are properly processed. Furthermore, the artificial intelligence technology is important in streamlining of the supply chain, assisting organization in forecasting the demand, lowering logistical costs as well as reducing carbon footprints.

Advanced AI algorithms also contribute to the product innovation through helping develop high-barrier mono-material films that improve the recyclability of the retort pouches. Furthermore, AI based consumer insights enables firms to customize their sustainable packaging strategy depending on the market trends as well as the preferences. As restrictions on the plastic waste get stricter, AI is assisting organizations in complying by evaluating environmental effect data and optimizing packaging design for more sustainability. AI integration is projected to drive the adoption of smart, eco-friendly packaging options, making recycle-ready retort pouches a more viable and sustainable option in the market.

The stand-up pouches segment held considerable share in the year 2024. These pouches have gained popularity due to its convenience and sustainability. Their lightweight flexible design reduces the material utilization as compared to the rigid packaging and this leads to lower transportation costs as well as a reduced carbon footprint. Consumers pick these pouches because they are resealable, convenient to store and portable and makes them perfect for on-the-go lifestyles. High-barrier protection benefits industries such as food, drinks, pet food and personal care through preserving product freshness and extending shelf life. Their appealing appearance and customizable printing also increase brand visibility and makes them a popular choice among both consumers and companies.

The food & beverages segment held largest share in the year 2024. This is owing to the evolving consumer preferences across the globe, the rising disposable incomes and urbanization. Furthermore, the increasing demand for the convenience foods, ready-to-eat meals along with the growing trend of diverse culinary experiences is also expected to support the segmental growth of the market.

Additionally, the surge in the organic, plant-based and functional foods as well as rise of food delivery services, cloud kitchens, and technological advancements in the food production and packaging is also further expected to contribute to the growth of the segment in the global market. Also, the increase in introduction of new flavors and cuisines has also boosted the growth of the segment within the estimated timeframe.

North America held considerable market share in the year 2024. This is due to the implementation of extended producer responsibility programs and recycling mandates across the region as well as the well-developed network of Material Recovery Facilities (MRFs) and the growing investments in the recycling technologies. Additionally, the rise in on-the-go lifestyles and demand for packaged food and beverages and this is further expected to contribute to the regional growth of the market. Furthermore, the presence of the strong pet food industry along with the rapid growth of online grocery shopping is also anticipated to support the growth of the market in the region during the forecast period.

Asia Pacific is likely to grow at a fastest CAGR during the forecast period. This is due to the increasing urban populations and fast-paced lifestyles. Furthermore, the increase in demand for eco-friendly and recyclable packaging and the increasing pet ownership rate in countries like China, India and Australia are likely to contribute to the regional growth of the market.

By Packaging Type

By End-Use Industry

By Region

February 2025

February 2025

February 2025

February 2025