April 2025

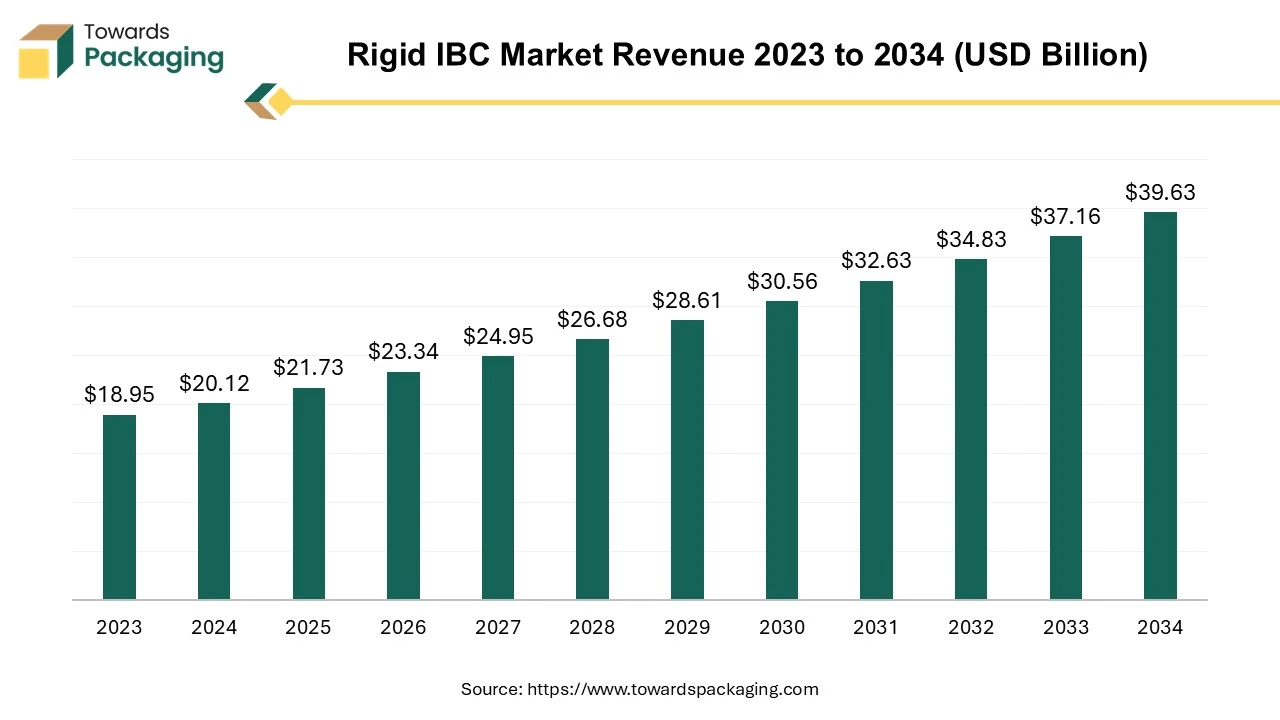

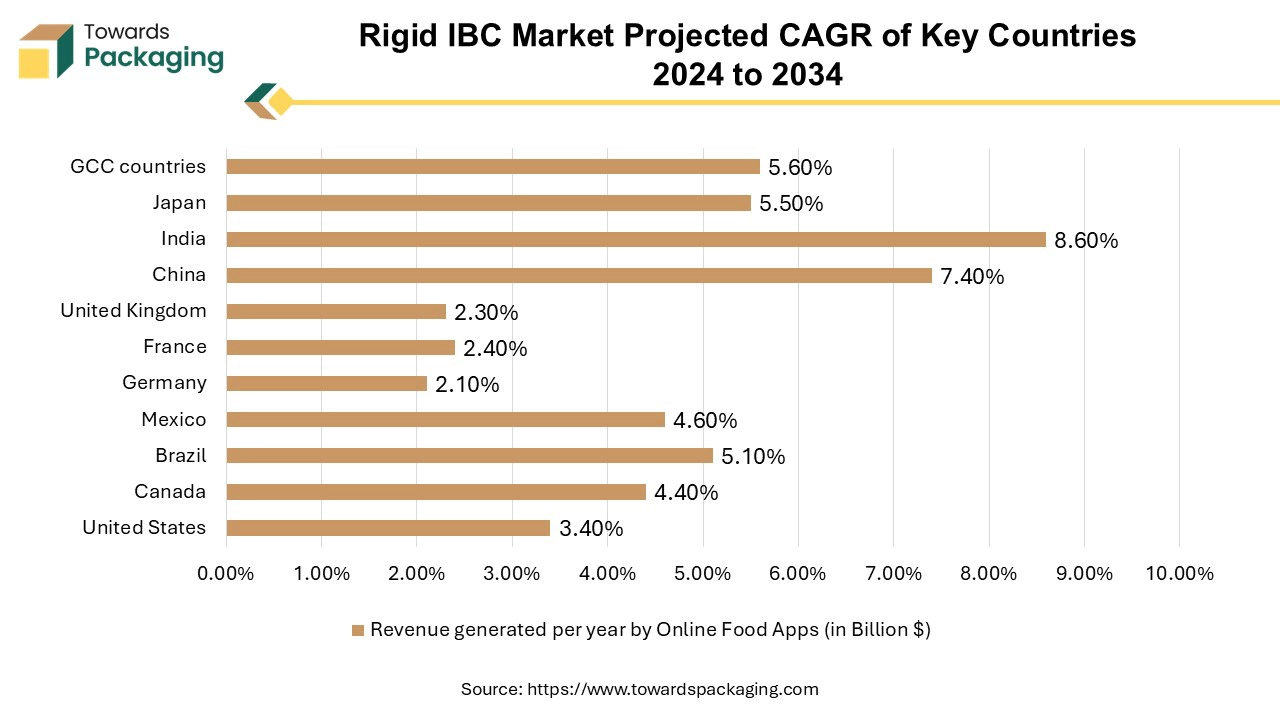

The rigid IBC market is forecasted to expand from USD 21.73 billion in 2025 to USD 39.63 billion by 2034, growing at a CAGR of 6.94% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

Almost every industry faces stringent regulations regarding the safe handling and shipment of non-hazardous and hazardous materials. Rigid IBCs often meet these regulatory requirements, making them a preferred choice. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop rigid IBC containers to meet the rising demand from the consumers which is estimated to drive the global rigid IBC market over the forecast period.

Rigid Intermediate Bulk Containers (IBCs) are well known for their durability, strength, and efficiency in storing and transporting large quantities of liquids or bulk materials. They are designed to be stackable, which maximizes space utilization, and they often feature a sturdy, rigid construction that can withstand handling and transport stresses. Their design usually includes features like a built-in pallet base, easy-to-open lids, and various outlet options for dispensing contents. Rigid intermediate bulk containers are commonly used to store and transport liquids.

Rigid IBC containers are UN/DOT certified and commonly used for carrying hazardous materials, packaging group Il, and packing Ill commodities. An intermediate bulk container (IBC) is a pallet-mounted, reusable container used to store and transport bulk liquids and powders. The IBC, sometimes known as a tote, can be stacked and transported using a pallet jack or forklift. Rigid intermediate bulk containers are utilized for storage and transportation of solvents, chemical, pharmaceuticals, liquids, food ingredients, sand and grains among others. Intermediate bulk containers are even utilized in unique areas such as general bulk storage, aquaponics and the collection of rainwater for drinking or harvesting.

There are three varieties of IBCs: rigid, foldable, and flexible. The term 'intermediate' refers to the volume of intermediate bulk containers, which is between tanks and drums. Rigid IBCs are typically 275 or 330 gallons in size.

AI can evaluate data from sensors implanted in IBCs to forecast when maintenance is required, decreasing downtime and increasing container longevity. AI-powered image recognition systems can examine IBCs for faults and irregularities during the manufacturing process, ensuring improved quality and decreasing waste. AI algorithms can improve inventory management, logistics, and supply chain operations by forecasting demand and expediting delivery. AI can automate a variety of production operations, including filling, sealing, and labeling, increasing productivity and lowering human costs.

Artificial intelligence (AI) can evaluate container usage and performance data, providing insights for improved design and more effective utilization methods. AI can evaluate consumer comments and usage patterns to help manufacturers customize their products and services more effectively. Artificial Intelligence has the capability to examine user feedback and usage trends to assist producers in better customizing their goods and services to meet consumer demands. Overall, AI can boost productivity, cut expenses, and enhance product quality in the rigid IBC sector.

Due to increase in literacy rate the rapid industrialization is taking place all over the world. Rapid industrialization across various sectors like pharmaceuticals, chemicals, food and beverages, and agriculture is fueling the demand for efficient transportation and storage solutions, including rigid intermediate bulk containers. The expansion of end-user industries, including the chemical industries and pharmaceutical industries, drives demand for rigid IBC storage solutions.

The key players operating in the Rigid IBC market are facing regulatory issues while manufacturing and supplying rigid IBC to industries. The fair cost of rigid IBCs, including procurement and deployment, can be high compared to other packaging solutions, which may deter some companies from adopting them. Compliance with stringent regulations and standards for quality, safety and environmental impact can be complex and high in cost, particularly for smaller businesses. Rigid IBCs are less adaptable to varying sizes and types of cargo compared to flexible packaging solutions, potentially restricting their use in some applications. The size and rigidity of intermediate bulk containers can present challenges in terms of storage and transportation, particularly if space is a constraint. Rigid IBCs require regular cleaning and maintenance particularly in industries like pharmaceuticals and food, can increase operational cost. These factors can impact the growth of the rigid IBC market by influencing costs, operational flexibility, and environmental consideration.

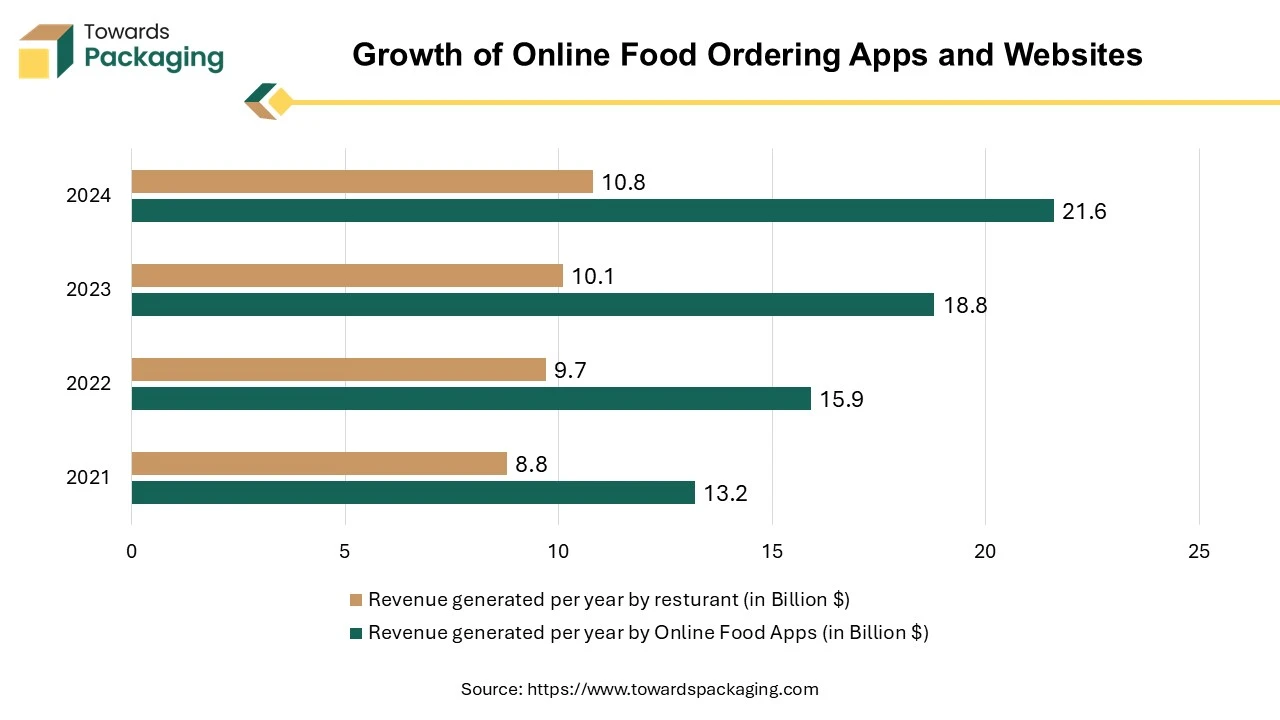

Growth into developing regions with growing manufacturing and industrial sectors create new opportunities for the rigid IBC market expansion. The increase in global trade and e-commerce can boost the need for efficient bulk transportation and storage solutions, including rigid intermediate bulk containers. Increasing launch of the new online shopping websites and company in different region is rising the demand for the rigid IBC which is estimated to create lucrative opportunity for the growth of rigid IBCs market in the near future.

Hence, increasing launch of the new E-commerce websites and warehouses has risen the need for the rigid IBCs for storage as well as transportation purpose.

The metal IBC segment held the dominating share of the rigid IBC market in 2024. The metal intermediate bulk containers are often manufactured using aluminium or stainless steel material, are highly durable and withstand adverse conditions, making them suitable for transporting and storing heavy, hazardous, or high-value materials. Metal containers offer better security against tampering and leakage, which is significant for sensitive or high-value materials.

These characteristics of metal intermediate bulk containers contribute to the increasing preference for metal IBCs in various sectors including pharmaceuticals, chemicals, food & beverages and manufacturing. The key players operating in the market are focused adopting inorganic growth strategies like acquisition to expand its product portfolio and market presence, to meet the rising demand for the metal IBCs all over globe.

The JWJ Packaging company’s portfolio expanded by including plastic and steel drums, intermediate bulk containers, and other shipping accessories. With this acquisition, Novvia enters its third market in the Northeastern US, which it views as a strategic and fast-growing area.

Additionally, Novvia stated last month that it will be purchasing Ocean State Packaging for an undisclosed amount. With this agreement, Novvia will now be able to sell its products throughout the US New England region. Novvia is a provider of customized services and packaging solutions for both domestic and foreign clients in a range of industries.

The other customized capacities segment held a significant share of the rigid IBC market in 2024. The customized capacities rigid intermediate bulk containers offer design to with stand rough handling and allows for efficient use of storage space. The key players operating in the market are focused on getting the approval for the product from the regulatory bodies and introduction of new standard 1250 liters rigid IBCs in the rigid IBC market.

Specific requirements for product packaging and transportation vary throughout industries. With customized capacities, producers can create IBCs that exactly meet the volume needs of any kind of product, including chemicals, medications, food, and drinks. Manufacturers can create IBCs that adhere to the regulations and guidelines that are relevant to particular sectors and geographical areas because of customized capacity. This guarantees that inflexible IBCs adhere to the regulations governing the transportation of specific items.

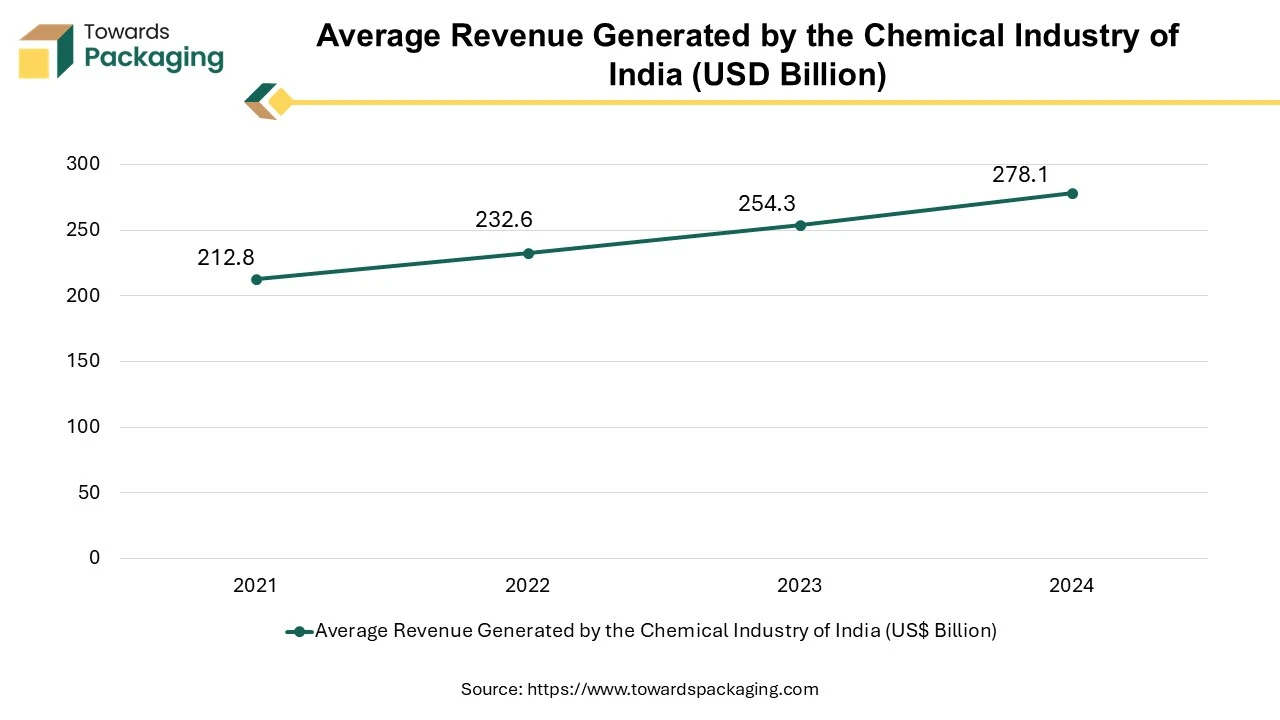

The chemical segment held significant share in 2024. The rise in demand for chemicals across various sectors such as automotive, construction, pharmaceutical and agriculture drives the growth of the rigid IBC market. Rapid urbanization and industrialization in emerging economies increase the need for chemicals in infrastructure, manufacturing, and consumer goods. The key players operating in the market are focused on adopting inorganic strategies like acquisition to develop rigid IBC for chemical industry.

The food & beverages segment is observed to grow at notable rate. Growing urban population, busy lifestyles and increased working hours’ boost demand for convenience foods, including ready-to-eat food options. Ongoing innovation in food technology and new product development expand choices and attract consumers. The rise of online grocery shopping trend and food delivery services makes food more accessible and convenient. Growing trend in sustainable and ethically sourced food products drives changes in food production and distribution patterns. The key players operating in the market are focused on adopting inorganic growth strategies like partnership to develop sustainable rigid intermediate bulk containers to meet the rising demand of it from the food & beverages industry.

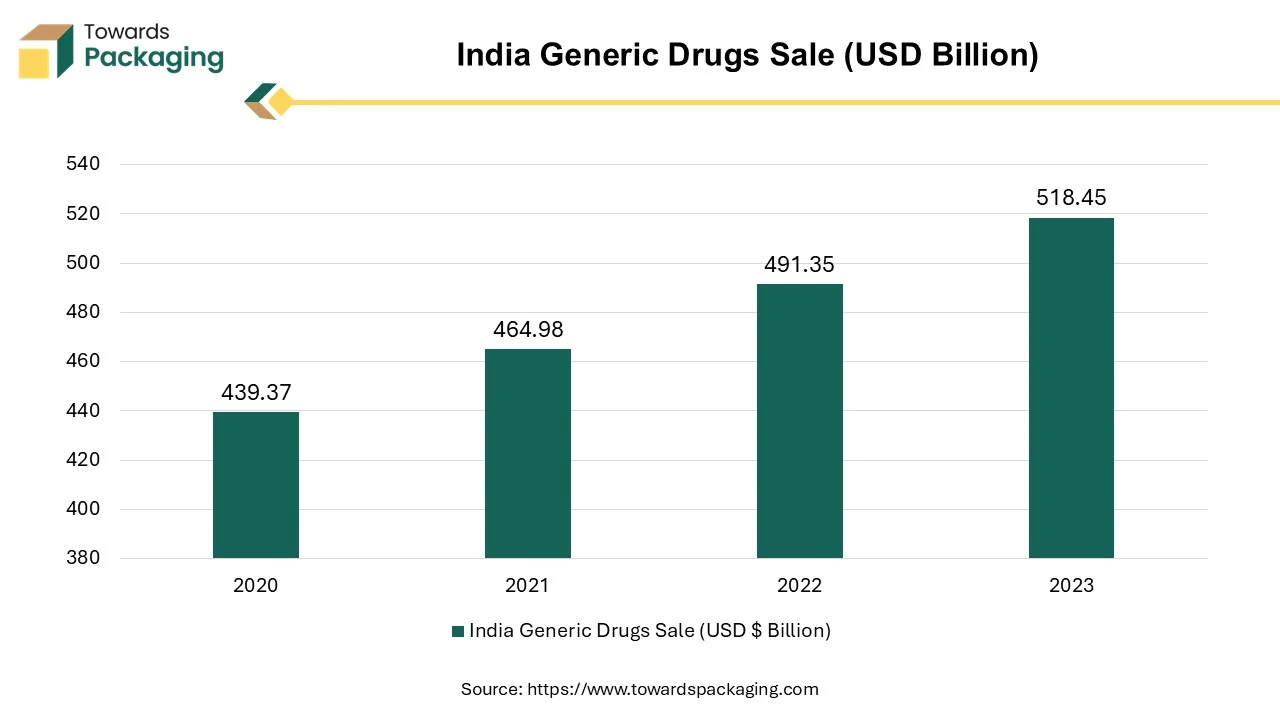

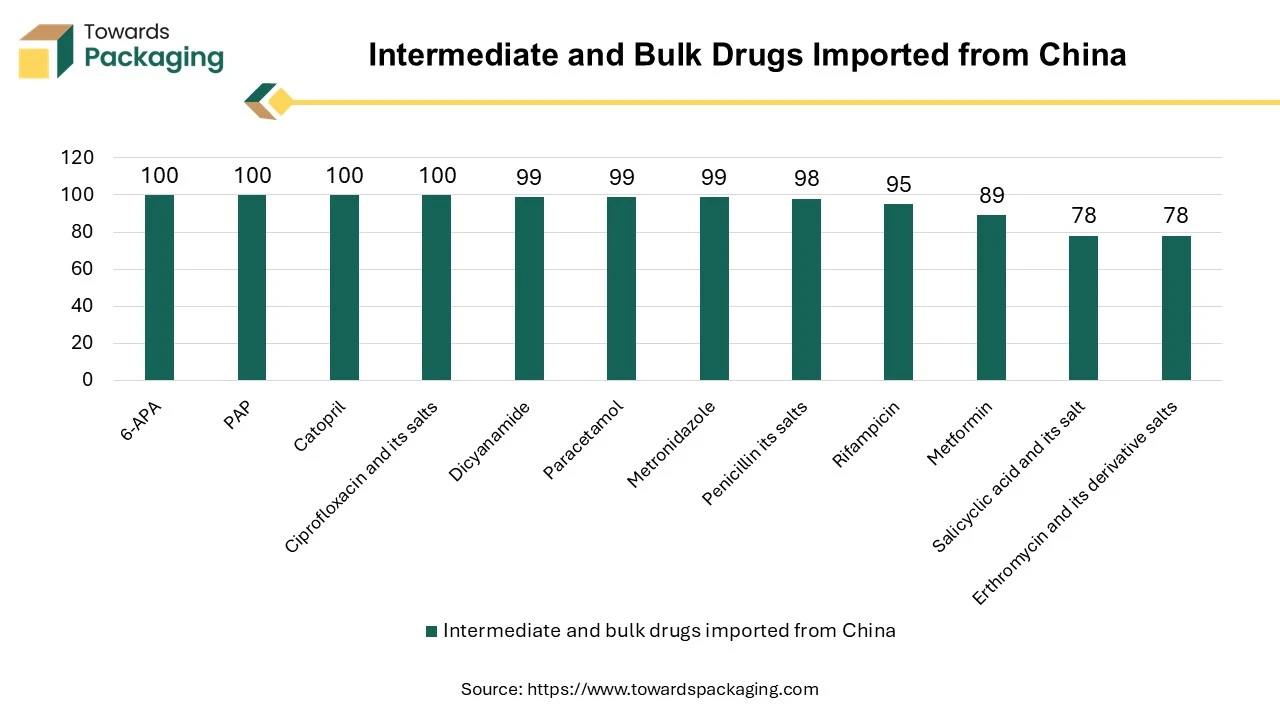

Asia Pacific held the largest share of the rigid IBC market in 2024. India is known for its cost-effective manufacturing capabilities, which attract global pharmaceutical companies looking for affordable production options. India is leading producer of generic drugs, which are in high demand globally due to their affordability compared to branded medications. The overall expansion of the pharmaceutical industry is observed to promote the marker’s expansion in the upcoming years.

The Indian government supports by providing various incentives, such as tax benefits and subsidies, to fuel the growth of the pharmaceutical industry. An increasing population and rising healthcare needs in China, India and Malaysia augment demand for pharmaceuticals, both domestically and for export. India exports a substantial amount of pharmaceutical products to develop markets, including the Europe and US, benefiting from favourable trade agreements and global demand. Foreign direct investment (FDI) and partnerships with pharmaceutical companies worldwide fuel the sector’s growth and rise in demand for the rigid IBC for storage and transportation purpose.

Europe region is estimated to grow at fastest rate over the forecast period. Active pharmaceutical ingredients are highly volatile and unstable, requiring packaging solutions like rigid IBCs that are compatible with these products. Growth in industries such as pharmaceuticals, food & beverages, chemicals, and oil and gas fuels the demand for durable and efficient rigid bulk packaging solutions. The key players operating in the Europe are focused on launching the rigid intermediate bulk container to meet the rising demand by the chemical and food industry.

Carrying up to 1000 litres and made from 100% highly resistant plastic, ChemiFlow is certified compliant with Alternative Dispute Redressal (ADR), Provider Identifier (RID) and International Maritime Dangerous Goods (IMDG) Code regulations – enabling seamless bulk international transportation and shipment.

By Material

By Capacities

By End-use

By Region

April 2025

February 2025

February 2025

February 2025