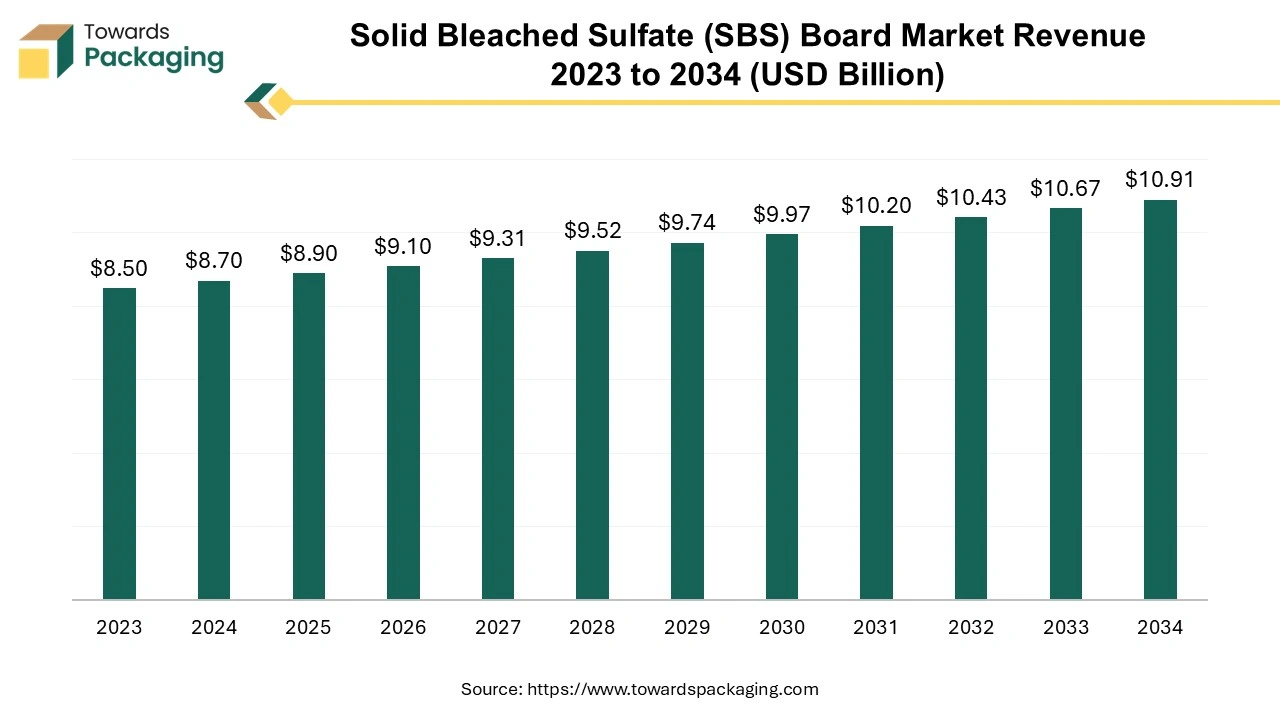

The solid bleached sulfate (SBS) board market is expected to grow from USD 8.90 billion in 2025 to USD 10.91 billion by 2034, with a CAGR of 2.3% throughout the forecast period from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The market is proliferating due to the increasing business of food, cosmetics, and pharmaceutical sectors requiring solid bleached sulfate (SBS) board for packaging due to its superior quality, printability, and other benefits.

Bleached chemical pulp with a coating in its top layer and some grades in its reverse side is known as solid bleached sulfate (SBS) board. It is used for high-quality graphical and packaging products as it has high strength, adaptability, and printability. These are widely used in electronics, cosmetics, chocolates, and pharmaceuticals for packaging purposes. These are the eco-friendly and sustainable packaging options due to which manufacturers, suppliers, and end-users depend upon SBS for packaging services. These are available in 200 to 600 GSM which makes them appropriate for various types of printing processes. SBS are found appropriate for flavour as well as essence packaging. The global packaging market size is growing at a 3.16% CAGR between 2025 and 2034.

Solid bleached sulfate (SBS) boards are mainly preferred due to their sustainable and versatile packaging quality. The rising awareness towards environmental issues leads to increasing customer preference towards eco-friendly products driving this solid bleached sulfate (SBS) board market significantly. The growing trend of making presentable packaging and branding has also had a major impact on this market.

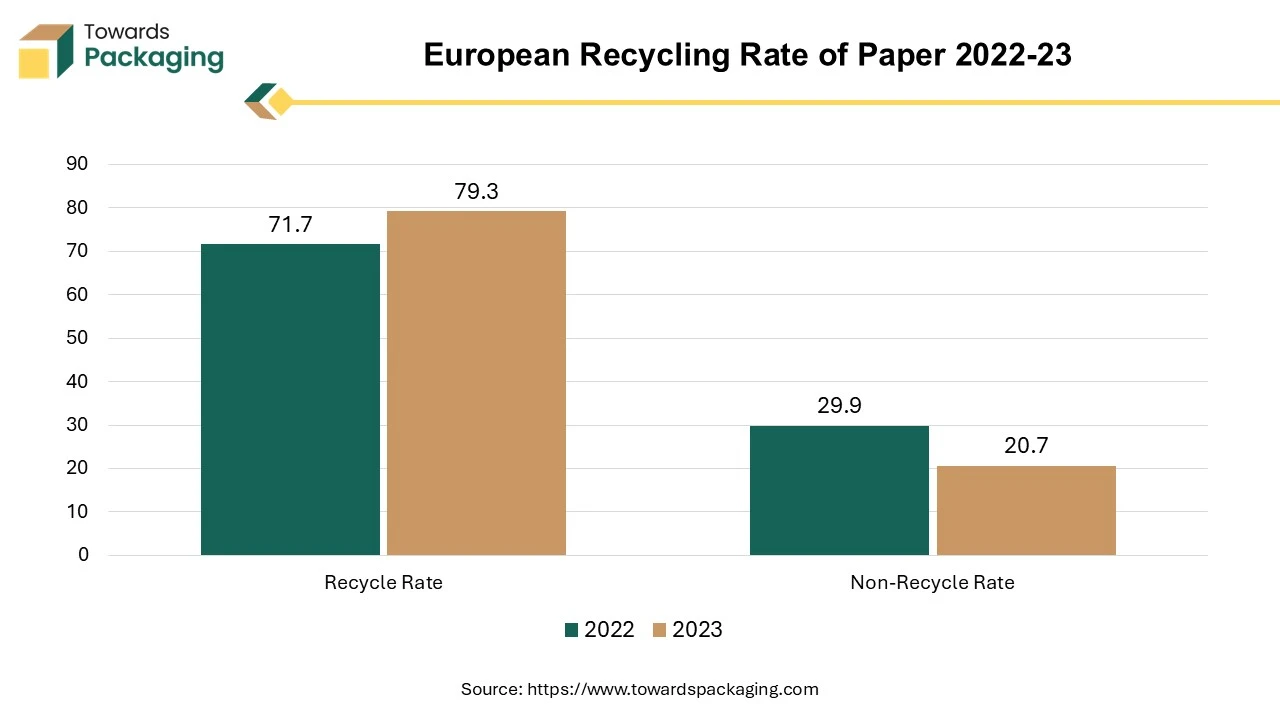

These packagings are highly used for luxury and food products due to clean and excellent printability. The rising online retail and e-commerce business also increases the demand for sturdy packaging that as a result influences this market. It can easily be creased, embossed, hot foil stamped and cut which has rigidity and a white core making it ideal for signage, folding-carton applications, greeting cards and various other purposes. Solid bleached sulfate (SBS) boards are made of bleached wood pulp and topped with clay minerals which can easily be recycled enhancing the sustainability of forests.

The SBS market is constantly experiencing a significant improvement due to the expansion of the packaging industry. Good quality packaging is in high demand in all sectors as it plays a crucial role in protecting products while transferring from one place to another. Due to such rapid growth in the packaging industry, the demand for premium-quality and exceptional SBS boards is increasing significantly. The growing online shopping culture also influences major changes in the production of SBS boards as there is a huge demand for the safe delivery of delicate products. It can ensure the safe delivery of products in adverse conditions due to its sustainability and build quality.

Many market players such as JK Paper Ltd., KR Pulp & Papers Ltd., ITC Ltd., Ningbo Zhonghua Paper, International Recycling Corp., and many others are continuously developing advanced quality products to satisfy the increasing market demand which promote the growth of the Solid Bleached Sulfate (SBS) board Market. The market is getting competitive due to which price of the packaging getting hiked which hinders the growth of the SBS boards market. As industries look for customs to diminish expenditures and improve supply chains, they may apply descending price pressure on the packaging industry, with the solid bleached sulfate board.

North America witness the highest revenue share for the year 2024. This growth in the market is influenced by multiple factors such as rising earning sources, home delivery services on every product, social media influence, eco-friendly packaging demand, and several others. The growing consumer demand for convenience and good-quality food packaging for safety and contamination-free. Governments in countries such as the U.S. and Canada have strict regulations for the packaging industries it is kept according to the consumer framework to meet their expectations. This has also enhanced the packaging quality and hence improved the market.

Several major market players are working to provide sustainable packaging in this industry by using biodegradable raw materials. Brands also use innovative technology for the production of these packaging that includes customization option which is useful for a variety of sectors to pack different shapes and sizes of products by giving an aesthetic look to it.

Europe is estimated to grow at the fastest rate over the forecast period. The rising concern for skincare, makeup and social media has a significant impact on the solid bleached sulfate (SBS) board market. The growing culture for grooming and usage of beauty products has surged the demand for premium packaging for brands to promote their business and enhance the aesthetic look of the packaging. Brands are investing widely in their packaging to attract customers with the appearance of products and to promote their business which results in the growth of SBS board packaging.

Customization of packaging in the field of cosmetic and personal care is highly in demand for which brands invest huge amounts and experience better customer response. This facility is to meet the demands of customers in unique ways, especially for brands producing organic products.

By type, the SBS C1S segment led the solid bleached sulfate (SBS) boards market in 2024. This rising trend for luxury packaging in various sectors has enhanced the growth of the packaging industry. It fulfils the demand for sustainability by producing recyclable products in the market. These boards have one smooth surface that is suitable for printability to enhance the product's appearance.

By application, the folding type segment led the solid bleached sulfate (SBS) boards market in 2024. This type is beneficial for pharmaceutical, food & beverage, and cosmetic markets by providing structural integrity while packaging products. Folding boards are durable yet lightweight which makes them ideal in these sectors for packaging purposes.

By Type

By Application

By Region