December 2025

The sustainable secondary packaging market is experiencing rapid growth, with revenue projections reaching hundreds of millions between 2025 and 2034, driving advancements in global sustainable infrastructure. Leading market players are increasingly adopting inorganic growth strategies, such as mergers and acquisitions, to develop advanced technologies for manufacturing eco-friendly secondary packaging.

Sustainable secondary packaging refers to packaging that is used to protect and group primary products for storage, transport, and display, while minimizing environmental impact. It is designed to be environmentally friendly throughout its lifecycle, including materials, production, usage, and disposal. The key aspects of secondary packaging are eco-friendly materials, efficient design, reusability, reduced carbon footprint, end-of-life considerations.

The sustainable secondary packaging is manufactured from recyclable, biodegradable, or compostable materials. Minimizes the use of materials without compromising functionality, reducing waste and resource consumption.

The sustainable secondary packaging market is experiencing significant growth and transformation, driven by evolving stringent environmental regulations, consumer preferences, and corporate sustainability initiatives.

Companies are increasingly adopting recyclable and biodegradable materials for secondary packaging to reduce environmental impact. For instance, in November 2023, Huhtamaki North America introduced a line of sustainable molded fiber-based cartons manufactured from 100% recycled material, serving as an alternative to traditional polystyrene foam in the egg market.

Governments worldwide are implementing regulations to curb single-use plastics, prompting companies to seek sustainable packaging alternatives. In Australia, for example, new legislation banning plastic spoons integrated into packaging led to the removal of such items from popular products like YoGo Mix. While this move aims to reduce plastic waste, it has sparked consumer frustration due to the perceived inconvenience.

Major corporations are setting ambitious sustainability goals, influencing the secondary packaging market. Retailers like Aldi have transitioned to paper packaging for products such as porridge oats, aiming to save significant amounts of plastic annually. Aldi's initiative is part of a broader strategy to reduce plastic packaging by 50% by 2025.

Advancements in recycling technologies and the development of compostable materials are gaining traction. Innovative solutions, such as seaweed-based bioplastics and effective PET bottle recycling systems, are being explored to address single-use plastic waste. For example, Norway's Infinitum has developed a highly effective PET bottle recycling system, achieving near-total recycling through incentivized taxation.

The artificial intelligence integration in the sustainable secondary packaging industry has ability to design sustainable packaging. Artificial intelligence (AI) aids in the creation of packaging that uses the least amount of material possible while perfectly safeguarding the contents within. Artificial intelligence (AI) can recommend improved packing techniques by looking at a variety of material and design areas. For instance, in some design solutions, the AI might suggest utilizing a material that is both thinner and stronger, or using less of something altogether. As a result, less trash is produced during production, which lowers expenses and protects the environment.

Sustainable packaging requires careful selection of packaging materials. Comparing different materials to determine which are the most environmentally friendly is one application of artificial intelligence. It takes into account elements like a material's ease of recycling or reintroduction into the environment. AI can also provide eco-friendlier substitutes, such as recycled content or biodegradable possibilities. This implies that businesses can select materials that are more environmentally friendly in addition to being useful.

The largest food and beverage corporation in the world, Nestlé, is enhancing the sustainability of its packaging by using AI-driven algorithms to assess the environmental sustainability of various package styles and materials. Artificial Intelligence (AI) is being used by Nestle to save on materials that they would have otherwise wasted, and municipalities are employing it to cut waste. These include AI-designed packaging that is lighter and thinner than traditional options without sacrificing protection; this minimizes transportation-related emissions because less material is wasted.

Innovations in packaging materials, such as biodegradable plastics, recycled paper, and plant-based alternatives, are expanding the options for sustainable secondary packaging. Development of energy-efficient production methods and lightweight packaging solutions. Innovation in advanced technology is a significant driver for the sustainable secondary packaging industry, as it enables the development of eco-friendly, efficient, and cost-effective solutions. Advanced research in bioplastics and bio-based materials provides alternatives to traditional plastics. Innovations in material science have improved the quality and performance of recycled paper, cardboard, and plastics for secondary packaging. The innovation of new technology enhances the strength and durability of sustainable materials, reducing the need for excess material. Advanced software tools analyze the environmental impact of packaging across its lifecycle, guiding manufacturers toward more sustainable choices.

By leveraging these technological advancements, the sustainable secondary packaging industry can address environmental challenges while meeting consumer and regulatory demands. These innovations not only reduce waste and resource consumption but also improve the economic viability of sustainable packaging solutions. Increasing launch of the advanced technology for manufacturing sustainable secondary packaging has estimated to drive the growth of the sustainable secondary packaging market in the near future.

In order to build reel-to-reel origami-inspired structures for fiber-based packaging materials, the VTT Technical Research Centre of Finland has developed a novel method for shaping cardboard in a distinctive continuous process in partnership with Aalto University and Finnish industrial partners. The origami folds can give cardboard completely new characteristics. Because of their resilience and low weight, the structures offer a great and aesthetically pleasing substitute for protective packing materials like expanded polystyrene and plastic. Designers are also taking notice of the material's attractiveness.

The stringent government regulations and bans on the single-use plastics is expected to create immense growth opportunity for the sustainable secondary packaging market in the near future. Across the globe, policymakers are implementing measures to combat the adverse environmental impacts of the plastic waste, encouraging companies to adopt the eco-friendly alternatives. These regulations consist of bans on the non-biodegradable plastics, higher taxation on traditional packaging materials as well as mandates for recycling and waste management.

These regulatory changes are compelling the companies to innovate and integrate recyclable materials into their packaging designs. Stringent regulatory policies not only drive the market growth but also foster an environment for innovation, enabling the development of the scalable sustainable secondary packaging options.

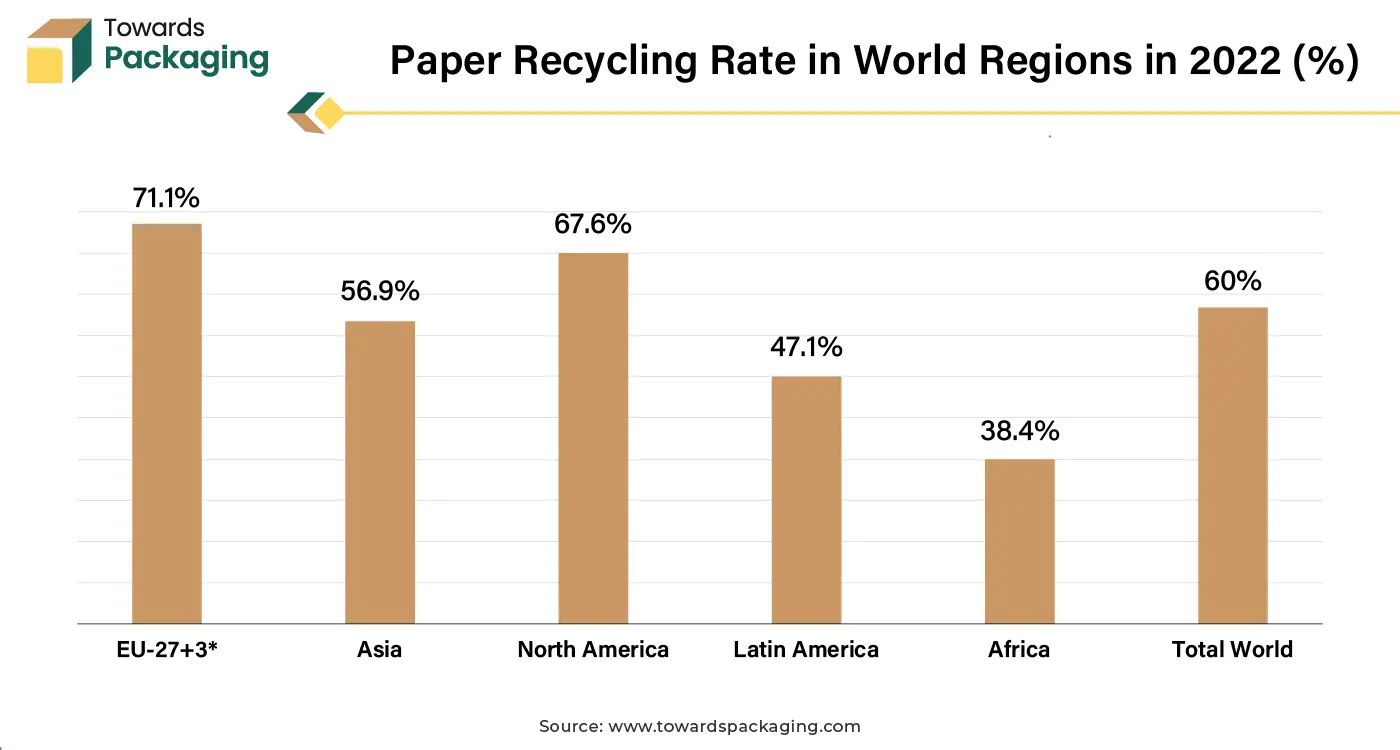

The paper and cardboard segment held a dominant presence in the sustainable secondary packaging market in 2024. Both materials are derived from wood pulp, a renewable resource, and are easily recyclable. This makes them environmentally friendly compared to plastic-based packaging. Paper and cardboard naturally decompose, reducing long-term waste and environmental impact when disposed of. The production process of paper and cardboard generally has a lower carbon footprint compared to alternatives like plastic, making them more sustainable. These materials are lightweight, which reduces transportation costs and associated carbon emissions.

Paper and cardboard can be easily molded, folded, and printed on, allowing for custom designs and efficient use of space in packaging. There is growing consumer demand for sustainable products, and brands often use paper and cardboard packaging to align with eco-conscious values. Both materials are relatively inexpensive to produce compared to alternatives like glass or plastic, making them an attractive choice for manufacturers.

The bamboo segment is expected to grow at the fastest rate in the market during the forecast period of 2024 to 2034. Bamboo is one of the fastest-growing plants in the world, with some species growing up to 3 feet per day. This makes it a highly renewable resource compared to trees used for wood or paper. Bamboo requires less water, no pesticides, and fewer resources to grow. Its cultivation has a smaller environmental footprint compared to traditional packaging materials like plastic or hardwood. Despite its lightweight nature, bamboo is incredibly strong and durable, providing sturdy packaging that can protect goods during transport and storage.

Despite its lightweight nature, bamboo is incredibly strong and durable, providing sturdy packaging that can protect goods during transport and storage. Many bamboo-based packaging materials can be recycled, supporting a circular economy and further reducing environmental impact.

The recyclable packaging segment accounted for a significant share of the sustainable secondary packaging market in 2024. Consumers are increasingly aware of the environmental impact of single-use plastics and non-recyclable materials. They are demanding eco-friendly alternatives to reduce pollution and conserve natural resources. Many companies are adopting sustainability initiatives to reduce their carbon footprint and meet environmental, social, and governance (ESG) standards. Recyclable packaging is a visible way to demonstrate commitment to sustainability.

Eco-conscious consumers prefer products with recyclable or biodegradable packaging, often choosing these over less sustainable alternatives. This shift in consumer behavior is driving businesses to offer more sustainable packaging. Environmental organizations and activists are advocating for reduced waste and better recycling systems. This public pressure influences companies to adopt recyclable packaging.

The reusable packaging segment is expected to grow at the fastest rate in the market during the forecast period of 2024 to 2034. The reusable secondary packaging minimizes the need for constant replacement, lowering long-term costs associated with single-use materials. It minimizes waste disposal expenses; as fewer materials are discarded. Reusable packaging helps industries meet sustainability goals by reducing waste and resource consumption. It aligns with environmental regulations and corporate responsibility initiatives.

These materials are often made from sturdy materials like plastic, metal, or wood, providing better protection for goods during transit and storage. They reduce damage to products, especially in logistics-intensive industries. Reusable packaging is designed for repeated use, often standardized for compatibility with automated handling systems, such as forklifts and conveyor belts.

The food & beverage segment registered its dominance over the global sustainable secondary packaging market in 2024. Consumers increasingly prefer products with eco-friendly packaging due to heightened awareness of environmental issues. Brands in the food and beverages sector are adopting sustainable secondary packaging to meet this demand and differentiate themselves in the market. Governments worldwide are imposing stricter regulations on packaging waste, especially single-use plastics. The food and beverage industry, being a major packaging user, is adopting sustainable secondary packaging to comply with these regulations.

Sustainable secondary packaging, such as reusable crates, pallets, and boxes, improves supply chain efficiency by reducing waste and enhancing durability. In the food and beverage sector, where supply chains are extensive and time-sensitive, durable and reusable packaging ensures better product protection and cost savings. The surge in online food and beverage sales requires robust secondary packaging for shipping and handling. Sustainable options are increasingly used to meet consumer expectations for eco-friendly practices in e-commerce. The reusable crates are used for transporting fruits, vegetables, and dairy products.

Corrugated cardboard is used for shipping dry goods like cereals and snacks. Compostable packaging for eco-friendly food delivery services. Returnable beverage containers are used for beer, water, and other drinks. As the food & beverages sector continues to grow and innovate, its reliance on sustainable secondary packaging is expanding, driven by consumer expectations, regulatory requirements, and the need for cost-effective, eco-conscious solutions. This symbiotic growth fuels demand in both industries.

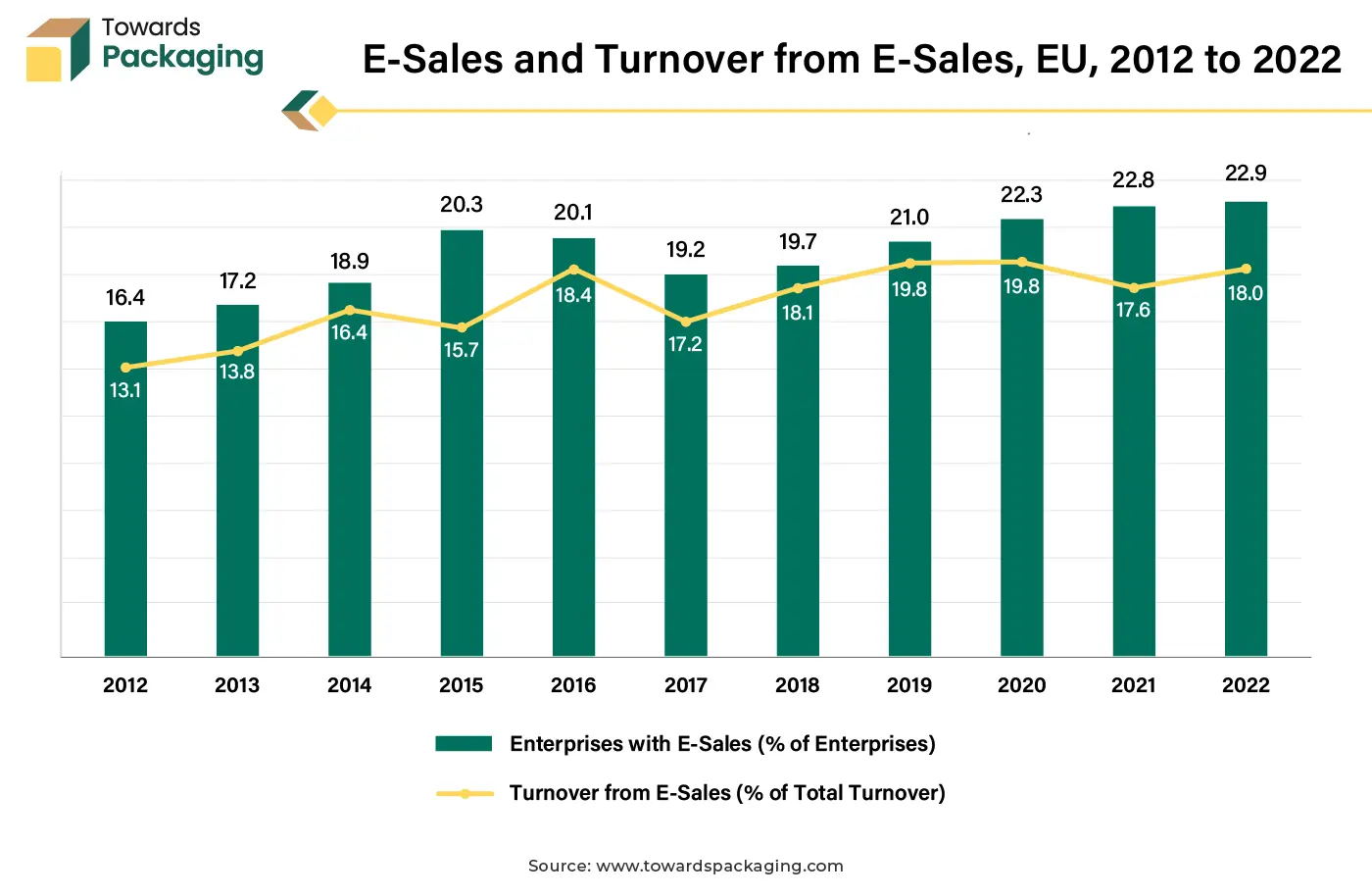

The retail & e-commerce segment is projected to expand rapidly in the market in the near future. E-commerce relies heavily on secondary packaging (boxes, cushioning materials, and protective layers) to ship products safely. As the volume of online orders grows, the demand for sustainable alternatives to traditional packaging materials (e.g., plastics) increases to reduce environmental impact. E-commerce customers are becoming more conscious of the environmental footprint of their purchases. Brands that adopt sustainable secondary packaging appeal to eco-conscious consumers and gain a competitive edge in the market. Governments worldwide are implementing stricter regulations to reduce single-use plastics and encourage recycling. E-commerce companies are incentivized to switch to sustainable secondary packaging to comply with these regulations and avoid penalties.

Leading e-commerce platforms and logistics providers are committing to sustainability goals, including using eco-friendly packaging materials. For example, companies like Flipkart, Amazon, and Alibaba have launched initiatives to minimize plastic waste and adopt sustainable packaging solutions. Sustainable secondary packaging, such as lightweight biodegradable materials or reusable options, reduces shipping costs by lowering the weight and volume of shipments. Durable and reusable materials also decrease breakage rates, further improving cost efficiency for e-commerce businesses. E-commerce platforms and brands use sustainable secondary packaging to differentiate themselves and reinforce their commitment to environmental stewardship. Customizable, eco-friendly packaging enhances brand recognition and customer loyalty.

Asia Pacific region dominated the global sustainable secondary packaging market in 2024. Rising environmental consciousness among consumers in the region, especially in countries like China, India, and Japan, is driving demand for sustainable packaging. Increasing awareness of the harmful effects of non-recyclable and non-biodegradable materials has led to a preference for eco-friendly packaging solutions. Asia Pacific region's fast-paced urbanization and growing e-commerce industry are boosting demand for secondary packaging to ensure the safe and efficient transportation of goods. Countries like China, Japan, and South Korea are significant contributors to the packaging demand due to their advanced logistics and retail sectors.

Asia-Pacific is a hub for innovation, with investments in research and development for sustainable materials like biodegradable plastics, recycled paper, and reusable materials. Countries such as Japan and South Korea lead in the development of smart, sustainable packaging solutions.

Many countries in Asia-Pacific have deep-rooted traditions of using natural materials for packaging, such as bamboo, jute, and banana leaves, influencing modern sustainable practices.

Europe region is anticipated to grow at the fastest rate in the sustainable secondary packaging market during the forecast period. Europe's dominance in the sustainable secondary packaging industry stems from its advanced regulatory framework, strong environmental consciousness, and industry innovation. The European Green Deal, aiming for carbon neutrality by 2050. The Packaging and Packaging Waste Directive (PPWD), mandating recycling targets and sustainable packaging standards. The Single-Use Plastics Directive, banning certain non-recyclable materials. These policies compel businesses to adopt sustainable secondary packaging solutions. Europe strongly emphasizes the circular economy, promoting the reuse, recycling, and reduction of waste in packaging materials.

European consumers prioritize sustainability and are willing to pay a premium for eco-friendly products. European companies, including multinationals, prioritize sustainability in their business models and packaging strategies. Retail giants like Tesco, Carrefour, and IKEA have adopted strict sustainable packaging guidelines has driven the growth of the sustainable secondary packaging market in the European region.

In partnership with Sonoco, Marigold Health Foods has introduced its completely recyclable packaging for a range of natural, plant-based food items, such as sauces, stock cubes, and meat and fish substitutes.

By Material

By Type

By Application

By Region

December 2025

December 2025

December 2025

December 2025