April 2025

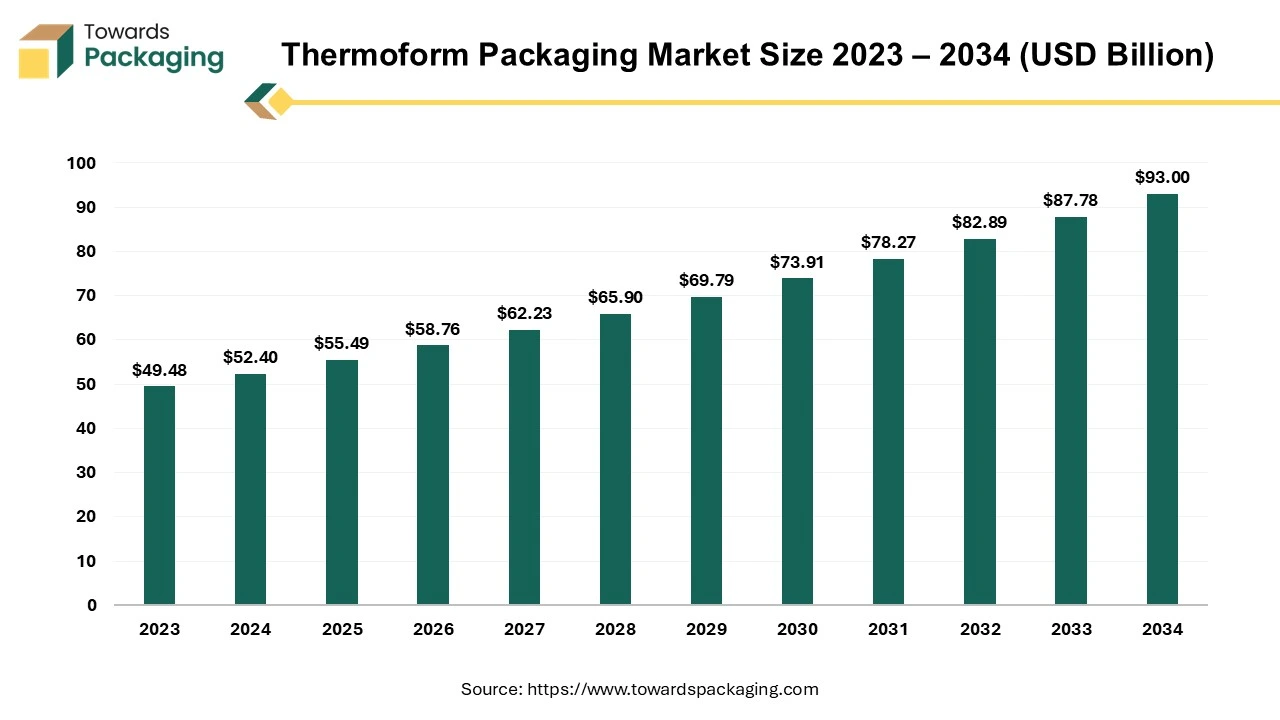

The global thermoform packaging market size to hit USD 93 billion by 2034, growing from USD 52.40 billion in 2024, expanding at 5.9% CAGR from 2024 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The thermoform packaging market is a thriving segment within the broader packaging industry, characterized by utilizing a specialized manufacturing process known as thermoforming. A plastic sheet is heated to a malleable forming temperature, shaped inside a mould, and then cooled to produce the finished product. The market encompasses a diverse range of packaging solutions, including blister packs, clamshells, trays, and various containers, catering to the needs of food and beverage, pharmaceuticals, electronics, and retail industries. One of the key drivers of the thermoform packaging market is its adaptability and versatility. Thermoforming allows the creation of custom-designed packaging with a wide range of plastic materials, such as polyethene, polypropylene, and polystyrene. This flexibility makes it a preferred choice for manufacturers looking to achieve specific design requirements and ensure product visibility. Furthermore, the ability to integrate advanced technologies, such as robotics and automation, has enhanced the thermoforming process's precision, speed, and efficiency, contributing to the market's growth.

The market has recently witnessed a trend towards sustainability and lightweight packaging. With increasing awareness of environmental concerns, thermoform packaging manufacturers are exploring eco-friendly materials and adopting practices that minimize the environmental impact of their products. The European plastics industry has goals and strategies to support the plastics industry, including developing novel solutions for packaging procedures. Up to 60% more plastic recycling and reusing are the goals of new solutions through 2030.

Moreover, the thermoform packaging market is characterized by ongoing innovations in design and graphics. Advanced tools and technologies, including 3D modelling and virtual prototyping, are being employed to create visually appealing and functional packaging solutions. This emphasis on design enhances the aesthetic appeal of products and contributes to brand differentiation in a competitive market landscape. As the demand for efficient and visually appealing packaging solutions grows across various industries, the thermoform packaging market is poised for further expansion, driven by technological advancements, sustainability considerations, and the continual pursuit of enhanced packaging design and functionality.

The adoption of Artificial Intelligence (AI) is steadily becoming a norm across many industries. The integration of AI into the thermoform packaging market is growing too. Utilization of AI in thermoform packaging has been a big boost in enhancing efficiency of production as well as quality control. With the AI technology, predictive maintenance, optimization of manufacturing process, real-time monitoring etc. has led to a noticeable reduction in downtime and decrease in labor costs. Features of this technology, for example, predictive maintenance helps in management of equipment that minimizes the risk of sudden breakdowns hampering productivity. Adoption of AI invariably encourages the rapid and scalable production capacities of the infrastructure. This technological advancement helps in cost reduction, but also provides support for the development of complex and more customized solutions in packaging.

| Trends | |

| Robotics Integration for Efficiency | The thermoform packaging industry is witnessing a notable trend towards integrating robotics and automation. Companies are increasingly adopting robotic systems in various stages of the thermoforming process, from material handling to packaging assembly. This enhances operational efficiency and ensures precision and consistency in the production of thermoformed packaging. Robotics is particularly valuable in tasks requiring high repeatability and speed, contributing to cost-effectiveness and improved production workflows. |

| Inventory Control Optimization | In response to the dynamic market demands, thermoform packaging companies optimize inventory control through advanced technologies. Implementing sophisticated inventory management systems enables better control over raw materials and finished goods, reducing waste, and ensuring timely production. This trend emphasizes the importance of real-time data analytics and intelligent inventory tracking systems to streamline supply chain processes and respond promptly to market fluctuations, enhancing business agility and competitiveness. |

| Improved Tools in Packaging Design and Graphics | Thermoform packaging design is evolving with the integration of advanced tools and technologies. Designers leverage innovative tools from 3D modelling to virtual prototyping to create visually appealing and functional packaging solutions. Enhanced graphics and printing technologies further contribute to brand differentiation and consumer engagement. This trend signifies a shift towards more collaborative and creative design processes, enabling companies to deliver customized and aesthetically pleasing thermoformed packaging solutions that align with evolving market preferences. |

| Lightweight Packaging and Sustainability Focus | Sustainability is a critical driver in the thermoform packaging market, leading to a significant trend towards lightweight materials and eco-friendly practices. Manufacturers are exploring alternative materials with reduced environmental impact while maintaining the integrity and functionality of packaging. This shift aligns with consumer preferences for sustainable products and contributes to companies meeting their corporate social responsibility goals. As sustainability becomes a more significant factor in purchasing decisions, thermoform packaging businesses are adopting practices prioritizing environmental responsibility, including recycling initiatives and developing biodegradable packaging options. |

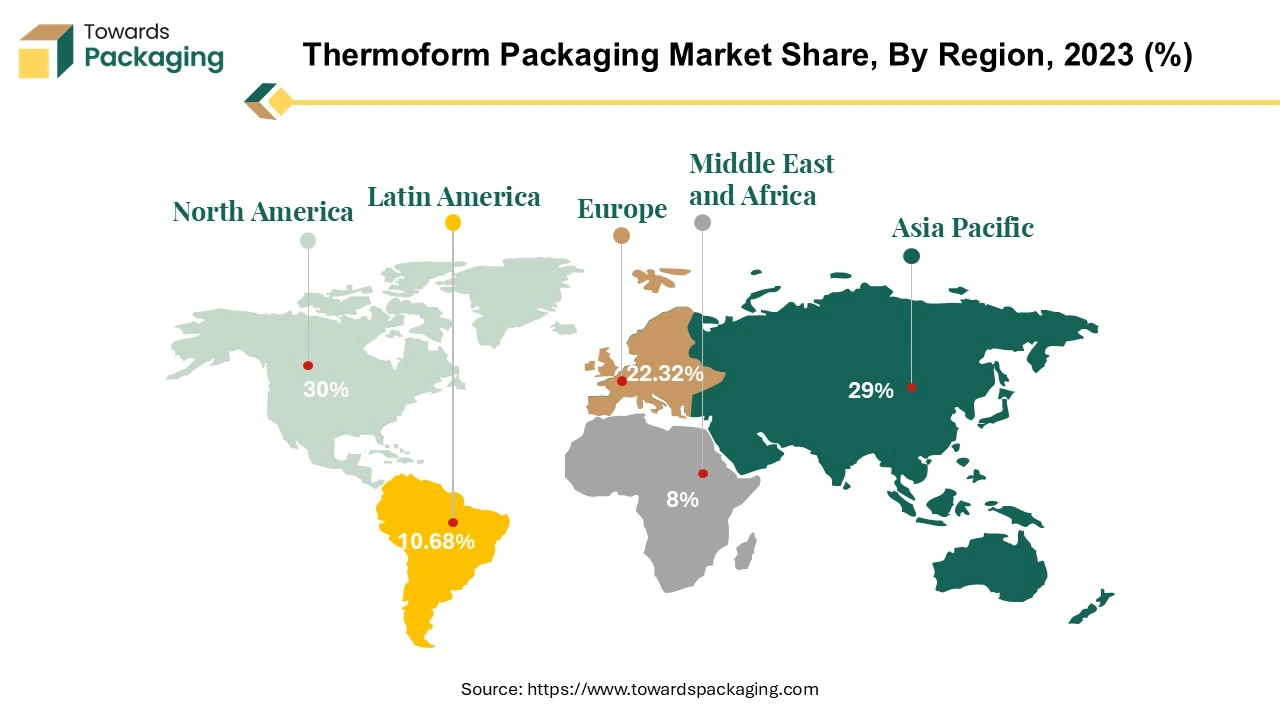

North America emerges as a stronghold in the ever-evolving landscape of thermoform packaging, playing a pivotal role as a primary end market for thermoforms. The packaging sector within the region has become a dynamic arena, constantly shaped by factors such as changing retail environments, an increased emphasis on health and safety precautions, and, most significantly, the ever-changing preferences of consumers. In response, the thermoform packaging industry in North America has undergone substantial technical evolution, continually adapting packaging designs and materials to meet the market's evolving needs while providing enduring value to consumers.

Despite its relatively modest footprint within the plastics processing sector, North America has witnessed remarkable strides in the thermoforming process. Tooling, machinery, and materials improvements have transformed thermoforming into a viable alternative for applications that might have been overlooked. This transformation underscores the industry's commitment to innovation and its determination to deliver value by staying responsive to consumer demands. Flexpak holds the 81st position in Plastics News' North American thermoforms ranking, reporting sales amounting to $11 million. Nelipak secures the 42nd spot on the list, with estimated sales in North America reaching $30 million.

A notable trend amplifying North America's influence is the resurgence of manufacturing, known as reshoring. The United States, in particular, is experiencing a revival in manufacturing activities, with work returning to the region from Asia. This reshoring phenomenon significantly impacts the thermoform packaging market, contributing to its growth and dynamics. A prime example is Direct Pack, Inc. (DPI), a sustainability-focused leader in thermoformed plastic packaging, expanding its North American manufacturing operations with the opening of Direct Pack Baja in Mexicali, Mexico. This strategic move positions the company to better serve its North American customer base by providing products manufactured in the region, enhancing resilience in the face of current global supply chain challenges. The expansion exemplifies the industry's adaptability and responsiveness to market demands, reinforcing North America's pivotal role in the evolution of thermoform packaging.

For Instance,

The Asia Pacific region has witnessed a remarkable ascent as a prominent player in the thermoform packaging market, showcasing substantial growth and a burgeoning market presence. The region's economic dynamism, burgeoning population, and evolving consumer preferences have fueled the demand for advanced packaging solutions, driving the adoption of thermoform packaging methodologies. China, in particular, is spearheading advancements in packaging technologies and embracing sustainable material science, thereby elevating the standards within the region.

The Asia Pacific thermoform packaging market has experienced significant expansion in recent years, fueled by increased industrialization, urbanization, and a robust manufacturing sector. The demand for diverse and innovative packaging solutions, especially in the food and healthcare industries, has driven the adoption of thermoformed packaging technologies. Moreover, the region's responsiveness to global sustainability trends has led to a growing emphasis on eco-friendly and recyclable packaging materials, aligning with the broader shift towards environmentally conscious practices.

As the Asia Pacific region embraces modern packaging solutions, it has become a focal point for key industry players and investors seeking strategic opportunities. Countries within the region, such as China and India, are emerging as significant contributors to the thermoform packaging market, leveraging their manufacturing capabilities and expanding consumer markets. While the North American market remains a leader in thermoform packaging, the Asia Pacific region is establishing itself as a formidable second leader, offering market potential, technological advancement, and a growing commitment to sustainable packaging practices. The evolving landscape in the Asia Pacific signifies a dynamic market poised for continued growth and innovation in the thermoform packaging sector.

For Instance,

The PET thermoform packaging market has ascended as a dominant force on the global stage, driven by the widespread adoption of post-consumer recycled PET in both food and non-food packaging applications. Over the past five years, the momentum in recycling PET thermoforms has gained substantial traction, exemplified by the U.S. achieving a milestone of recycling 139 million pounds of PET thermoform packaging. This underscores the industry's commitment to sustainable practices and circular economy principles.

One of the key factors propelling the prominence of PET thermoforms is their ability to provide higher value at a lower cost, coupled with reduced greenhouse gas emissions compared to alternative packaging materials such as laminated cartons, bagasse (pulp), and paper- and wood-fibre moulded materials. The thin yet durable sidewalls of PET thermoform contribute to material efficiency and result in lightweight packaging. Moreover, these thermoforms are thoughtfully designed with user-friendly features such as easy-to-open and tamper-evident attributes, streamlining the recycling process.

As an end-user of post-consumer recycled PET, PET thermoforms play a crucial part in sustainable packaging practices. Annually, more than 139 million pounds of post-consumer recycled PET is channelled into producing new thermoforms in the U.S., serving as protective packaging for a diverse range of products, including food items. The PET thermoform market has fostered a comprehensive value chain from package manufacturers and retailers to recycling collectors, Material Recovery Facility (MRF) operators, PET reclaimers, and recycled PET end-users.

The sustainability focus within the PET thermoform industry is further underscored by a remarkable 68% growth in collections for recycling. Reclaimers, representing the majority of U.S. capacity, consistently process PET thermoforms alongside PET bottles, highlighting the industry's commitment to maximizing the use of recycled materials. As the global demand for sustainable packaging solutions intensifies, the PET thermoform market is poised to continue its trajectory of growth and innovation, solidifying its position as a frontrunner in the packaging industry.

PP materials are growing in demand in the market due to their significance and easy availability. The fundamentals of PP, its modifications, and its advancements are demonstrated using a drinking cup. Furthermore, the conversation will cover all significant influences on the properties of PP film and its thermoformability because it covers the various processing settings used in the PP film production process. Over 30 million tonnes of PP are needed globally, with typical annual growth rates of 6% to 7%. Western Europe, North America, and Asia meet seventy per cent of this demand. The three primary industries using these applications are consumer goods, the food sector, and the automobile industry.

For Instance,

The food and beverage industry stands as a paramount end-user, focusing on delivering consistent and high-quality packaging solutions. Thermoform fill-and-sealing machines play a pivotal role in manufacturing packages, such as cups and bowls, catering specifically to the discerning needs of the food industry. The consumer expectation for reliably superior packaging quality necessitates seamless machinability of the diverse range of films employed in these thermoforming processes. Many plastic films are currently in use, each chosen based on its suitability for specific applications and products. For Instance, the production of yoghurt cups predominantly relies on PET (polyethene terephthalate), PS (polystyrene), and PP (polypropylene) films. These materials are selected for their unique properties that contribute to the packaging's durability, transparency, and overall appeal.

When delicate food products requiring an extended shelf life are in question, using multilayer films becomes imperative. These films incorporate a barrier layer to shield the contents primarily from ambient oxygen. Products such as coffee cream, condensed milk, soups, convenience foods, and baby food benefit from the protective properties of these specialized films, ensuring the preservation of freshness and quality.

For Instance,

The thermoform packaging market's dedication to meeting the specific requirements of the food industry underscores its commitment to innovation and adaptability. By continually optimizing the machinability of various plastic films and tailoring packaging solutions to the unique needs of different food products, thermoform packaging remains a critical driver in enhancing the efficiency and quality of food packaging within the broader food and beverage sector of plastic films and the incorporation of advanced packaging technologies ensure that the thermoform packaging market continues to meet and exceed consumer expectations in terms of consistency, quality, and adaptability across a wide array of food products.

The market for thermoforming packaging machines is evolving rapidly due to key trends that reflect the shifting landscape of packaging solutions. Here’s a look at the major trends influencing this sector:

From material point of view, the PET segment dominated the market in the year 2023. The PET materials have features like – light weight, high tensile strength, and recyclability which makes this material is desirable choice for packaging. This material does not absorb much water and thus, has no interaction with the food or beverages, making it a safe choice for packaging. For thermoform packaging, PET grades such as C-PET, R-PET and A-PET are widely used. Recycled Polyethylene Terephthalate (R-PET) is becoming popular due to its sustainable properties which caters to eco-friendly packaging solutions. Amorphous Polyethylene Terephthalate (A-PET) has translucent properties that find utility in packaging for bakery or confectionary good which can be displayed. C-PET i.e. crystalline polyethylene terephthalate is commonly used for frozen food or oven-ready food packaging as it is capable of withstanding high temperatures. Such properties of these materials will help PET materials segment to continue its domination during the forecast period.

On the basis of product, the containers segment held the highest revenue share of the market globally. The rapid growth of food and beverage industry worldwide has been a big factor directly affecting this segment’s rise. The rising usage of thermoformed containers in the food service industry was a major contributor for this segment’s growth. The growing food service industry especially in the emerging countries, will help aiding the growth of this segment during the forecast period. The use of clamshells’ for higher visual appeal will help this product segment grow rapidly in the forecast period.

The food and beverage sector is the primary end-use industry for the thermoform packaging market. Thus, this end user segment holds the biggest share of the market. The wide use of different items such as trays, containers, clamshells etc. in the packaged food and food service industry has helped propel this segment’s growth. The incredible growth of the food and beverage industry due to changing consumer patterns has been a big push for the thermoform packaging market. The continuous growth of this industry combined with upcoming sustainable packaging solutions will elevate this segment’s growth in the forecast period.

The market for thermoform packaging marker is characterized by intense competition because there are several key players such as Amcor, Placon Corp., Sonoco Products Company, Dart Container Corp., Pactiv LLC, Tray-Pak Corp., Constantia, Lacerta Group, Inc., D&W Fine Pack, Silgan Holdings, Inc., RPC Group Plc, Rompa Group, Display Pack Inc. and others. This market has a medium level of market concentration, and several major players are present, using tactics such as product innovation, acquisitions, and mergers to obtain a competitive edge. The market players are significantly impacting environmental development by adopting sustainable packaging and creating consumer awareness through innovative packaging materials.

By Material

By Product

By Heat Seal Coating

By End User

By Geography

April 2025

April 2025

April 2025

April 2025