April 2025

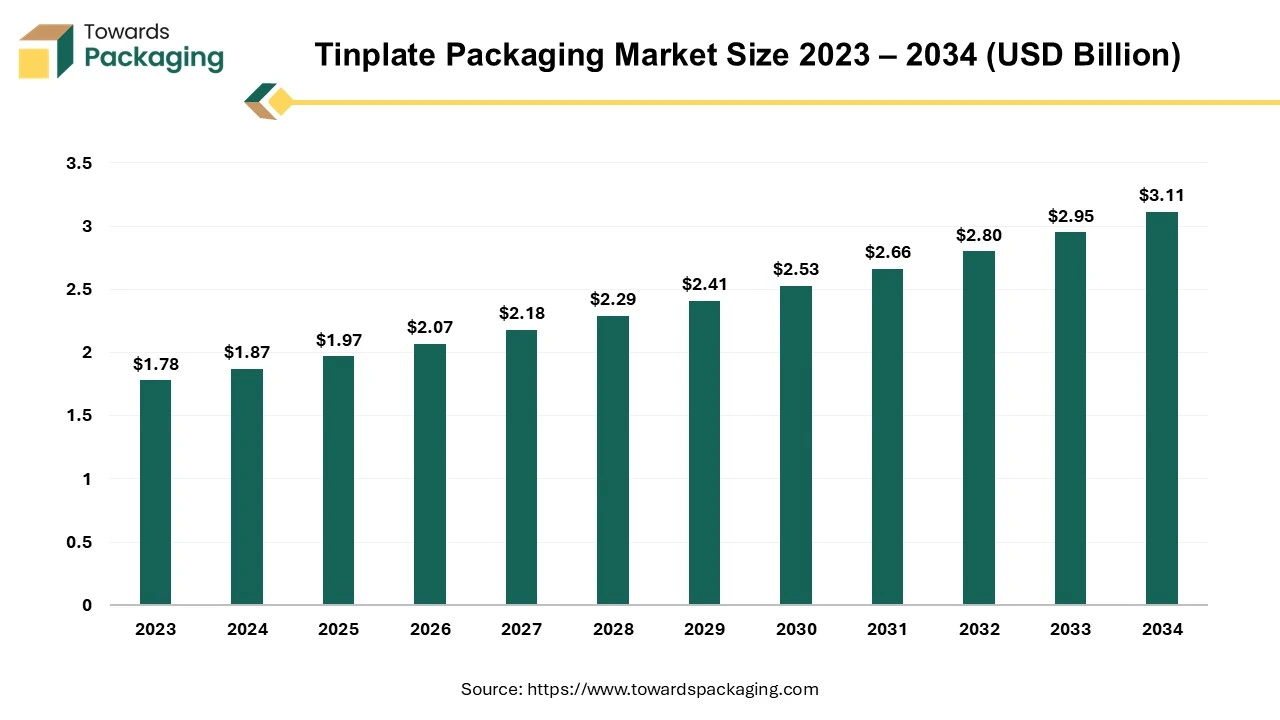

The tinplate packaging market is forecasted to expand from USD 1.97 billion in 2025 to USD 3.11 billion by 2034, growing at a CAGR of 5.17% from 2025 to 2034.

The tinplate packaging market is set to grow prominently during the forecast period. Tinplate is a thin sheet of steel or iron metal with a tin coating deposited by electroplating or dipping. Tinplate is a highly effective packaging material due to its efficient recycling systems and excellent recycling qualities. As packaging steel is so prevalent in daily life—for instance, as jar and bottle tops, aerosol spray cans, food and drink cans and packaging for chemical and technical products, thus individuals can have a significant impact on the circular economy. Additionally, by selecting tinplate packaging, companies may easily promote multiple recycling and a complete material cycle by simply placing the used tinplate packing into the recycling bin.

The increasing focus on the sustainability and the rising demand for the premium and aesthetically appealing packaging in the luxury goods sector are expected to augment the growth of the tinplate packaging market during the forecast period. Furthermore, the growth in the ready-to-eat and processed food segments coupled with the surge in the e-commerce segment is also likely to support the growth of the market. Additionally, the growing consumer preference for long-lasting and protective packaging as well as the stringent regulations regarding food safety and packaging materials is also projected to contribute to the growth of the market in the years to come. The packaging market size is growing at a 3.16% CAGR.

The increasing demand from end-use industries such as food and beverages, chemicals and cosmetics, among others is projected to support the growth of the tinplate packaging market during the forecast period. In the food, beverage and other industries, tin containers are a common choice of packaging. Tinplate packaging has a longer shelf life, which is one of the main benefits when it comes to storing the food.

Tin packaging greatly slows down the process of the food deterioration, thus guaranteeing that the food stays fresh for extended period of time. It is also airtight as well as resistant to the external elements such as the light and the humidity. The capacity of the tin packing to preserve the food's nutritional value is an additional advantage. Food that is kept in the tin packaging retains its nutritional value since the vital nutrients are sealed inside. Tin containers are also utilized for transporting items across large distances. Food cans are utilized to store food such as the ready meals, pet food, fruit, veggies, soup, meat, fish and olive oils, among others.

Furthermore, as far as the production complies with regulatory regulations, it is also feasible to package medications in tinplate. Additionally, due to their easy operation and straightforward use, aerosol or spray cans have been widely used in both daily life and industrial production. Some examples of such products include pesticides, paint aerosols, deodorants, cosmetics and hair care products, shaving foams, rust removers, car care items, antifreeze, air fresheners and more. These tin aerosols can be formed into a variety of shapes that complement the identity of the brand.

Additionally, tinplate is used not just to make can ends but also to make bottle closures, such as crown corks with their distinctive corrugated rims and cork or plastic pad sealant that creates a tight, hermetic seal once applied to a bottle. Tinplate pressed from sheet is also used to make twist-off closures. As these industries continue to grow owing to the urbanization, rising disposable incomes as well as changing consumer lifestyles, demand for the tinplate packaging is also likely to surge, establishing its position as an essential component in the global packaging ecosystem.

The availability of different alternative packaging materials and options is anticipated to hamper the growth of the tinplate packaging market within the estimated timeframe. For example, plastics are a feasible substitute to tinplate owing to its cost-effectiveness, lightweight design and adaptability. Even though glass packaging is more delicate and heavier, it is regarded as high-end and is frequently utilized for products where luxury and visual appeal are important, like in the alcohol and cosmetics sectors.

Nothing in contact with glass will be impacted or changed since it is a non-reactive material. This characteristic is particularly vital for the protection of the contents of the container. A sealed glass jar with the right closure prevents air from entering or leaving, keeping contents dry, safe and fresh. Glass packaging is currently accepted by the consumers as one of the recyclable and sustainable options available.

Furthermore, flexible packaging has also gained popularity. This kind of packaging is used to make storage bags, pouches and other products across industries like the food and beverage, pharmaceutical, and cosmetics, among others. Numerous products are distributed, marketed, and secured using flexible packaging. The affordability of flexible packaging is among its one of the primary benefits. Brands don't have to go over budget to pack their products in an elegant and useful way.

Furthermore, flexible packaging saves producers cost on shipping since it is lightweight. Other factors also contribute to the growing popularity of flexible packaging. Due in large part to their lower production and shipping costs as well as their capacity to meet the growing demand for convenience, these alternatives is popular with both manufacturers and the customers. The increasing inclination towards substitute materials has the potential to decrease the market share of tinplate packaging, especially in markets with limited budgets where material efficiency and cost are important factors.

The shift towards sustainability and capability of recycling is expected to create opportunities for the growth of the tinplate packaging market in the near future. Tinplate has an excellent environmental balance when it comes to the packaging materials. It is nearly 100% recyclable, infinitely reusable and doesn't even lose quality when recycled. Tinplate is a recycling pioneer and a promoter of the circular economy; in 2020, the rate of recycling for the tinplate from residential buildings in Germany was 91.4%. Since tin is fully recyclable, meaning it can be processed as well as put back into the production cycle without losing its quality, it is regarded as a sustainable packaging substrate.

Tin recycling rates have reached over 90% in several countries globally, which is evidence of the metal's recyclability. At the end of the recycling process, tin remains capable of being melted down and repeatedly reformed when utilized as a coating over other metals. It is a magnetic metal as well. Tin cans therefore are readily and swiftly removed from the streams of waste. Tin is a great option for the high-end and luxury firms who want to increase their sustainability standards without sacrificing the premium feel and appearance of their packaging.

Additionally, if today's consumers properly segregate their garbage and recycle their cans, these cans may one day be used as parts of a bike and another day as parts of a car. By assuring that packaging metal is recycled for both the industrial sectors as well as the private sector; companies are contributing to the successful closure of the material cycle.

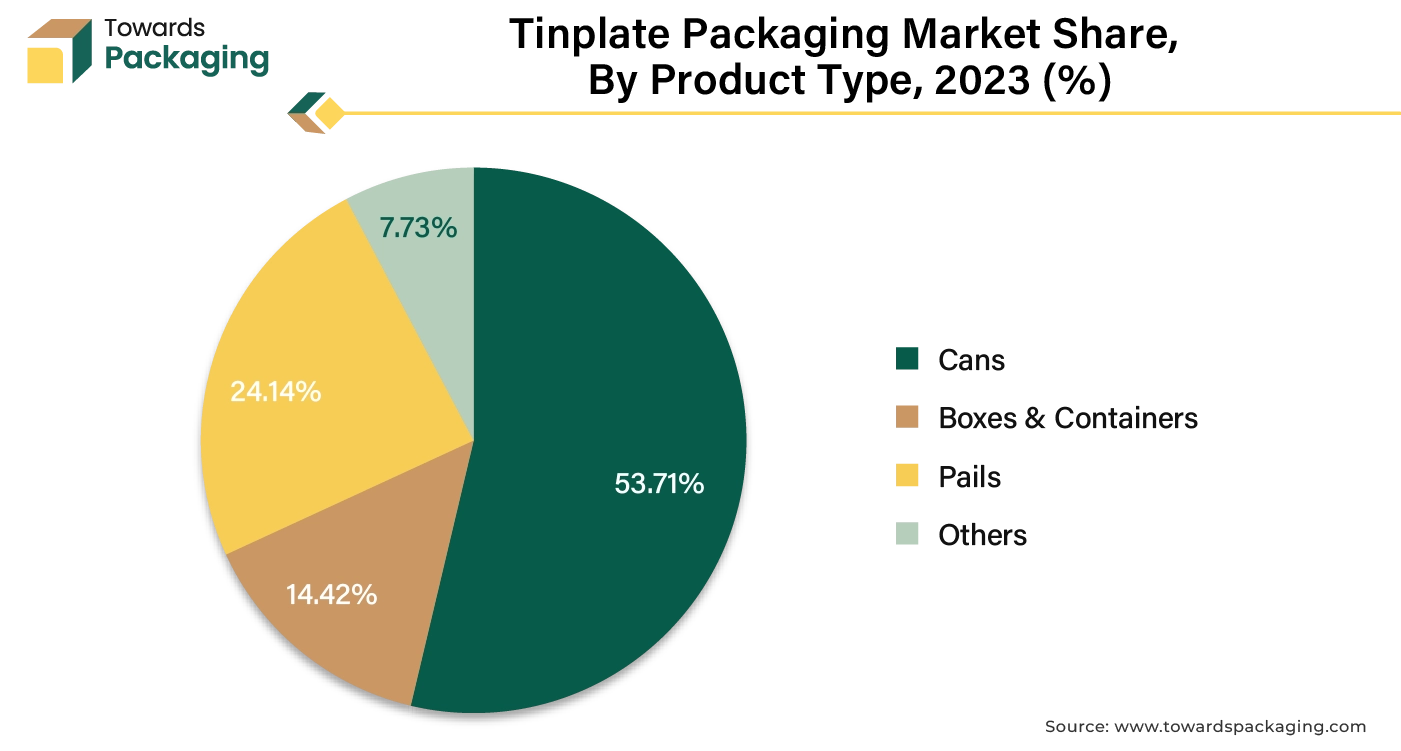

The cans segment captured largest market share of 53.71% in 2024. This is owing to the widespread use of tinplate cans in the food and beverage industry, particularly for the canned foods, soft drinks and the alcoholic beverages. Thick cans are used to preserve things like beef, tuna and sardines, whereas the thinner cans are utilized to store beverages. Typically used for tuna, sardine, and ready-meal cans, single-drawn cans are produced in a single drawing procedure.

Large, tall cans known as "drawn and redrawn" are typically used to store bulk foods like salmon and canned fruit. Cans marked Drawn and Wall-Ironed, or DWI, are frequently utilized for beer and other beverages. Furthermore, tin cans are also widely used for aerosol packaging, which includes products like deodorants, air fresheners, spray paints, insecticides and hair sprays. It is frequently used as a sustainable substitute for the conventional plastic products.

The beverage segment held largest market share in 2024. This is owing to the increasing consumption of both alcoholic as well as non-alcoholic beverages across the globe. Cans are becoming more and more common in drink packaging since they can be recycled, utilized for products other than carbonated beverages and they can also be manufactured at a low cost. Drink packaging serves as a link between a product and its consumers, acting as a mediator beyond its external appearance. It is essential to stand out from the competition on the shelves and in online stores in order to generate interest, engagement and sales from the customers as well as establish brand awareness. In the end, the goal is to prevent customers from passing by or scrolling by. Packaging is altering in response to the changing consumer demands as a way to remain competitive in the drink categories. Traditionally associated with sodas, the simple can is now being utilized for beer and functional beverages, among other types of drinks.

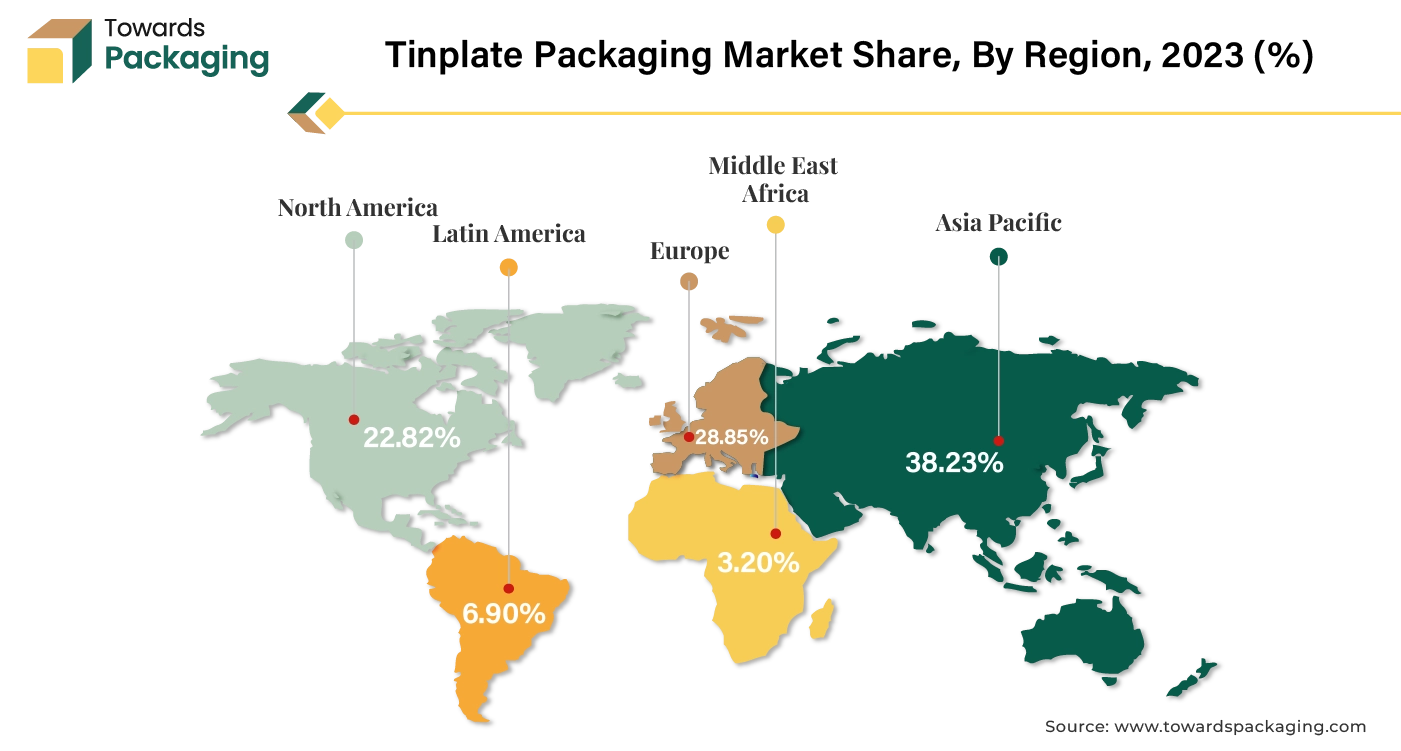

Asia Pacific held is likely to grow at fastest CAGR of 7.01% during the forecast period. This is owing to the rising disposable income that is leading to increased demand for packaged food, beverages, and consumer goods across the region. Additionally, the growing food and beverage sector in countries like China, India and Japan along with the rapid expansion of e-commerce industry are also anticipated to promote the growth of the market in the region in the years to come. China's leading beverage manufacturers saw double-digit output increases in 2021. Major beverage makers saw a 12 percent year-over-year increase in output in 2021, reaching over 183 million tons, as reported by the Ministry of Industry and Information Technology. The beverage output reached 13.59 million tons in December 2021 alone, an increase of 8.3 percent from the previous year.

North America held considerable market share of 22.82% in 2024. This is due to the well-established recycling infrastructure along with the strong consumer and regulatory focus on sustainability and reducing environmental impact across the region. Also, the mature food and beverage industry is further expected to support regional growth of the market in the years to come. Furthermore, the growing consumer demand for convenient, long-lasting products, such as canned goods and beverages as well as the changing lifestyle is also expected to support the regional growth of the market in the near future.

By Product Type

By Thickness

By End Use

By Region

April 2025

April 2025

April 2025

April 2025