April 2025

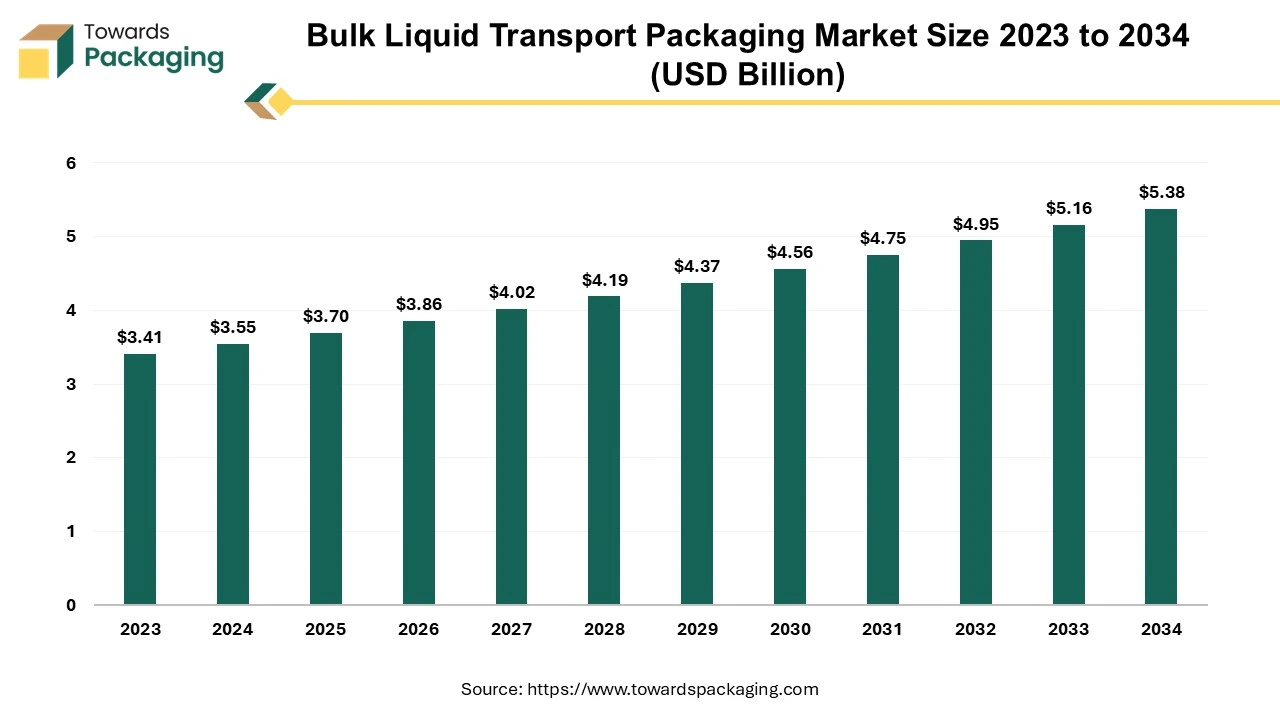

The bulk liquid transport packaging market is forecast to grow from USD 3.70 billion in 2025 to USD 5.38 billion by 2034, driven by a CAGR of 4.23% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

The bulk liquid transport packaging market is likely to witness strong growth over the forecast period. Bulk liquid transport packaging is important for sectors that handle huge amounts of liquids such as chemicals, food and drinks and pharmaceuticals. Liquids can be transported and stored in a variety of containers such as drums and barrels, tank containers, flexitanks, rigid IBC tanks and flexible IBCs. The qualities of the liquid to be carried or stored, as well as the circumstances between the sender and the recipient (such as the route and local infrastructure), will determine which container is appropriate.

The increasing global trade of liquid goods such as the chemicals, food products and pharmaceuticals are expected to augment the growth of the bulk liquid transport packaging market during the forecast period. Furthermore, the rise in industrialization and urbanization in emerging markets along with the growing focus on sustainability is pushing industries toward eco-friendly packaging options such as reusable intermediate bulk containers (IBCs) and flexitanks.

The expansion of e-commerce in the food and beverage sector as well as the increasing adoption of automation in manufacturing and logistics is also projected to contribute to the growth of the market in the years to come. The packaging industry size is growing at a 3.16% CAGR.

The rise in international trade, especially in chemicals, food and beverages are projected to support the growth of the bulk liquid transport packaging market during the forecast period. This is owing to the increasing interconnectedness of economies, innovations in transportation and increase in the cross-border movement of components, raw materials and finished goods. This year, the growth of global trade is expected to more than double due to low inflation and a robust US economy.

Global trade in products and services is expected to increase by 2.3% this year and 3.3% in 2025, according to the Organization for Economic Co-operation and Development (OECD). This is a growth rate that is more than double that of 1% in 2023. The World Trade Organization (WTO) predicts that following a notable fall last year, the volume of world commerce (goods) trade will increase by 2.6% and 3.3% in 2024 and 2025, respectively.

The International Monetary Fund's (IMF) most recent World Economic Outlook forecasts global trade growth of 3% and 3.3% in 2024 and 2025, respectively, after reviewing down the earlier projections. As international trade expands, there is an increasing demand for the economical packaging options capable of transporting huge volumes of liquids across great distances. The purpose of bulk liquid packaging options such as the intermediate bulk containers (IBCs), is to minimize the risk of product degradation, contamination as well as the leakage while guaranteeing the safe and effective international transportation of a variety of liquid products. This is particularly important for the chemical industry since hazardous materials need to be packaged in accordance with the strict international safety regulations.

The risk of leakage and contamination is expected to hamper the growth of the bulk liquid transport packaging market within the estimated timeframe. Even with the improvements in the packaging design, spills and leaks can still happen in transit, especially when sensitive or hazardous liquids like chemicals and pharmaceuticals are being transported. Though flexitanks are a common and inexpensive option but they are more prone to rupture or puncture compared to the rigid containers like drums or intermediate bulk containers (IBCs).

Also, for loading and unloading, very viscous liquids such as the oil and syrups might need extra heating and specific equipment. This could increase the complexity along with the costs associated with the transportation. A rupture might risk both the quantity and quality of the liquid by causing considerable product loss. Handling the complicated logistics which is important to deliver the liquid bulk material is another difficulty. Careful planning as well as cooperation is needed to manage the infrastructure constraints, navigate regulatory requirements and coordinate the flow of the huge volumes of liquids across various transportation modes.

Furthermore, despite intermediate bulk containers are widely recognized for their adaptability and effectiveness in the service applications, there are some possible disadvantages to these containers. When fully loaded, IBC containers can weigh a lot, which makes moving them difficult without a suitable vehicle or the right tools. Also, even though IBCs can withstand a variety of chemical substances, but over time some substances may degrade and harm the containers. Additionally, the size, materials used in construction and intended purpose of used IBCs can make disposal challenging. The integrity of the tank may be compromised as a result, so it's important to confirm the chemicals and IBC compatibility with the material before using it. These factors are further likely to restrict the growth of the market during the forecast period.

The growing demand in the agricultural sector is expected to create immense growth opportunities for the bulk liquid transport packaging market in the years to come. As the world population grows, there is more demand from the agricultural sector to increase the food production. As per the U.S. Department of Agriculture, in terms of the calories available for the consumption, the amount of the food produced by the entire global agriculture system rose by 61%. The average expenditure share for domestic food consumption worldwide is 40% in economies with low incomes and 22% in middle-income ones. Also, as per the data by the United Nations, the population of the globe has increased by more than three times since the middle of the 20th century.

After a projected 2.5 billion individuals in 1950, the world's population increased to 8.0 billion in the mid-November 2022, with an additional 1 billion since 2010 and 2 billion after 1998. The population of the world is expected to grow by almost 2 billion people over the course of the next 30 years, from the present 8 billion to 9.7 billion in 2050, with a potential peak of roughly 10.4 billion in the middle of the 2080s.

As large-scale farming operations increase around the world, particularly in the emerging countries, there is a growing demand for the efficient, cost-effective packaging options capable of carrying huge volumes of the liquid products. Bulk liquid packaging is increasingly being used to meet this demand, providing farmers and agrochemical manufacturers with a dependable option to transport these important commodities over large distances without affecting product integrity.

The IBCs segment captured considerable market share in 2024. An intermediate bulk container (IBC) is an industrial-grade reusable and recyclable container designed for the transportation and storage of bulk liquids. For bulk shipping companies, shipping materials may be a major expense; therefore the savings that IBCs provide can make all the difference. They can effectively ship huge volumes of commodities at once owing to their vast capacity, which enables effective shipping techniques. Since firms can ship a single container instead of multiple smaller ones, they are particularly useful for carrying bulk liquids that will eventually need to be portioned out into smaller containers for end consumers.

Furthermore, when compared to the single-use containers, the reusability of the IBCs reduces the production of waste. Companies can support the waste reduction initiatives and adhere to the sustainable practices by selecting IBCs. IBCs can be recycled at the end of their life cycle, which minimizes their environmental effect even further. Due to their greater capacity and stack ability, IBCs make transportation more efficient, which can lower carbon emissions by decreasing the number of trips. Thus, these factors are expected to support the segment growth of the market during the forecast period.

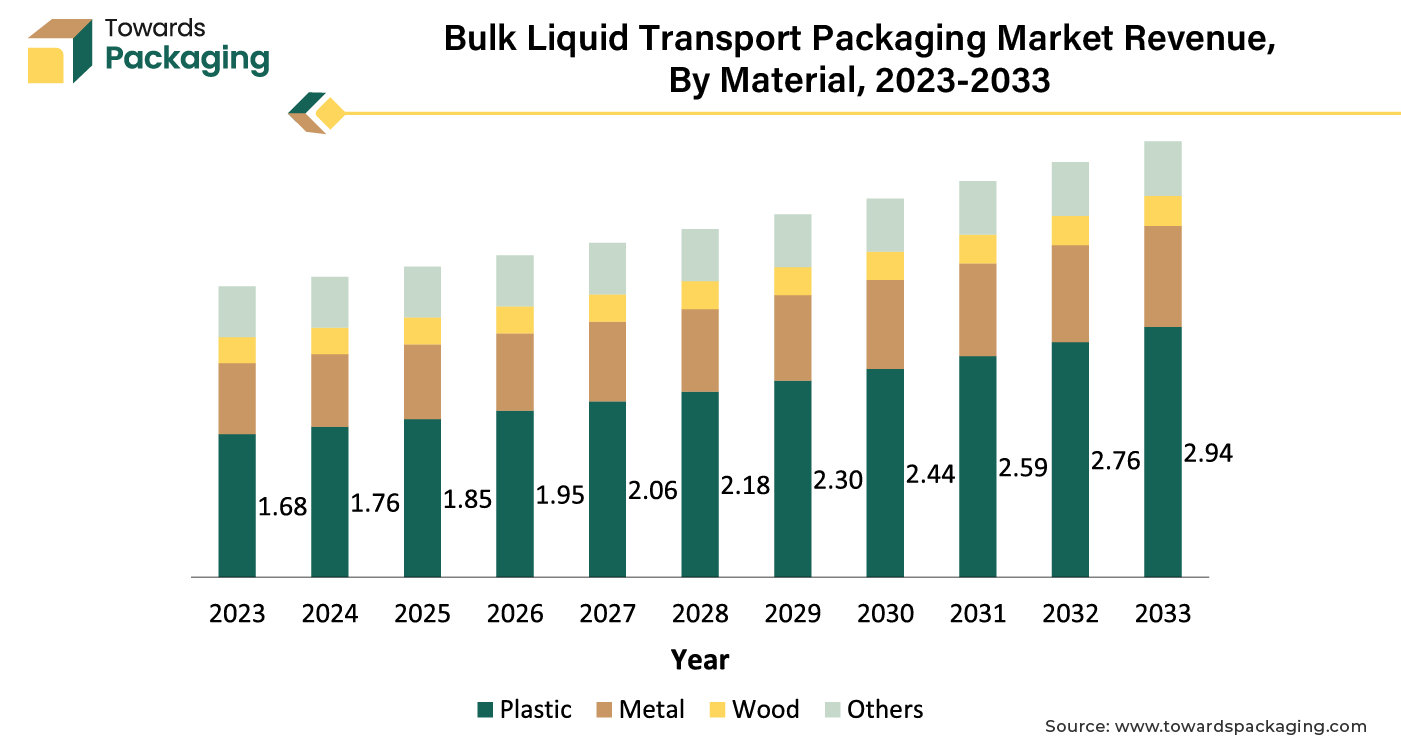

The plastic segment held considerable market share of 49.24% in 2024. The primary driver are the adaptability and affordability of the plastic materials, especially high-density polyethylene (HDPE), which is extensively utilized in the production of drums, various liquid transport options, and intermediate bulk containers (IBCs). Plastic is a great material for carrying a variety of liquids, such as chemicals, food and drink, and medications, due to its strong, lightweight and anti-corrosion property. Furthermore, plastic packaging options offer a great degree of customization, enabling producers to create containers that adhere to certain safety and regulatory requirements for various industries.

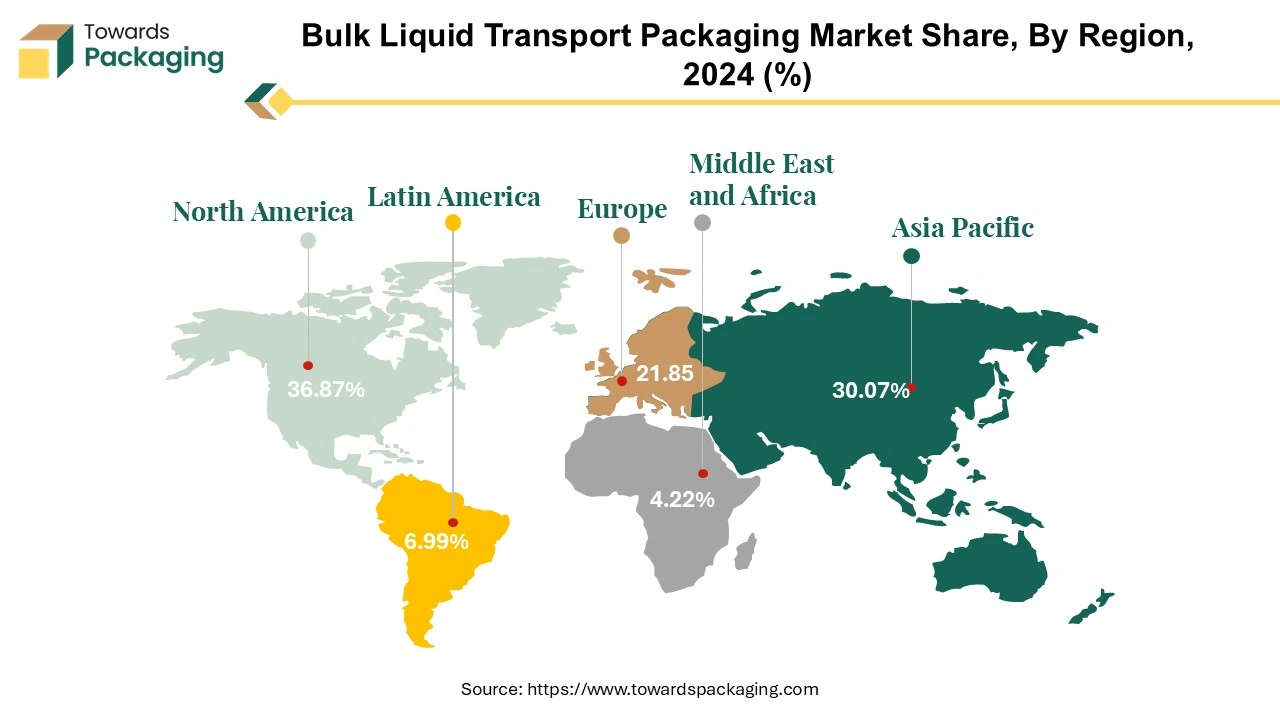

Asia Pacific is likely to grow at fastest CAGR of 6.18% during the forecast period. This is owing to the rapid industrialization and urbanization along with the increasing demand for chemicals, industrial liquids and other bulk liquid products across the region. Additionally, the growing exports of chemicals and food products are also anticipated to promote the growth of the market in the region in the years to come. According to the data by the Observatory of Economic Complexity, China exported $248 billion worth of chemical products in 2022. China's principal export markets for chemical products were the United States at $23.7B, South Korea ($17B), Brazil ($14.5B), India ($19.1B) and Japan ($13.2B). Furthermore, the growing population as well as the increasing percentage of middle class across the region is also expected to support the growth of the market within the estimated timeframe.

North America held considerable market share of 36.87% in 2024. This is due to the strong presence of a large number of chemical and petrochemical manufacturers across the region. Furthermore, the well-established food and beverage industry and the growing demand for processed and packaged foods is also expected to contribute to the regional growth of the market. Also, the strong focus on environmental sustainability and regulatory requirements as well as the well-developed transportation infrastructure is further expected to support regional growth of the market in the years to come.

By Product Type

By Material

By End-Use

By Region

April 2025

April 2025

April 2025

April 2025