July 2025

The chemical packaging material market is on a strong growth trajectory, with revenue expected to surge into the hundreds of millions from 2025 to 2034. This expansion is driven by the rising demand for sustainable and secure packaging solutions across industries such as transportation, agriculture, and specialty chemicals.

The chemical packaging materials market is expected to experience significant growth in the coming years. Chemical packaging materials are materials that are used to pack, store, and transport chemicals safely. These materials are designed to meet specific requirements such as chemical resistance, durability and regulatory compliance, making sure that the chemicals are contained without spillage, degradation, and contamination during handling as well as in transit. Inadequate product packaging substantially increases the possibility of mishaps, harming both the environment and people. Plastic and metal are the most widely used materials for chemical packaging, and these materials are commonly utilized to make drums, bottles, totes, pails, bulk tank trucks, and bulk rails. Additionally, cartons and boxes that hold, organize, and secure individual packaging units are made from cardboard.

The expanding chemical industry mostly in the emerging economies along with the globalization of the chemical trade is expected to augment the growth of the chemical packaging material market during the forecast period. Furthermore, the stringent safety and regulatory standards for hazardous materials as well as advancements in the material technology such as lightweight composites and barrier coatings are also anticipated to augment the growth of the market. Additionally, the increasing demand for the specialty and agrochemical sectors coupled with the growth of the industries such as pharmaceuticals, agriculture and petrochemicals are also projected to contribute to the growth of the market in the near future.

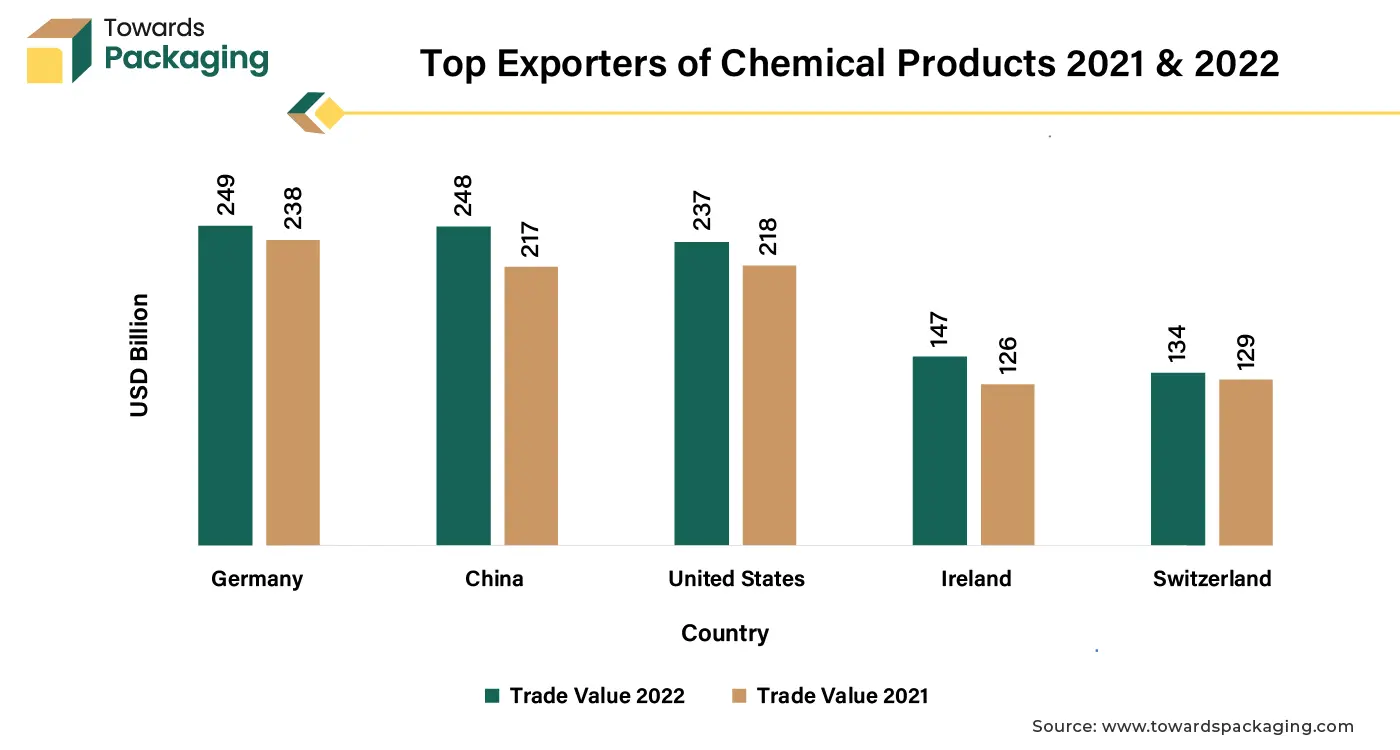

The rapid growth of international chemical trade due to the globalization of industries as well as the increasing interdependence of countries for raw materials, intermediates, and finished chemical products is anticipated to augment the growth of the chemical packaging material market during the forecast period. According to the Observatory of Economic Complexity (OEC), with an overall trade of $2.39 trillion in 2022, chemical products ranked third in terms of global trade. Chemical product exports increased by 8.43% between 2021 and 2022, from $2.2T to $2.39T and its trade accounted for 10.1% of the global trade. In 2022, Germany, China, the United States, Ireland, and Switzerland were the leading exporters of the chemical products.

Germany's trade value increased from $238 billion in 2021 to $249 billion in 2022, making it the country with the greatest value in both years. China follows closely, increasing from $217 billion to $248 billion. The United States had a smaller but substantial gain, from $218 billion to $237 billion. The figure shows constant rise in the chemical trade between these countries, illustrating the growing worldwide demand for the chemicals and related products.

Thus, the need for innovative and legal chemical packaging materials that guarantee both product integrity as well as environmental safety while addressing the logistical demands of an evolving economy is expected to grow as international trade continues to increase. Additionally, chemicals must comply with stringent international regulations such as the Globally Harmonized System (GHS) of the United Nations and other regional transportation standards. These mandates demonstrate the importance of packaging that can withstand environmental, chemical, as well as physical stress while in transit, thereby reducing the possibility of leaks.

The supply chain disruptions are expected to impede the growth of the chemical packaging material market within the estimated timeframe. Due to the supply chain disruptions, beginning with the COVID-19 epidemic; vendors, manufacturers, and customers have had a difficult couple of years. Later, Hurricane Ida triggered substantial refinery closures around the Gulf Coast, raising the costs of resins and plastic components. Furthermore, the lack of raw materials is one of the biggest problems faced by the plastics packaging industry. Plastics originate primarily from petrochemicals produced from crude oil and natural gas. Factors such as fluctuating crude oil prices, which affect the plastic production as well as the geopolitical tensions that limit access to the critical raw materials exacerbate these challenges.

Additionally, the Middle East crisis has caused a great deal of volatility in the prices of crude throughout the past year, specifically due to concerns that if the conflict worsens, it could negatively impact the infrastructure of key commodities producers that depend on the gas and oil. As per the World Bank data, the yearly average price of the Brent crude is expected to drop from $80 a barrel this year to a 4 year low of $73 in 2025 assuming the conflict does not worsen. The world oil supply might be reduced by 2%, or 2 million barrels per day, by the end of this year if conflict escalates, which happened during the Libyan civil war in 2011 and the Iraq war in 2003. The price of the Brent would first surge substantially to a top of $92 per barrel if the same disruption were to occur again. These fluctuations not only delay the production but also increase the costs and reduce the reliability of supply, ultimately hindering the market growth and stability.

The expansion of the chemical production facilities are expected to create substantial opportunity for the chemical packaging material market in the years to come. This is owing to the rising demand across diverse industries such as pharmaceuticals, agriculture, automotive and construction. Thus, chemical manufacturers are increasingly investing in scaling up their production capacities. For instance

Due to the expansion of these facilities the demand for durable packaging materials is also likely to increase to guarantee safe storage and transportation of chemical products. Furthermore, as sustainability is becoming a major focus for the whole chemical industry, there is growing need for eco-friendly packaging options.

The integration of the artificial intelligence (AI) is expected to revolutionize the chemical packaging materials market with the innovation and improving the operational efficiency. Through advanced automation systems, AI is optimizing the production workflows, reducing the errors and minimizing costs of the packaging along with the handling processes. The first step in the material sourcing process is a comprehensive demand assessment to determine the precise materials that are needed for the production.

To maintain the sourcing as per the manufacturing timelines and standards; artificial intelligence (AI) can be utilized to evaluate the market projections and the inventory levels. AI has the ability to rank the possible providers based on the predetermined standards such as the price, quality and dependability. AI can use this method to rate a list of providers and suggest the best ones for sourcing. This technological evolution is enabling chemical packaging manufacturers to adapt to market demands, improve the operational resilience as well as meet the stringent regulatory and environmental requirements.

The plastic segment held the largest market share in 2024. The most widely used material for chemical packing is plastic. It is strong, flexible, affordable to produce and resistant to the majority of chemicals. Additionally, it is lightweight, which minimizes the packaging's total weight. As a result, the expenses of the logistics and transportation are also expected to reduce. Its recyclable nature is another important factor that can minimize adverse environmental effects. In addition, advancements in the polymer technology such as improved barrier properties, UV resistance and anti-static capabilities are likely to support the segmental growth of the market during the forecast period.

The commodity chemicals segment held the largest market shares in 2024. The primary factors that impact the commodity chemical purchases tend to be the price and ease of availability. Due to this, it is also common for buyers to switch suppliers for these chemicals on a regular basis. Furthermore, the global industrialization, predominantly in the emerging economies as well as the growing need for the food security is also anticipated to promote the growth of the segment. Also, the rapid infrastructure development, expanding agricultural activities along with the increased manufacturing output are further expected to contribute to the segmental growth of the market during the forecast period.

Asia Pacific held the largest market shares in 2024 and is likely to grow at the fastest CAGR during the forecast period. This is due to the fast-paced industrial growth in economies such as China, India and Southeast Asia. Also, the expanding manufacturing sector along with as well as rising chemical production is likely to contribute to the regional growth of the market. As per the data by the India Brand Equity Foundation, in March, India's manufacturing sector achieved a 16-year high, with the HSBC Manufacturing Purchasing Managers' Index (PMI) increasing to 59.1. Also, in May 2024, 949.5 million metric tonnes (MMT) of major chemicals and 1,820.1 MMT of petrochemicals were produced. Furthermore, the growing agricultural activities are also expected to contribute to the regional growth of the market.

North America held substantial market share in 2024. This is owing to the well-established chemical manufacturing sector in the region. Additionally, the strong industrial activities and extensive exports of chemicals are also expected to contribute to the regional growth of the market. As per the statistics by the Observatory of Economic Complexity (OEC), the United States recorded the third largest trade value of $237 billion in 2022. Furthermore, the better transportation infrastructure and focus on the supply chain optimization as well as the revival of the manufacturing and infrastructure projects is also expected to contribute to the regional growth of the market.

By Material

By Packaging Type

By End-Use Industry

By Region

July 2025

July 2025

July 2025

June 2025