February 2025

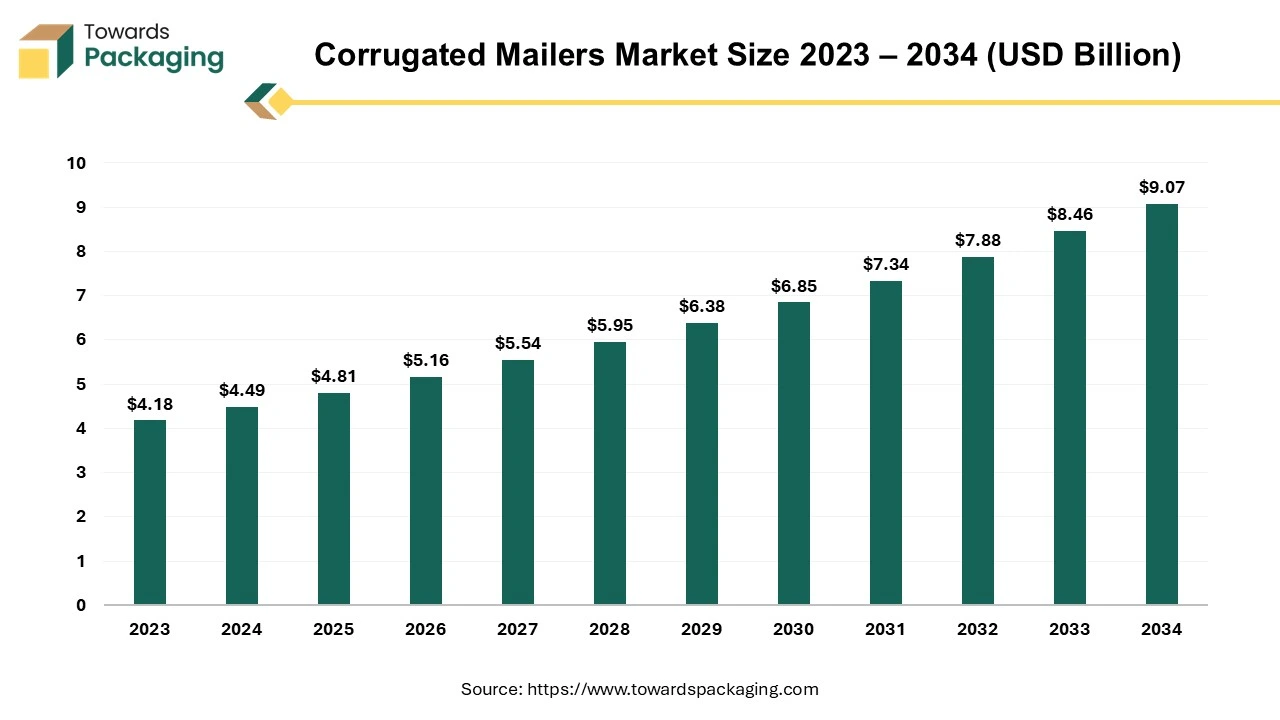

The corrugated mailers market is forecasted to expand from USD 4.81 billion in 2025 to USD 9.07 billion by 2034, growing at a CAGR of 7.30% from 2025 to 2034.

Unlock Infinite Advantages: Subscribe to Annual Membership

Corrugated mailer boxes find extensive use in product displays, retail packaging, shipping cartons, and numerous other applications where a robust yet lightweight material is needed. Corrugated Material Linerboard and Medium make up corrugated mailers. The smooth exterior surface that sticks to the Medium is called linerboard. The fluted, wavy paper in between the liners is called the Medium. Both are constructed from a unique type of paper known as containerboard. Depending on the different Linerboard and Medium combinations, the board strength will change.

Corrugated mailers are shipping containers used for transport packing that have important practical and economic ramifications. Boxes have to contain the goods from the point of manufacture to the point of distribution, sale, and occasionally end use. Although boxes can hide products from damage to some extent, they often require internal components such as cushioning, bracing, and blocking to assist safeguard fragile contents. Many transportation risks are determined by the particular logistics system that is being used. Four distinct kinds of boards can be used to make corrugated mailers.

Single-wall and double-wall boards are the most common types among them. There is also single-face board, which is made up of one liner sheet and one corrugated medium sheet adhered to each other. This type of board, which is typically sold in rolls, is helpful for shielding and cushioning areas surrounding things.

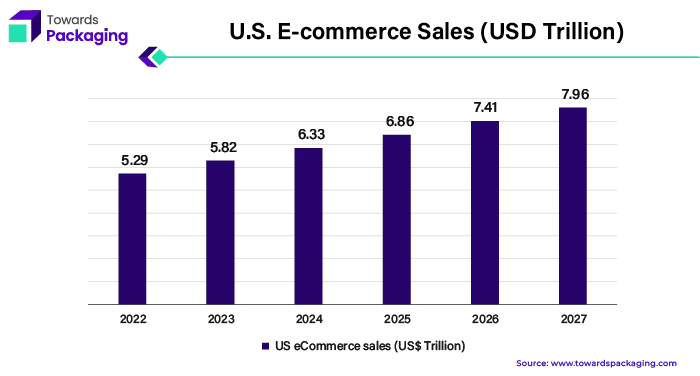

The corporate landscape has changed dramatically over the past ten years due to the expanding use of the internet and technological advancements. The retail industry is one that has undergone significant disruption as e-commerce platforms have made it possible for businesses to communicate with customers directly online. Retailers have increased their online presence because consumers now demand flawless buying experiences across a variety of online and offline platforms. Particularly millennials have a high affinity for online buying, according to polls, because of its advantages, which include easy purchasing from home and convenient browsing. The e-commerce industry's growth has brought envelope package producers both opportunities and challenges.

On the one hand, the popularity of internet shopping has increased demand for attractive mailing packages that deliver goods to clients securely. Retailers understand the significance of initial package impressions since they can impact customer satisfaction and likelihood of repeat purchases. As a result, producers have innovated and tailored their products to meet the particular needs of online retailers. But e-commerce's widespread use of single-shipped purchases has also led to an increase in packaging waste.

For instance,

Due to high initial investment required the key players operating in the market are facing restriction in the growth of the corrugated mailers market. It is true that the market for mailer packaging is being held back by the high capital investment requirements. Setting up production lines for mailer packing includes significant infrastructure and machinery costs. To make mailers on a big scale, manufacturers must invest considerably in cutting-edge quality testing systems, high-speed printing presses, sophisticated packaging equipment, and cutting and folding machines. The majority of small firms cannot afford the substantial initial capital outlay required for this. Furthermore, as technology develops, packaging machinery must also constantly be upgraded and replaced. Although they are more expensive, next-generation machines have state-of-the-art capabilities like automatic feeding, digital printing, laser cutting, barcode scanning, etc.

For instance,

There is a sharp increase in demand for personalized mailers that may be made to meet the demands of individual customers, which is estimated to create lucrative opportunity for the growth of the corrugated mailers market. With the growth of e-commerce and direct-to-consumer delivery, companies are realizing how important it is to design distinctive, branded packaging experiences. Businesses can display their logos, messages, discounts, and other marketing materials in a personalized fashion by using customized mailers. This raises brand engagement and client happiness. Additionally, it makes goods and companies stand out in the face of growing competition. Personalized mailers give businesses the chance to use creative packaging to leave a lasting impression on their clients, since consumers receive more goods than ever before.

Companies in the corrugated mailers market have a significant window of opportunity to expand as a result of this growing demand. To capitalize on this, packaging suppliers must expand the range of products they offer and increase the level of customization options. For example, they may invest in custom visuals, variable data, and on-demand short runs through innovative printing technologies. Their value proposition will be further reinforced by the addition of personalized addressing and cut-to-shape capabilities. They can also provide more specialized materials like foil stamping and embossed graphics. According to data provided by the United Nations Environment Programme, there was an approximate 9.5% global rise in packaging trash between 2022 and 2023.

The C flute segment is held the dominating share of the global corrugated mailers market in 2023. C Flute is utilized to make corrugated mailers, which are used to package food, ship packages, and secure breakable objects like glass and furniture. It is resistant to crushing and has compression qualities. It offers an exceptional printing surface as well. Focusing on the advantages offered by the C flute corrugated mailers, the key players are focused on launching C flute type of corrugated material to develop mailers, which is estimated to drive the growth of the segment over the forecast period.

For instance,

The E flute segment is expected to grow at fastest rate over the forecast period. Corrugated food mailers, ballot boxes, displays, and consumer goods are all frequently packaged in Type E corrugated mailers, such as corrugated pizza mailers. It takes up less storage space because the box holding the E type flute is made of very thin material. Both its crush resistance and printing surface are excellent. With a 1/16 thickness, there are 90 flutes per foot.

The triple wall segment held the largest share of the global corrugated mailers market in 2023. Triple wall corrugated mailers have three layers of flutes, as the name suggests. To increase stability, each layer features flutes of varying sizes. The extra layers increase compression strength and cushioning. Boxes with three walls provide greater security than those with just one or two walls. The company design and construct a corrugated mailer with protective foam inserts to ensure safe transit or storage of any kind of heavy or fragile object ship. The triple wall type mailers are strong and tough of all patterns of wall which developed of three layers of corrugated medium and four layers of liner board.

Triple wall corrugated mailers are generally used for packaging and shipping of industrial parts since they have high endurance, toughness and next-level burst strength. Rapid industrialization has raised the demand of the triple wall corrugated mailers which is expected to drive the growth of the segment over the forecast period. Moreover, increasing launch and sales of the medical devices has risen the demand of the corrugated mailers, which is estimated to drive the growth of the segment over the forecast.

For instance,

Double wall segment is estimated to grow at fastest over the forecast over the forecast. The double walled corrugated mailers is manufactured of two-layer of corrugated medium glued between three layers of liner board. The double wall corrugated mailers are more rigid and can be utilized for packaging of heavy products and even used for packing delicate products. Double wall corrugated mailers is extensively utilized for shipping of electronic products.

The food & beverage segment held the largest share of the global corrugated mailers market in 2024. Products that contain food or beverages must be packaged with the utmost care to preserve freshness, prevent contamination, and comply with food safety laws. Corrugated mailers are an essential component of food packaging because they provide excellent protection for perishable items during storage, transit, and display. In addition to being a crucial component of food and beverage firms' overall marketing and sales strategies, corrugated mailers are also frequently utilized in retail environments for the primary and secondary packaging of food and beverage products. The enormous quantity of fruits, vegetables, packaged goods, cereals, and beverage bottles are the major items transported in corrugated mailers.

Corrugated mailers are a convenient way to transport food because of their ability to stop foodborne bacteria. The enormous quantity of fruits, vegetables, packaged goods, cereals, and beverage bottles are the major items transported in corrugated mailers. Corrugated mailers are a convenient way to transport food because of their ability to stop foodborne bacteria. Strong heat is used to fuse materials together to create corrugated mailers. It may occur that the temperature rises above 180 degrees Fahrenheit, which most bacteria cannot tolerate. The food and beverages are protected from damage and their flavor, texture, and aroma are maintained by the corrugated mailers, which serve as a barrier against light, oxygen, and moisture. Increasing launch of new corrugated mailer for the packaging of food is estimated to drive the growth of the segment over the forecast period.

For instance,

The e-commerce and parcel delivery segment is estimated to grow at fastest rate over the forecast period. The growing number of consumers who prefer to shop online has resulted in a sharp increase in demand for corrugated mailers. The COVID-19 pandemic accelerated this trend by encouraging more individuals to shop online for a wide range of products, including clothing, electronics, groceries, and more. Corrugated mailers provide good cushioning and protection for the products, reducing the chance of damage during shipment. Because they are strong and long-lasting, corrugated mailers are the best option for ensuring that goods arrive to clients undamaged. Additionally, the need for corrugated mailers to carefully package glass beverage bottles has increased due to the growing popularity of online liquor sales. This need is anticipated to fuel the segment's expansion throughout the course of the forecast period.

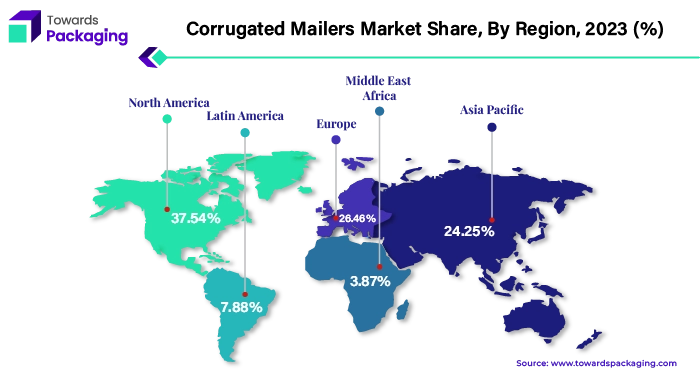

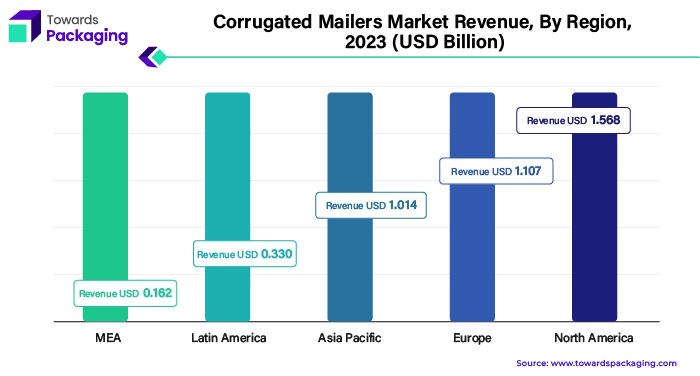

North America witnessed the largest market share in 2024. The COVID-19 pandemic caused the e-commerce market to grow more quickly. The United Nations Conference on Trade and Development (UNCTAD) reports that global e-commerce sales surged to US$ 26.7 trillion in 2020. In addition, the US continued to dominate the e-commerce sector. In the US, e-commerce revenues totaled US$ 9.6 trillion. This shows that as consumer demand for recyclable, lightweight, and environmentally friendly packaging solutions grows, there will be room for expansion for paper and paperboard packaging solutions, including corrugated mailers. The sales of paper and paperboard packaging, including boxes and mailers, are increased by the growth of the e-commerce industry.

According to the American Forest & Paper Association (AF&PA), the postal service in the United States has expanded, leading to the delivery of 7.3 billion items containing paper-based packaging material. Hence, the growing e-commerce market and postal services present a chance for paper and paperboard packaging to expand, which drives global sales of corrugated packaging, especially corrugated mailers.

In 2020, sales were reported at US$ 159.8 billion in the first quarter. This amount increased by 33.5% to US$ 213.3 billion in the second quarter of 2024. The transition to internet shopping was sped up by approximately five years by this surge. Experts estimate that by 2027, sales will have increased to US$1.72 trillion from US$ 1.26 trillion in 2024. By that time, approximately 22.6% of all U.S. retail sales will occur online.

Asia is estimated to witness the fastest growth over the forecast period. The increasing need for inexpensive, fast internet connectivity is helping the market. The product's growing use in a variety of industries, including electronics, automotive, home care, and personal care, is further propelling market expansion. In addition, Asia Pacific's fast urbanization is encouraging the construction of contemporary infrastructure, such as transportation networks, warehouses, and logistics networks, which is boosting the region's demand for the good. Asia Pacific has a substantial market share because of the food and beverage, electronics, and personal care sectors, especially in China, Japan, Korea, and India.

These sectors also have effective demand and supply cycles. The local market is being driven by the expansion of e-commerce. The significant number of corrugated mailers manufacturers in this region contributes to its strong market share. In addition, the major companies in the Asia Pacific region are concentrated on implementing new packaging patterns and advanced technology to expand their product lines, which is expected to drive the growth of the corrugated mailers market in that region. Increasing development of the automotive companies as well as rapid industrialization in the Asia Pacific region has risen the demand for the corrugated mailers, which is estimated to drive the corrugated mailers market in Asia Pacific region over the forecast period.

For instance,

Over the next 10 years, corrugated mailer sales are expected to increase significantly in India due to the country's burgeoning e-commerce sector, greater emphasis on eco-friendly packaging options, and rising consumer spending. Additionally, throughout the projected period, the market will rise due to the increasing number of packaging firms offering corrugated mailers, the growing popularity of paper packaging, and the rising use of corrugated mailers among households. India's ongoing digital revolution combined with the country's fast smartphone adoption rate have led to a surge in the e-commerce industry.

The India Brand Equity Foundation projects that by 2030, the e-commerce industry will be valued at an enormous US$ 350 billion. This would serve as a driving force behind the expansion of the corrugated mailer market in India. Due to the industry's record-breaking sales events since June, such as Myntra, Flipkart's Independence Day Sale, and Amazon's Prime Day Sales, order volumes have surged. In its most recent financial report, Walmart revealed that Flipkart's (Gross Merchandising Volume) had surpassed pre-Covid-19 levels. As a result, the expansion of e-commerce platforms will continue to significantly boost the market for corrugated mailers.

Due to the fast growth of the packaging sector, rising exports of packaging goods including corrugated boxes and mailers, and easy access to raw materials at reduced prices, China will continue to be a lucrative market for corrugated mailers over the projection period. By 2032, the Chinese corrugated mailer market is projected to provide an additional US$ 616 million in opportunity. China is now among the top exporters of a range of packaging products, including corrugated mailers.

Manufacturers of corrugated mailers are seeing increased revenue as a result, which is driving up output. Corrugated mailers are also in high demand due to the nation's thriving e-commerce industry, and this trend is probably going to continue during the projected period. A more dependable and efficient method of minimizing damage during transit and cutting down on packaging expenses is needed for e-commerce and mail and postal services. Consequently, they choose packaging options such as corrugated mailers. The corrugated mailers market has been increasing rapidly since they are the best delivery option currently available and the most preferred delivery product in e-commerce.

Europe region is estimated to be the second fastest growing region over the forecast period. Due to e-commerce enterprises' increasing use of paper mailers, Europe has witnessed tremendous development. The European mailer packaging industry is expected to continue growing as more people shop online, particularly in the fashion, media, and electronics sectors.

By Product Type

By Wall Type

By End Use

By Region

February 2025

February 2025

February 2025

February 2025