April 2025

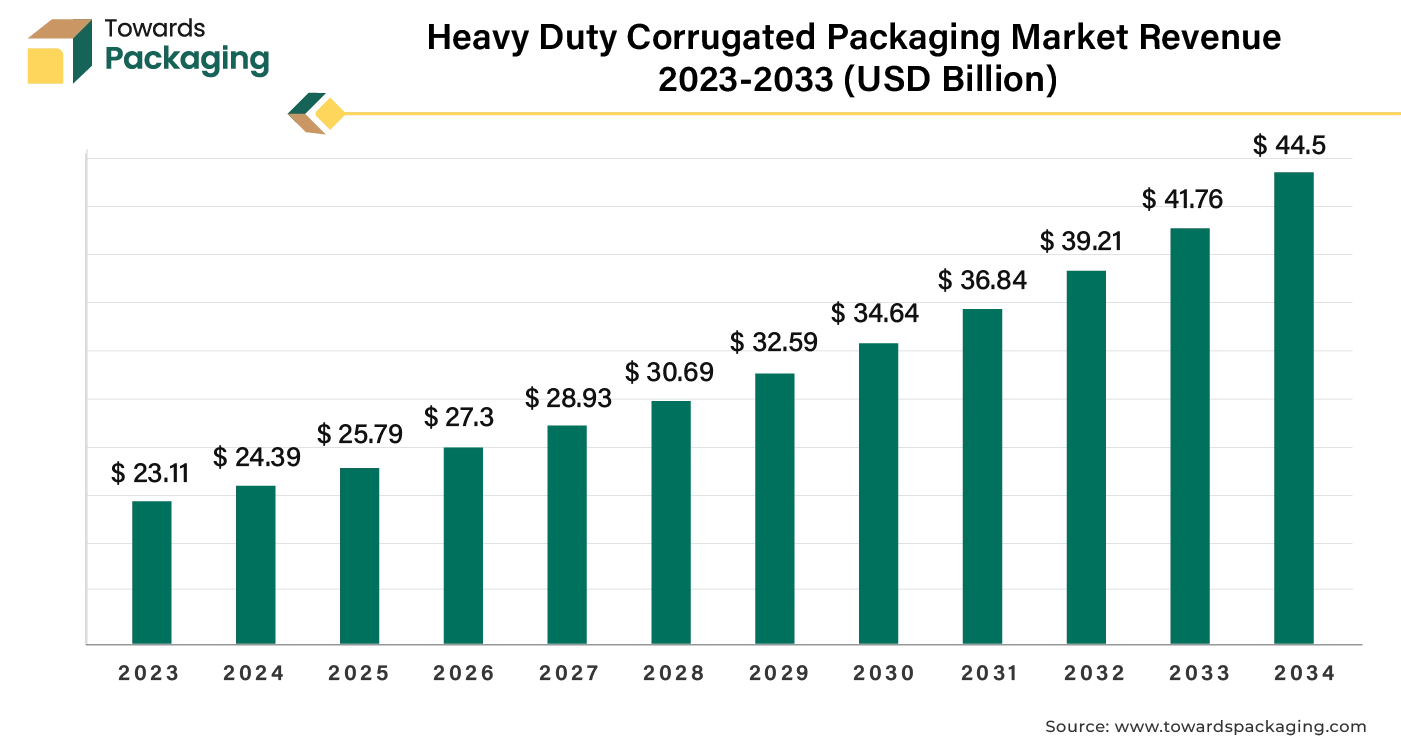

The heavy duty corrugated packaging market is projected to reach USD 44.5 billion by 2034, expanding from USD 25.79 billion in 2025, at an annual growth rate of 5.57% during the forecast period from 2025 to 2034.

Heavy-duty corrugated packaging is frequently used for bulky, heavy, fragile, or expensive goods because it provides exceptional protection during transportation. The need of dependable and sturdy external protection for protecting shipments especially those that are heavy or prone to damage cannot be emphasized. The robust corrugated boxes are a symbol of security and strength. Heavy-duty corrugated packaging is designed to provide robust protection for goods during shipping and handling. It typically involves a thicker, more durable layer of cardboard compared to standard corrugated packaging. This type of packaging is often used for heavy or fragile items, providing extra strength and cushioning. It can also include features like double-walled construction or additional internal supports to enhance durability.

Heavy duty corrugated packaging provides superior protection for products, reducing the risk of damage during transportation and handling, which is especially important for fragile or valuable items. Its strength helps prevent packaging from collapsing or tearing, ensuring that items arrive in good condition. By reducing damage and returns, heavy duty corrugated packaging helps lower overall costs for businesses and consumers, leading to fewer replacements and repairs.

Corrugated packaging is often recyclable and can be made from recycled materials, contributing to environmental sustainability. Enhanced protection reduces the likelihood of injuries caused by broken or damaged items, improving safety for handlers and consumers alike. High-quality packaging can enhance a company's image and consumer trust, showcasing a commitment to quality and customer satisfaction. The global packaging market size is growing at a 3.16% CAGR.

Heavy-duty corrugated boxes are developed through several key processes to ensure they meet durability and strength requirement. The development starts with choosing high-quality materials, including thicker or multiple layers of kraft paper. The strength of the box is often determined by the type of paper and the flute configuration used. Corrugated boxes are made with various flute profiles (e.g., A-flute, B-flute, C-flute, E-flute). Heavy duty corrugated packaging boxes are not just tough and strong but even exceptionally substantial, providing the safety to shipped items. The double-walled construction of heavy duty corrugated packaging secures an additional layer of protection against external elements.

Artificial intelligence systems may examine different design factors and material characteristics to produce heavy duty corrugated packaging that minimizes material usage and maximizes strength, cutting expenses and environmental effect. AI can predict demand patterns and assist businesses in better managing their inventory, cutting down on waste and guaranteeing timely delivery of packaging supplies. AI-driven picture recognition systems may identify flaws or irregularities in heavy duty corrugated packaging manufacturing, guaranteeing better quality and cutting down on waste from defective goods. By controlling inventory levels, forecasting delivery times, and lowering transportation expenses, AI can improve logistics and supply chain operations. The heavy duty corrugated packaging can be designed and customized for personal use.

AI driven analytical insights can assist in designing custom packaging solutions that meet specific customer needs, enhancing brand appeal and customer satisfaction. AI can automate repetitive tasks in the packaging production process, improving efficiency and reducing labor costs. By leveraging these AI capabilities, companies in the heavy duty corrugated packaging industry can achieve greater efficiency, lower costs, and better product quality.

For instance,

As online shopping continues to rise, the demand for durable and protective packaging increases to ensure products are safely delivered. There is a growing preference for eco-friendly and recyclable packaging solutions, which boosts the demand for corrugated materials that are both sustainable and versatile. Growth in various industries, including electronics, automotive, and consumer goods, requires heavy-duty packaging to handle and protect goods during transit and storage, has risen the demand of the heavy duty corrugated packaging.

As global supply chains expand, there is a need for robust packaging solutions to withstand long-distance transportation and handling. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition to develop material required to develop heavy duty corrugated packaging, which is estimated to drive the growth of the heavy duty corrugated packaging market over the forecast.

For instance,

The key players operating in the market are facing several stringent laws and regulations by the government regarding manufacturing of heavy duty corrugated packaging, which is estimated to hamper the growth of the heavy duty corrugated packaging market. The waste water left out in rivers and lakes after manufacturing of the cardboard of corrugated box are affecting the environment adversely. Stringent environmental regulations may increase production costs and require investments in sustainable practices. Limitations in technology can affect the ability to produce high-quality, durable corrugated packaging efficiently. The rise of alternative packaging materials, such as plastics or biodegradable options, can divert demand away from corrugated packaging. Economic downturns can reduce demand for packaging as businesses cut costs and scale back production. Issues related to transportation and logistics can affect the distribution and availability of heavy-duty corrugated packaging.

Expanding industries such as automotive, electronics, and pharmaceuticals require heavy-duty corrugated packaging to handle and transport goods safely. Growing economies in regions like Asia-Pacific, Latin America, and Africa are seeing increased industrialization and consumer spending, leading to higher demand for robust packaging solutions. The surge in online retail drives demand for durable packaging solutions to protect products during shipping and handling. The key players operating in the market are focused on adopting inorganic growth strategies like acquisition to develop new products and meet the rising demand of the consumers, which is estimated to create lucrative opportunities for the growth of the heavy duty corrugated packaging market over the forecast period.

For instance,

Smurfit Kappa plans to quadruple the capacity of its Ibi Bag-in-Box plant in Alicante, Spain, with an investment of US$ 56 million. Through improved waste management systems and notable energy savings, Smurfit Kappa's most recent investment is expected to boost the sustainability of the plant's operations as well as its product line. Bag-in-Box Ibi has a proven recycling track record and uses many cutting edge techniques to detect and segregate by-products.

The corrugated boxes segment held the dominating share of 58.85% in the heavy duty corrugated packaging market in 2024. Corrugated boxes are highly effective in packaging due to corrugated structure provides strength and rigidity, protecting contents from damage during shipping and handling. They are relatively light, which helps reduce shipping costs. They can be easily tailored in size, shape, and design to fit various products. They are inexpensive to produce and can be recycled, which is both economical and environmentally friendly. The fluted layer between the outer layers provides cushioning, absorbing shocks and vibrations.

As the textile industry increasingly focuses on sustainability, corrugated boxes are valued for being recyclable and environmentally friendly. These features make corrugated boxes ideal for a wide range of packaging needs. Corrugated box packages even encourages for branding purposes as they can be printed on in eye-catching ways. The key players operating in the market are focused on developing corrugated box plant to meet the rising demand of the costumers which is estimated to drive the growth of the market over the forecast period.

For instance,

The triple wall heavy duty corrugated packaging segment held a significant share in 2024. Triple-wall corrugated packaging offers superior strength and durability compared to single or double-wall options. This makes it ideal for heavy or fragile items that need extra protection during transit and handling. The additional layers in triple-wall corrugated packaging allow it to support greater weights and withstand more pressure, making it suitable for heavy or bulk items. The extra layers provide improved cushioning and resistance to impacts, moisture, and other environmental factors, reducing the risk of damage to the contents. Triple-wall corrugated boxes can be customized to fit specific dimensions and shapes, providing tailored solutions for various industrial needs.

While more expensive than single or double-wall boxes, triple-wall corrugated packaging often reduces costs associated with product damage and returns, offering long-term savings. Made from recyclable materials, triple-wall corrugated packaging aligns with growing environmental sustainability trends.

Overall, the robust protection and load-bearing capacity make triple-wall heavy-duty corrugated packaging a preferred choice for industries requiring reliable and durable packaging solutions. Increasing advancement in the textile industry has risen the demand for the heavy duty corrugated packaging. The key players operating in the market are focused on launching ceramic products which need the heavy duty corrugated packaging for shipping purpose which is estimated to drive the growth of the heavy duty corrugated packaging market over the forecast period.

For instance,

The 100-300 lbs segment held the significant growth of the heavy duty corrugated packaging market in 2024. The heavy duty corrugated packaging with a weight capacity of 100-300 lbs offers various benefits. It can withstand substantial weight and rough handling, reducing the risk of damage during transit or storage. Provides excellent protection for contents against impact, moisture, and environmental conditions. Often less expensive than alternative heavy-duty packaging options like wooden crates or metal containers.

The heavy duty corrugated packaging with a weight capacity of 100-300 lbs can be easily customized in terms of size, strength, and design to fit specific needs. The 100-300 lbs heavy duty corrugated packaging typically manufactured from recyclable materials, making it an eco-friendly choice. Despite its strength, it remains relatively lightweight compared to other heavy-duty packaging materials, reducing shipping costs. Hence, due to overall benefits offered by the 100-300 lbs heavy duty corrugated packaging, the segment held the significant growth.

The consumer electronics segment is observed to grow at a notable rate while the segment held a significant share in 2024. Heavy-duty corrugated packaging is widely used in the consumer electronics sector as it provides excellent protection against physical damage during shipping and handling. The corrugated structure absorbs shocks and impacts, safeguarding sensitive electronic components. Heavy-duty corrugated materials are strong and can withstand the stresses of transportation and storage, ensuring that products arrive intact. Despite its strength, heavy duty corrugated packaging is relatively lightweight, which helps reduce shipping costs and makes handling easier. Heavy duty corrugated packaging is generally affordable to produce and can be customized to fit a variety of product shapes and sizes, making it a cost-effective solution for manufacturers and retailers.

It can be easily designed and printed with branding, instructions, and product information, enhancing the consumer experience and aiding in marketing efforts. These factors combine to make heavy-duty corrugated packaging a practical and popular choice for protecting and presenting consumer electronics. Increasing launch of the new consumer electronics has risen the demand for the heavy duty corrugated packaging which is estimated to drive the growth of the segment over the forecast period.

For instance,

Moreover, increasing use of online apps for ordering consumer electronics has risen the demand for the heavy duty corrugated packaging which is estimated to drive the growth of the segment over the forecast period.

For instance,

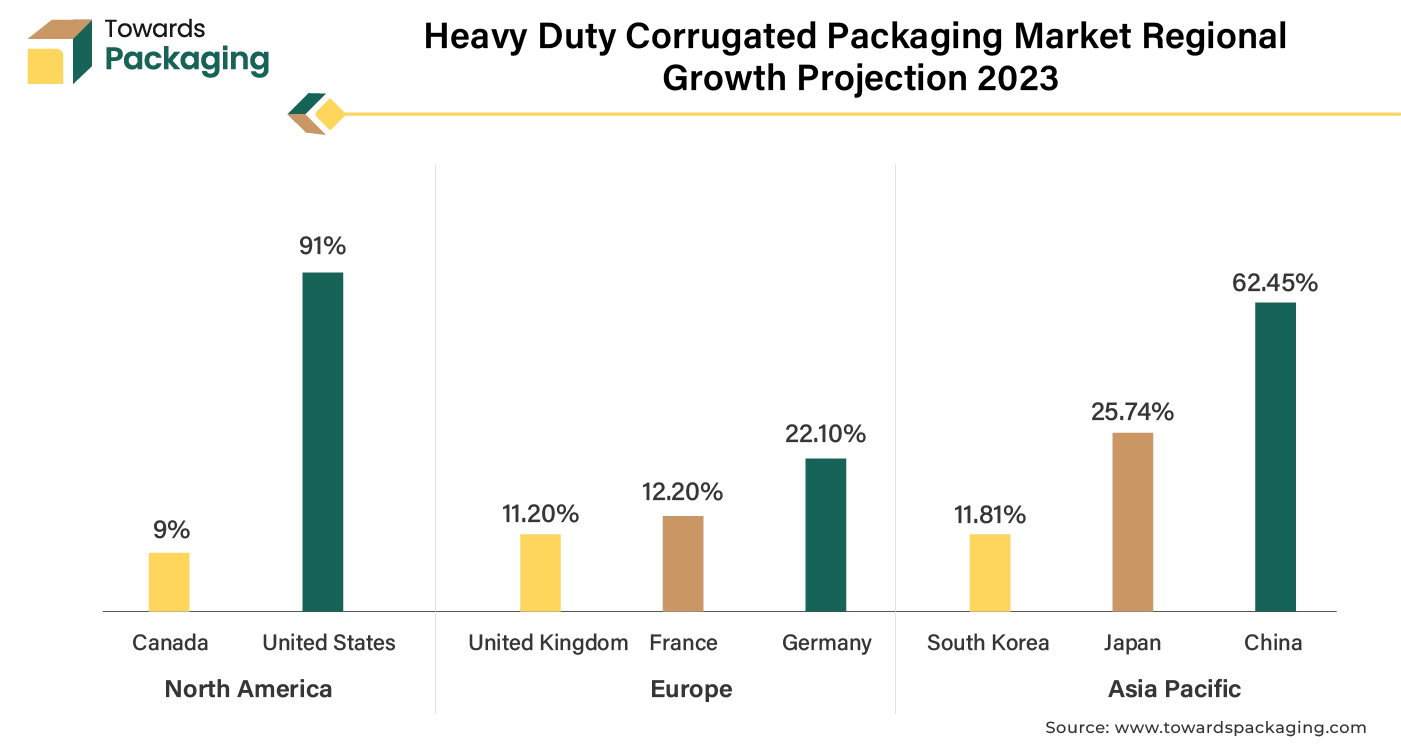

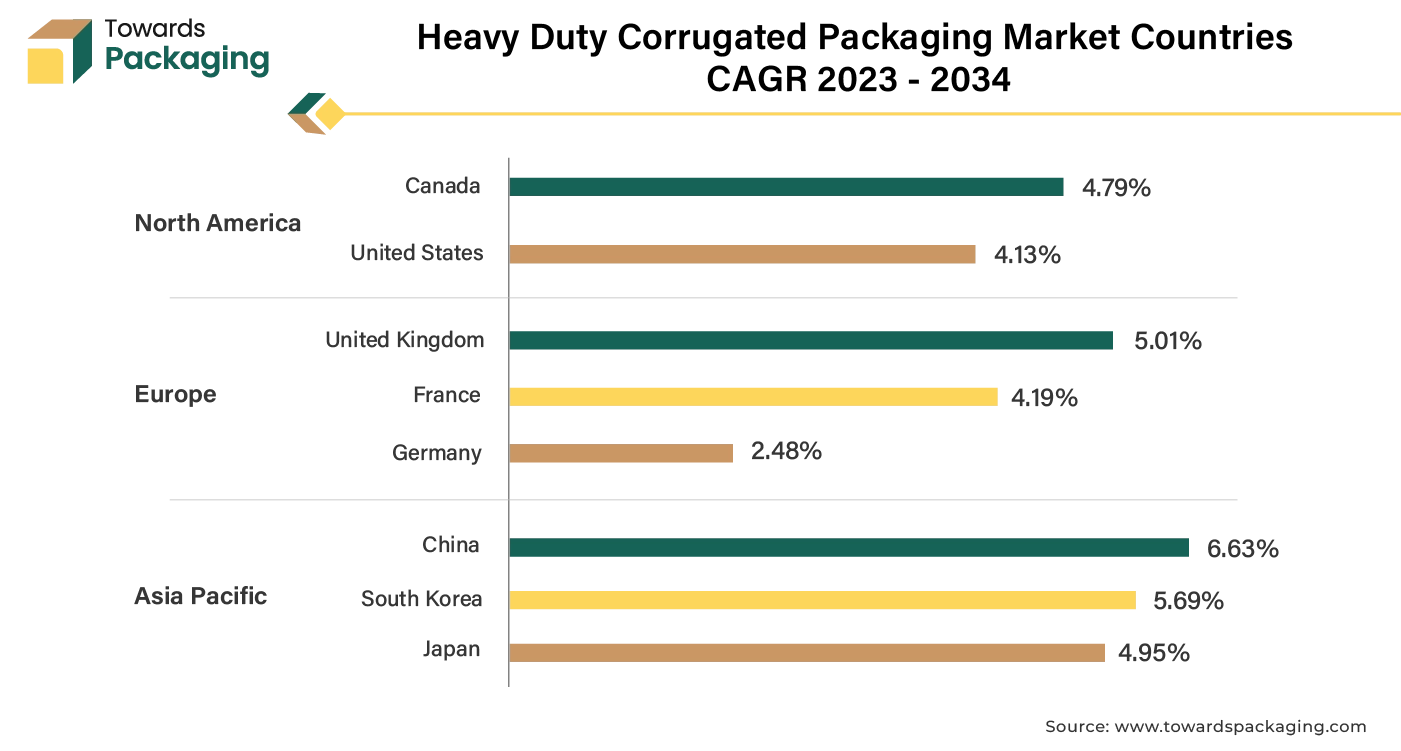

Europe held a significant share of the market in 2024. The rise in online shopping in Europe drives demand for sturdy packaging to protect goods during transit. Increasing awareness of environmental issues in Europe boosts the demand for recyclable and eco-friendly packaging materials. The expansion of various industries in Europe, such as automotive and electronics, necessitates robust packaging solutions. European regulations favouring sustainable practices and packaging waste reduction can spur market growth. The key players operating in Europe are focused on innovating in corrugated packaging technology, including improved strength and design, contribute to market expansion. Overall, the combination of consumer demand for sustainable options, industrial needs, and technological improvements is likely to drive the growth of the heavy duty corrugated packaging market in Europe. The key players operating in the market are focused on adopting inorganic growth strategies like collaboration to develop corrugated cardboard material to meet the rising demand of the consumers which is estimated to drive the growth of the heavy duty corrugated packaging market in Europe.

For instance,

Asia Pacific is observed to witness the fastest growth rate in the market during the forecast period. Several important factors are driving the growth of the heavy-duty corrugated packaging market in the Asia-Pacific area: The need for robust packaging solutions to support a variety of industries, including consumer goods, electronics, and the automotive sector, is increased by the continued industrialization of nations like China and India. As e-commerce grows throughout Asia-Pacific, more robust packaging is required to guarantee product delivery safely. The demand for heavy-duty corrugated packaging rises as a result of rising packaged goods consumption brought on by urbanization and population growth.

Governments in the area are progressively putting laws into place that support environmentally friendly and sustainable packaging, urging the use of long-lasting and recyclable materials. Technological developments in corrugated packaging have improved the robustness and usability of packaging options, encouraging more sectors to use heavy-duty solutions. The general economic expansion of the area increases consumer spending and purchasing power, which supports the growing demand of durable packaging solutions.

All of these elements work together to create an atmosphere that is favourable for the growth of the heavy-duty corrugated packaging market in Asia-Pacific. Moreover, the key players operating in the market are carrying out marketing and events to promote the packaging solutions offered by different industries which is estimated to drive the growth of the heavy duty corrugated packaging market in Asia Pacific region over the forecast period.

For instance,

Moreover, various initiatives by the key players operating in the Asia Pacific region to develop and launch of new application which will help in revolutionizing overall packaging market which is estimated to drive the growth of the heavy duty corrugated packaging market in the Asia Pacific region over the forecast region.

For instance,

By Product Type

By Board Type

By Capacity

By End Use

By Region

April 2025

April 2025

April 2025

April 2025