April 2025

Principal Consultant

Reviewed By

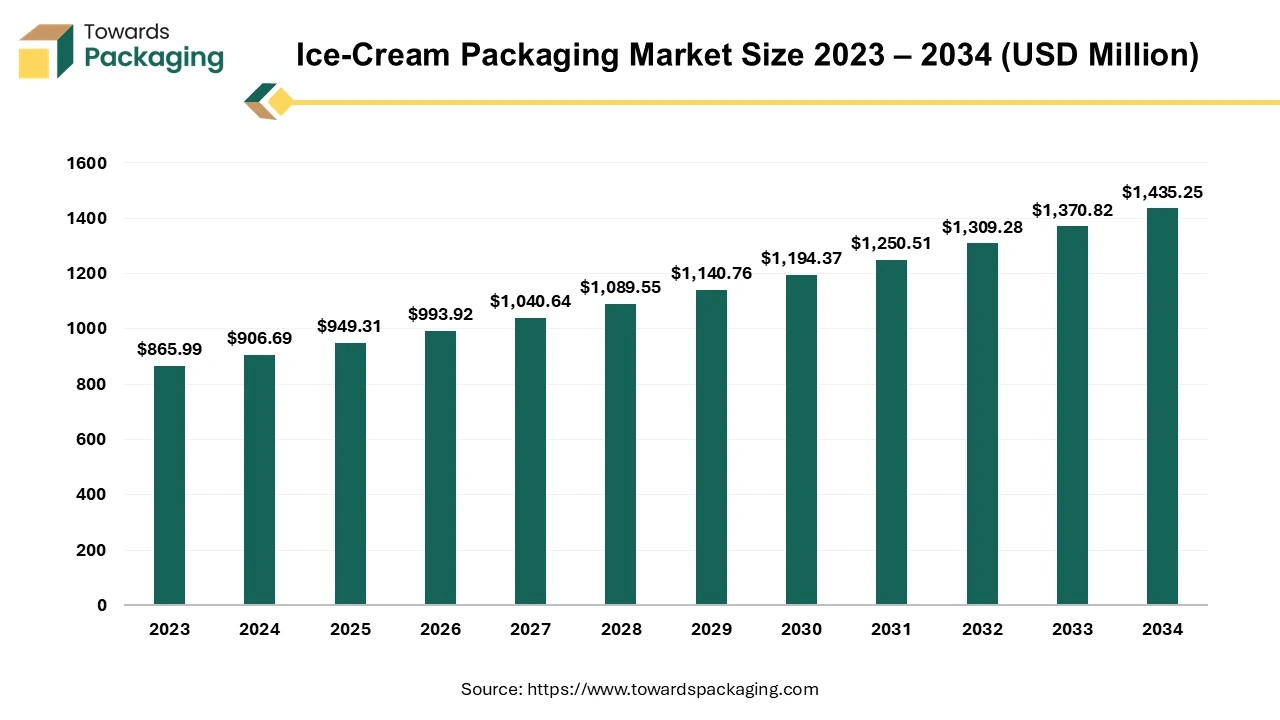

The ice-cream packaging market is projected to reach USD 1435.25 million by 2034, expanding from USD 949.31 million in 2025, at an annual growth rate of 4.7% during the forecast period from 2025 to 2034.

Ice cream, a popular frozen dessert, is experiencing a significant increase in market demand. Despite having lower per capita consumption than other major countries, the ice cream sector is on a spectacular development trajectory, with a Compound Annual Development Rate (CAGR) of around 10-15%. This expansion reflects shifting customer tastes and drives consumption trends, especially in the branded and inventive ice cream categories.

Ice cream has a particular place in the hearts of consumers across all demographics. From youngsters to older people, it is a favourite comfort dish and a symbol of celebration on special occasions. The shifting landscape of ice cream is more than taste; it also includes changing trends in packaging and distribution. Cutting-edge packaging technology and robust cold-chain management techniques provide strict quality standards while improving marketing methods.

The ice cream packaging industry is experiencing a vital change towards sustainability and convenience. Brands increasingly invest in innovative packaging solutions, prioritizing sustainability and user comfort. For example, industry giants like Nestlé are increasing sustainability efforts in their ice cream packaging methods, reflecting a broader industry trend towards environmental consciousness. As the market evolves, creative packaging solutions will play an essential role in determining the future of ice cream consumption.

For Instance,

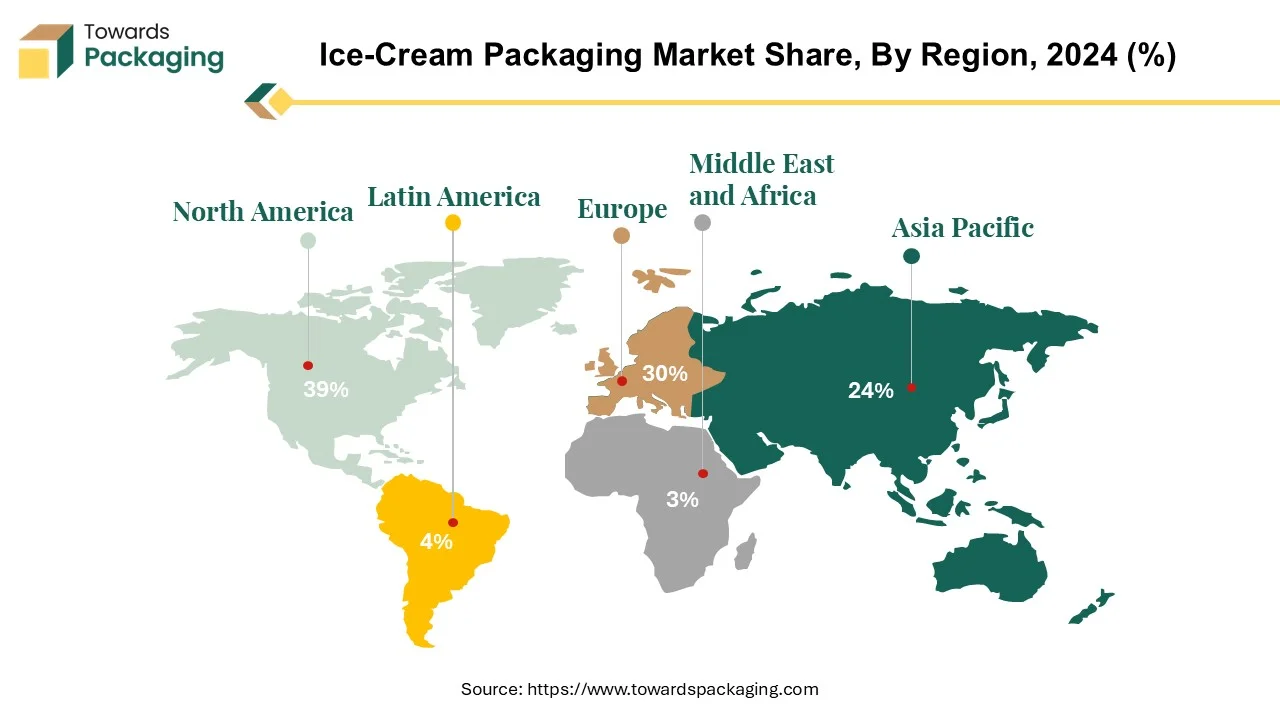

North America is the primary hub for the ice cream packaging market, with the United States emerging as a key player. The United States alone produced 1.38 billion gallons of ice cream in 2022, demonstrating the country's considerable contribution to the sector. This thriving sector has a significant economic impact, contributing $13.1 billion to the United States economy. Furthermore, it creates employment opportunities, sustaining 28,800 direct jobs and earning $1.8 billion in direct payments. Tradition and heritage are essential in the US ice cream scene, with many makers having a rich history extending over 50 years, frequently as family-owned businesses.

Recent consumer trends show a shift toward higher consumption at home, with 23% of ice cream customers enjoying more frequently and spending more time at home. However, a preference for smaller pack sizes indicates both portion control and value.

The industry innovates in packaging, striving to provide indulgence and value to customers. This includes the creation of tiny, snackable delicacies that give pleasure and convenience. Notably, while flavor remains the critical motivator of purchase decisions, price comes in a close second, emphasizing the importance of pricing tactics in the competitive ice cream industry. North America's ice cream packaging business is evolving in response to consumer demand for creative and value-driven goods.

Europe is the second-largest market for ice cream packaging, and significant production figures fuel its importance. The European Union (EU) produced 3.2 billion liters of ice cream in 2022, a 5% increase over the previous year. With 620 million liters produced, Germany led the EU in ice cream manufacturing. France and Italy came in second and third, respectively, with 591 million and 571 million liters produced.

Germany dominated production volume and distinguished out as having the most competitively priced ice cream, with an average price of €1.5 per liter. France and Italy reported higher average costs, €1.9 and €2.3 per liter, respectively. In contrast, Austria produced the costliest ice cream, with an average price of €7.0 per liter, followed by Denmark (€4.4 per liter) and Finland (€2.8 per liter).

France further cemented its position in the ice cream market by being the biggest exporter within the EU, accounting for 21% of ice cream exports outside the EU in 2022, with 53 million kg of ice cream shipped. The ice cream packaging market grew due to this export success, underscoring the crucial role that production and export dynamics play in determining market trends.

For Instance,

Plastic ice cream packing is the most common material encapsulating this popular frozen delicacy. Plastic containers have evolved significantly in design and material, essential in maintaining ice cream quality. This article dives into the history and significance of ice cream containers, shedding light on how they affect the pleasure and distribution of this exquisite dessert.

As ice cream popularity grew, so did the desire for more practical and hygienic packaging solutions. Plastic has risen to the top of the preferred ice cream container materials list due to technological and material advancements. Plastic tubs had various benefits, including lightweight construction, shatter resistance, and an airtight seal that extended the freshness of ice cream.

Plastic containers allowed for greater flexibility in shape and size, responding to a wide range of consumer needs, from single servings to more extensive family-sized solutions. Companies like Unilever are innovating with plastic ice cream packaging to improve sustainability. For example, their new "Solero Peach" ice cream packaging uses 35% less plastic, with integrated compartments and a thin layer of polyethylene replacing the need for additional plastic sleeves, contributing to environmental conservation efforts.

For Instance,

Cups are one of the most used packing materials. These cups are adaptable containers that can accommodate a variety of ice cream, from single serves to larger meals. Cups are famous for their ease, portability, and ability to keep frozen treats fresh.

Cups are available in various materials, including plastic, paper, and edible options such as waffle cones or cookie cups. Plastic cups, in particular, are durable and have airtight sealing capabilities, guaranteeing that the ice cream retains its quality during storage and transportation. On the other hand, paper cups are widely used because of their environmental friendliness and biodegradability.

For Instance,

Ice cream cups play an essential role in both branding and marketing. Manufacturers frequently personalize cups with eye-catching designs, logos, and branding to entice buyers and distinguish their products on store shelves.

Retail outlets are the primary distribution channel in the ice cream packaging business. These retailers include a variety of venues such as supermarkets, convenience stores, specialty ice cream shops, and wholesale clubs. Retail establishments provide a convenient and accessible platform for customers to buy ice cream and other related products. They offer diverse ice cream brands and packaging options, allowing customers to browse and compare products.

Retail outlets frequently use strategic merchandising strategies to promote ice cream items, such as eye-catching displays, signs, and special prices. With their ubiquitous presence and capacity to reach a large consumer base, retail establishments are critical in boosting sales and distribution in the ice cream packaging business.

For Instance,

The competitive landscape of the Ice-Cream packaging market is dominated by established industry giants such as included ITC Packaging, Uniflex, Huhtamaki Oyj, Amcor Plc, Tetra Laval, Sonoco Products Company, Berry Global Group, Delkor Systems Inc., Insta Polypack, Stora Enso Oyj, Stanpac Inc., IIC Packaging, Delkor Systems Inc., International Paper Company, Sirane Limited. And Safepack Solutions. These giants compete with upstart direct-to-consumer firms that use digital platforms to gain market share. Key competitive characteristics include product innovation, sustainable practices, and the ability to respond to changing consumer tastes.

ITC Packaging is a significant ice cream packaging maker in the European market. It has experience and skills, specialized in developing original, customized packaging that fulfills customer needs—manufacturers of polypropylene lids for cardboard ice cream cups.

For Instance,

Ice cream packaging should strike a balance between appealing aesthetics and reliable protection. Premium packaging increases the product's shelf life, sales, and brand visibility. Uniflex offers ice cream packaging perfect for promotions, advertising initiatives, and increased customer involvement. Use promotional codes, customization choices, or any other variable information on the box.

For Instance,

By Material

By Product Type

By Distribution

By Region

April 2025

March 2025

March 2025

March 2025