April 2025

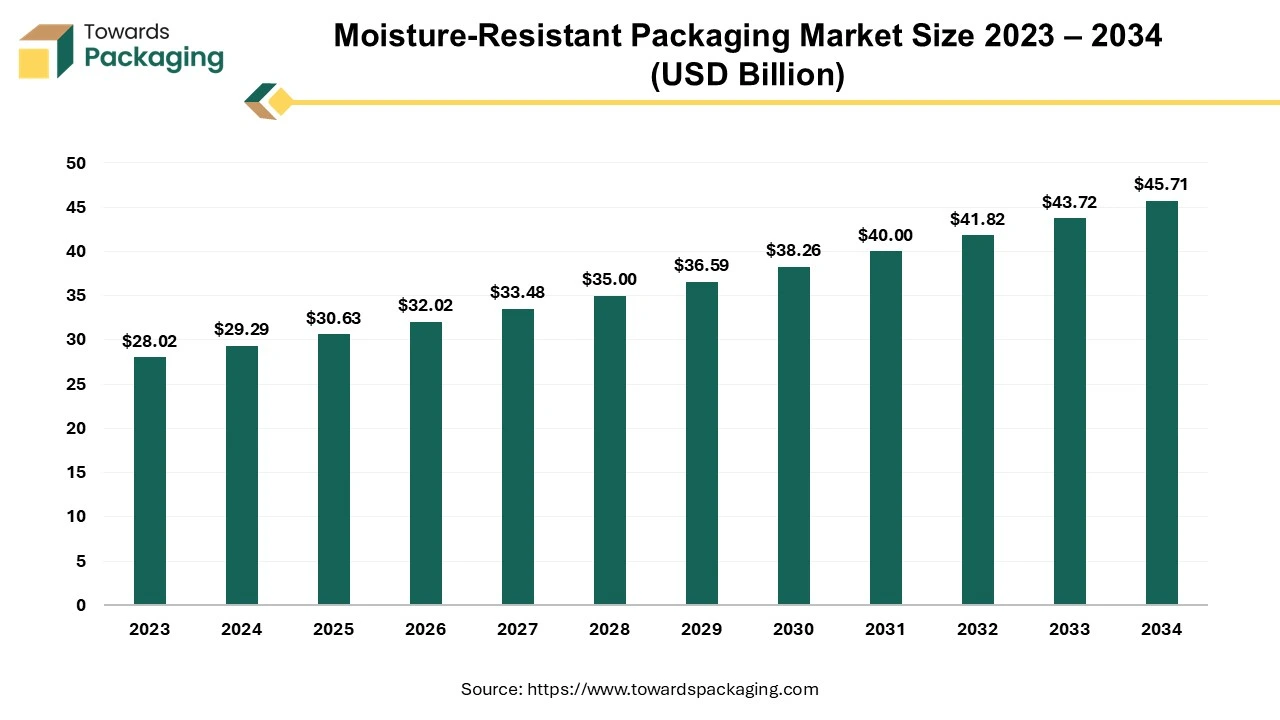

The global moisture-resistant packaging market size reached US$ 29.29 billion in 2024 and is projected to hit around US$ 45.71 billion by 2034, expanding at a CAGR of 4.55% during the forecast period from 2025 to 2034. This market proliferates due to the growing pharmaceuticals, food and beverage, and personal care industries, increasing the demand for moisture-resistant packaging. The rising concern for top-quality packaging that protects products from external adverse factors and provides a unique appearance boosts the market's development.

The moisture-resistant packaging market is growing significantly due to the rising demand in industries such as personal care, pharmaceuticals, and food & beverages in which moisture-resistant packaging is highly required. Growing demand among various industries influences the innovation from the major market players of this sector. It is expanding the size of this market also the expansion of products requires enhanced-quality packaging for safety purposes.

Huge investments by businesses as well as the government for research and development of moisture-resistant packaging result in the elaboration of the market which allows brands to use such packaging for products. Sustainability plays a crucial role in the development of this market as currently there is a huge demand for sustainable packaging of products. With the growing awareness of environmental issues, there is a rising concern for eco-friendly products which is highly observed in the packaging industry.

In the moisture-resistance packaging market, there is a huge impact AI as it is useful in developing the packaging quality. With the incorporation of AI, the possibility of manufacturing superior quality moisture-resistance packaging with enhanced protection is high which ultimately results in the advancement of the market. AI supports extracting real-time information from the gathered data which in turn helps to fulfil the market demand of the consumers.

It reduces the chances of the production of defective packaging pieces which enhances the reliability of the manufacturing companies. It helps improve the quality of the packaging with the help of machine learning. Artificial intelligence reduces the manpower in the production area which ultimately decreases the pricing of the packaging without any compromise on the quality of the packaging.

Growing Health and Safety Consciousness among Consumers

The moisture-resistance packaging market is growing rapidly due to rising concern among consumers majorly in the healthcare sector. This type of packaging helps to maintain the integrity and quality of the products by protecting them from external agents such as temperature, moisture, dust, and pollution. It is also helpful for the electronics sector as it protects products from rusting due to moisture.

Due to the growing demand for fresh food packaging and moisture-free packaging of snacks it fuels the development of the market. This type of packaging prevents food from spoilage of food products by minimizing contamination. The rapid expansion of online food service platforms is highly increasing the demand for moisture-resistance packaging.

There are a huge number of people ordering food or groceries online which require superior quality packaging and boost this market development. There is a huge demand for eco-friendly and sustainable packaging which can be recycled, reused, and decomposed easily and cause less or no harm to the environment. The rising demand for eco-friendly packaging by several industries plays an important role in shaping this industry. To increase the expiry date of food, brands prefer to use moisture-resistant packaging for a variety of products.

Diverse Products Offering Raises the Moisture-Resistant Packaging Market Potential

With a growing online shopping trend, the demand for high-quality packaging is also rising rapidly. There are a variety of products available online starting from medicines to home décor which require packaging with top-quality protection from external factors. This expansion is mainly influenced by growing customer demand for sturdy and supportable packaging choices, specifically in industries such as food & beverages, personal care, and pharmaceuticals.

Goods in these sectors frequently come across moisture at the time of transportation or storage, which can cooperate with their excellence. As a consequence, producers are concentrating on packaging resources that provide higher moisture defence. In accumulation to sturdiness, there is a rising change in the direction of environment-friendly packaging as ecological consciousness increases. Several market players are substituting outdated plastics with biodegradable, moisture-resistant resources, contributing to the drift in the direction of sustainable packaging choices. The pharmaceutical sector has strict guidelines regarding packaging resources. Moisture-resistant packaging is important for preserving the firmness and efficiency of medicines through their longevity.

High Production Cost

The major challenge associated with this market is the high production cost associated with this packaging. The arrangement for resources needs high costs which hinders the growth of the market and creates huge challenges for market players. Due to this small to medium businesses face issues in starting this business.

The plastic segment dominated the market in 2024. These are highly in demand as they are considered to be the perfect combination of durability, cost-effectiveness, and flexibility. Plastic material is made of polyethene terephthalate, polyethene, and polypropylene which create a barrier between any pollutant or external agent that can damage products. It keeps the integrity of the product by protecting it from external factors such as dust, air, contamination and moisture in various sectors like pharmaceuticals, food & beverages, and cosmetics.

These are lightweight packaging, making them more suitable than others for transporting products. With rising e-commerce industries there is a huge demand for the safe transportation of products in all sectors. Continuous advancement in the plastic manufacturing companies also influences the market majorly. The development of reusable and recyclable plastic packaging fuels the growth of the market.

The bags and pouches segment held the largest share of the market in 2024. This is due to the growing demand for different shapes and sizes of packaging for products in several sectors and customers' demand for travel-friendly kits influences brands to produce such packaging. These bags and pouches are versatile as they fit in any corner and are lightweight which is good for transportation along with cost-effectiveness.

These are highly preferred by several industries such as pharmaceuticals, food & beverages, electronics, and various others. These types of packaging are useful for small businesses as well as huge industries that require bulk packaging with product safety and longevity. To provide user-friendly packaging companies prefer bags and pouch packaging. Products such as food items, medicines, and electrical equipment can be significantly damaged due to moisture, these types of packaging are suitable to protect and enhance their shelf-life.

The food & beverages segment held the largest share of the market in 2024. There is a huge demand for food products with enhanced shelf life and to ensure the freshness of the food products moisture-resistant packaging plays a significant role. It helps to maintain the quality of the food products as it protects from any external harmful agents such as dust, air, light, and various others. It also plays an important role in keeping the taste and texture of the food intact for a long period. The rising demand for ready-to-eat food and packed beverages enhances the moisture-resistant packaging demand in almost all sectors.

North America is estimated to generate the highest revenue over the forecast period. This is due to the rising demand for packaged food in the region. There are a high number of working women living in this region which pushes the packaged food market exponentially. Countries such as the U.S. and Canada are contributing significantly towards the development of the market due to the high demand for fresh and packaged food and beverages which should be healthy.

In this region, there is a high risk of spoilage of packaged food products as they get high moisture exposure in the environment so these moisture-resistant packaging plays a vital role in preventing food products for a long period. Packaging such as vacuum-sealed packaging, foil-laminates, and stand-up pouches are superior quality packaging which protects food products from external harmful factors by providing superior quality protection.

Asia Pacific is observed to grow at the fastest rate during the forecast period. There is a rapid shift in the lifestyle of the people in this region and urbanization has influenced the growth of the moisture-resistant packaging market. This region is experiencing rapid economic growth which is contributing profoundly towards the development of the market.

The growing demand for the enhanced shelf life of packaged food has compelled market players to grow moisture-resistant food product packaging by using materials that do not react with products. There is a huge demand for electronic products in this region which has raised the moisture-resistant packaging market. In countries such as India, Japan, China, Thailand, and South Korea the pharmaceutical sector is growing rapidly which in turn influences this market expansion.

By Material

By Packaging Type

By End-Use

By Region Covered

April 2025

April 2025

April 2025

April 2025