Packaging Additives Market Outlook Scenario Planning & Strategic Insights for 2034

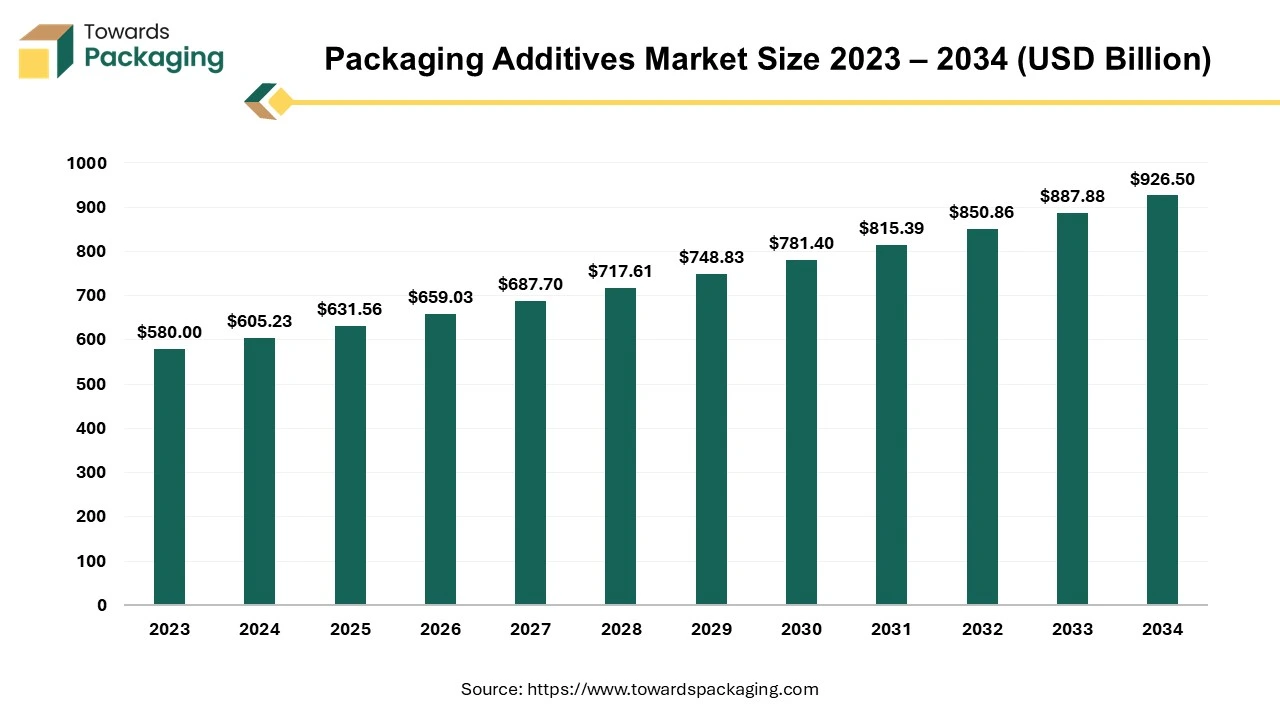

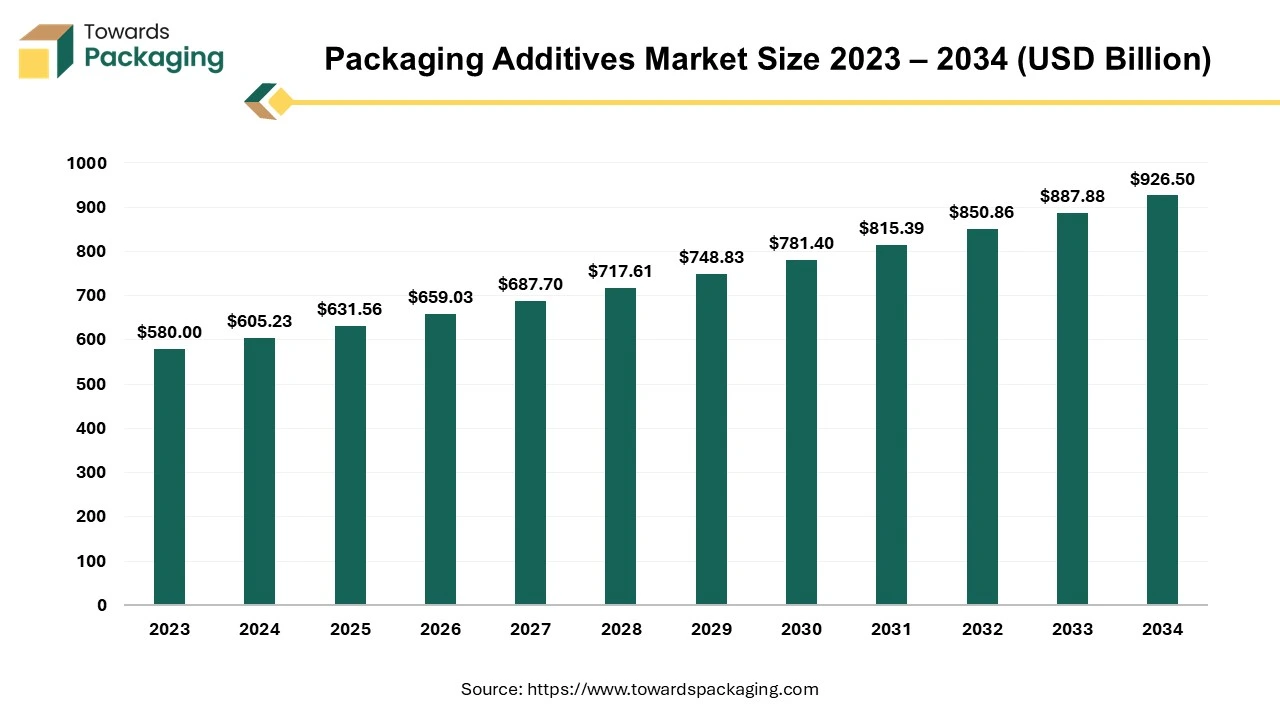

The packaging additives market reached USD 659.03 billion in 2026 and is projected to climb to USD 966.8 billion by 2035, expanding at a 4.35% CAGR from 2025–2034. Our report covers every essential aspect — market size, detailed product and application segments, complete regional analysis across NA, EU, APAC, LA, and MEA, along with profiles of key companies adopting mergers and acquisitions to advance additive technologies. We also include competitive benchmarking, value chain mapping, global trade statistics, and comprehensive data on manufacturers and suppliers.

Major Key Insights of the Packaging Additives Market

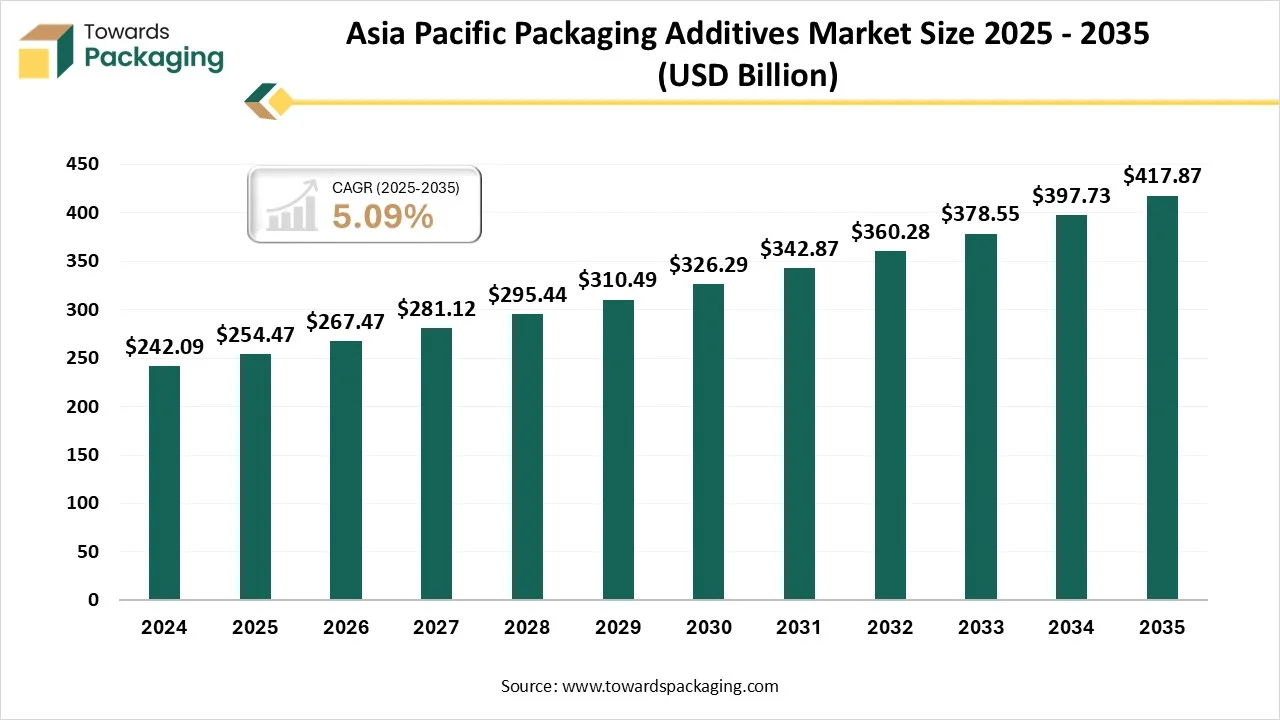

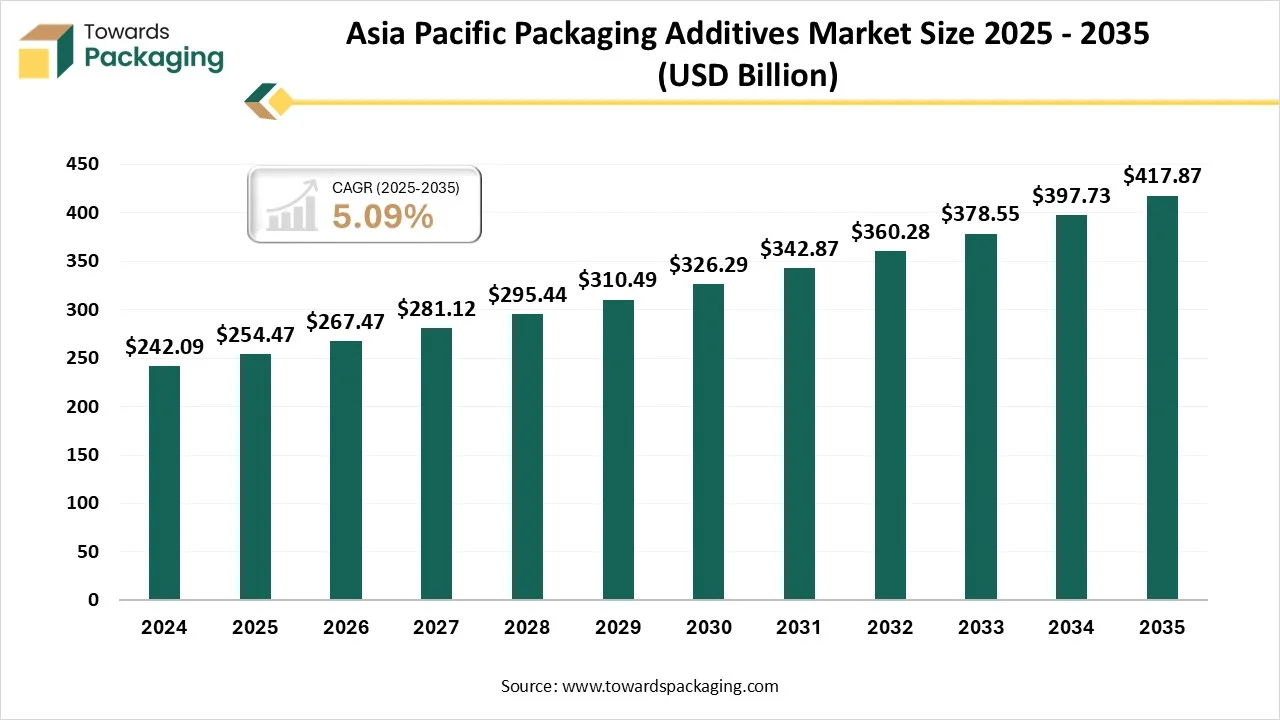

- Asia Pacific dominated the packaging additives market in 2024.

- North America is expected to grow at a significant rate in the market during the forecast period.

- By substrate type, the packaging additives for plastics segment dominated the market with the largest share in 2024.

- By product type, the antifog agents segment registered its dominance over the global packaging additives market in 2024.

- By packaging type, the packaging additives in flexible packaging segment dominated the packaging additives market in 2024.

- By application, food & beverages segment is expected to grow at significant rate during the forecast period.

Packaging additives are compounds incorporated into packaging materials to improve their durability, functionality, or aesthetic appeal. These additives can improve the performance of the packaging or provide specific properties that help preserve the quality and shelf life of the packaged product.

Packaging additives' future depends on utilizing cutting-edge technologies to improve the sustainability and material qualities. On the other hand, nanotechnology is leading the way in providing additives that minimize environmental impact while offering better mechanical strength and barrier qualities. Production processes are becoming more efficient and fewer distinct additions are needed thanks to the emergence of multifunctional additives that provide several advantages at once. These developments represent a shift toward packaging solutions that are more intelligent, effective, and ecologically friendly.

Market Trends

Sustainability & Biodegradability Trend

Global regulatory agencies are closely examining packaging additives in an effort to protect the environment and guarantee consumer safety. Due to increased compliance requirements brought about by this scrutiny, producers are now using eco-friendly, non-toxic chemicals that meet international regulatory standards. Transparency in additive formulations and life cycle evaluations is becoming the norm, which is impacting industry changes to safer and more environmentally friendly addition choices.

There's a significant shift towards eco-friendly additives that enhance the biodegradability of packaging materials. Starch-based additives, for instance, are increasingly used to make synthetic plastics more biodegradable. These additives allow microorganisms to consume the plastic more efficiently, reducing environmental impact.

Active and Smart Packaging

The integration of active components, such as antimicrobial agents and oxygen scavengers, into packaging materials is on the rise. These additives assist to extend product shelf life by preventing microbial expansion and oxidation. For example, zinc oxide nanoparticles embedded in starch-based biofilms have demonstrated antimicrobial properties suitable for food packaging.

Nanotechnology Integration

Nanotechnology is being used to innovate packaging materials with improved barrier properties and functional attributes. Nanoparticles can enhance mechanical strength, thermal stability, and provide antimicrobial effects, contributing to longer shelf life and better protection of packaged goods.

How Can AI Improve the Packaging Additives Industry?

AI integration can significantly enhance the packaging additives industry by driving innovation, improving efficiency, and ensuring sustainability. AI models can analyze vast datasets to predict the performance of various additives and their impact on packaging materials, reducing trial-and-error experimentation.

AI integration helps to streamline the production process of additives, minimizing waste and energy consumption through real-time monitoring and adjustment. AI gives assess the environmental impact of additives throughout their lifecycle, guiding the development of more sustainable alternatives.

AI has ability to analyze specific customer requirements, such as shelf-life extension or resistance to certain conditions, to recommend or develop bespoke additive formulations. AI-driven analytics helps to predict market trends and consumer preferences, enabling manufacturers to align their product offerings with demand.

Driver

Growth in Sales Through E-commerce Platform

The boom in e-commerce has increased the demand for durable and functional packaging solutions, requiring additives for strength, barrier protection, and aesthetics. E-commerce products go through multiple handling stages, making durability crucial. Additives like impact modifiers and strengthening agents enhance packaging material resilience. Additives provide additional protection against compression, vibration, and temperature fluctuations during transit.

Packaging additives like UV stabilizers, moisture barriers, and oxygen scavengers help maintain product freshness and quality, especially for food and pharmaceuticals. For global shipping, additives protect packaging against environmental factors like humidity and extreme temperatures. In e-commerce, the packaging often serves as the first physical interaction with a brand. Additives for color enhancement, gloss, and texture customization help create visually appealing packaging.

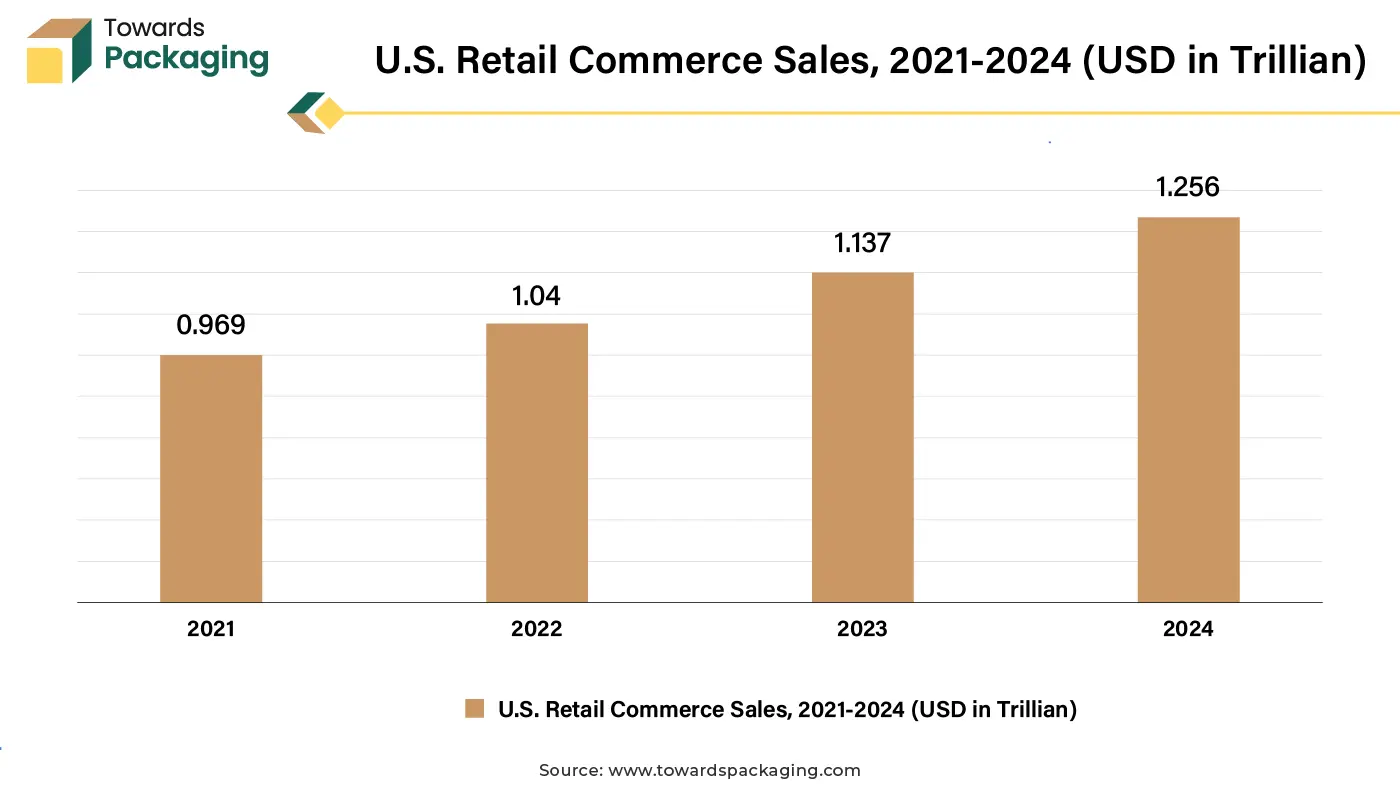

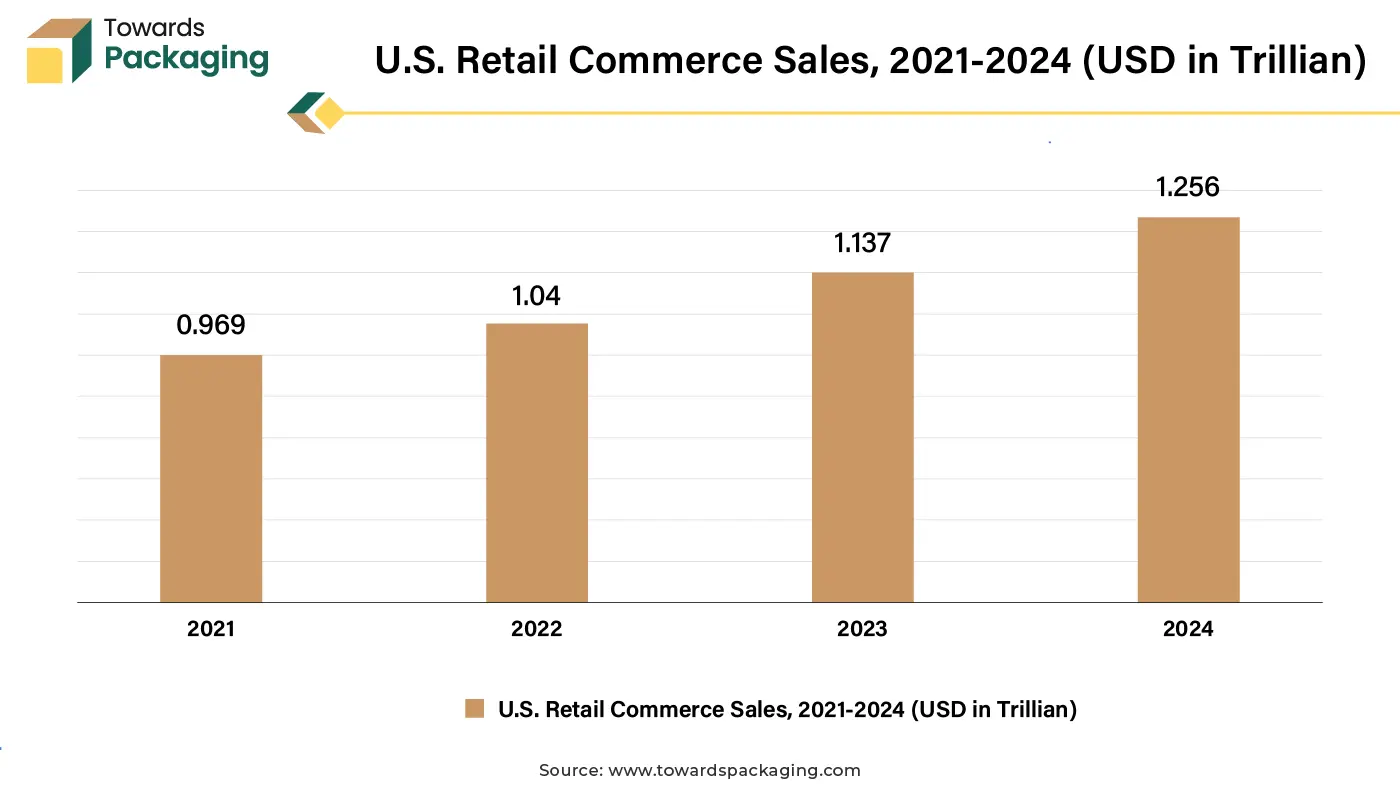

- In August 2024, according to the data published by the National E-commerce Associations, retail e-commerce sales in the United States were projected to reach US$300.1 billion in the third quarter of 2024, a 2.6% rise over the second quarter. This represented 16.2% of the total sales. Global e-commerce sales are predicted to reach US$6.3 trillion in 2024, an 8.8% growth. The market is expected to reach over US$7.9 trillion by 2027.

Restraint

Stringent Regulatory Standards & Environmental Concerns

Regulatory requirements regarding the use of chemicals in packaging, especially for food and pharmaceutical products, can pose challenges. Compliance costs and delays in approvals can hinder market growth. Many additives are derived from non-biodegradable or non-recyclable materials, leading to environmental concerns. Increasing awareness and strict regulations around plastic waste management can restrict the use of certain additives.

Opportunities

Advancements in Packaging Technologies

Innovations in packaging technologies, such as smart and active packaging, have increased the use of additives that provide specific functionalities, like UV resistance, moisture control, and antimicrobial properties. Hence, rising advancement in packaging technology has increased the demand for the new packaging additives, which has created lucrative opportunity for the growth of the packaging additives market in near future.

- For instance, in December 2024, the VT Technical Research Centre of Finland has created a novel continuous process for bending cardboard to produce reel-to-reel origami-inspired structures for fiber-based packaging materials. This technology was developed in partnership with Aalto University and Finnish industrial partners. Origami folds have the ability to give cardboard completely new characteristics. The structures are a great and aesthetically pleasing substitute for protective packing materials like plastic and expanded polystyrene because of their resilience and low weight. Designers have also expressed interest in the material's aesthetics.

Market Segments

Packaging Additives for Plastics Led the Market in 2024

The packaging additives for plastics segment dominated the packaging additives market globally. Plastics are highly versatile materials, adaptable to various packaging requirements such as food, beverages, pharmaceuticals, and personal care. They can be easily modified with additives to achieve properties like flexibility, strength, transparency, and lightweight, making them ideal for a wide range of applications. Plastic packaging, with additives like impact modifiers and UV stabilizers, offers robust protection during handling, shipping, and storage, meeting the needs of e-commerce and logistics sectors.

Plastic packaging is generally more economical compared to alternatives like metal, glass, or paper. Additives further enhance their functionality without significantly increasing costs, making them an attractive option for manufacturers.

Antifog Agents Witnessed Significant Share in 2024

The antifog agents segment accounted for a considerable share of the packaging additives market in 2024. Antifog agents prevent the formation of water droplets (fog) on the inside surface of transparent packaging, such as plastic films. Fogging occurs due to temperature differences and high humidity, creating condensation. Antifog agents are widely used as packaging additives because they address specific challenges related to condensation and visibility in packaging, particularly in industries like food and agriculture.

Antifog agents are particularly useful in fresh produce packaging, where humidity levels are high. They are also essential in frozen food packaging to prevent fogging during defrosting.

Antimicrobial Agents to Show Fastest Growth

The antimicrobial agents segment is expected to grow at the fastest rate in the packaging additives market during the forecast period of 2024 to 2034. Antimicrobial agents prevent the growth of bacteria, mold, and fungi on the packaging surface and the product, keeping food and other perishable items fresher for longer.

The increasing consumption of processed and ready-to-eat foods drives the need for antimicrobial packaging to ensure these products remain safe during storage and transit. The antimicrobial agent is widely used in pharmaceutical products to protect sensitive drugs and medical devices from microbial contamination. For products shipped over long distances, antimicrobial packaging helps maintain product integrity by mitigating microbial risks during transit and storage.

Large Consumers Base for Flexible Packaging to Support Dominance

The packaging additives in flexible packaging segment registered its dominance over the global packaging additives market in 2024. Flexible plastic packaging, such as pouches, films, and bags, is in high demand due to its lightweight and space-saving properties. Additives play a crucial role in improving the performance of these materials.

Expansion of Food & Beverages Sector to Support Dominance

The food & beverages segment held a dominant presence in the packaging additives market in 2024. Due to the modern and busy lifestyle the demand for the packaged food has increased, which has created lucrative opportunity for the growth of the packaging additives market in the near future. The rise in urbanization, changing lifestyles, and growing preference for convenience foods have fueled the demand for packaged foods, driving the need for packaging additives. Hence, due to rising Demand for packaged foods, the food & beverages segment shows significant share in the packaging additives market.

Asia’s Highest Plastic Consumption to Promote Dominance

Asia Pacific region dominated the global packaging additives market in 2024. Asia has the largest and fastest-growing population, which is the first explanation. According to research, there will be 4.3 billion people in Asia by 2022. Additionally, both the GDP and population growth rates are desired and at the "gold rate."

According to new research, the single-use plastic packaging market is predicted to develop rapidly due to increased spending power in Asia Pacific, reaching a global value of US$26 billion this year. The e-commerce, healthcare, and food and beverage industries in important, rapidly expanding Asian economies like China, India, and Indonesia are expected to propel the 6.1% global growth in single-use plastic packaging this year.

As a result of increasing urbanization and a developing middle class X, which is drawn to plastic products and packaging because of their ease and adaptability, Southeast Asia has become a hotspot for plastic pollution. However, the infrastructure for managing garbage in the area has not kept up, leading to a significant amount of waste that is poorly handled. COVID-19 has made matters worse by increasing the use of masks, sanitizing bottles, and packaging for online deliveries. According to a number of groundbreaking studies conducted by the World Bank Group, single-use plastic that is thrown away instead than recovered and recycled cost Thailand, the Philippines, and Malaysia $6 billion year, or more than 75% of the material value of recyclable plastic.

China Market Trends

China packaging additives market is driven by the robust manufacturing infrastructure. China's burgeoning middle class and increasing urbanization have led to a surge in demand for packaged goods. This trend is particularly evident in the food and beverage industry, where consumers seek convenience and quality. The rise in e-commerce has further amplified the need for effective packaging solutions to ensure product safety and integrity during transit. China's well-established manufacturing sector, characterized by abundant raw materials and cost-effective labor, supports large-scale production of packaging materials and additives. This infrastructure enables rapid innovation and scalability, catering to both domestic and international markets. The Chinese government's initiatives to reduce plastic waste and promote sustainable practices have spurred the development and adoption of eco-friendly packaging additives.

Policies such as the ban on non-biodegradable single-use plastics have encouraged manufacturers to explore biodegradable and recyclable additive solutions. Investments in research and development have led to the creation of advanced packaging additives that enhance product shelf life, safety, and functionality. Innovations include antimicrobial agents to prevent contamination and additives that improve the durability and appearance of packaging materials. The expansion of industries such as food and beverage, pharmaceuticals, and personal care products has increased the demand for specialized packaging solutions. These sectors require packaging that not only preserves product quality but also complies with stringent safety and regulatory standards.

North America’s Supportive Infrastructure Supports Rapid Growth

North America region is anticipated to grow at the fastest rate in the packaging additives market during the forecast period. North America has a highly developed consumer goods industry, including food and beverages, pharmaceuticals, and personal care products. These industries require advanced packaging solutions to preserve product quality, extend shelf life, and maintain safety. The region is a leader in innovation, with continuous advancements in packaging technologies, including the development of eco-friendly additives, active packaging solutions, and smart packaging.

These innovations drive demand for packaging additives. North America has stringent regulations governing product packaging, particularly in the food and pharmaceutical sectors. These regulations encourage the use of additives that improve the safety, functionality, and environmental impact of packaging materials.

Many major global packaging additive manufacturers such as ALPLA, CASE & Plastics USA HQ, Avery Dennison, DS Smith, etc. are based in North America. These companies invest heavily in research and development, enabling the region to lead in market innovation.

U.S. Market Trends

U.S. packaging additives market is growing owing to expanding consumer base and strong demand from end-use industries. Food & Beverage, Pharmaceuticals, and Personal Care sectors in the U.S. demand high-performance packaging. These industries require additives that offer barrier protection, UV resistance, anti-microbial properties, and enhanced shelf life. The U.S. is home to leading packaging and chemical companies investing heavily in research and development. Innovations include bio-based additives, smart packaging materials, and active packaging technologies. This keeps the U.S. at the forefront of functional, sustainable, and high-tech packaging solutions. Regulatory bodies like the FDA (Food and Drug Administration) and EPA (Environmental Protection Agency) enforce strict guidelines. This drives demand for safe, non-toxic, and compliant packaging additives.

Rising awareness of environmental issues has led U.S. consumers and companies to prioritize eco-friendly packaging. There’s growing use of biodegradable, recyclable, and compostable materials, boosting the need for compatible sustainable additives. The U.S. benefits from mature logistics networks, advanced manufacturing facilities, and global trade relationships. This helps scale production and support exports of packaging additives. U.S. consumers prefer durable, attractive, and functional packaging, driving demand for aesthetic and performance-enhancing additives (e.g., anti-fog, anti-static, clarifying agents). Major global players such as Dow, Eastman Chemical, and BASF (U.S. division) are headquartered or operate in the U.S., strengthening domestic capabilities and innovation.

Europe’s Stringent Regulatory Laws to Project Notable Growth

Europe region is seen to grow at a notable rate in the foreseeable future. The European Union (EU) has implemented rigorous policies aimed at reducing packaging waste and promoting sustainability. Notably, the EU Parliament approved legislation to ban certain single-use plastic packaging items by 2030, such as mini shampoo bottles in hotels and thin plastic grocery bags. These regulations are designed to decrease packaging waste and encourage the use of recyclable and reusable materials.

Additionally, the EU is set to enforce stringent rules on food packaging, effectively banning plastic recycled outside the bloc from being used. This measure aims to ensure packaging complies with EU recycling standards and supports the development of a market for EU-compliant recycled plastic.

European countries are investing in research and development to create advanced packaging additives that enhance product functionality and sustainability. Innovations include fiber-based coatings, low-carbon production processes, and plastic-free barrier additives. These advancements contribute to more efficient and eco-friendly packaging solutions. Research institutions across Europe are also exploring AI-driven production optimization, moisture-resistant coatings, and biodegradable packaging films, further driving the adoption of sustainable packaging additives.

European consumers are increasingly prioritizing sustainability, leading to a higher demand for biodegradable and recyclable packaging options. This shift in consumer behavior encourages manufacturers to adopt eco-friendly additives that align with environmental values. Europe's well-established food and beverage, pharmaceutical, and personal care industries significantly contribute to the demand for packaging additives. These sectors require packaging solutions that ensure product safety, quality, and compliance with stringent regulations, thereby supporting market growth. European governments provide support measures, such as tax breaks, subsidies, and incentives, to promote the development and adoption of sustainable packaging solutions. These initiatives encourage companies to invest in eco-friendly packaging additives and technologies.

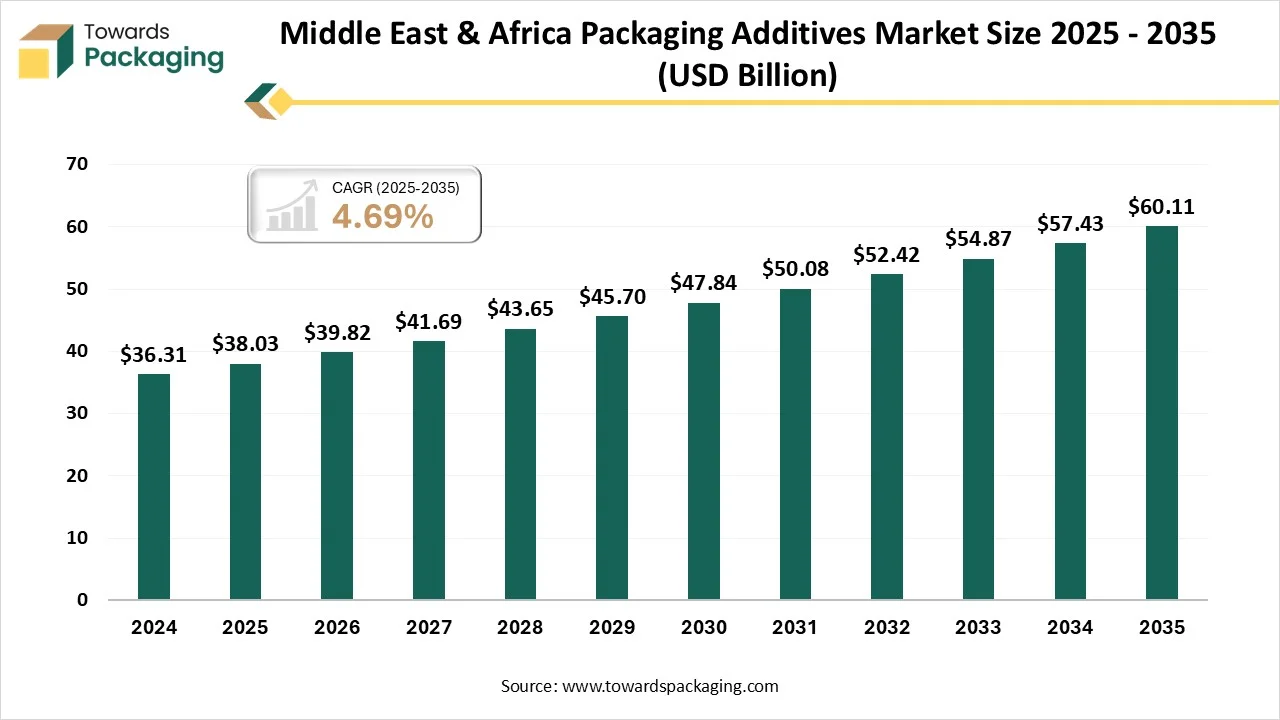

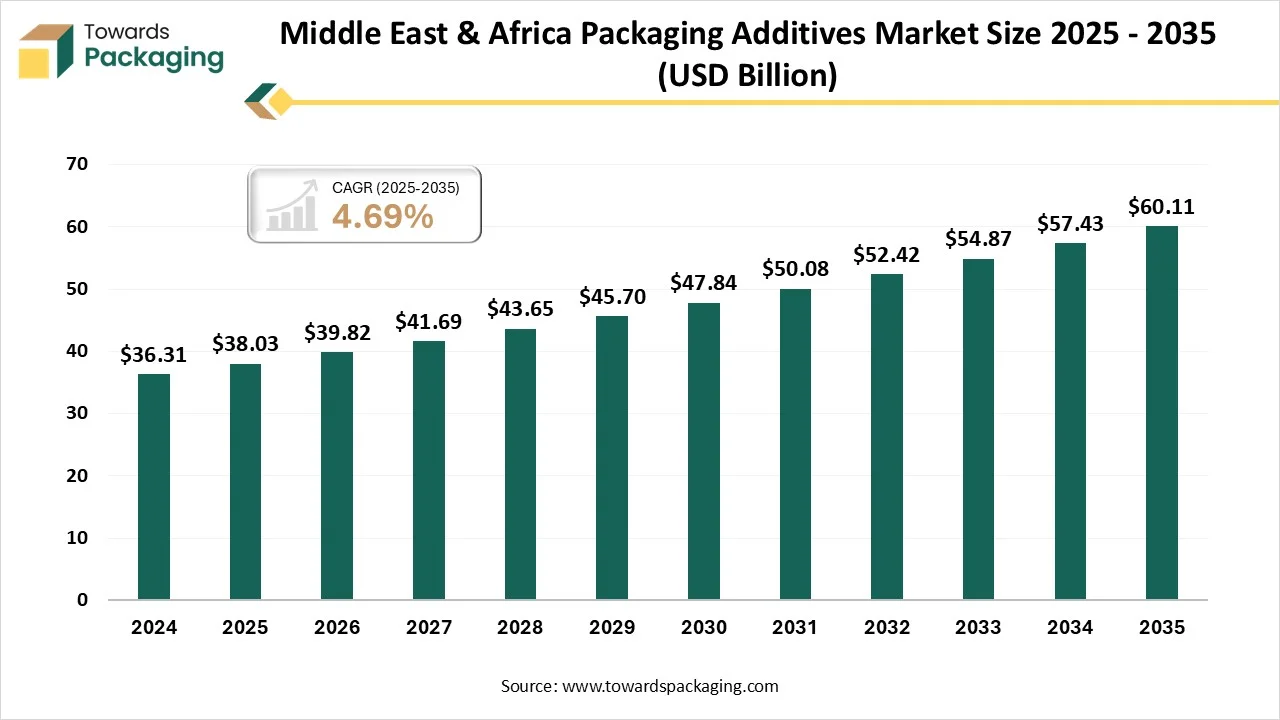

Middle East & Africa Packaging Additives Market Size 2025 - 2035 (USD Billion)

Global Packaging Additives Market Key Players

Latest Announcements by Packaging Additives Industry Leaders

- In September 2024, Evonik Industries AG company’s Head of Coating Additives, Elias Lacerda, stated With TEGO Wet 570 Terra and TEGO Wet 580 Terra, the company provide clients with entirely new high-performance solutions that also propel the packaging and coatings industry's green transition. Novel biosurfactants created especially for coating and ink compositions are being introduced by Evonik Coating Additives. With their remarkable sustainability profile and outstanding performance, the two new products, TEGO Wet 570 Terra and TEGO Wet 580 Terra, are poised to revolutionize the paint, coating, and inks sector.

New Advancements in Packaging Additives Industry

- In March 2025, according to the results are published in a new paper on small-format plastic packaging recovery by Closed Loop Partners' Centre for the Circular Economy. Closed Loop Partners finished its work with assistance from Kraft Heinz, P&G, Target, Maybelline New York, and its parent company L'Oréal Groupe, building on two years of market research and recycling testing. The company discovered that tens of thousands of tons of valuable tiny materials, such as polypropylene and other plastics, may be recovered from glass recycling plants and materials recovery facilities (MRFs) spread throughout the United States. Large volumes of these materials could be successfully recycled instead of being wasted if the proper tools are available. It is now possible to sift and route waste materials from glass recycling facilities to the proper bales for sale in the recycled materials market.

- In February 2025, Sun Chemical will introduce two new effect pigments in addition to its entire line of high-performing color stylings at the European Coatings Show in Nuremberg, Germany. The company will also present new and inventive polymers, resins, and packaging film treatments for the coatings sector. Digital Tools, Color Innovations, and Styling Trends In addition to new digital pigment tools and an expanded supply of perylene pigments, Sun Chemical will showcase its most recent product advancements at booth 3C-448, including color solutions and trend stylings for motorcycle coatings.

- In January 2025, Avient Corporation, a materials solutions provider revealed the introduction of the ColorMatrix Lactra EL, an additive solution designed for the extended shelf-life (ESL) dairy sector. Compared to conventional masterbatch solutions for ESL dairy protection, this next-generation light-blocking additive delivers better protection and is more economical and environmentally friendly. The ESL dairy market is expanding significantly on a global scale, and Avient's Lactra ESL is well-positioned to satisfy the changing demands of this vibrant sector. By increasing the shelf life of dairy products to help avoid food spoiling and lowering inorganic content in packaging without sacrificing light-blocking efficacy, Lactra ESL's low titanium dioxide (TiO2) levels can support sustainability goals.

- In September 2024, EcoCortec, the Cortec Corporation's European subsidary, introduced EcoSonic VpCI-125 PCR HP Permanent ESD Films and Bags, which are constructed with a high, consistent quality, 30% post-consumer recycled material. Nano-VpCI, which has a significant post-consumer recycled plastic content, powers the permanent ESD film. High-performance corrosion-inhibiting film and bags are designed to be used in the protection of multi-metal objects that are susceptible to static, such electronics.

- In October 2024, At the 29th Fakuma International Trade Fair for Plastics Processing, which is taking place today through October 19, 2024, Avient Corporation will showcase its most recent sustainable and specialized materials solutions and services for the plastics sector, along with the introduction of two new products. Globally produced thermoplastic elastomers (TPEs) with up to 60% post-consumer recycled (PR) content and new metallic pre-colored sulfone compound colorants with gold, bronze, and silver aesthetic effects are examples of newly introduced products.

Global Packaging Additives Market Segments

By Substrate Type

- Packaging Additives for Plastics

- Packaging Additives for Metals

- Packaging Additives for Paper & Paperboards

- Others (Glass)

By Product Type

- Antifog Agents

- Antimicrobial Agents

- Antistatic Agents

- Clarifying Agents

- Oxygen Scavengers

- UV Stabilizers

By Packaging Type

- Packaging Additives in Flexible Packaging

- Packaging Additives in Rigid Packaging

By Application

- Food & Beverages

- Pharmaceutical and Healthcare

- Personal Care & Cosmetics

- Automobile

- Others

By Region

- North America

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Latin America

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait