April 2025

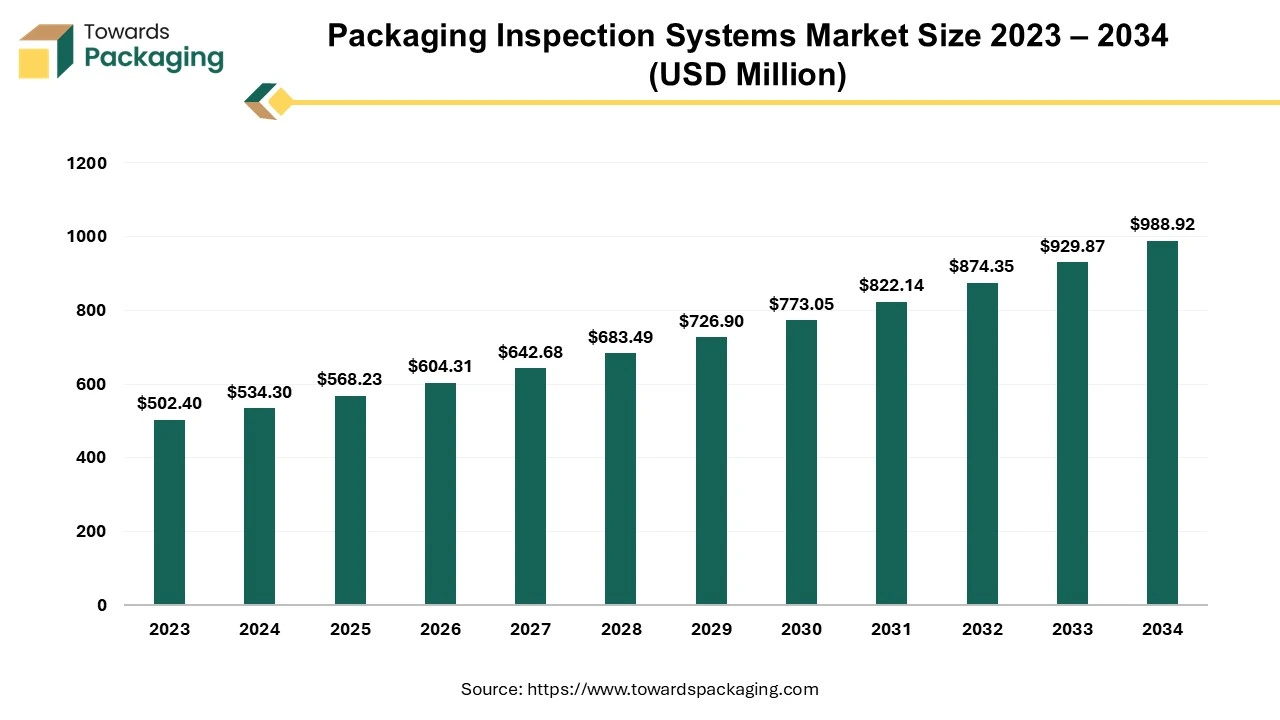

The global packaging inspection systems market size reached US$ 534.30 million in 2024 and is projected to hit around US$ 988.92 million by 2034, expanding at a CAGR of 6.35% during the forecast period from 2025 to 2034.

The key players operating in the market are focused on adopting inorganic growth strategies like acquisition and merger to develop advance technology for manufacturing packaging inspection systems which is estimated to drive the global packaging inspection systems market over the forecast period.

Packaging inspection systems is known as an automated systems or equipment utilized to evaluate and ensure the safety, integrity and quality of packaging materials and products during production. These systems employ advanced technologies such as machine vision, X-rays, sensors, and lasers to detect defects or irregularities in packaged goods across industries like food and beverages, pharmaceuticals, cosmetics, and consumer goods.

One can be sure that your packaging will shield the product from deterioration or damage while it is being transported and distributed by doing packaging testing. Through the identification of suitable protection levels and the reduction of packaging materials, packaging testing can help lower the package expenses.

The packaging inspection systems identify packaging issues such as cracks, leaks, dents, or contamination in containers, cans, trays, bottles, or flexible packaging. The packaging inspection systems ensure that liquid, solid, or powdered products are filled to the correct level, preventing underfilling or overfilling. It verifies that seals, caps, lids, or closures are intact and airtight to maintain product freshness and safety. The system checks for accurate labeling, correct barcodes, and proper placement of printed information to avoid errors. The packaging inspection systems identify foreign particles or contaminants inside packages using X-ray or advanced imaging technologies. Assess the overall shape, size, and alignment of packages to detect deformation, misalignment, or damage.

The packaging inspection systems play an important role in maintaining product quality, ensuring compliance with regulations, and enhancing production efficiency across industries. They are integral to preventing defects, reducing waste, and safeguarding consumer satisfaction.

AI-powered systems can analyze vast amounts of data to identify patterns and improve defect detection accuracy over time. Machine learning algorithms enable self-learning inspection systems to adapt to new packaging formats, materials, and defects, reducing false positives and increasing reliability. AI enhances real-time decision-making, improving overall production efficiency.

Machine vision and high-speed cameras are becoming more advanced, providing better resolution and real-time inspection of complex packaging at high speeds. Vision systems with 3D imaging and multi-angle inspection ensure precise defect detection for irregularly shaped bottles, containers, and flexible packaging. These systems are increasingly used for detecting label misalignment, fill-level errors, and sealing issues.

Packaging inspection systems are being integrated with the Internet of Things (IoT), allowing real-time data collection, analysis, and remote monitoring. Connectivity with smart factories enables predictive maintenance, reduced downtime, and optimized production efficiency. Manufacturers can monitor inspection processes and quality metrics in real time across production lines.

VR and AR are being used to train operators on complex inspection systems, ensuring quick onboarding and minimizing errors. Simulated environments allow workers to understand how systems operate without interrupting production lines.

As the demand for flexible packaging (e.g., pouches, sachets) grows, inspection systems are being developed to detect defects like leaks, improper seals, and fill-level inconsistencies in non-rigid materials. These systems ensure quality for lightweight, eco-friendly packaging options.

Combining technologies such as machine vision, lasers, X-rays, and infrared sensors into a single system provides comprehensive inspection capabilities. These systems offer multi-layer analysis, ensuring detection of both internal and external defects.

Packaging inspection systems are increasingly equipped with tools for serialization and track-and-trace functionalities. Integration of barcodes, QR codes, and RFID tags enables traceability across the supply chain, ensuring product safety and regulatory compliance.

Cloud-based inspection systems with Software-as-a-Service (SaaS) models provide flexibility for smaller manufacturers to adopt advanced inspection technologies without heavy upfront investments. Data storage and process optimization can be accessed remotely, improving operational efficiency.

The integration of artificial intelligence enhances defect detection. The AI-powered computer vision can identify subtle defects (e.g., scratches, misprints, leaks, or irregular sealing) that traditional systems or manual inspection might miss. Machine learning algorithms can learn to detect new types of defects over time through data training. AI enables real-time analysis of packaging lines, identifying issues instantaneously and reducing delays in production. Immediate feedback allows quick corrective actions, minimizing material waste and downtime.

AI can automate visual inspections without requiring human intervention, reducing labor costs and increasing throughput. Robots equipped with AI vision systems can handle high-speed inspection processes more efficiently than humans. Deep learning models can analyze large datasets of packaging images to understand patterns and anomalies with high precision. AI can detect variations that might not conform to quality standards, such as inconsistencies in label alignment, text errors, or barcode readability.

The surge in e-commerce drives the demand for robust packaging that ensures product safety during shipping and handling. Packaging inspection systems play an important role in maintaining quality for online deliveries. With the growing push for sustainable, minimal, and eco-friendly packaging, inspection systems help manufacturers ensure these new materials maintain functionality and integrity. AI-powered systems can detect defects or weaknesses in lightweight and biodegradable packaging, which are often more prone to damage. eCommerce fulfillment centers operate at high speeds to process orders quickly. Advanced inspection systems integrate seamlessly into automated production lines to maintain throughput without compromising quality, ensuring error-free packaging at scale.

eCommerce logistics depend heavily on barcode scanning, QR codes, and other labeling systems to facilitate sorting, tracking, and delivery. Packaging inspection systems equipped with advanced vision technologies ensure accurate label placement, clarity, and readability, preventing shipment delays or losses due to errors. Smart packaging (e.g., RFID tags, IoT sensors, and NFC-enabled labels) is becoming more common in eCommerce for enhanced product tracking and engagement. Inspection systems verify the placement, functionality, and integrity of these technologies, ensuring operational efficiency.

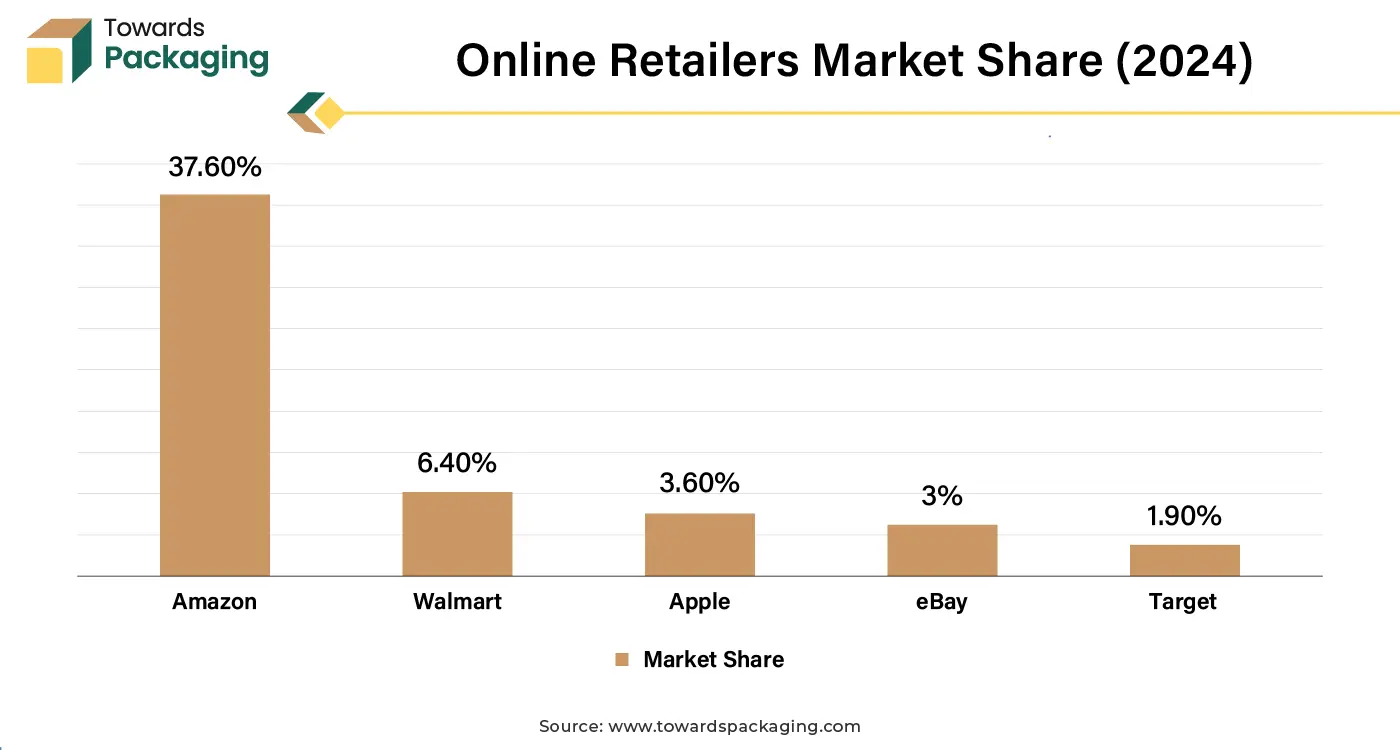

In August 2024, according to the data published by the B2B eCommerce Association, with an average of 2.84 billion visits every month, Amazon continues to be the most popular eCommerce website. Amazon and Walmart are two American corporations that ranked in the top three websites in terms of visitors. However, China-based AliExpress saw the most gain in popularity from year to year, growing by an astounding 44%.

Last year, executives in the commerce sector spent US$3.5 billion on advertising overall, with individual expenditures ranging from US$41.3 million to US$1.7 billion. With a staggering US$1.7 billion, more than four times Walmart's expenditure, Amazon took the lead. However, Aliexpress spent the least amount at only US$322,000, which is 5,000 times less than Amazon. This is mostly because Aliexpress is utilized more frequently outside of the US than it is in the U.S. Even with this small investment, Aliexpress.com's website traffic has increased significantly in the U.S.

The key players operating in the packaging inspection systems market face challenges in system integration and challenges in inspecting complex material, which has estimated to restrict the growth of the packaging inspection systems market over the forecast period. Integrating inspection systems with existing production lines and legacy machinery can be complex, requiring specialized expertise and time.

Compatibility issues can create bottlenecks in production, discouraging companies from adopting new systems. The increasing use of sustainable, lightweight, and eco-friendly materials introduces challenges in defect detection. These materials may require specialized inspection systems, limiting the capabilities of standard solutions. Complex packaging formats, such as smart packaging or multi-layered materials, may require further technological advancements.

The rise of smart packaging technologies like NFC tags, QR codes and RFID, and for tracking and consumer engagement creates opportunities for inspection systems that can verify the accuracy and functionality of these features. Systems that ensure proper placement and readability of these technologies will see high demand. Hence, the growth in smart packaging solutions, has increased the sales of the packaging inspection systems, which has created opportunity for the growth of the packaging inspection systems market over the forecast.

The bottles & cans segment held a dominant presence in the packaging inspection systems market in 2024. Inspection systems detect defects such as cracks, dents, improper sealing, or missing caps that can compromise the integrity of bottles and cans. Consistent quality ensures customer satisfaction and brand reputation. These systems identify contaminants, foreign objects, or irregularities in packaging that could pose health risks. For food and beverages, safety compliance is essential to meet regulations and avoid recalls.

Inspection systems verify proper filling levels to ensure neither underfilling nor overfilling, maintaining product weight standards. They also check for correct label placement and print quality, preventing misbranding and regulatory issues. Modern manufacturing lines operate at extremely high speeds.

Automated inspection systems can keep up with production rates, ensuring each bottle or can is inspected quickly and accurately without slowing down operations. Continuous monitoring of packaging helps detects production line issues, allowing for timely maintenance and reducing costly production stoppages. Overall, packaging inspection systems improve reliability, reduce human error, and enhance product quality and safety, making them indispensable in bottle and can packaging processes.

The food & beverages segment registered its dominance over the global packaging inspection systems market in 2024. Food and beverages are directly consumed, so packaging defects (e.g., leaks, contamination, or improper seals) can pose significant health risks. Inspection systems detect foreign objects, contamination, or faulty seals to ensure safe consumption. The food and beverage industry is subject to stringent health and safety regulations (e.g., FDA, ISO standards).

Packaging inspection systems help ensure compliance by identifying defects and ensuring accurate labeling and packaging. Inspection systems ensure that bottles, cans, or containers are filled to the correct level. This prevents underfilling, which can lead to customer dissatisfaction, or overfilling, which can cause product loss and inefficiencies. Mislabelling can lead to legal consequences and customer confusion. Inspection systems verify that labels are correctly applied, readable, and contain accurate information.

The pharmaceutical segment accounted for a considerable share of the market in 2024. Pharmaceuticals directly impact health and well-being. Defective packaging (e.g., leaks, cracks, improper seals) can compromise the sterility and efficacy of medicines, leading to health risks for patients. The pharmaceutical industry is governed by strict global regulations (e.g., EMA, FDA, GMP) that require rigorous quality control. Inspection systems help ensure compliance by detecting defects in packaging, labeling, and seals. Accurate labeling is crucial for pharmaceuticals to ensure correct dosage, patient safety, and avoid medication errors.

Inspection systems verify that labels contain the correct information, such as drug name, dosage, expiry date, and batch number. Contaminants, such as particulates or foreign materials, can enter the packaging process and pose serious health hazards. Inspection systems, including X-ray and vision systems, identify such issues before products are released.

In conclusion, packaging inspection systems are important in the pharmaceutical sector to ensure regulatory adherence, patient safety, and product integrity while maintaining operational efficiency and protecting brand reputation.

North America region held a significant share of the packaging inspection systems market in 2024. North America, particularly the United States and Canada, enforces stringent regulations to ensure product safety and quality, especially in sectors like pharmaceuticals, food & beverages, and healthcare. Agencies such as the FDA (Food and Drug Administration) and the USDA mandate compliance with strict packaging and labeling standards, driving demand for advanced inspection systems. North America is home to some of the largest food & beverage, pharmaceutical, and cosmetic manufacturing industries.

These industries rely heavily on packaging inspection systems to maintain quality, ensure regulatory compliance, and enhance productivity. North America is home to some of the largest food & beverage, pharmaceutical, and cosmetic manufacturing industries. These industries rely heavily on packaging inspection systems to maintain quality, ensure regulatory compliance, and enhance productivity.

North America is home to major technology developers and solution providers who continuously invest in research and development to improve inspection technologies. Companies such as Cognex, Omron, and Mettler-Toledo lead the innovation in this sector.

Asia Pacific region is anticipated to grow at the fastest rate in the packaging inspection systems market during the forecast period. The Asia Pacific region, led by countries such as China, Japan, India, and South Korea, has become a global hub for pharmaceutical manufacturing. Increased production of vaccines, medicines, and medical supplies requires stringent quality control, boosting the demand for packaging inspection systems.

Growing populations, an expanding middle class, and increased healthcare awareness in Asia Pacific have led to greater demand for pharmaceuticals. This surge in drug production necessitates advanced inspection systems to ensure product safety, quality, and integrity. Countries like India and China are adopting stricter pharmaceutical quality and safety regulations to meet international standards (e.g., FDA and WHO compliance). Packaging inspection systems help manufacturers comply with these standards, ensuring defect-free products for both domestic and export markets.

Asia Pacific countries, particularly India and China, are leading exporters of generic drugs and vaccines to global markets. To maintain quality and meet international regulatory requirements, advanced packaging inspection systems are essential for detecting defects, contamination, and labeling issues.

Asia Pacific has seen significant growth in Contract Manufacturing Organizations (CMOs) that manufacture drugs for global pharmaceutical companies. Contract Manufacturing Organizations (CMOs) invest in state-of-the-art inspection systems to ensure their processes align with global quality standards.

By Packaging

By End-Use

By Region

April 2025

April 2025

April 2025

April 2025