April 2025

.webp)

Principal Consultant

Reviewed By

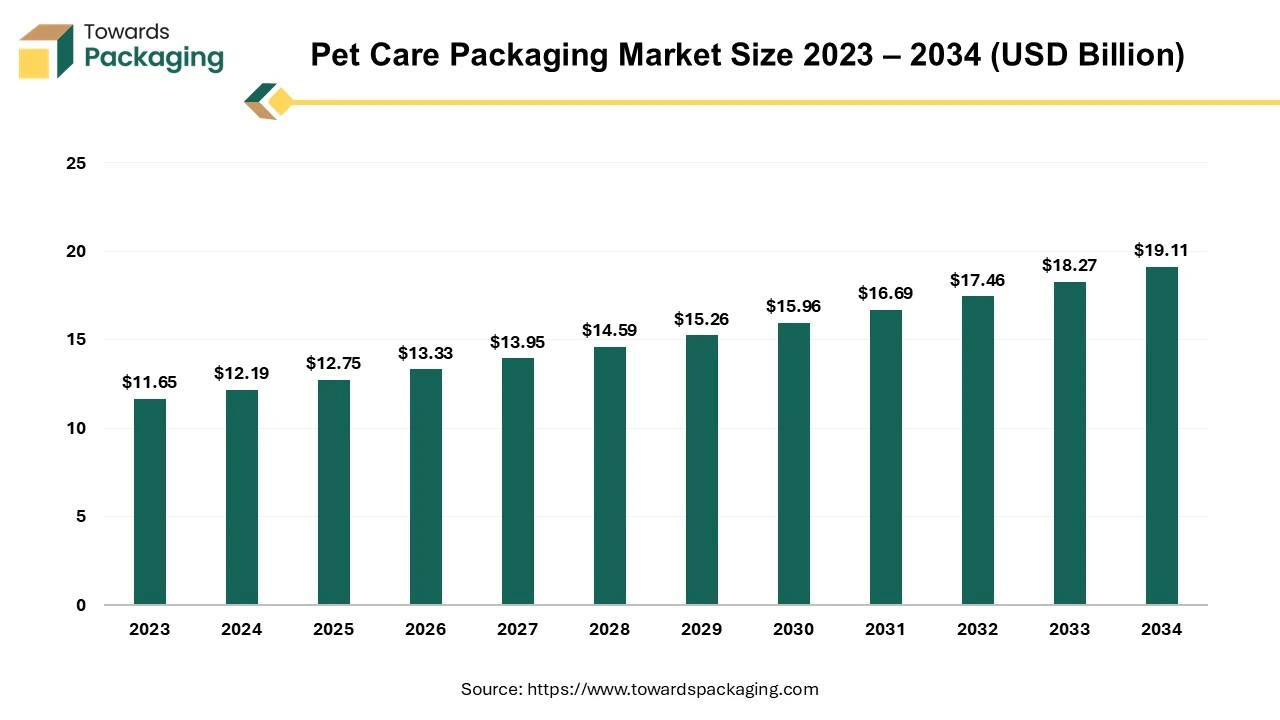

The pet care packaging market size is projected to reach USD 19.11 billion by 2034, expanding from USD 12.75 billion in 2025, at an annual growth rate of 4.6% during the forecast period from 2025 to 2034.

The industry that creates solutions and materials for packaging pet care items is known as the pet care packaging market. Pet food, treats, toys, grooming supplies, and other accessories are just a few of the packaged products this sector offers for pet owners. The standard package of grooming services includes bathing, brushing, cutting hair, clipping nails, cleaning ears, removing tears from stains, shaving, shaving pad and foot, sanitary trimming, and cleansing of the anal glands. The standard package of grooming services includes bathing, brushing, cutting hair, clipping nails, cleaning ears, removing tears from stains, shaving, shaving pad and foot, sanitary trimming, and cleansing of the anal glands.

The pet care industry has experienced a significant upswing in developed nations in recent years, mirroring the rising number of pet companions. The restrictions imposed by the pandemic undoubtedly contributed to heightened interest in pets, leading to an unprecedented surge in the pet care sector. Notably, the sale of dog and cat food packaging units has outpaced every other category in the fast-moving consumer goods (FMCG) market. Pet care manufacturers are not only creating traditional products but are also introducing innovative offerings, including beneficial foods and supplements. These products come in convenient, resealable packaging designed to induce relaxation, support skin and coat health, and enhance immunity. Neo Bites, for example, has unveiled purposeful meal toppers in flexible, resealable packaging, addressing specific wellness and health concerns.

The pet care industry is evolving beyond conventional products to include a variety of innovative solutions, such as pet-calming items that contribute to creating a tranquil environment. Wild One, for instance, markets a gummy supplement for relaxation, packaged in a resealable plastic bottle, showcasing the industry's adaptability and growth potential.

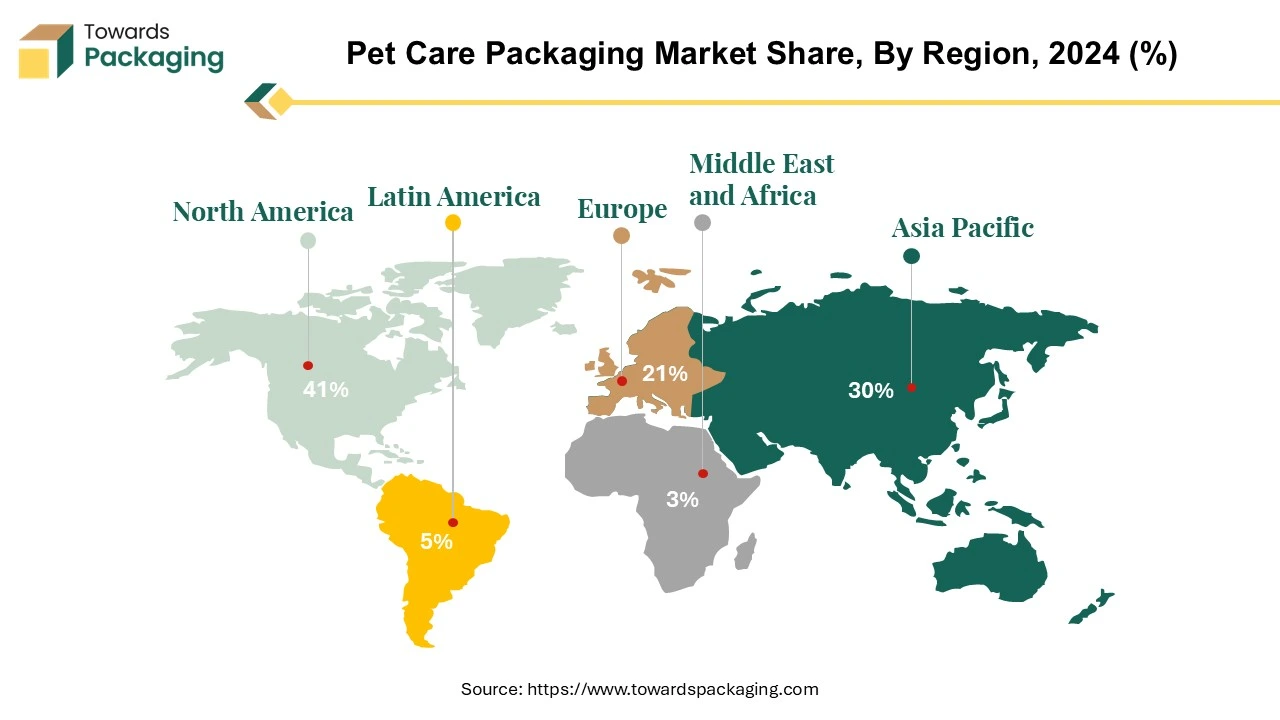

North America is the leading, United States continues to be the nation with the most significant number of dogs and cats, and this tendency is gradually growing across historical and projected periods. Simultaneously, customers are exhibiting an increased consciousness of the environmental consequences linked to different items, especially those concerning pets. There has been a noticeable shift in consumer tastes, as evidenced by the rising demand for packaging options that support sustainable practices—mainly recyclable options. Customers' increasing awareness of environmental issues is one of the key factors influencing the packaging industry in North America.

The increasing popularity of pet ownership and the active search for products for these loyal companions means that sustainability considerations play a crucial role in consumer decision-making. The increase in demand for recyclable packaging indicates a more significant trend in which consumers place a higher value on environmentally friendly decisions, which impacts the business strategies of companies that manufacture pet products. As a result, to fulfil these changing consumer expectations, the North American packaging sector is adapting, focusing on offering recyclable and ecologically friendly packaging options.

This change not only satisfies customer tastes that are ecologically conscientious, but it also makes a substantial contribution to the region's broader sustainability agenda. The pet industry's adoption of sustainable packaging practices is a result of a concerted effort to address environmental issues and positively influence consumer choices and the ecological footprint of pet-related products in North America. This is achieved through encouraging a more environmentally friendly approach within the pet industry.

Asia Pacific region is ranked second in the pet care packaging industry, Since pet ownership is growing significantly in nations like India and China. China is distinguished as having the fastest-growing pet population worldwide. The remarkable increase in China's pet population can be ascribed to several factors, chief among which is the broad endorsement of distinct pet populations.

China's support for multiple pet populations demonstrates its dedication to promoting a flourishing pet culture. The rising acceptance of pet ownership in China can be attributed to government programmes and shifting social attitudes. Due to changing lifestyles and income trends, companion animals, such as dogs and cats, are increasingly becoming essential parts of homes.

Asia Pacific pet care packaging market is expanding significantly due to China's expanding pet population. This trend highlights more general changes in consumer behaviour and preferences about owning pets and decisions about the products and packaging related to pet care. To satisfy the expectations of this growing market, the Asia Pacific packaging business is changing, emphasising creative and customised solutions for pet care goods. The Asia Pacific area is positioned as a significant player in the changing landscape of pet care packaging due to the convergence of a growing pet population, shifting consumer attitudes, and a dynamic packaging market.

Plastics used in pet care packaging make up most of the industry's plastics, and as pets become more sophisticated, plastic pouches will stand to gain the most. These pouches are becoming increasingly well-liked because they are convenient for consumers and economical to ship, thanks to their zippered closure systems and lightweight design. Because of their adaptability, pouches are handy for moist and dry pet food, which has significantly increased their use. One popular pet care item is dry pet food, usually packed in various paper or plastic bags with different weights. On the other side, many different options are available for moist pet food packaging, including foil trays, pouches, and cans. Because of their ease of use and ability to preserve the freshness of pet food, pouches are becoming increasingly popular.

Pet treats are typically packaged in plastic or paper bags like dry food. Notably, some treat packaging has zippered openings—a design choice meant to maintain the crunchy or crisp quality of the goodies. This packaging innovation aligns with the industry's more significant trend of providing nutrients while preserving the product's quality and appeal. The selection of package designs and materials is becoming increasingly important as the pet care industry develops. Because of its many uses and capacity to fit different kinds of pet food, plastic pouches are well-positioned to satisfy the needs of the industry and pet owners alike, fostering innovation and growth in the pet care packaging market.

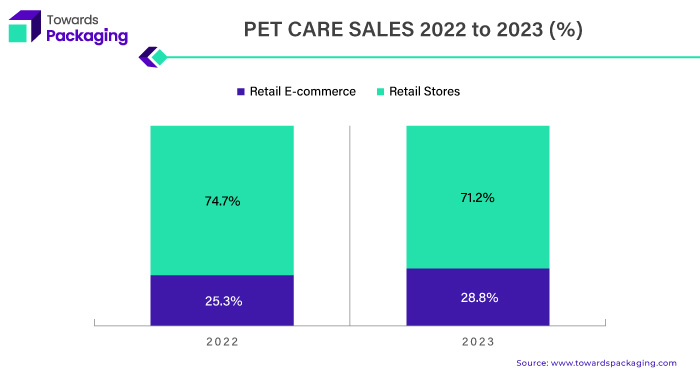

During the pandemic, the surge in e-commerce not only thrived but also gave rise to enduring consumer purchasing behaviours. Pet owners have become accustomed to the subscription model's advantages, such as swift delivery, a diverse selection, easy comparison shopping, personalized discounts, and more. The proportion of pet care sales conducted online has risen from 18% to 29%. The growing pet care markets in the Asia Pacific region owe much of their success to the widespread use of e-commerce platforms and O2O (online-to-offline) distribution.

Even as lockdowns ease, many consumers have reverted to in-person shopping, capitalizing on same-day delivery and face-to-face assistance. Consequently, pet owners exhibit a willingness to seamlessly switch between offline and online resources. In response, modern retailers must adopt an omnichannel strategy, ensuring a presence across various platforms and providing customers with a cohesive and uninterrupted experience. This approach is vital for reaching a broader audience and meeting the evolving preferences of contemporary consumers. Pet owners have embraced the subscription model, valuing its prompt delivery, diverse selections, easy comparison shopping, personalized discounts, and other conveniences.

Post-lockdown, some consumers have returned to in-person shopping, capitalizing on same-day delivery and on-site assistance. Pet owners now exhibit a willingness to seamlessly switch between offline and online resources. To effectively cater to this dynamic consumer behaviour, contemporary retailers must adopt an omnichannel strategy. This entails establishing a presence across multiple platforms, ensuring a cohesive and seamless experience for customers who prefer to engage with businesses through various channels.

The pet care industry has experienced a significant upswing in developed nations in recent years, mirroring the rising number of pet companions. The restrictions imposed by the pandemic undoubtedly contributed to heightened interest in pets, leading to an unprecedented surge in the pet care sector. Notably, the sale of dog and cat food packaging units has outpaced every other category in the fast-moving consumer goods (FMCG) market. Pet Care manufacturers are not only creating traditional products but are also introducing innovative offerings, including beneficial foods and supplements. These products come in convenient, resealable packaging designed to induce relaxation, support skin and coat health, and enhance immunity. Neo Bites, for example, has unveiled purposeful meal toppers in flexible, resealable packaging, addressing specific wellness and health concerns.

The pet care industry is evolving beyond conventional products to include a variety of innovative solutions, such as pet-calming items that contribute to creating a tranquil environment. Wild One, for instance, markets a gummy supplement for relaxation, packaged in a resealable plastic bottle, showcasing the industry's adaptability and growth potential.

Sustainability continues to play a significant role in consumer behaviour, even in the pet care industry. The growing concern for the environment has a major impact on the choices and purchases of three-quarters of pet owners when it comes to caring for their furry friends. This includes being mindful of the type of food they feed their pets, as reported by 40% of pet owners. Early 75% of pet food consumers express a positive opinion towards companies that prioritize eco-friendly packaging options.

For manufacturers, incorporating sustainability into packaging can be a challenging task as it often competes with other packaging trends. While environmentally friendly materials may not always offer the best food safety, quality, and longevity, single-serve or smaller packaging can also contribute to the issue of waste rather than offering a solution. A potential solution to this predicament is to continue to improve the recyclability of packaging and provide more sustainable options for consumers.

The competitive landscape of the pet care packaging market is characterized by established industry leaders such as Amcor Plc, Mondi Group Plc, Crown Holdings Inc., ProAmpac LLC, Coveris Holdings S.A., WestRock Company, Sonoco Products Co, Berry Global Inc., Constantia Flexibles Group GmbH, and Ardagh Group S.A. These giants face competition from emerging direct-to-consumer brands, leveraging digital platforms for market entry. Key factors influencing competition include innovation in product offerings, sustainable practices, and the ability to adapt to changing consumer preferences. Additionally, the sector sees dynamic collaborations, acquisitions, and strategic partnerships as companies strive to capture market share in this highly competitive and evolving industry.

By Material

By Packaging Type

By Region

April 2025

April 2025

March 2025

March 2025